Are you feeling overwhelmed by your student loan repayments? You're not alone; many borrowers find themselves in need of adjustment options to ease their financial burden. Navigating the world of student loans can be tricky, but understanding the options available to you can lead to a more manageable repayment plan. Let's dive deeper into how you can adjust your student loan repayments and find the right solution for your circumstancesâread on to learn more!

Loan Account Details

Loan account details are crucial for managing repayment schedules effectively. The loan account number serves as a unique identifier for each borrower's student loan agreement. Monthly payment amounts are determined based on total loan balance, interest rates, and repayment terms, which often range from 10 to 30 years. For federal student loans, the interest rate can vary, typically ranging from 3% to 7%, depending on the type of loan, such as Direct Subsidized or Unsubsidized Loans. Payment plan options include standard repayment, graduated repayment, and income-driven repayment plans, each providing different strategies for borrowers to manage their financial obligations. Communication with the loan servicer is important for adjustments, providing necessary documentation to reflect any changes in income or family size.

Reason for Adjustment Request

Requesting an adjustment for student loan repayment is often necessary when financial circumstances change significantly. Recent information indicates a potential increase in living costs, such as rent and utilities, impacting monthly budgets. For example, a recent 15% rise in housing prices in metropolitan areas like San Francisco can strain finances for recent graduates. Additionally, unexpected medical expenses, averaging around $1,200 annually for individuals under 30 in the United States, may contribute to the need for repayment adjustment. Job market dynamics, including unemployment rates hovering around 6% in various regions, further complicate the ability to meet original loan payment schedules. Hence, these factors collectively create a viable reason to request a modification in repayment terms to prevent default and ensure manageable payment plans.

Current Financial Situation

Current financial situations often affect student loan repayment capabilities significantly. Recent data indicates that over 43 million borrowers in the United States are navigating this landscape, particularly in the aftermath of economic disruptions like the COVID-19 pandemic. Factors such as employment fluctuations (with unemployment rates peaking at 14.8% in April 2020), rising living costs (increases exceeding 6.8% in consumer prices), and ongoing inflation challenges can hinder the ability to meet monthly payment obligations. Borrowers may experience diminished income levels (with average wages stagnating) while facing escalating rent prices (with urban rents increasing 10% annually in major cities). Such financial pressures stress the importance of evaluating current repayment options, including income-driven repayment plans or deferment considerations to ensure sustainable financial health.

Proposed Repayment Plan

For students seeking assistance with their education financing, a proposed repayment plan is essential for managing student loan obligations effectively. Graduates navigating financial challenges may consider a modified repayment schedule, often based on factors like income and expenses. Income-Driven Repayment Plans (IDR) allow borrowers, such as those with Federal Direct Loans, to adjust monthly payments according to their financial capacity. Interest rates on these loans typically range from 4% to 7%, which can significantly influence total repayment amounts over time. Regions with a higher cost of living, like New York City or San Francisco, might necessitate further adjustments to the repayment strategy, ensuring that borrowers can meet their obligations without compromising essential living expenses. Clear documentation, including income verification and detailed budgeting, is crucial for negotiating favorable terms with loan servicers.

