Navigating the world of debt collection can be daunting, especially when you're faced with the challenge of appealing a case. Understanding your rights and the steps you need to take is crucial in making your voice heard. In this article, we'll explore a tailored letter template that will help you craft a compelling appeal, ensuring you present your situation clearly and effectively. Ready to learn more about how to take control of your debt collection case? Let's dive in!

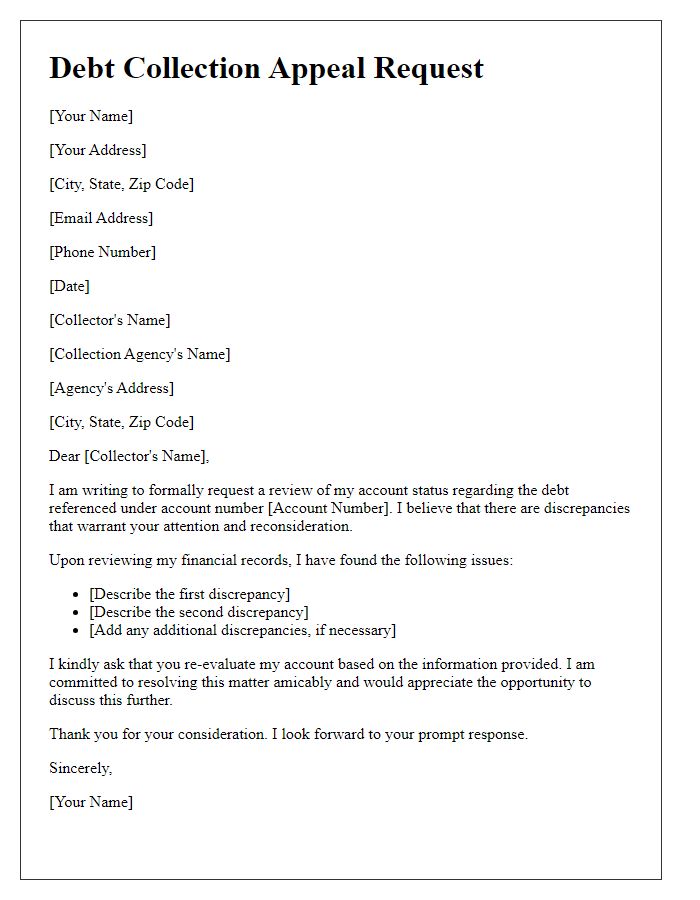

Clear Identification of Debtor and Creditor

In a debt collection case, clear identification of the debtor (the individual or entity responsible for the debt, including their full name and address) and the creditor (the party or organization that is owed money, detailing their legal name and contact information) is crucial. Accurate identification ensures effective communication and establishes accountability. For example, if a small business, like ABC Supplies, is pursuing a debt against John Doe, the debtor's identification should include his address, phone number, and account number, while the creditor should provide its business name, address, and any relevant account details. This clarity mitigates confusion around obligations and fosters proper resolution channels within the collection process.

