Are you feeling overwhelmed by relentless debt collection efforts? If so, you're not aloneâmany individuals find themselves in similar situations where debt collectors seem to be everywhere. Fortunately, there are ways to put a stop to this pressure, and one effective method is to send a formal request to halt immediate collection activities. Want to learn how to craft the perfect letter to gain some peace of mind? Read on for helpful tips!

Account Information

The request for an immediate halt on debt collection activities is crucial for individuals facing financial hardship. Specific account information, such as account number and creditor name, must be included clearly to facilitate processing. State laws, particularly under the Fair Debt Collection Practices Act, provide mechanisms for consumers to dispute charges and ask for verification. When initiating this request, it is essential to document the date and method of communication, whether it's a written letter or electronic email, to ensure that the creditor receives notice. Furthermore, individuals should reference any relevant case numbers or previous communications to establish a clear contextual framework for their request.

Immediate Halt Request Statement

Immediate debt collection halt requests often stem from various circumstances requiring debtors to approach the situation judiciously. A cease and desist letter can formally notify collection agencies such as ABC Collections that all collection efforts must stop. Individuals must include relevant personal information, such as the account number (e.g., 123456789) and the specific reason for the request, like financial hardship or ongoing disputes. In accordance with the Fair Debt Collection Practices Act (FDCPA), debtors have the legal right to request communication cessation until the validity of the debt is confirmed. Prompt action on this matter helps avoid potential harassment and maintains the individual's financial dignity.

Reason for Request

The urgent request for an immediate halt to debt collection stems from a recent financial hardship experienced by the individual, specifically loss of employment due to company downsizing during an economic downturn. This unexpected job loss has significantly impacted their ability to meet financial obligations, with monthly expenses, including rent in New York City, totaling approximately $2,500, and outstanding debts accumulating over $15,000. The individual is actively seeking new employment opportunities and anticipates potential interviews within the next month. Moreover, recent medical expenses have added to the financial strain, exacerbating the current situation. A temporary cessation of collection efforts would facilitate a more manageable path towards resolution and financial stability.

Contact Information

Immediate debt collection halt requests demand prompt communication with relevant collection agencies. Accurate contact information such as full name, mailing address, phone number, and email address is critical for processing. Ensure to include the account number associated with the debt for proper identification. Under the Fair Debt Collection Practices Act (FDCPA), consumers possess the right to request a cessation of collection activities until verification of the debt is provided by collectors. Documentation should clearly state intentions to dispute the debt and request cessation of contact under the regulation.

Legal References

A formal request to halt immediate debt collection can be made under the Fair Debt Collection Practices Act (FDCPA), a federal law established in 1977 in the United States. This act prohibits debt collectors from using abusive, unfair, or deceptive practices to collect debts. Under Section 805 of the FDCPA, consumers have the right to request verification of the debt, halting further collection activities until this verification is provided. Additionally, a consumer can legally invoke their rights under state-specific debt collection laws, which may offer further protections depending on the locality, such as California's Rosenthal Fair Debt Collection Practices Act. Citing these legal references reinforces the legitimacy of the request and emphasizes the consumer's rights. Providing relevant personal information, including account numbers and the collector's details, will help streamline the process and ensure that communication is precisely directed.