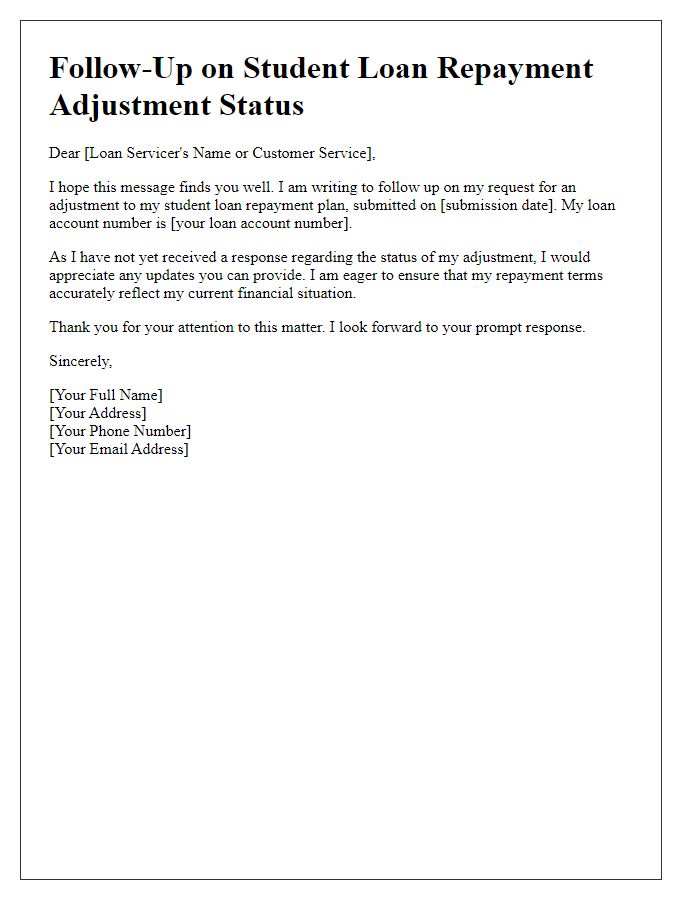

Contact Information for Follow-up

Student loan repayment programs provide critical financial assistance to individuals pursuing higher education. The contact information for follow-up enables borrowers to reach their loan servicers or agencies managing their loans efficiently. Key details, such as customer service phone numbers and email addresses, are essential for addressing repayment adjustments, deferment inquiries, or consolidation options. National Student Loan Data System (NSLDS) serves as a crucial resource for borrowers to track their loans and manage repayment plans effectively. Further, understanding repayment options available through federal programs, including Income-Driven Repayment (IDR), enhances the ability to customize the repayment strategy based on individual financial circumstances.

