Are you struggling to get a response about an unacknowledged debt? It can be incredibly frustrating, especially when you're trying to maintain clear communication. In this article, we'll explore effective strategies and templates for following up on outstanding debts, ensuring you have the right tools to make your case. So, let's dive in and find the best approach to resolve those lingering debts!

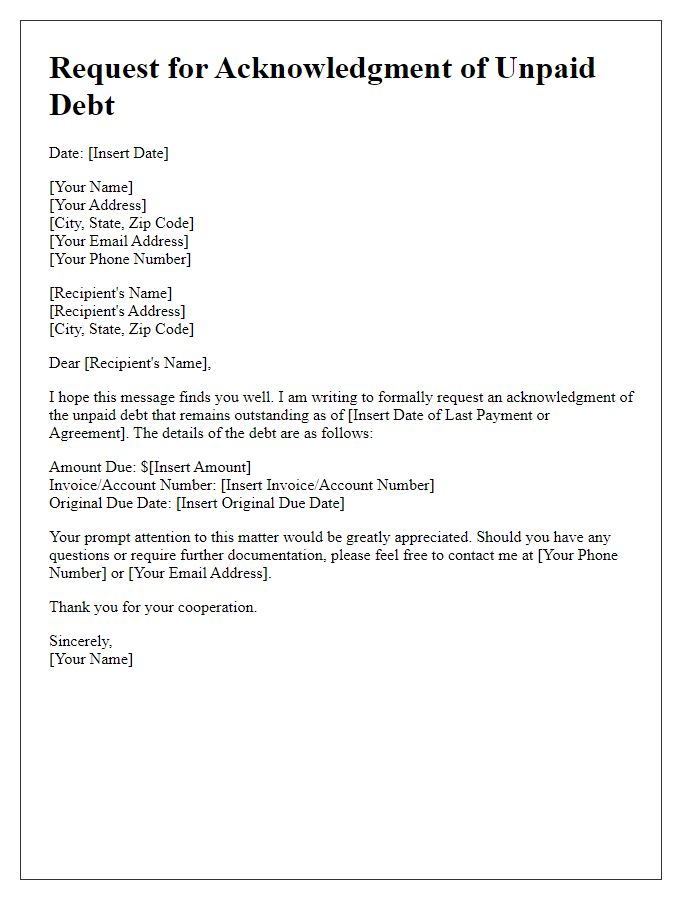

Clear identification of debtor and creditor

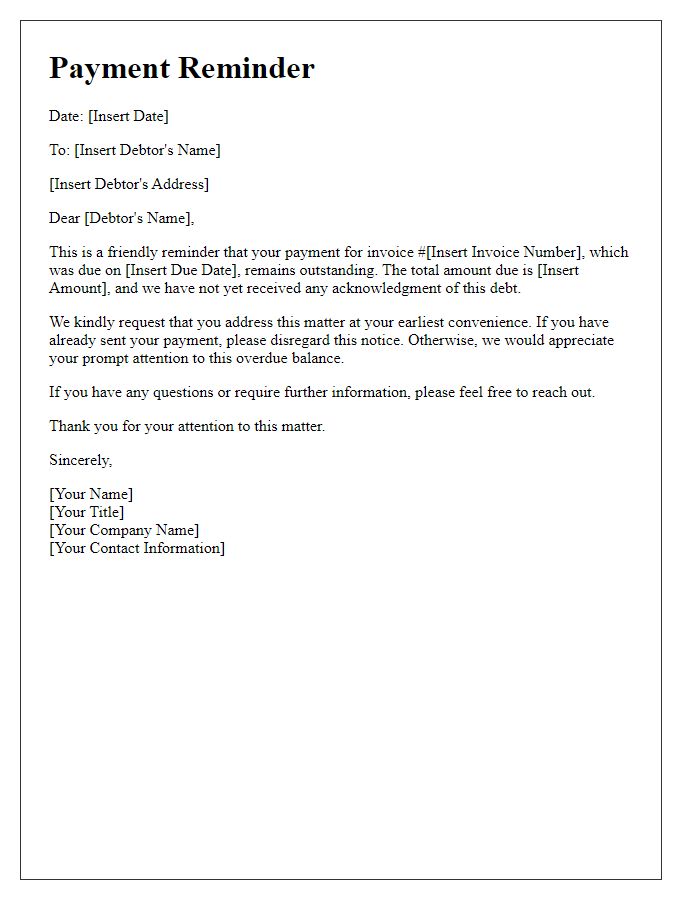

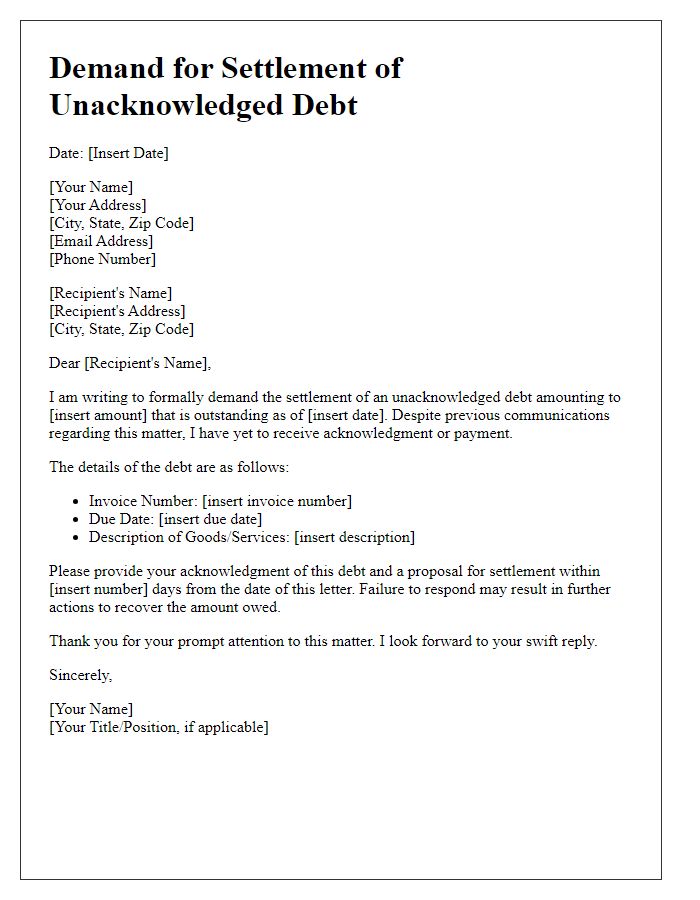

A follow-up on unacknowledged debt usually requires clear identification of both debtor and creditor. The debtor, identified as John Smith, residing at 123 Main Street, Cityville, owes a sum of $5,000 which was due on March 15, 2023. The creditor, known as ABC Finance Company located at 456 Market Avenue, Capital City, holds the initial agreement, documented under Invoice #12345. This unresolved debt has been outstanding for over six months, impacting financial records and credit ratings of both parties. Reminder communications have been sent on multiple occasions, including emails dated June 1, 2023, and July 15, 2023.

