Are you frustrated by unexpected interest charges on your account? You're not alone, and this article will guide you on how to effectively dispute those fees. We'll walk you through a friendly and professional letter template that clearly outlines your concerns and demands fair treatment. So, if you're ready to take control of your finances and advocate for your rights, let's dive in and explore how you can craft the perfect dispute letter!

Clearly State the Dispute

Disputed interest charges often originate from credit card statements, bank loans, or installment agreements. For instance, an interest charge of 29.99% on a credit card debt of $1,500 can significantly inflate repayments. Such discrepancies may arise from misunderstood terms or incorrect application of rates. Documented evidence, such as payment history or promotional rate terms, can support disputes. Timely resolution of these issues can prevent enduring financial implications and restore consumer trust in financial institutions. Clear communication with the respective financial entity based on accurate records is vital for effective dispute resolution.

Provide Account and Transaction Details

A dispute regarding interest charges often requires precise details for resolution. Account information (Account Number: 123456789) identifies the specific record. Recent transactions should include dates (e.g., July 15, 2023), amounts (e.g., $500), and descriptions that clarify the nature of the transactions (e.g., purchase at Business Name). Furthermore, any discrepancies noted should reference the interest rate applied (e.g., 18% APR) and the specific charge amount in question (e.g., $25 in interest) to ensure clarity. Proper documentation (e.g., monthly statements, payment history) reinforces the case for review, aiding in swift resolution.

Cite Relevant Policies or Agreements

Interest charges on credit cards can significantly impact consumer finances, especially when they arise unexpectedly. These charges often reference specific policies, such as the Truth in Lending Act, which mandates clear disclosure of interest rates and terms. Credit agreements frequently specify the Annual Percentage Rate (APR), detailing the calculation method for interest. A common practice involves calculating interest on a daily basis, particularly for outstanding balances. Disputing unjust interest charges may necessitate a review of billing statements, identifying discrepancies related to rate changes or late fees. Guidance from the Consumer Financial Protection Bureau offers additional clarity on handling disputes effectively, ensuring consumers are aware of their rights regarding interest assessments.

Request for Adjustment or Review

Interest charges on credit card accounts can significantly impact an individual's financial balance if not properly managed. Annual percentage rates (APRs) may reach as high as 29.99% for some credit cards, leading to increased monthly payments and extended debt repayment periods. A review of the account history, especially payment due dates and any promotional interest rates, may clarify discrepancies. Documentation such as billing statements from the last six months could reveal erroneous charges or misapplied payments. Additionally, reaching out to customer service representatives through established channels, like dedicated support hotlines, can initiate the review process for disputing these fees.

Include Contact Information for Follow-up

Disputing interest charges can lead to a resolution of billing discrepancies. Clear communication through formal letters can expedite the process. Relevant account details (such as account number and specific charges) should be included. Documented evidence (such as statements or terms agreed upon) strengthens the claim. Contact information for follow-up needs to be precise, including a phone number (typically a customer service line), email address, and physical address of the financial institution (like a bank or credit card company). Timely follow-up can ensure a quicker response and clarification of interest rates applied.

