Are you worried about inaccuracies on your credit report? You're not alone, as many people find themselves facing the frustrating task of disputing erroneous information that could impact their financial health. Thankfully, taking the right steps can help you resolve these issues and improve your credit standing. Let's dive into how you can effectively draft a letter to dispute credit report errors and reclaim your peace of mind!

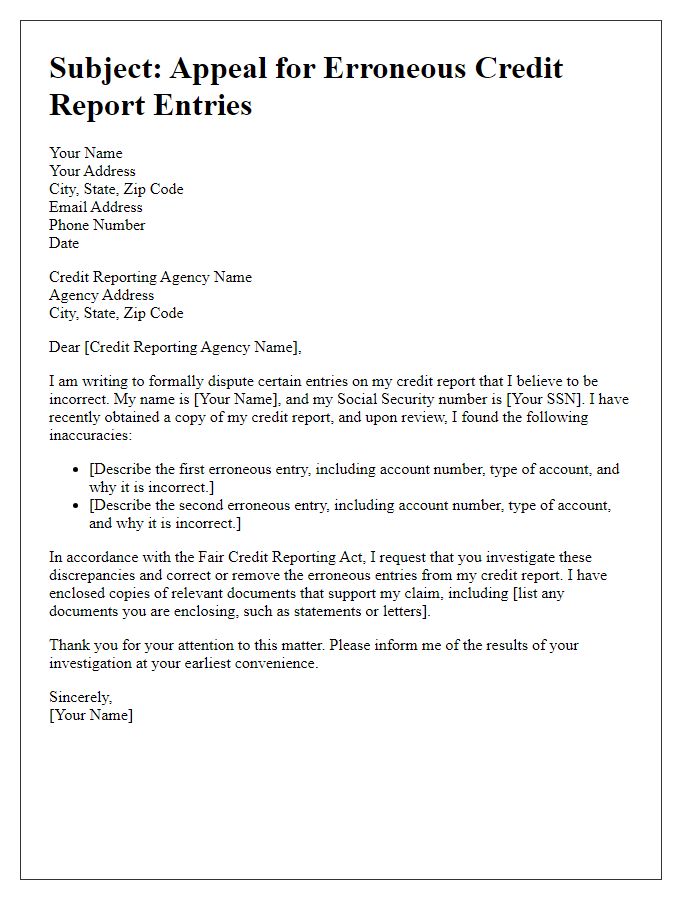

