Are you in need of a reliable letter template to request additional collateral? Whether you're a business owner seeking to strengthen your loan agreement or an individual looking to secure a personal loan, crafting the perfect request can make all the difference. This article will guide you through the essential elements of a compelling letter while maintaining a professional tone. Ready to enhance your financial negotiations? Let's dive in!

Clear purpose statement

A request for additional collateral is essential in securing financial agreements. In markets fluctuating due to economic conditions, lenders often require extra security to mitigate risk. This request typically pertains to scenarios involving property, equipment, or financial instruments. Providing detailed information about the current collateral's value and market conditions supporting the need for additional assets is crucial. Supply documentation reflecting increased valuation, such as appraisals or recent financial statements, to strengthen your case. Clarity in purpose ensures that the lender understands the rationale for your request and can make an informed decision.

Detailed collateral description

In business transactions, additional collateral can significantly mitigate risk for lenders. Collateral might include real estate, such as commercial properties located in downtown metropolitan areas with high foot traffic, or financial assets like stocks from stable companies with consistent dividend payouts. Equipment can also serve as collateral, including machinery used in manufacturing, with detailed lists of serial numbers and estimated market values, highlighting their significance in production processes. Furthermore, inventory that includes high-demand consumer goods may be pledged, with descriptions of quantities and market trends bolstering the request for additional collateral. Each piece of collateral strengthens the lender's confidence in the transaction, ensuring greater security against potential defaults.

Justification for additional collateral

In financial transactions, additional collateral can enhance security for lenders. Institutions often require supplemental collateral when an initial asset or guarantee becomes inadequate due to fluctuating market conditions. In the case of real estate, a property's value may diminish by over 20% in a volatile market, necessitating further collateral to mitigate risk. For businesses, a significant drop in the share price (e.g., a decline of at least 15% in the last quarter) may prompt lenders to reassess the collateralization levels. Furthermore, upcoming economic indicators, such as interest rate hikes by the Federal Reserve or inflation rates exceeding 5%, can signal increased risk for secured loans. Therefore, providing additional collateral under these conditions can ensure stability and safeguard both parties' interests in the transaction.

Borrower's financial information

A request for additional collateral is often necessitated by fluctuations in the borrower's financial standings. For instance, a recent credit score decline may indicate increased risk, prompting lenders to seek further security. Financial documents, such as income statements, balance sheets, or cash flow statements, provide insights into the borrower's economic health. Details regarding existing debts or liabilities, potentially exceeding a specified threshold (e.g., 30% of total assets), might also warrant reassessment of collateral. In this context, tangible assets like real estate, machinery, or inventory can serve as effective collateral, ensuring the lender's protection against default and securing their financial interests during periods of uncertainty.

Submission instructions and deadline

Financing institutions frequently require additional collateral to secure loans. Often, borrowers must submit required documents including appraisals, financial statements, and personal guarantees. The submission deadline for additional collateral documentation is typically set for 30 days from the initial request, necessitating prompt action. Each institution may provide unique submission instructions, which can encompass both physical delivery to specific branch locations and electronic uploads through secure online portals. This process ensures the protection of sensitive financial information. Providing thorough and accurate collateral documentation is crucial to maintaining loan approval status and ensuring favorable lending terms.