Letter Template For Disputing Interest Charges Samples

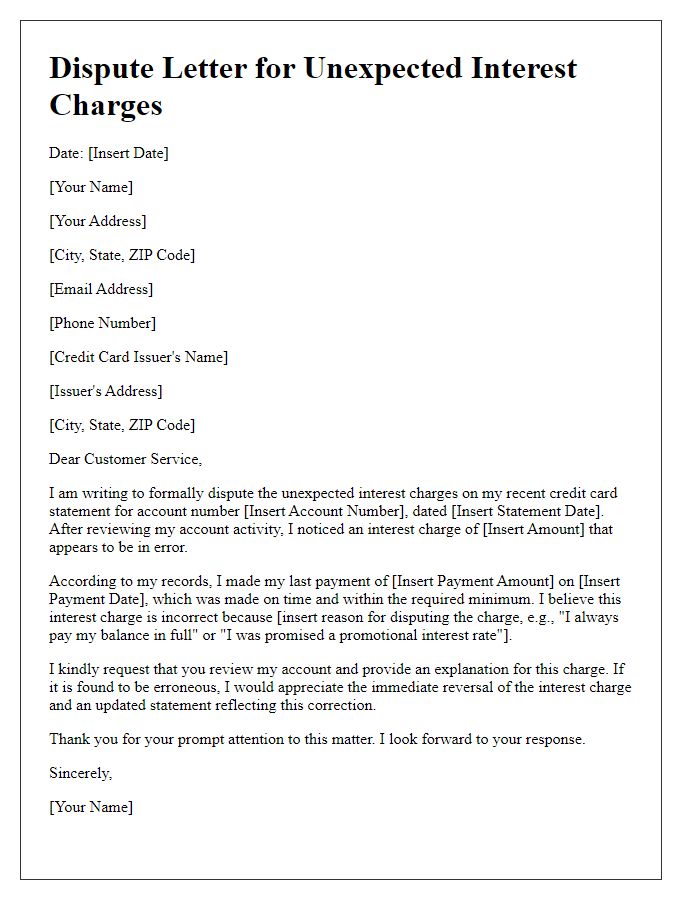

Letter template of disputing unexpected interest charges on credit card statement.

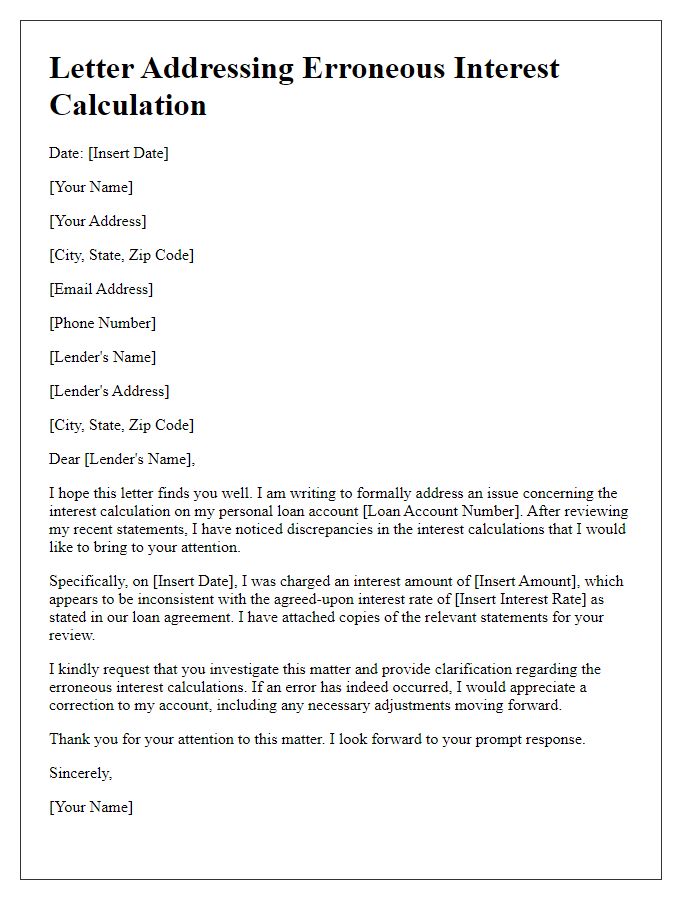

Letter template of addressing erroneous interest calculation on personal loan.

