Are you looking to elevate your debt compensation claim but unsure where to start? Crafting the perfect letter can be the key to effectively communicating your situation and maximizing your chances of a favorable outcome. This guide will provide you with essential tips and a template to streamline the process, making it easier for you to articulate your claim clearly. So, let's dive in and explore how you can assert your rights more effectivelyâkeep reading for insights and examples!

Clear and concise subject line

Subject line: Request for Elevation of Debt Compensation Claim - [Claim Number] Note: The subject line includes the specific claim number to ensure easy identification of the case being referenced.

Full account and contact information

The elevation of a debt compensation claim involves formal communication to a financial institution or a debtor regarding a debt that remains unpaid after previous attempts at resolution. The claimant must provide comprehensive information including their full account details such as the account number (typically a 12 to 16-digit identifier), the type of account (checking, credit card, loan), and the balance owed (specific amount in dollars). Contact information should be clearly stated, including the claimant's full name, address (including city, state, and ZIP code), phone number, and email address. Relevant details such as dates of prior correspondence, amounts claimed, and any reference numbers must be included to aid in identification of the claim. Detailed documentation should support the request, such as invoices, contracts, or prior payment records, emphasizing the legal basis for the compensation being sought.

Detailed explanation of the debt or claim

A debt compensation claim, often associated with unpaid loans, overdue invoices, or delinquent accounts, requires detailed documentation to substantiate the request. The claim may originate from various sources such as small businesses, financial institutions, or individual creditors seeking recovery of amounts owed. Detailed accounts should highlight the original debt amount, including any applicable interest rates (typically ranging from 5% to 30%) and any relevant fees incurred during the collection process. Supporting documents such as contracts, promissory notes, invoices, or account statements must be attached to provide a comprehensive overview of the transaction. Additionally, it is essential to document communication attempts with the debtor, which may include letters, emails, or phone call records, showcasing efforts made to resolve the matter amicably. This evidence solidifies the legitimacy of the claim, making it more likely to succeed in administrative or legal settings, such as court proceedings or alternative dispute resolution mechanisms.

Legal references and documentation

The elevation of a debt compensation claim often involves referencing pertinent legal frameworks and supporting documentation. Key legal statutes such as the Fair Debt Collection Practices Act (FDCPA) provide protections against abusive debt collection practices and delineate the rights of consumers. Additionally, courts often require essential documents, including a detailed account statement indicating the outstanding balance owed, communication records with the creditor, and any prior agreements relevant to the claim. The inclusion of tax returns, proof of income, and documentation of previous payment attempts can further substantiate the claim. Other crucial elements might include notices of default or any settlement agreements previously established between the parties involved. Addressing jurisdictional statutes is vital, particularly if the claim is pursued in a specific state court, ensuring adherence to local laws and regulations concerning debt recovery.

Signature and contact for follow-up

In the process of elevating a debt compensation claim, it is crucial to include essential contact details for facilitating follow-up communications. Clear identification of the signatory (individual or representative) ensures accountability and fosters transparency. Signature lines should include printed names, titles, and organizational affiliations if applicable. Contact information, such as phone numbers (including area codes) and email addresses, should be prominently displayed, allowing claim reviewers to reach out for additional clarification or documentation. Including office hours for direct calls can further streamline communication, reducing response times. This level of detail enhances the claim's legitimacy and demonstrates professionalism, which can positively influence the resolution process.

