Are you feeling overwhelmed by your current debt payments and wondering how to get some relief? You're not alone; many people are navigating similar challenges, and a debt payment reduction can be a game-changer. In this article, we'll explore a simple yet effective letter template you can use to formally request a reduction in your debt payments. So, if you're ready to take control of your financial situation, keep reading to discover how to craft your request!

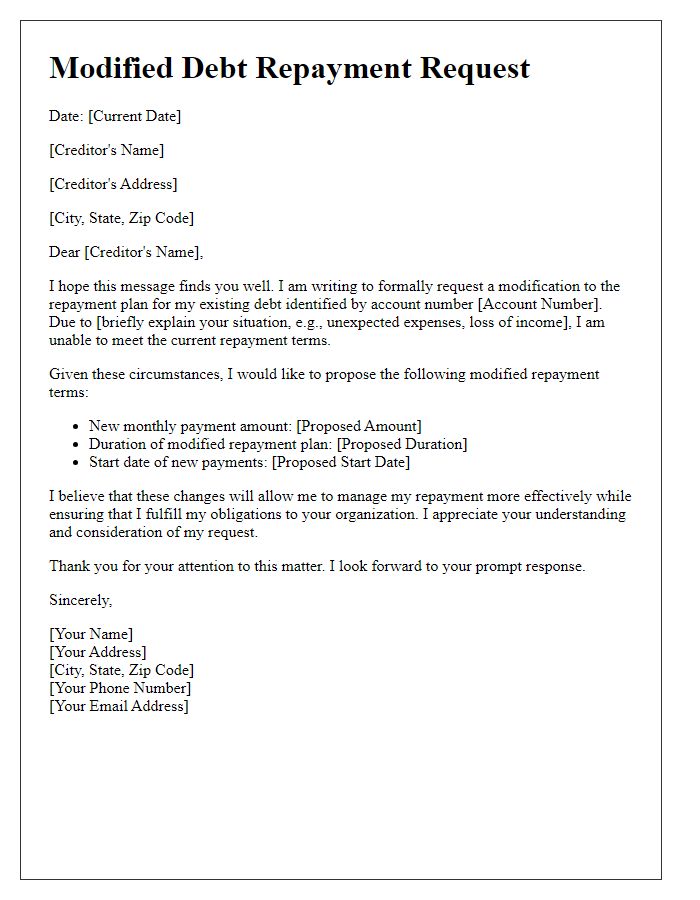

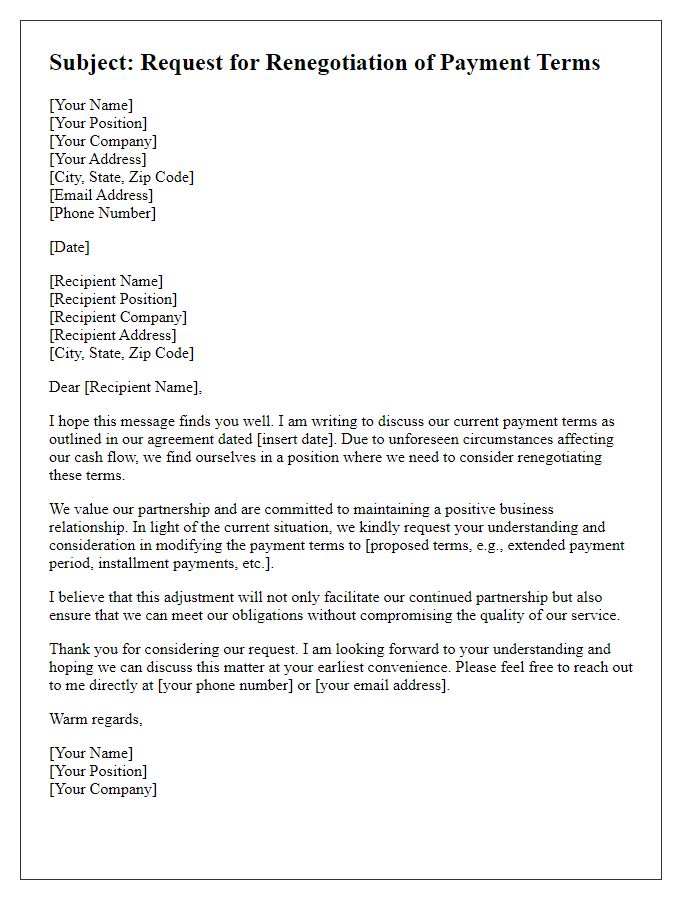

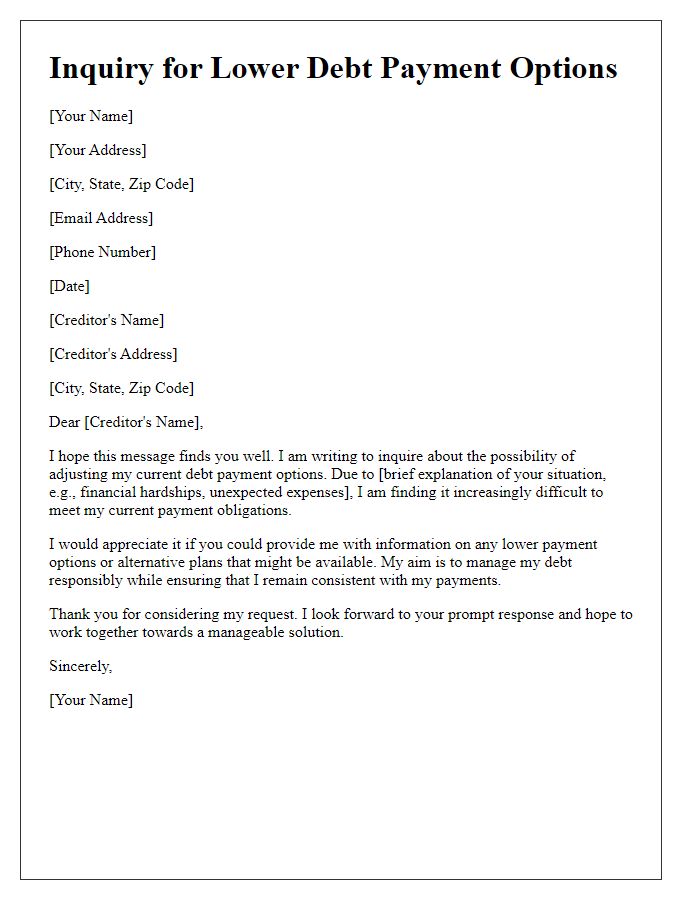

Creditor's contact information inclusion

When seeking a debt payment reduction, the creditor's contact information plays a crucial role in establishing formal communication. For instance, include the creditor's name, title, and full mailing address, which may often consist of a street number, street name, city, state, and ZIP code. Additionally, a phone number ensures an efficient response to inquiries, while an email address offers a quick, convenient channel for ongoing correspondence. Including this information not only lends credibility to the request but also facilitates a smoother negotiation process regarding financial obligations, such as outstanding loan or credit card payments. Always remember to verify the accuracy of the creditor's contact details through official records or their website before submission.

Clear identification of debtor's account or reference number

Requesting a reduction in debt payment can be important for financial stability. A clear identification of the debtor's account is essential in this context. The debtor's account number serves as a unique identifier, ensuring that all correspondence regarding the request pertains specifically to the correct financial obligation. This information, typically a combination of numbers and letters assigned by the lender, becomes crucial in tracking the status of the debt, facilitating any necessary adjustments, and maintaining organized records. Providing accurate details about outstanding balances and the original loan amounts further supports the request for a reconsideration of payment terms, potentially leading to decreased monthly payments that align better with the debtor's current financial situation.