Accurate Identification Details

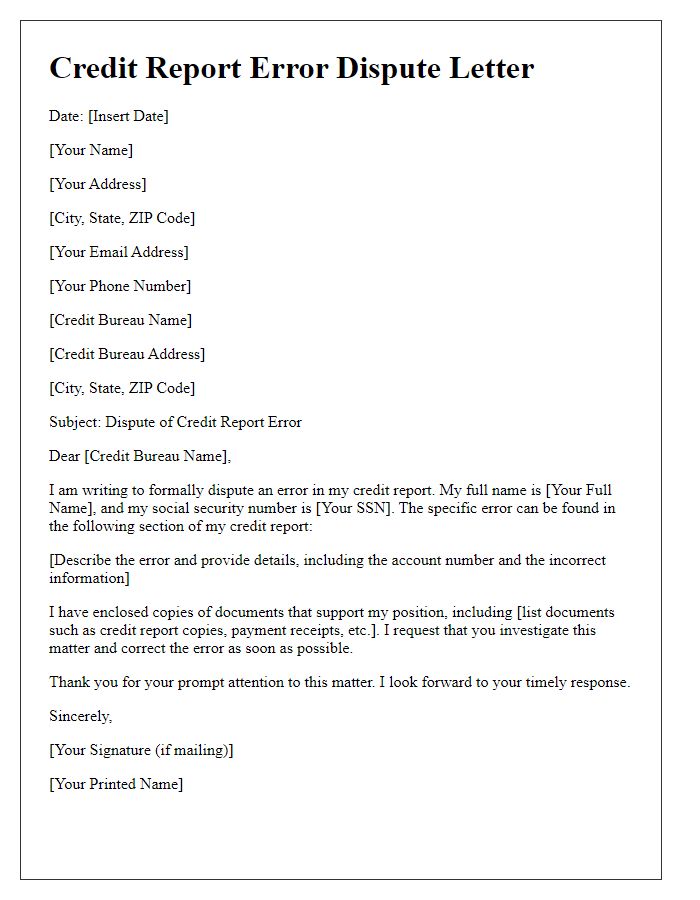

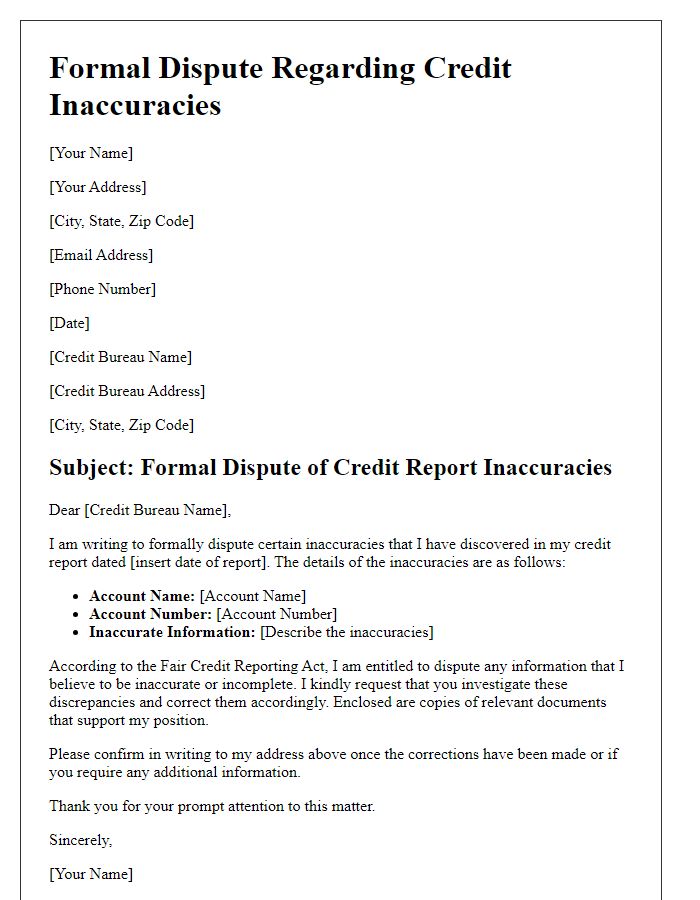

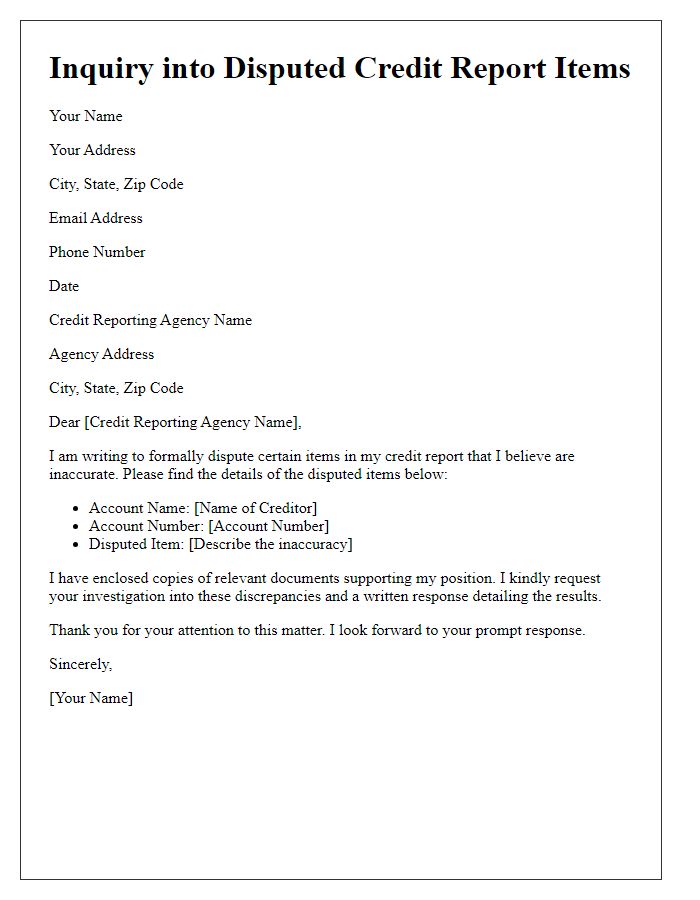

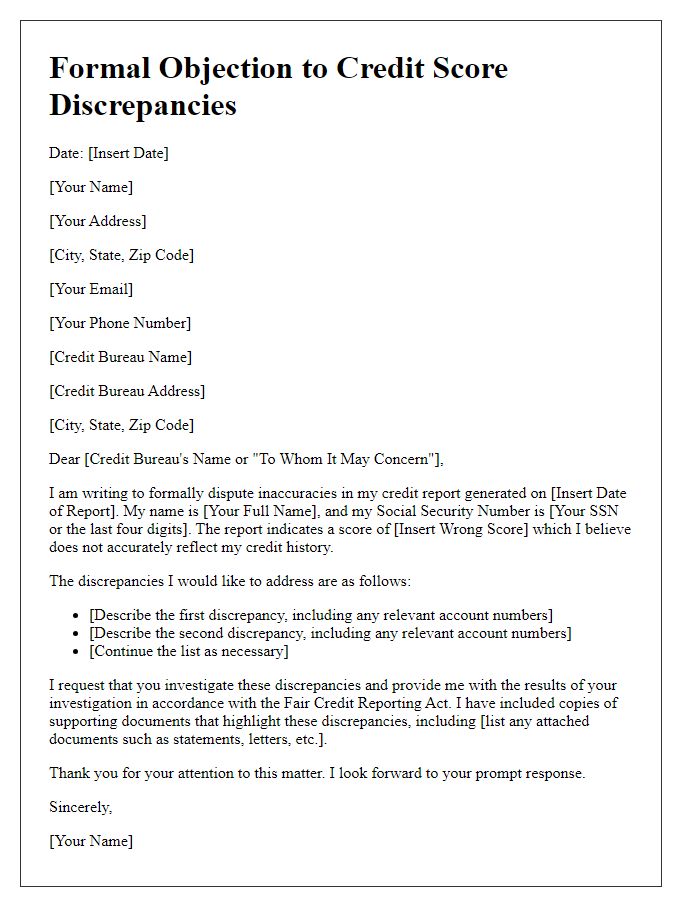

Accurate identification details are essential when disputing credit report errors. Personal information such as full name, date of birth, and Social Security number provides clarity and ensures that the credit reporting agency (CRA) can quickly locate the specific report in question. Inaccuracies, such as misspellings or outdated addresses, can lead to delays in the dispute process. Including identification details such as account numbers related to the disputed entries, dates of events related to the errors, and any previously disputed reports assists in validating the claim. Using certified mail or specific dispute forms provided by agencies like Experian or Equifax enhances the legitimacy of the request, ensuring timely and correct resolution of the discrepancies.