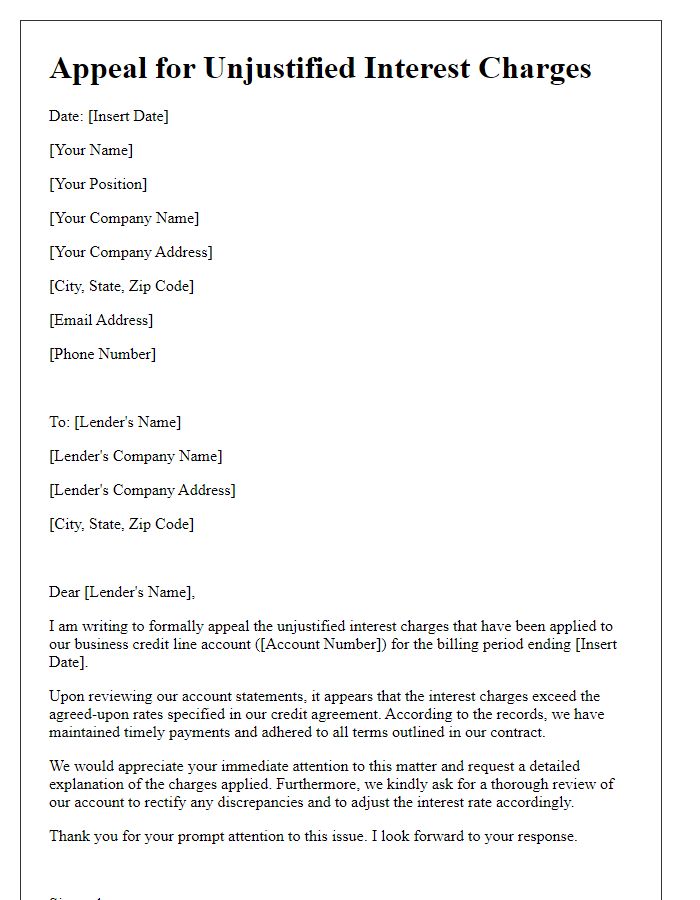

Letter template of appealing unjustified interest charges on business credit line.

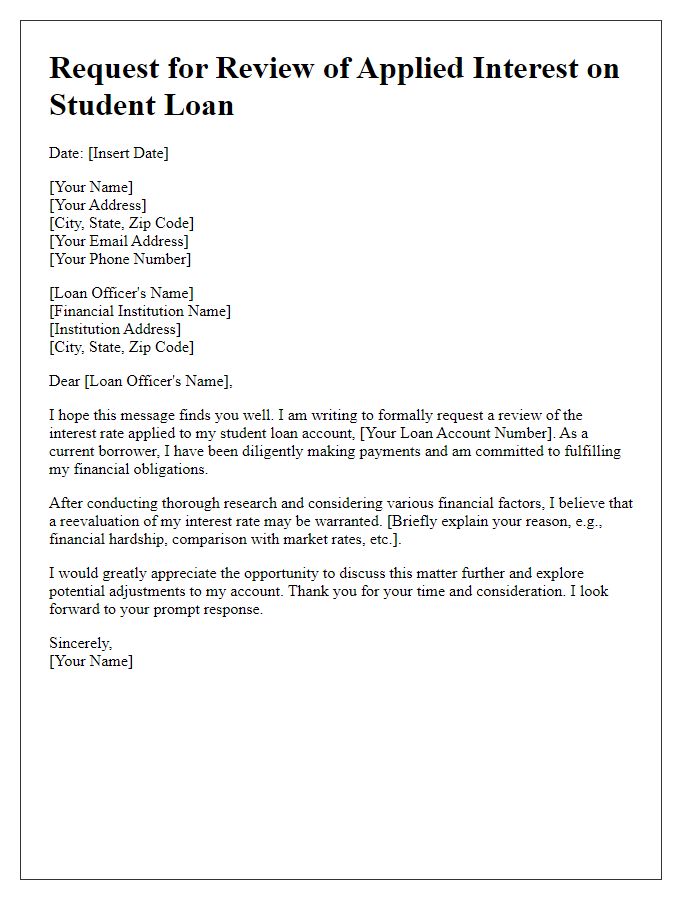

Letter template of requesting revue of applied interest on student loan.

Letter template of inquiring about interest discrepancies in savings account.

Letter template of refuting interest penalties imposed on a payment plan.

Comments