When life throws unexpected challenges our way, managing finances can become quite a juggling act. If you find yourself in a situation where you need to delay a debt collection payment, crafting a clear and respectful letter can make all the difference. It's important to explain your circumstances while expressing your commitment to resolving the matter. Curious about how to structure your letter and maintain a positive rapport with your creditors? Read on to discover a helpful template that will guide you through the process!

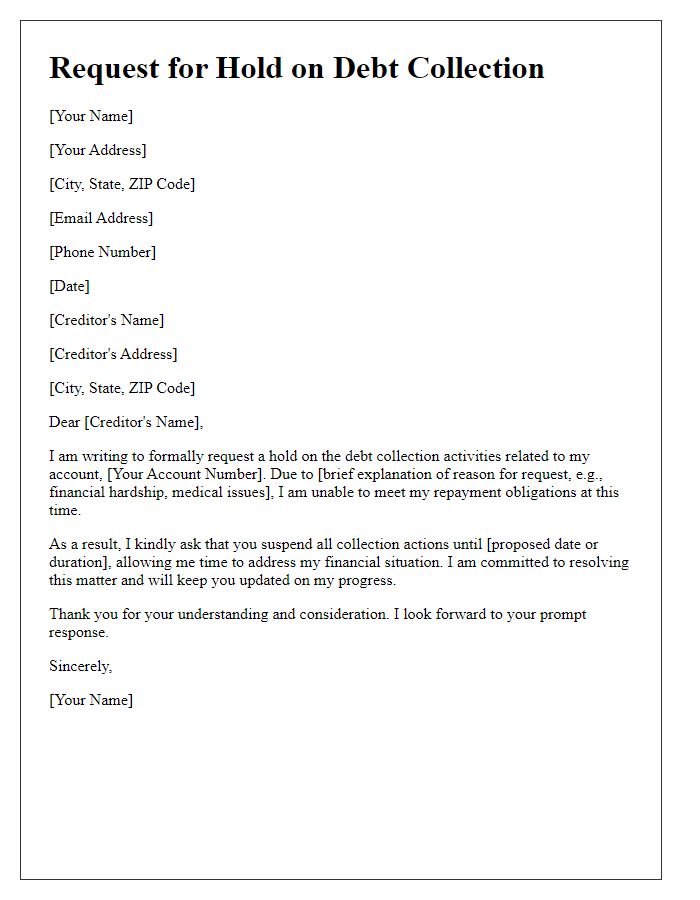

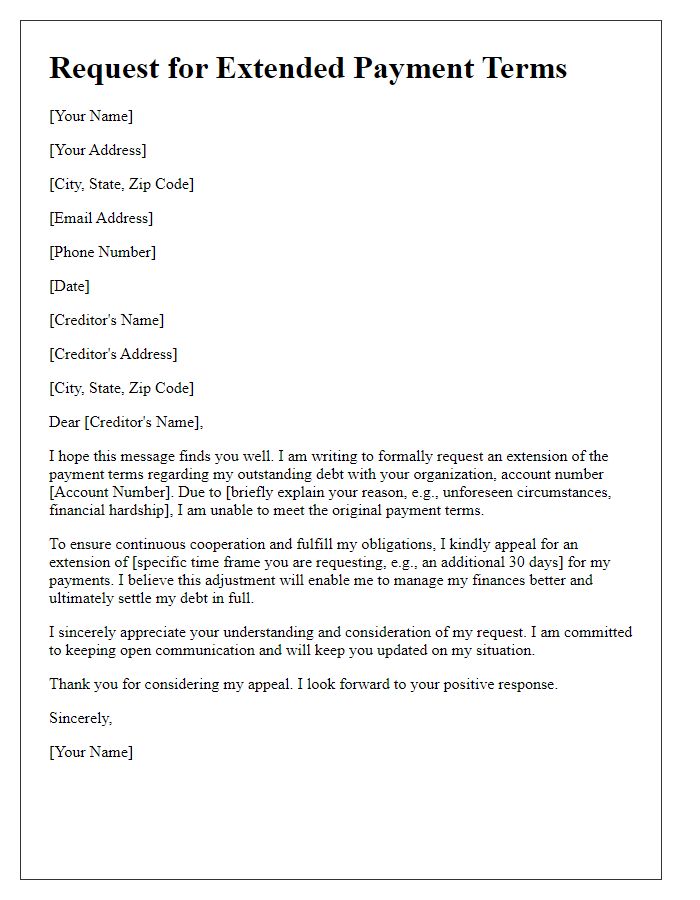

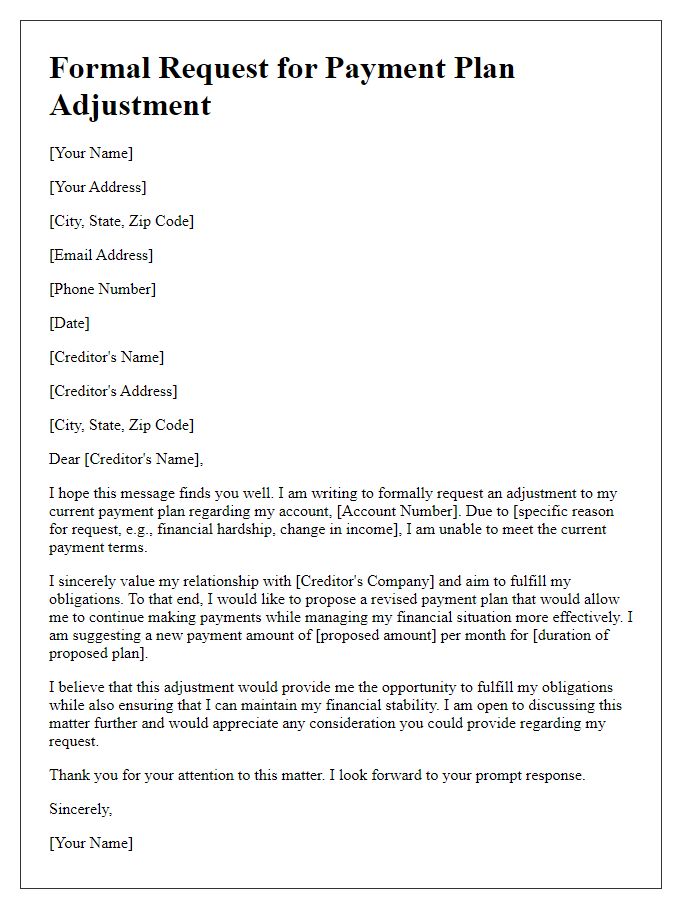

Personalization and Contact Information

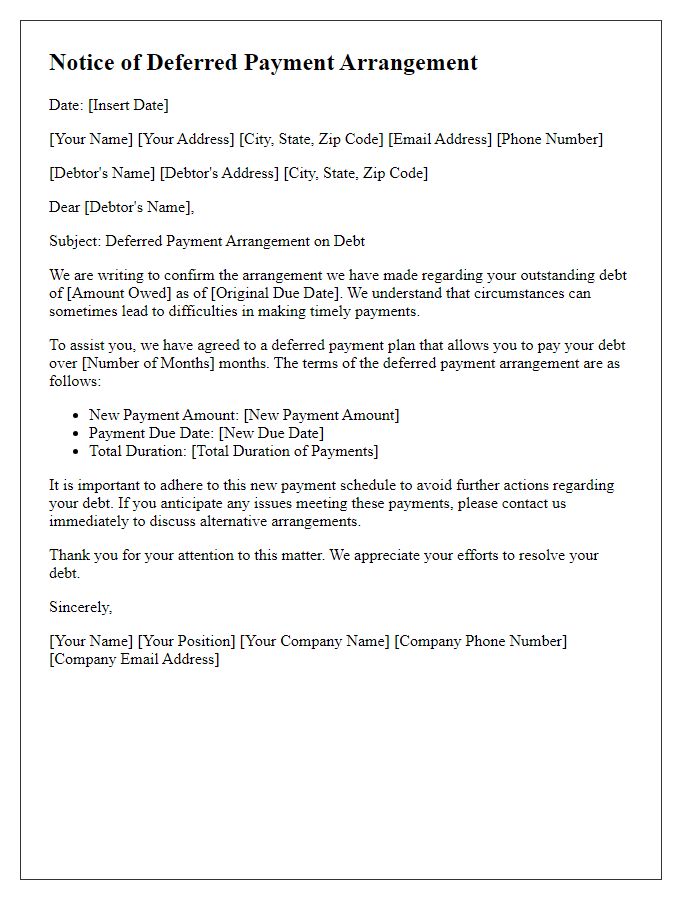

In today's economic landscape, managing debt obligations becomes increasingly challenging for individuals and businesses alike. With rising inflation rates (currently averaging around 8% in many countries) and fluctuating interest rates (often influenced by the Federal Reserve's monetary policy), timely payments can often slip through the cracks. This situation may compel debtors to seek temporary relief from collection agencies while they reorganize their finances. Establishing communication with creditors, such as in the case of personal loans or credit card debts from major banks like JPMorgan Chase or Citibank, enables individuals to negotiate new payment terms. Documenting the arrangement, including specific dates and amounts, is crucial to prevent further penalties or negative impacts on credit scores.

