Are you feeling overwhelmed by unexpected financial challenges? You're not alone, and many people find themselves in need of a little extra support during tough times. Writing a personal loan hardship request can be a straightforward way to communicate your situation and seek assistance from your lender. If you're ready to learn how to craft an effective letter that could help ease your financial burden, keep reading!

Borrower's personal information

Navigating personal loan hardships can require clear communication about one's situation. Individuals facing financial challenges due to events such as job loss, medical emergencies, or unexpected expenses may need to articulate their circumstances to lenders. Providing detailed borrower information, including full name, social security number, and account details related to the loan, becomes essential for identity verification. In addition, it is important to specify the nature of financial hardship, such as reduced income (e.g., a 30% decrease), duration of difficulties (e.g., since April 2023), and any steps taken to mitigate the situation, like seeking alternative employment or enrolling in financial counseling programs. Clarity on the desired outcome, such as loan deferment or modified payment terms, fosters constructive dialogue with the lender.

Loan details and current status

A personal loan hardship request typically includes essential details that provide context to the lender regarding the borrower's situation. The request should start with the specific loan amount, for example, a $10,000 personal loan with a 5-year term, started in January 2022, indicating the original repayment schedule and monthly installment, such as $200 per month. The current status of the account should reflect the payment history, mentioning any missed payments or financial difficulties during the last few months, perhaps due to job loss or medical expenses. It's crucial to detail the borrower's current income situation, for instance, a reduction in monthly income to $3,000 due to unemployment or part-time work, emphasizing the urgency for loan modification or temporary relief options. Including a specific request, like a three-month deferment on payments or an adjustment to lower monthly payments, can also be helpful, thereby presenting a clear path for resolution to the lender.

Explanation of hardship circumstances

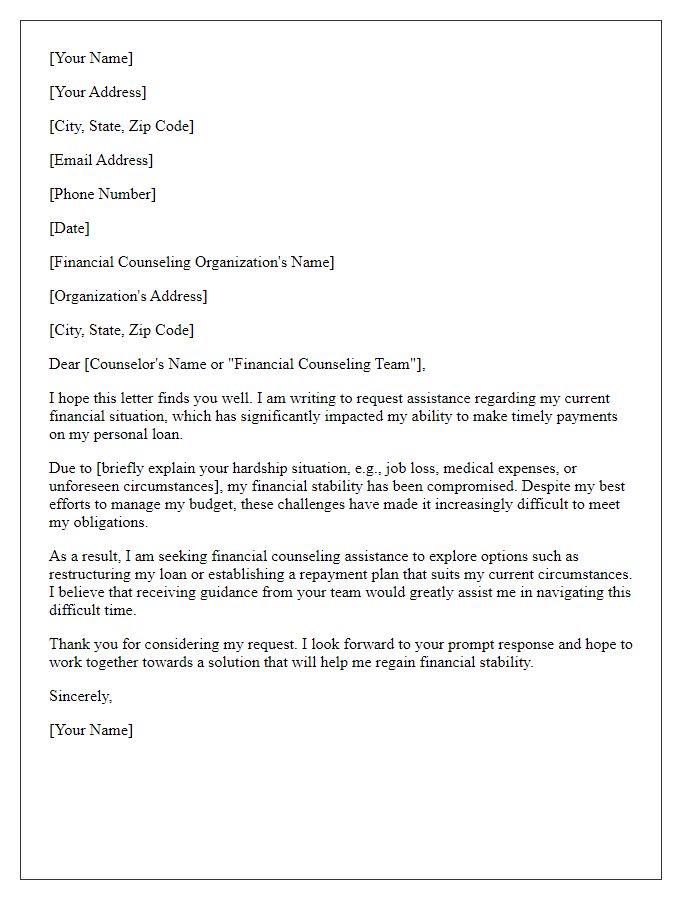

A personal loan hardship request letter template serves as a formal document for individuals facing financial difficulties due to unexpected circumstances such as job loss, medical emergencies, or natural disasters. This template includes sections for clear articulation of the hardship circumstances, allowing the borrower to explain their situation comprehensively. Important details may encompass income changes, unexpected expenses, and the timeline of financial struggle. The template helps organize pertinent information, making it easier for lenders to understand the context and consider potential options such as deferment or restructuring the loan. By using this structured approach, borrowers can effectively communicate their needs and seek assistance during challenging times.

