Hey there! If you've ever found yourself needing a little extra financial flexibility, you're not alone. A credit limit re-evaluation can provide just that, often leading to greater purchasing power and better options for managing expenses. In our latest article, we'll guide you through crafting a compelling letter for this request, making the process smoother and more effective. So, let's dive in and explore how you can strengthen your case!

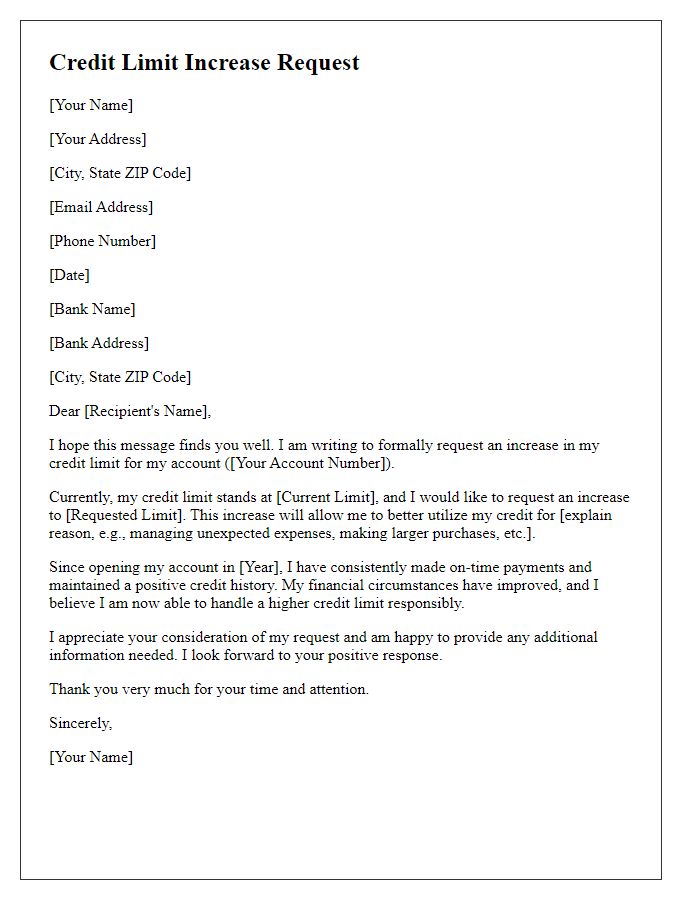

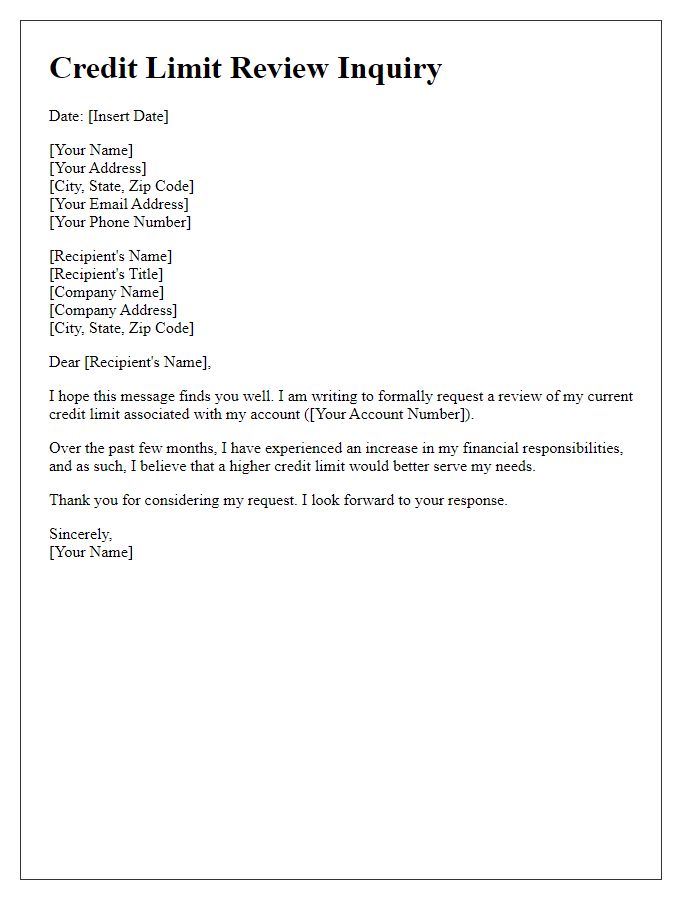

Personal Information

A credit limit re-evaluation request involves providing essential personal information to lenders, typically including full name, social security number, and current address. Personal income details, such as annual salary or monthly income, may also be necessary to assess financial standing. Employment history plays a vital role; documenting employer name, position, and duration of employment can highlight job