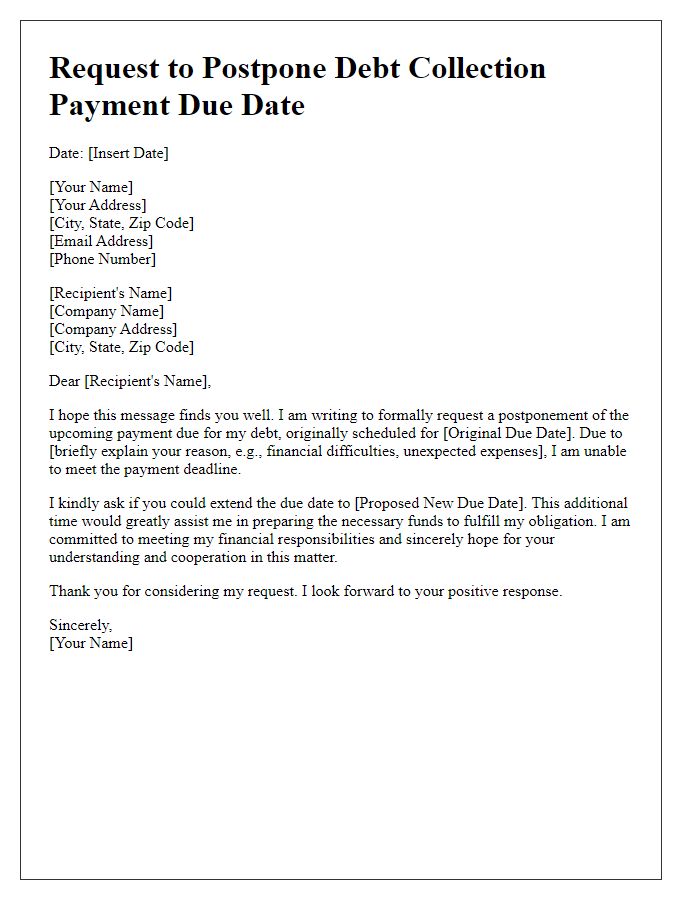

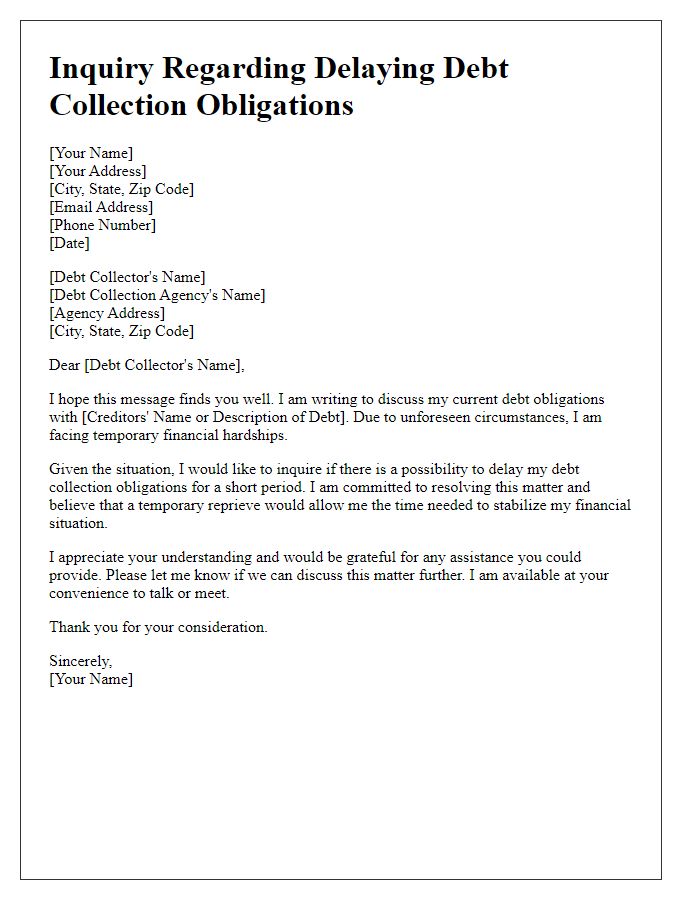

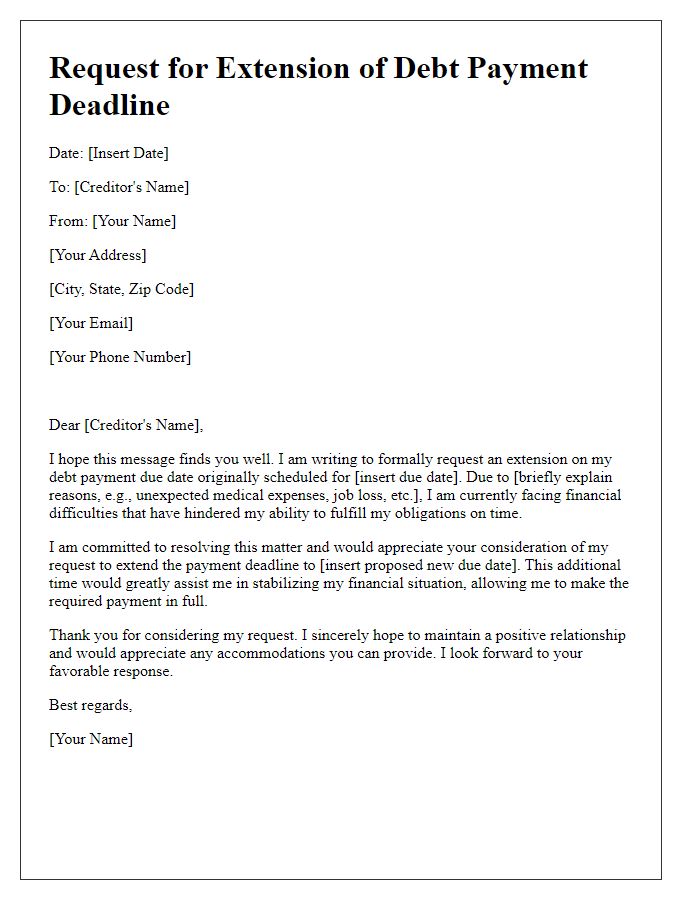

Clear Reason for Delay

Delaying debt collection payments can be a significant issue for both borrowers and creditors. Late payments often arise from unforeseen circumstances such as job loss, medical emergencies, or unexpected expenses. For instance, a sudden illness requiring hospitalization may result in exorbitant medical bills, diverting available funds from scheduled payments. Additionally, economic downturns, like the recession in 2008, can lead to widespread layoffs, affecting many individuals' ability to meet financial obligations. In urban areas such as New York City, the high cost of living further exacerbates these challenges, causing delays in payment to creditors. Clear communication with lenders about these specific reasons for delay can foster understanding and potentially lead to revised payment plans or temporary relief options.

