Are you feeling overwhelmed by debt and unsure where to turn for answers? You're not alone, and understanding your financial situation can be the first step toward regaining control. In this article, we'll explore effective strategies for crafting a debt inquiry letter that clarifies your obligations and rights. So, let's dive in and equip you with the tools you need to tackle your debt with confidence!

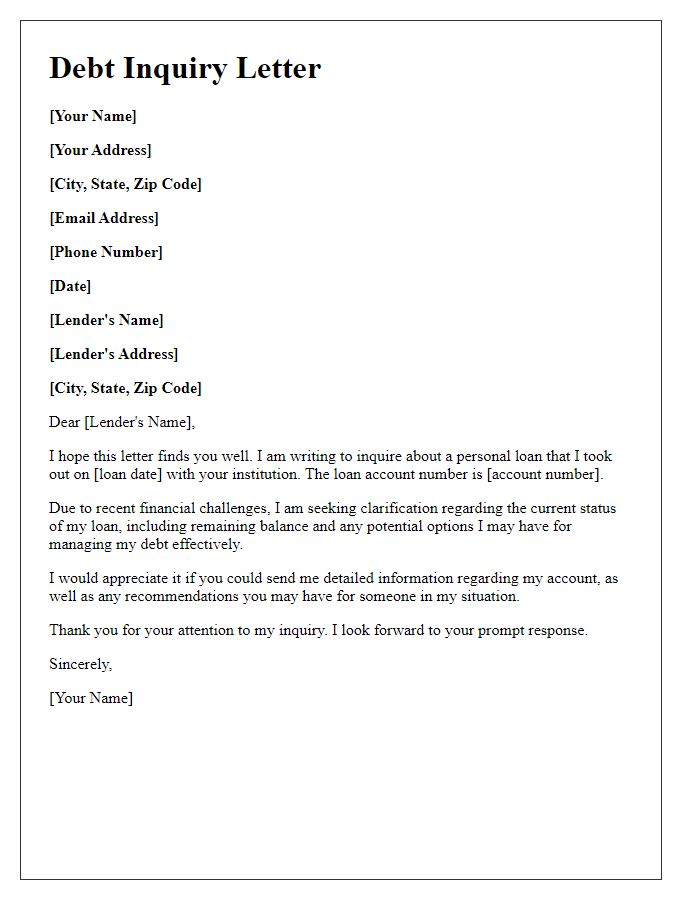

