Are you feeling overwhelmed by debt and unsure of your next steps? Crafting a debt restructuring proposal can be a game-changer, helping you negotiate better terms and find financial relief. This article walks you through a simple yet effective letter template that you can customize to fit your unique situation. So, if you're ready to take control of your financial future, keep reading to discover how to create an impactful proposal!

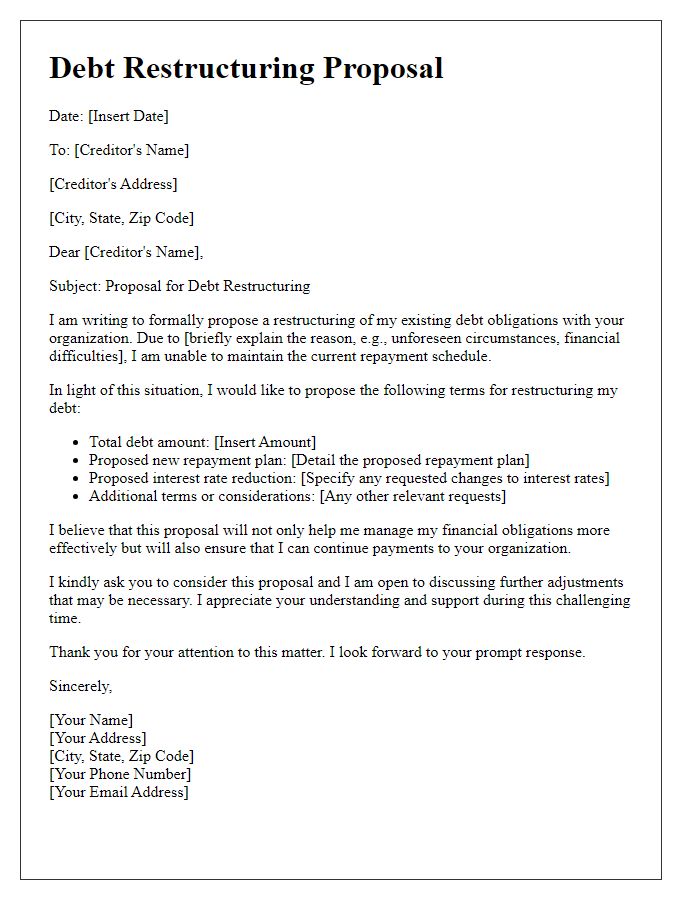

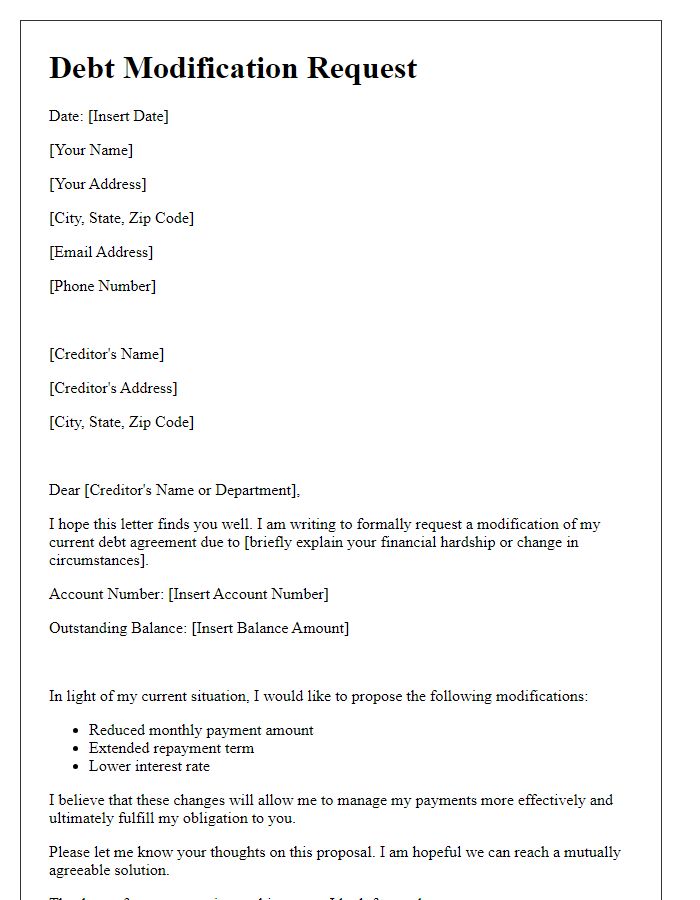

