Are you feeling overwhelmed by the demands of property tax payments? You're not alone; many homeowners face challenges that can make timely payments difficult. Understanding your options and the steps to take when facing a delay is crucial for maintaining your financial well-being. Join us as we explore helpful insights and solutions to navigate this situation effectively.

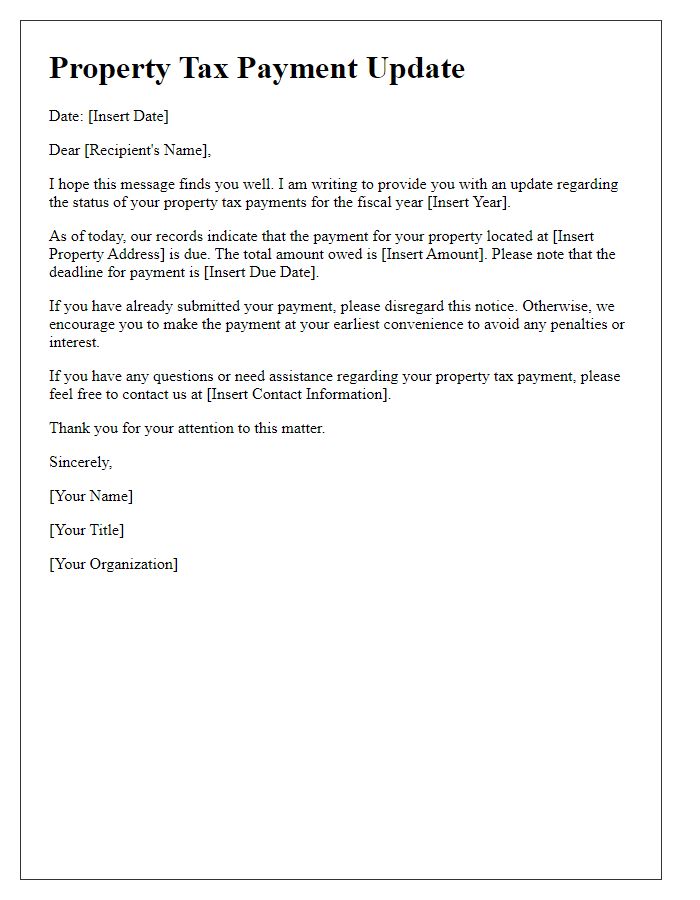

Polite Language

Homeowners often encounter delays in property tax payments due to various circumstances, including unexpected expenses or changes in financial situations. In often-urbanized regions like San Francisco, the deadline for property tax payments typically falls on December 10th for the first installment and April 10th for the second installment. Such delays may prompt residents to communicate with their local tax authority for potential extensions or arrangements. The impact of delayed payments can lead to penalties, interest, or even liens on properties, emphasizing the importance of timely communication and resolution. By reaching out to tax offices with clear explanations of circumstances leading to delays, homeowners may navigate penalties or explore alternative payment options.

