Struggling with tax debt can feel overwhelming, but you're not alone, and there are ways to find relief. Negotiating a tax debt settlement can be a powerful step toward regaining your financial footing, and knowing how to approach this delicate conversation is crucial. In this article, we'll share a practical letter template that will guide you through the negotiation process, making it easier to present your case to the tax authorities. Ready to take control of your financial future? Let's dive in!

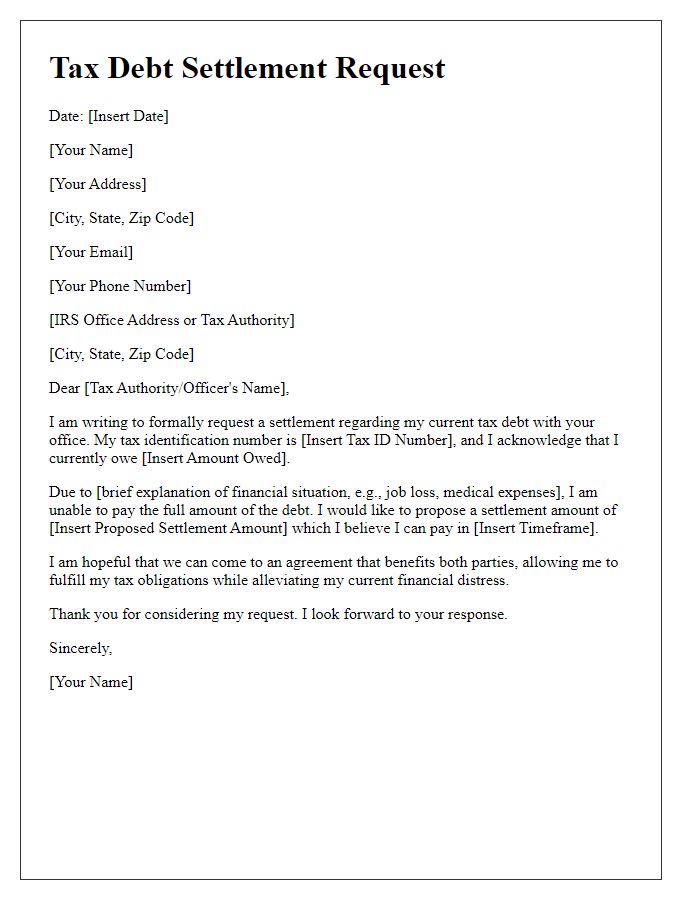

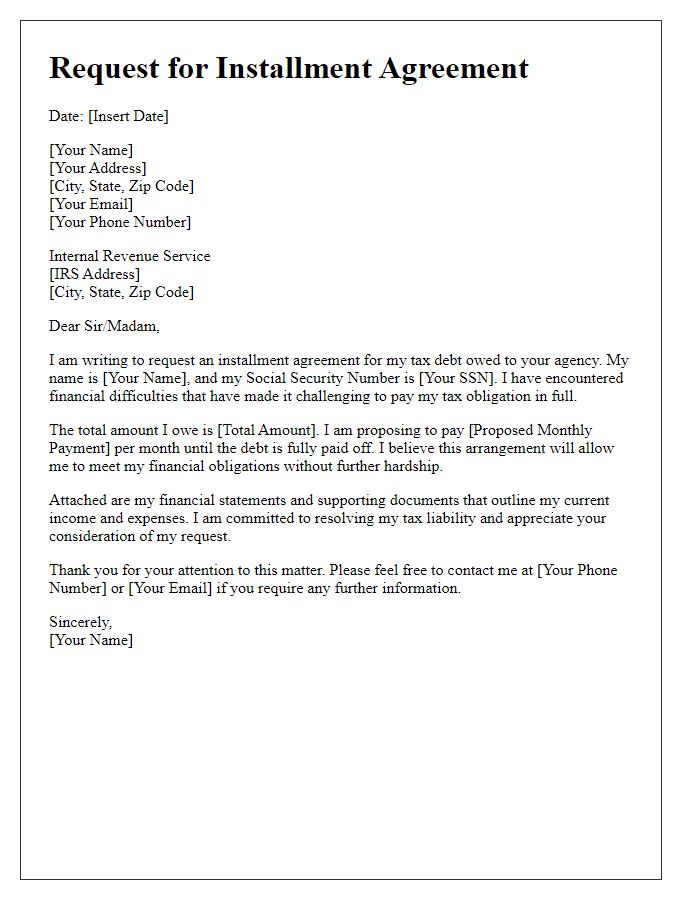

Clear subject line

Negotiating tax debt settlements involves a clear and precise approach. Start with a subject line such as "Proposal for Tax Debt Settlement Negotiation." Outline the proposed settlement amount, specific tax years affected (e.g., 2018, 2019), total outstanding balance (e.g., $20,000), and relevant financial hardships (such as unemployment or medical expenses) impacting your ability to pay. Include a request for consideration of an installment agreement or reduced payment plan. Mention your willingness to provide documentation supporting your financial situation, referencing IRS Form 433 (Collection Information Statement). Finally, express appreciation for their assistance and consideration of your proposal, emphasizing your commitment to resolving your tax obligations responsibly.