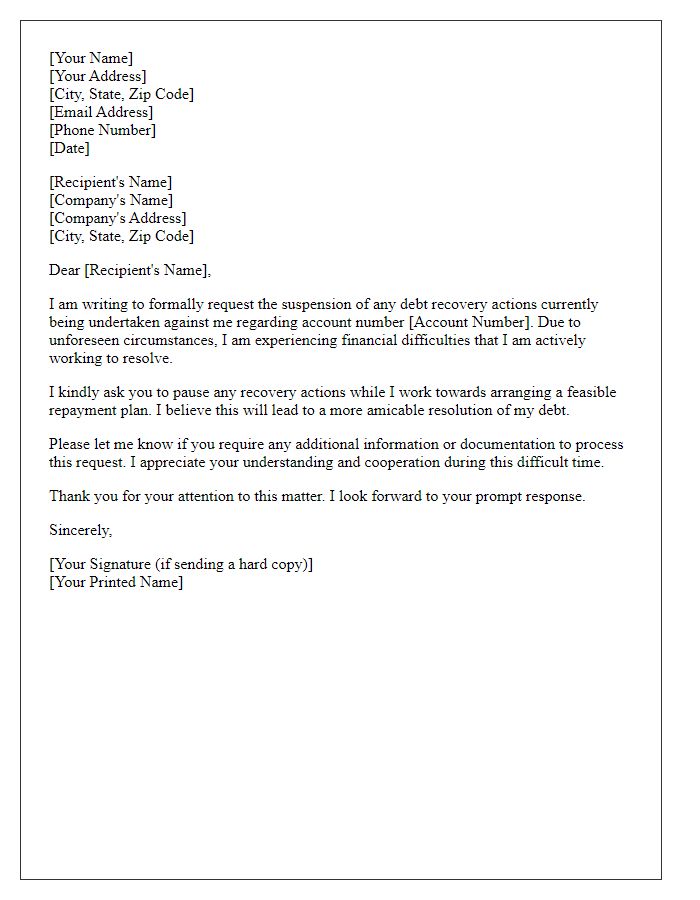

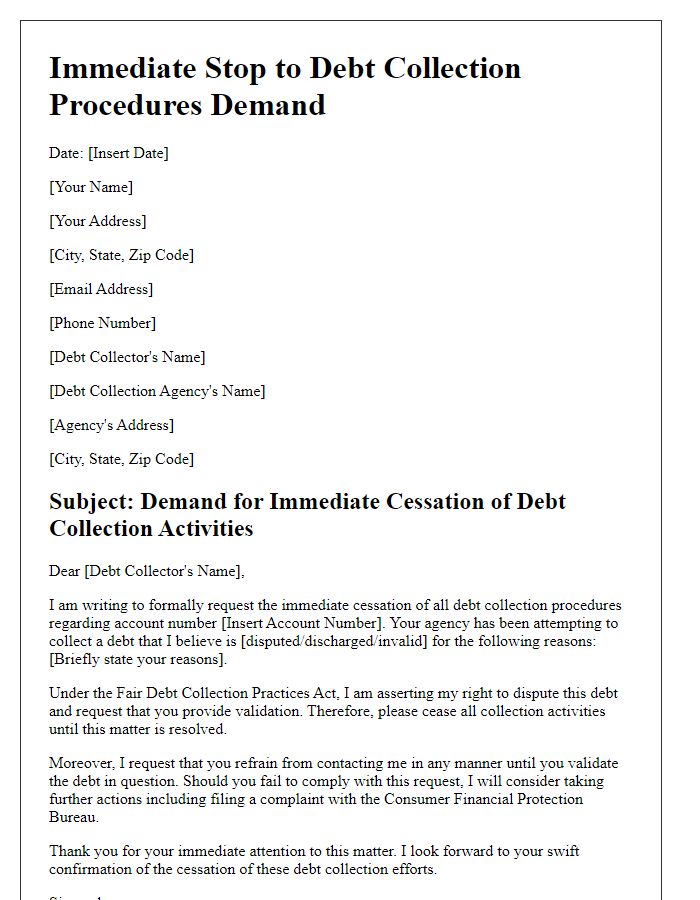

Letter Template For Immediate Debt Collection Halt Request Samples

