Are you feeling overwhelmed by your finances and unsure about the state of your debts? It's completely normal to seek clarity, especially when it comes to managing your financial obligations. An independent debt audit can provide valuable insights, helping you understand where you stand and how to regain control of your financial future. Let's explore how this process works and why it might be the solution you've been looking forâread on to discover more!

Clear Subject Line

A thorough independent debt audit is essential for assessing the financial accuracy and transparency of individual debts, particularly for consumers facing multiple liabilities. A qualified financial auditor can identify discrepancies, questionable fees, or inaccuracies within financial statements, which are especially prevalent in revolving credit accounts such as credit cards or personal loans. Engaging an auditing firm with experience in consumer debt, such as those licensed under the American Institute of Certified Public Accountants (AICPA), can provide a detailed analysis of outstanding balances and terms. Additionally, audits can highlight potential avenues for debt relief, including negotiation strategies or validation requests to debt collectors, ensuring consumers fully understand their obligations and rights under the Fair Debt Collection Practices Act (FDCPA). Overall, an independent debt audit serves as a critical tool in achieving a clearer financial pathway.

Formal Salutation

A thorough audit of outstanding debts can provide individuals or organizations with a clear understanding of their financial obligations. An independent debt audit involves a detailed examination of various financial records, credit agreements, and payment histories, ensuring accuracy and transparency. This audit typically includes scrutiny of invoices, loan statements, and interest calculations to uncover any discrepancies. Engaging a certified financial auditor can be crucial, as professionals possess the expertise required for identifying errors or potential fraudulent activities. The location of the audit may significantly influence its comprehensiveness, particularly if it involves multiple creditors or jurisdictions.

Precise Purpose Statement

An independent debt audit serves to thoroughly evaluate financial obligations, ensuring accuracy and transparency in account balances. Engaging a certified audit firm, such as the American Institute of Certified Public Accountants (AICPA), can reveal discrepancies or errors in the reported debts, potentially amounting to thousands of dollars. A detailed forensic analysis can clarify the nature of debts, including outstanding loans, credit card balances, and tax liabilities, enhancing the understanding of personal financial health. The review process typically spans several weeks, involving documentation collection, stakeholder interviews, and comprehensive reporting, which provides valuable insights for effective debt management and strategic financial planning.

Detailed Account Information

Requesting an independent debt audit for detailed account information is a crucial step for consumers seeking clarity on their financial situation. A comprehensive audit can uncover discrepancies in outstanding debts, including specific amounts owed, interest rates, and payment histories related to various lenders or credit agencies. For example, if an individual has multiple credit card balances with varying interest rates (ranging from 14% to 25%) and loans from different financial institutions (such as personal loans from banks like Wells Fargo or Citibank), the audit can provide a clearer picture of their total liabilities. It can also identify any potential errors or fraudulent charges, ensuring the consumer is not held accountable for unjust debts. This proactive approach can empower individuals to make informed decisions regarding debt repayment strategies and financial management.

Contact Information and Signature

Independent debt audits can provide a comprehensive overview of financial obligations, ensuring accuracy and fairness in debt assessment. For individuals seeking to manage personal finances, an audit can identify discrepancies or errors in credit accounts. Engaging a certified public accountant (CPA) or a financial expert can provide insights into debt consolidation options and potential remedies. The audit process typically includes reviewing credit reports, outstanding balances, interest rates, and repayment terms. Consumers located in jurisdictions with stringent consumer protection laws may find additional benefits, such as dispute resolution, through this method. Engaging a debt audit can ultimately empower individuals to take control of their financial health and align their repayment strategies with long-term financial goals.

