Are you feeling overwhelmed by debt and unsure where to start? Writing an initial debt notification letter can be a crucial step in addressing your financial situation and opening the lines of communication with your creditors. This letter not only outlines your current standing but also demonstrates your willingness to find a solution together. Curious about how to craft the perfect letter? Keep reading for essential tips and a helpful template!

Debtor's Details

Initial debt notification involves informing individuals about their outstanding payments. Accurate details are crucial. Debtor's name needs to be clear to avoid confusion. Address must include street, city, and ZIP code for proper communication. Contact number provides direct access for inquiries or discussions. A unique account number assigned by the creditor specifically identifies the debtor's obligations, ensuring clarity in the notification process. Financial statements may reference the original loan amount and any accrued interest, giving the debtor a complete overview of their balance. Clear language and concise details promote understanding of obligations and urgency for repayment.

Creditor's Information

Debt notification letters are crucial for creditors to inform individuals or businesses about outstanding debts. This formal document typically includes specific details such as the creditor's name, contact information, and account numbers associated with the debt. For example, the creditor could be XYZ Financial Services, located in New York City, with an outstanding balance of $2,500 for a personal loan taken out in July 2022. Including the original transaction date can provide context for the account and its expected payment timeline. Furthermore, it is essential to mention any relevant policies that may apply, such as interest rates accruing post-deadline or potential legal actions for unresolved debts. This transparency equips the debtor with necessary information to address the debt responsibly.

Debt Amount and Description

Initial debt notification letters, often sent by collection agencies or creditors, primarily outline the total debt amount owed, detailed descriptions of the debt (such as original creditor names and account numbers), and specific timelines for payment or response. These letters serve to formally inform the debtor that their account has been referred for collection due to non-payment. More importantly, they also include essential legal disclosures mandated by regulations such as the Fair Debt Collection Practices Act (FDCPA), providing debtors with rights and options for dispute. This process typically aims to prompt immediate action, ensuring that the creditor's interests are safeguarded while adhering to legal standards.

Payment Instructions

Initial debt notifications serve as formal communication to inform debtors about outstanding balances, typically presented by collection agencies or creditors. These notifications outline the amount due, often stated prominently to emphasize urgency (for example, "$500 overdue since March 1, 2023"). Specific payment instructions accompany this, indicating accepted methods such as credit card transactions, bank transfers to specified accounts (like "Bank of America, account number 123456789"), or payment through online portals designed for secure transactions. Additionally, a deadline for payment might be included (e.g., "Please remit payment by April 15, 2023") to encourage prompt resolution. Failure to respond may result in further actions, including fees or escalation to credit reporting agencies. Such notifications typically reference a unique case number to facilitate tracking and communication between the debtor and creditor.

Due Dates and Consequences

A debt notification serves to inform borrowers about overdue payments. This communication often includes vital information such as due dates, which typically specify the exact day a payment is expected, and consequences of late payments, such as penalties or increased interest rates. It is essential to highlight the potential impact on credit scores, particularly for those individuals with outstanding balances exceeding $1000, as late payments can remain on credit reports for up to seven years. Borrowers in jurisdictions like California and New York may also face additional state-specific regulations affecting debt collection practices. Clear and concise representation of the amount owed, original due dates, and specific terms outlined in loan agreements contributes to a transparent process that encourages timely payments.

