Are you feeling overwhelmed by debt and searching for a way to lighten your financial burden? If you've found yourself in a challenging situation, knowing how to effectively request debt forgiveness can be a game changer. In this article, we'll explore the essential steps to craft a compelling letter that captures your circumstances and appeals to creditors for relief. So, let's dive in and discover how you can take control of your financial future!

Reason for Debt Forgiveness Request

Debt forgiveness requests often stem from various financial hardships faced by individuals or businesses. Economic downturns (such as the COVID-19 pandemic) frequently lead to job loss, resulting in unemployment rates as high as 14.7% in the United States during April 2020. Medical emergencies can add significant expenses, with the average hospital stay costing over $10,000. Natural disasters, like hurricanes and wildfires, can decimate personal finances and property, leading to overwhelming debt burdens. Additionally, unexpected life events (such as divorce or the death of a spouse) can complicate financial situations, resulting in the need for forgiveness on debts like student loans or credit cards. These factors highlight a growing reliance on debt relief programs to restore financial stability amidst challenging circumstances.

Demonstration of Financial Hardship

Demonstrating financial hardship requires a thorough presentation of one's current economic situation and the impact of debt obligations. A person experiencing severe financial distress, such as unemployment (with unemployment rates fluctuating around 5% according to recent figures), medical expenses from chronic illnesses (like diabetes, costing an average of $8,000 annually), or unexpected emergencies (like major home repairs costing $15,000), can illustrate their plight convincingly. Additionally, documenting income sources, such as a monthly paycheck of $2,500 or government assistance benefits, can furnish a clearer picture of one's financial baseline. The inclusion of supportive statements from creditors and evidence of payment difficulties, like missed payments or notices from debt collectors, can strengthen the case for debt forgiveness. This approach creates a comprehensive narrative to present to financial institutions, outlining the individual's need for relief from debt burdens.

Outstanding Debt Details

Outstanding debt can significantly impact financial stability, with factors such as unpaid balances affecting credit scores. This debt, sometimes originating from loans, credit cards, or medical bills, can escalate due to interest rates, potentially exceeding the original amount. For example, a $5,000 personal loan at an annual percentage rate (APR) of 15% can accumulate over $1,500 in interest over five years. Contacting creditors or debt collectors, such as collection agencies with large portfolios, may lead to negotiations for debt forgiveness. In many cases, a detailed account of financial hardship, including job loss or medical emergencies, is required to strengthen the request for forgiveness, alleviating financial burdens for affected individuals.

Formal Polite Language

A significant number of individuals face financial hardship due to unforeseen circumstances, such as medical emergencies or job loss, often leading them to seek debt forgiveness. Debt forgiveness refers to the cancellation of all or a portion of a borrower's outstanding debt, allowing for financial relief and a fresh start. Many nonprofit organizations provide resources and guidance for individuals navigating this process, ensuring they have the necessary information to communicate effectively with creditors. Successful requests for debt forgiveness often require a thorough understanding of one's financial situation, including income, expenses, and any relevant supporting documentation. Additionally, various government programs offer assistance and sometimes direct pathways to debt relief for eligible applicants, highlighting the importance of researching available options in one's locality.

Supporting Documentation

Submitting a request for debt forgiveness often involves providing comprehensive supporting documentation to strengthen the case for relief. Key documents include detailed financial statements, which may consist of income statements and balance sheets highlighting the individual's or entity's financial situation. Additional evidence could feature recent tax returns, typically from the past two years, which illustrate income levels and any unforeseen hardships, such as medical emergencies or job loss. Essential also are any correspondence related to the debt itself, especially notices or statements from creditors detailing account status and payment history. Sometimes, a personal statement outlining the rationale for the debt forgiveness request can further clarify circumstances and demonstrate genuine need. Each of these documents collectively contributes to building a strong case that may prompt favorable consideration from financial institutions, government bodies like the U.S. Department of Education, or nonprofit organizations managing debt relief programs.

