Are you facing a situation where you need to send a pre-legal debt warning? Crafting the right message can make all the difference in encouraging prompt payment while maintaining professionalism. In this article, we'll explore effective templates and strategies to ensure your communication is clear, concise, and legally sound. Read on to discover how to navigate this sensitive topic with confidence!

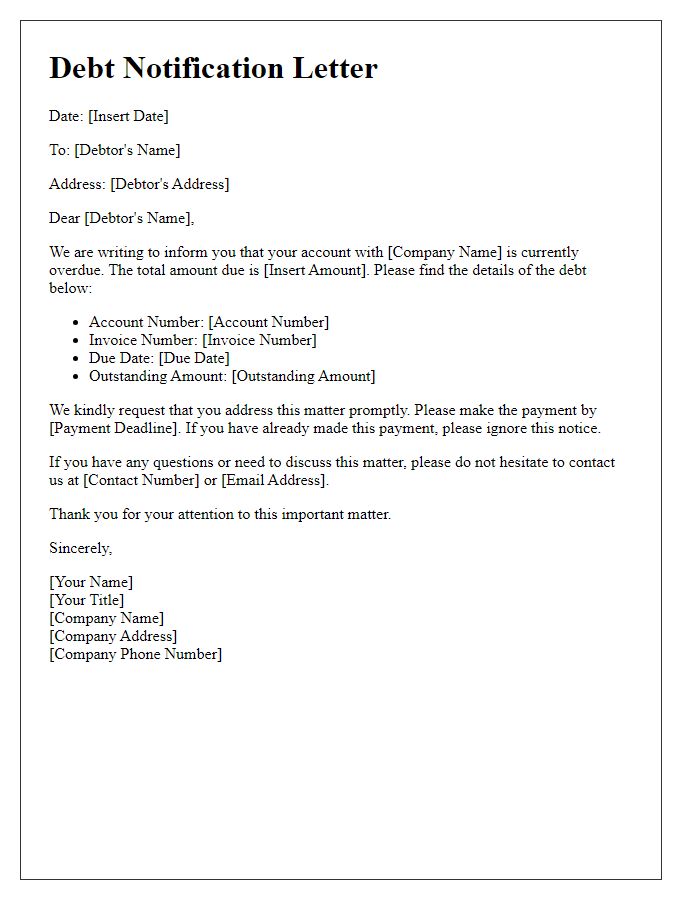

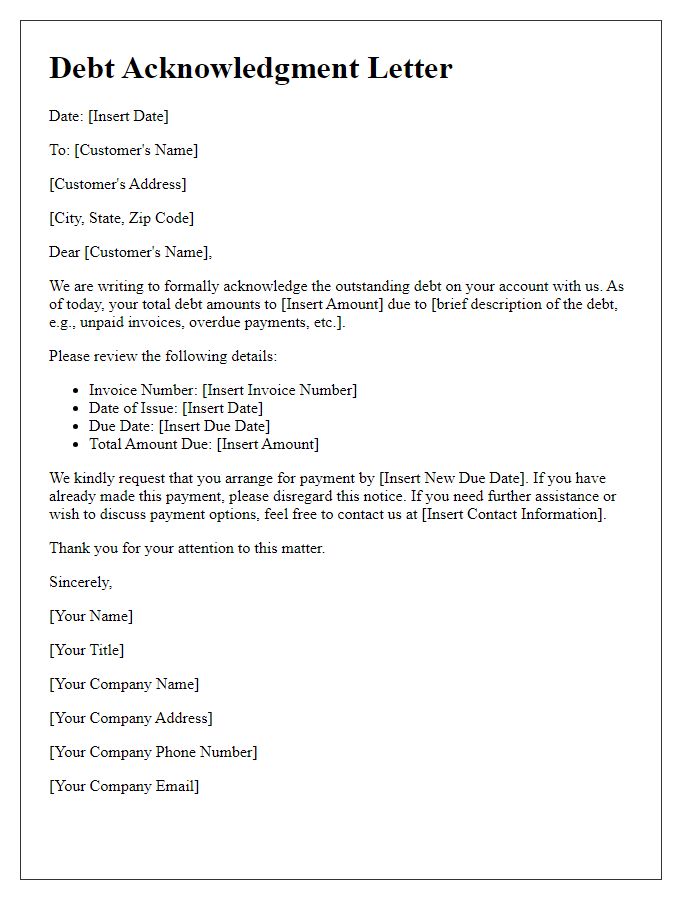

Creditor's contact information

A pre-legal debt warning communication must be precise and professional, ensuring that key details are communicated effectively. The creditor's contact information, including the name of the institution or individual, should be prominently displayed at the top. This includes the official name of the creditor (e.g., XYZ Financial Services), their address (e.g., 1234 Main St, Suite 100, Anytown, State, ZIP Code), phone number (e.g., (123) 456-7890), and email address (e.g., contact@xyzfinancial.com) to facilitate prompt correspondence. Including specific account details, such as the account number assigned to the debtor, will clarify the context of the warning and elevate the seriousness of the situation. The document must maintain a formal tone while clearly stating the amount owed, deadlines for payment, and potential legal implications if the matter remains unresolved.

Debtor's details