stability. Additionally, current credit score and outstanding debts should be mentioned, as they influence creditworthiness. Including recent bank statements or tax returns can further support the request and demonstrate financial responsibility.

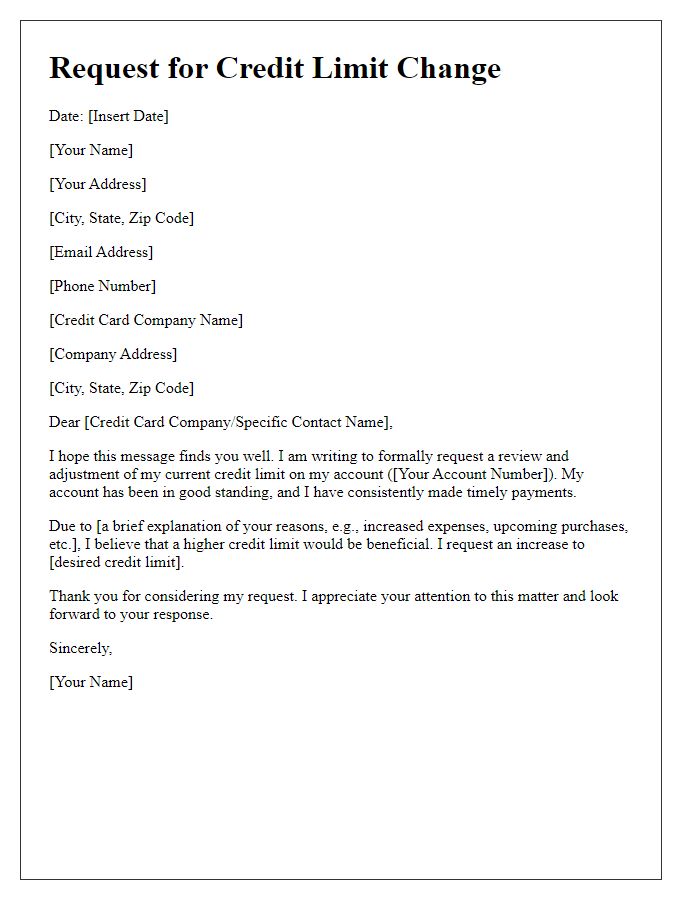

Account Details

A credit limit re-evaluation request is a formal appeal made to financial institutions to increase the spending limit on a credit account, enhancing financial flexibility. Account details typically include information such as the account number (a unique identifier for the credit account), the account holder's name (the individual responsible for payments), current credit limit (the maximum amount available for borrowing), payment history (record of on-time or late payments), and annual income (used to assess repayment capability). This request often indicates a customer's active financial management, aiming to utilize credit for purchases or emergency expenses more effectively.