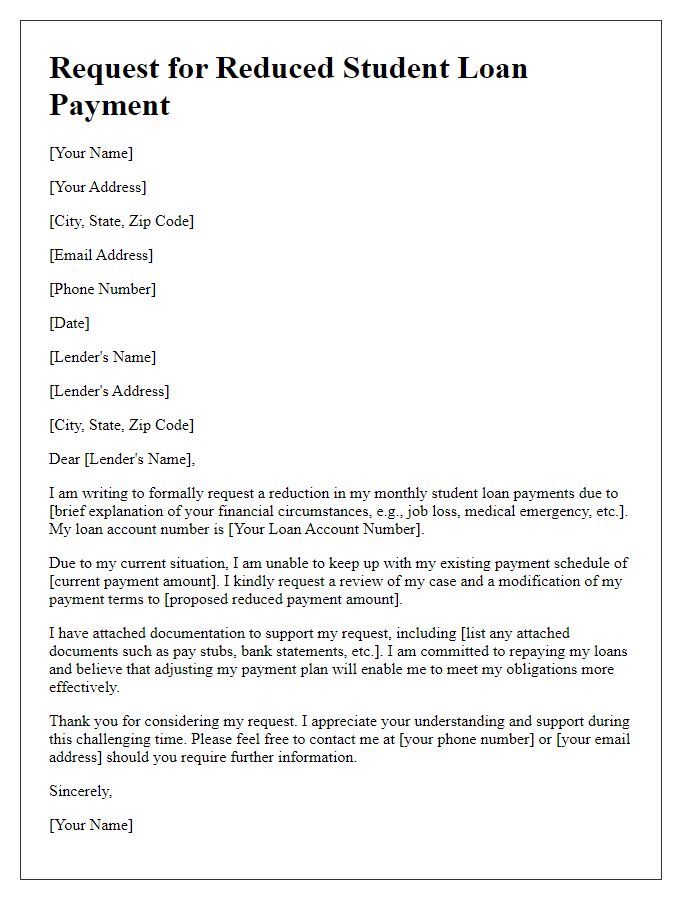

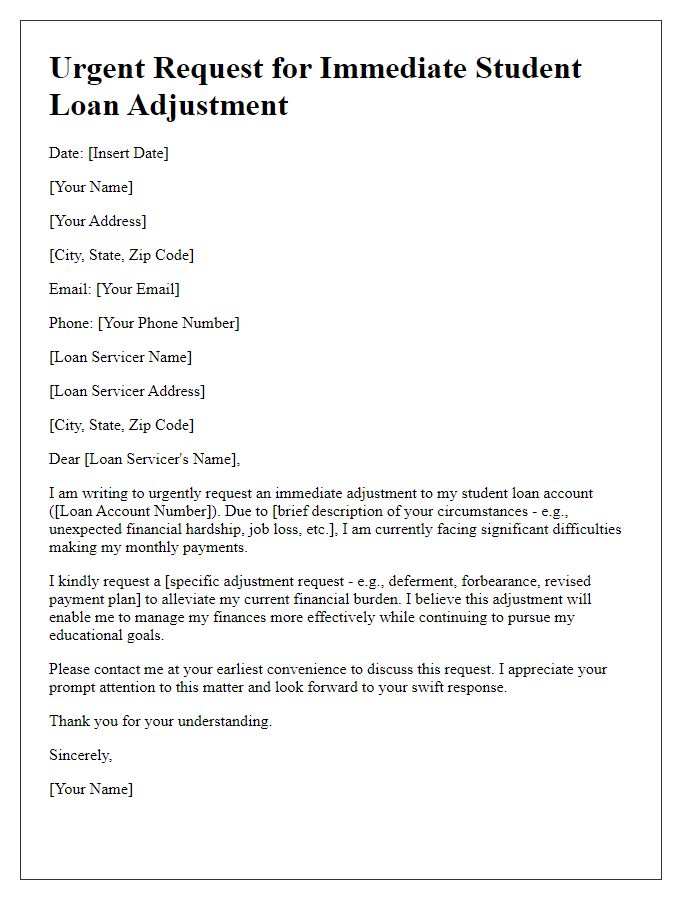

Letter Template For Student Loan Repayment Adjustment Samples