Precise description of the debt details

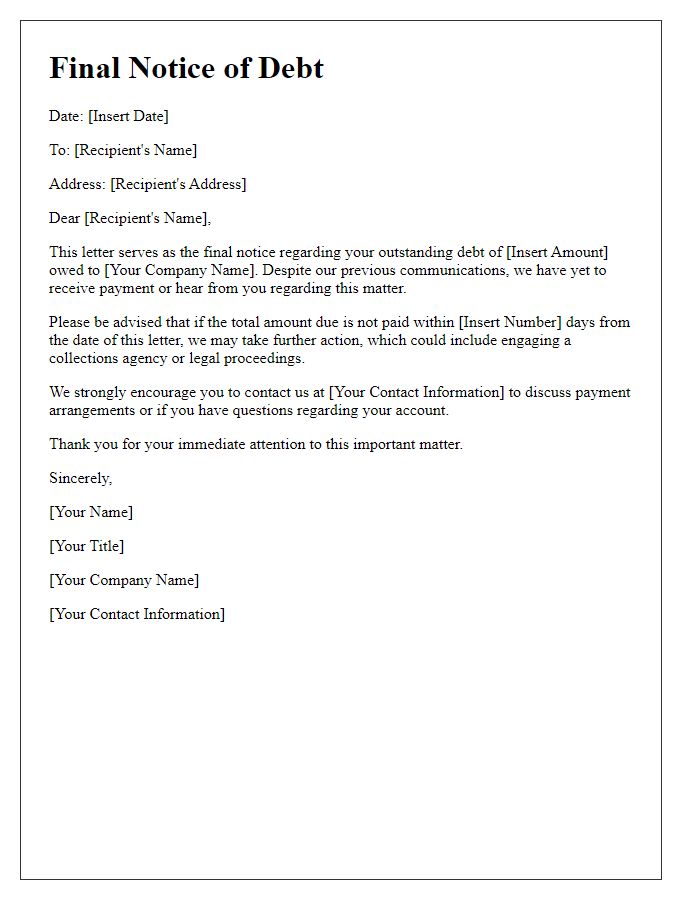

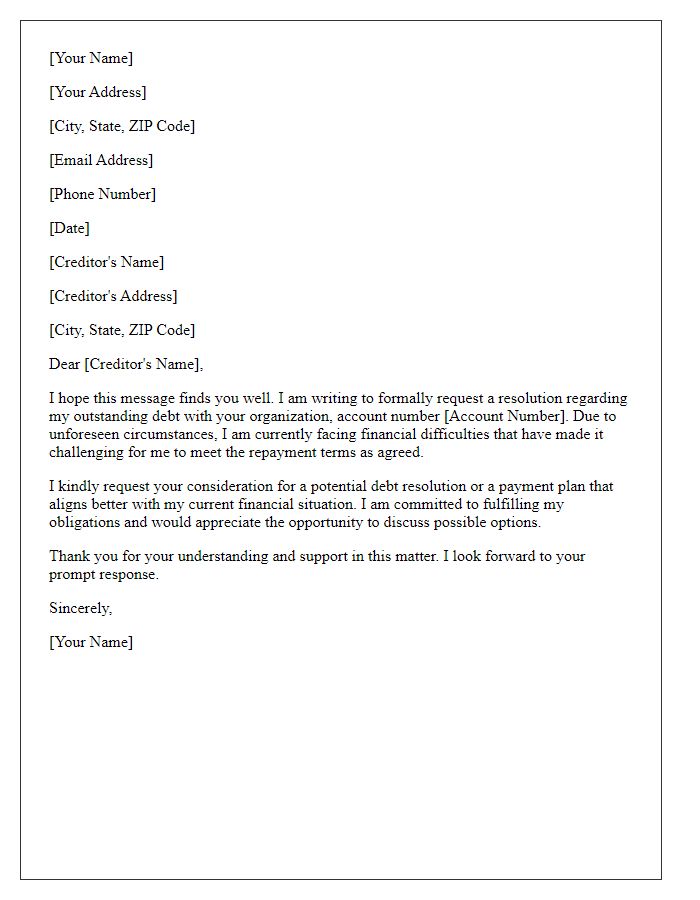

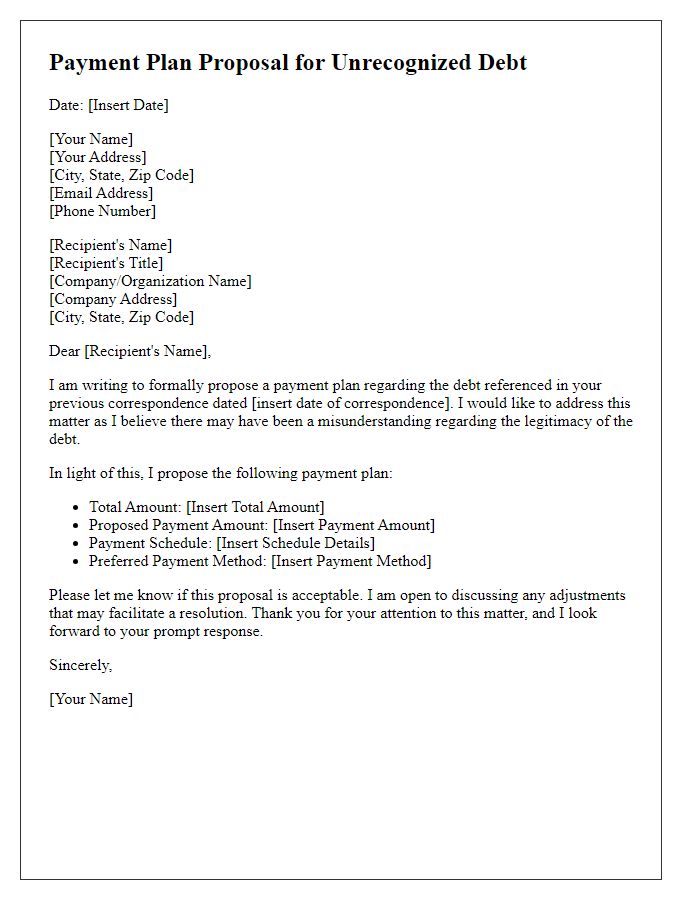

The unacknowledged debt totals $5,000, originally due on March 15, 2023, related to a services contract for digital marketing executed on January 5, 2022, undertaken by XYZ Marketing Firm located in San Francisco, California. The payment, expected within 30 days of service completion, remains outstanding with no prior communication regarding adjustments or delays. Invoices numbered 001234 and 001235, dated February 1, 2023, detail specific deliverables including social media management and SEO optimization, yet payment has not been received. As of now, the overdue amount has accrued interest per the terms established in the contract, indicating potential escalation to legal collections. A clear resolution or response is sought to rectify this matter promptly.