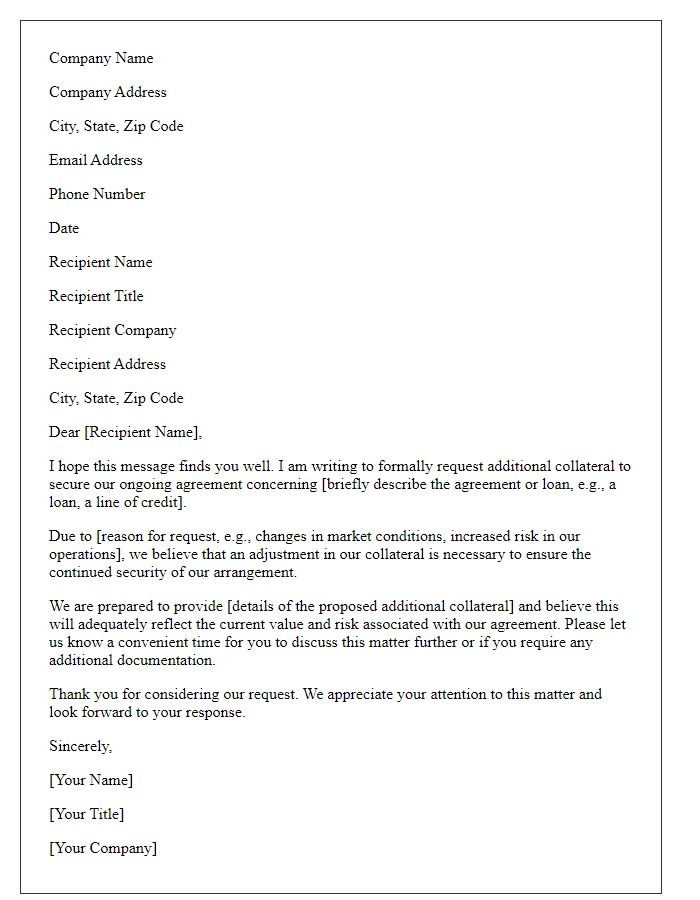

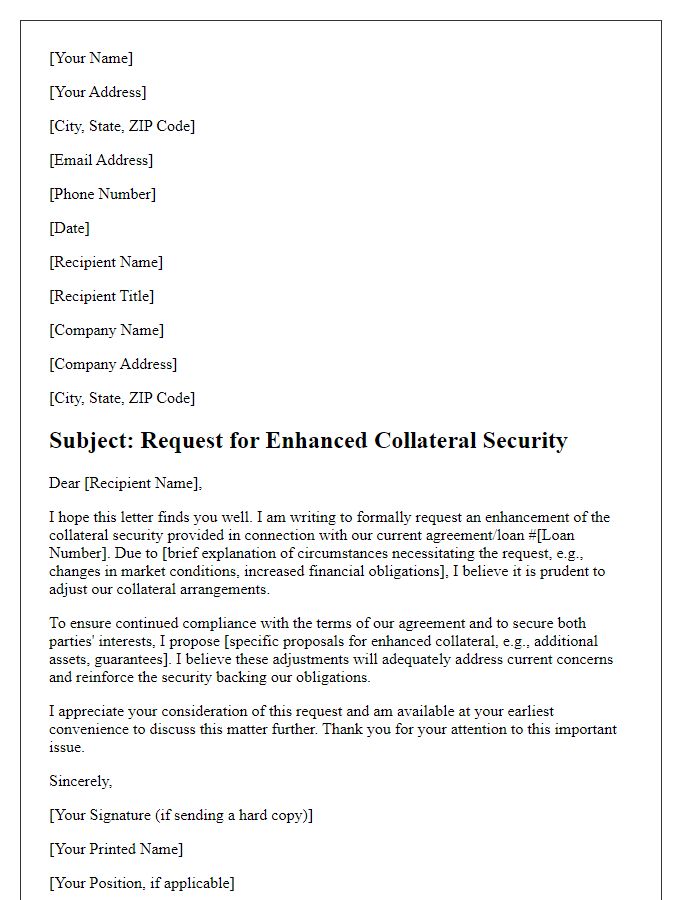

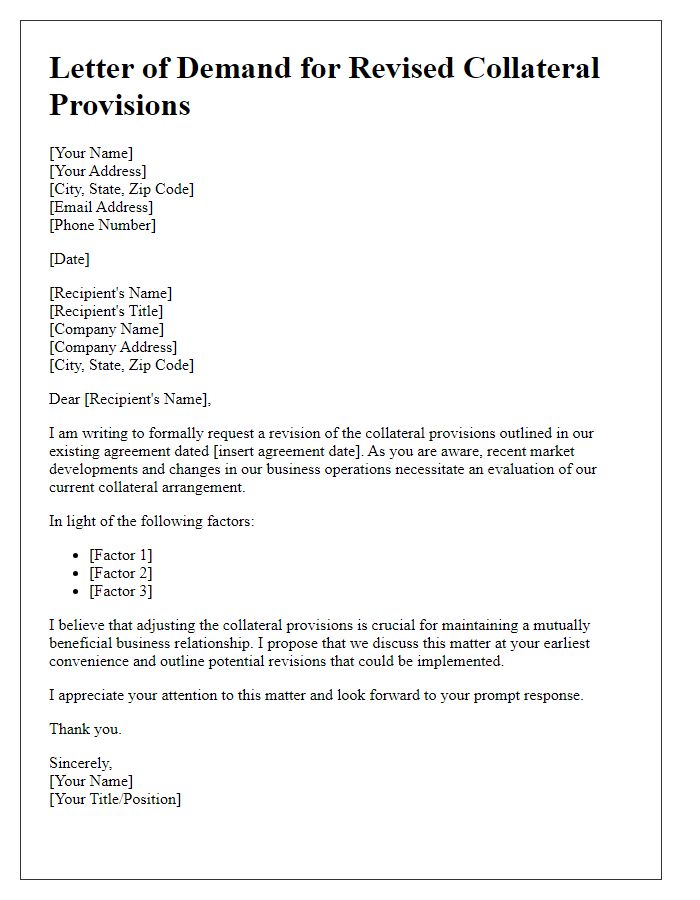