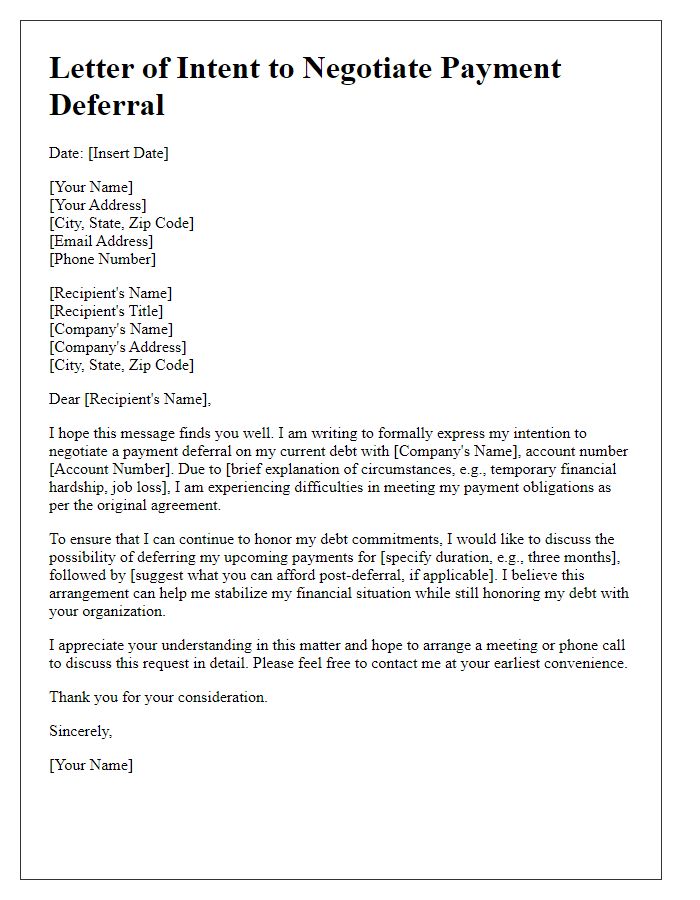

Revised Payment Plan Proposal

A revised payment plan proposal can be helpful for managing outstanding debts while ensuring that creditors understand your commitment. This approach typically outlines a structured schedule for repayment, often adjusting monthly amounts based on personal financial circumstances. Including financial details, such as current income and expenses, can demonstrate transparency and responsibility. Specific terms can cover the duration of the plan, such as six months or a year, and clarify repercussions for missed payments. Providing clear communication regarding intentions to settle the debt can aid in maintaining a positive relationship with the creditor.

