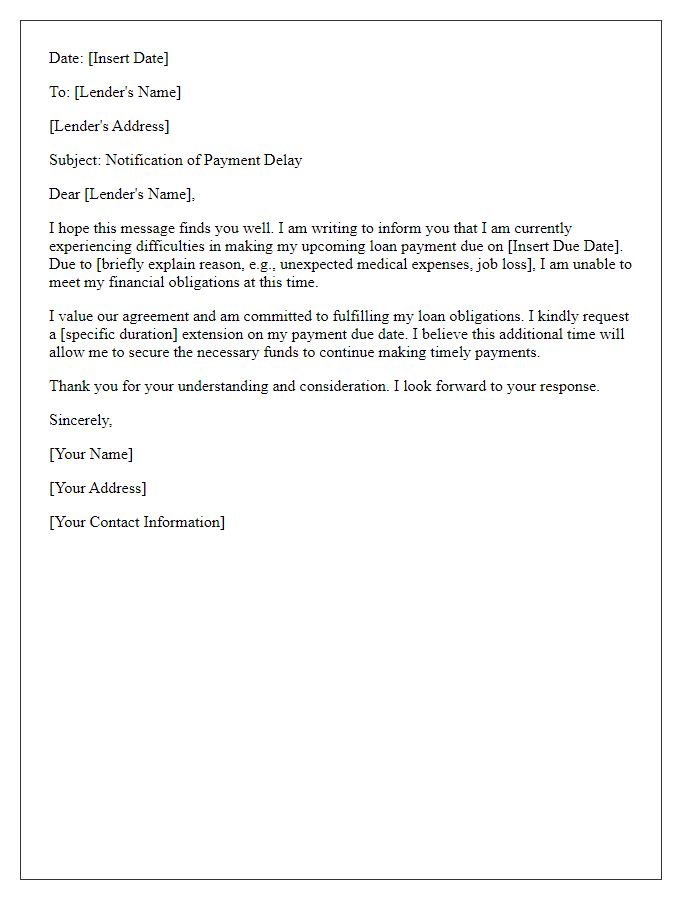

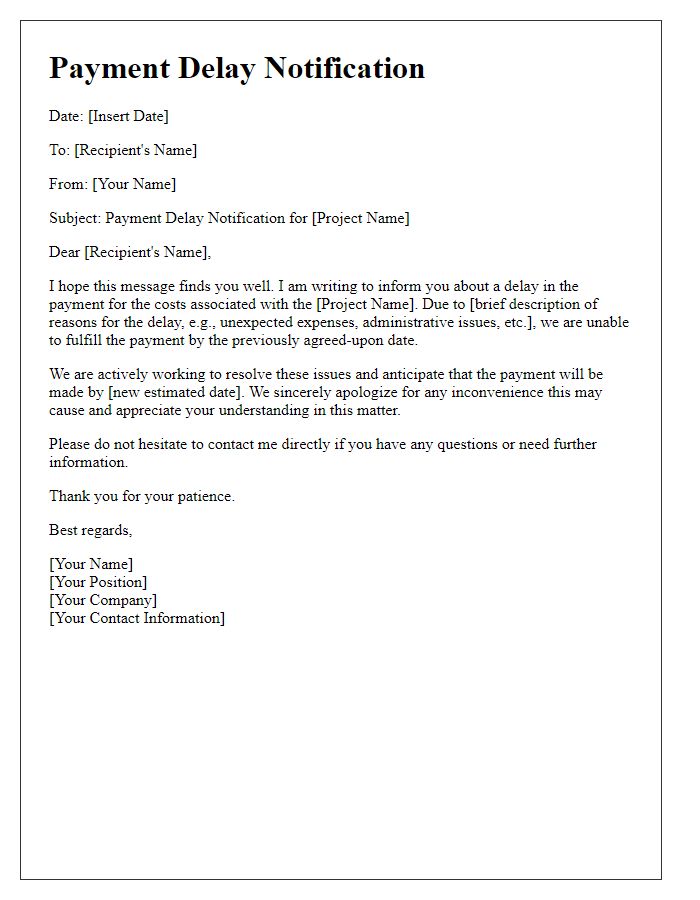

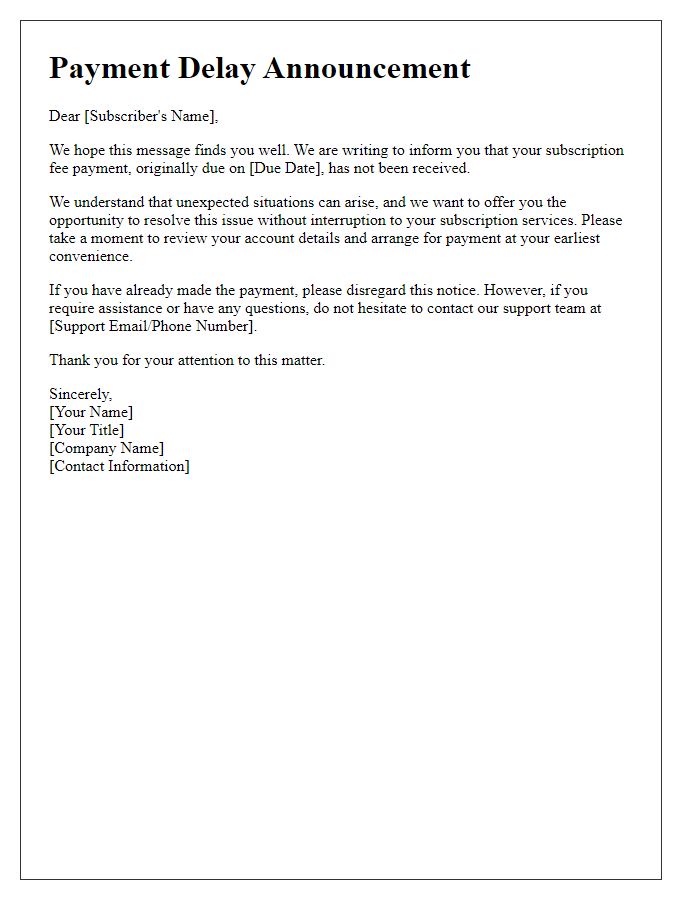

Hey there! We've all been thereâsometimes life throws us a curveball, and managing finances can get tricky. If you find yourself needing to explain a payment delay, it's important to communicate clearly and honestly to maintain trust. In this article, we'll dive into crafting a considerate letter template that effectively conveys your situation while keeping the lines of communication open. Ready to learn more?