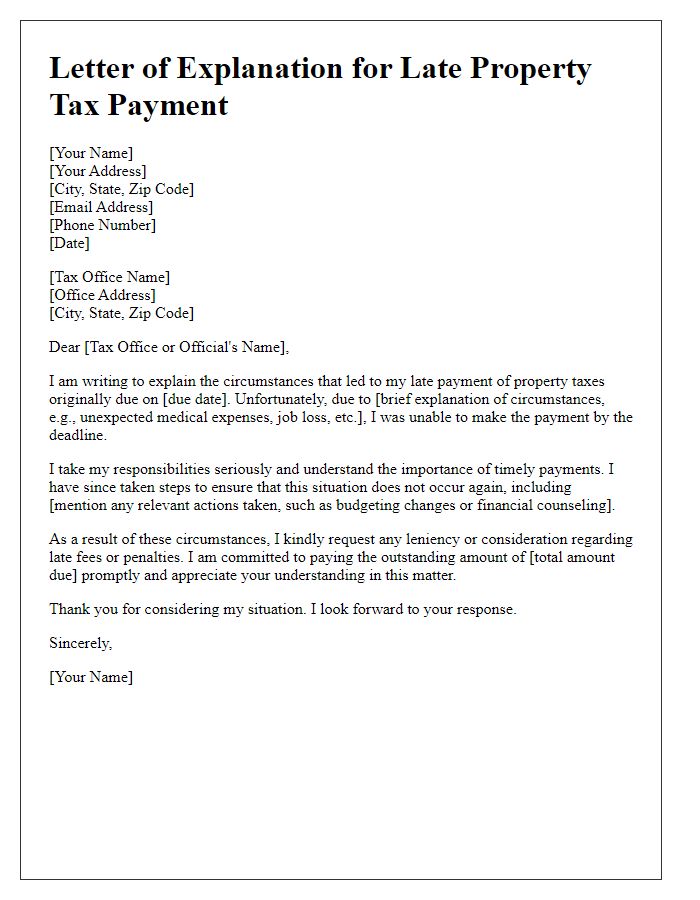

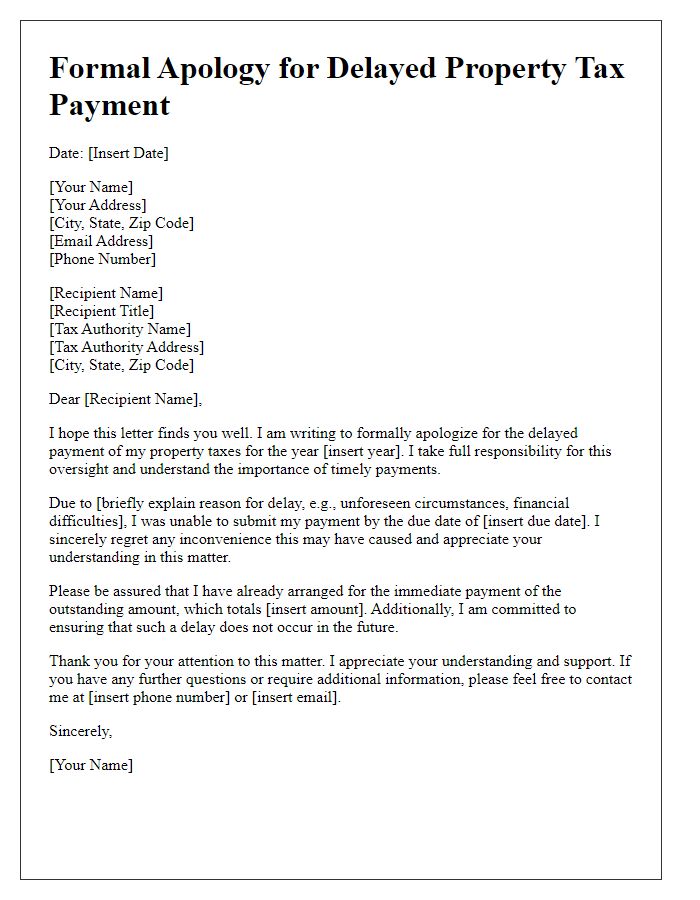

Reason for Delay

Property tax payment delays often arise from various factors impacting homeowners. Economic downturns, such as the recession (2020-2021), can result in unexpected job loss or reduced income, leading to financial strain. Additionally, administrative issues, such as incorrect tax assessments or billing errors in local jurisdictions, can cause confusion and hinder timely payments. Natural disasters, like hurricanes affecting regions such as Florida, may disrupt normal financial operations. Furthermore, personal circumstances, including medical emergencies or family issues, often contribute to the inability to meet tax obligations. These situations necessitate communication with local tax authorities to explore potential payment arrangements or extensions.

