When it comes to managing personal and business finances, clear communication is essential, especially in matters related to debt. A debt acknowledgment receipt serves as a vital document that confirms the receipt of a payment, reinforcing trust between creditors and debtors. Not only does it provide legal protection, but it also helps in maintaining accurate records for future reference. Curious about how to create your own debt acknowledgment receipt? Read on to discover a handy template and tips for drafting your letter!

Clear identification of parties involved

A debt acknowledgment receipt serves as a formal document confirming the recognition of a monetary obligation by the debtor towards the creditor. This receipt should contain detailed information regarding both parties involved: the full name of the debtor (individual or business entity), their identification number or specific tax ID, and complete contact information, including address and phone number. The creditor's details should similarly include their full name, identification details, and contact information. It is essential to specify the exact amount of debt acknowledged, the purpose of the debt, payment terms, and the date of acknowledgment. This clear identification of parties ensures legal validity and clarity in the event of future disputes related to the debt.

Detailed description of debt acknowledged

The debt acknowledgment receipt serves as a formal document verifying the outstanding financial obligation between two parties, typically a lender and a borrower. This receipt outlines specific details about the debt, including the total amount owed, which may exceed a defined amount such as $5,000, the purpose of the loan, such as business expansion or personal expenses, and the terms of repayment, including the interest rate set at 7% annually and the due date scheduled for December 31, 2024. Additionally, the receipt may specify whether collateral, such as property or assets, has been provided, alongside any relevant legal stipulations pertaining to the debt. This legally binding acknowledgment protects both parties by ensuring clarity regarding the debt's existence and terms, referencing any agreements made, such as promissory notes, which may detail the installment payments due monthly.

Payment terms and conditions

A debt acknowledgment receipt serves as an important document in financial transactions, confirming that a debtor recognizes the existence of their debt. Essential elements include debtor information (name, address), creditor details (business name, contact), and the specific debt amount (total owed, currency type). The document typically outlines payment terms, such as due dates (monthly, quarterly), interest rates (fixed, variable), and consequences of late payment (late fees, increased interest). Additionally, a clear statement regarding the method of payment (bank transfer, check, cash) is crucial. This receipt may also include a section for signatures (both debtor and creditor) to formalize the acknowledgment.

Confirmation of receipt of acknowledgment

A debt acknowledgment receipt serves as a formal record indicating that a debtor recognizes the existence of a financial obligation. This document can be critical in legal contexts, especially in financial transactions involving amounts exceeding $500. The receipt should detail the debtor's name, the creditor's name, the specific amount owed, the date of the acknowledgment, and any payment terms discussed. Such documentation can help prevent disputes and provide clarity on the debt's status, ensuring that both parties understand their obligations. Additionally, issuing this receipt can establish a paper trail, which can be important if the situation escalates or requires legal intervention in future scenarios.