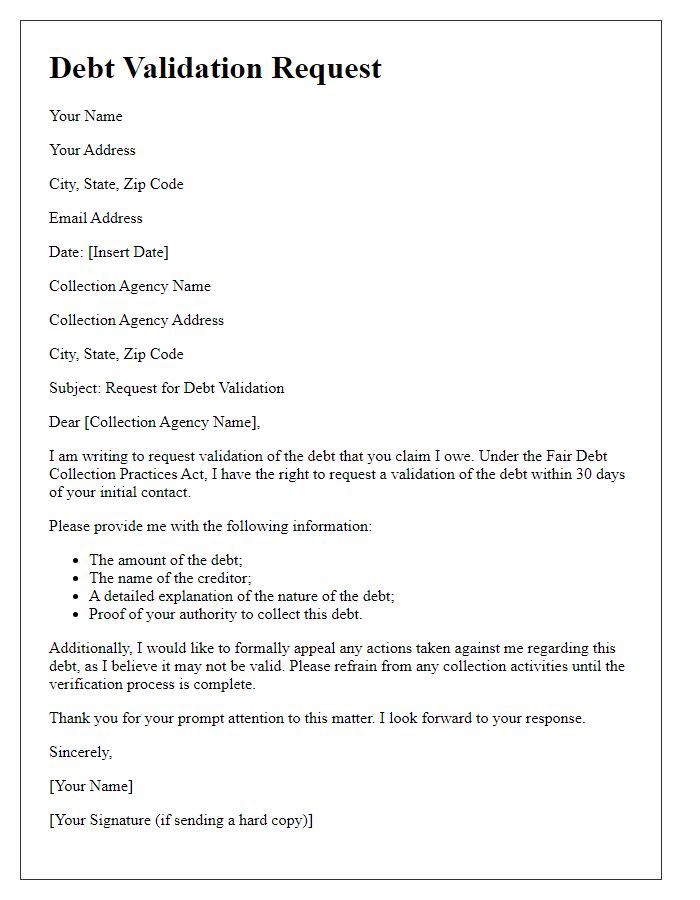

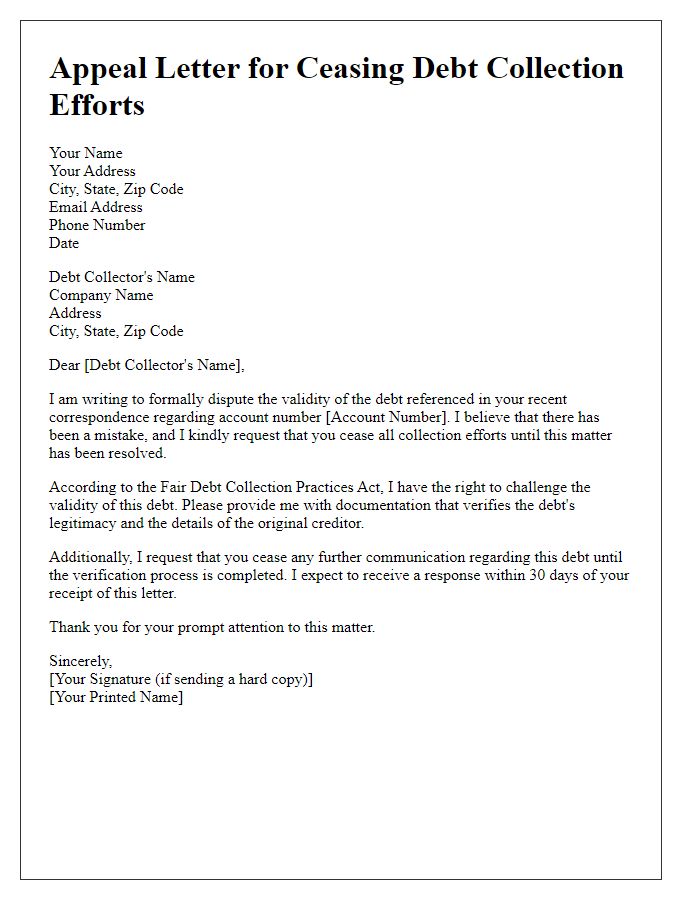

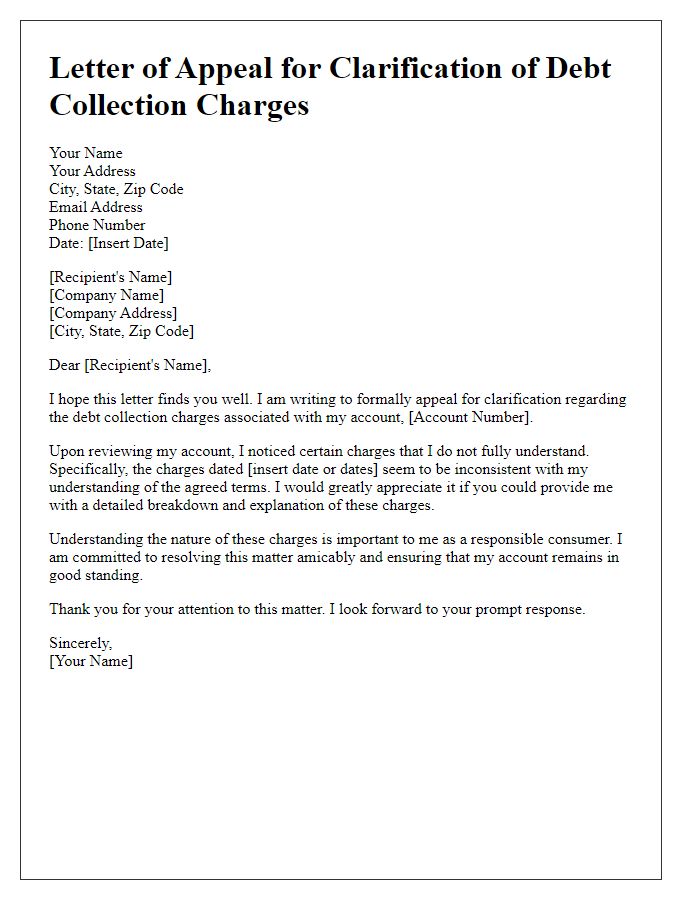

Detailed Account of Debt Discrepancy

An appeal for a debt collection case requires a detailed overview of the disputed amount, creditor, and relevant correspondence. The account of debt discrepancy can involve the original creditor, such as Capital One (date of account initiation: January 2020), and the collection agency, like Midland Credit Management (contacted on August 15, 2023). Key details include account numbers (e.g., 1234-5678-9012) and specific charges in question, such as a late fee of $50 applied on March 5, 2023. Additionally, references to any previous payment attempts or correspondence (letters sent on July 1, 2023, and July 15, 2023) can strengthen the case. Documenting evidence, including bank statements displaying payments made during disputed periods, will provide crucial support for the appeal process.

