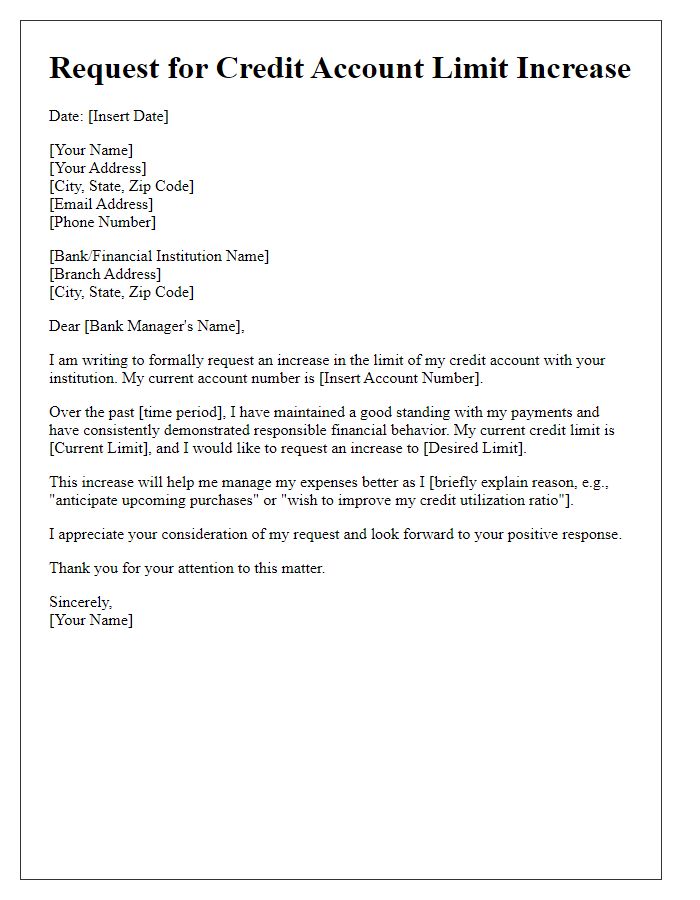

Are you considering requesting a credit line increase but don't know where to start? You're not alone; many people find it challenging to navigate their way through the process. With the right approach and understanding of what lenders are looking for, you can boost your chances of approval significantly. Join me as we delve into crafting a compelling letter for your credit line increase request that will set you on the path to financial flexibility!