Letter Template For Requesting Independent Debt Audit Samples

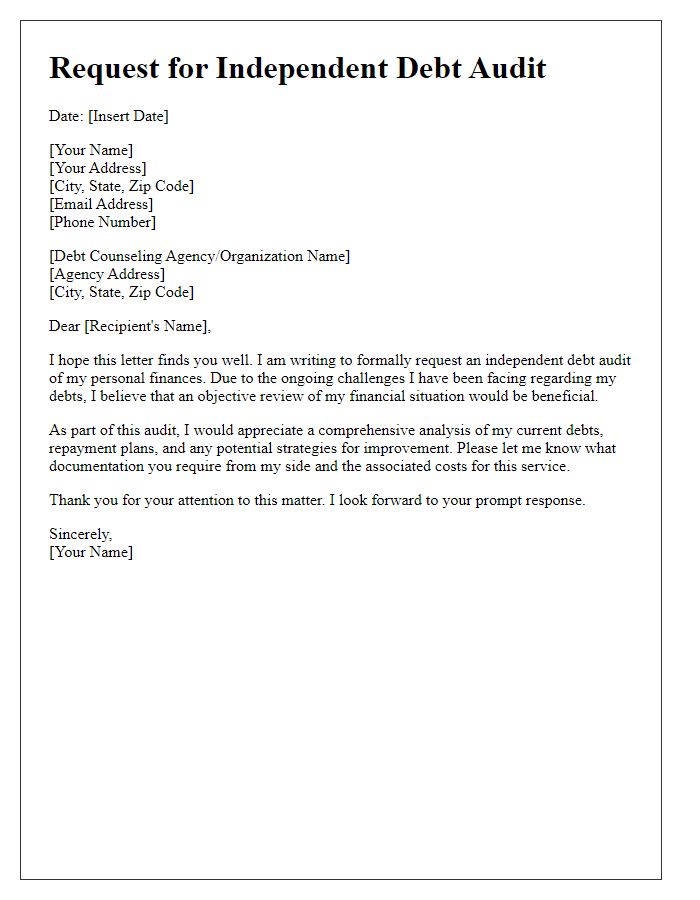

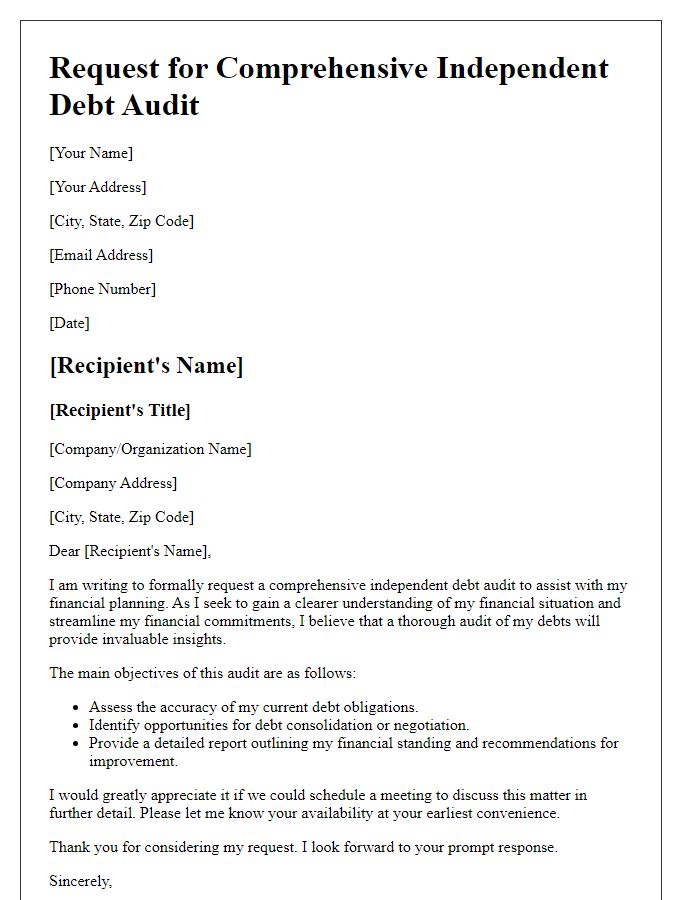

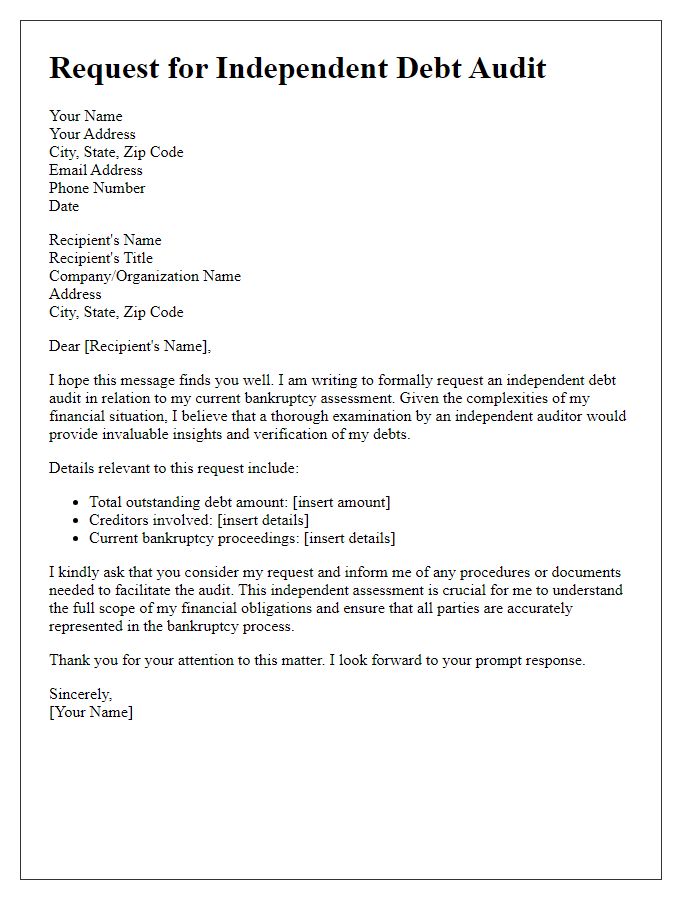