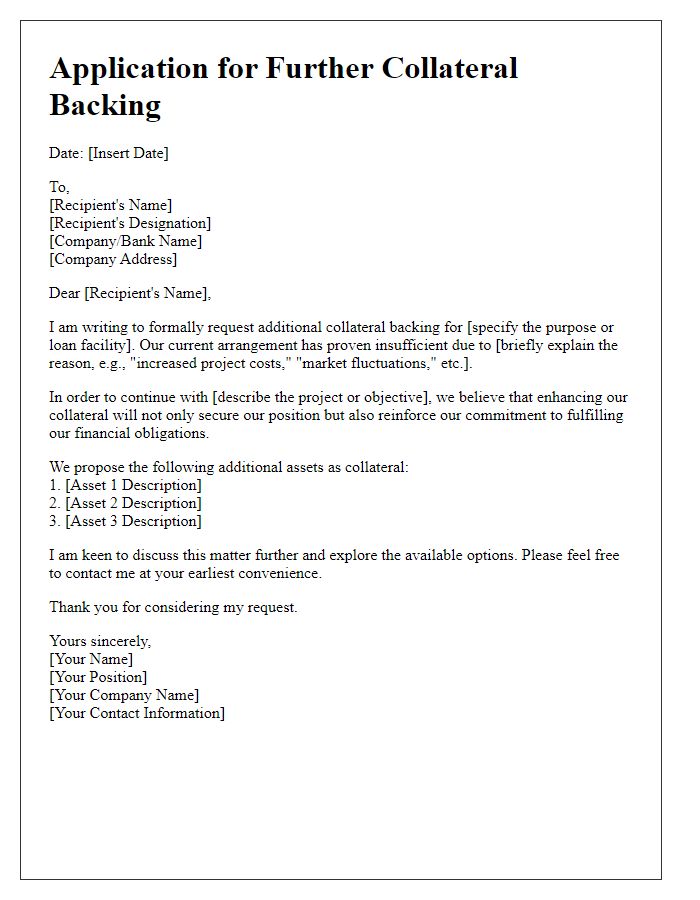

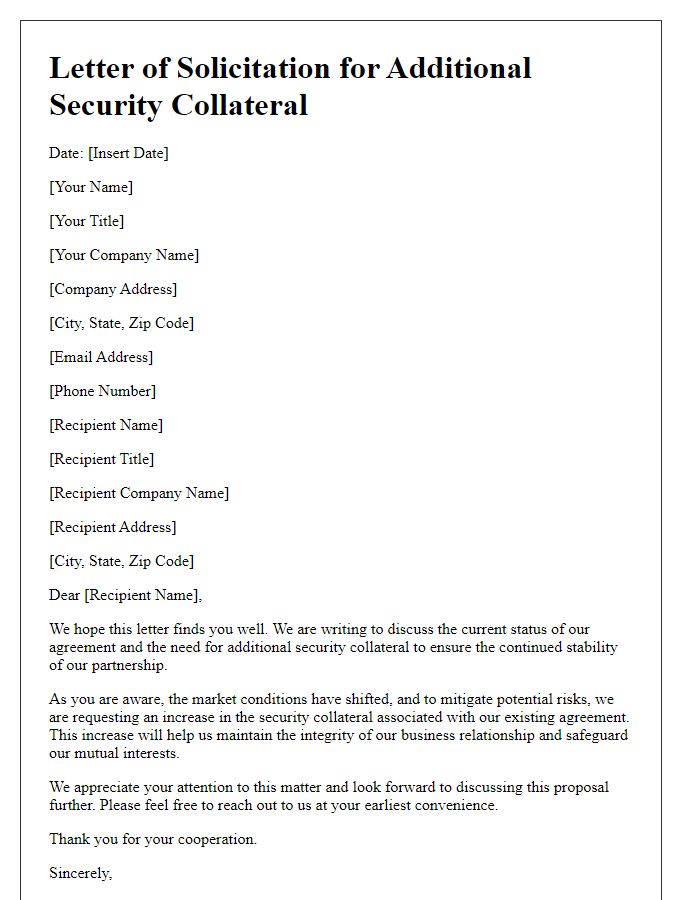

Letter Template For Request Of Additional Collateral Samples

