Are you feeling overwhelmed by your mortgage payments and searching for ways to ease the financial strain? Crafting a compelling letter for a mortgage payment reduction can be your first step toward regaining control over your budget. In this article, we'll guide you through the essential elements of a well-structured request that lenders look for, ensuring your plea stands out. So, let's dive in and explore how you can take charge of your financial future!

Borrower's Financial Hardship

Borrowers experiencing financial hardship often request a mortgage payment reduction due to life-changing events such as job loss, medical emergencies, or unexpected expenses. A significant number of individuals facing economic challenges may seek assistance from their lenders, hoping to negotiate affordable payment terms. For instance, in 2021, it was reported that approximately 8 million homeowners in the United States sought mortgage relief during the economic downturn caused by the COVID-19 pandemic. Mortgage servicers typically evaluate each case based on the homeowner's current financial situation, including income information, expenses, and debt obligations to determine eligibility for programs such as loan modification, forbearance, or repayment plans. Providing detailed documentation and a clear explanation of the hardship can enhance the likelihood of a favorable outcome.

Requested Payment Adjustment

In financial negotiations, a mortgage payment reduction request can significantly alleviate monthly expenses, providing relief to homeowners facing economic hardships. Borrowers may reference specific circumstances, such as job loss, medical emergencies, or natural disasters, like Hurricane Katrina in 2005, which highlighted the vulnerability of many homeowners. Institutions, such as Fannie Mae, often provide guidelines for requesting modifications. A thorough examination of the loan details, including the principal balance and current interest rates, can strengthen the case for adjustment. Additionally, submitting supporting documentation, such as income statements and expenses, plays a critical role in illustrating the need for a payment reduction. Timely communication with the mortgage servicer is essential for a smoother negotiation process.

Current Loan Details

Current mortgage details include principal balance ($300,000), interest rate (3.5%), payment term (30 years), and monthly payment amount ($1,347). This loan is secured by the property located at 123 Main Street, Anytown, which has experienced a decrease in market value (approx. 10% reduction) due to economic conditions. Current financial challenges include job loss and increased living expenses, leading to difficulty in maintaining regular mortgage obligations. This situation necessitates a formal request for mortgage payment reduction to alleviate financial strain and avoid foreclosure.

Supporting Documentation

A mortgage payment reduction involves submitting a request to a lender to lower monthly payments based on financial hardship or changes in income. Supporting documentation includes recent pay stubs (typically last two months), bank statements (covering the past three months), tax returns (previous two years), a cover letter detailing the reasons for the request, and any other relevant documents such as medical bills or job loss letters. These documents provide evidence of financial circumstances, demonstrating the necessity for reduced payments to ensure continued homeownership. Timely submission enhances the chances of approval for more manageable mortgage terms.

Contact Information

Homeowners facing financial hardship may seek a mortgage payment reduction through a formal letter to their lender. Essential elements include the homeowner's name and address, along with the mortgage account number, ensuring the lender can efficiently process the request. The current lender's name, department, and address must also be clearly stated, establishing the communication channel. In the letter, details of the homeowner's financial situation should include any relevant events, such as job loss or unexpected medical expenses, which have significantly impacted income. Specific requests for reduced payments, along with preferred terms and the reason for the request, should be outlined concisely. Additionally, including supporting documents like pay stubs, bank statements, or tax returns will enhance credibility and aid in the lender's assessment.