A pre-legal debt warning serves as an important communication tool intended to inform debtors of outstanding financial obligations. Key debtor details include full name, address (specifically the street, city, and zip code), and contact number for verification purposes. The document typically outlines the total debt amount, including any accrued interest (often expressed as a percentage like 5% annually), and the date when the debt was initially incurred. Important notes may include deadlines for payment (usually within 30 days), as well as consequences of non-payment, which could lead to legal action in a court (specific to the local jurisdiction, such as New York City or Los Angeles). The warning often emphasizes the importance of resolving the matter to avoid further complications, such as additional fees or damage to the debtor's credit score. This type of communication demands accuracy and clarity, as it serves as a formal notification of serious financial consequences.

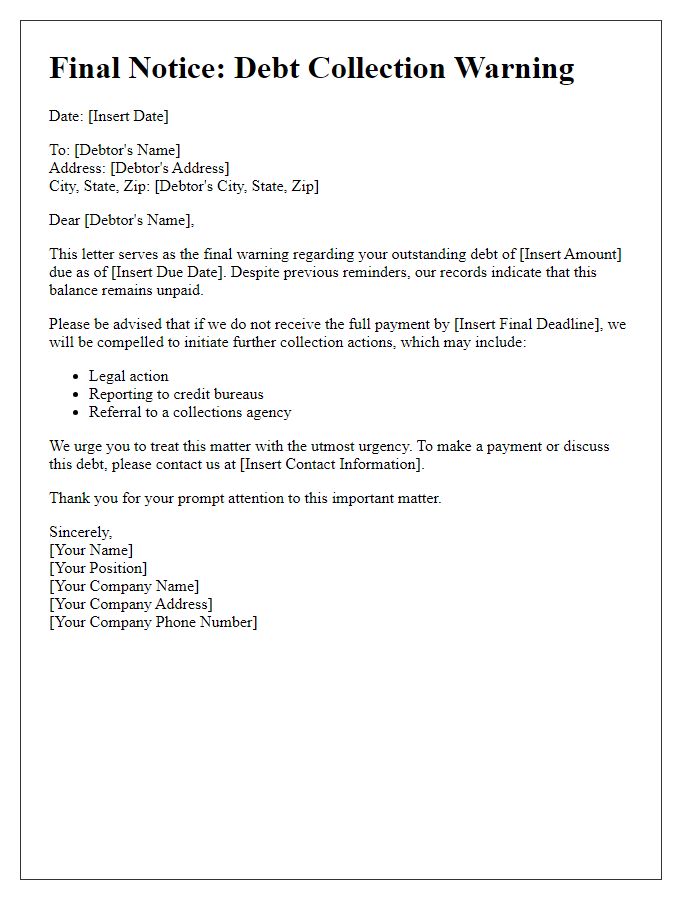

Outstanding debt amount

The outstanding debt amount, which totals $5,000, should be addressed urgently to avoid escalation into pre-legal procedures. Such scenarios often involve third-party debt collectors and potential court actions. Timely payment can prevent these measures, which might incur additional costs including legal fees and court charges. Essential details include the payment due date, which is set for March 15, 2024. Delays in payment may severely affect credit scores, influencing future lending opportunities. Documentation related to this debt, including invoices and previous communication, serves as critical evidence of the owed amount and payment agreements.