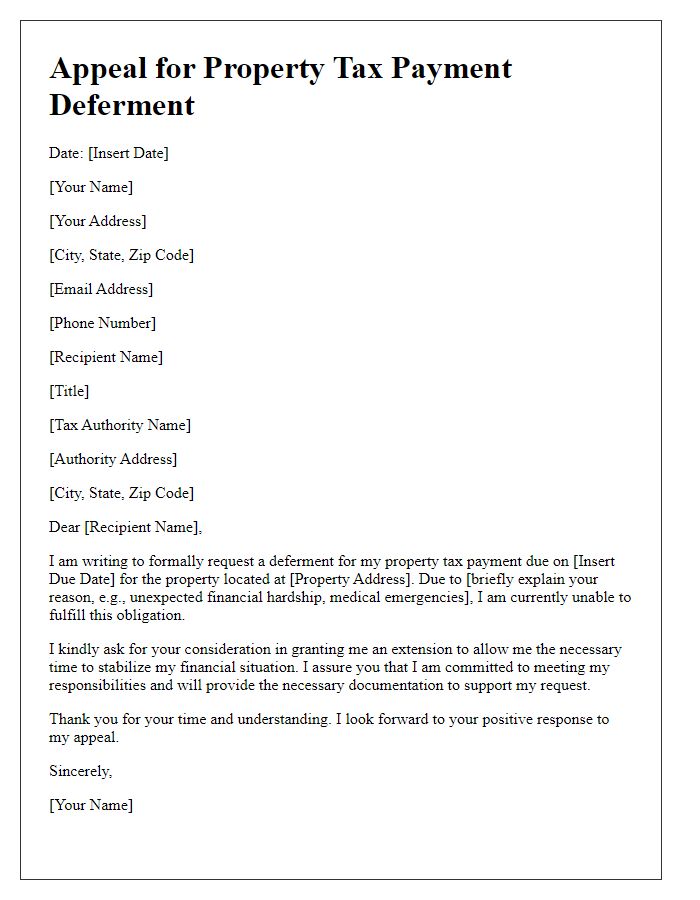

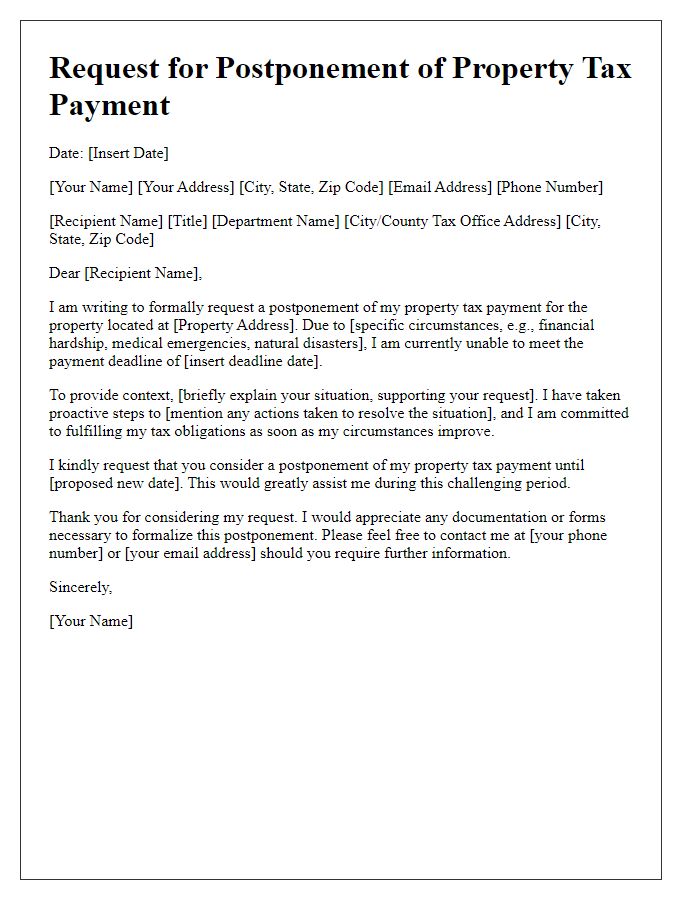

Request for Extension

Delays in property tax payments can lead to significant penalties and interest charges for homeowners, such as those outlined by local tax authorities. Often, these consequences arise when payments exceed due dates, like September 30th for many municipalities. Formal requests for extensions must be submitted to the local tax office, detailing the reasons for the delay, which could include financial hardships or unexpected life events. Documentation such as bank statements or proof of income loss may be required to validate claims. It is essential to adhere to any specific formatting or submission guidelines provided by the jurisdiction, ensuring that appeals are processed in a timely manner. Prompt communication demonstrates responsibility and may mitigate repercussions associated with the delay.