Letter template of request for an independent debt audit for personal finances.

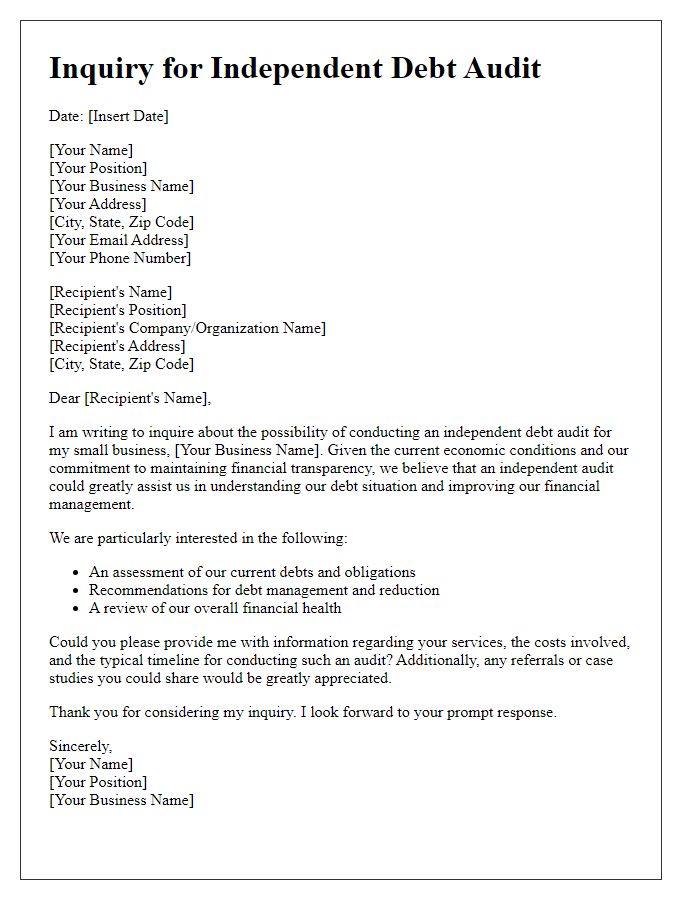

Letter template of inquiry for an independent debt audit for small business.