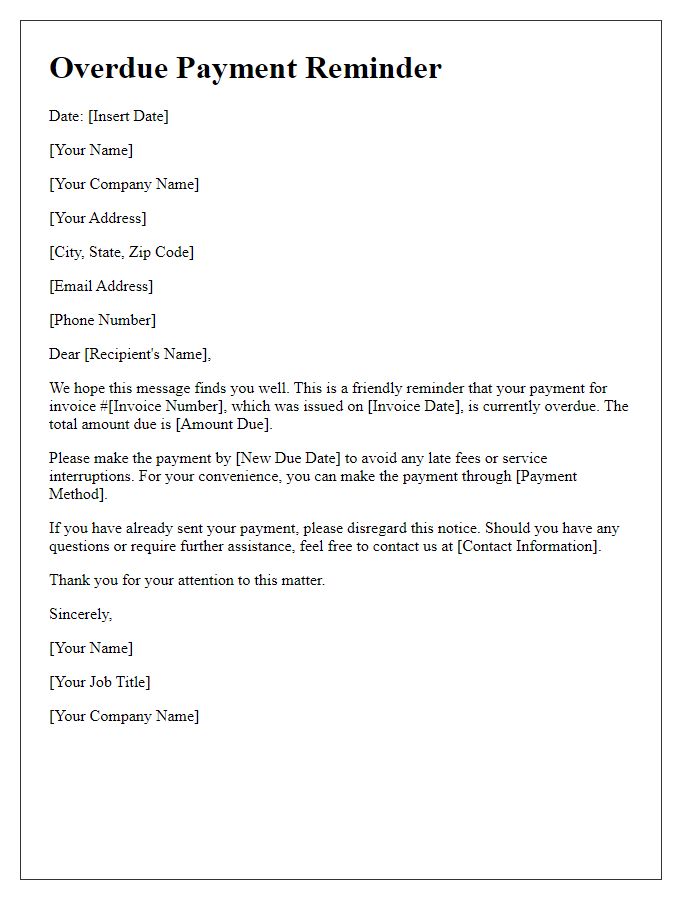

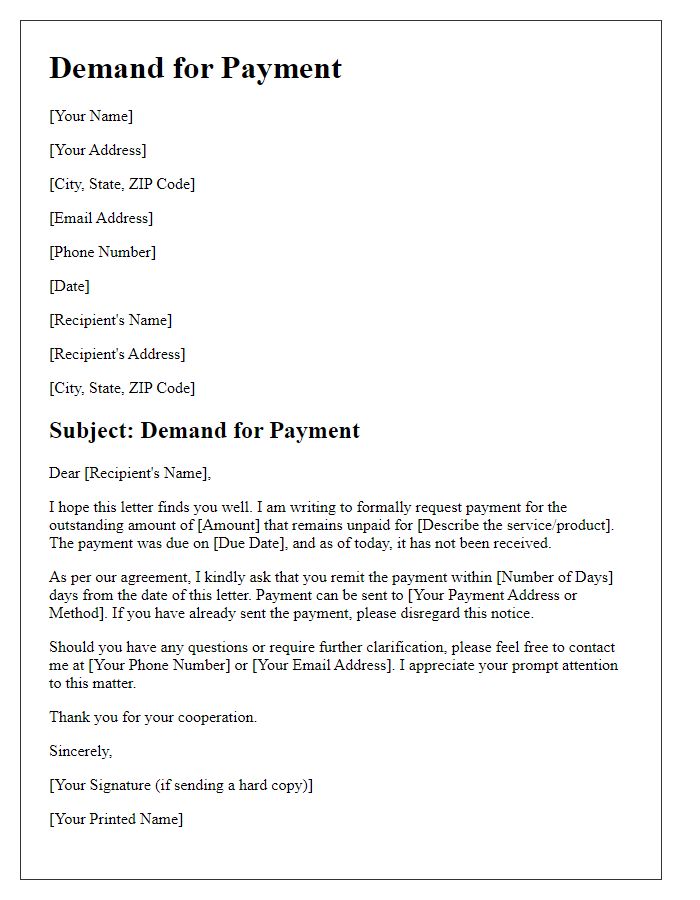

Payment deadline and options

A pre-legal debt warning serves as a reminder for an outstanding payment that has reached the deadline for resolution. This notice, typically sent out 30 days after the due date, highlights the total amount owed, including any late fees incurred, and emphasizes the urgency of addressing the situation to avoid further legal action. It may include detailed payment options available for settling the debt, such as a payment plan or a direct payment method through secure platforms. Failure to respond could lead to escalating consequences, including court proceedings wherein the creditor seeks recovery of the debt through legal channels. Prompt action is advisable to avoid additional charges or negative impacts on credit ratings.