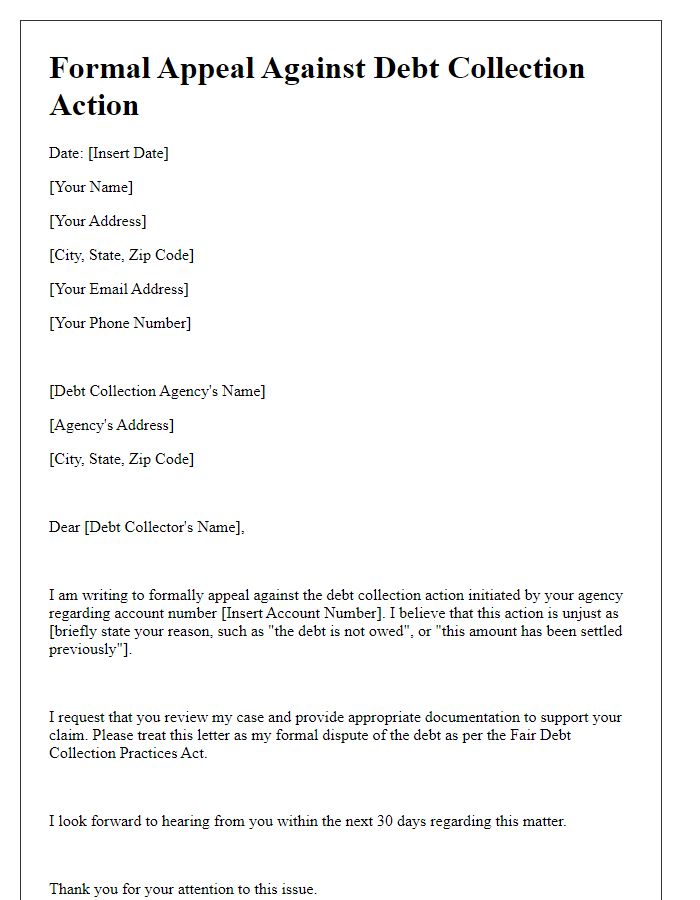

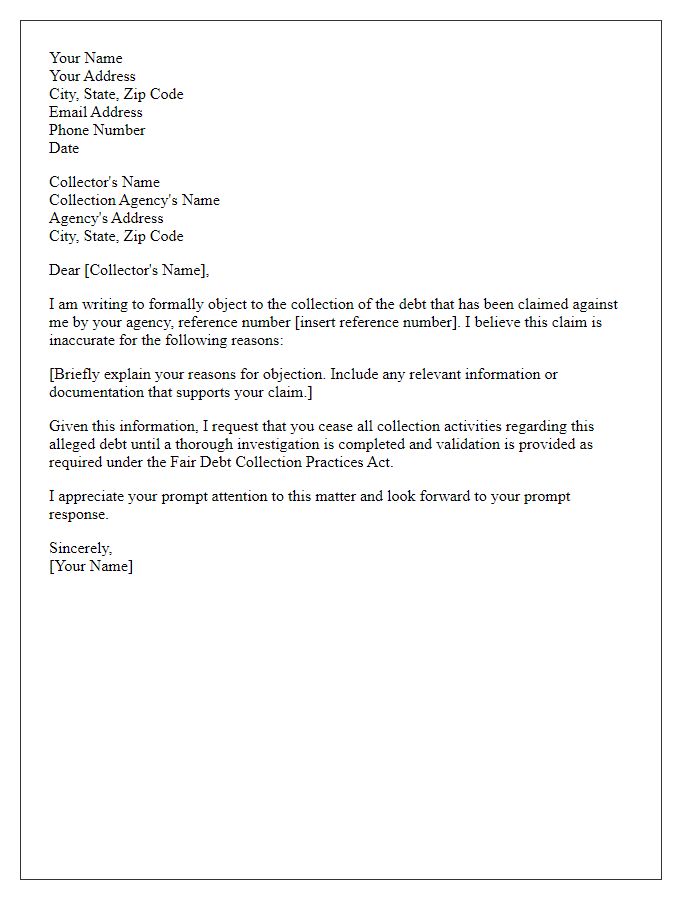

Legal References and Supporting Documentation

A debt collection case often requires comprehensive documentation and legal references to support an appeal effectively. Essential elements include the Fair Debt Collection Practices Act (FDCPA), which outlines consumer rights against illegal collection practices. Important supporting documents may consist of account statements detailing the original balance, payment history, and any correspondence between the debtor and the collection agency. Additionally, the original credit agreement signed by the debtor provides crucial evidence of the terms and obligation. Accurate records of communication, such as emails or letters exchanged, can further substantiate claims of harassment or misinformation. Seeking advice from consumer protection agencies such as the Consumer Financial Protection Bureau (CFPB) can provide authoritative guidance in crafting a defense strategy. Court rulings related to similar cases may also serve as persuasive references to bolster the appeal's credibility.