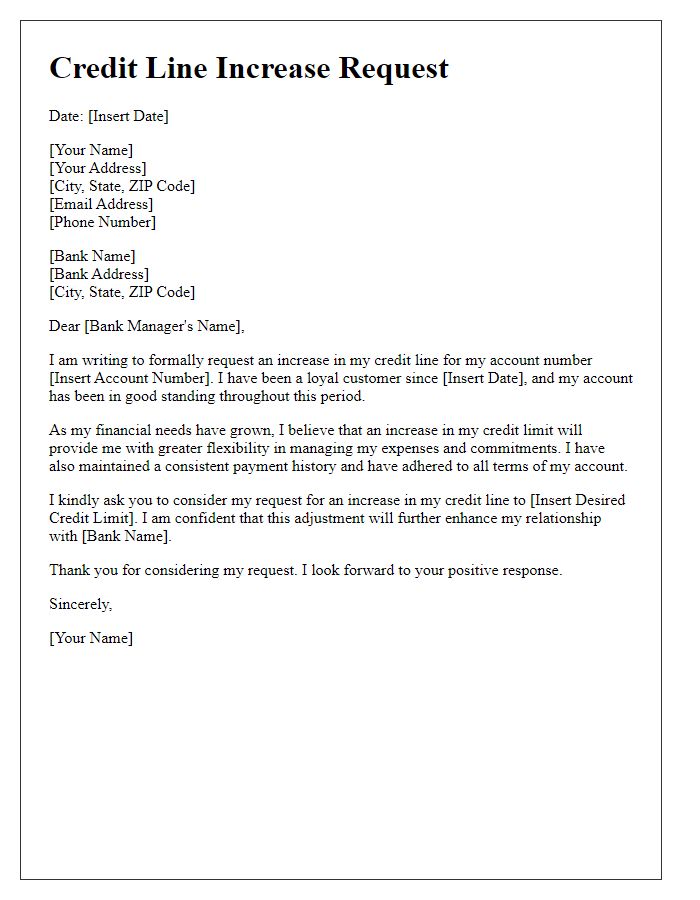

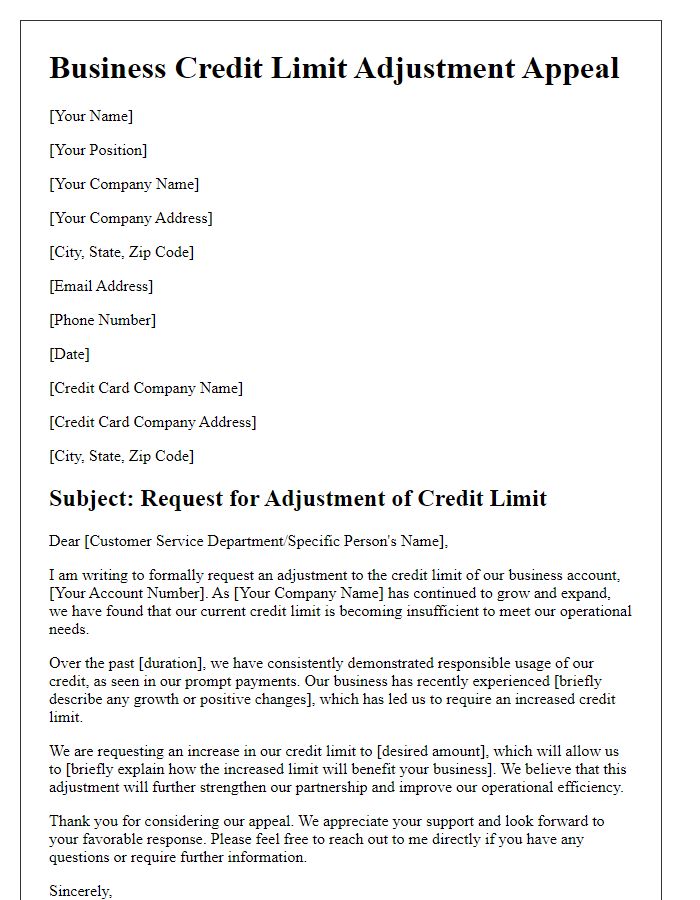

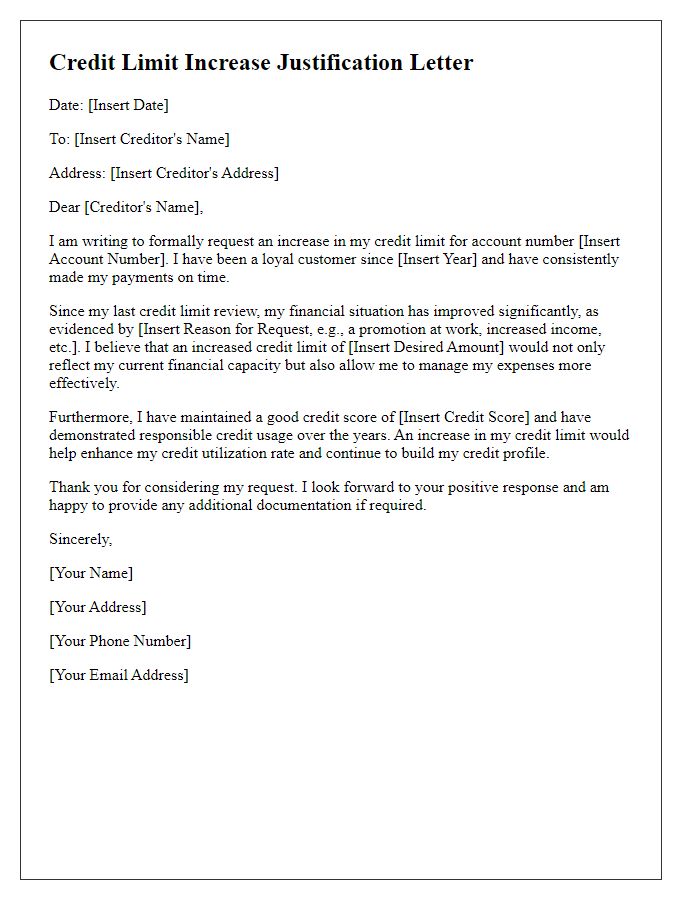

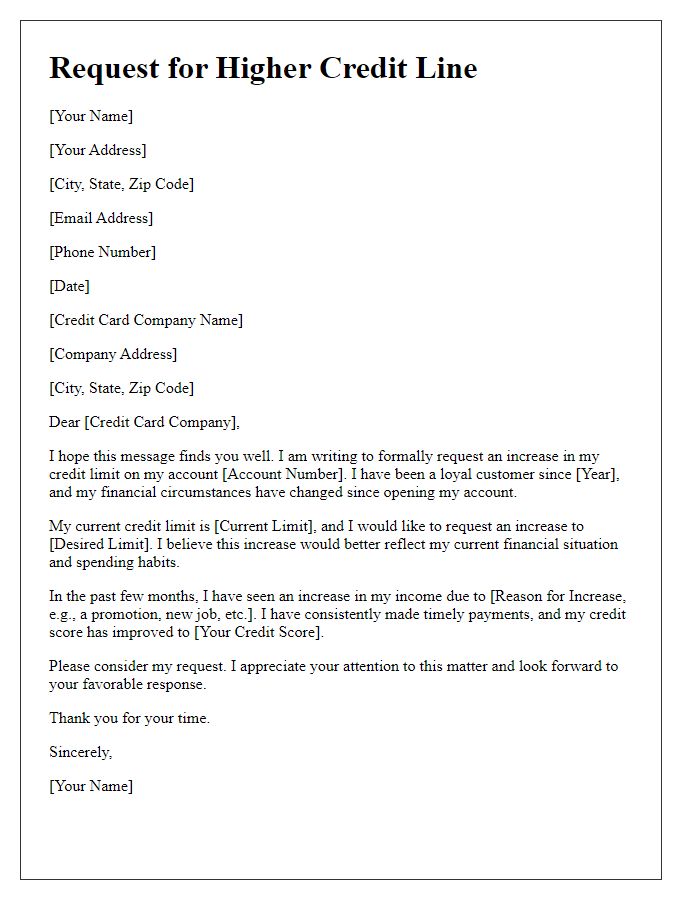

Clear request statement

A clear request statement for a credit line increase can significantly enhance the chances of approval. The request should include specific details, such as the current credit limit, the desired increase amount, and the rationale behind the request. For example, a customer might currently have a credit limit of $5,000 and may seek an increase to $10,000 to manage expenses during a life event, such as a wedding or home renovation project. Mentioning responsible credit usage, such as timely payments and low credit utilization, can strengthen the request. Additionally, including information about increased income or improved financial stability over the last year can add credibility to the request. Providing context helps the lender assess the request favorably, considering it aligns with the company's criteria for credit line increases.