Request for specific assistance or modification

When individuals face financial difficulties, personal loans may become burdensome. Hardship requests often seek assistance or loan modifications to alleviate payment strains. Documentation such as income statements, medical bills, or unemployment notices may be necessary to substantiate the claim. A borrower may need to outline specific requests, like a reduced monthly payment, extended repayment terms, or temporary forbearance. Institutions often require the submission to their customer service department, typically located in major cities such as New York or Los Angeles, where financial advisors can review and respond to hardship cases. Understanding the lender's policies and procedures is essential for a successful loan modification outcome.

Contact information for follow-up

A personal loan hardship request may stem from financial challenges resulting from events such as unemployment, medical emergencies, or unexpected expenses. Individuals may reach out to financial institutions like Wells Fargo or Bank of America to discuss tailored options. Clear communication about circumstances is essential; detailed accounts of income changes, monthly expenses, and any relevant documentation are advisable. Providing contact information for follow-up, such as a cell phone number, ensures prompt responses, while an email address allows for written communication regarding the status of the request. Maintaining organized records of all correspondence can facilitate a smoother process in seeking assistance with loan repayments.

Letter Template For Personal Loan Hardship Request Samples

Letter template of personal loan hardship appeal for temporary financial relief.

Letter template of personal loan hardship request due to medical expenses.

Letter template of personal loan hardship application for unemployment situation.

Letter template of personal loan hardship assistance inquiry due to family emergency.

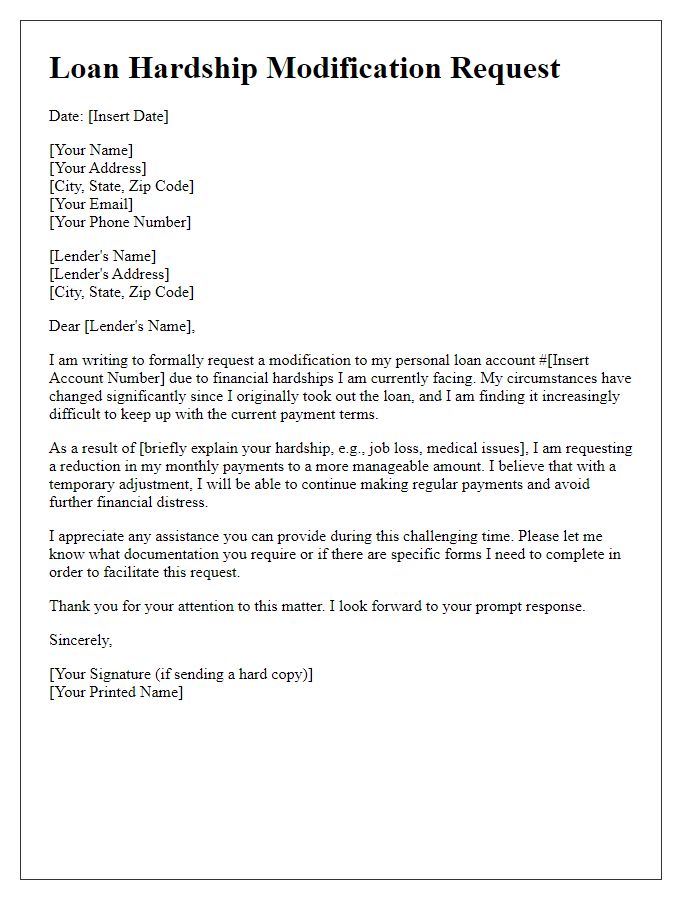

Letter template of personal loan hardship modification request for reduced payments.