Assurance of Future Payment

Property tax payments often carry significant importance for local government funding, such as public services and infrastructure. Delays in payment can lead to penalties or interest fees. In certain cases, property owners may experience unforeseen financial hardships, such as job loss or medical expenses, which can hinder timely payment. It is essential for these property owners to communicate with the local tax authority promptly. Providing assurance of future payment can help mitigate consequences. Clear documentation is necessary, including a proposed payment plan. Additionally, referencing the specific tax identification number associated with the property (commonly a unique identifier for tax records) can facilitate smoother communication. It's vital to express an intention to resolve the situation and adhere to future payment commitments.

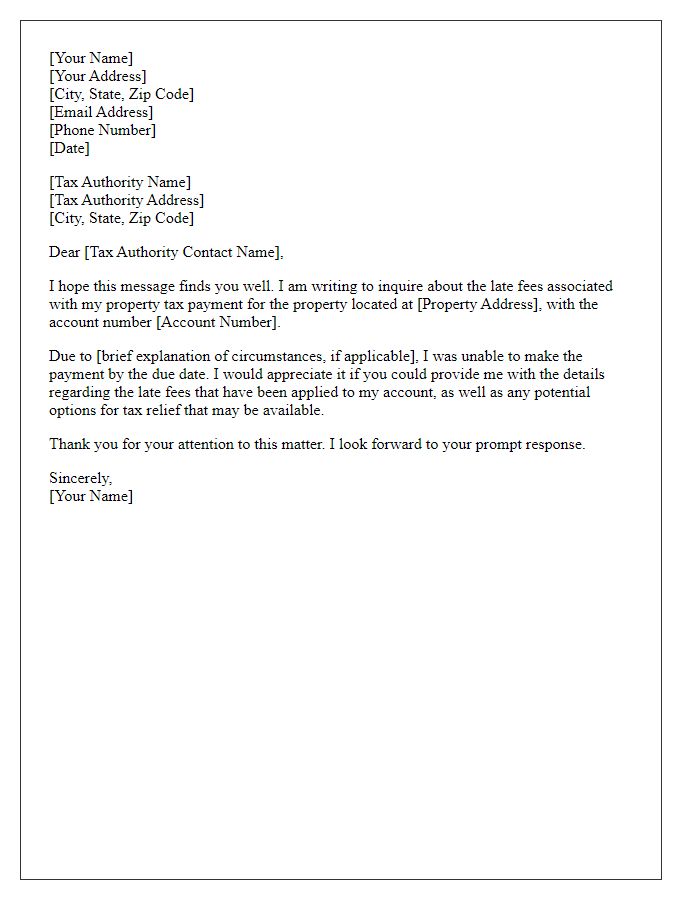

Contact Information

Delaying property tax payments can lead to financial penalties and interest charges imposed by local tax authorities. In the United States, states like California and Texas have specific deadlines for property tax payments, usually around December 10 and January 31 respectively. Failure to meet these deadlines may result in a lien being placed on the property, affecting credit scores. Local agencies, such as the County Tax Assessor's Office, can provide information regarding payment plans or assistance programs available for homeowners facing financial difficulties. Property owners are encouraged to contact relevant offices as soon as possible to mitigate potential repercussions.