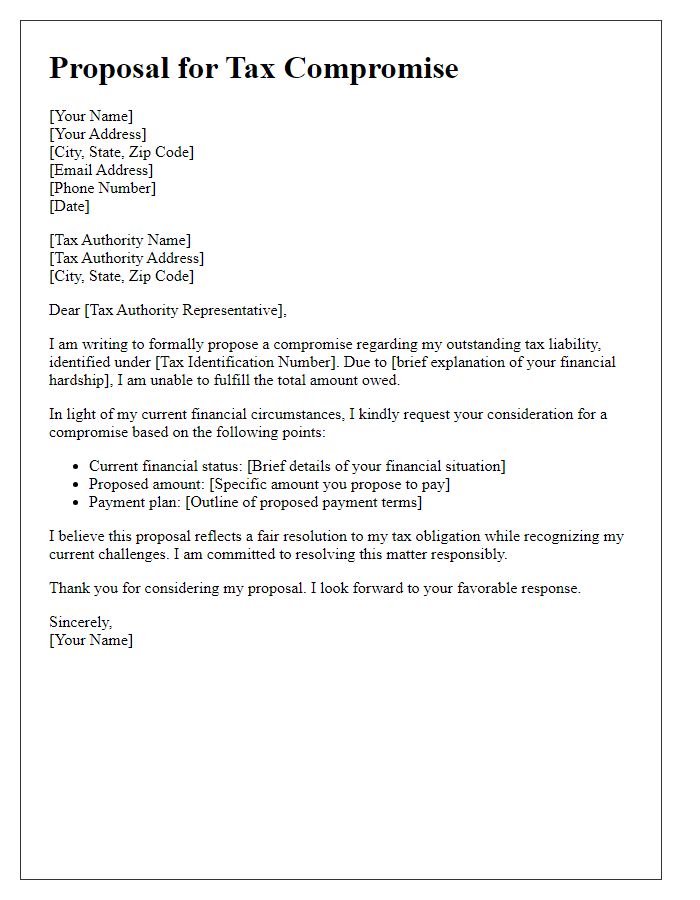

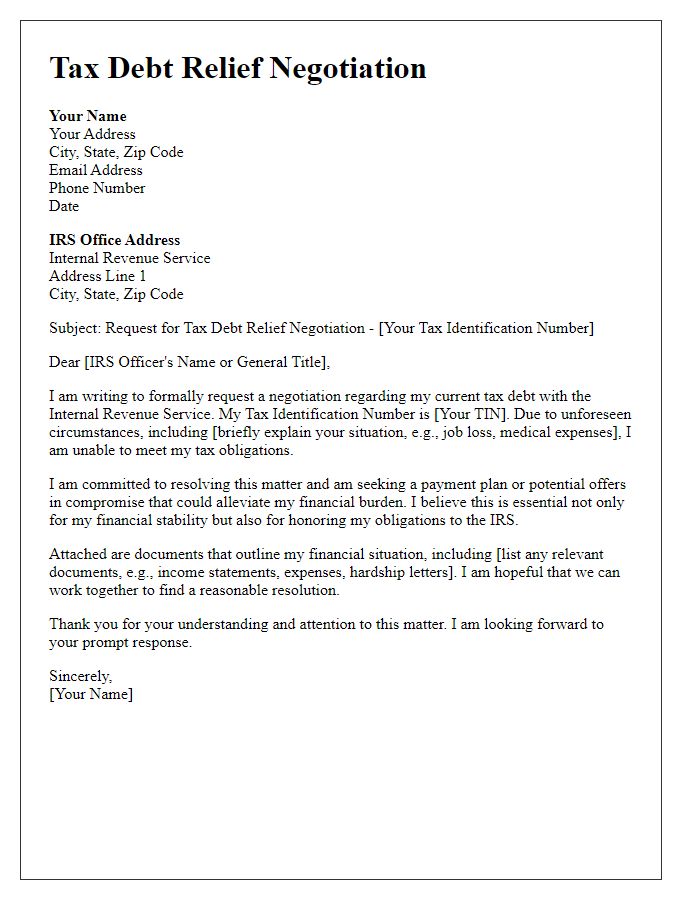

Accurate account information

Tax debt settlement negotiations require precise account information to effectively address outstanding liabilities. The Internal Revenue Service (IRS) or your local tax authority assesses your debt based on your income, expenses, and asset information. Providing accurate details, such as your total outstanding balance, any interest accrued, and penalties incurred, is essential for transparency. Documented evidence, including pay stubs, bank statements, and expense reports, supports your financial claims. An accurate negotiation process can lead to potential resolutions such as an Offer in Compromise, which allows individuals to settle their tax debt for less than the full amount owed, or installment agreements that create manageable payment plans. Consistency in reporting financial information can lead to favorable outcomes in tax negotiations.