Letter Template For Elevation Of Debt Compensation Claim Samples

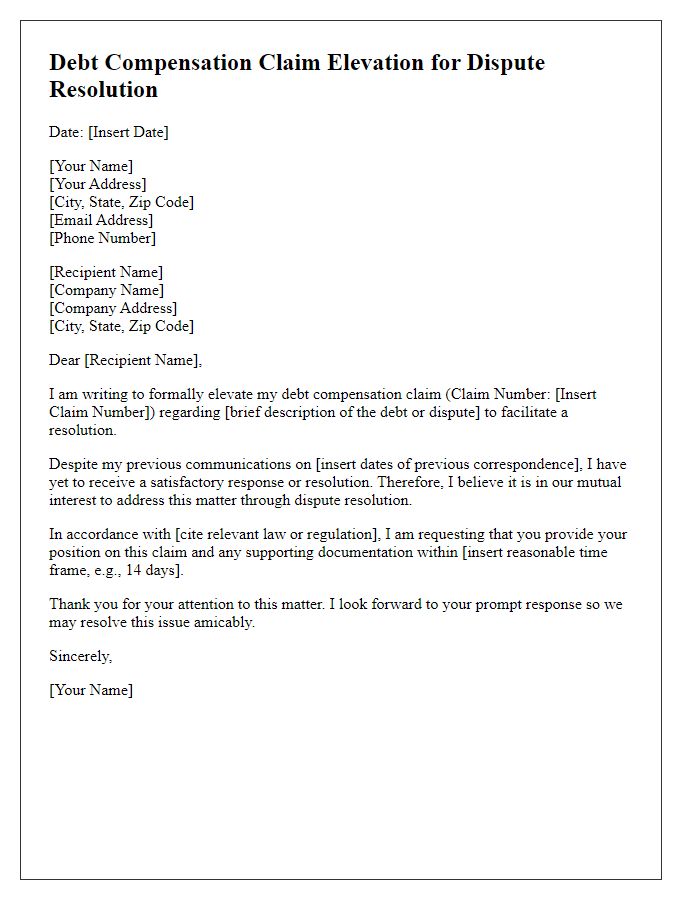

Letter template of debt compensation claim elevation for dispute resolution.

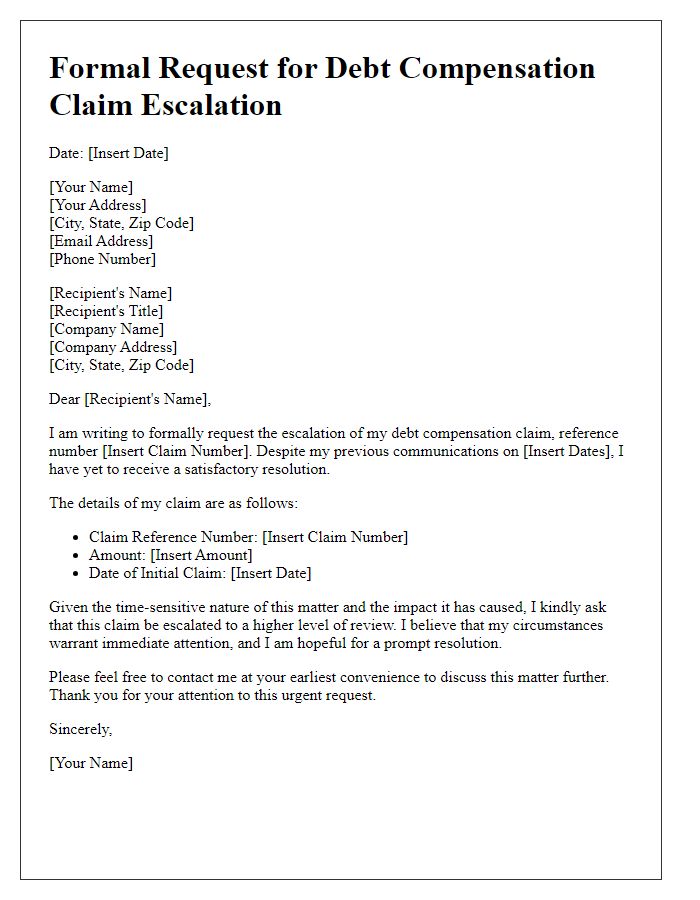

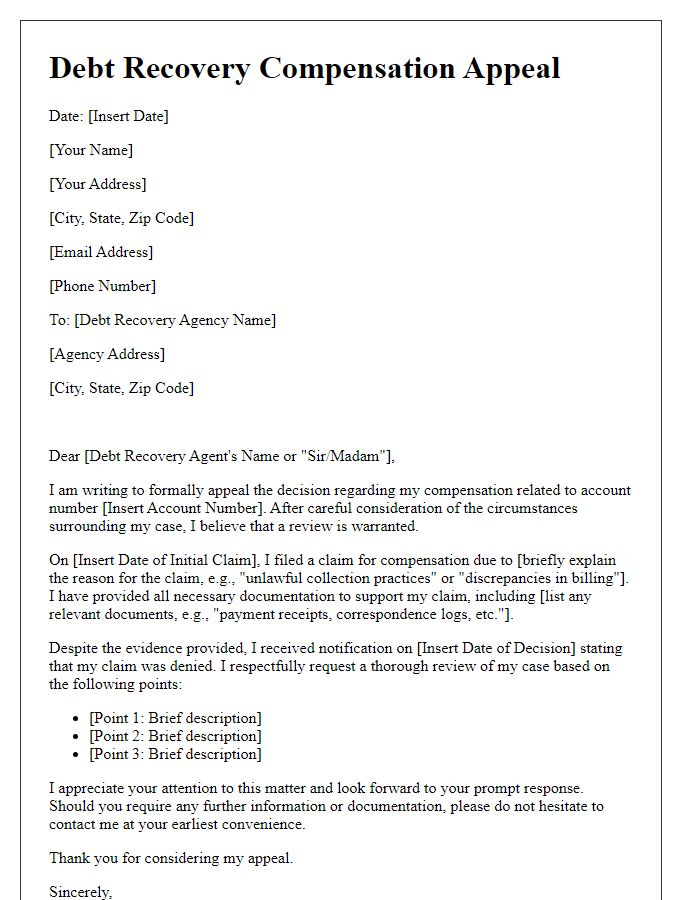

Letter template of formal request for debt compensation claim escalation.