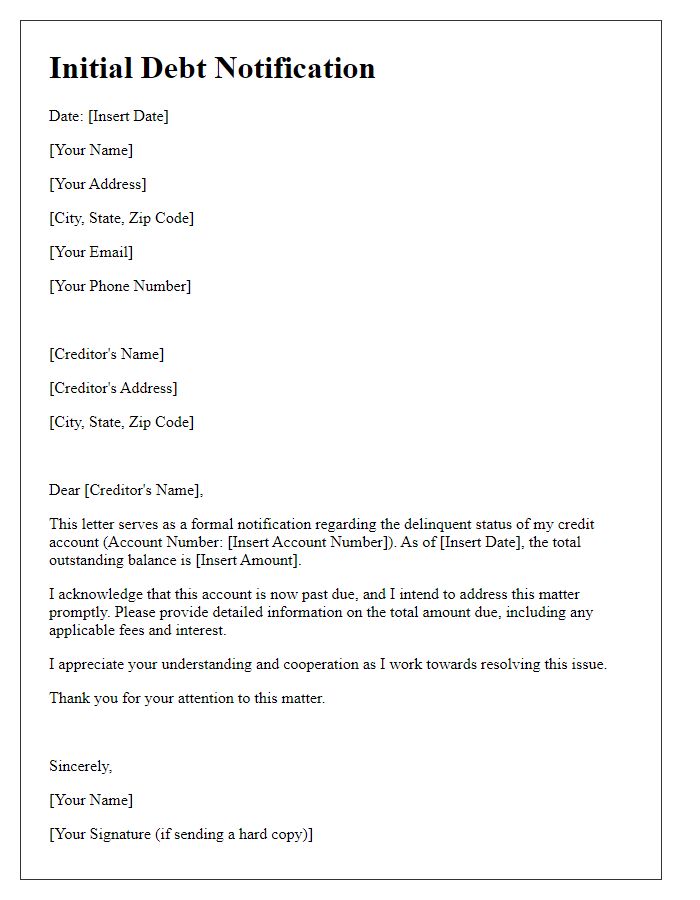

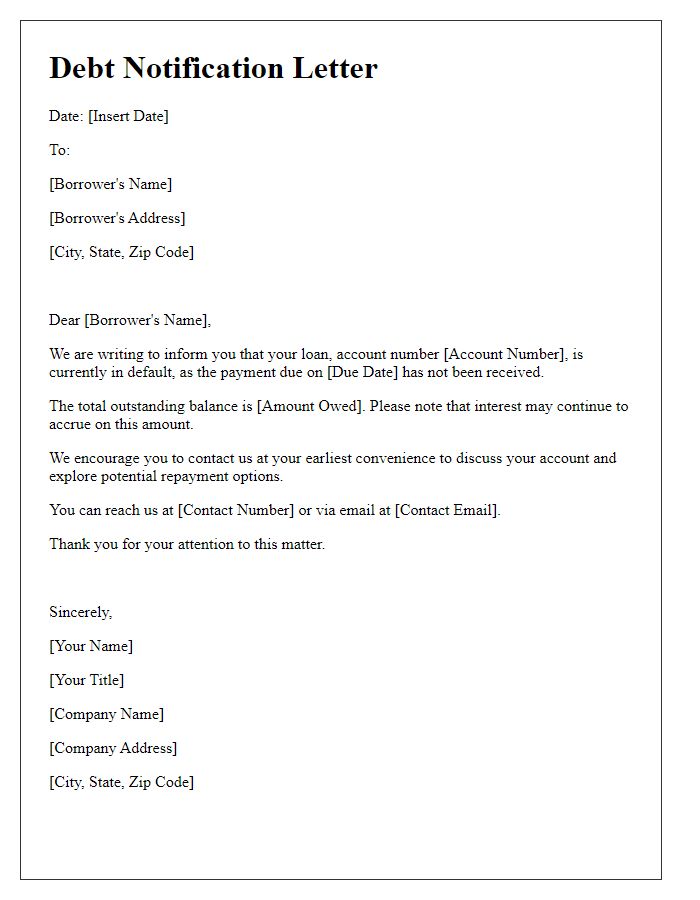

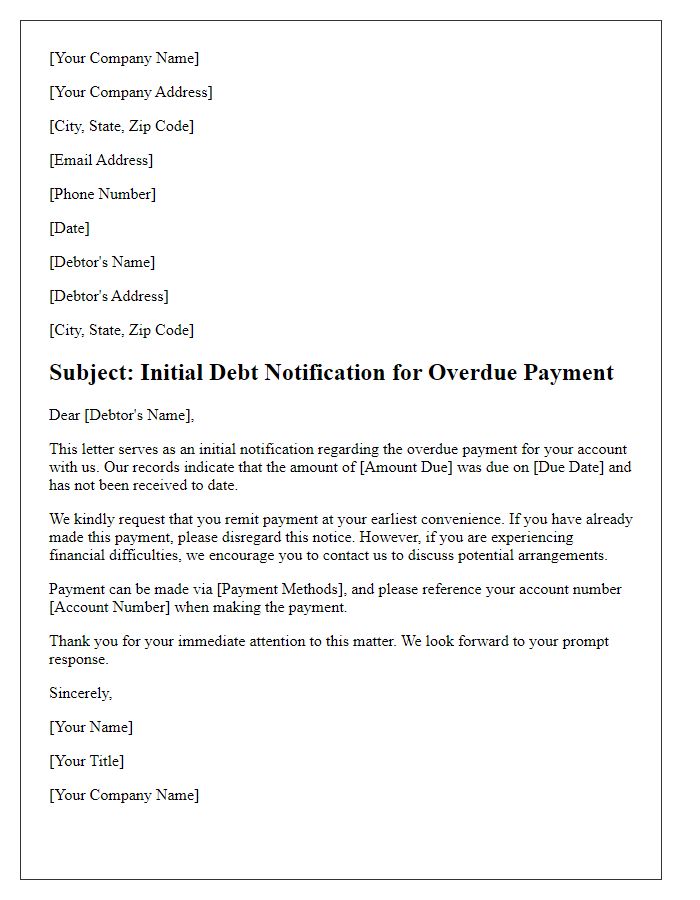