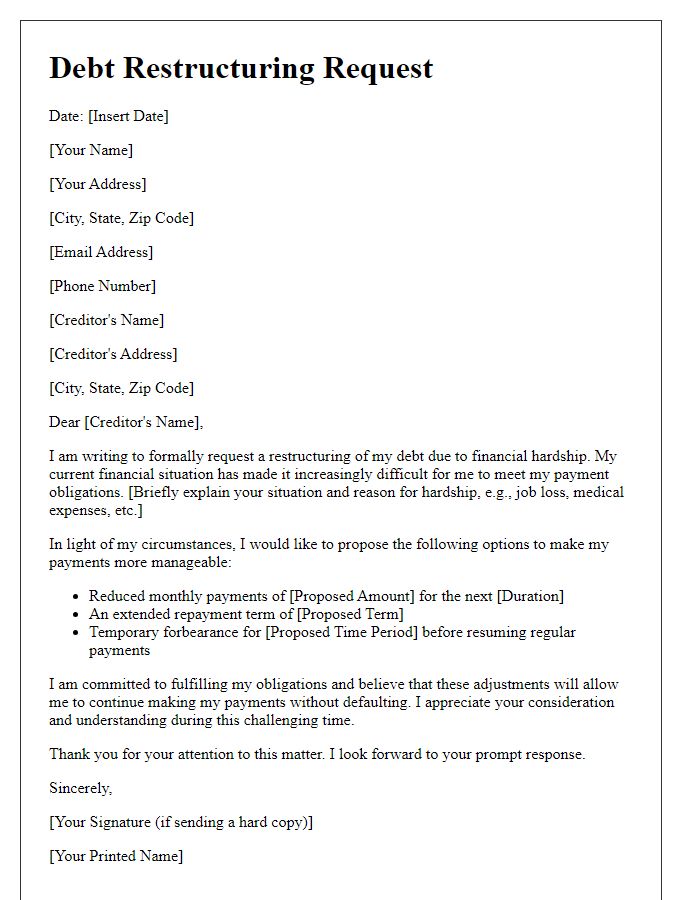

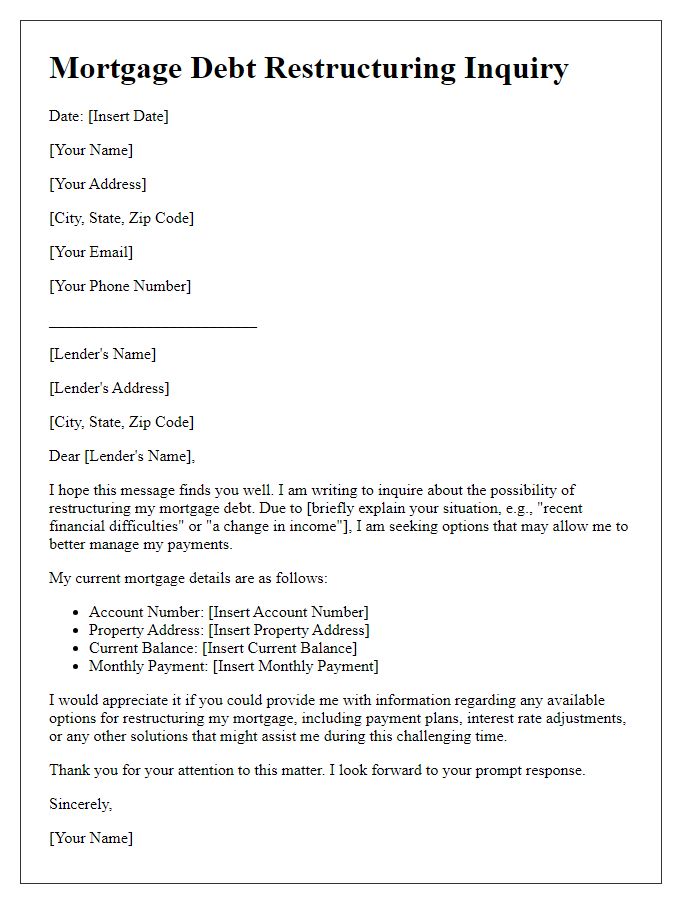

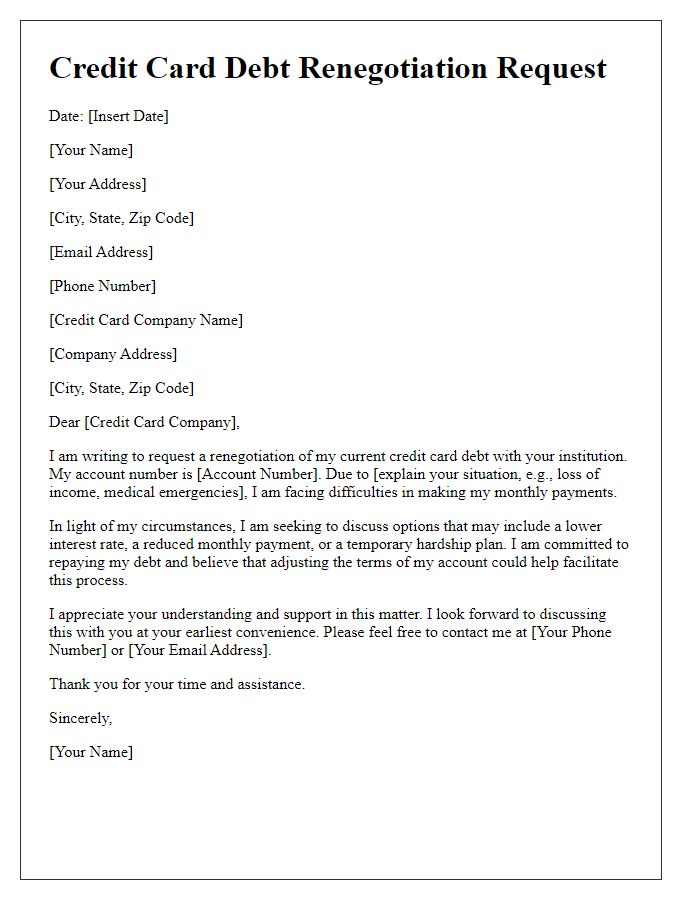

Clear identification of debtor and creditor details

The debt restructuring proposal should begin with a comprehensive overview of the debtor, including their full name, address, and contact information. Essential creditor identification follows, incorporating the creditor's name, organization, address, and contact details. Specific details about the debt at hand, including the total amount owed (expressed in currency, such as US dollars), repayment terms, and any accrued interest, are crucial for clarity. Additionally, the proposal should outline the reasons for requesting restructuring, such as financial hardship due to unforeseen circumstances or market volatility. The document may include proposed new terms, including adjusted repayment schedules, reduced interest rates, or partial debt forgiveness. The inclusion of supporting documentation, such as financial statements or cash flow analyses, can enhance the proposal's credibility.