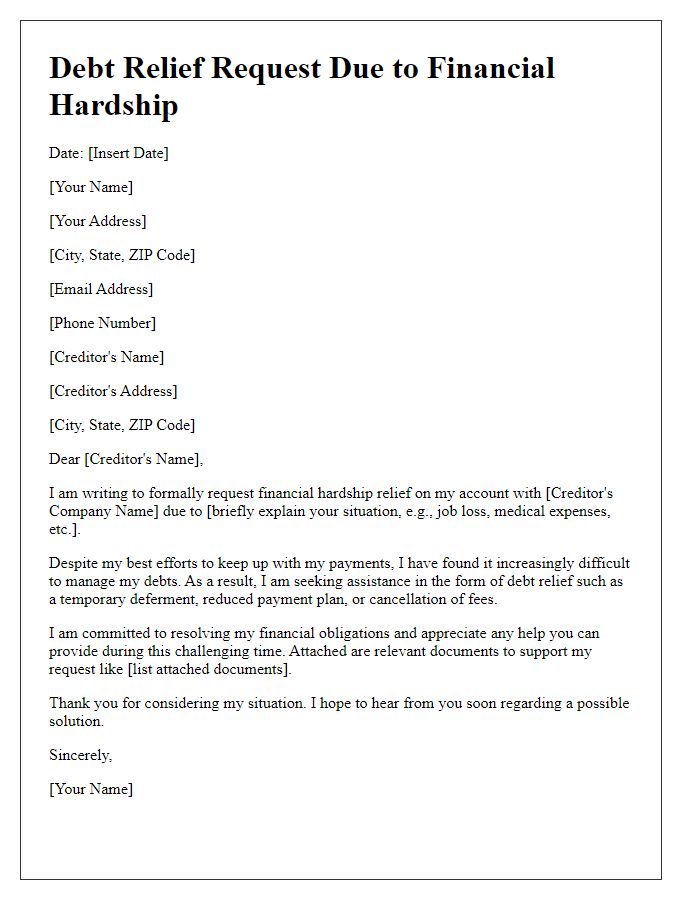

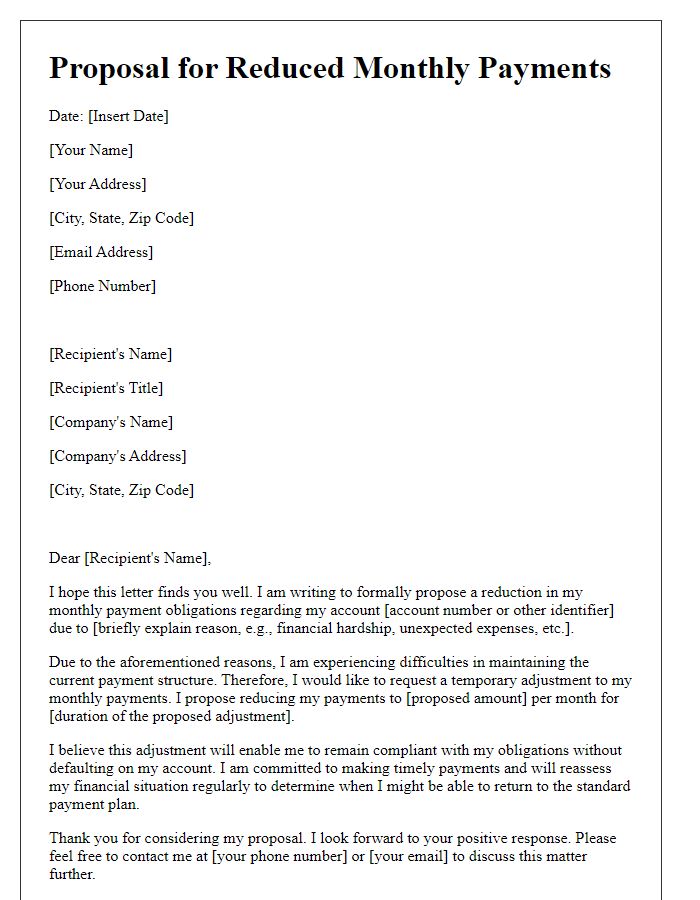

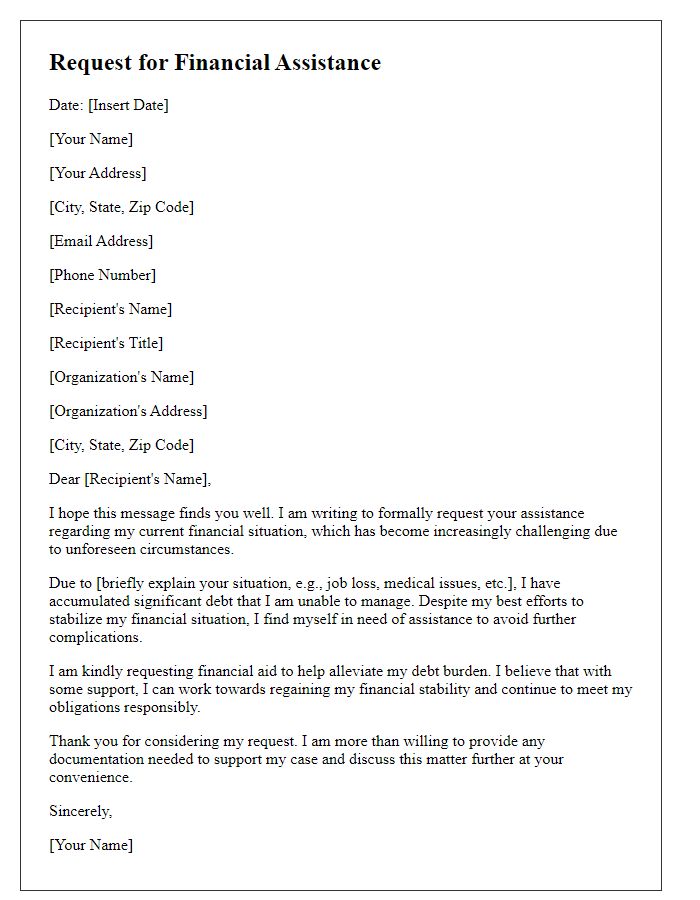

Detailed explanation of financial hardship

Experiencing financial hardship can significantly impact an individual's ability to meet their debt obligations. Situations such as job loss, dramatic income reduction (sometimes exceeding 50% of monthly earnings), unexpected medical expenses (averaging over $1,000), or major life events like divorce can all contribute to this struggle. Additionally, costs associated with living expenses in areas with high costs of living, such as San Francisco or New York City, can further strain one's budget. This compounded financial strain often leads to an inability to maintain regular debt payments, especially when existing debt levels approach or exceed 30% of one's income. Acknowledging these factors is crucial when discussing potential options for debt payment reduction.