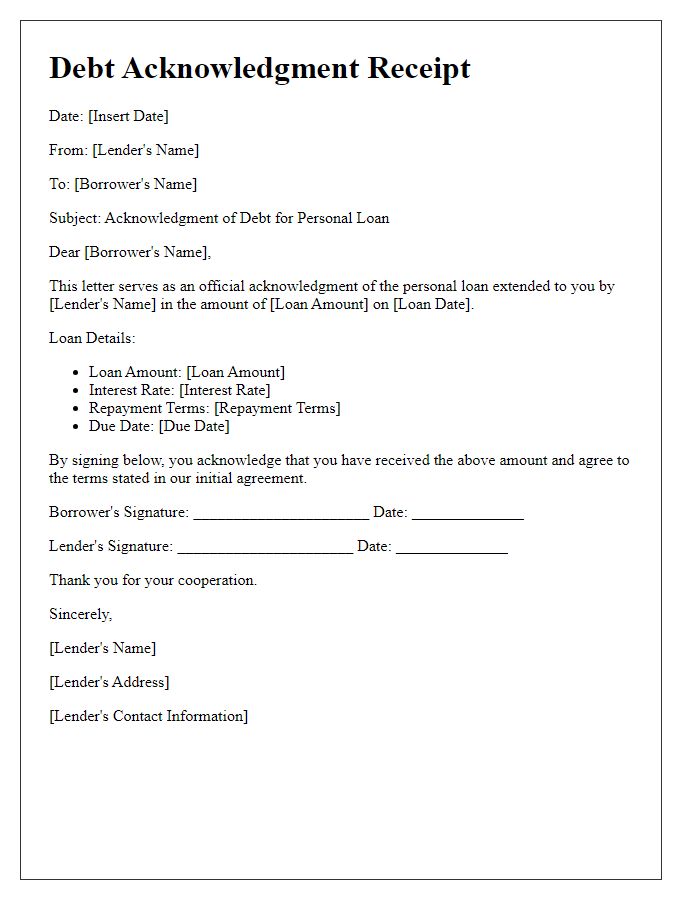

Signature and date lines

In financial transactions, a debt acknowledgment receipt serves as a formal document verifying that an individual has received a sum of money or valuable consideration owed to another party. Typically, it includes crucial details such as the amount of debt, date of transaction, and the names of both the debtor and creditor for clarity. This receipt includes signature lines where both parties can provide their signatures, confirming the agreement and the date on which the acknowledgment takes place, offering legal validity. Effective documentation is essential in financial affairs, ensuring transparency and traceability of transactions to prevent disputes in the future.