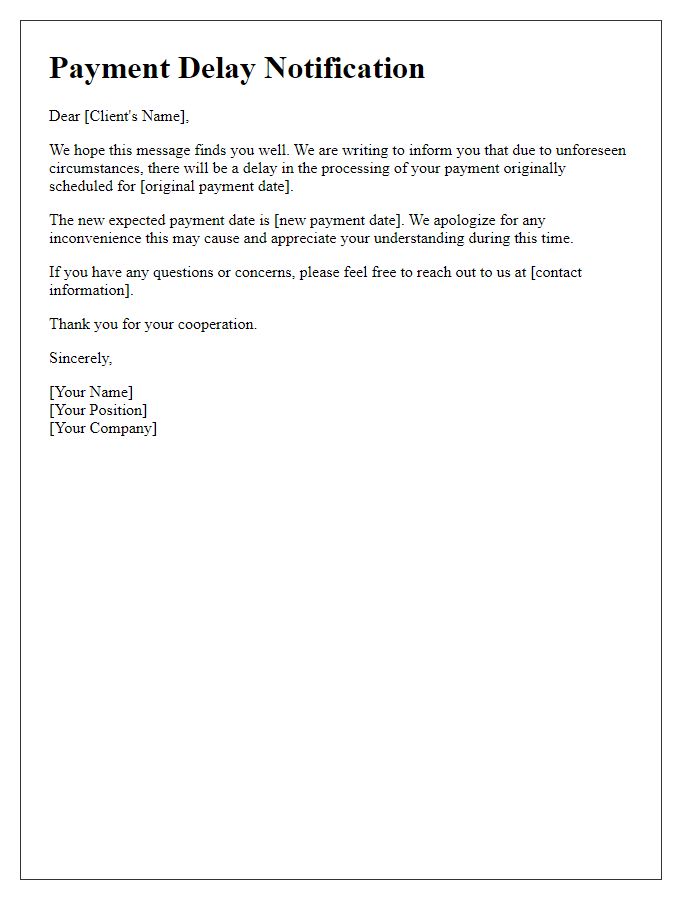

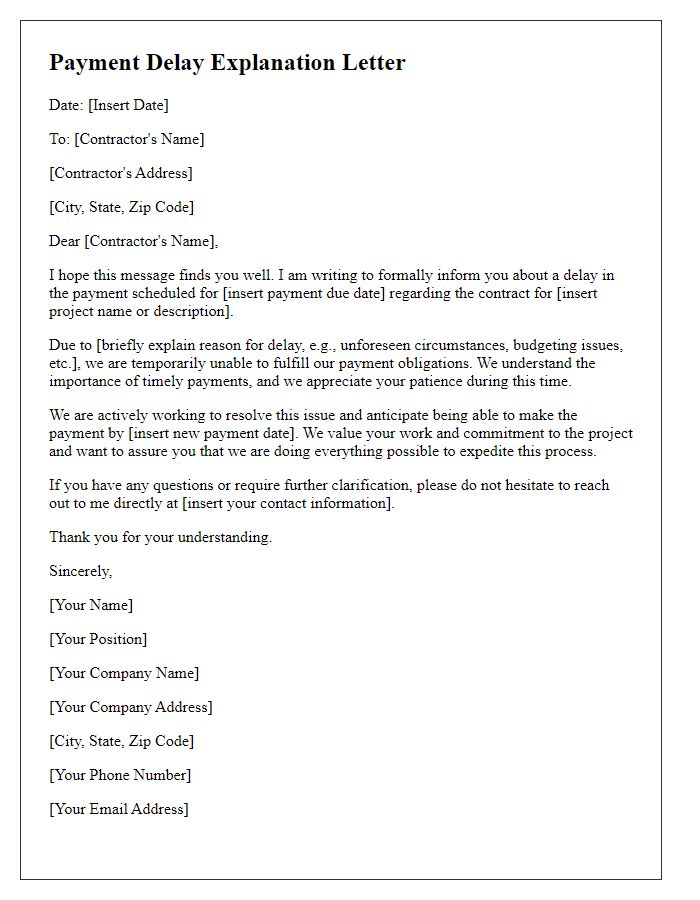

Payment Delay Reason

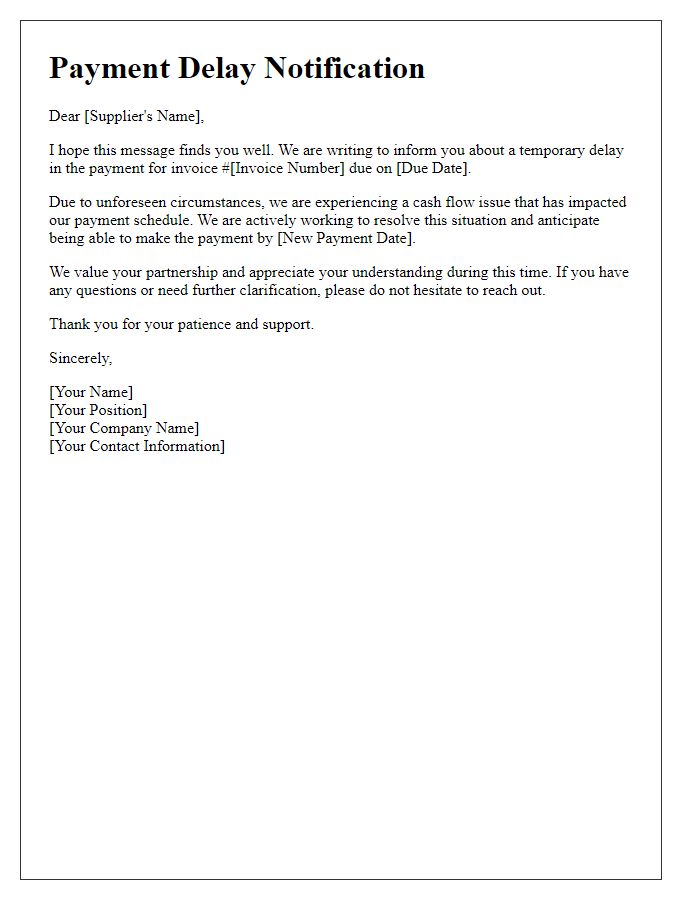

A payment delay can occur due to various factors, including administrative errors, banking issues, or unexpected changes in financial circumstances. Common reasons for delays include a billing cycle interruption, where invoices may not have been generated on schedule, leading to late payments. Additionally, banking errors, such as miscommunication between banks or delays in wire transfers, can cause significant hold-ups, particularly for large transactions exceeding $10,000. In some situations, a client's unforeseen financial setbacks, like an unexpected dip in revenue or cash flow issues, can contribute to delays. Maintaining open communication with all parties involved is crucial to ensure transparency and facilitate resolution of the payment issue.

Apology Statement

A delay in payment processing can create complications for small business operations. Various factors such as unexpected cash flow shortages or technical issues with payment systems can contribute to these delays. For example, the transition to new accounting software or bank processing errors might extend payment timelines beyond normal standards, which typically ensure transactions complete within 24 to 48 hours. Additionally, payment delays can disrupt vendor relationships, impacting the supply chain and potentially leading to service interruptions or increased costs. Addressing these issues promptly and transparently is crucial for maintaining trust and ensuring continued collaboration in the future.

Assurance of Payment Timeline

In financial transactions, clarity regarding payment timelines is crucial for maintaining trust between parties. Delays in payments can arise due to various factors, including processing issues within banking institutions which may take three to five business days, or reconciliations within an organization's accounts payable department that necessitate thorough cross-verification, often requiring additional documentation or