Are you tired of being hit with surprise charges on your credit card bill? Disputing an overcharged fee can feel overwhelming, but it doesn't have to be! With the right approach, you'll find that clarifying your statement and getting your money back is entirely possible. Stay with us as we guide you through effective steps to take when disputing those pesky fees!

Accurate account details and transaction information.

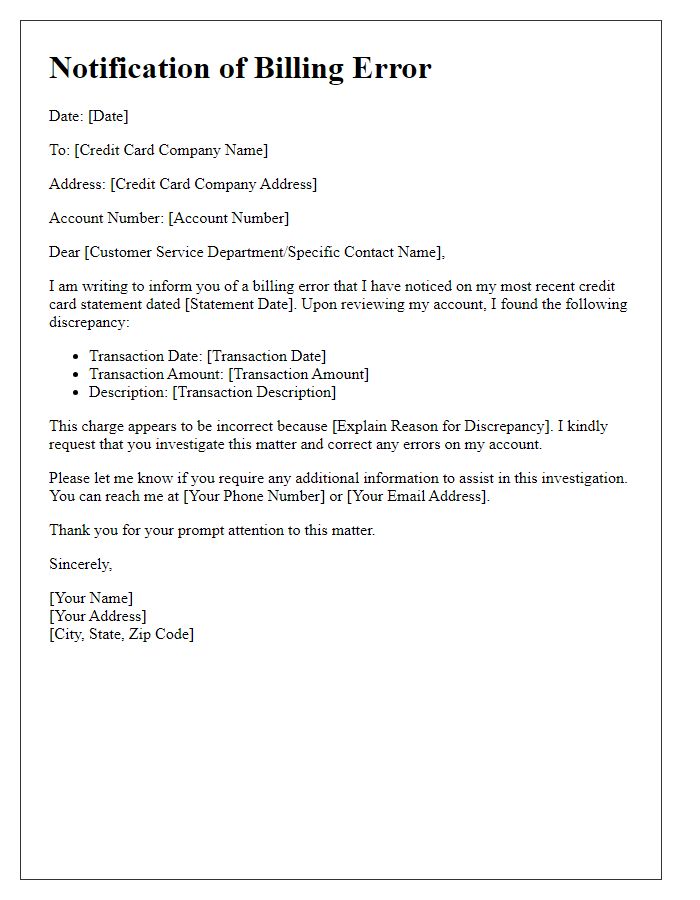

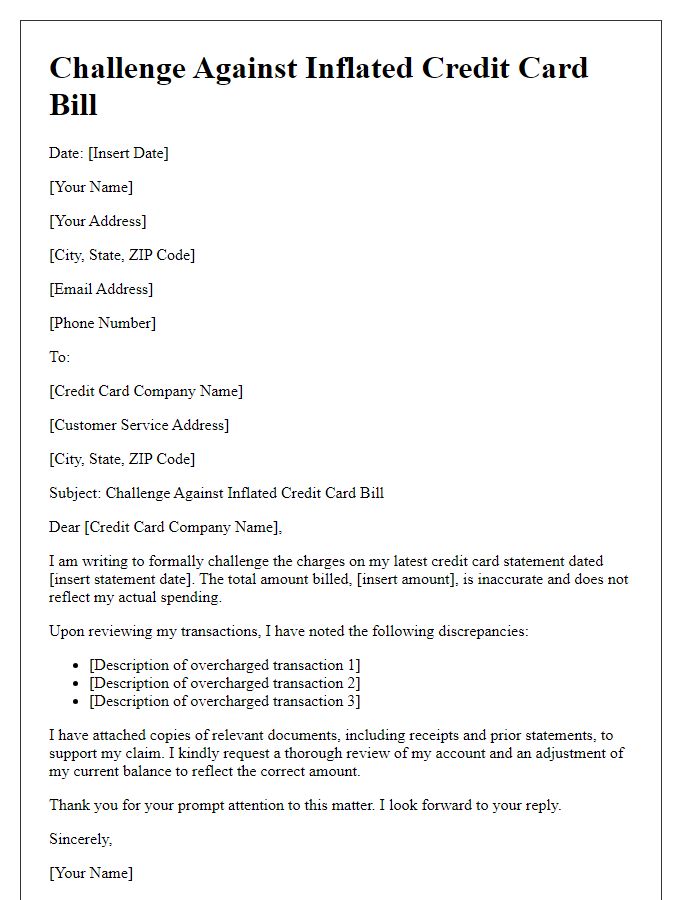

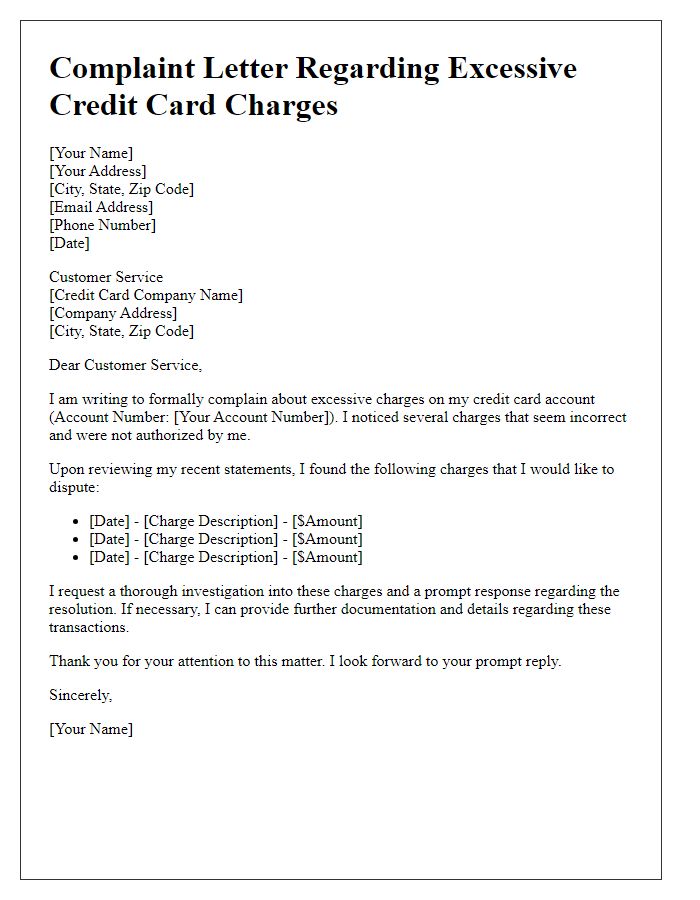

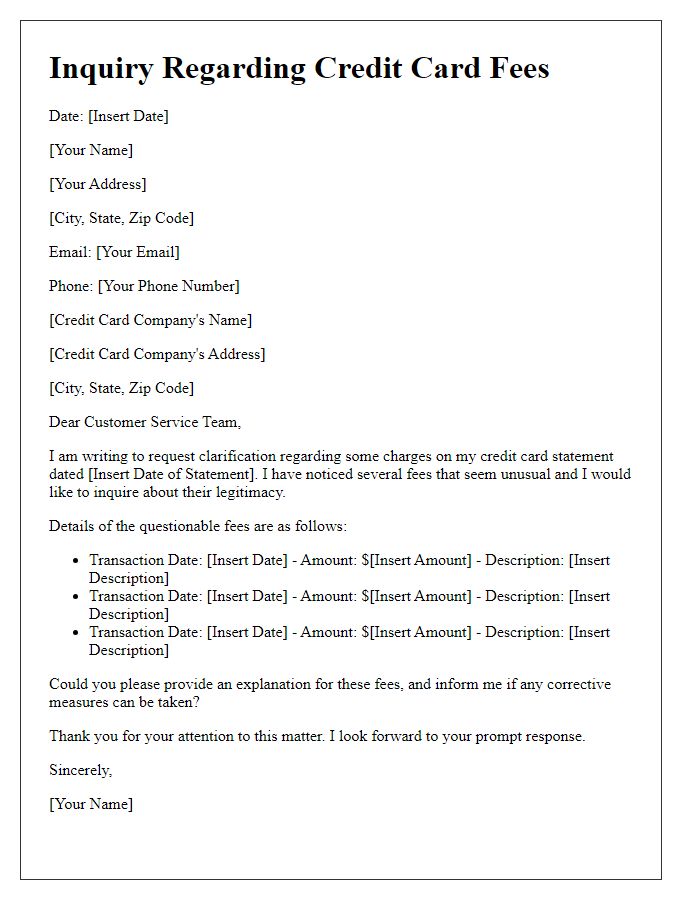

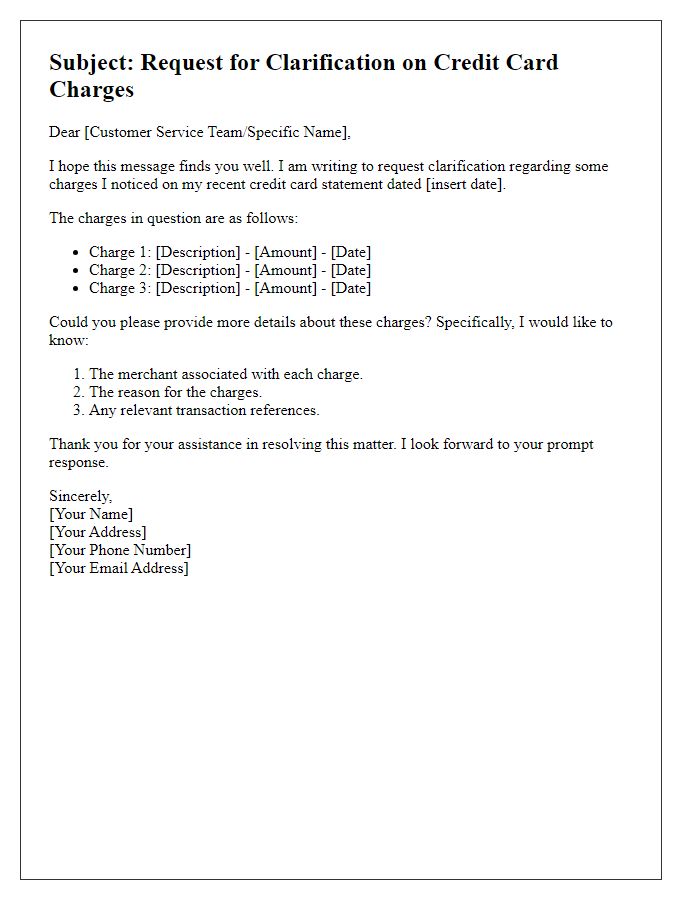

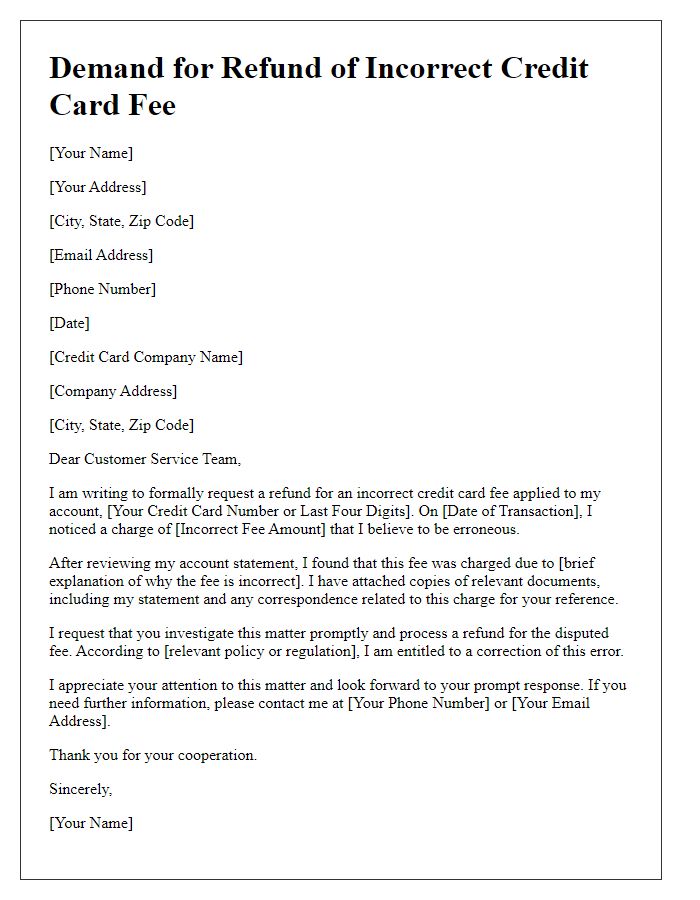

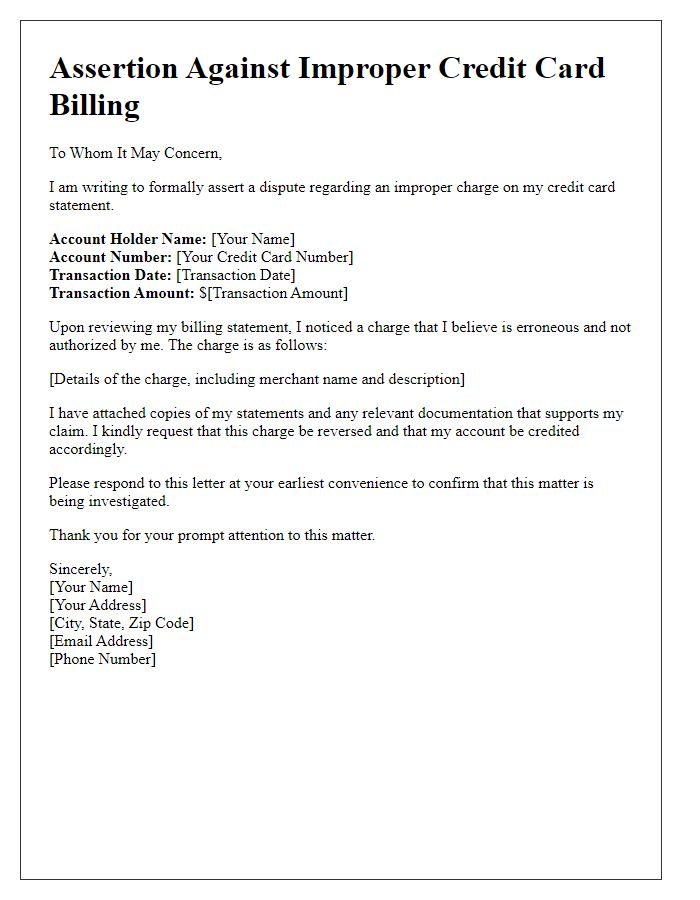

Disputing overcharged credit card fees requires accurate account details and precise transaction information for a successful resolution. Individuals must provide their credit card number (which typically consists of 16 digits), and account holder name as it appears on the card. Transaction details need to include the date of the charge (listing exact dates such as September 15, 2023), the name of the merchant (for example, XYZ Retail), and the transaction amount that appears incorrectly (for instance, $150 instead of $100). Additionally, the statement reference number (often found on monthly billing statements) should be included to streamline the investigation process. Contacting customer service representatives at the card issuer, often found on the back of the card, initiates a formal dispute that requires tracking and following up on the status within a specific timeframe.

Clear and concise explanation of the dispute.