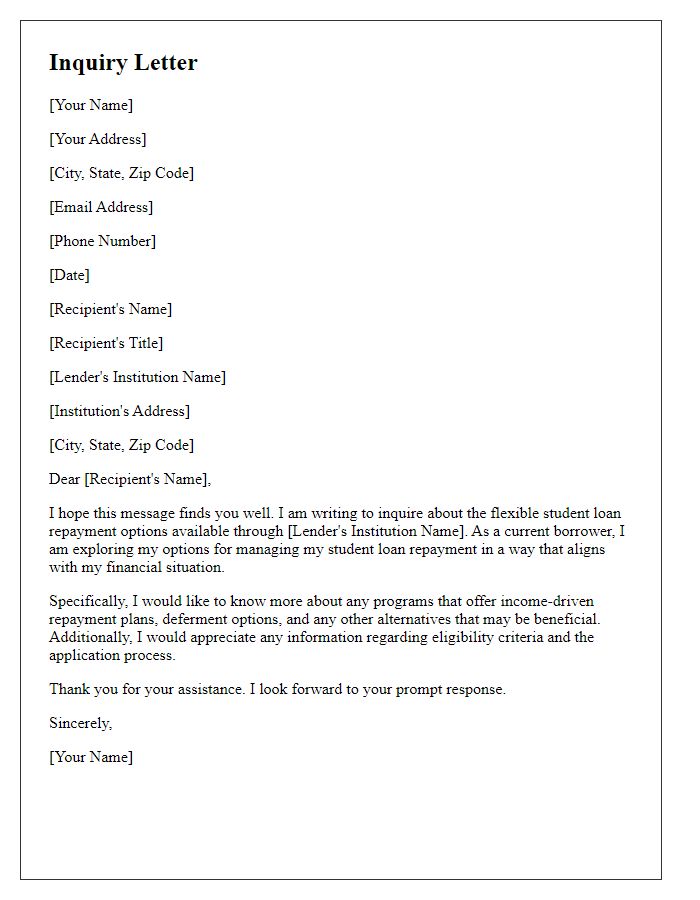

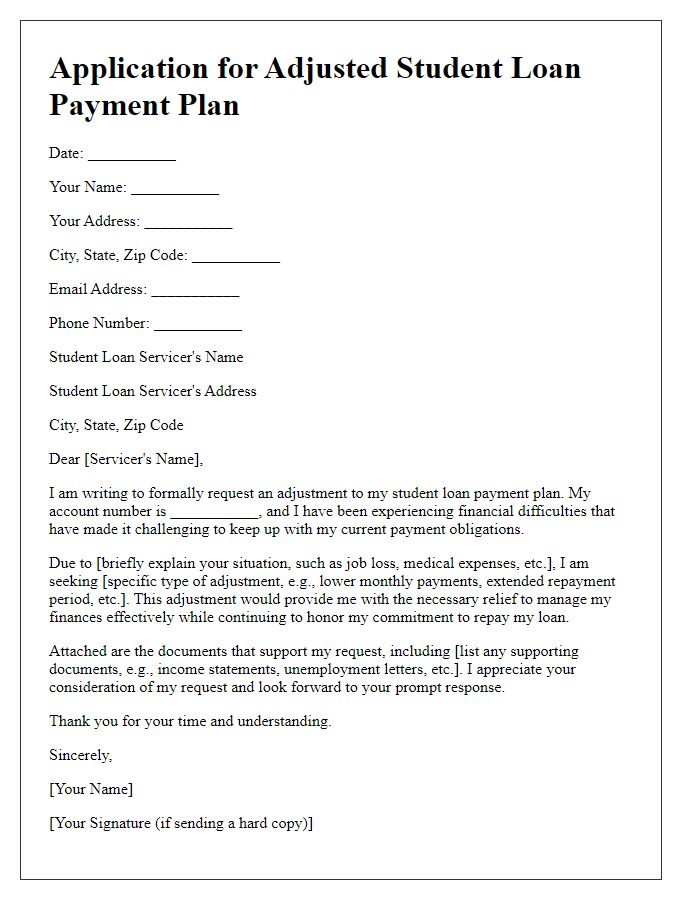

Letter template of inquiry about flexible student loan repayment options