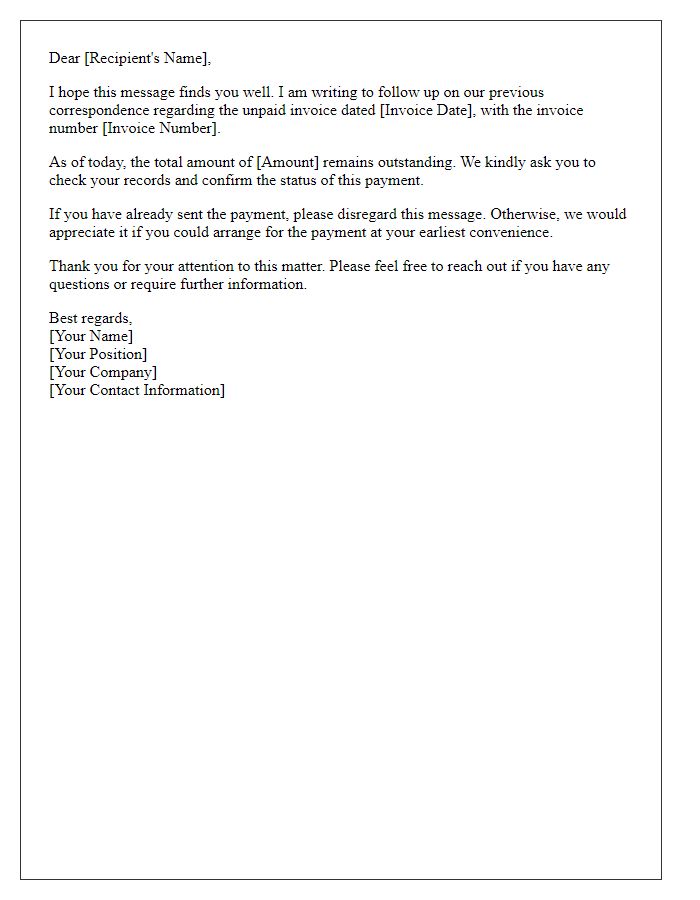

Specific date of initial communication

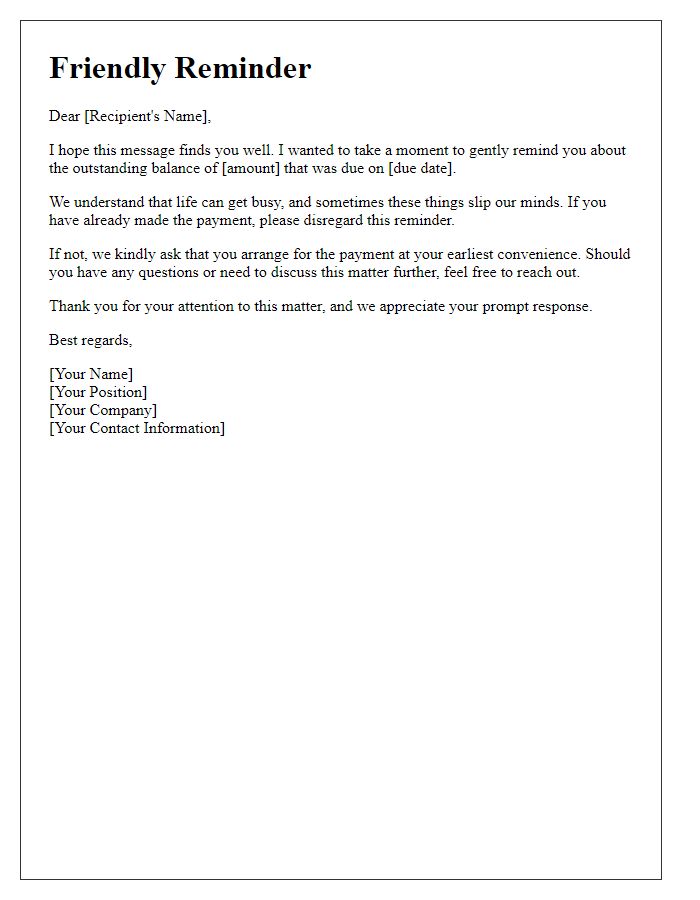

Unacknowledged debts often require diligent follow-up. Communication initiated on September 15, 2023, detailed the outstanding amount of $1,500 owed for services rendered by ABC Consulting. The subsequent lack of response from the debtor prompts concerns about the financial stewardship of the account. Documentation including the original invoice (Invoice #4567) and email correspondence provides crucial evidence of the obligation. Following up becomes imperative to ensure resolution of this financial matter and prevent escalation, which includes potential collection agency involvement or legal action in places like California, where debt recovery laws enforce strict regulations. Effective collection strategies emphasize clarity and professionalism to encourage repayment and maintain business relationships.