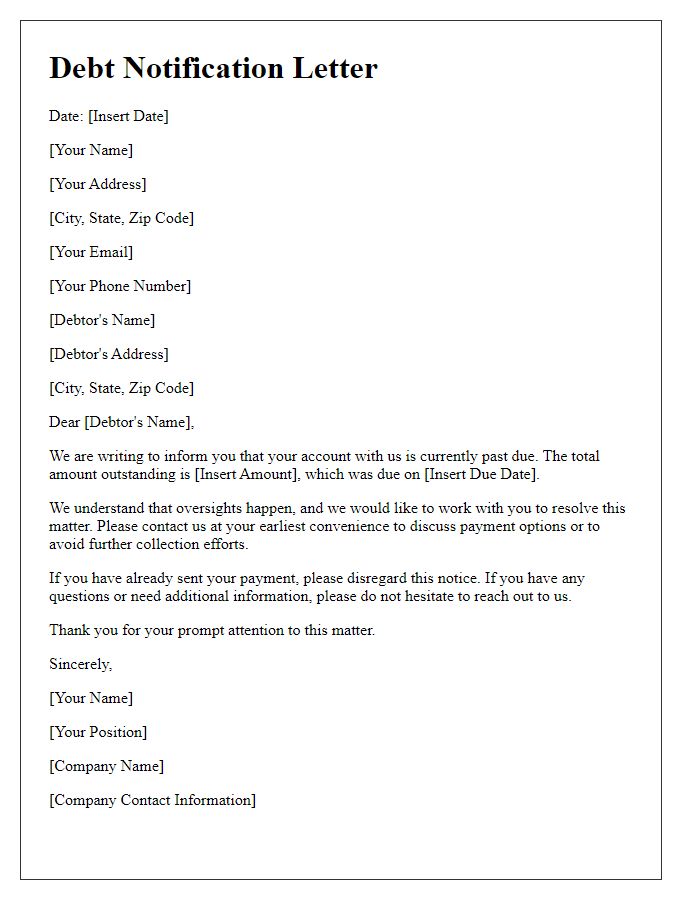

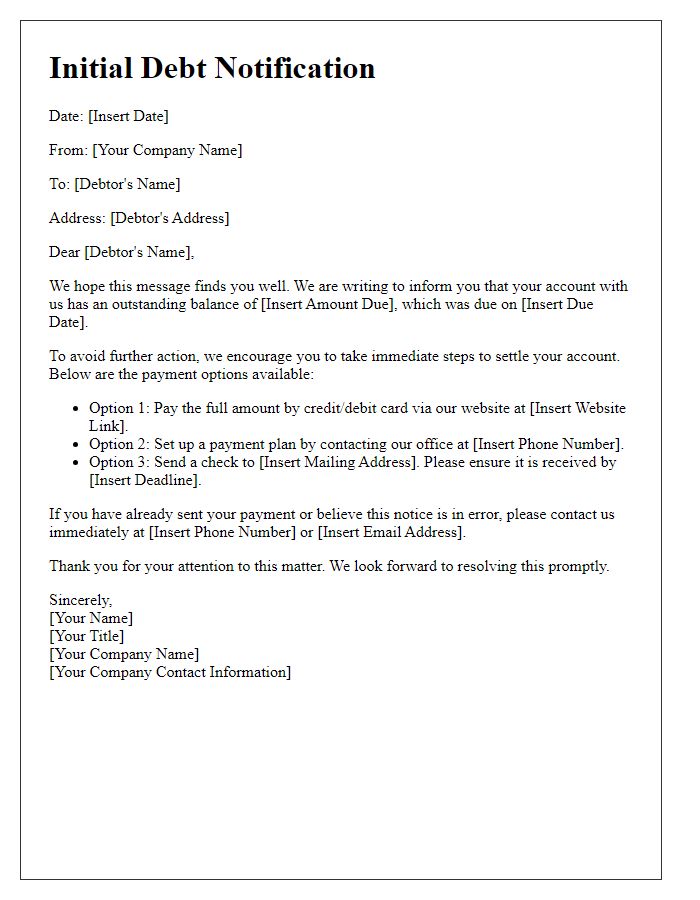