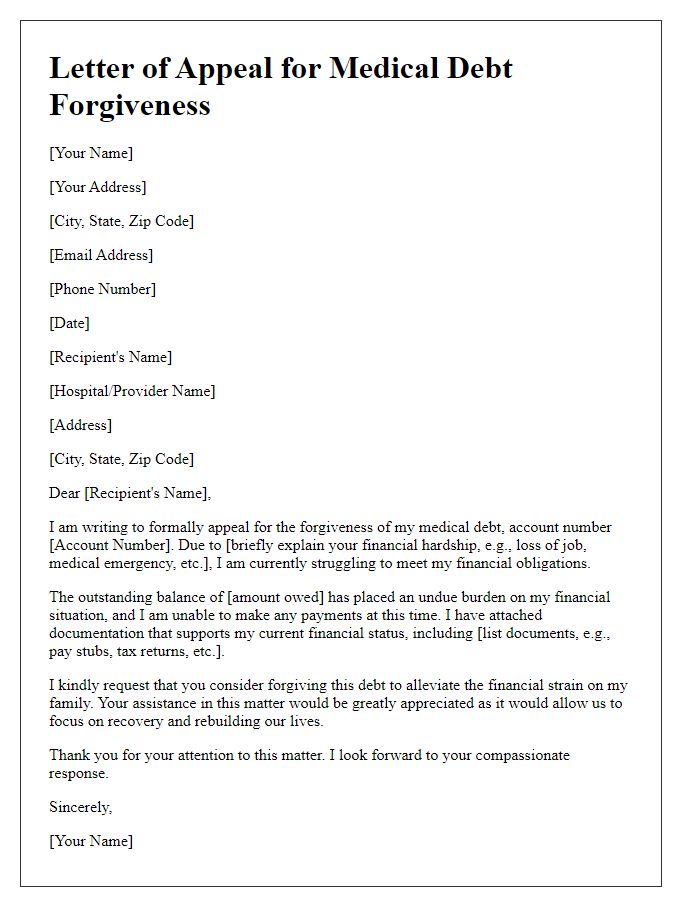

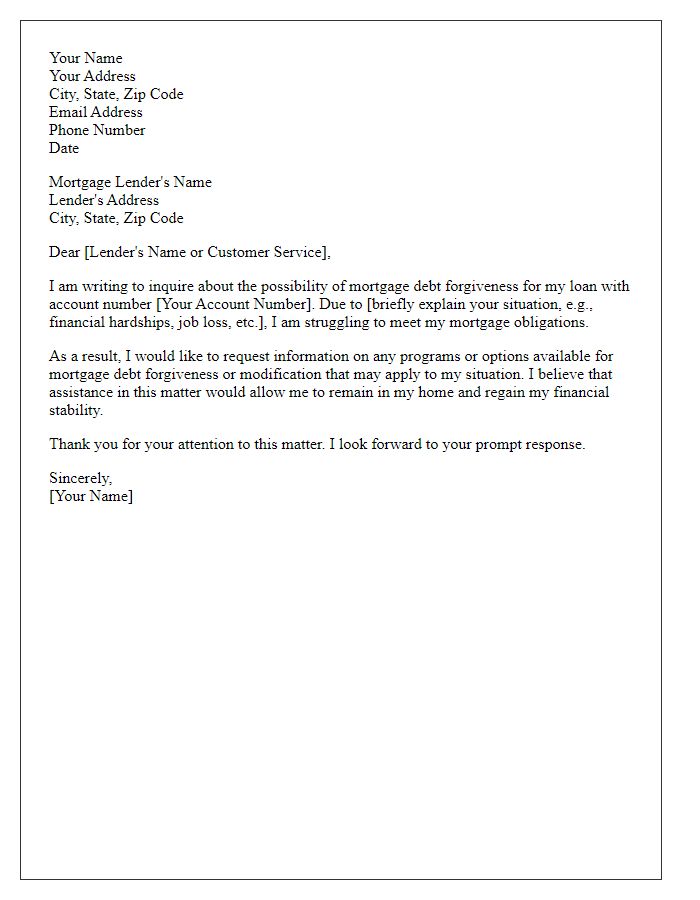

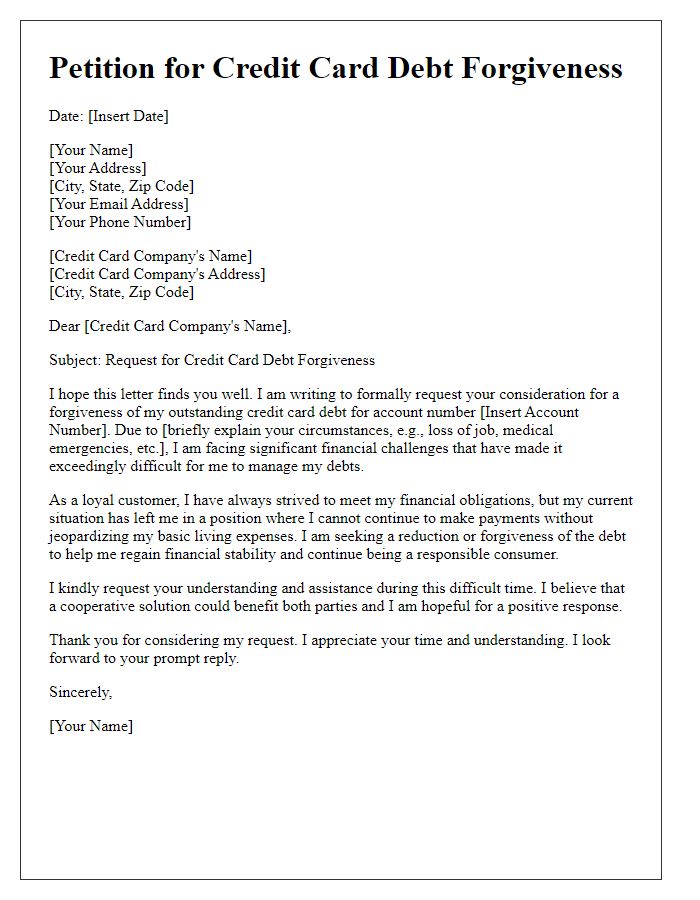

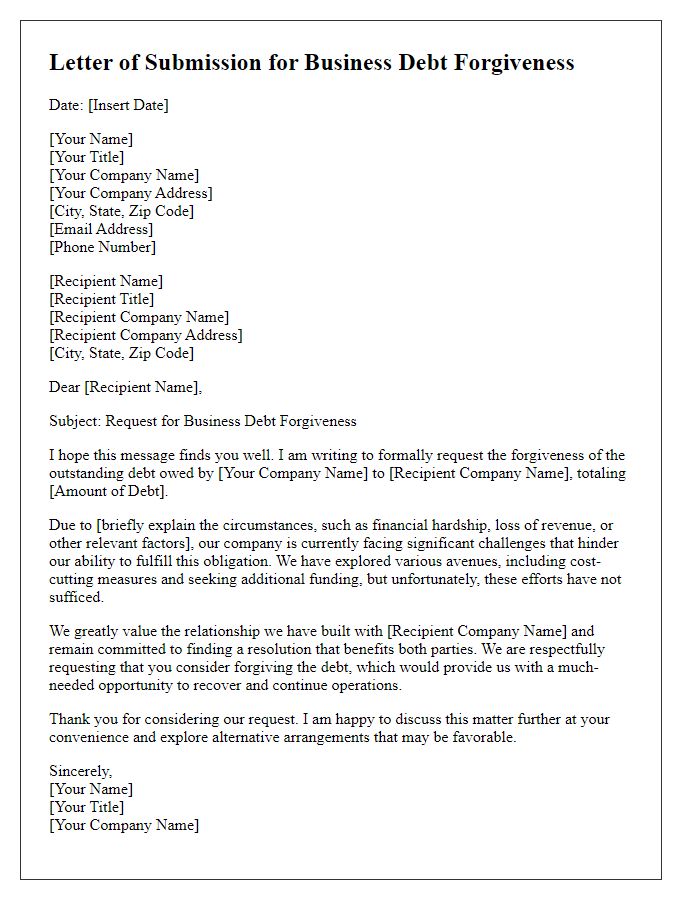

