Are you feeling stressed about a wage garnishment notice? It's essential to understand that you do have options when faced with this situation. In this article, we'll guide you through a letter template that can help you formally object to the garnishment. So, if you're ready to take control of your financial future, keep reading to discover the steps you can take to protect your hard-earned wages!

Personal Information (Name, Address, Contact Details)

Wage garnishment objections involve a complex legal process. Individuals experiencing garnishment may face significant financial strain, especially if their essential needs are jeopardized. Documentation, such as the garnishment order, must be gathered carefully. Local laws and regulations, like those established under the Fair Debt Collection Practices Act in the United States, provide a framework for legal response. Formal communication can be sent to the court or creditor involved, often requiring precise wording and adherence to specified timelines. Legal representation is advisable, given the potential implications for income and credit score. Exploring options such as payment plans or settlement agreements may provide relief from garnishment.

Case Details (Case Number, Creditor Information)

Wage garnishment laws can significantly impact an individual's financial situation, particularly with cases involving legal judgments. The case number (specific identifier assigned to the legal proceeding) serves as a critical reference point for tracking related documents and actions. Creditor information (details about the entity or individual to whom the debt is owed, including name, address, and contact information) plays a vital role in understanding the legitimacy and background of the garnishment. Individuals looking to contest wage garnishment must typically prepare a formal objection, which addresses these case fundamentals. Proper documentation submitted to the court needs to articulate valid reasons for disputing the garnishment, such as inaccuracies in the debt amount, improper notification processes, or requests for hardship exemptions. Timeliness (often required within a specific timeframe after receiving the garnishment notice) is crucial for ensuring that objections are considered legally valid.

Legal Grounds for Objection (Specific Laws, Documentation)

Wage garnishment can have significant financial implications for individuals, often leading to reduced disposable income and stress. Under the Consumer Credit Protection Act (CCPA), specific limitations exist regarding the amount that can be garnished, typically capped at 25% of disposable earnings. Additionally, state laws may impose further restrictions; for example, in California, the garnishment limit is lower at 20% for disposable earnings. Documentation required for an objection may include pay stubs reflecting income, evidence of financial hardship, and a formal objection letter citing relevant statutes. Furthermore, the Fair Debt Collection Practices Act (FDCPA) provides protections against abusive collection practices, which could bolster an objection. It's crucial to address these legal frameworks to present a compelling case against wage garnishment.

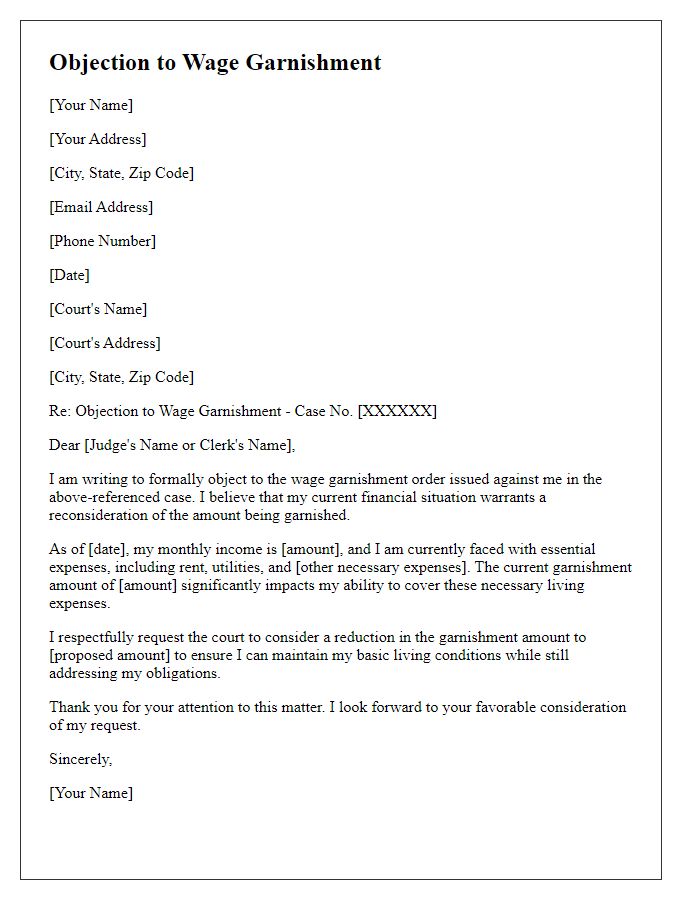

Financial Hardship Explanation (Income Details, Expenses)