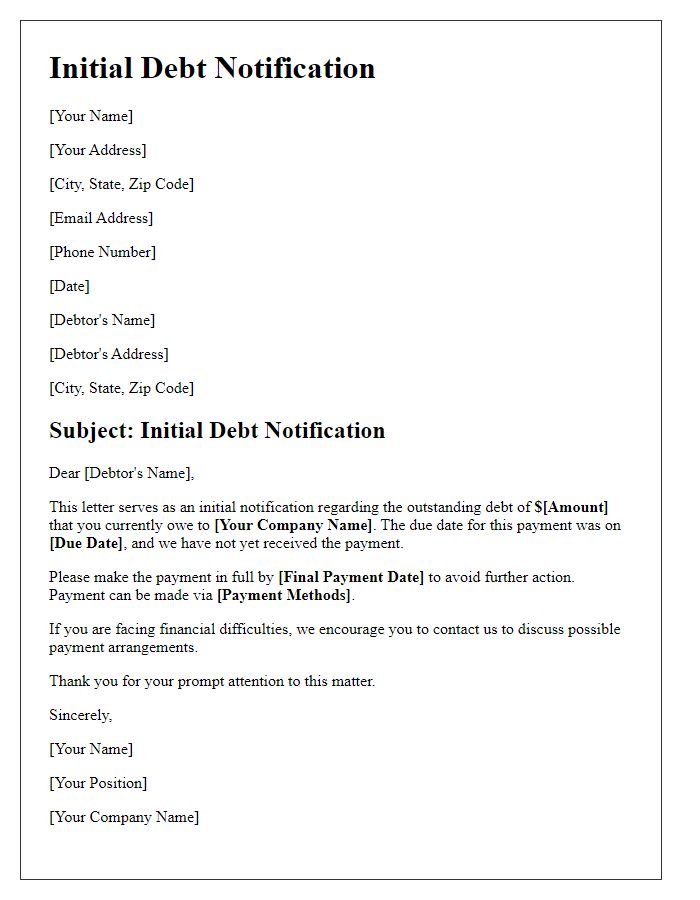

Letter Template For Initial Debt Notification Samples

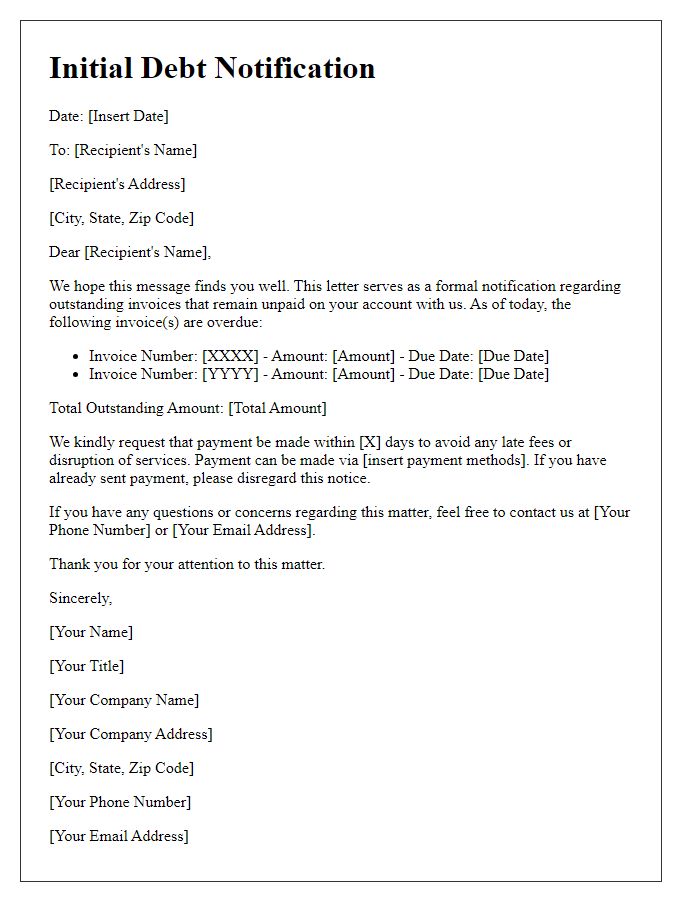