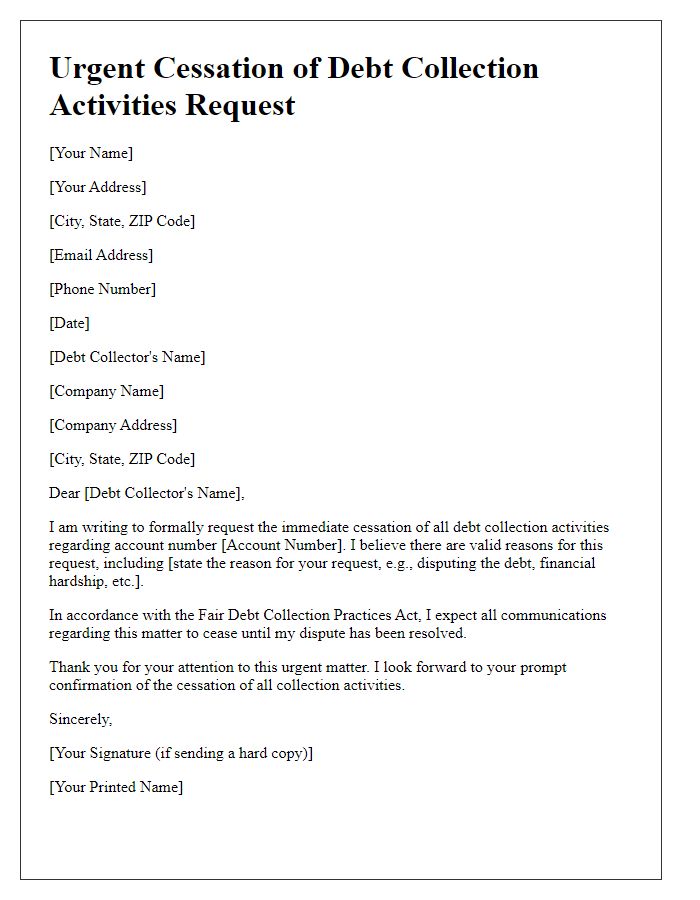

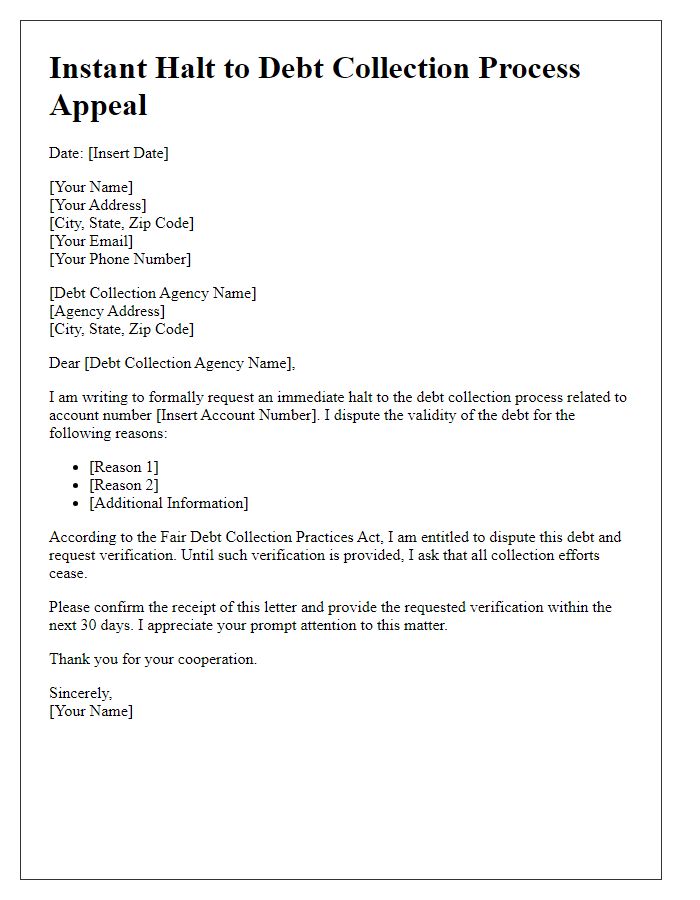

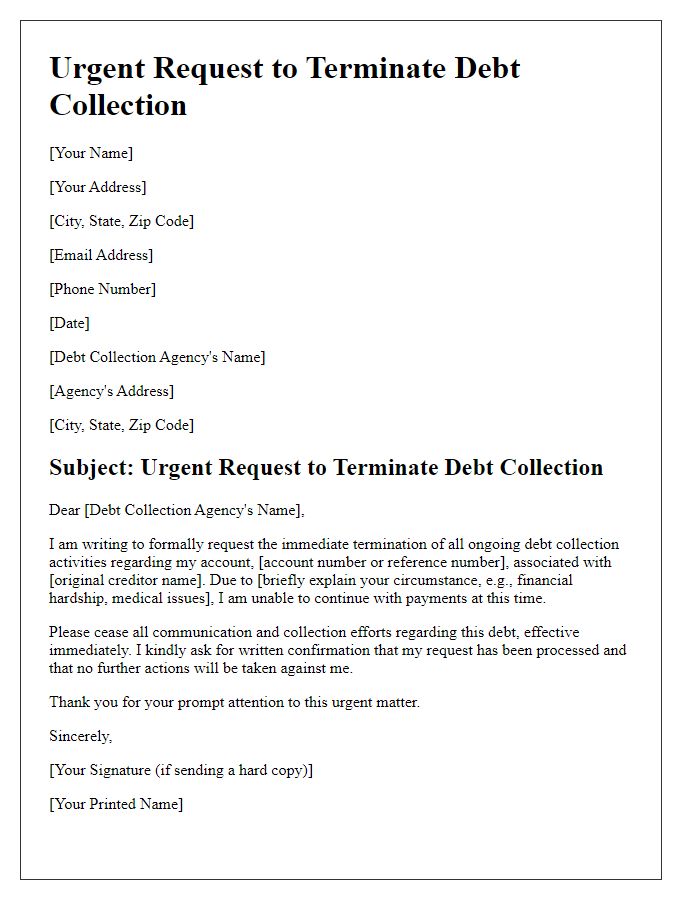