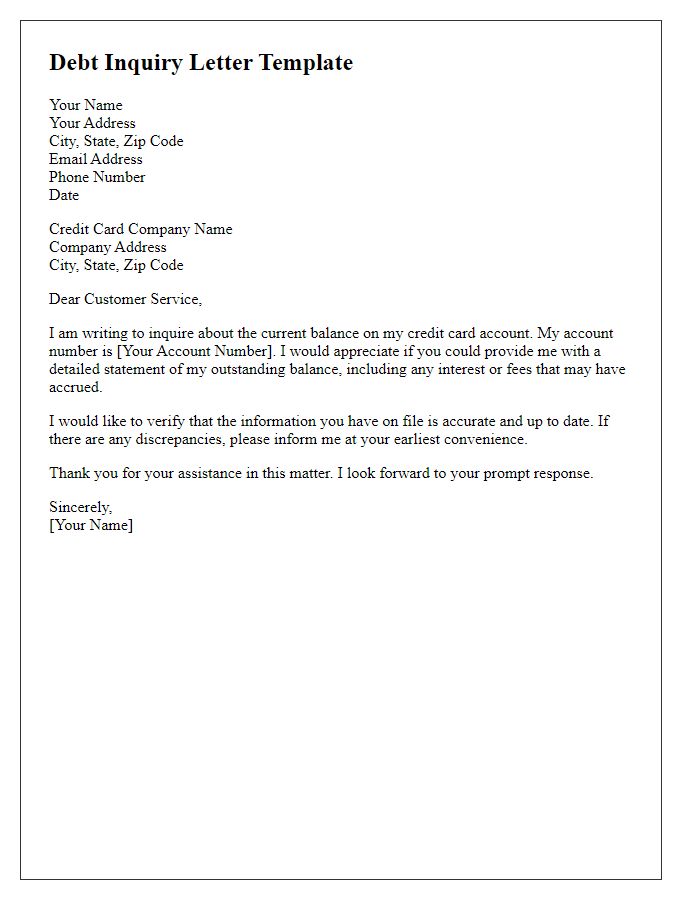

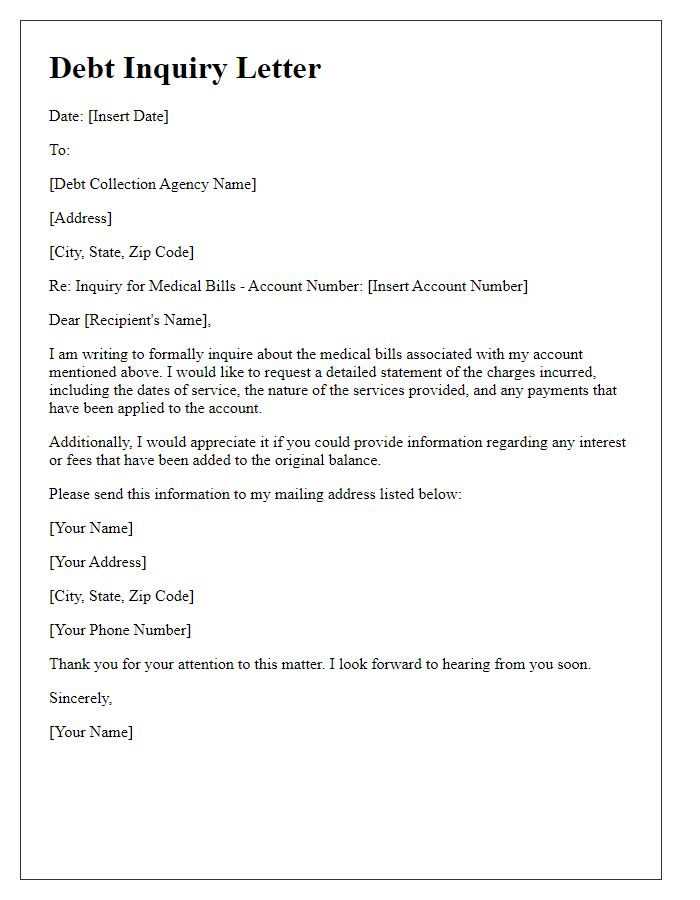

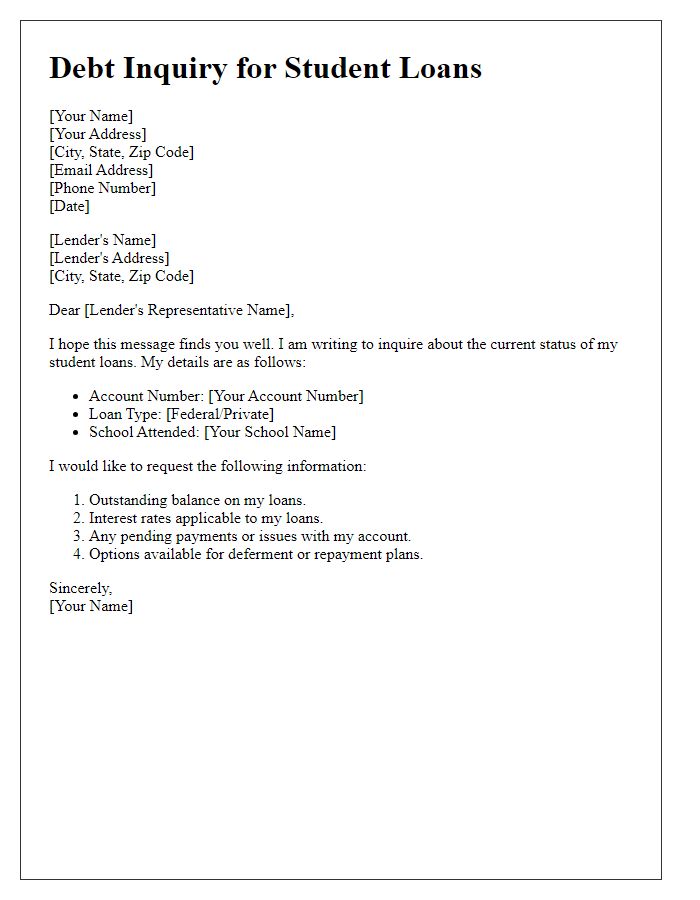

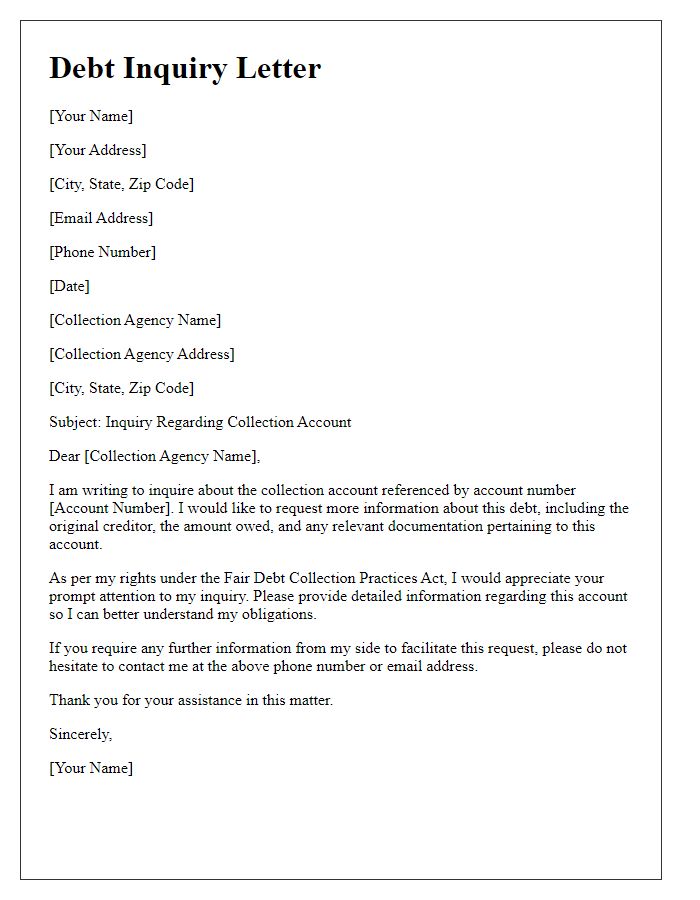

Recipient's contact information

Debt inquiry letters are essential for consumers seeking clarity on outstanding balances or discrepancies in financial statements. The recipient's contact information typically includes the creditor's name, address, and specific department (like customer service or collections). Including precise details, such as the account number associated with the debt, provides context for your inquiry. Proper formatting ensures that your letter reaches the appropriate party efficiently, thereby aiding in quicker resolution of any issues. Utilizing correct titles and ensuring legibility emphasizes professionalism and seriousness regarding the debt matter.

