Are you finding yourself overwhelmed by debt and considering a negotiation for a payoff amount? You're not alone, and there's a way to tackle this challenge effectively. Crafting a well-thought-out letter to your creditor can be your first step toward financial relief. Want to learn how to create a compelling debt negotiation letter? Keep reading to discover some valuable tips and templates!

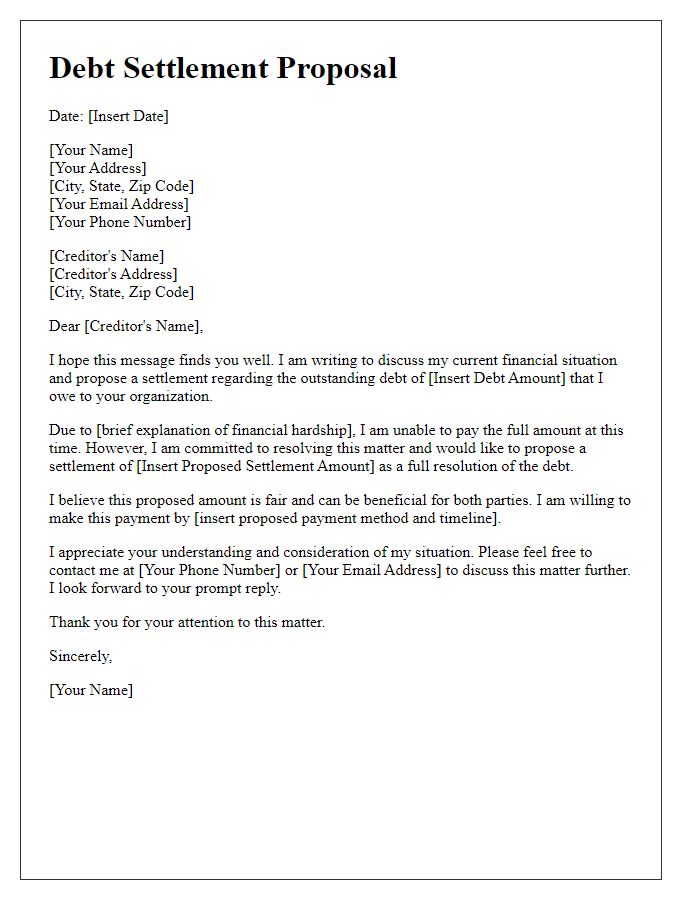

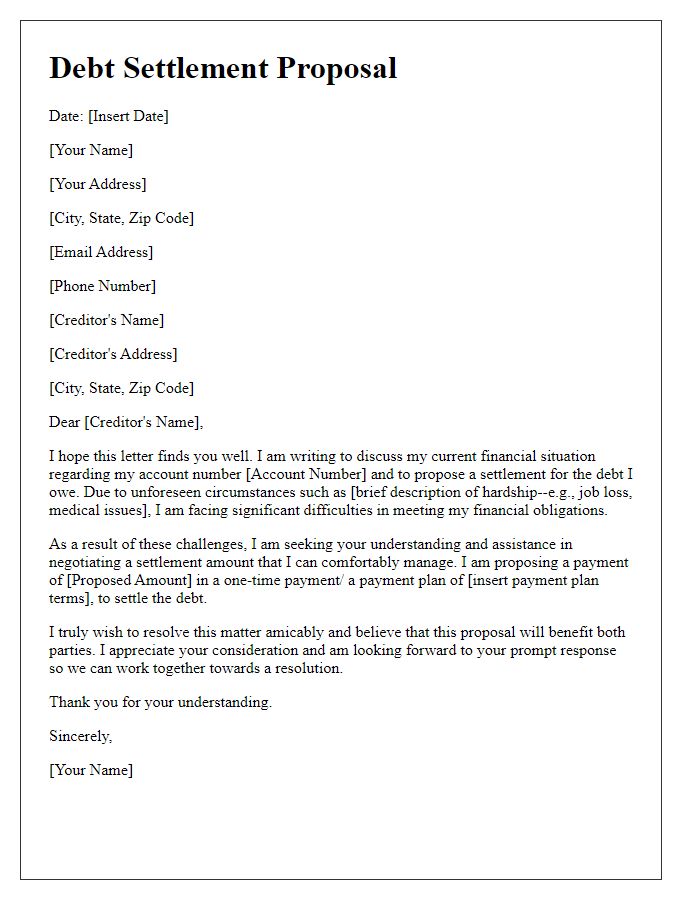

Clear Identification of Debtor and Creditor

A well-structured letter template for negotiating a debt payoff amount requires a clear identification of both debtor and creditor. The debtor, an individual or entity owing money, must provide their full name, address, and any account numbers related to the debt. The creditor, typically a financial institution or collection agency, should also be clearly identified with their name, contact information, and account details associated with the debt. By establishing this explicit context, the letter promotes clarity and facilitates the negotiation process, ensuring that both parties understand their roles and the specifics of the financial obligation at hand. This technique enhances communication, paving the way for possible compromises that can lead to a satisfactory resolution.

Specific Debt Details and Amount

Negotiating a debt payoff can help alleviate financial stress and manage outstanding balances. For example, a personal loan of $20,000 from XYZ Bank with an interest rate of 7% may result in monthly payments of approximately $400 over five years. If the aim is to settle the debt for a lower amount, presenting a lump sum offer around $12,000 could be effective, particularly if accompanied by financial documentation, such as recent pay stubs or bank statements from Miami, Florida, showing financial hardship. Highlighting potential benefits for the creditor, including the assurance of receiving a swift payment and closing the account, can strengthen negotiations. Offering a defined timeframe for resolution, such as within 30 days, encourages prompt communication and decision-making.