Letter template of urgent cessation of debt collection activities request

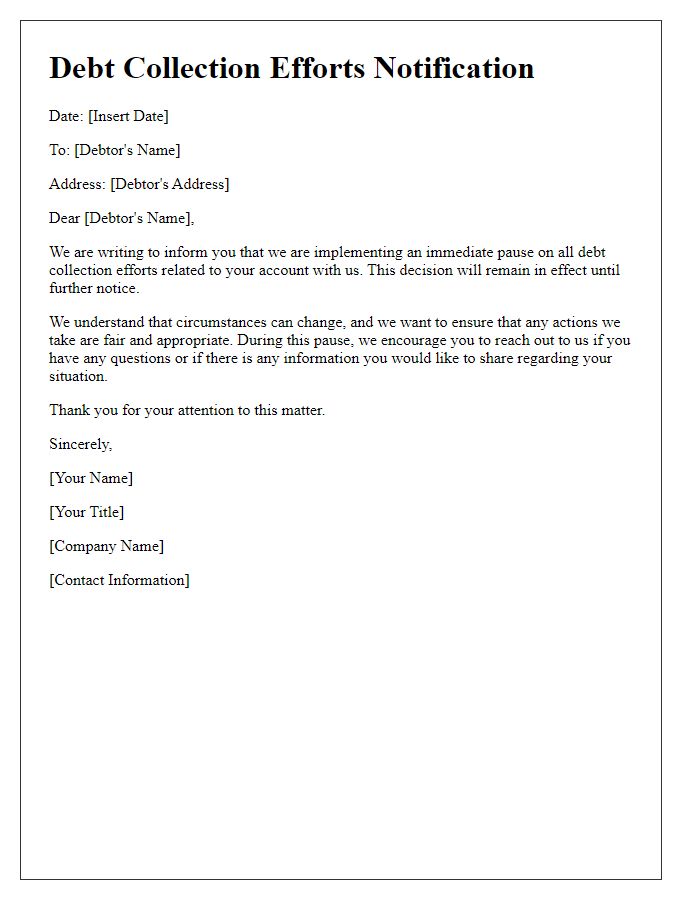

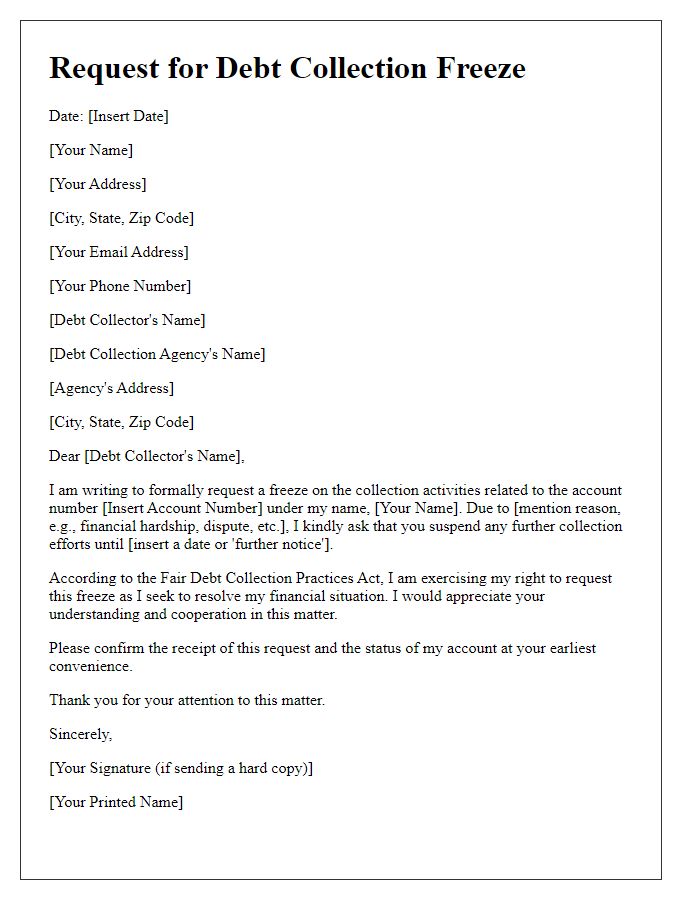