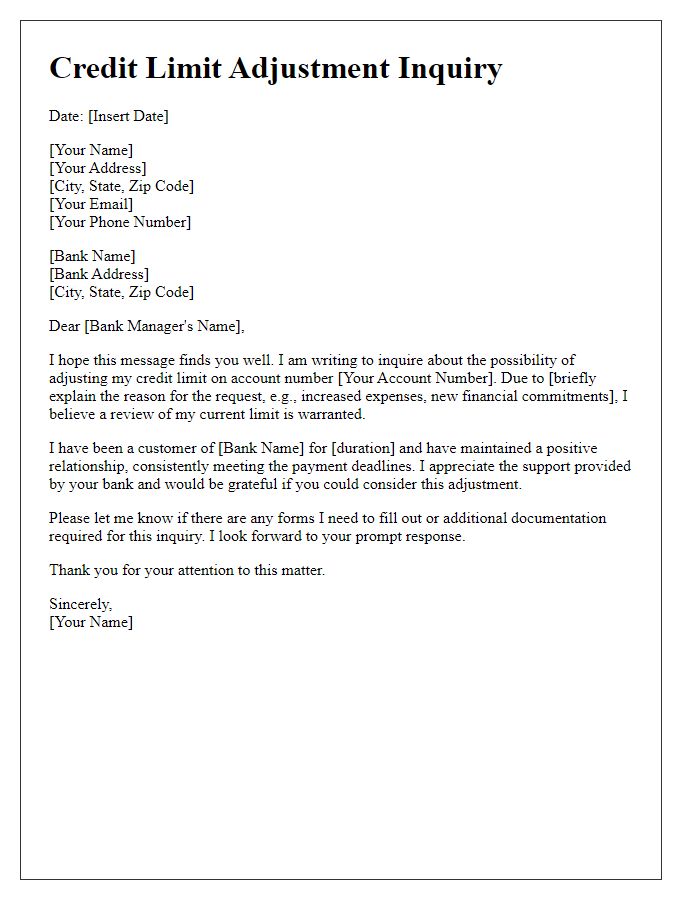

Reason for Re-evaluation

A credit limit re-evaluation request can be initiated for several reasons, including significant changes in income, improved credit score, increased monthly expenses, or the need for larger purchasing capabilities. For instance, an individual may experience a salary increase of 20% due to a recent promotion, resulting in a higher capacity to manage credit. Additionally, if the credit score has improved beyond 700, the rationale for increased credit limits becomes stronger. Other potential reasons involve recent changes in lifestyle or financial obligations, such as a new mortgage or education expenses that may require increased financial flexibility. Ensuing this request can lead to better-managed finances and increased purchasing power while maintaining responsible credit utilization.