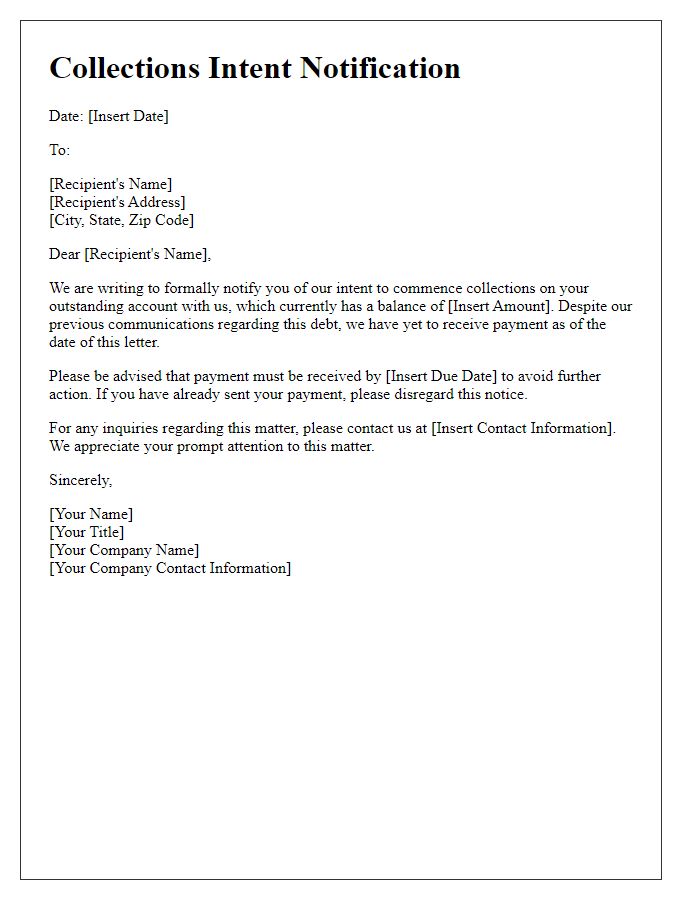

Consequences of non-payment

Failure to settle outstanding debts can lead to severe consequences for individuals, such as legal actions initiated by creditors. Unpaid amounts may result in court judgments, which could impose additional fees and interest, increasing the total liability significantly. In extreme cases, collections agencies could become involved, potentially damaging credit scores substantially. The Fair Debt Collection Practices Act (FDCPA) outlines regulations to protect consumers, yet violations by collectors can still occur. Assets may be at risk of seizure, or wage garnishment could be enforced, leading to diminished monthly income. All these factors can create a cycle of financial difficulty, making it crucial to address repayment promptly.

Comments