Wage garnishment can lead to significant financial strain, particularly for individuals facing economic hardship. Monthly income from sources such as salaries or benefits, which typically falls within the range of $2,500 to $4,000, often needs to be stretched to cover essential expenses. Rent or mortgage payments may account for around 30% to 40% of total income, while utilities, groceries, and transportation add an additional burden of approximately $800 to $1,200 monthly. Unexpected medical bills or child care expenses can further exacerbate this financial strain, pushing the total monthly expenses beyond available income. Consequently, wage garnishment can leave individuals in an untenable situation, struggling to meet basic living standards, highlighting the need for reconsideration or modification of garnishment orders in cases of demonstrated financial hardship.

Request for Hearing or Resolution (Dates, Additional Evidence)

Wage garnishment objections require timely action and documentation to ensure a fair resolution. When disputing a wage garnishment notice issued by a creditor, it is critical to reference specific dates such as the notice receipt date (usually within the past 30 days) and the scheduled hearing date (often set by the court). Additional evidence, which might include financial statements, pay stubs, or proof of exemption eligibility (like child support obligations or undue hardship), should clearly support the argument against the garnishment. Each state, such as California or New York, has different procedures and regulations regarding wage garnishments that may affect the objection process, so understanding the applicable laws is essential for an effective challenge. It is vital to maintain a detailed record of all communications with the court and creditor to substantiate claims made during the hearing or negotiation process.