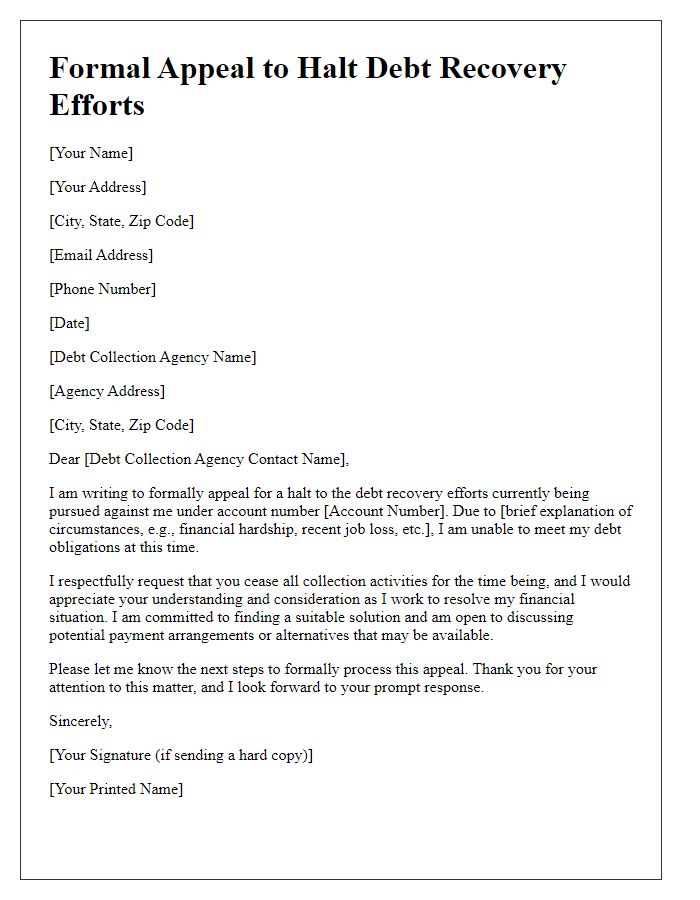

Letter template of immediate pause on debt collection efforts notification

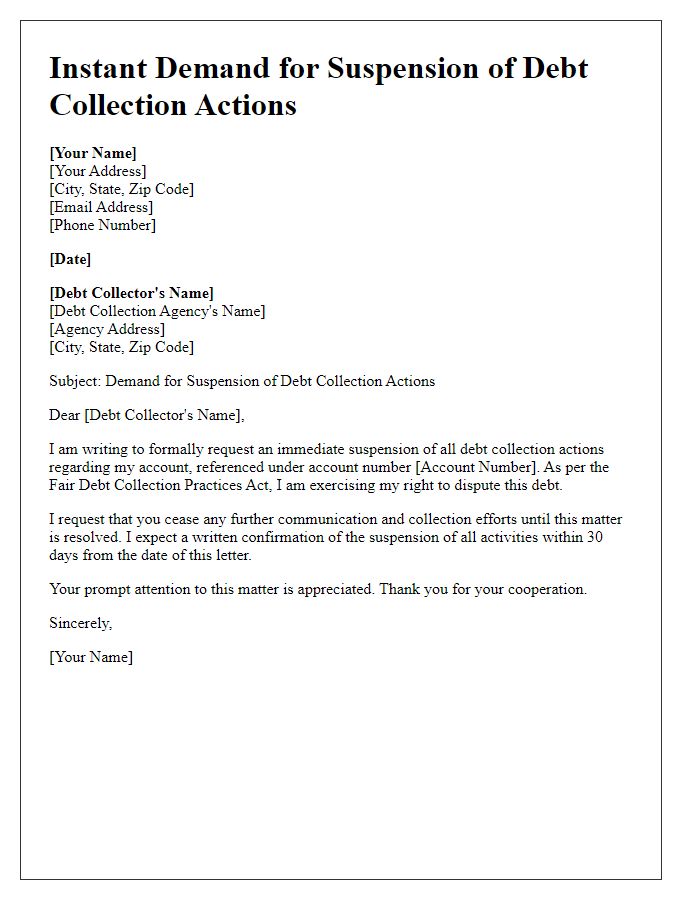