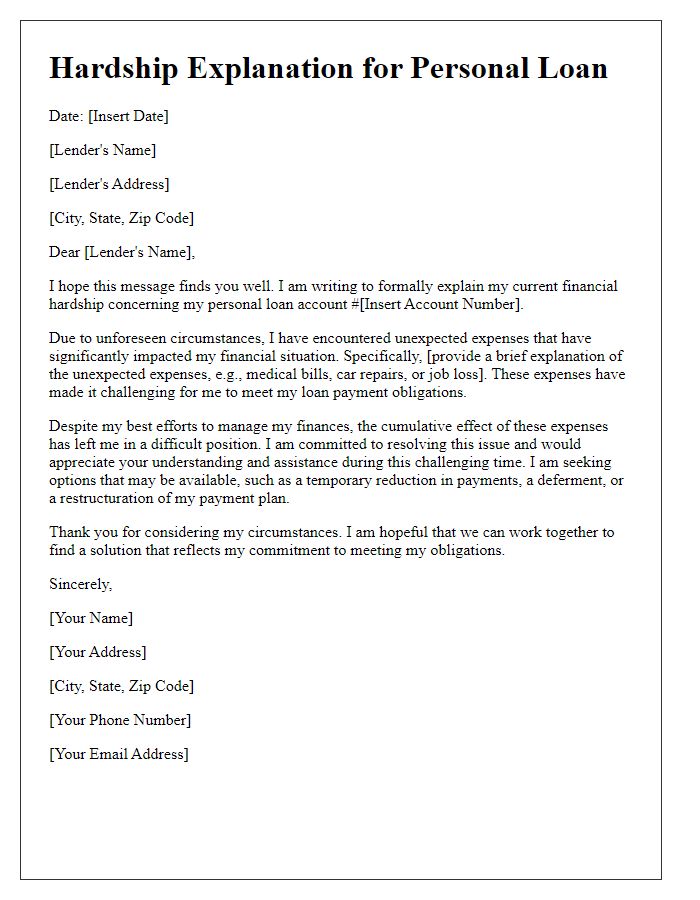

Letter template of personal loan hardship explanation due to unexpected expenses.

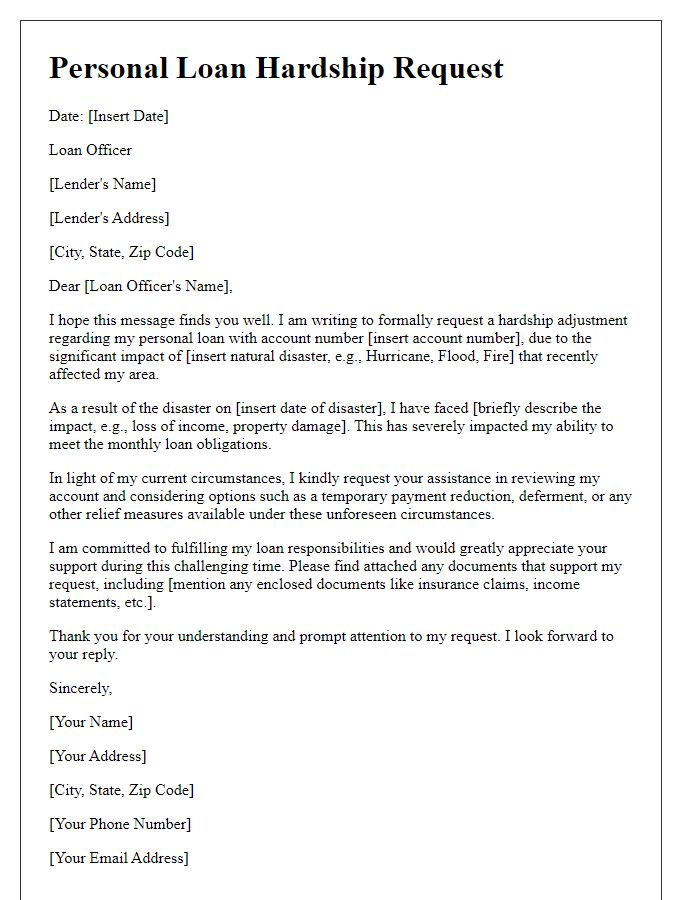

Letter template of personal loan hardship request following natural disaster.

