Are you looking to streamline your communication when notifying clients about interest charges? Crafting an effective letter can make all the difference in ensuring transparency and maintaining positive relationships. In this article, we'll explore the essential components of a well-structured interest charge notification, giving you insights to convey the message clearly and professionally. So, grab a cup of coffee and let's dive into this topic together!

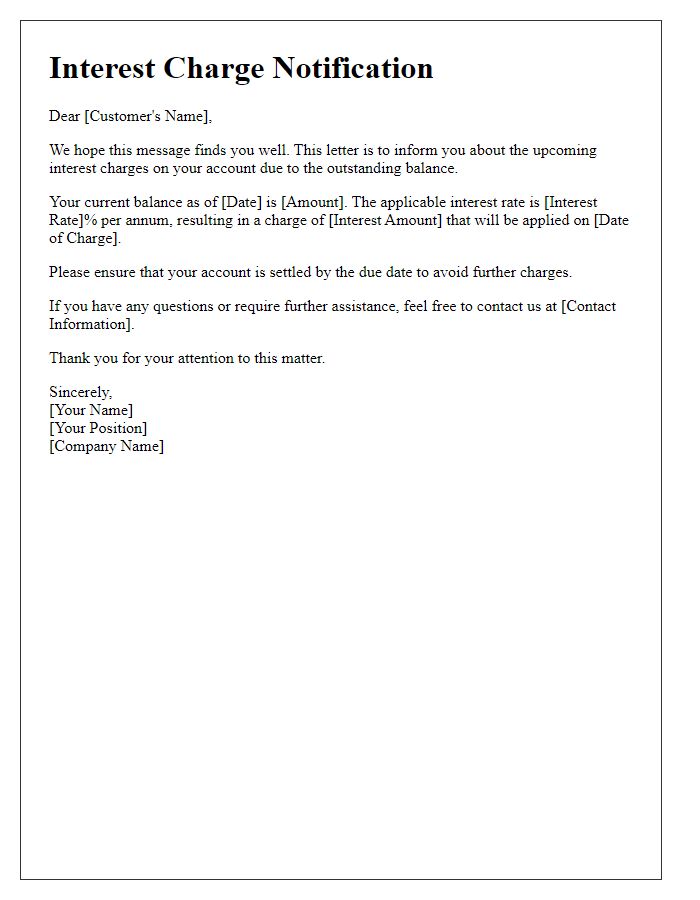

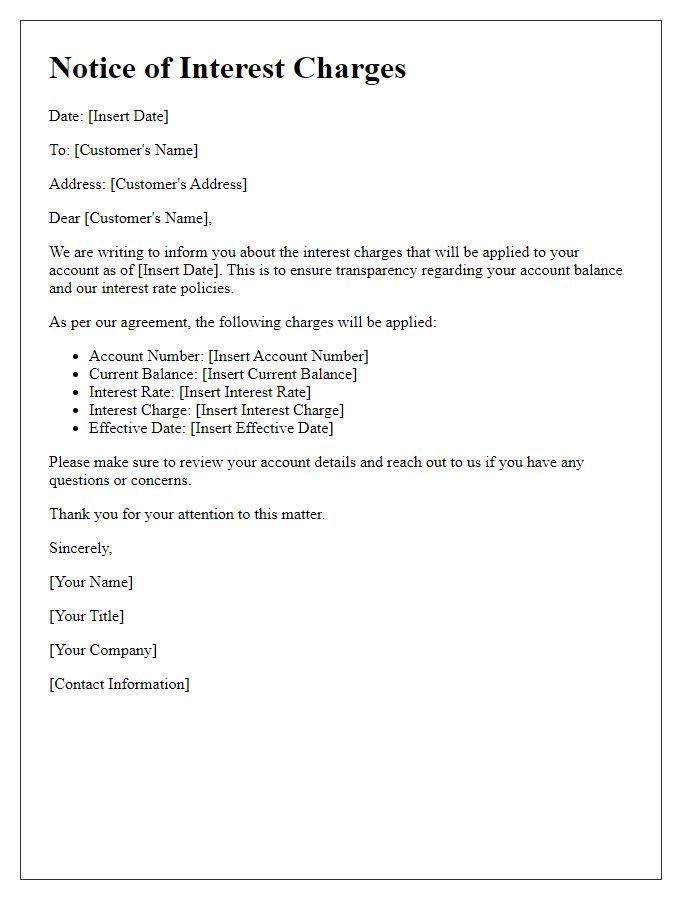

Client's account details

Clients maintaining overdue accounts may incur interest charges, which can significantly impact their total balance. An example includes accounts with a due amount exceeding $500, subject to interest rates ranging from 1.5% to 2.5% per month, depending on company policy and local regulations. Accounts not settled within 30 days of the original invoice date may see interest applied, increasing financial liability. For instance, if a $1,000 bill is unpaid for 60 days, the accrued interest could reach $50 to $125, depending on the precise interest rate. Notifying clients promptly ensures transparency and assists in maintaining an amicable financial relationship. Key account details, such as account number, invoice date, and outstanding balance, should be clearly communicated in the notification.