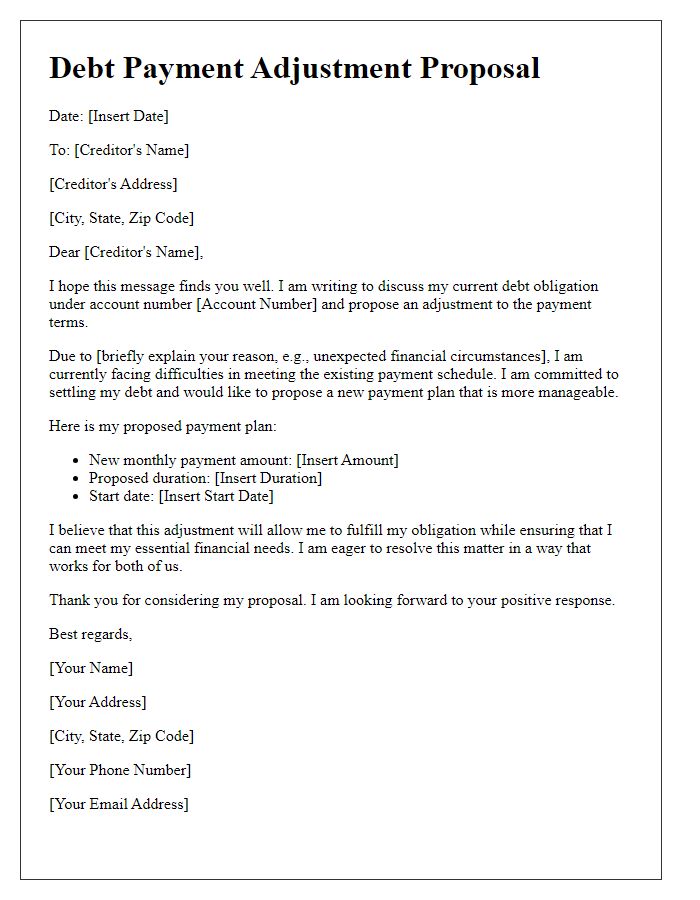

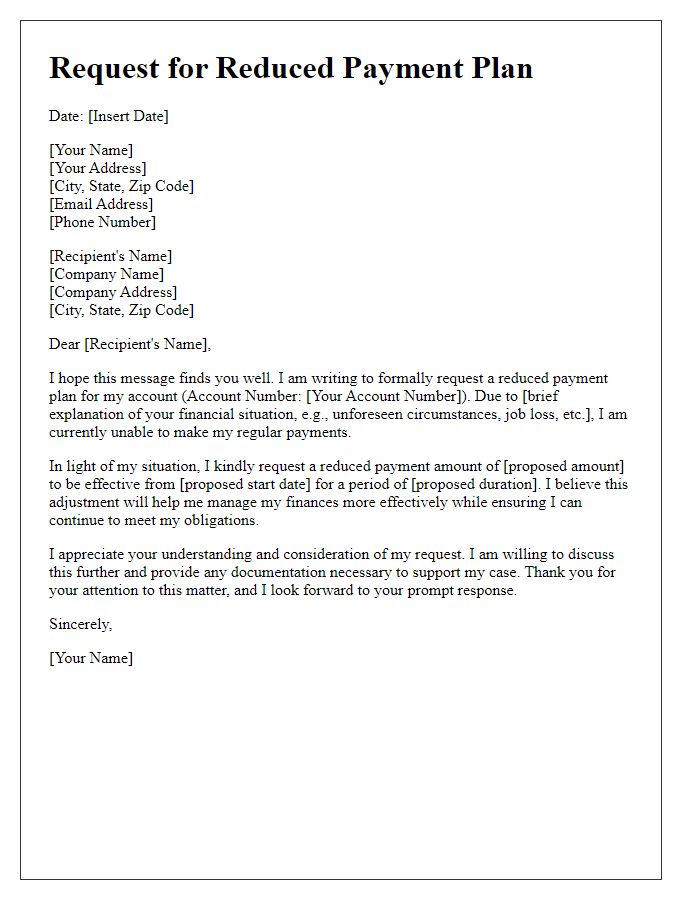

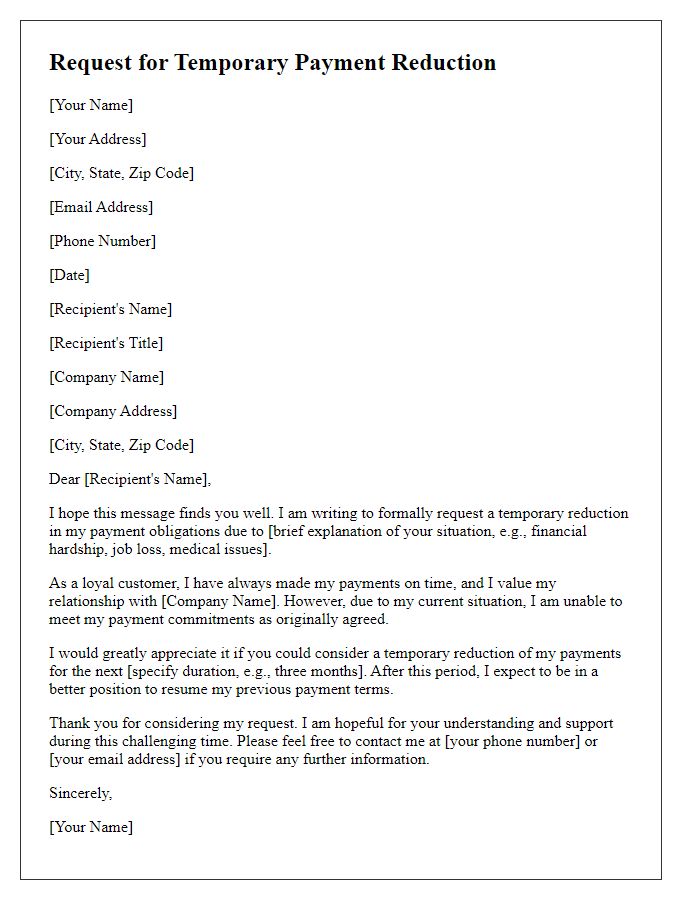

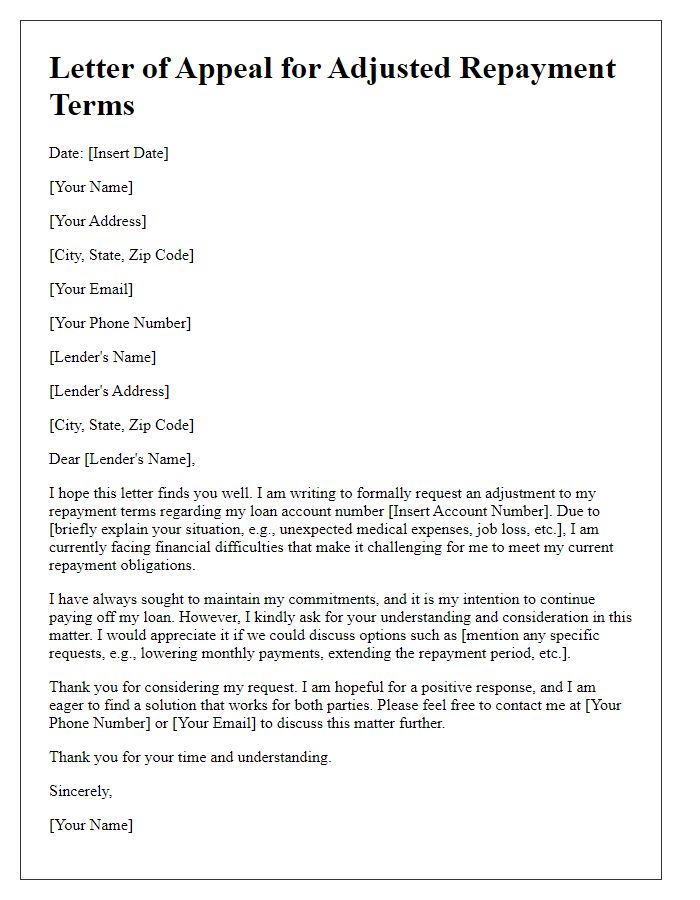

Proposed payment reduction plan and terms

Individuals facing financial difficulties often seek a debt payment reduction plan, especially when circumstances change such as unexpected medical bills or job loss. A proposed payment reduction plan typically outlines a new agreed-upon monthly payment amount (generally a percentage of the original debt). The terms might include a specific duration of reduced payments (often ranging from six months to two years) and potential forgiveness of fees or interest accrual during this period. Communication with creditors is crucial, especially through formal requests sent via certified mail to ensure a record of the agreement. Detailed financial disclosures, including income statements and monthly expenses, often accompany these requests to support the reduction case. Clear documentation serves to establish credibility and build trust with the creditor, potentially leading to a favorable outcome for the debtor.

Request for written confirmation of agreement

Many individuals facing financial hardship seek debt payment reductions to manage their monetary obligations more effectively. A debt payment reduction request often addresses the lender or creditor, such as a bank or credit card company, outlining the individual's current financial situation, including outstanding balances, income level, and monthly expenses. Providing documentation like bank statements and pay stubs can help support the request. A clear explanation of the reasons for seeking reduced payments, such as job loss or medical expenses, emphasizes the need for leniency. Moreover, requesting written confirmation of any agreement reached ensures that both parties have a clear understanding of the terms, including reduced payment amounts and timelines. Engaging communication and documenting all interaction is crucial in navigating debt negotiations successfully.

Comments