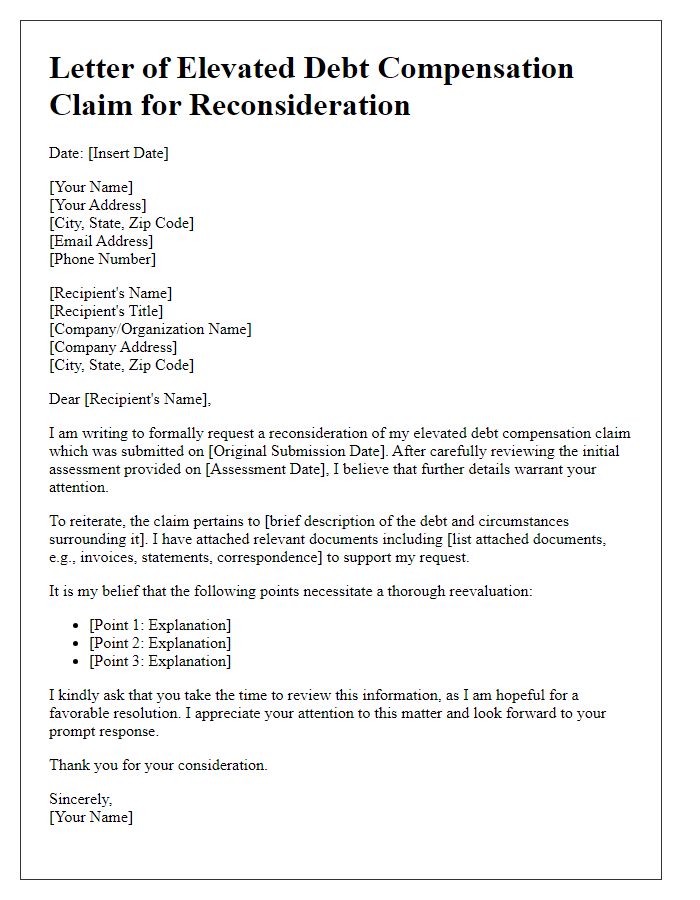

Letter template of elevated debt compensation claim for reconsideration.

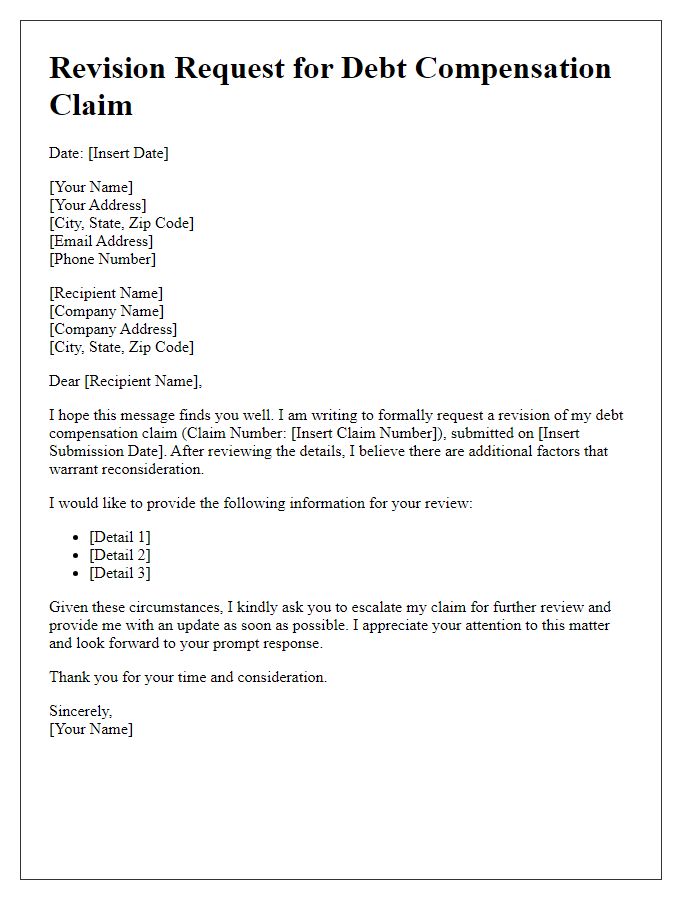

Letter template of revision request for debt compensation claim escalation.