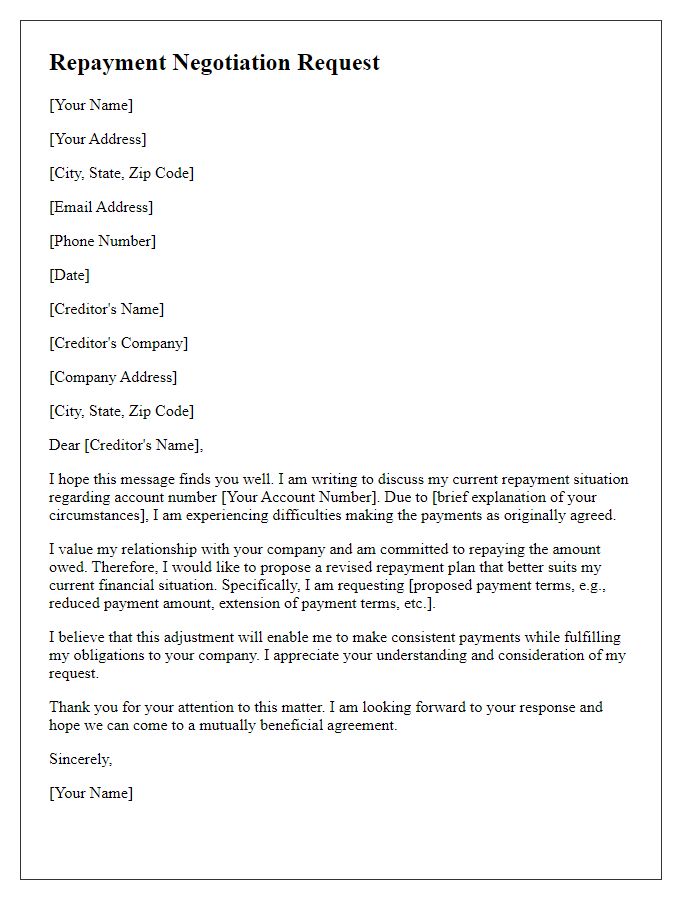

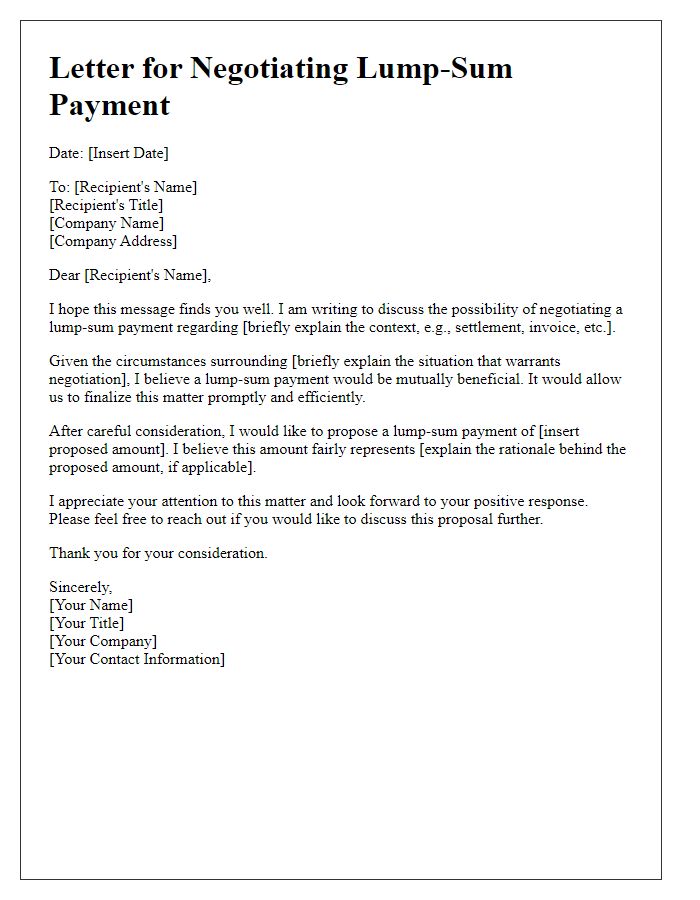

Proposed Settlement Offer

Debt negotiation often requires careful consideration of your financial situation and the creditor's willingness to settle for less than the full amount owed. A proposed settlement offer should clearly outline the total amount of debt (for example, $10,000) you wish to negotiate. Include relevant details such as the type of debt (credit card, personal loan) and mention any financial hardships (such as job loss or medical expenses) you're currently facing. Specify the amount you're able to pay as a lump sum (for instance, $4,000), including a proposed timeframe (like within 30 days) for making this payment. Highlight how this settlement will allow you to resolve the debt efficiently and prevent further collection actions. Providing your contact information and remaining open to further discussions can facilitate better communication with the creditor.