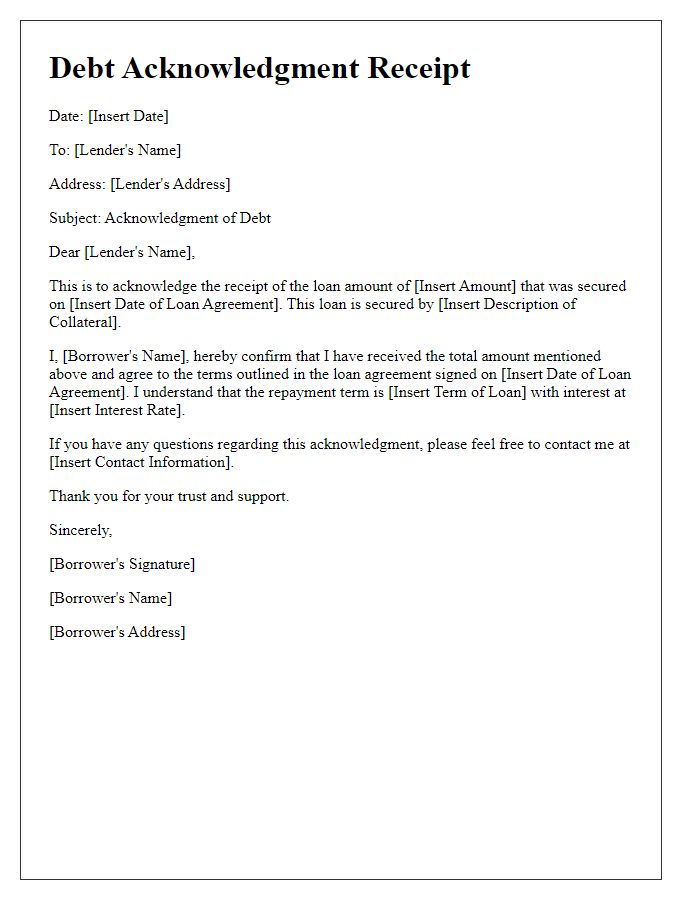

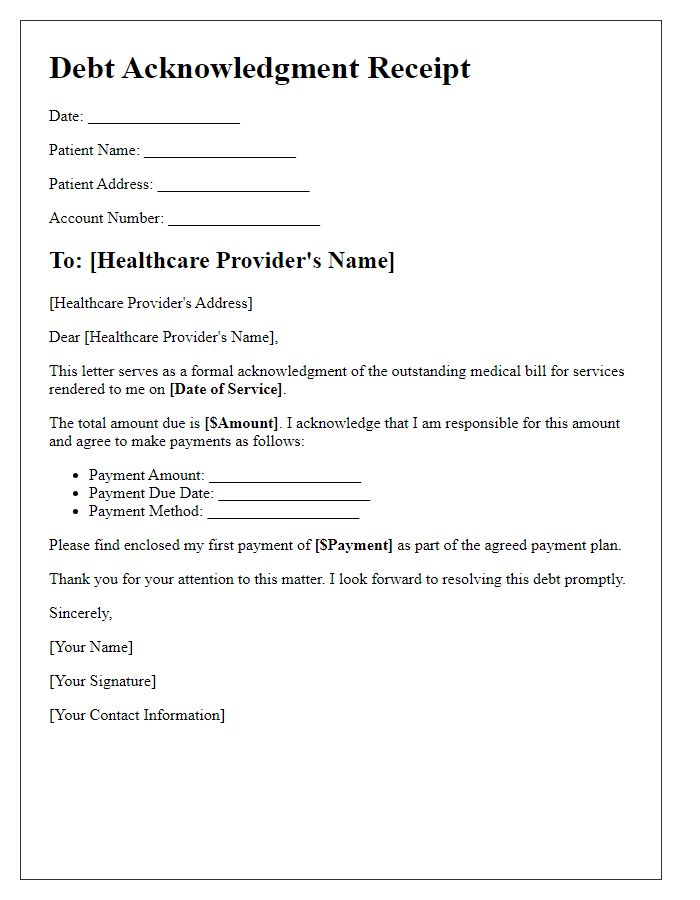

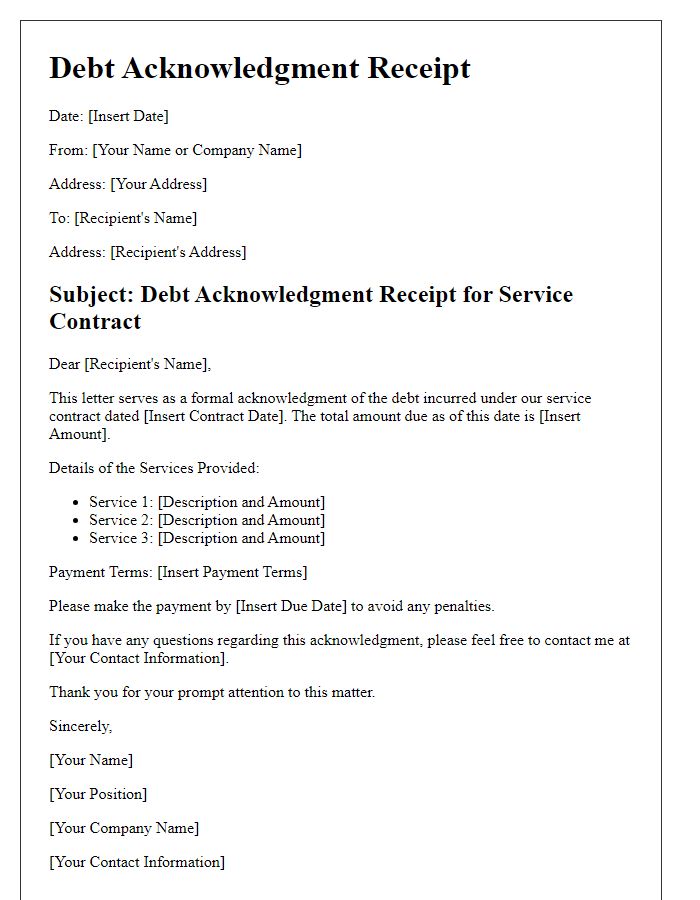

Letter Template For Debt Acknowledgment Receipt Samples