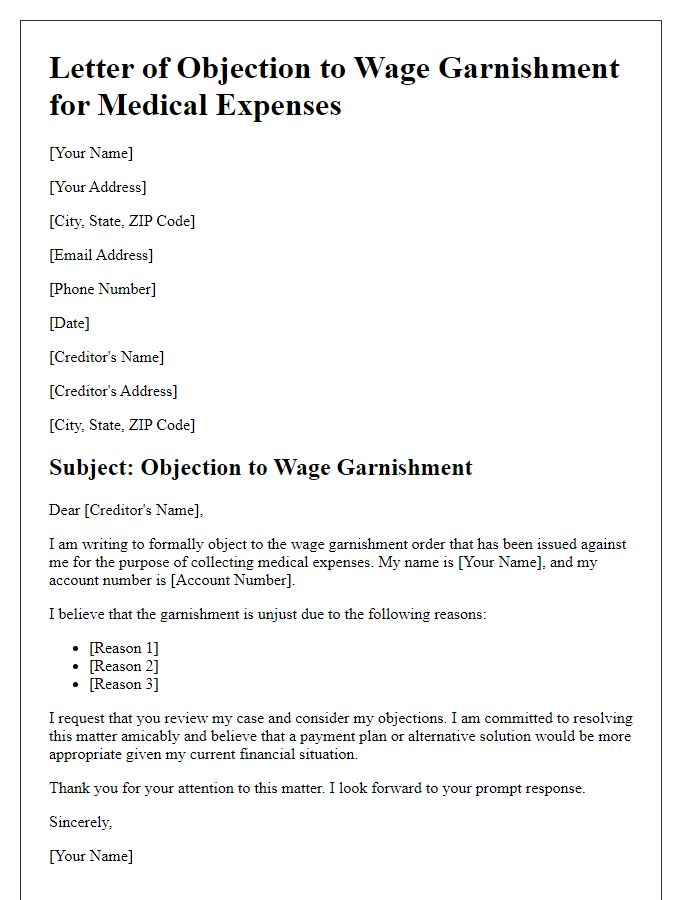

Letter Template For Wage Garnishment Objection Samples

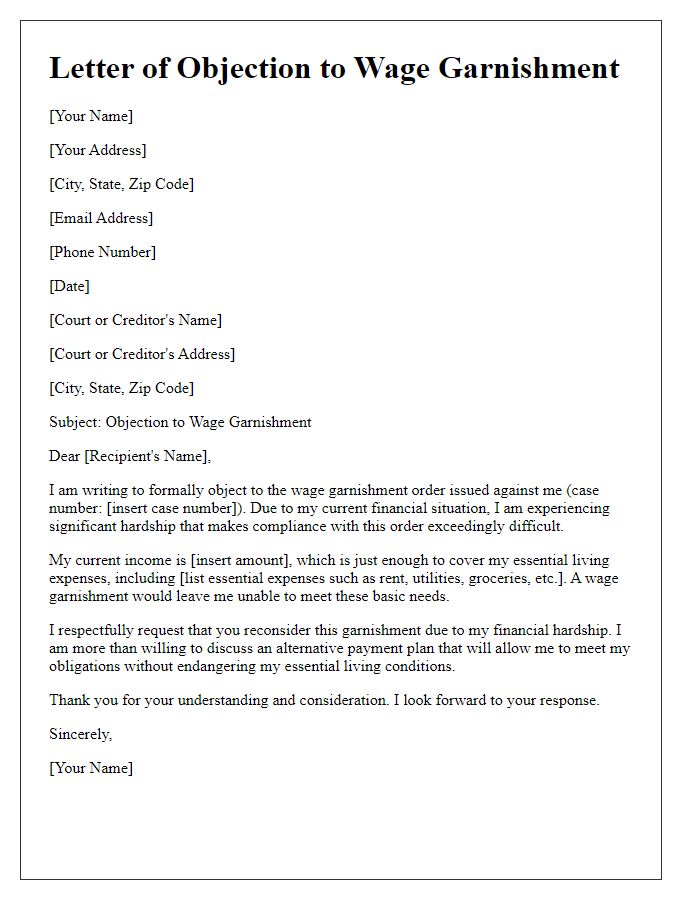

Letter template of objection to wage garnishment due to financial hardship.

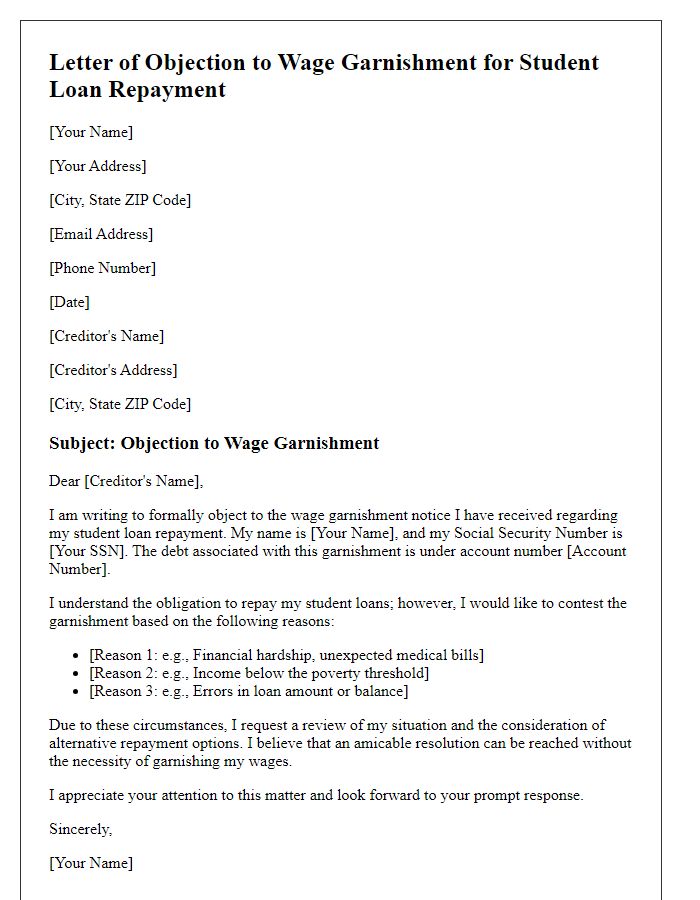

Letter template of objection to wage garnishment for student loan repayment.