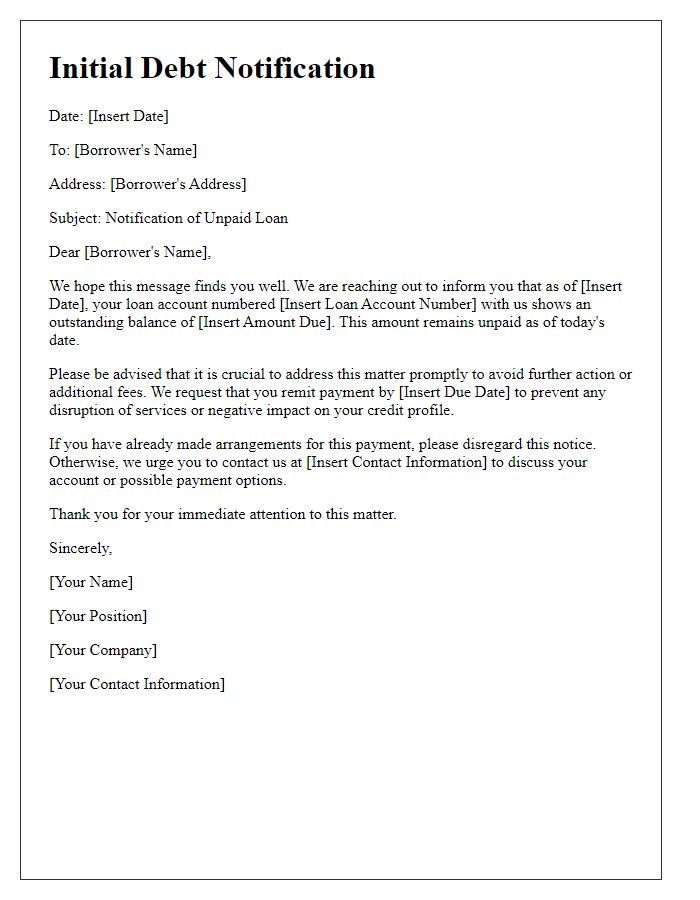

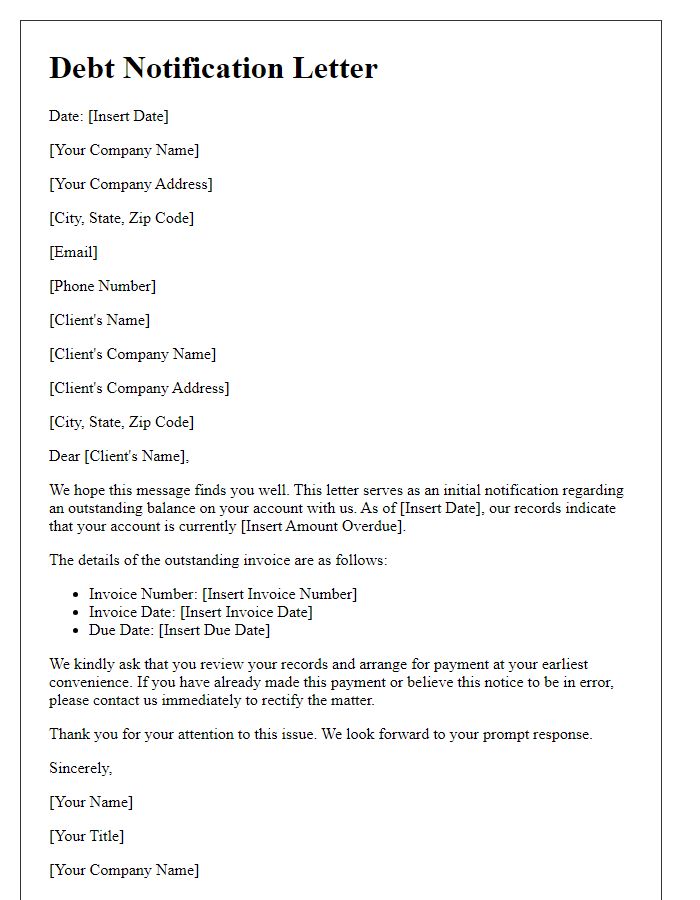