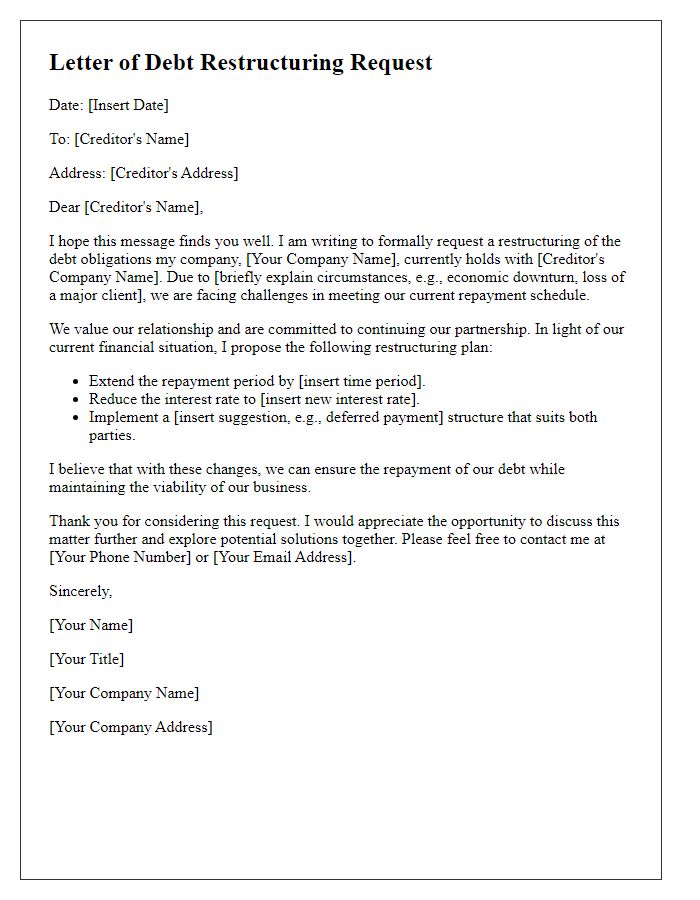

Comprehensive overview of current financial situation

The current financial situation of the affected entity, specifically Company X, reveals a total outstanding debt of $2 million, encompassing various creditors including five major banks and two private lenders. Monthly cash flow statements indicate a net loss of $50,000 in the previous quarter, driven by declining sales in a competitive market sector, particularly within the retail industry of New York City. High fixed costs, particularly rent averaging $15,000 per month in a prime Manhattan location, exacerbate financial strain. Ongoing operational expenses, including payroll for a workforce of 30 employees, add another $120,000 to monthly expenditures, straining liquidity. A comprehensive assessment of asset valuation shows current assets at $500,000, primarily in inventory and receivables, leading to a current ratio of 0.25, indicating potential insolvency risks. This data underscores the urgent need for a debt restructuring plan aimed at alleviating financial pressure and ensuring long-term sustainability.