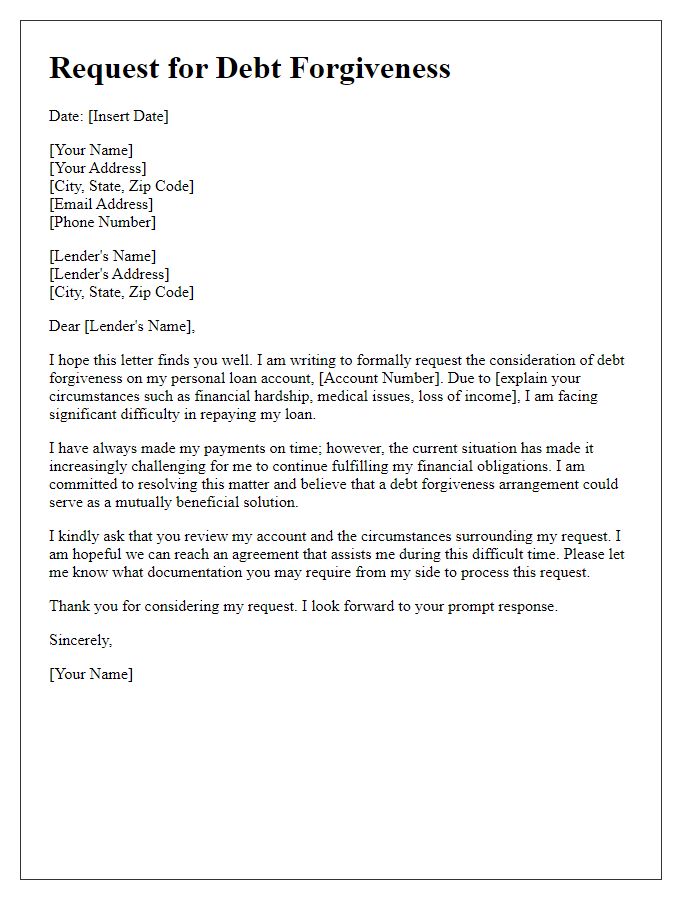

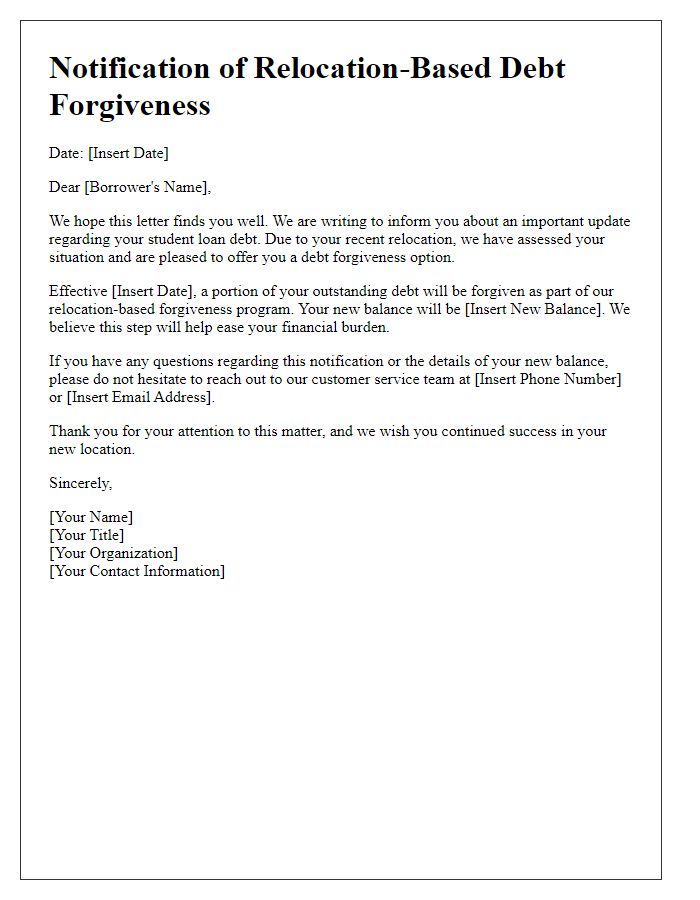

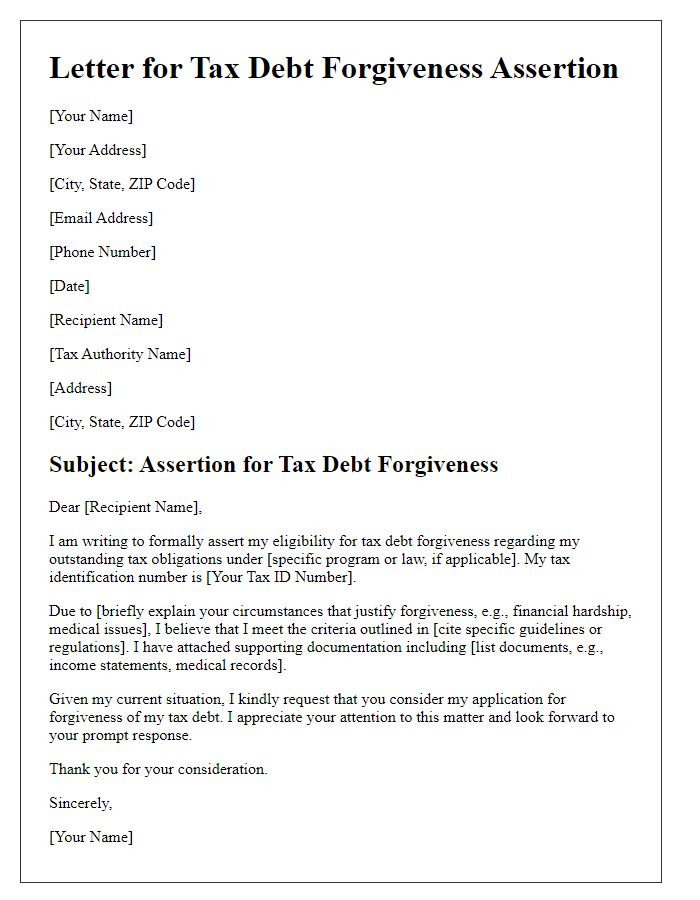