Interest rate information

Interest charges can significantly impact account balances on credit products, such as loans or credit cards. Commonly, annual percentage rates (APRs) vary between 15% to 30% depending on the borrower's creditworthiness. Late payments can incur penalties of $25 or more, increasing overall financial obligations. Detailed statements outlining interest calculations are typically provided monthly, enabling consumers to monitor accrued charges effectively. Furthermore, many financial institutions offer grace periods, often ranging from 21 to 30 days, before interest is applied to new purchases, granting borrowers a temporary relief from additional costs.

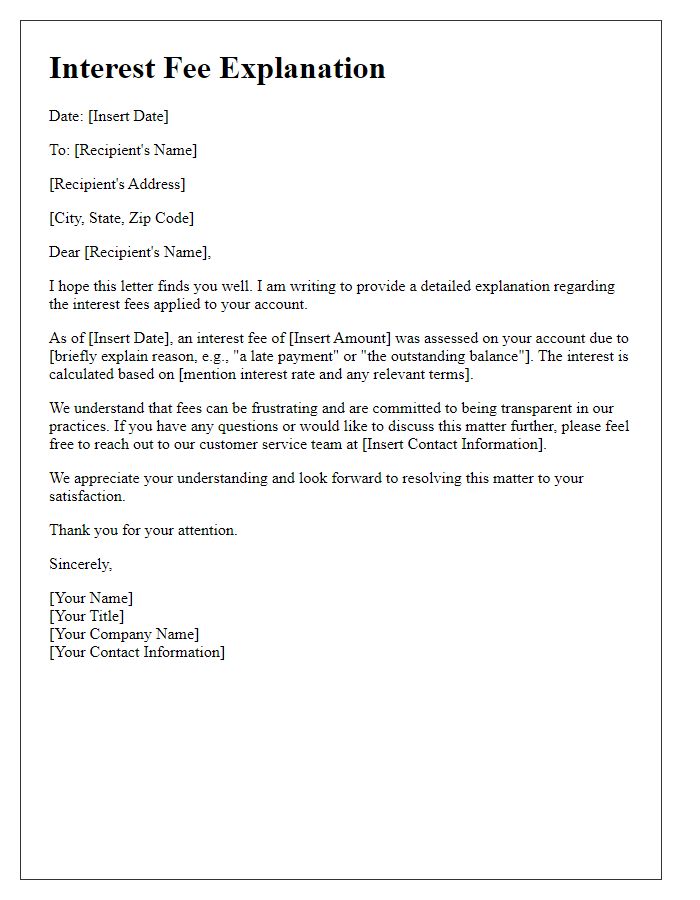

Calculation of charges

Interest charges can significantly impact financial outcomes, particularly in credit accounts such as personal loans and credit cards. These charges, often calculated based on the annual percentage rate (APR), typically apply to the outstanding balance over a specific period, usually monthly. For example, if an account has an APR of 18%, the monthly interest charge can be computed by dividing the APR by 12, resulting in a rate of 1.5%. Consequently, if the outstanding balance is $1,000, the interest charge for that month would amount to $15. Failure to pay the minimum required amount can lead to additional fees, compounding the total debt. Understanding the calculation and implications of these charges is essential for effective financial management.

Payment due date

Credit accounts often incur interest charges if balances remain unpaid past the due date. Financial institutions like banks or credit card companies typically set specific payment due dates, often seen on monthly statements. For example, a payment due date may fall on the 15th of each month, meaning any outstanding balance could accrue interest rates ranging from 15% to 25% annually, depending on the account. Additionally, late payments may lead to penalties, impacting credit scores and financial standing. Regular monitoring of account statements ensures timely payments, minimizing potential interest charges and maintaining healthy financial habits.

Contact information for inquiries

Interest charges on outstanding balances can significantly impact financial well-being. Typically levied by financial institutions like banks or credit card companies, these charges often accrue at annual percentage rates (APRs) ranging from 15% to 30%. For inquiries regarding specific interest charges, consumers should reach out to customer service departments, usually accessible via official websites or phone numbers listed on monthly statements. Proper contact information ensures prompt responses to clarify account details, discuss payment options, or address discrepancies related to interest calculations.

Comments