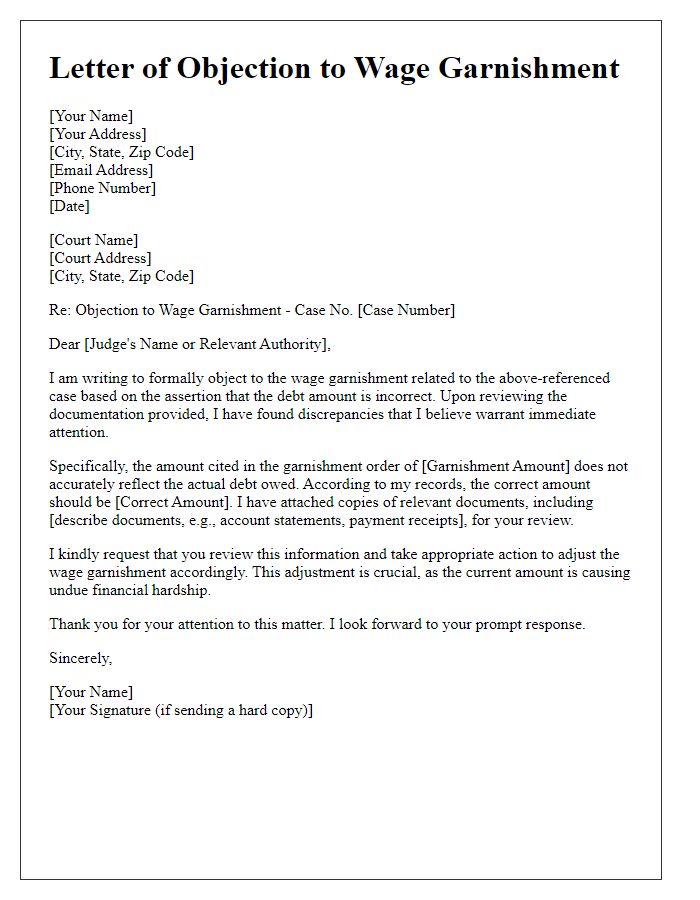

Letter template of objection to wage garnishment based on incorrect debt amount.

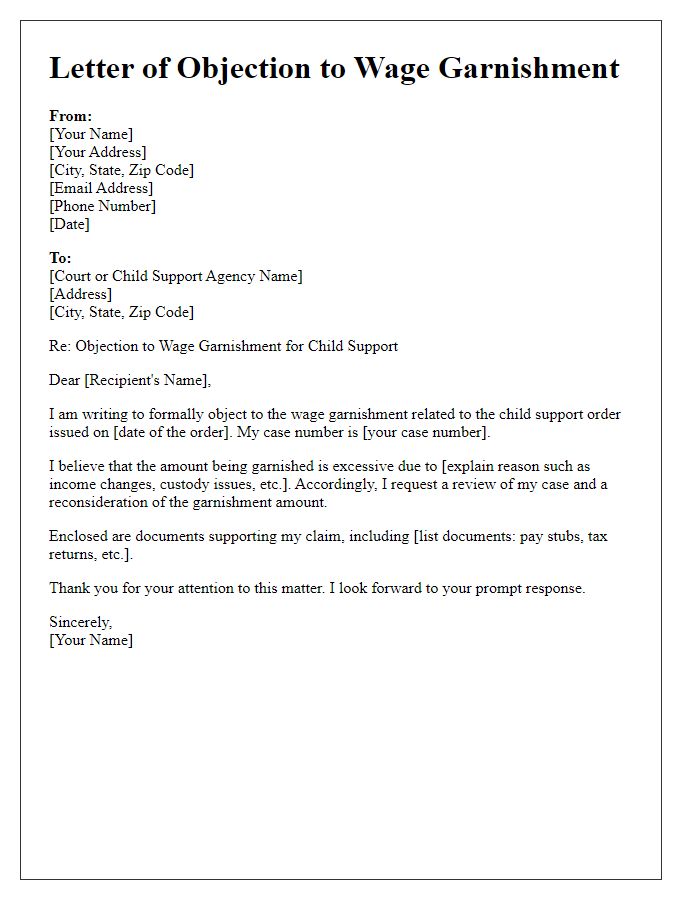

Letter template of objection to wage garnishment for child support disputes.