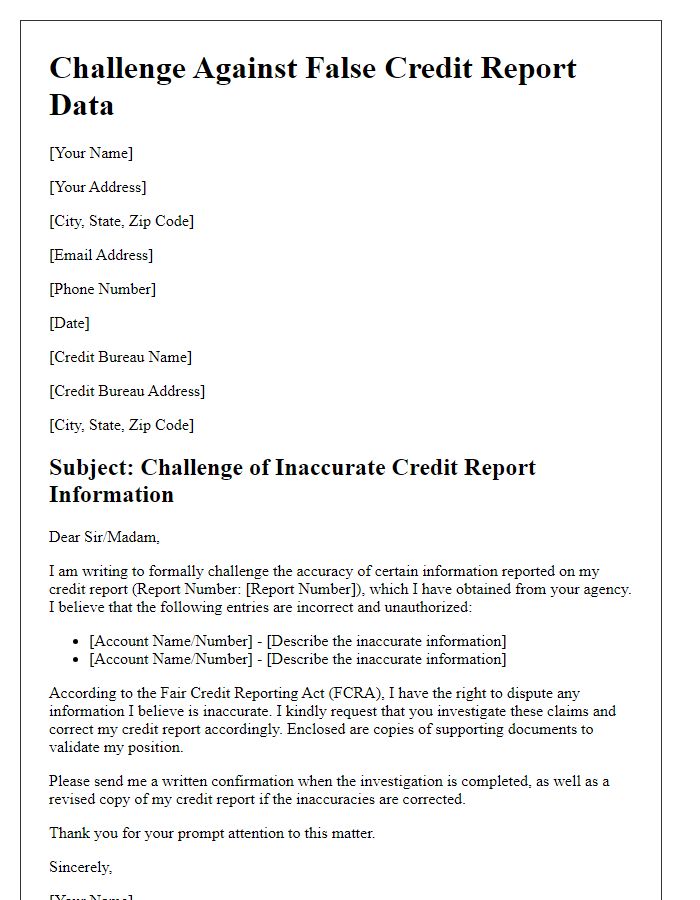

Specific Error Description

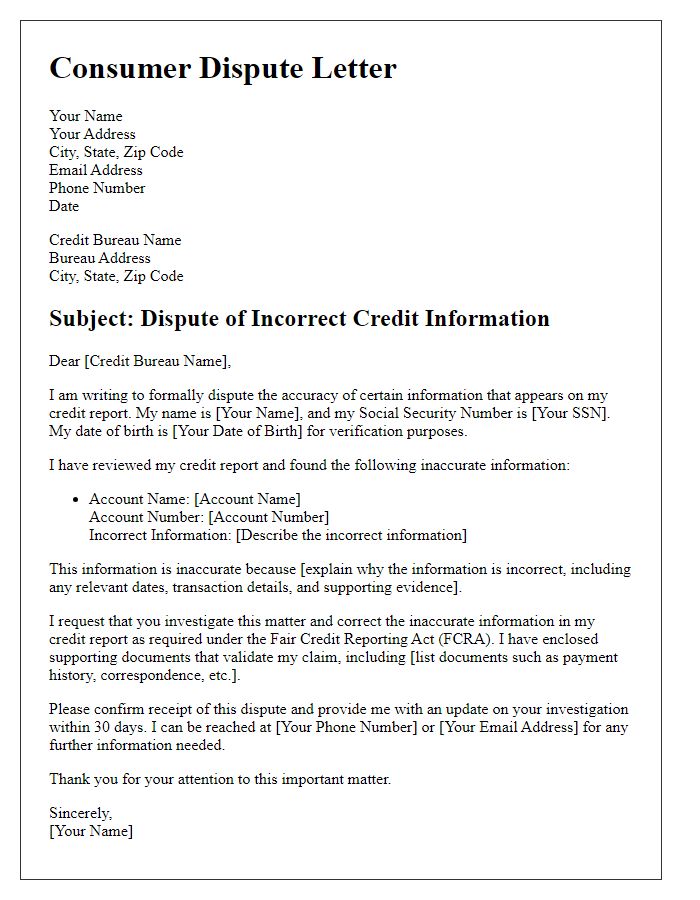

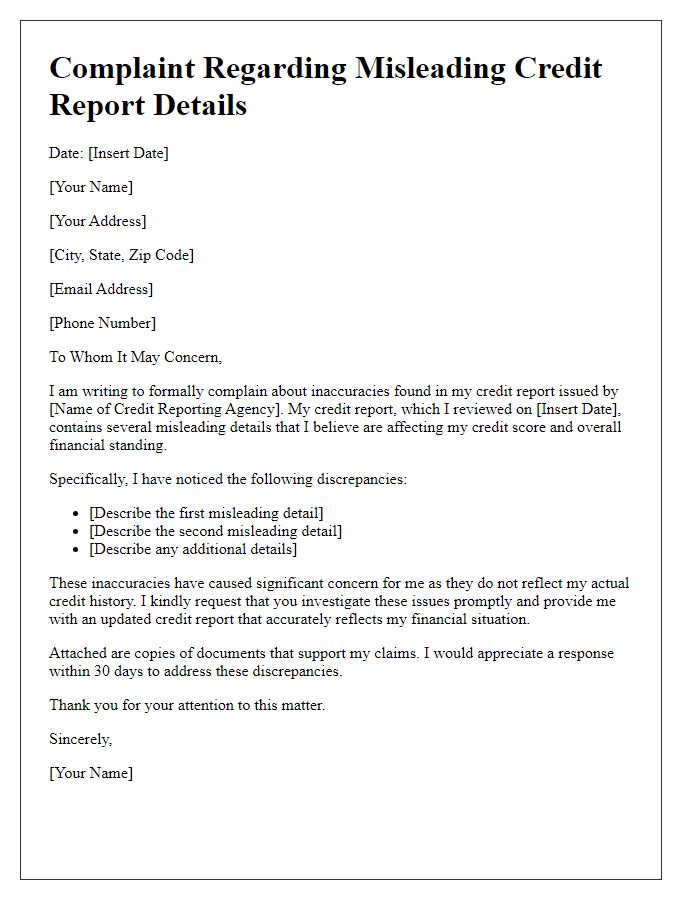

Credit report errors can significantly impact financial decisions, such as loan applications or mortgage approvals. A specific error description may include incorrect account balances, erroneous personal information, or accounts listed under the wrong names. For instance, in October 2023, the Federal Trade Commission reported that approximately 20% of consumers identified errors in their credit reports. Incorrect account balances may originate from late payments incorrectly recorded by creditors, affecting the actual credit utilization ratio, while erroneous personal information can stem from identity theft or data entry mistakes. Identifying and documenting these discrepancies is vital for disputing inaccuracies with credit reporting agencies, such as Experian, TransUnion, or Equifax, to ensure a fair evaluation of one's creditworthiness.