authorization. It's important to communicate proactively about potential delays to avoid misunderstandings. Establishing a definitive payment timeline, ideally within a 30-day period from the payment due date, reassures the receiving party of the intent to fulfill obligations. Keeping stakeholders informed about any delays, alongside a commitment to settle the payment, aids in upholding professional relationships and financial transparency.

Contact Information for Follow-up

Payment delays can significantly impact cash flow for businesses, especially small to medium-sized enterprises. Clients, such as freelancers or service providers, often encounter tardiness in payment from major corporations or government contracts. This can lead to challenges in meeting operational costs, including employee salaries and vendors. Communication with clients (like invoices or reminder emails) is crucial; delays longer than 30 days may necessitate formal agreements or renegotiations. Establishing clear follow-up contact information, such as specific roles (accounts payable manager) and direct phone numbers, enhances the process of resolving payment issues efficiently. Prompt resolution not only maintains professional relationships but also ensures operational stability.

Commitment to Future Punctuality

Payment delays can occur due to various unforeseen circumstances, such as cash flow issues or administrative errors within organizations, affecting the timely disbursement of payments. For instance, a business may experience delays if its accounts payable department encounters unexpected staffing shortages or if external factors, like economic downturns affecting revenue streams, impact overall finances. A commitment to future punctuality is essential, with plans for implementing improved processes or technology solutions that enhance invoicing efficiency and reminder systems. Continued focus on financial management practices can help prevent future discrepancies and maintain positive relationships with vendors and suppliers in the long term, paving the way for reliable business operations.

Comments