Are you grappling with the complexities of a debt reassessment after receiving forgiveness? You're not alone; many people find themselves needing clarity and guidance on this important financial matter. In this article, we'll explore the essential steps to effectively address and reassess forgiven debts, helping you navigate this often confusing terrain. So, let's dive in and empower you with the knowledge you needâread on for more insights!

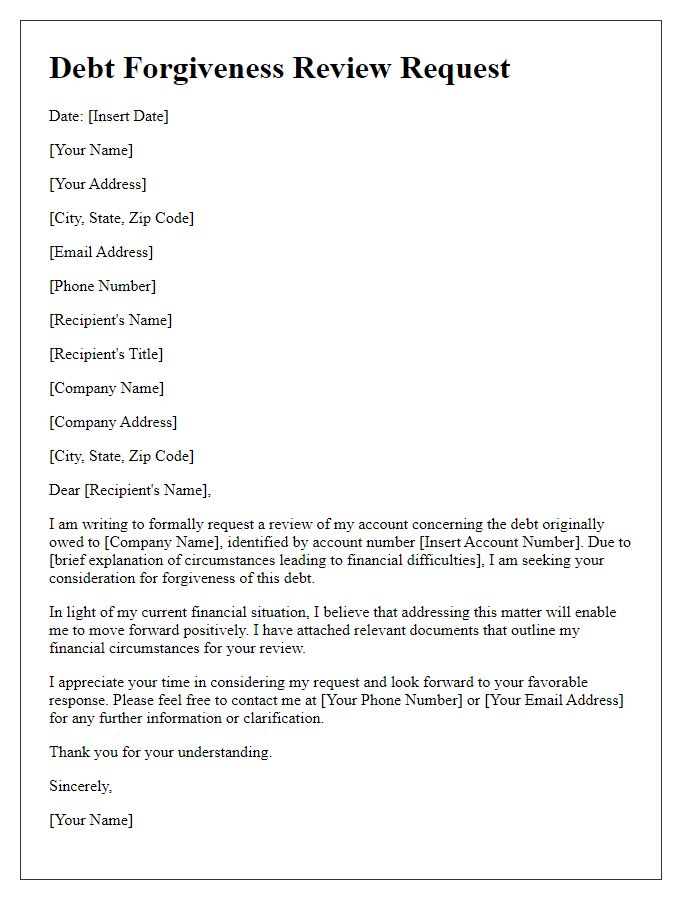

Clear Identification of Parties

In formal debt reassessment, clear identification of parties is essential. Debtor, John Smith, residing at 123 Maple Street, Springfield, contracted with creditor, XYZ Financial Services, located at 456 Elm Avenue, Springfield. Agreement dated March 15, 2020, stipulated a loan of $10,000. Current assessment seeks to address the original terms, repayment status, and potential adjustments in light of recent financial circumstances impacting both entities. Documentation should include updated financial statements from the debtor and a reassessment of repayment capabilities by the creditor. Legal representatives for both sides may also be involved for fairness in negotiations.