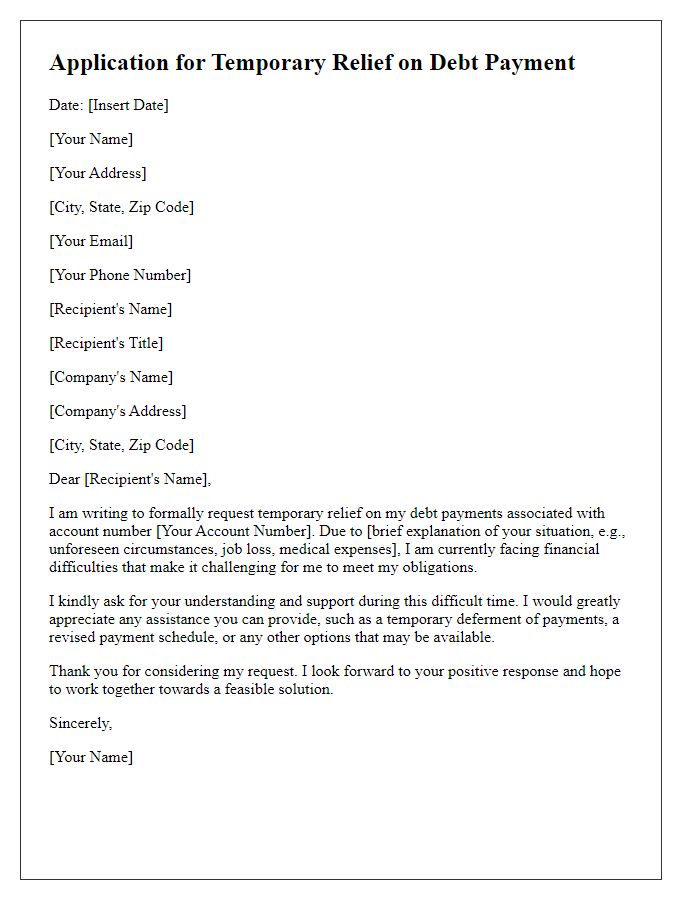

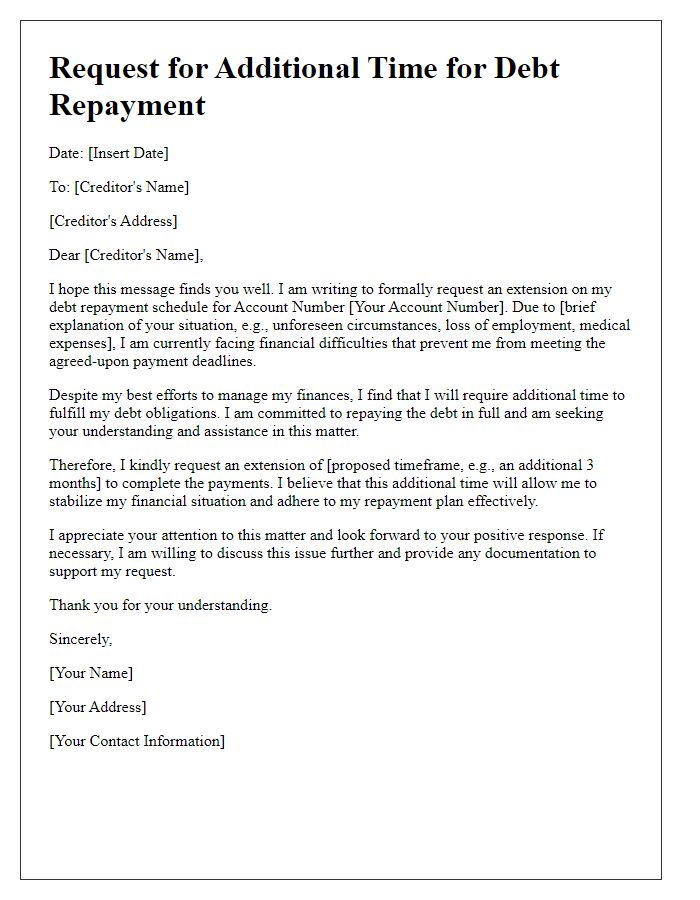

Expression of Commitment and Responsibility

In the realm of finance, debt collection processes often necessitate clear communication and expressions of commitment to repaying obligations. Current economic conditions, such as inflation rates (averaging around 8% in recent times), can significantly impact individuals' cash flow. Responsible debtors may encounter unforeseen challenges affecting their ability to meet payment deadlines. In these situations, it's crucial to convey a strong sense of responsibility to creditors, affirming intentions to fulfill financial obligations. This can involve outlining a revised payment schedule, detailing specific dates for installment payments, and expressing genuine appreciation for the creditor's understanding. Additionally, maintaining open lines of communication fosters trust and can mitigate potential repercussions of delayed payments.

Request for Confirmation and Understanding

Delaying payment for debt collection can create a prolonged burden on the debtor and the creditor alike. Economic conditions may force consumers into difficult financial situations, leading to requests for extended payment terms. Financial organizations, like banks or credit unions, evaluate the impact of delayed payments on their cash flow and overall financial health. Debt collection agencies often follow specific regulations, such as those outlined in the Fair Debt Collection Practices Act, which mandate clear communication and fair treatment of consumers. Understanding the legal ramifications and setting clear timelines can help establish a cooperative relationship between the debtor and the creditor, ensuring that all parties are aware of their rights and obligations during this challenging period.

Letter Template For Delaying Debt Collection Payment Samples

Letter template of communication for requesting a hold on debt collection

Comments