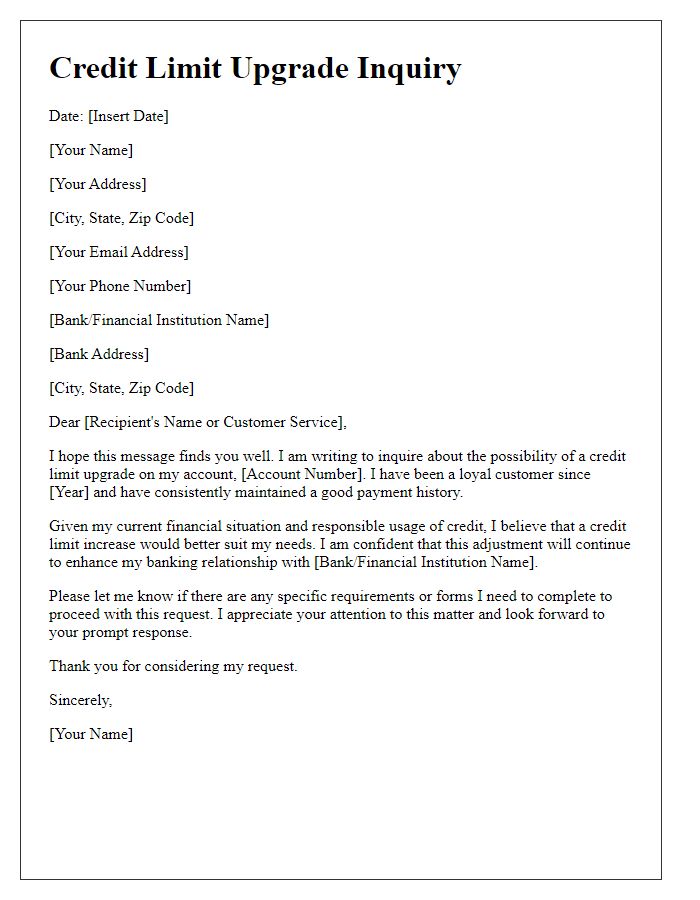

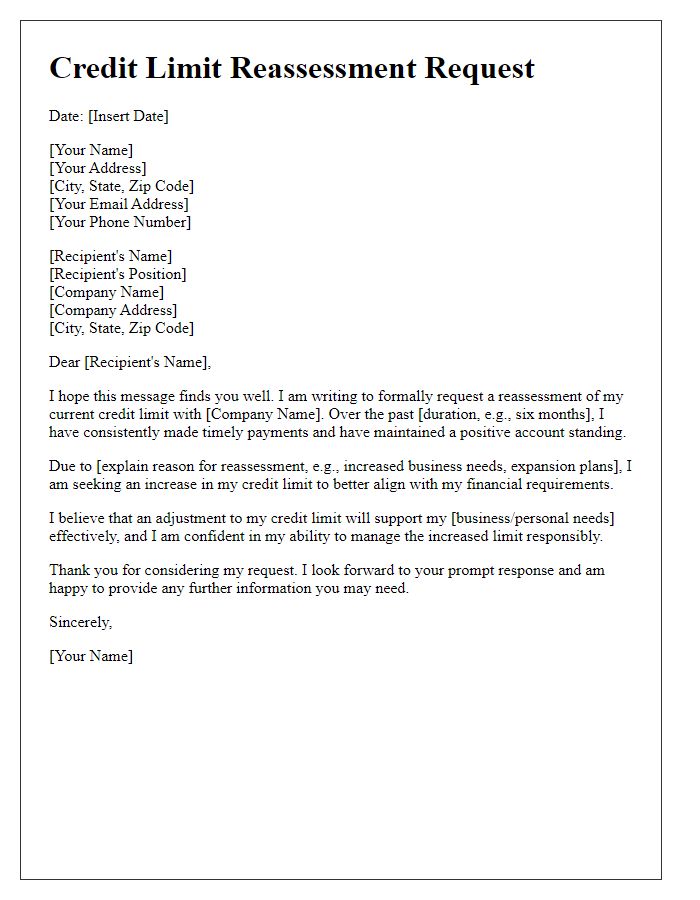

Current account information

A credit line increase request typically revolves around existing financial relationships and account management. For instance, a customer might provide details about their current credit account, including account number (which could be a 16-digit figure), current credit limit (e.g., $5,000), and available balance (e.g., $1,200) to establish context. They may also highlight their payment history, noting that over the last year, they have consistently made monthly payments on time (12 consecutive payments) without late fees. Additionally, mentioning employment stability, such as tenure at a company (e.g., 3 years) or an annual income (e.g., $60,000) can enhance the justification for the increase. This contextual information establishes a solid basis for the credit line increase request.