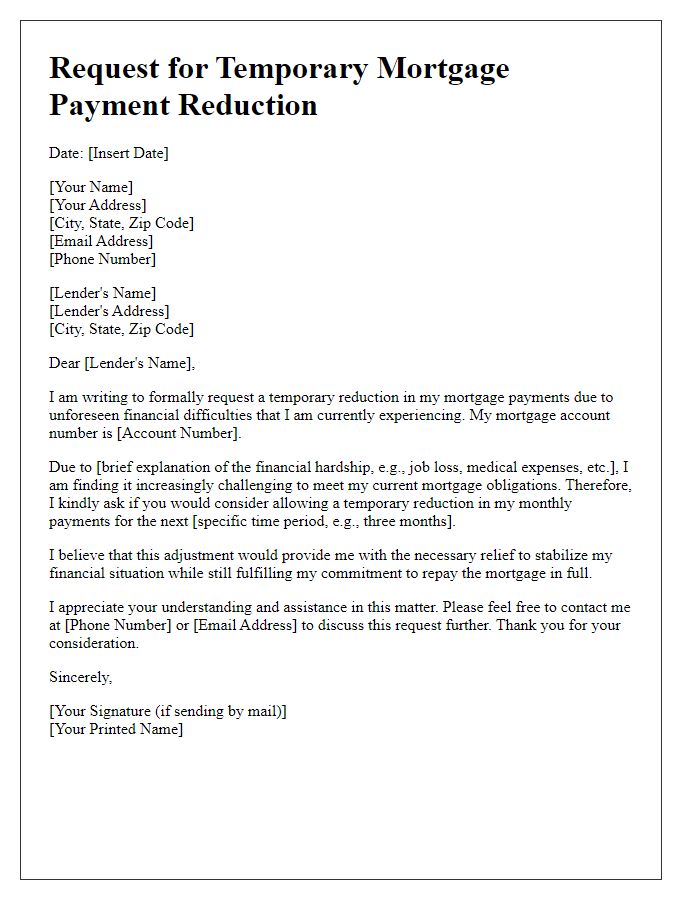

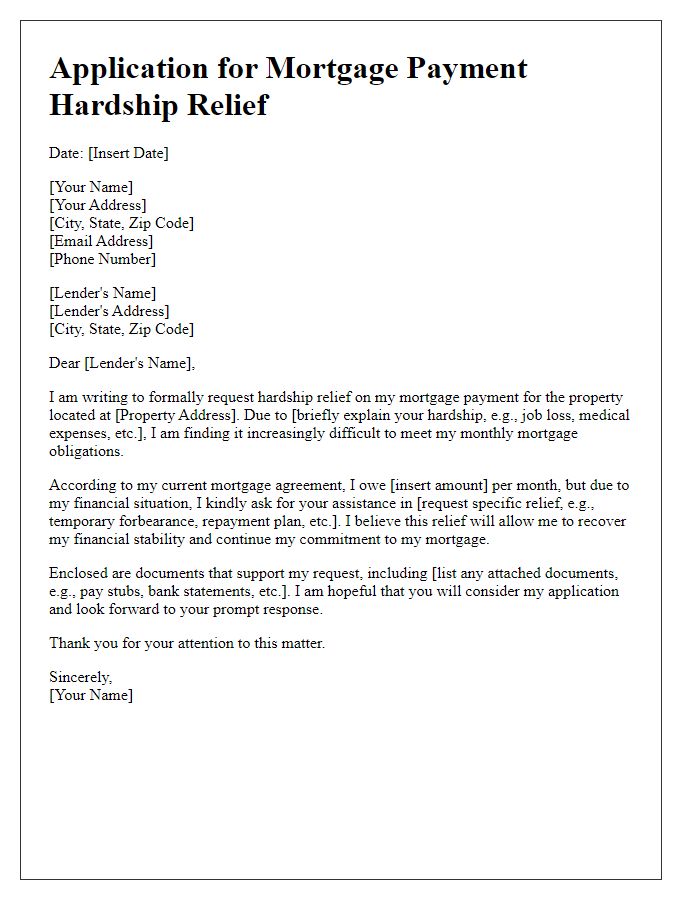

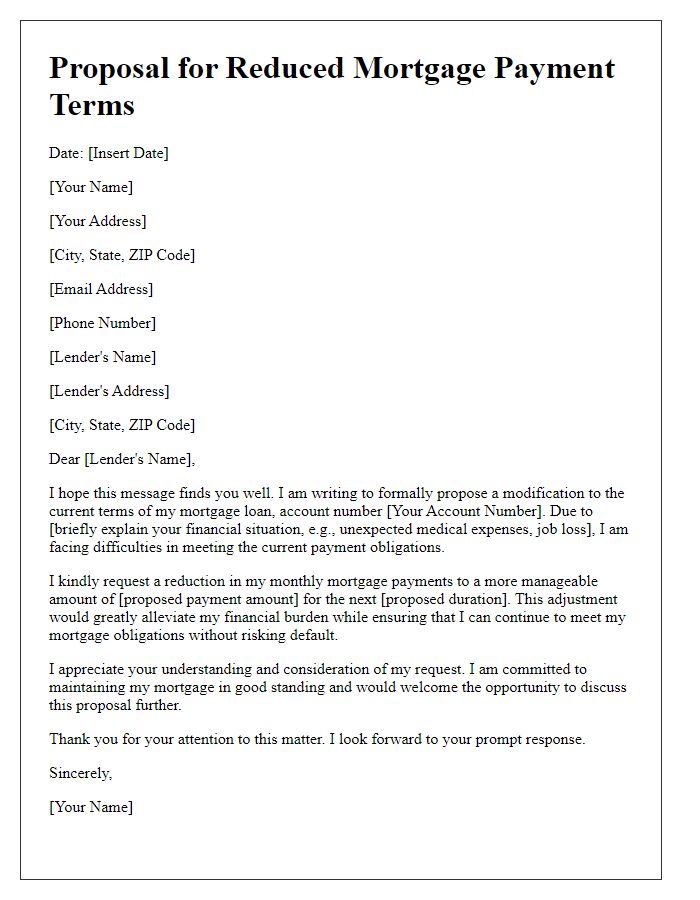