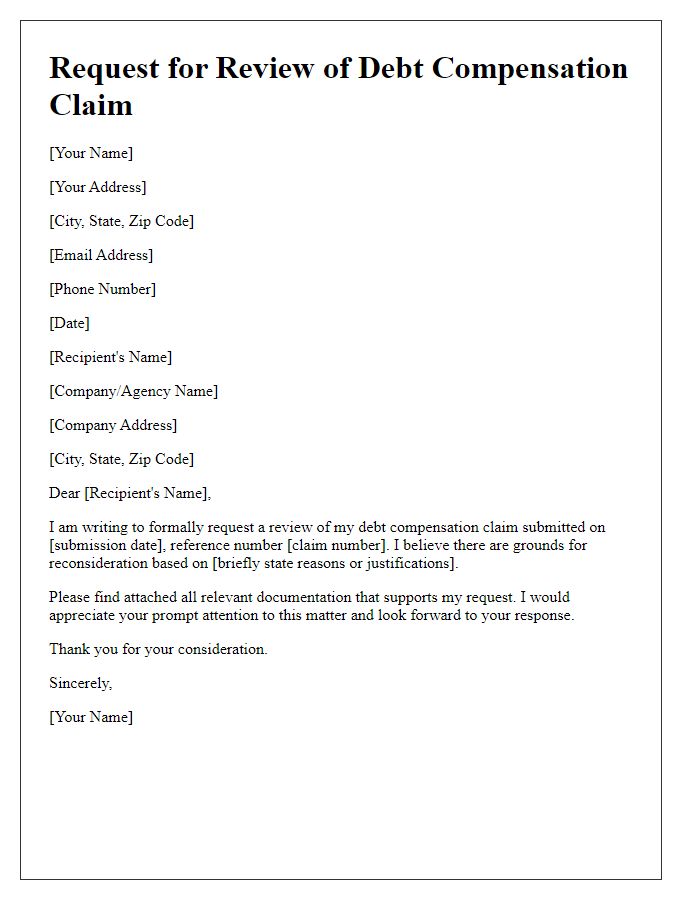

Letter template of advanced request for review of debt compensation claim.

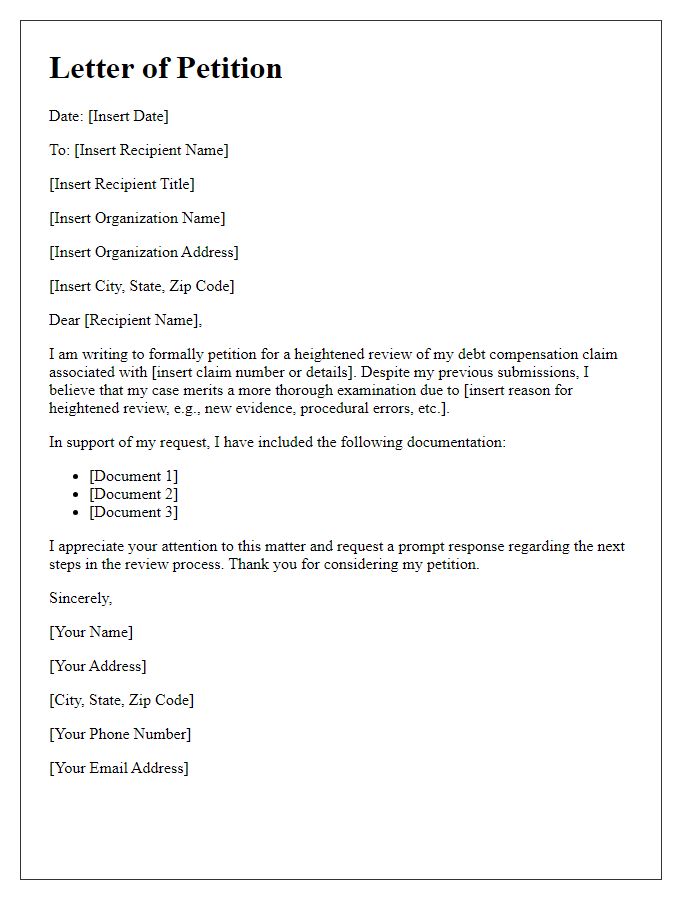

Letter template of petition for heightened review of debt compensation claim.

Comments