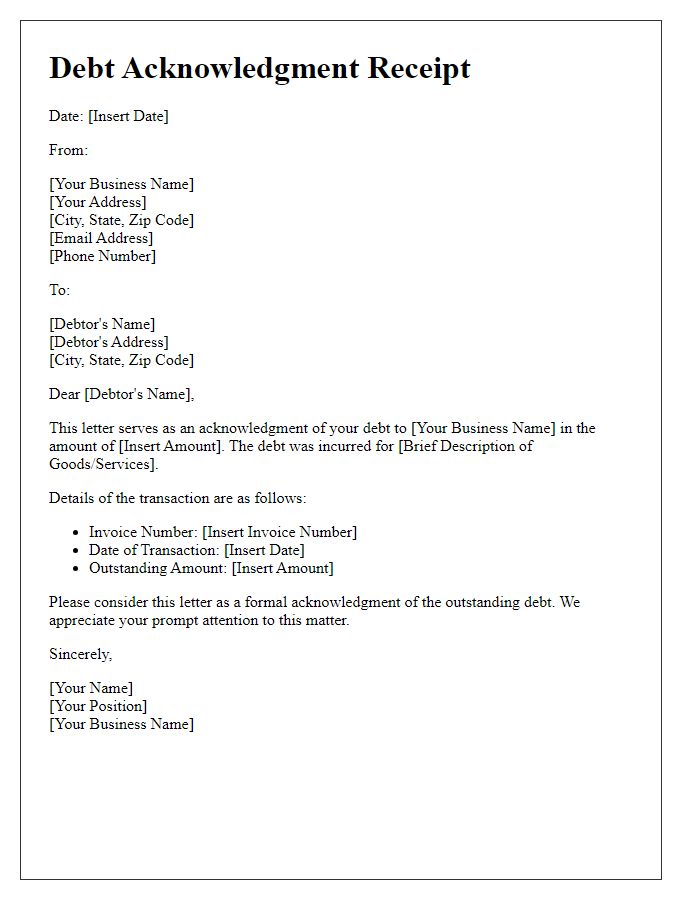

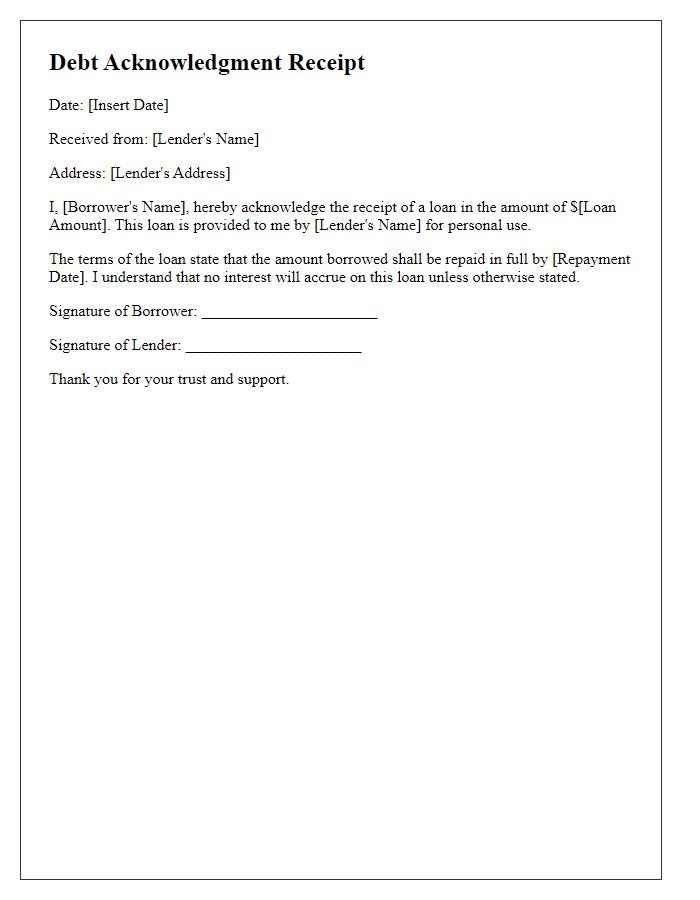

Letter template of debt acknowledgment receipt for business transactions.