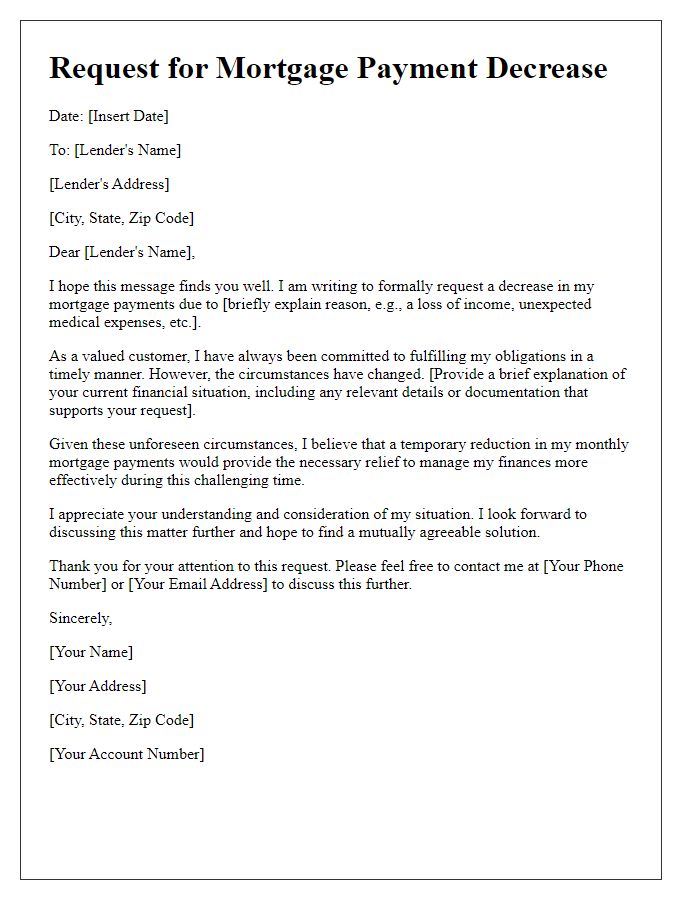

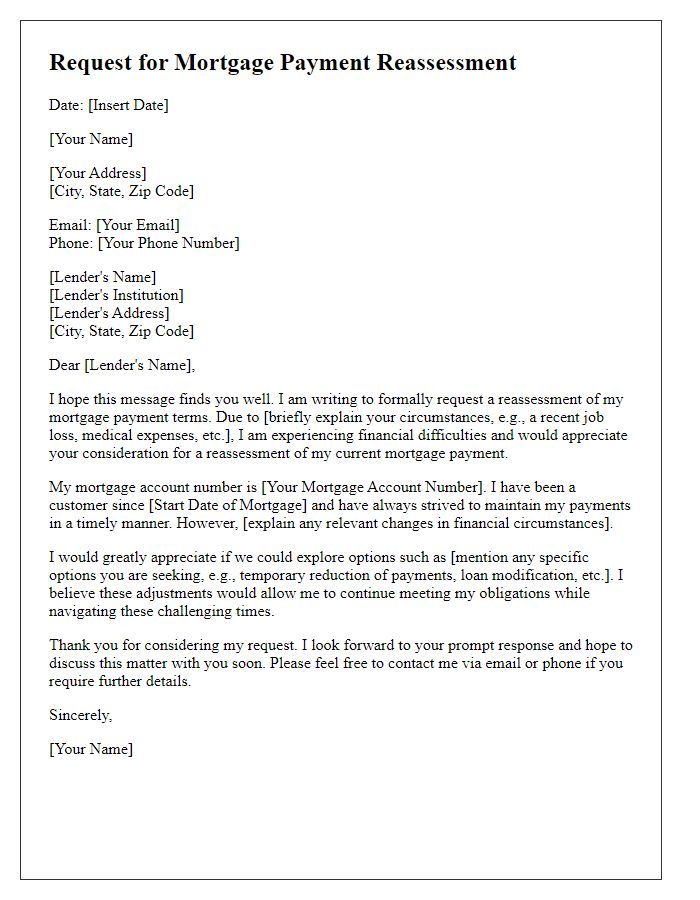

Letter Template For Mortgage Payment Reduction Samples