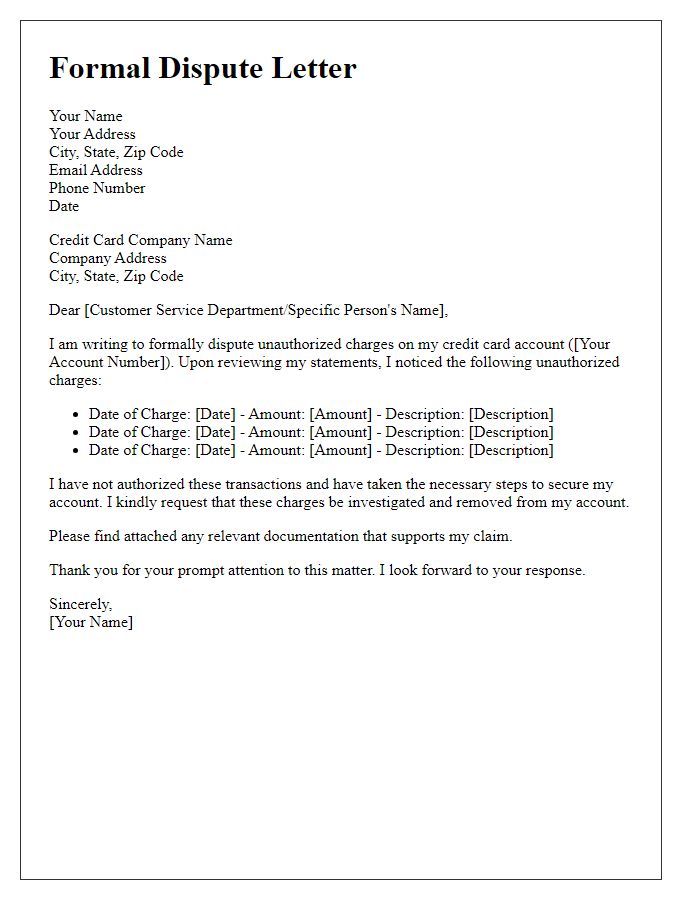

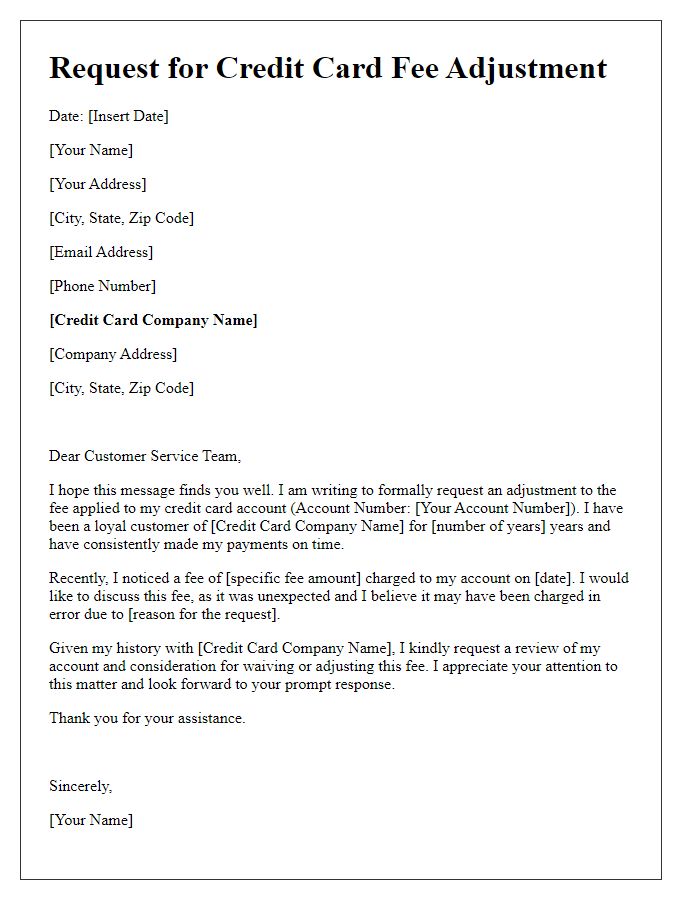

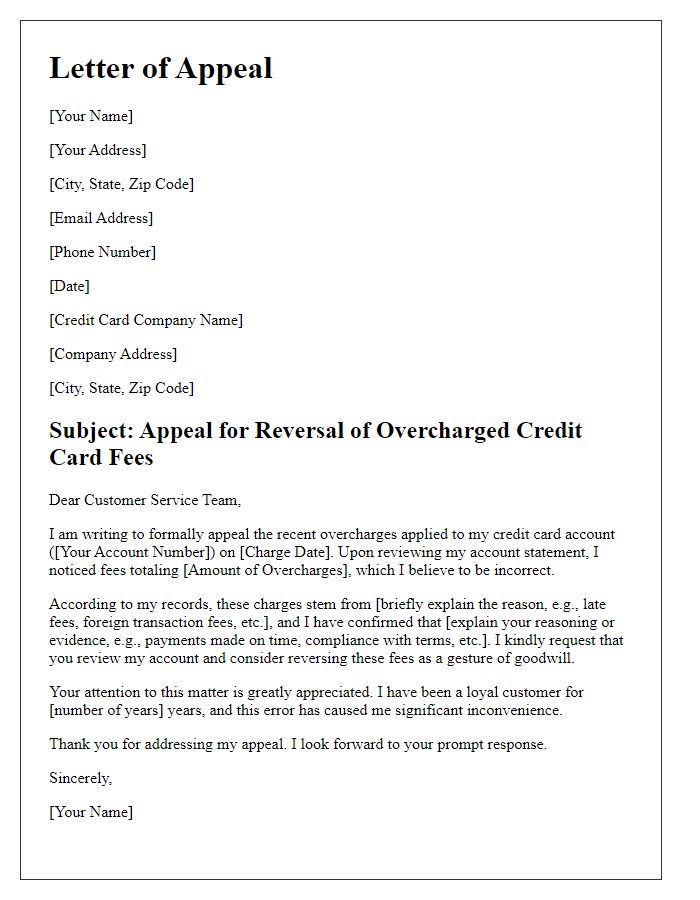

Unexpected credit card fees can lead to financial strain for consumers. In April 2023, a transaction at XYZ Retailer resulted in a charge of $150, when the expected amount was only $100. This discrepancy occurred despite clear pricing stated on the retailer's website. An investigation into the charges revealed the fee included unauthorized add-ons such as a premium service fee of $50 that was not disclosed at the time of purchase. Documentation, including a copy of the receipt and transaction confirmation email, supports the claim of overcharging. Prompt resolution of this issue can restore trust in the financial institution and ensure consumer rights are upheld.

Request for specific action or resolution.

A consumer dispute regarding overcharged credit card fees often revolves around discrepancy in billing statements, inaccurate transaction amounts, or unapproved service charges. Disputed fees can range from small charges of $5 to substantial amounts exceeding $100, impacting overall financial health. Credit card companies, such as Visa or Mastercard, typically require detailed information: account number, transaction date, and merchant identity. Documentation, including receipts or emails, substantiates claims. Prompt action is crucial; consumers often have 60 days from the statement date to report inconsistencies to ensure timely resolution. Regulatory bodies, like the Consumer Financial Protection Bureau (CFPB), provide guidance on consumer rights regarding billing disputes under the Fair Credit Billing Act.

Supporting documentation or evidence.

Disputing an overcharged credit card fee requires clear documentation that substantiates the claim. Credit card statements must show the specific charge in question, along with identification of the date, amount, and merchant involved. Supporting documents, such as receipts or transaction confirmations, are crucial to demonstrate the expected amount versus the charged amount. Additionally, any correspondence with the credit card issuer, including prior attempts to resolve the discrepancy, will strengthen the dispute. Contact logs detailing conversations or communications with customer service representatives may provide evidence of the issue being reported. All these elements collectively serve to create a comprehensive record, essential for substantiating the claim and facilitating a resolution.

Contact information for follow-up.

When disputing an overcharged credit card fee, provide specific details regarding the transaction. The statement should include the date of the charge, the amount mistakenly billed, and the merchant's name, for example, "Acme Grocery Store." Indicate the exact nature of the overcharge, such as an additional fee not disclosed at the time of the transaction. Mention the account number (last four digits for security) associated with the credit card in question, and ensure to include your full name and billing address. Include a timeline for resolution, emphasizing a prompt response for your inquiry. Always maintain a professional tone to encourage constructive communication.

Letter Template For Disputing Overcharged Credit Card Fee Samples

Letter template of notification of billing error on credit card statement

Comments