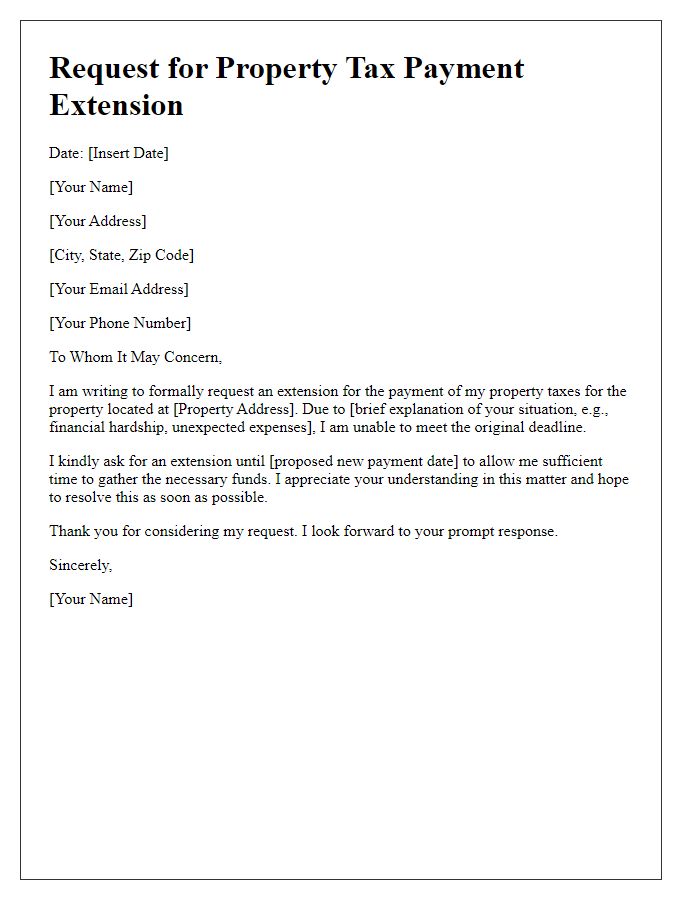

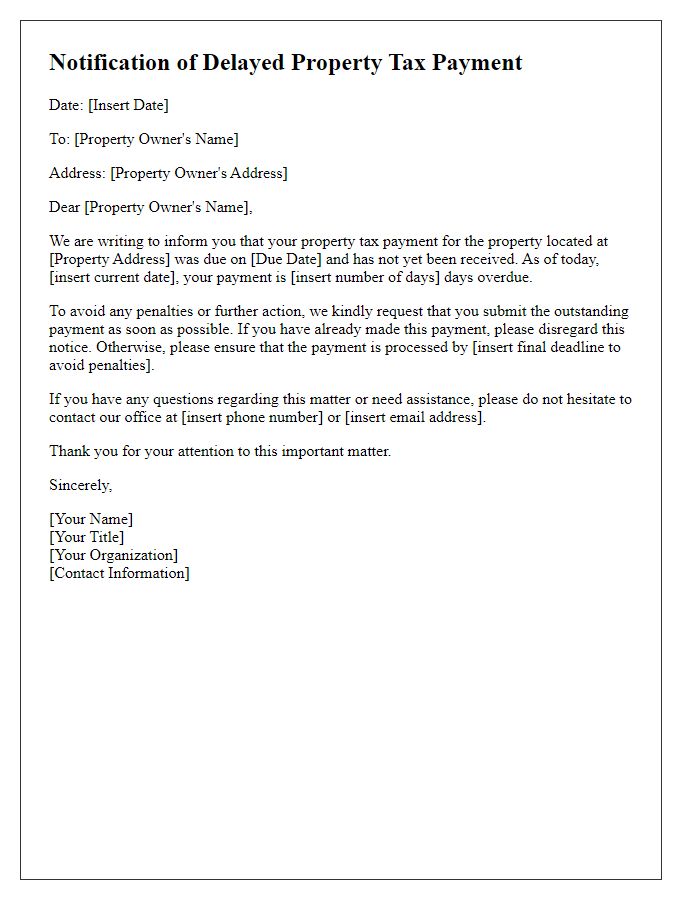

Letter Template For Property Tax Payment Delay Samples

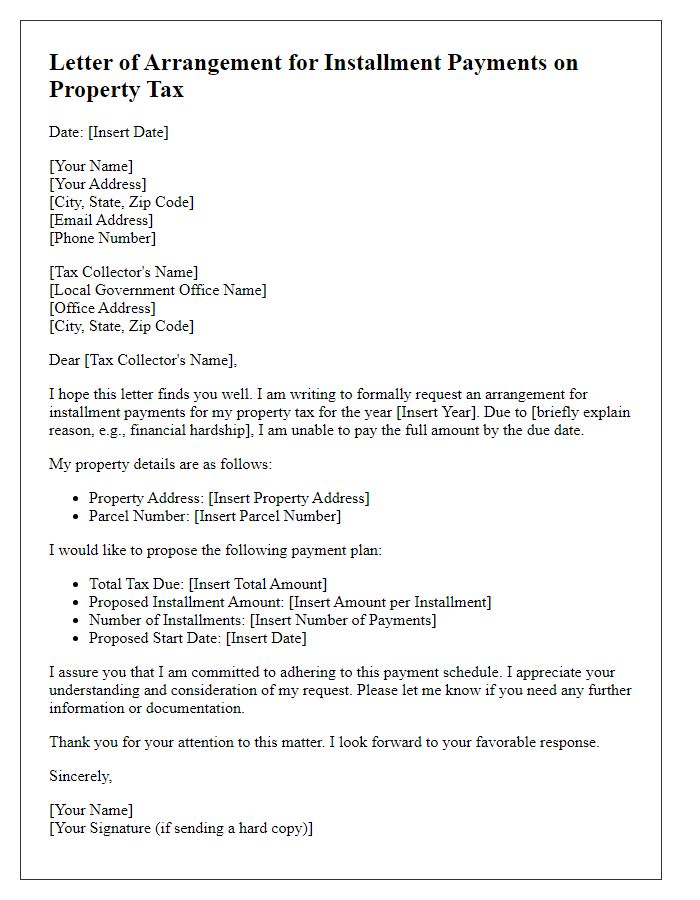