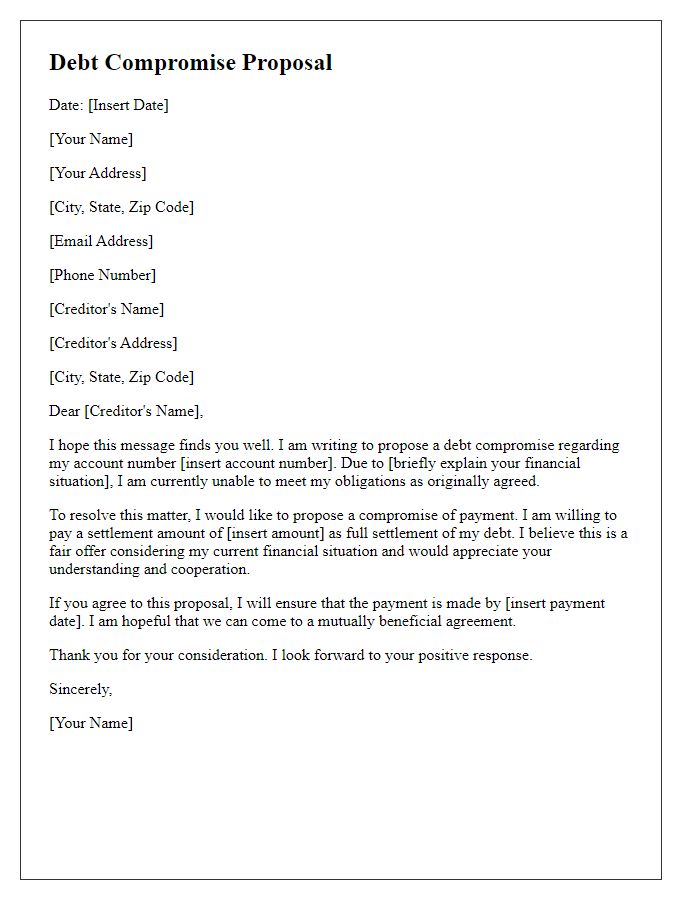

Justification for Offer or Financial Hardship Explanation

Negotiating a debt payoff amount can be influenced by various factors, including financial hardship, unexpected medical expenses, or loss of employment. Financial challenges, such as those experienced during the COVID-19 pandemic, can hinder an individual's ability to meet monthly payments on debts, like credit card bills or student loans. For instance, a family facing a sudden medical emergency may accumulate over $10,000 in unforeseen expenses, resulting in difficulties in managing existing obligations. A well-structured negotiation can present a reduced settlement offer, benefiting both the debtor and creditor; the debtor alleviates financial burdens while ensuring the creditor receives a portion of the owed amount. Formulating a clear repayment plan that outlines specific circumstances and demonstrates genuine intent to settle can enhance the likelihood of a favorable outcome.

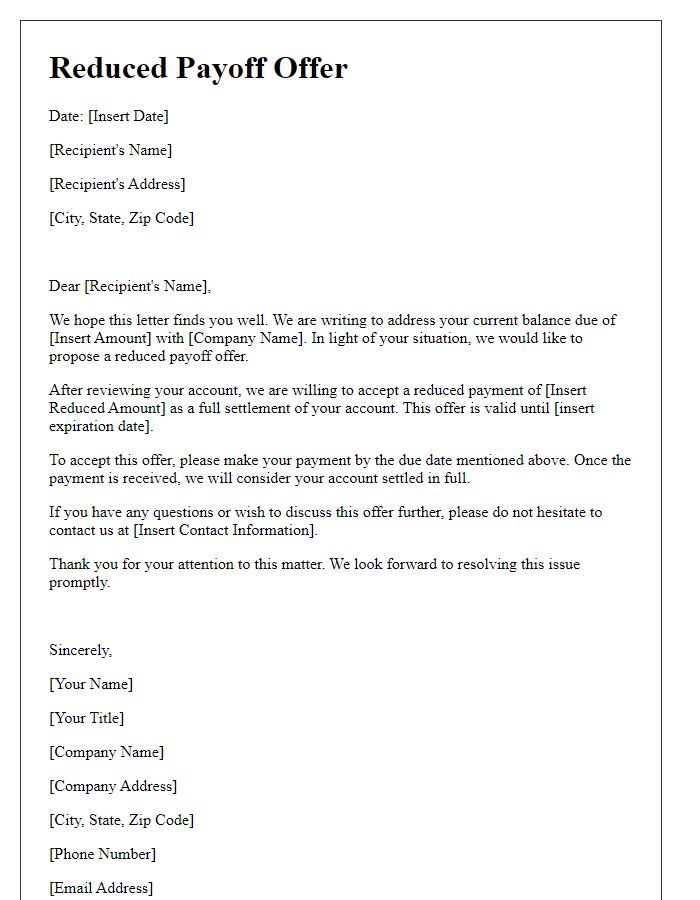

Formal Request for Written Confirmation

Negotiating a debt payoff amount can be a complex process, particularly when dealing with financial institutions and credit agencies. A formal request for written confirmation should include specific details such as the lender's name, account number, and details about the debt (original amount, current balance). For instance, a debtor may owe $10,000 to XYZ Bank, with a current payoff amount offered at $6,000 as a settlement. Clearly stating the date of the agreement and terms of the negotiation is crucial, as it aids in preventing misunderstandings. Additionally, including a deadline for the lender's response can expedite the process, ensuring both parties are aligned on expectations. Documentation may also outline any intentions for credit reporting and future payments, reinforcing the debtor's commitment to resolving the account.

Comments