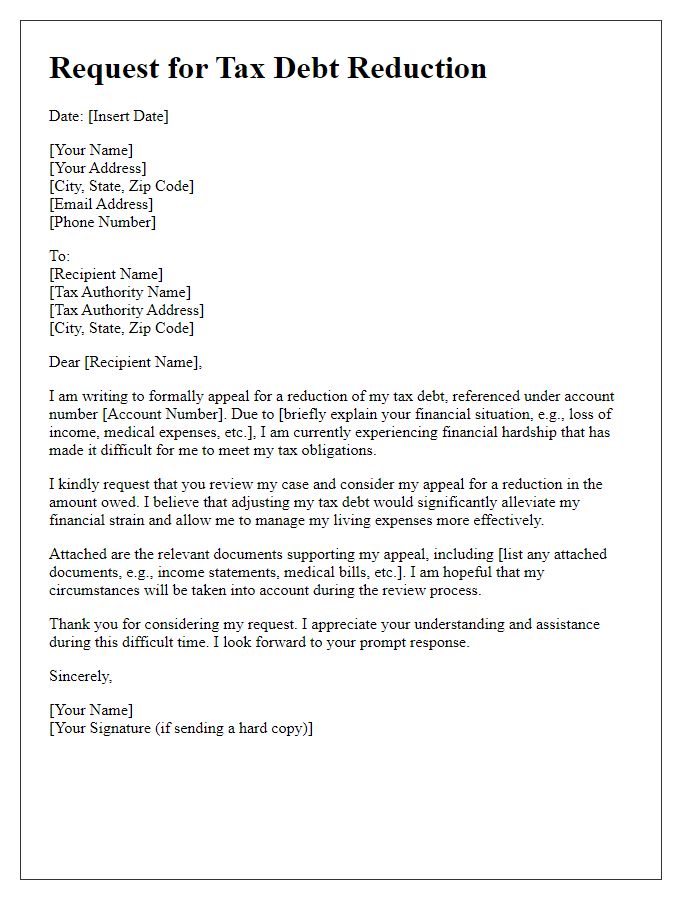

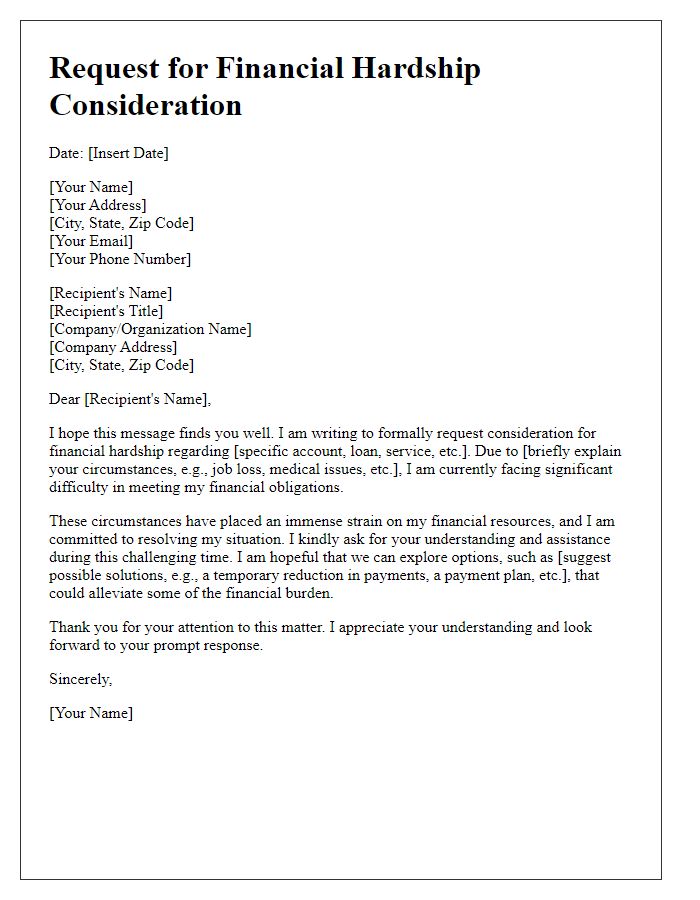

Detailed financial situation

Financial difficulties can lead individuals to seek tax debt settlements, especially when dealing with outstanding amounts owed to the Internal Revenue Service (IRS). For example, a person earning an annual income of $45,000 may face unexpected medical expenses, totaling $10,000, that significantly reduce disposable income. Additionally, household expenses in urban areas, such as Los Angeles, may reach $2,500 monthly, encompassing rent, utilities, and groceries. When combined, these financial pressures can make repaying a tax debt of $15,000 unmanageable. A taxpayer in this scenario can provide documentation, such as bank statements and a budget breakdown, to demonstrate hardship effectively. Utilizing IRS resources like the Offer in Compromise program can offer negotiated settlement terms based on a taxpayer's unique financial landscape, allowing them the possibility of paying less than the full amount owed, ultimately helping to achieve financial relief and a fresh start.