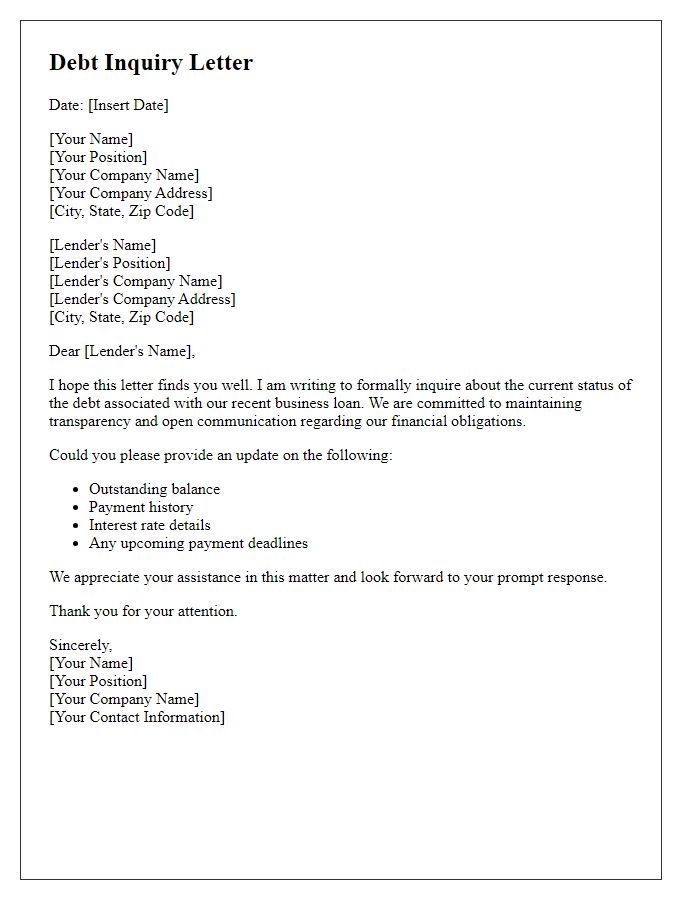

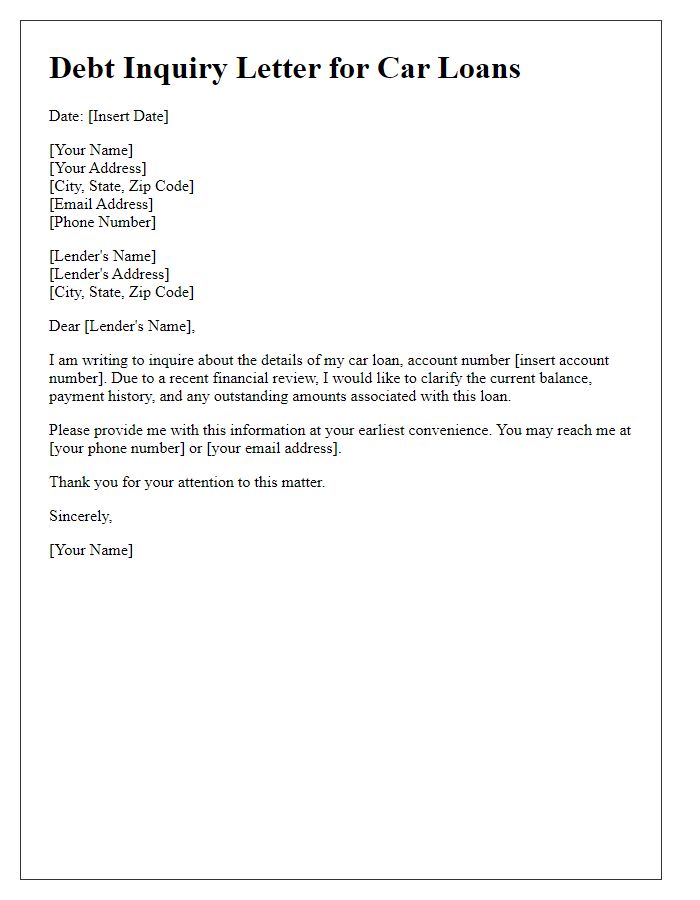

Account reference number

Debt inquiries often require precise details for clarity and efficient resolution. An account reference number (usually a unique identifier assigned by creditors) is crucial for locating the relevant information quickly. This number allows for streamlined communication regarding account status and outstanding balances. Clarity in the inquiry enhances the promptness of responses, reducing the potential for misunderstanding. Effective communication of account details such as the amount owed, due dates, or payment arrangements is essential for resolving any disputes and maintaining accurate financial records.