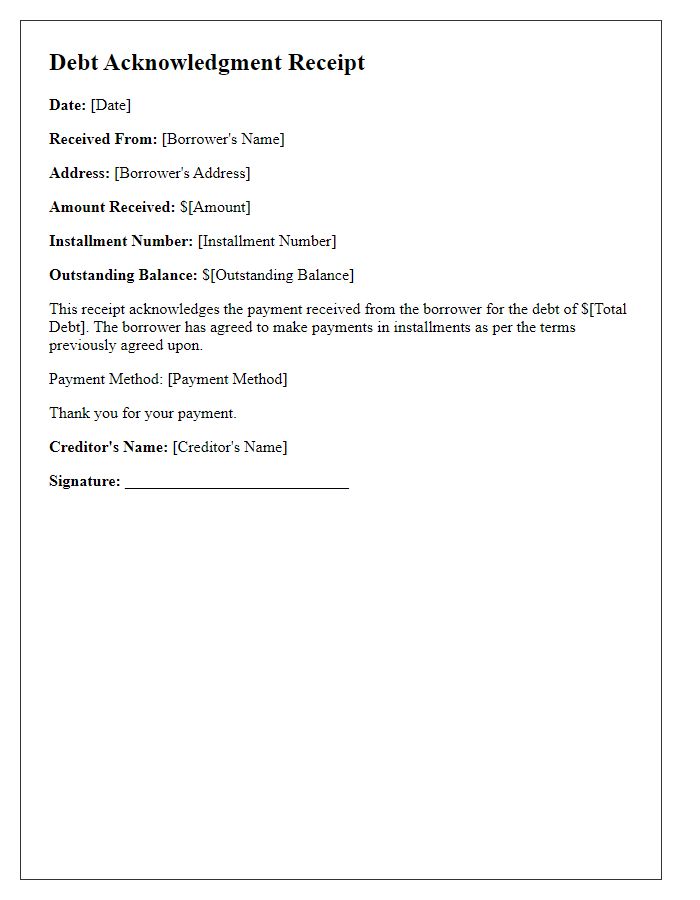

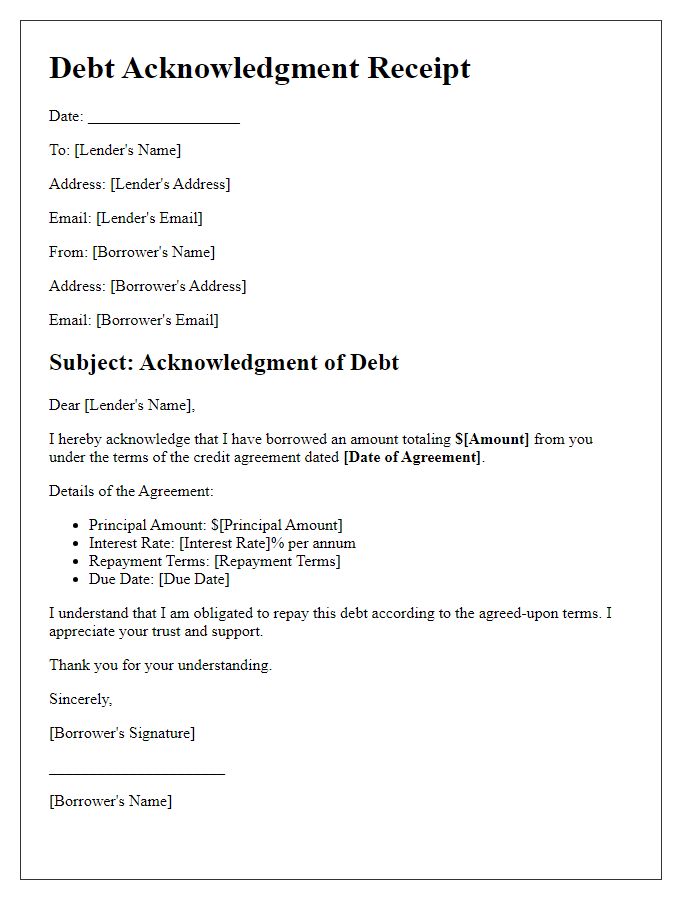

Letter template of debt acknowledgment receipt for installment payments.