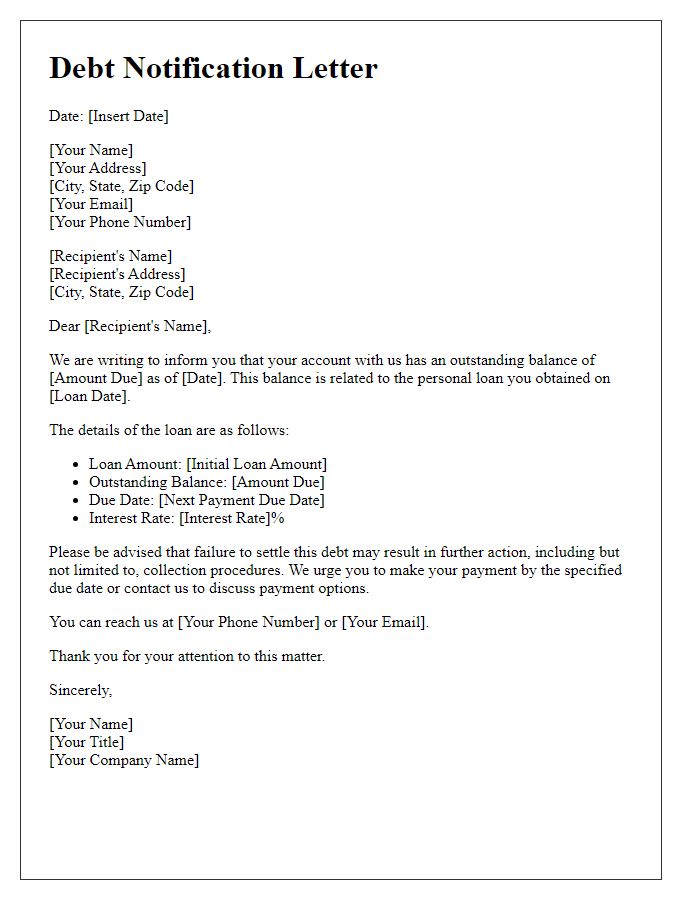

Letter template of initial debt notification for credit account delinquency.

Comments