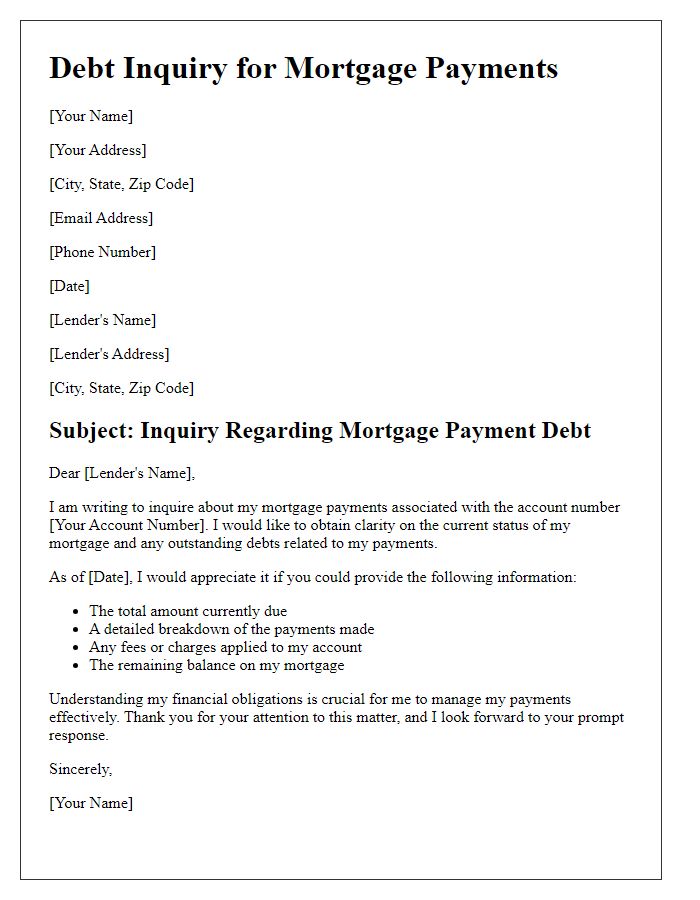

Detailed account inquiry

A detailed account inquiry regarding outstanding debt reveals essential insights into financial obligations. An examination of the account, numbered 123456789, uncovers the principal amount of $5,000, alongside accrued interest of 15% annually, resulting in a total balance of approximately $5,750 as of October 2023. Transaction history includes notable payments, such as a $1,000 payment made on July 15, 2023, which reduces the balance significantly. Additionally, the inquiry into the account reveals potential discrepancies in billing statements from the debt management agency, XYZ Financial, located in New York, which warrant clarification. Timely communication with customer service for further details can enhance understanding and facilitate resolution of the outstanding debt.