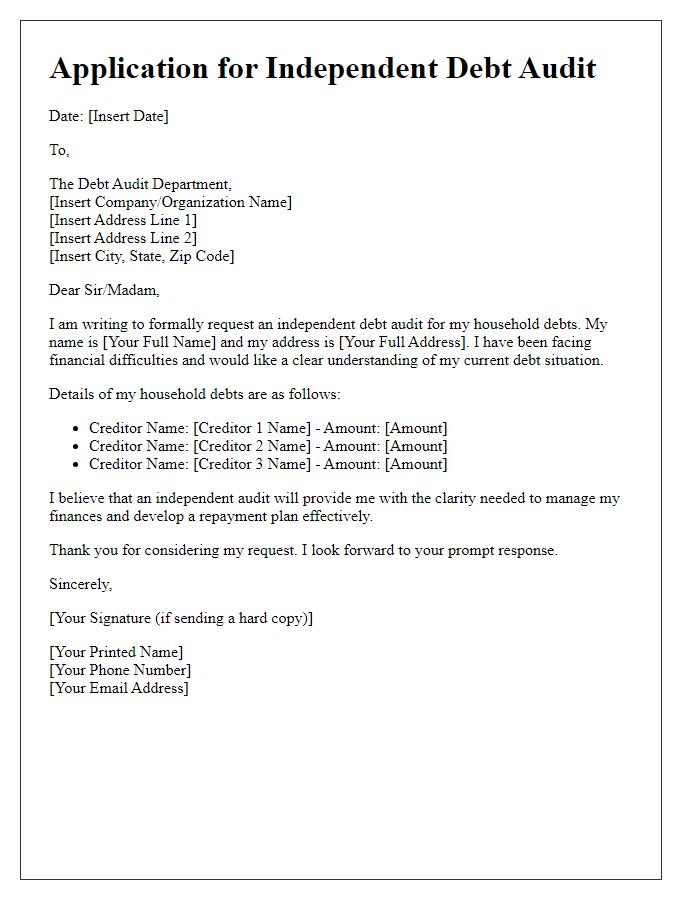

Letter template of application for an independent debt audit for household debts.

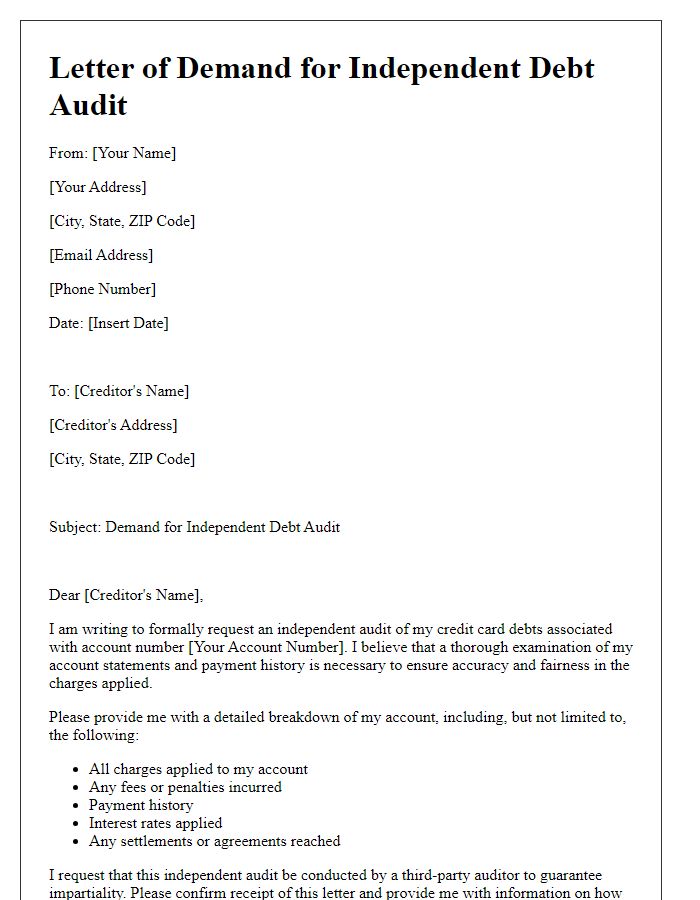

Letter template of demand for an independent debt audit for credit card debts.

Letter template of solicitation for an independent debt audit for student loans.

Letter template of petition for an independent debt audit for mortgage liabilities.

Letter template of appeal for an independent debt audit for corporate debts.

Letter template of notification for an independent debt audit for tax liabilities.

Letter template of request for a comprehensive independent debt audit for financial planning.

Comments