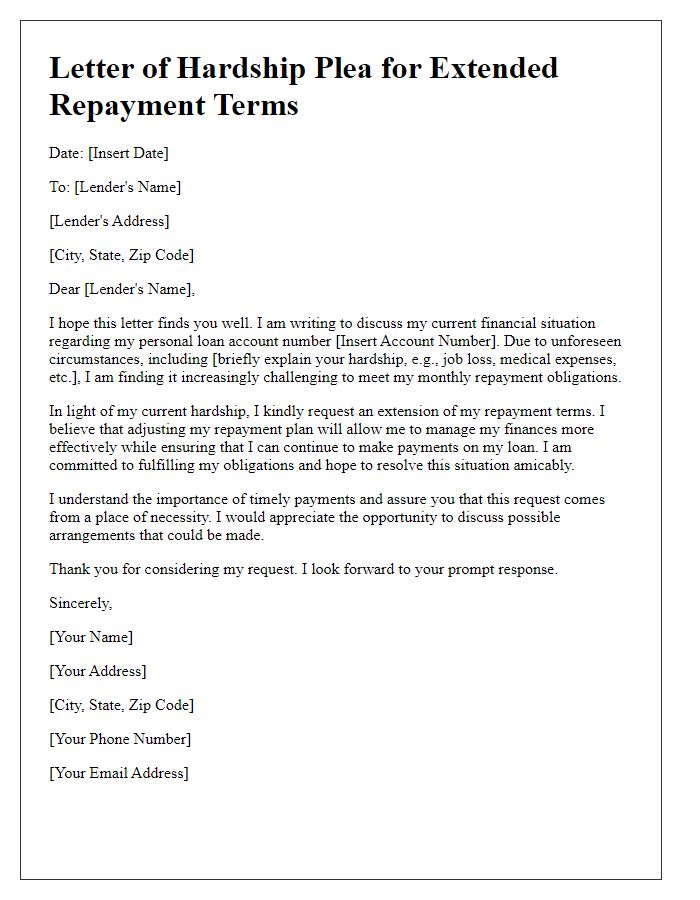

Letter template of personal loan hardship plea for extended repayment terms.

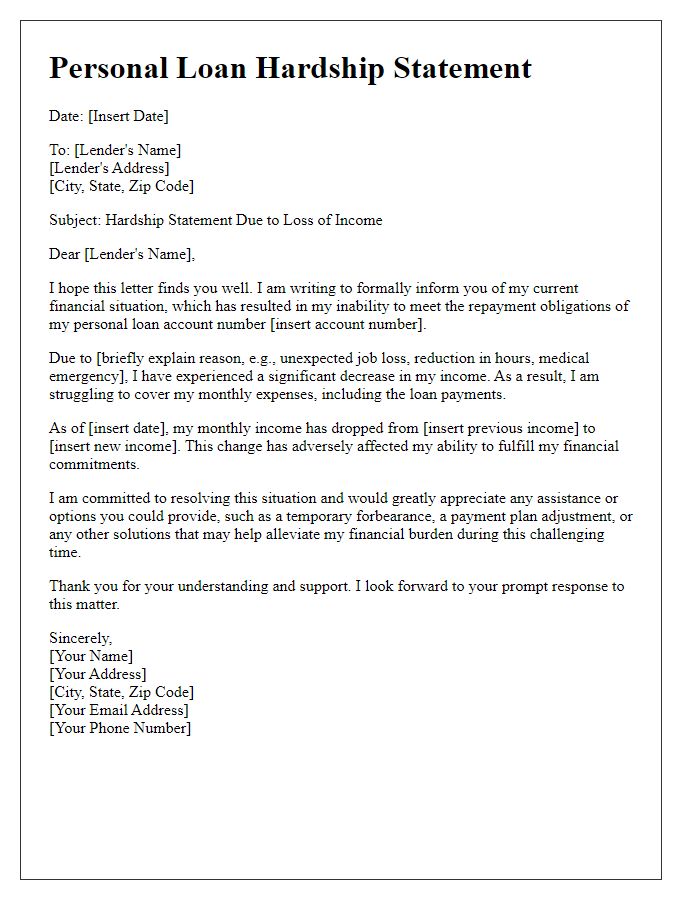

Letter template of personal loan hardship statement due to loss of income.

Comments