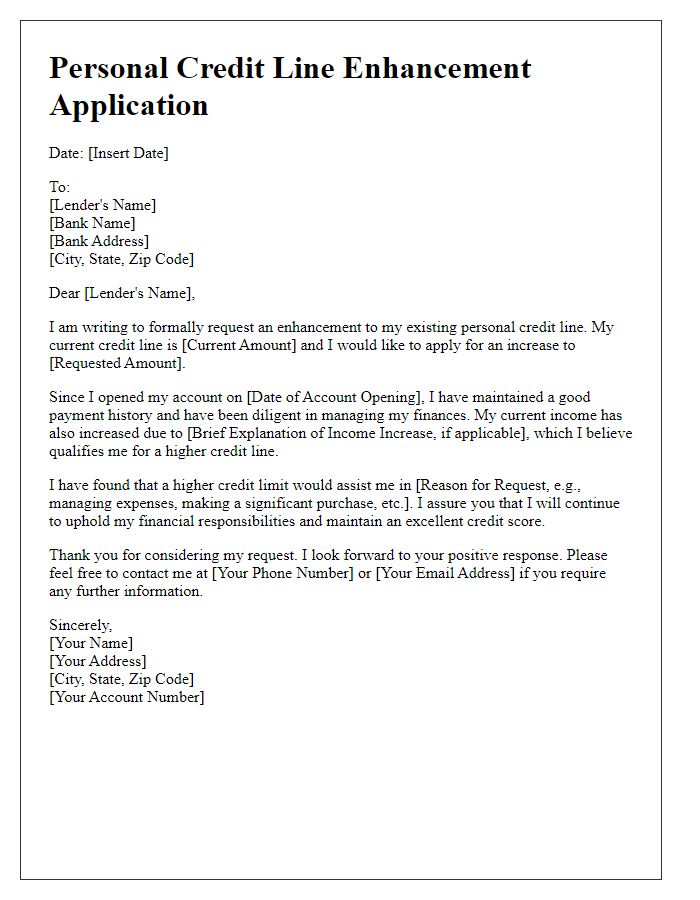

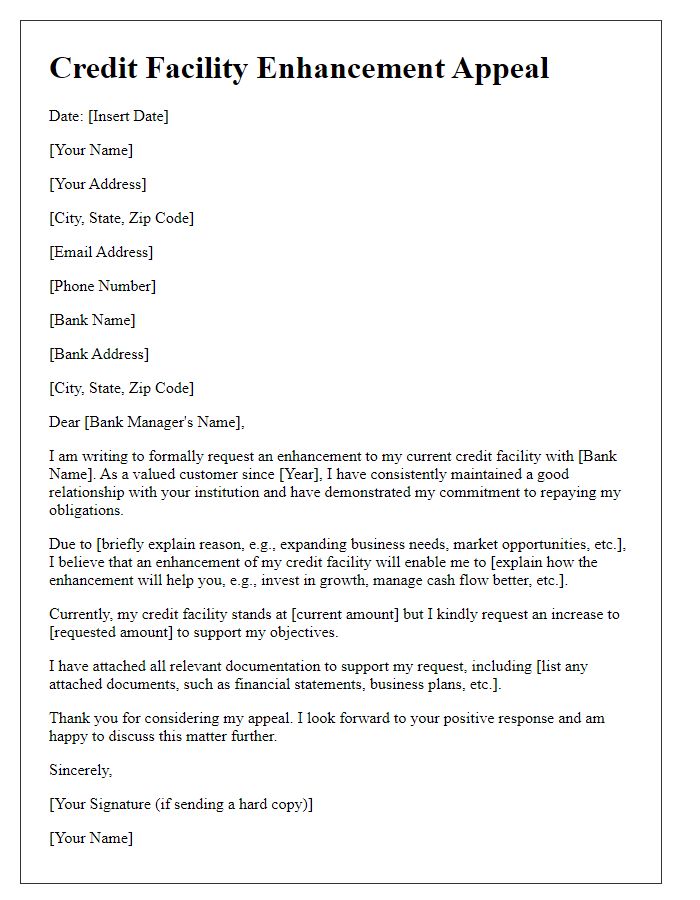

Justification for increase

A credit line increase request often stems from various financial needs and justifications. A solid increase can enhance purchasing power, enabling consumers to manage expenses better, especially during important events like home renovations or travel plans that may require significant upfront costs. Increased credit limits can improve credit utilization ratios, positively impacting credit scores and facilitating future credit applications. Additionally, individuals facing unexpected expenses, such as medical emergencies or vehicle repairs, can benefit from enhanced access to funds, ensuring stability during financial strain. Financial institutions may also look favorably on long-standing clients with consistent payment histories, as this reflects reliability and responsible credit management.

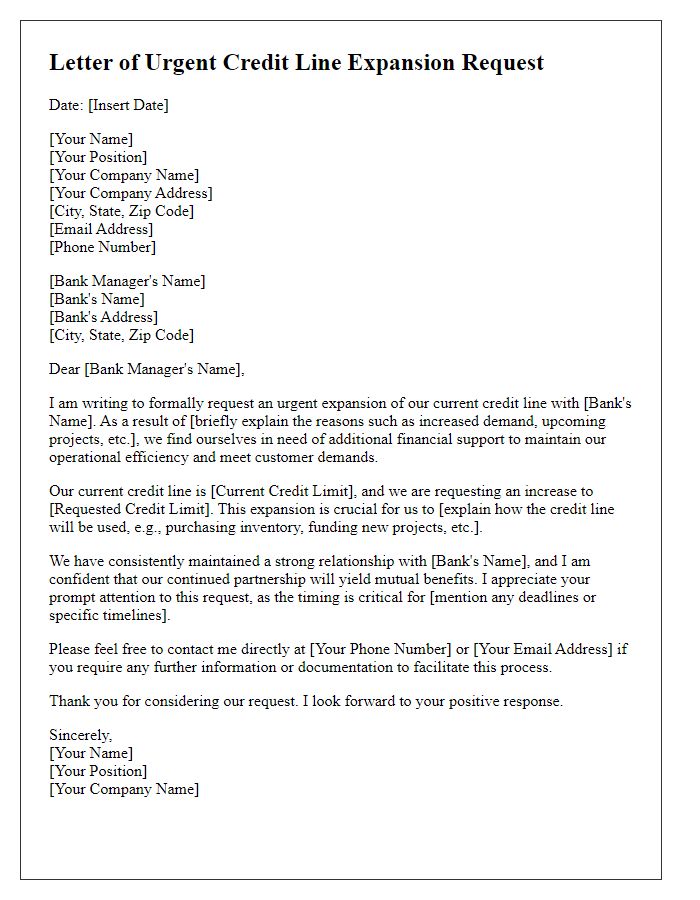

Benefits to the lender

A credit line increase can enhance the lender's portfolio appeal, particularly fostering better customer loyalty and retention among borrowers. When a reliable borrower displays a consistent payment history, such as consistently meeting payment deadlines for over 12 months, lenders can capitalize on this trust by offering increased credit limits. This strategic decision can result in an upsurge in interest income, potentially generating an additional revenue stream of 5% to 10% on existing loans by encouraging higher spending. Furthermore, increased credit lines often lead to higher utilization rates of available credit, allowing lenders to benefit from transaction fees associated with funded purchases. Enhanced credit limits can also improve a lender's competitive edge in the marketplace, attracting new clientele seeking flexible financing options.

Contact information

A credit line increase request is an essential financial document that can help consumers secure additional funds from financial institutions, such as banks. Personal details like full name, address, phone number, and email address (important for identification and communication) must be included clearly. Additionally, account numbers associated with the credit line provide easy reference. The financial institution's name and contact information should also be noted to ensure correct routing of the request. Including current income and employment information can lend support to the request, as financial institutions assess creditworthiness based on these details. Providing a brief explanation of the increase's purpose enhances the request's context, indicating responsible usage and financial planning.

Comments