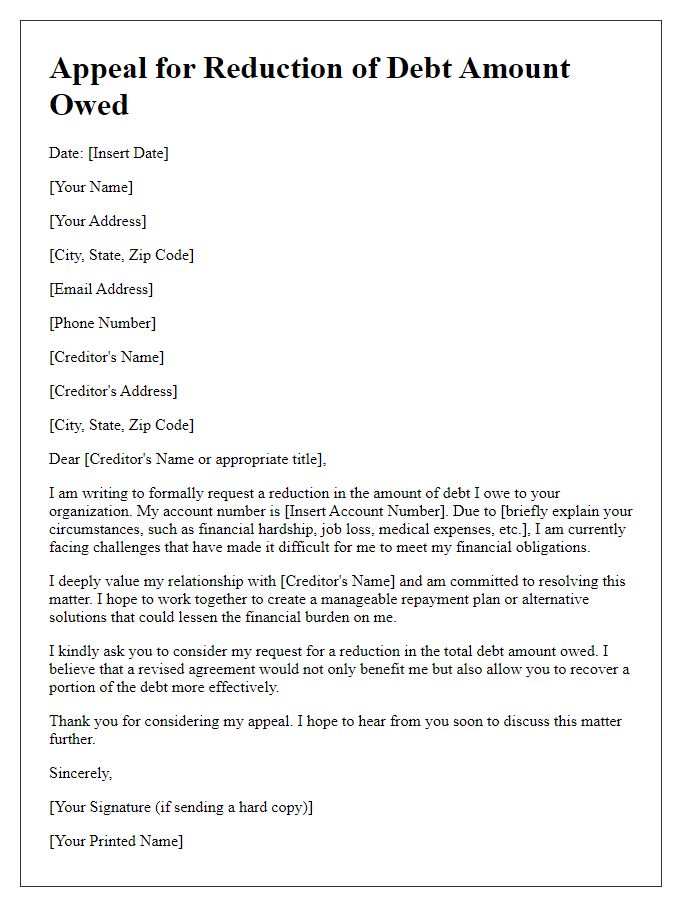

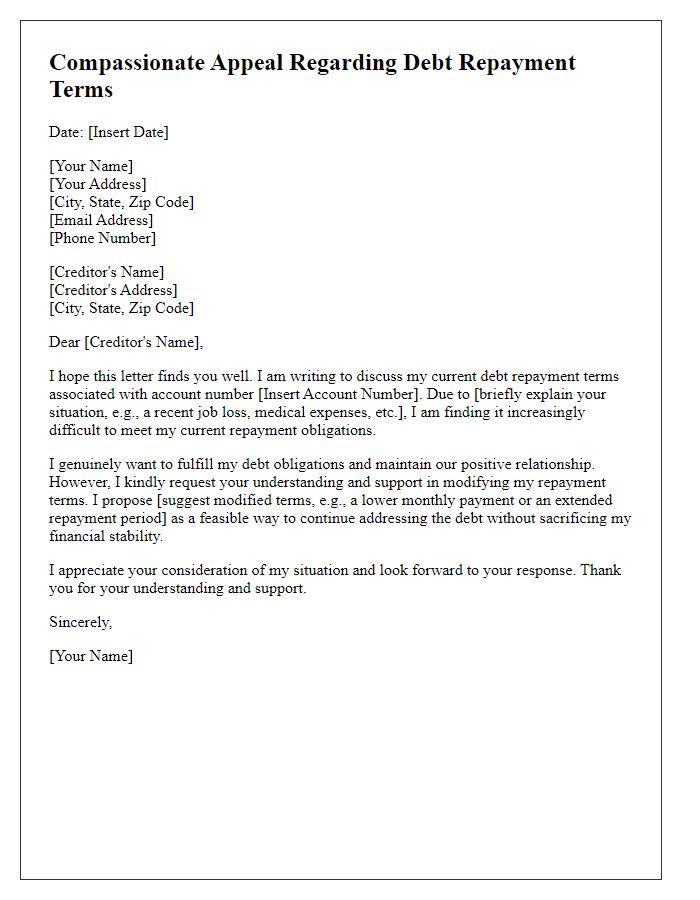

Emotional Appeal and Personal Circumstances

Dealing with a debt collection case can be overwhelming, especially when personal circumstances change unexpectedly. Many individuals may find themselves in difficult financial situations due to unforeseen events like job loss or medical emergencies. Such challenges can often lead to falling behind on payments, resulting in relentless calls from collection agencies. Emotional strain compounds these issues, leading to heightened anxiety and stress levels. The appeal to debt collectors often includes personal stories that highlight struggles, such as a sudden illness requiring costly treatments or a spouse's job loss leading to diminished household income. Articulating these circumstances allows individuals to seek understanding and possibly negotiate a more manageable payment plan or forgiveness of certain fees, fostering a sense of empathy in the heart of the collectors.