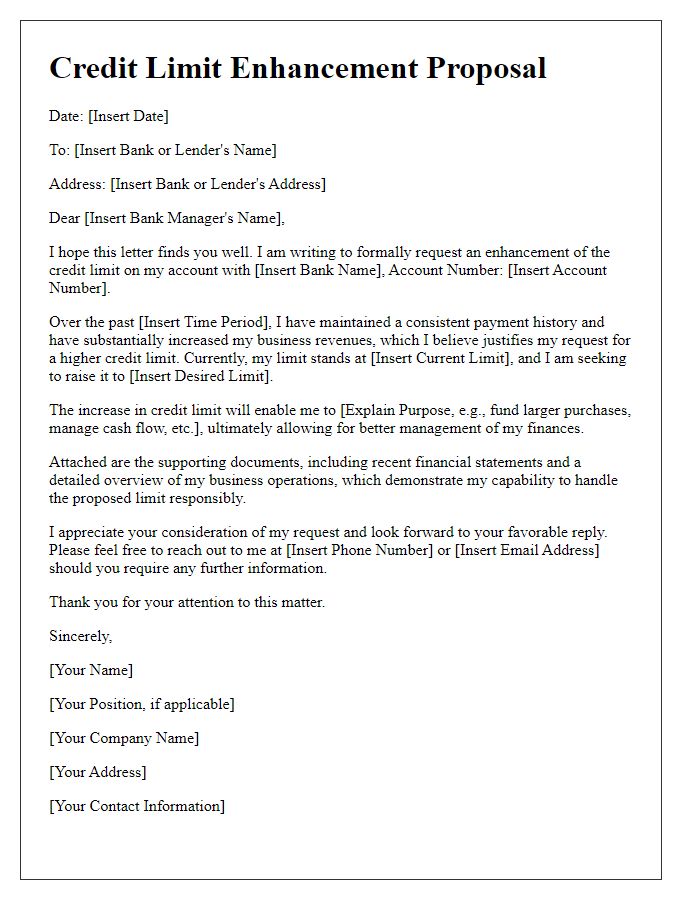

Financial Overview

A comprehensive financial overview outlines key factors influencing a credit limit re-evaluation request. The evaluation typically considers an individual's credit score (typically ranging from 300 to 850), which reflects creditworthiness based on payment history, debt-to-income ratio (an optimal ratio is around 30%), and overall income level. Additional aspects such as employment stability (length of employment, type of job) significantly impact the perceived financial reliability. Furthermore, existing debts, including credit card balances, personal loans, and mortgages, contribute vital information for lenders assessing the ability to manage increased credit limits. Timely payments on these obligations strengthen the case for credit limit adjustments, demonstrating responsible financial behavior. Economic indicators, like inflation rates affecting purchasing power, may also play a role in the lender's decision-making process regarding revised credit limits.

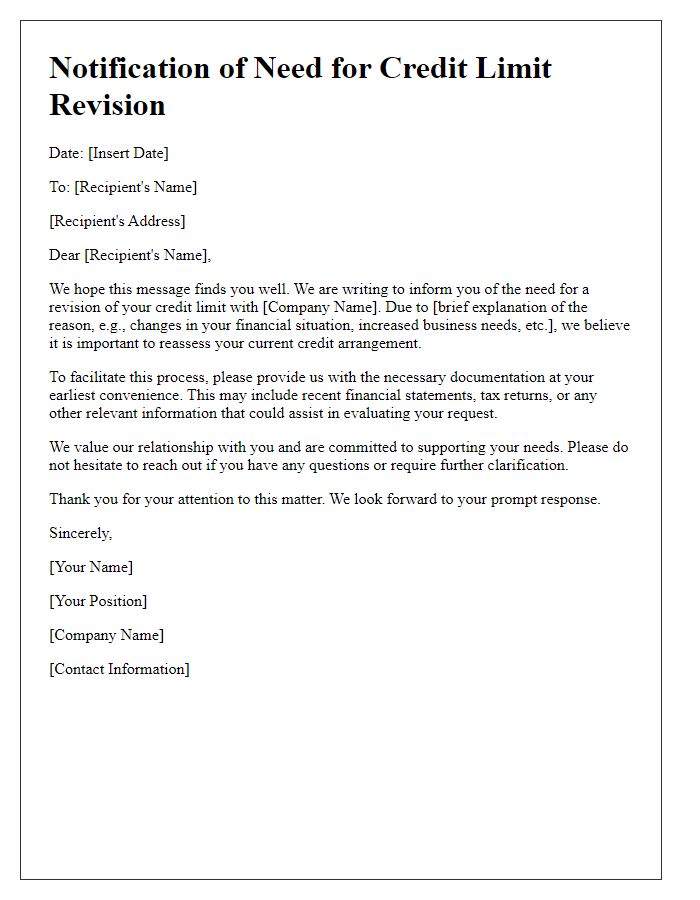

Supporting Documents

The submission of supporting documents for a credit limit re-evaluation request is crucial for demonstrating financial stability and creditworthiness. Recent pay stubs (issued within the last 30 days), bank statements (covering the last three months), and tax returns (for the previous year) provide evidence of income stability and employment. A detailed statement of existing debts (including credit card balances, loans, and mortgages) offers clarity on current financial obligations. Additionally, providing documentation of any significant changes in financial circumstances, such as an increase in salary or a new source of income, is vital for a comprehensive review. These documents collectively assist in reassessing a customer's credit limit, potentially leading to a more favorable decision.

Comments