Letter Template For Requesting Debt Forgiveness Samples

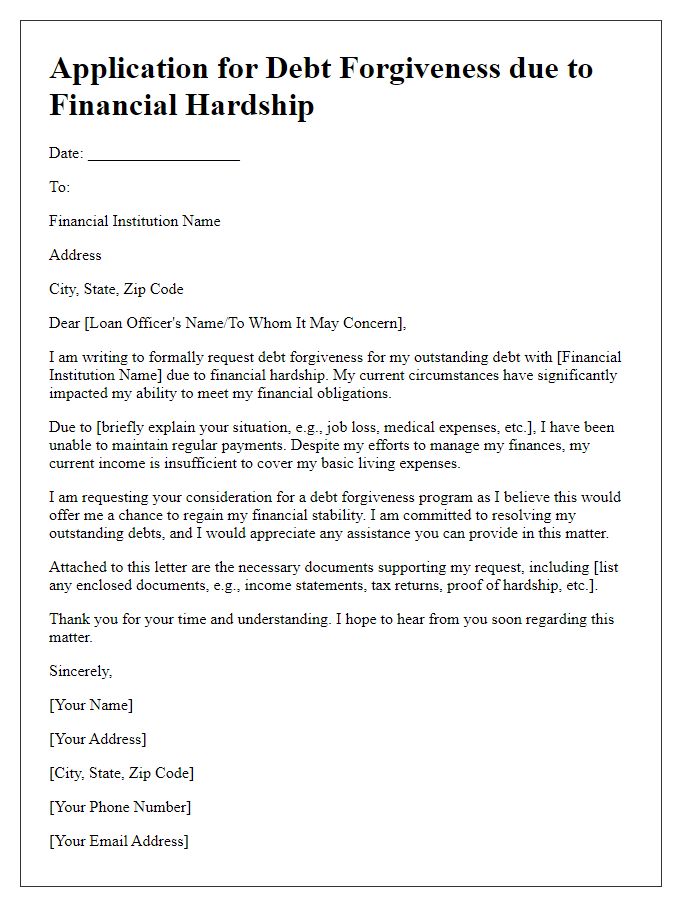

Letter template of application for debt forgiveness