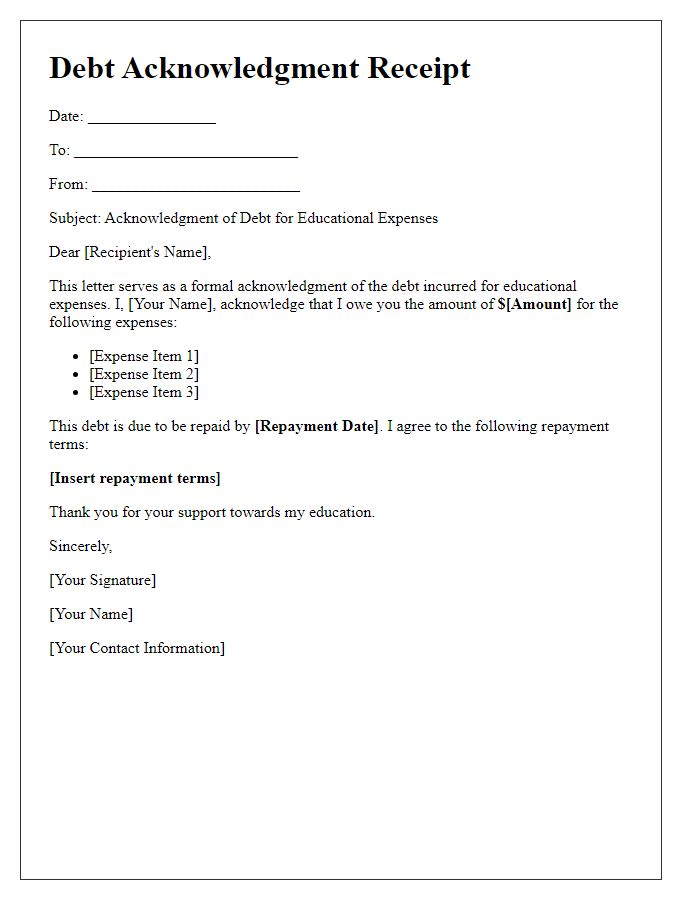

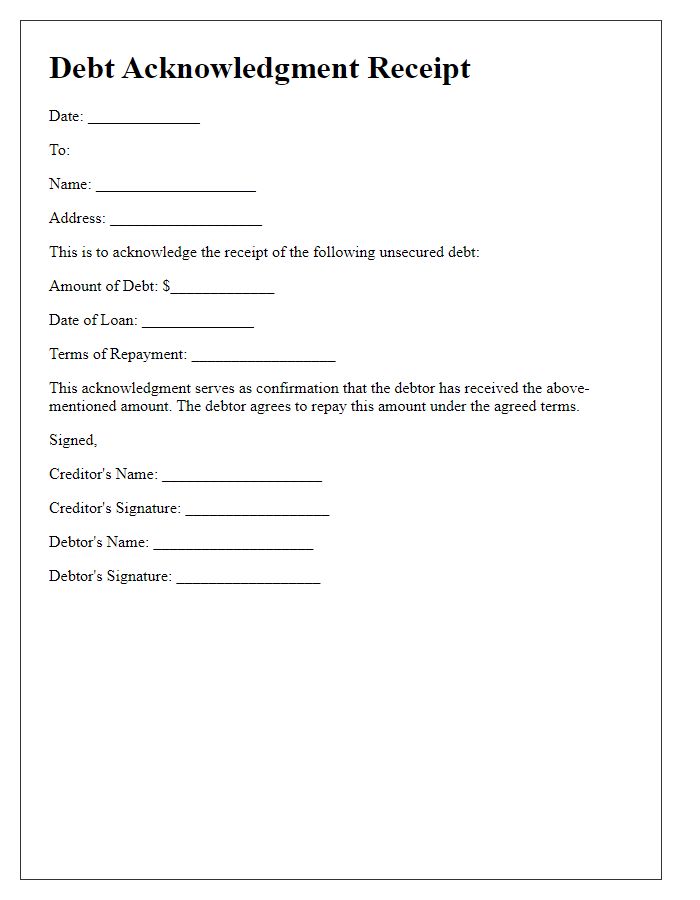

Letter template of debt acknowledgment receipt for educational expenses.

Comments