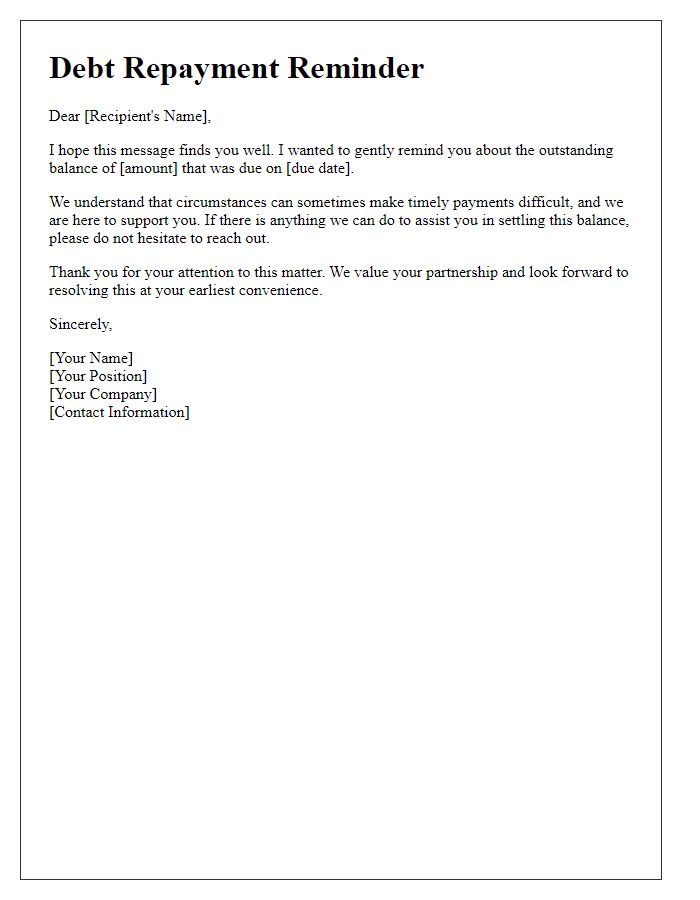

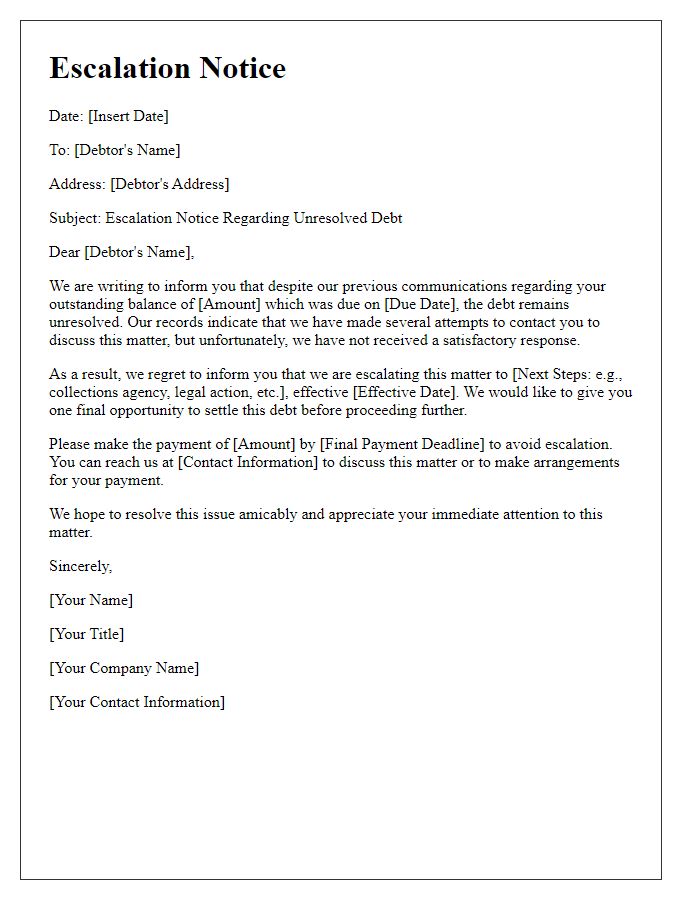

Firm request for payment or response

A firm request for payment regarding an unacknowledged debt can often lead to further complications. A standard debt amount of $1,500, originating from a contract signed on April 15, 2023, remains unpaid. Documentation detailing the terms of payment, with invoices sent on May 1 and June 1, 2023, provides clear evidence of the obligation. Communication attempts via email on July 10, August 15, and September 5, 2023, have yielded no replies or acknowledgment of the debt. Legal implications can arise after 90 days of non-response, escalating the situation significantly. Additionally, records indicate potential adverse effects on credit ratings for non-payment scenarios. Prompt action is essential to resolve this matter amicably and prevent further escalation.

Contact information for further discussion

Unacknowledged debts can lead to significant financial strain for individuals and businesses alike. A thorough follow-up process is essential for resolving these matters effectively. Accurate contact information, including phone numbers, email addresses, and physical addresses, is crucial for ensuring direct communication. Legal documents such as invoices or formal agreements may provide additional context, highlighting specific amounts owed and due dates, which can facilitate discussions. Establishing a clear timeline for resolution can also aid in accountability, making it easier for both parties to agree on terms moving forward. Engaging in respectful dialogue fosters a cooperative atmosphere, increasing the likelihood of successful debt acknowledgment and repayment.

Comments