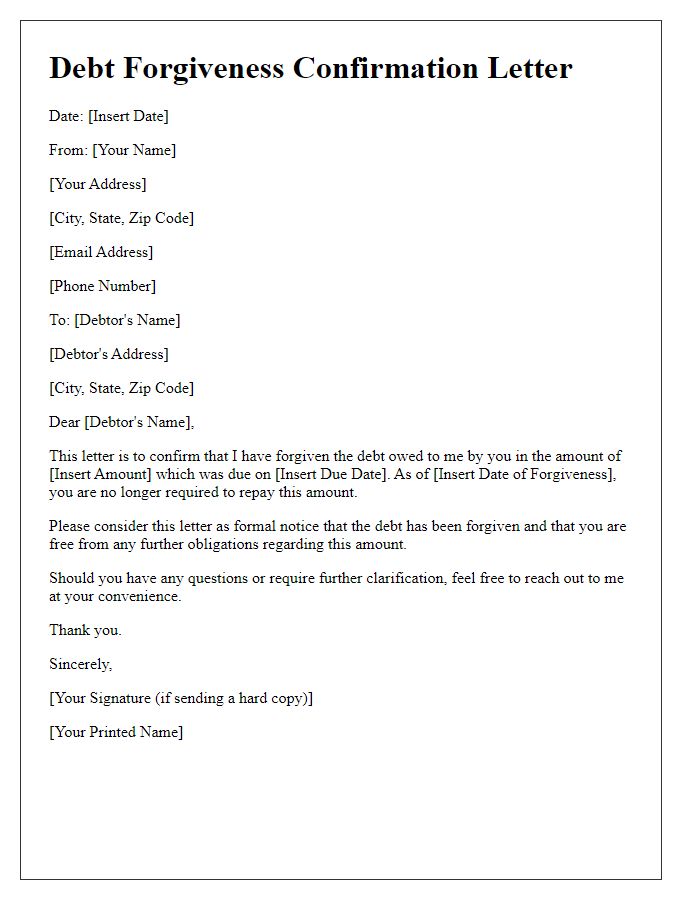

Detailed Account Information

A forgiven debt reassessment involves reviewing financial documents related to debts that have been canceled or forgiven, such as credit card debt or student loans. The IRS recognizes forgiven debts as taxable income, affecting individuals or businesses in places like California, where debt forgiveness can significantly impact state tax liabilities. The reevaluation process should include meticulous gathering of account statements, evidence of debt cancellation (e.g., 1099-C forms), and previous tax returns (especially for the tax year in which forgiveness occurred). Accurate records assist in understanding the amount forgiven, ensuring compliance during tax assessments and potential audits. Preparing for a reassessment typically requires consulting with financial advisors or tax professionals to navigate the complexities of tax laws and regulations effectively.

Original Debt Terms and Forgiveness Details

Original debt terms specify the total amount owed, interest rates, and payment schedules. For example, a loan of $10,000 with a 5% annual interest rate and a five-year repayment plan includes monthly payments of approximately $188. In some cases, lenders may offer forgiveness details, such as reducing the debt by 50% or waiving remaining balance upon successful completion of specific conditions like on-time payments for two years. Understanding these terms is crucial for individuals seeking reassessment of their debt obligations, especially in light of financial challenges that may arise unexpectedly, such as job loss or medical expenses. Effective communication with lenders regarding the request for reassessment can lead to more manageable terms.

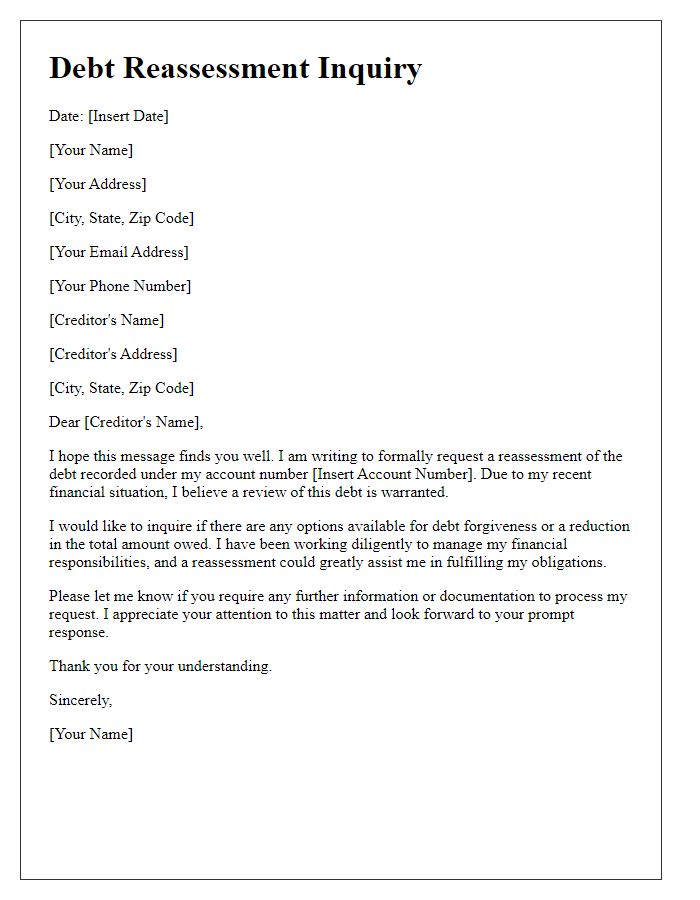

Reassessment Explanation and Justification

In financial discussions regarding debt reassessment, understanding the implications and reasons for forgiveness is crucial. Debt forgiveness, often seen during events such as major economic downturns or personal financial hardship, alters an individual's credit report significantly. For instance, the cancellation of debt usually involves amounts exceeding $600 being reported to the IRS, which is classified as taxable income. Organizations such as nonprofits may offer programs aimed at assisting individuals through restructuring payments or reducing total principal amounts owed (for example, the student loan forgiveness program initiated under the CARES Act in 2020). Furthermore, presenting evidence of changed financial circumstances, such as job loss, medical emergencies, or other unforeseen expenditures, plays a vital role in advocating for reassessment. Personal finance experts recommend keeping detailed documentation of income changes to support requests effectively.

Contact Information for Further Inquiries

A reassessment of forgiven debt can impact taxation and financial records significantly. The Internal Revenue Service (IRS) guidelines, particularly Publication 4681, outline how forgiven debt may be considered taxable income under certain conditions. Always include specific contact information such as a phone number or email address for inquiries related to the reassessment. Providing clear access to customer service representatives experienced in debt management can facilitate understanding of the implications, process requirements, and required documentation for the reassessment. Ensure any details associated with the debt, including original amounts, dates, and creditor information, are clearly noted to streamline communications.

Comments