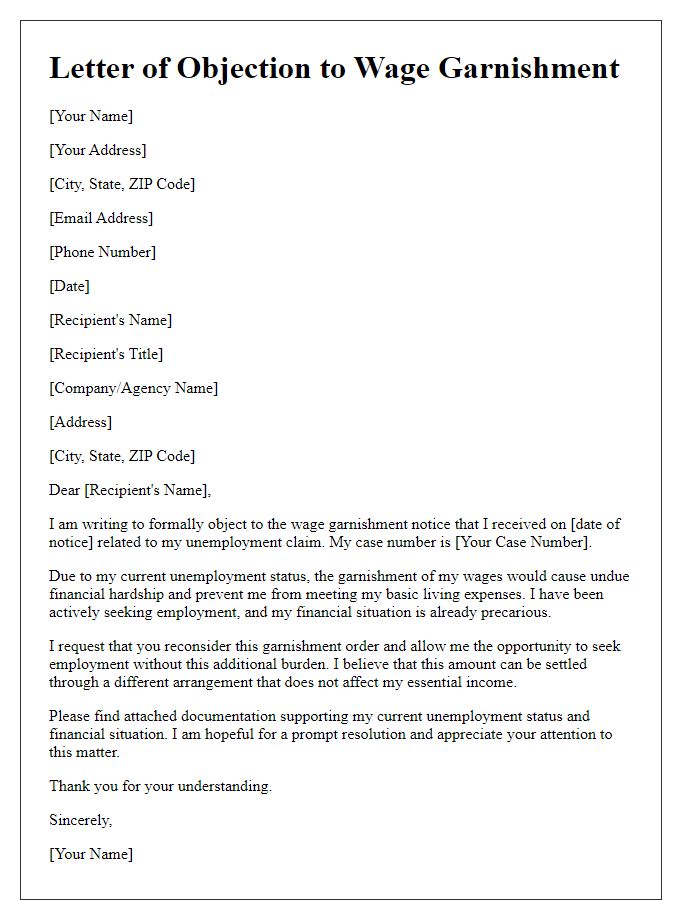

Letter template of objection to wage garnishment related to unemployment.

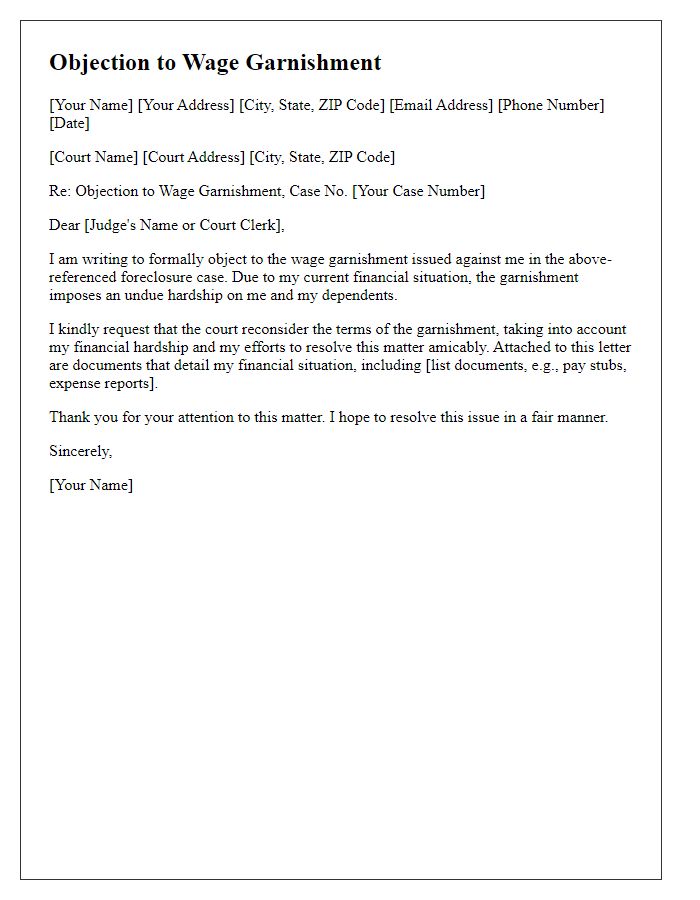

Letter template of objection to wage garnishment for a foreclosure case.