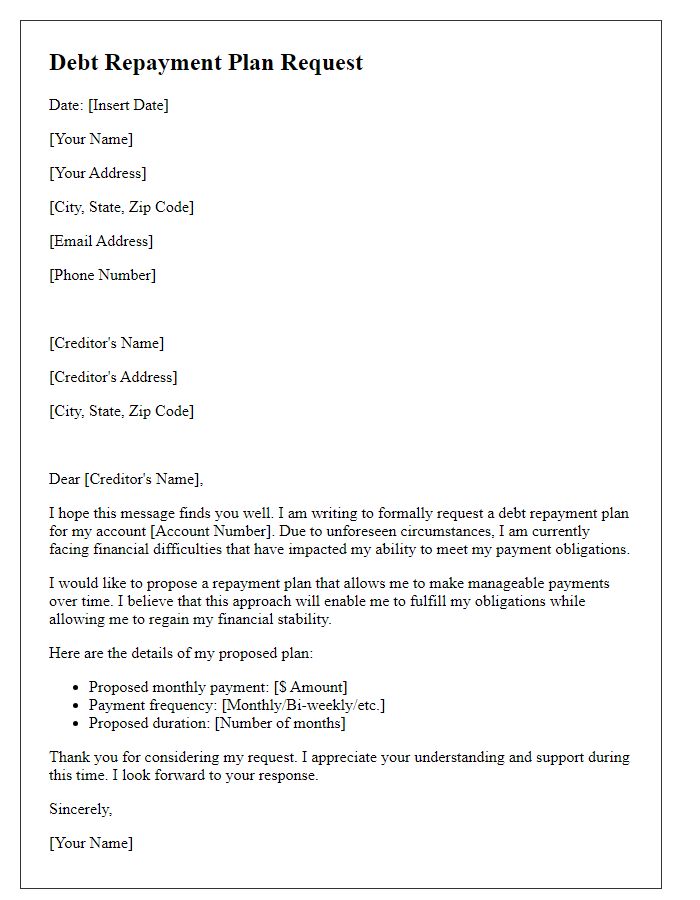

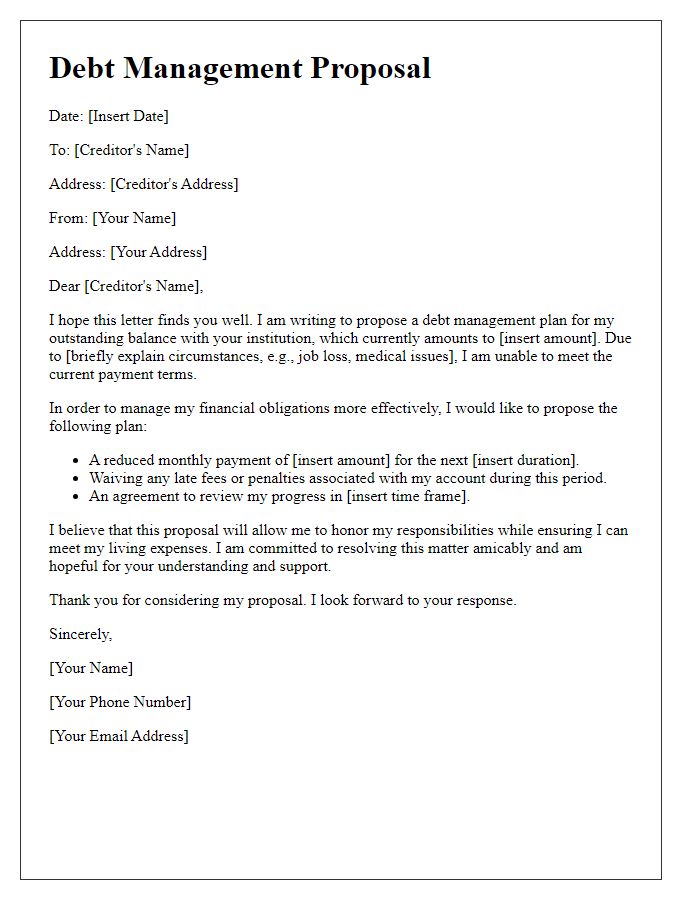

Specific terms and conditions proposed for restructuring

A debt restructuring proposal outlines specific terms and conditions aimed at modifying existing debt obligations to provide relief to the debtor. Key elements include the proposed reduction in principal amount, adjustment of interest rates (possibly lowering them from prevailing rates of 5% to 3%), and extension of the repayment period (possibly stretching from five years to ten years). Additional provisions may include a moratorium on payments for a specified period, such as six months, allowing for financial recovery. The proposal may also detail any concessions or guarantees offered by the debtor, including potential asset liquidation timelines or collateral adjustments, which could encompass properties or securities. Financial projections reflecting the debtor's ability to meet restructured payments might be included, with specific figures illustrating anticipated cash flow improvements. Each term aims to create a sustainable payment plan that satisfies creditor interests while enabling the debtor to regain financial stability.