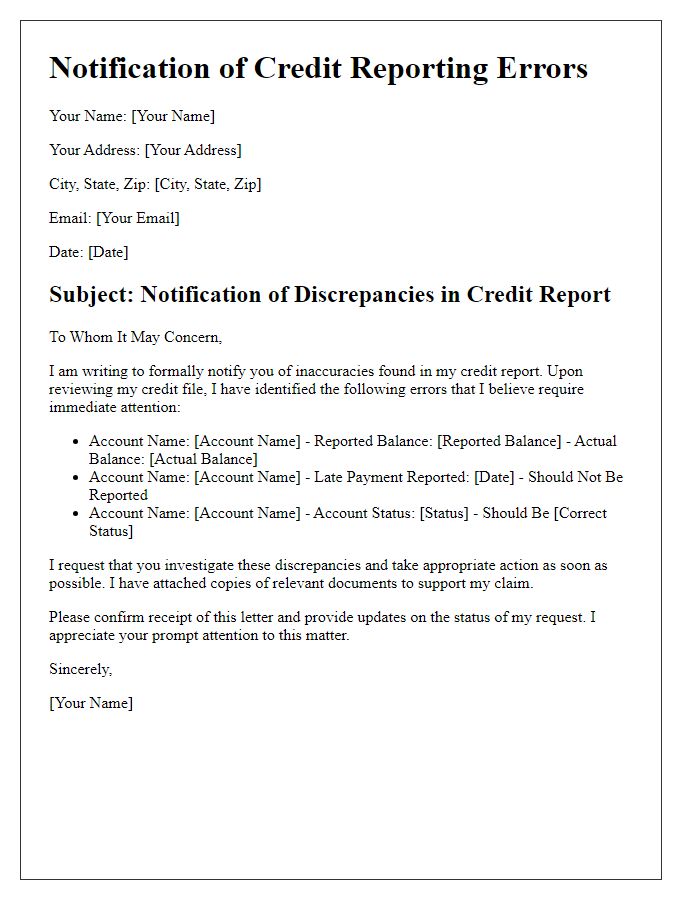

Supporting Documentation

Disputing credit report errors requires precise documentation to support your claims. A recent credit report from Experian or TransUnion showing inaccuracies must be secured, highlighting specific entries under dispute. Correspondence with creditors, such as Bank of America or Capital One, detailing any payment discrepancies should be included. Attach any relevant documents, such as payment receipts from March 2022, indicating timely payments made against credit accounts that have been incorrectly marked late. Include a formal dispute letter summarizing the errors, along with a copy of your state-issued ID and proof of address, ensuring proper identification and context for the dispute. Additionally, follow the guidelines set by the Fair Credit Reporting Act (FCRA) to ensure compliance and expedite the resolution process.

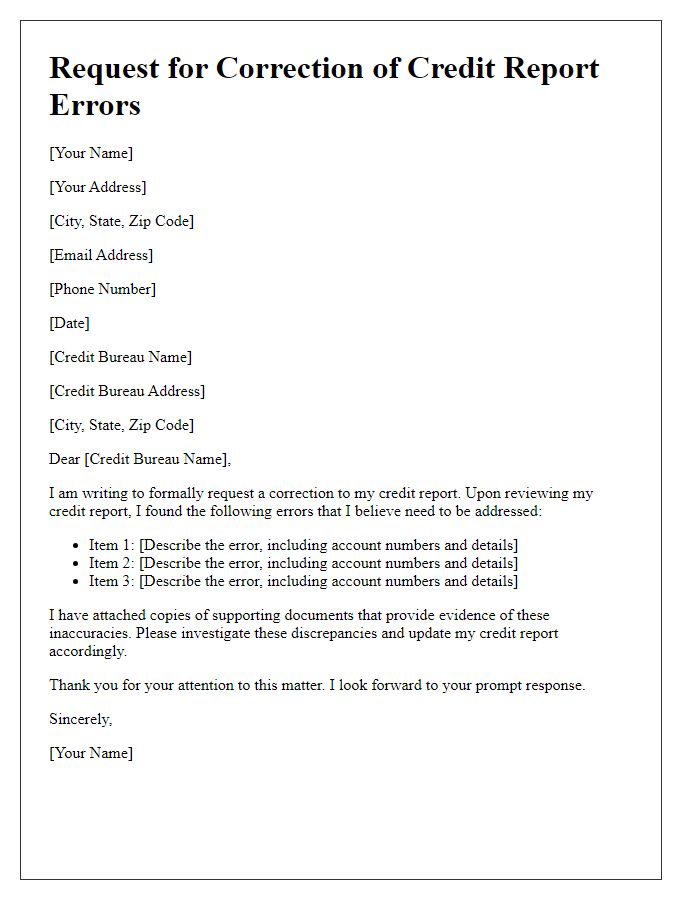

Request for Correction

Disputing errors on a credit report is crucial for maintaining individual financial health. Common inaccuracies include incorrect account balances, mistaken payment history, or identities linked to the wrong individual. The Fair Credit Reporting Act (FCRA) grants consumers the right to request corrections within 30 days upon discovering discrepancies. When addressing a credit reporting agency, such as Experian or Equifax, provide specific details like account numbers, disputed items, and attached supporting documentation. Clear communication ensures timely resolution. Persistent inaccuracies, if unaddressed, can lead to implications like denial of loans or increased interest rates, significantly impacting financial well-being.

Clear Contact Information

Clear contact information is essential when disputing errors in a credit report. Include full name, address, phone number, and email address to ensure proper identification. This information aids credit reporting agencies, such as Equifax, Experian, and TransUnion, in efficiently locating the disputed report. Accurate contact details also facilitate timely communication regarding the resolution process. It is advisable to use a permanent address rather than temporary housing, enabling a stable point of reference for correspondence. Providing a clear and complete contact picture is vital for successful dispute resolution.

Comments