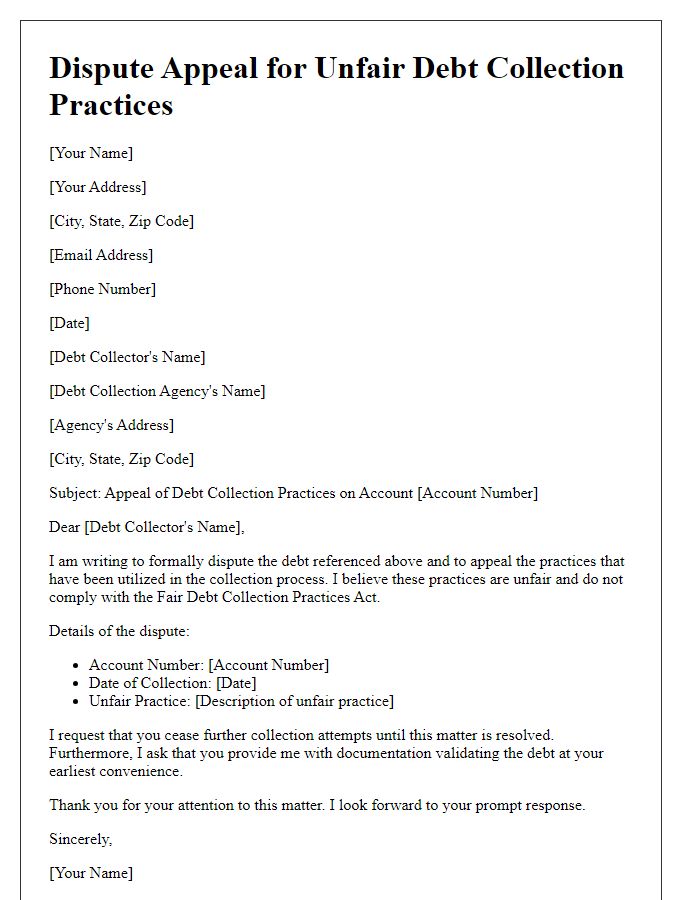

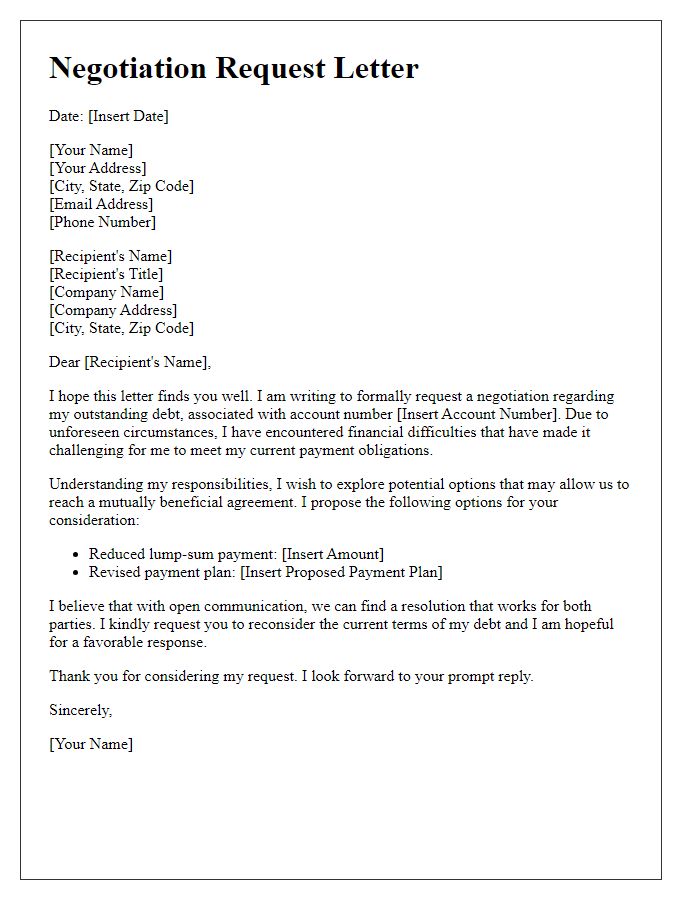

Formal Request for Resolution and Next Steps

Formal debt collection processes often involve various stages of communication between creditors and debtors. A clear understanding of procedures is essential. Agencies, such as the Fair Debt Collection Practices Act (FDCPA) in the United States, outline the rights of consumers, preventing harassment and ensuring transparency. In a typical case, initial contact usually occurs through a written notice, including the amount owed, the name of the creditor, and a demand for payment within a specific timeframe, often 30 days. Debtors then have the right to dispute the debt or request validation. Additionally, subsequent communications may detail payment arrangements, potential legal actions, or consequences for non-payment, affecting the debtor's credit score. Keeping meticulous records, including dates and contents of communications, is critical for both parties throughout the process.

Comments