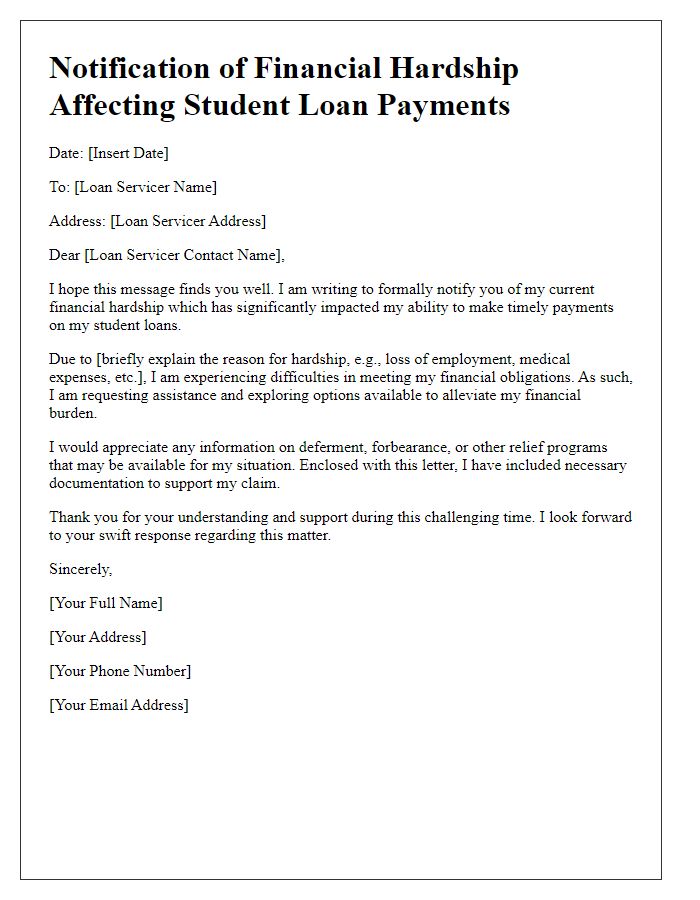

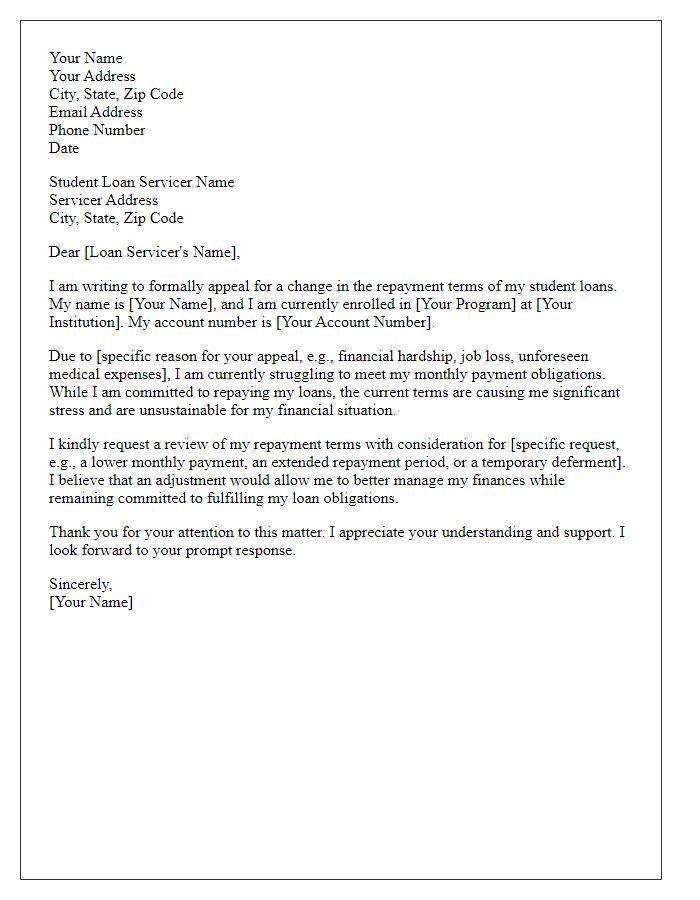

Letter template of notification for financial hardship affecting student loan payments