Letter template of arrangement for installment payments on property tax.

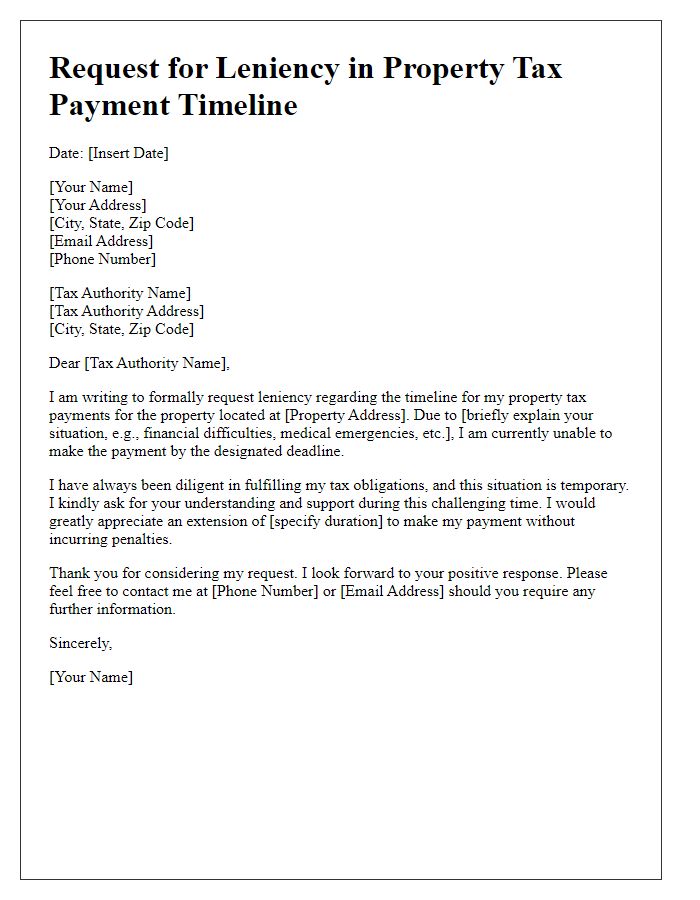

Letter template of request for leniency in property tax payment timeline.

Comments