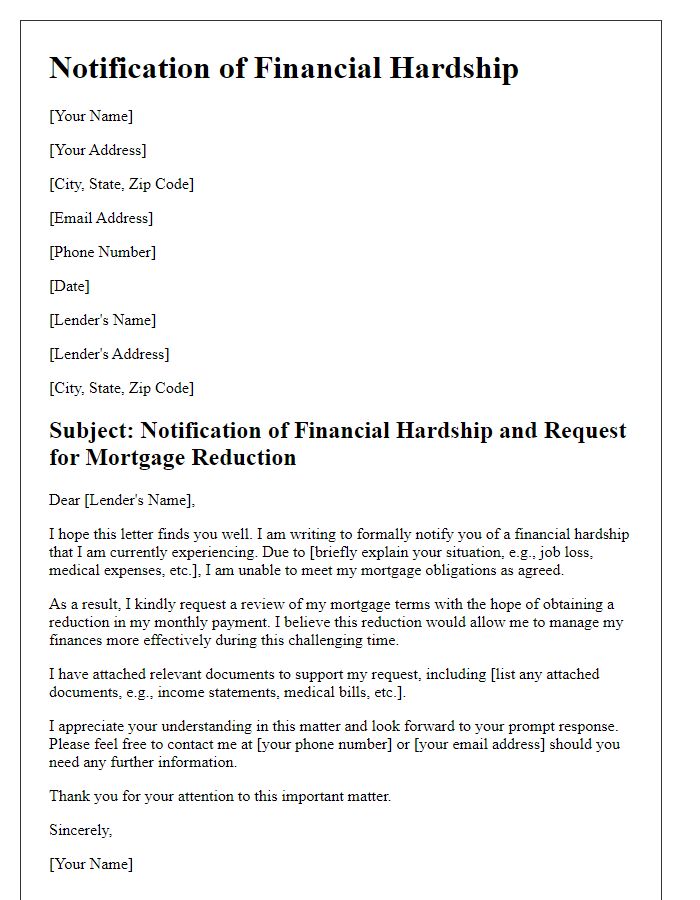

Letter template of notification for financial hardship and mortgage reduction

Comments