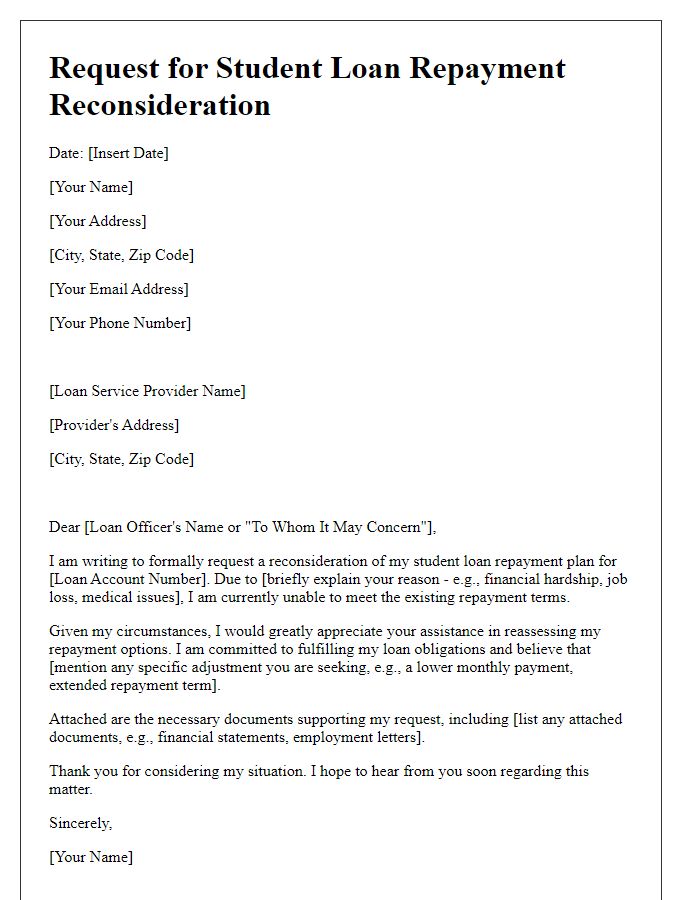

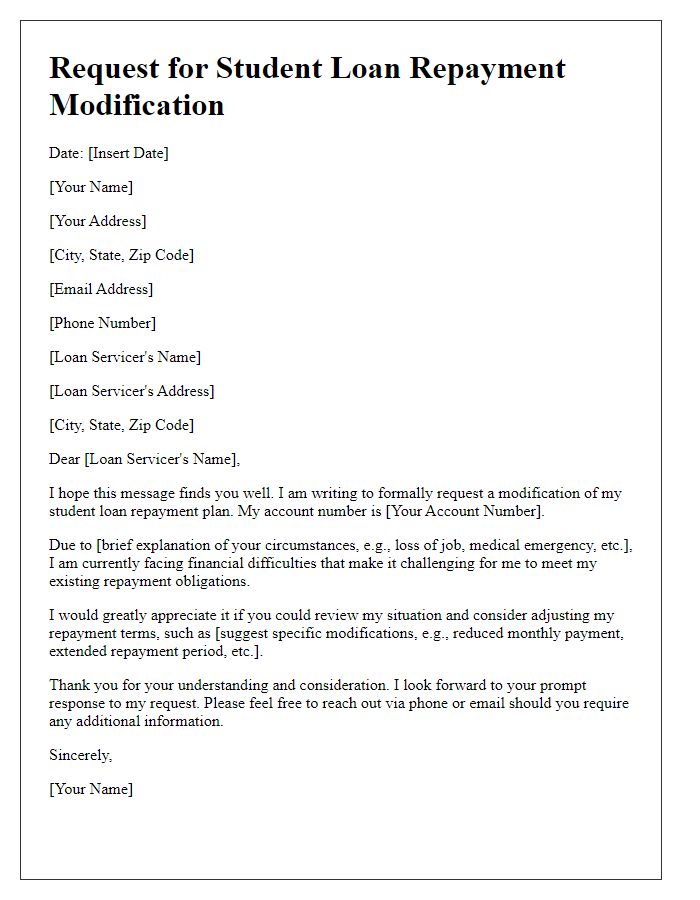

Letter template of formal request for student loan repayment reconsideration

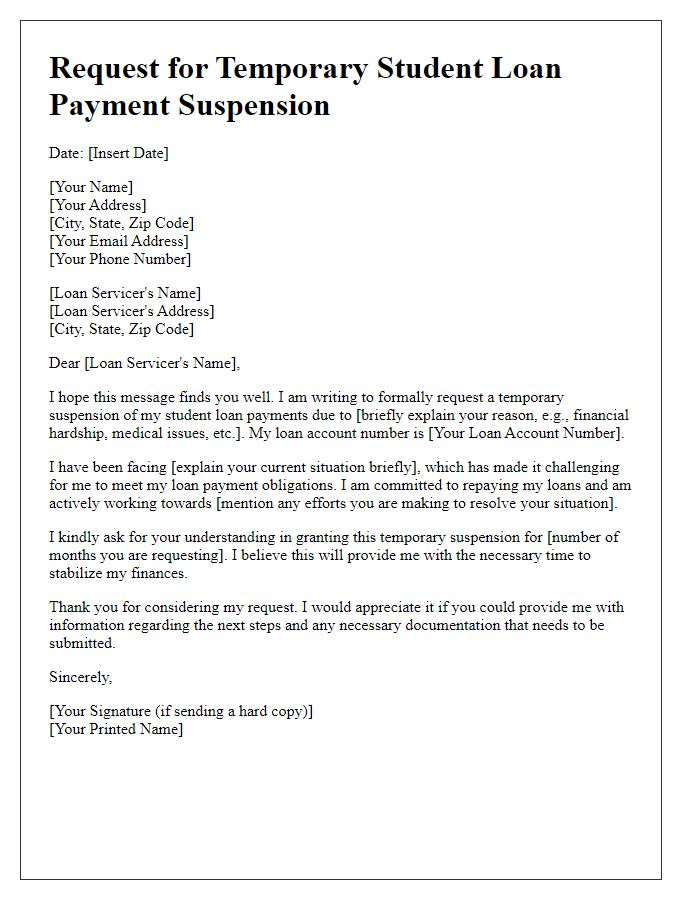

Letter template of statement for temporary student loan payment suspension

Comments