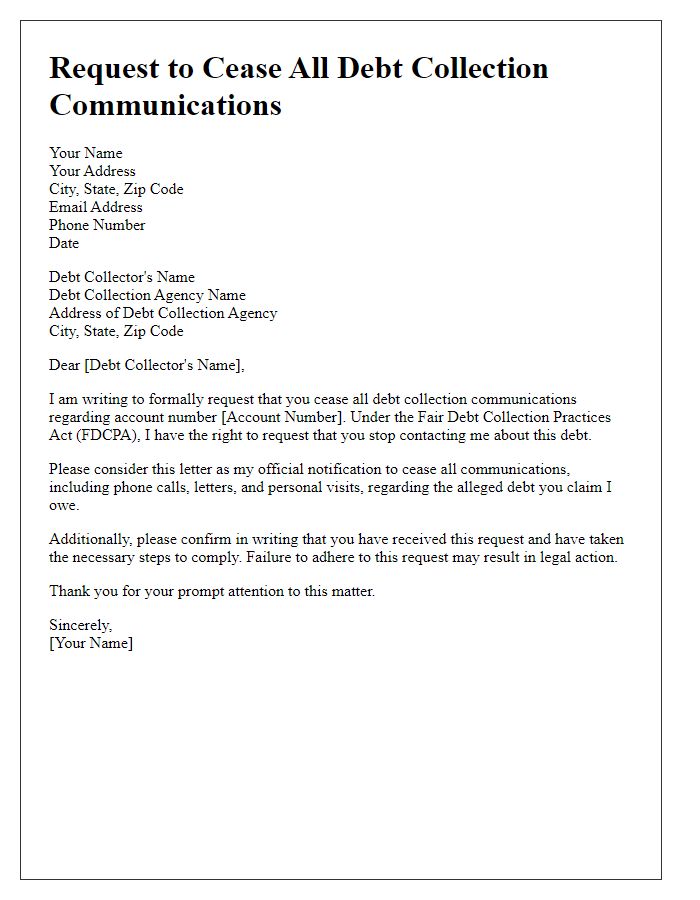

Letter template of instant demand for suspension of debt collection actions

Comments