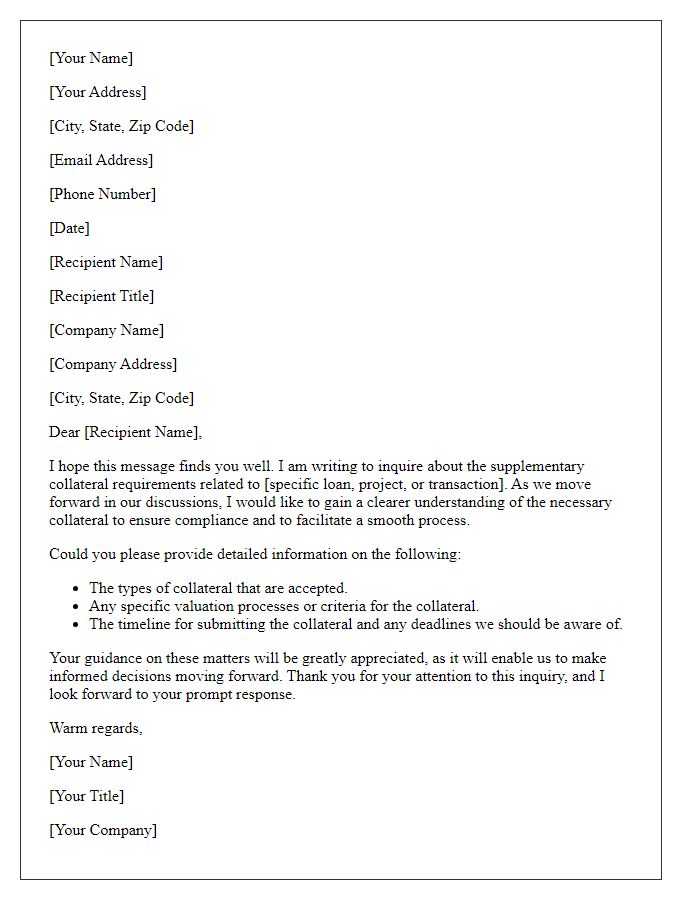

Letter template of inquiry regarding supplementary collateral requirements

Comments