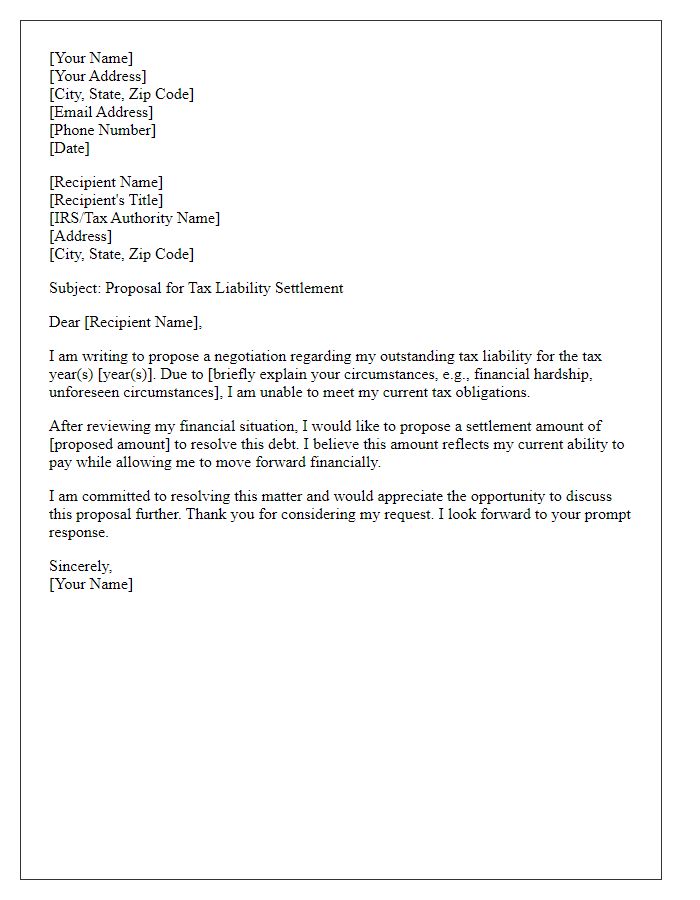

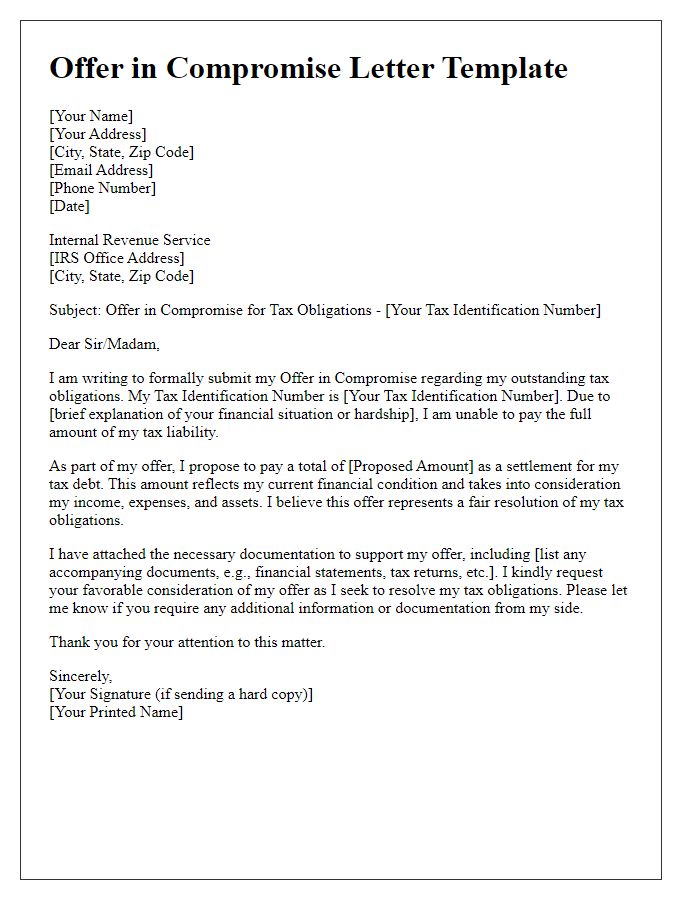

Proposed settlement amount

Negotiating tax debt settlements can be an intricate process involving specific financial figures and relevant personal information. Individuals often face challenges with tax authorities, such as the Internal Revenue Service (IRS) in the United States, due to outstanding obligations that may stem from various sources, including income discrepancies or missed payments. A proposed settlement amount typically corresponds to the total outstanding balance owed, which can include penalties and accrued interest over time. For instance, if an individual owes $10,000, they may suggest a settlement of $5,000, reflecting their current financial capacity. Additionally, demonstrating hardship through detailed documentation, such as income statements, monthly expenses, and proof of assets, can immensely support the negotiation efforts, leading to a potential resolution that alleviates financial burden while satisfying tax obligations.

Justification for proposal

Negotiating tax debt settlement requires a thorough understanding of your financial situation, such as outstanding liabilities, income levels, and any extenuating circumstances that led to the inability to pay the full amount owed to the Internal Revenue Service (IRS). A proposal should outline the total tax debt, specifying the year or years it pertains to, and justify why a settlement is necessary. For instance, presenting documentation about job loss, medical bills, or other financial hardships can support the claim. Including a proposed monthly payment plan reflecting realistic capabilities based on current cash flow, alongside an explanation of how this plan allows for both debt repayment and essential living expenses, aids in persuading tax authorities. Highlighting willingness to comply with future tax obligations, alongside commitment to settle debt, can strengthen the negotiation stance.

Comments