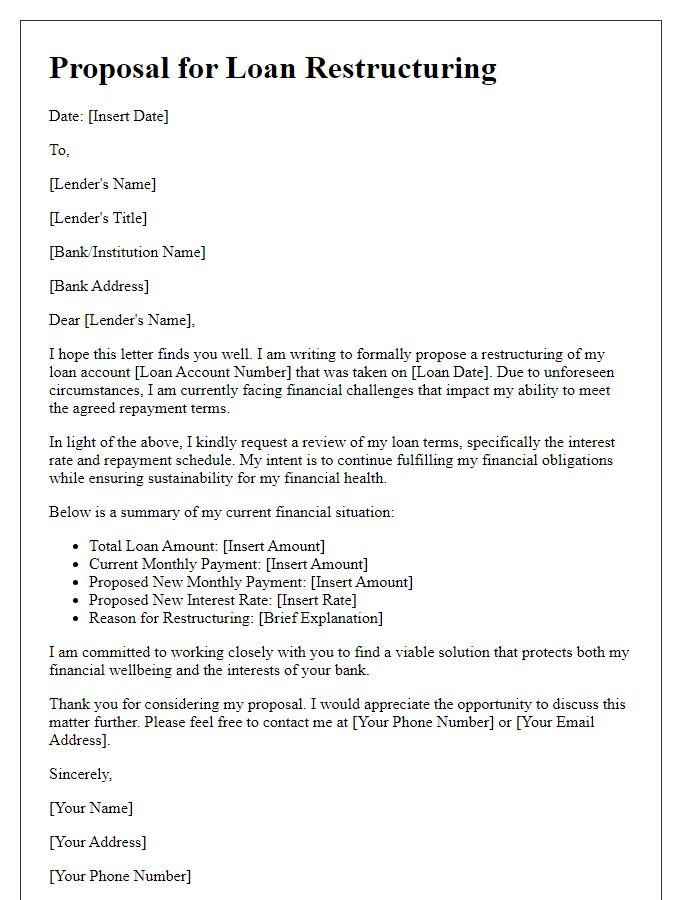

Justification and benefits of the restructuring proposal

A well-structured debt restructuring proposal can significantly improve a company's financial stability and operational efficiency. By negotiating terms with creditors, businesses can achieve lower interest rates and extended payment periods, alleviating immediate financial pressure. This can lead to enhanced cash flow management, allowing for investment in essential areas such as technology upgrades or workforce training, thus fostering competitive advantage. Successful examples of restructuring, as seen in companies like General Motors in 2009, demonstrate that strategic debt management can lead to increased stakeholder confidence and investor interest. Additionally, restructuring can avoid bankruptcy proceedings, preserving jobs and maintaining community stability, especially in areas reliant on major employers. A solid proposal outlines clear financial forecasts, providing transparency and instilling trust among all parties involved.

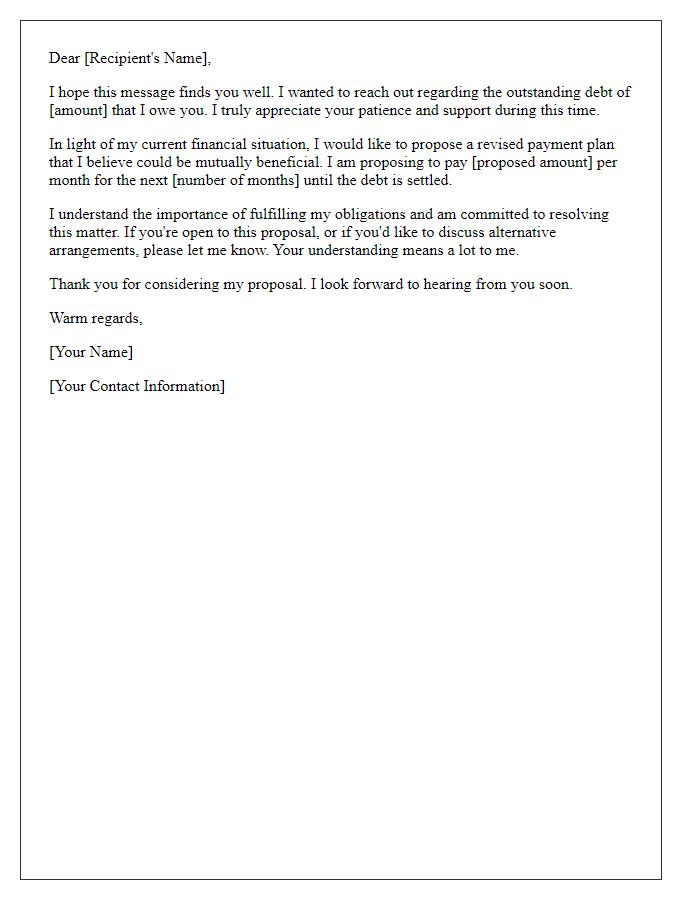

Contact information for further negotiation and discussion

A debt restructuring proposal can include numerous complex details that require clear communication. Engaging in discussions regarding terms, timelines, and potential agreements is essential. For efficient negotiation, provide explicit contact information, including phone numbers (preferably direct lines) and email addresses (professional domain preferred). This ensures timely responses to inquiries and facilitates the exchange of essential documents. Given the sensitive nature of the topic, ensure confidentiality agreements are discussed. Additionally, including a dedicated time frame for follow-ups (such as one week from proposal reception) can help manage expectations and demonstrate commitment to resolving outstanding financial obligations.

Comments