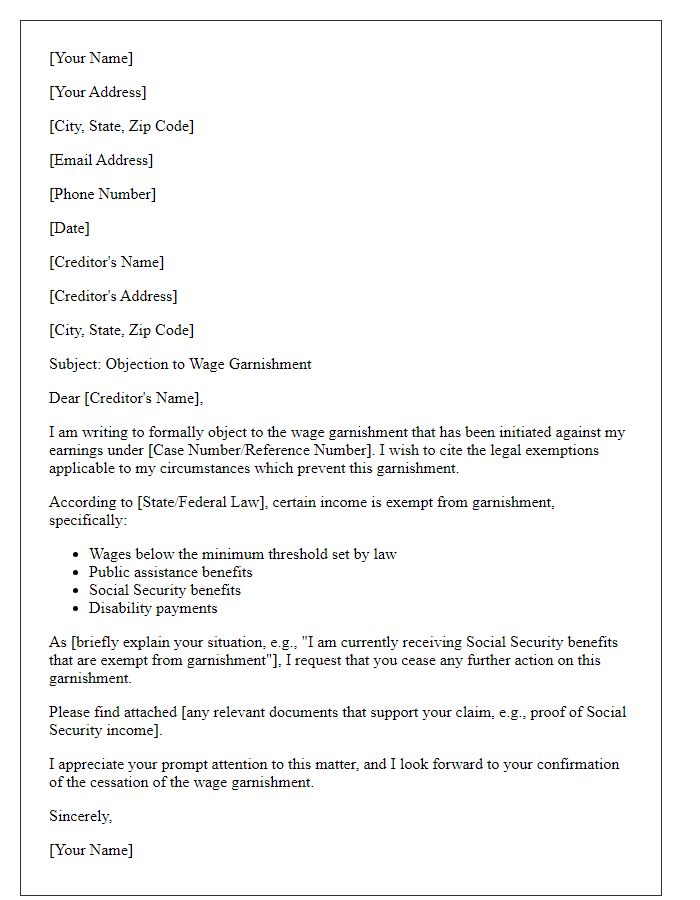

Letter template of objection to wage garnishment citing legal exemptions.

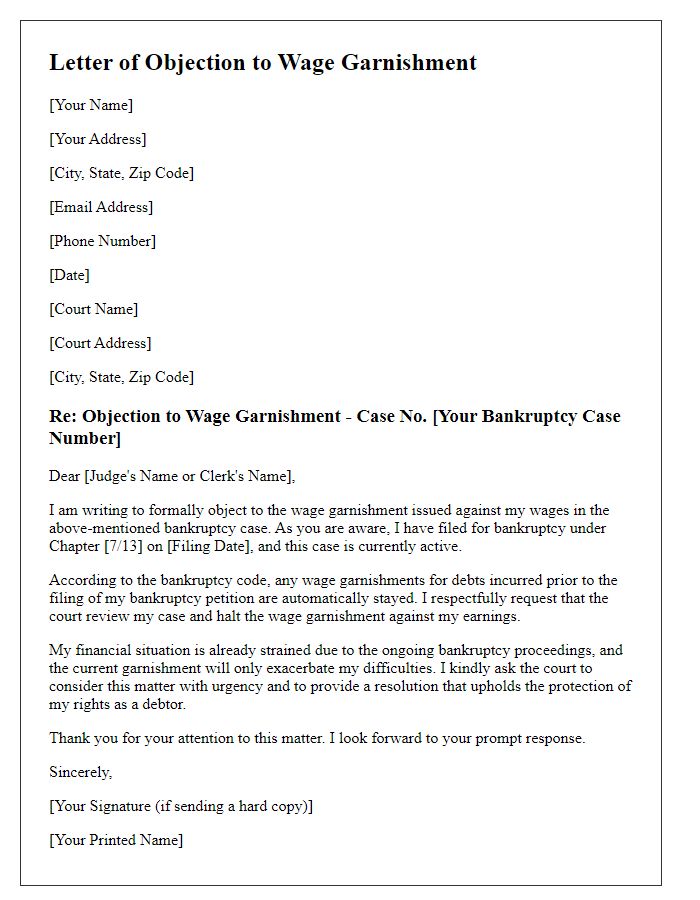

Letter template of objection to wage garnishment for an active bankruptcy case.

Comments