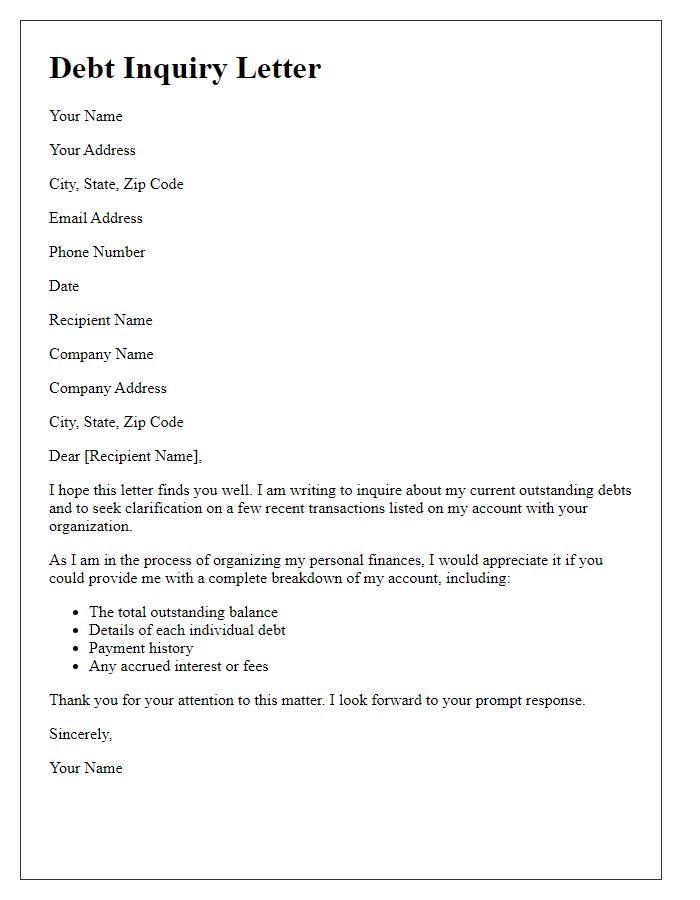

Request for outstanding balance

A debt inquiry regarding outstanding balances typically involves an assessment of account details. The individual or organization may request information about unpaid invoices or late fees accumulated over specific payment periods. The inquiry generally highlights the account number for better identification, and it may ask for a detailed statement reflecting the exact outstanding amount, interest rates applicable, and any payment history since the inception of the debt. This information is crucial for understanding financial obligations and planning for timely repayments. Clear communication can prevent further complications related to debt management and financial accountability.

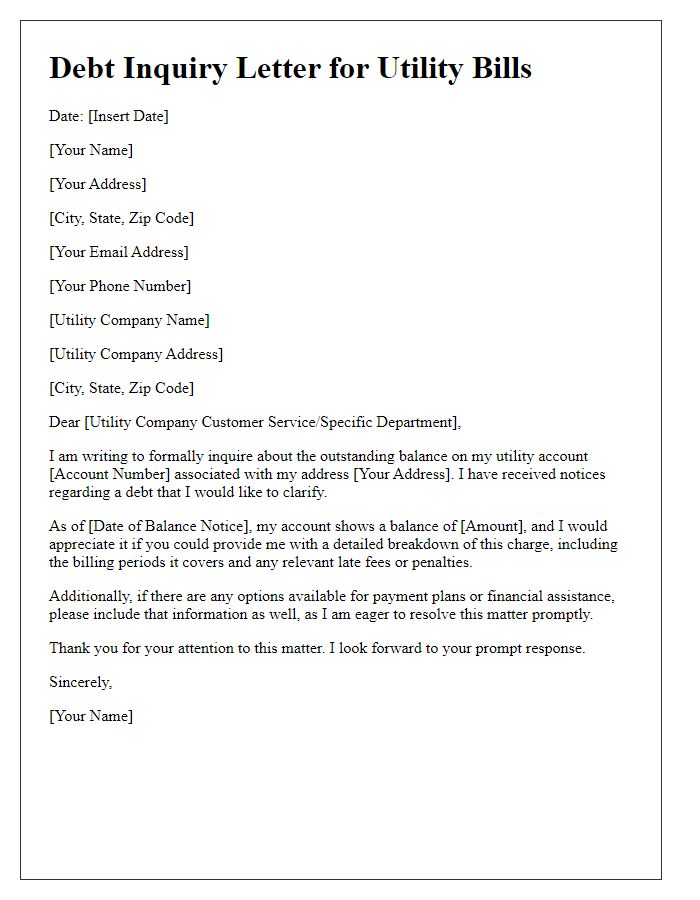

Contact information for follow-up

A debt inquiry involves reaching out to financial institutions or creditors to clarify outstanding amounts or payment terms. Collecting necessary contact information is crucial for subsequent communication. Include the creditor's name, such as ABC Lending Company, along with their phone number, like (555) 123-4567, and email address, for instance, support@abclending.com. Document any reference numbers related to the account, ensuring a clear connection to the debt in question. Additionally, recording specific dates of prior communications, such as October 5, 2023, enhances the inquiry's effectiveness, establishing a timeline for follow-up discussions. Having this organized information facilitates a smoother resolution process.

Comments