due to financial hardship

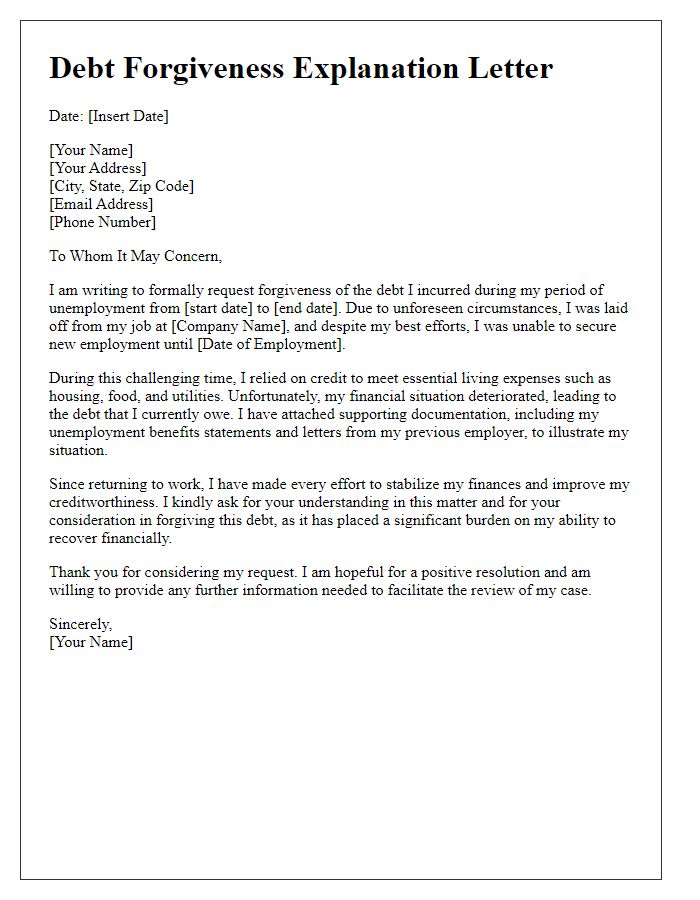

Letter template of explanation for unemployment-related debt forgiveness

Comments