Are you juggling multiple bills and just realized you missed a payment? Don't worry; you're not alone! In our fast-paced lives, it's easy for deadlines to slip through the cracks, but staying on top of your finances is crucial. Let's dive into some essential tips for handling missed payments effectively and ensuring you're always in the loop.

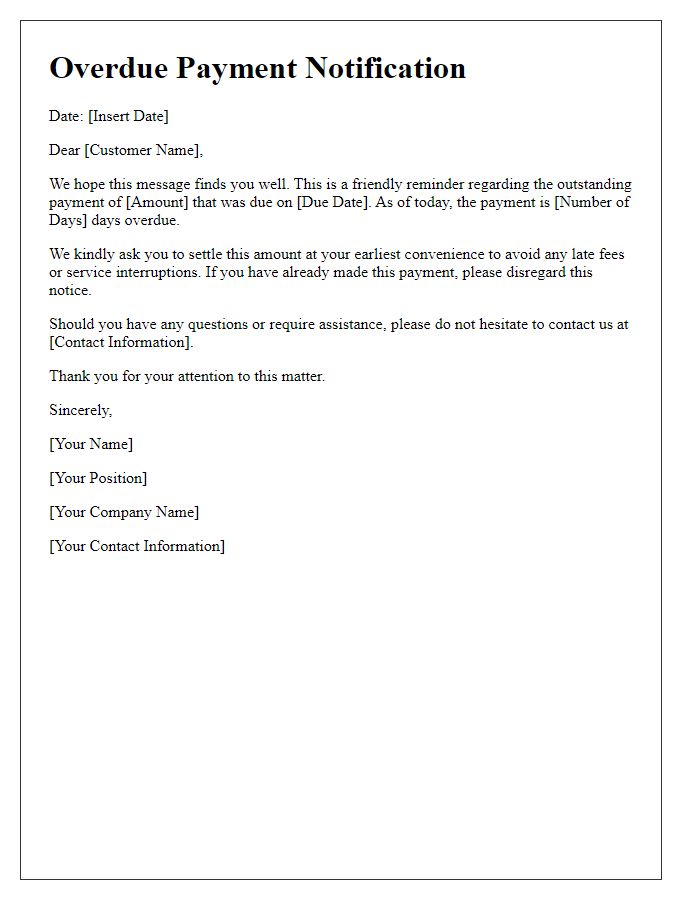

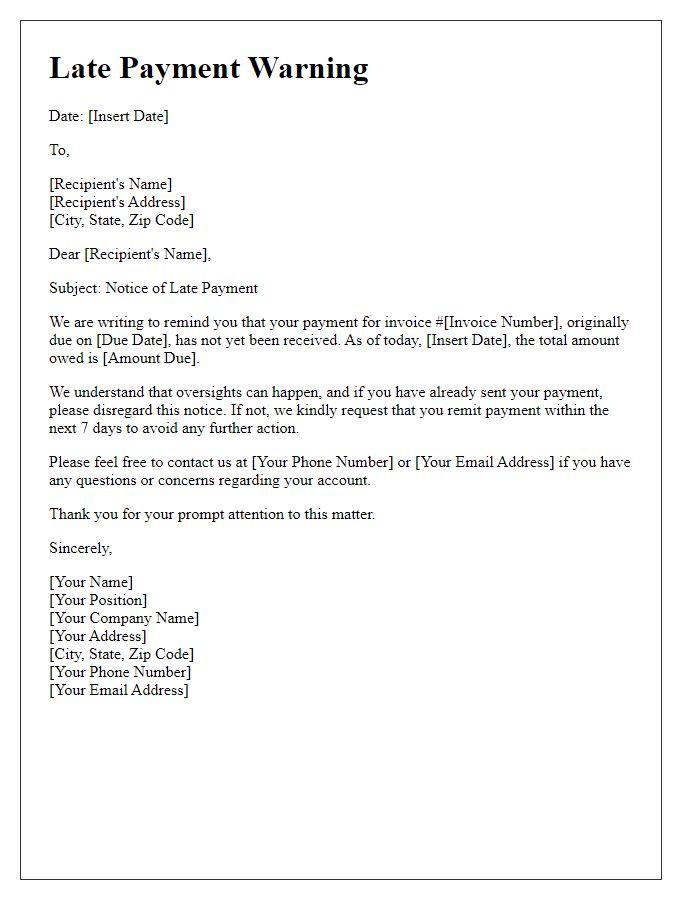

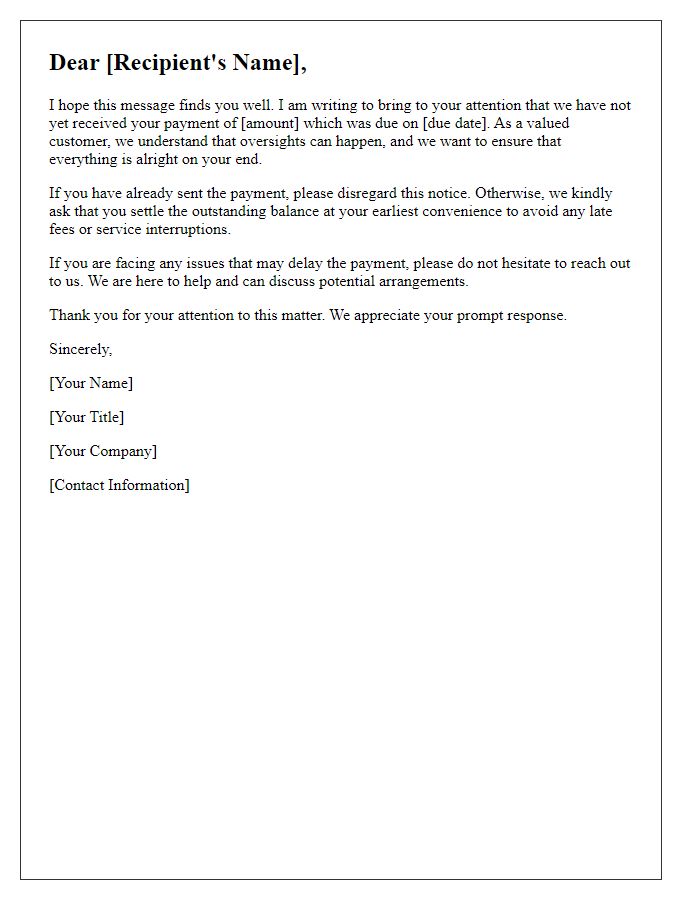

Clear Identification of Parties Involved

Missed payments can cause significant issues for both creditors and debtors, highlighting the importance of clear identification of parties involved in financial agreements. The debtor, usually an individual or entity responsible for repayment, needs to be explicitly named in communications to avoid confusion. Similarly, the creditor, often a financial institution or service provider, must be clearly identified to ensure the debtor knows who to contact regarding payment issues. Including unique identifiers such as account numbers, contract references, or even due dates can enhance clarity, providing essential context. Accurate labeling of these parties facilitates efficient resolution of payment discrepancies, helping maintain financial relationships and accountability.

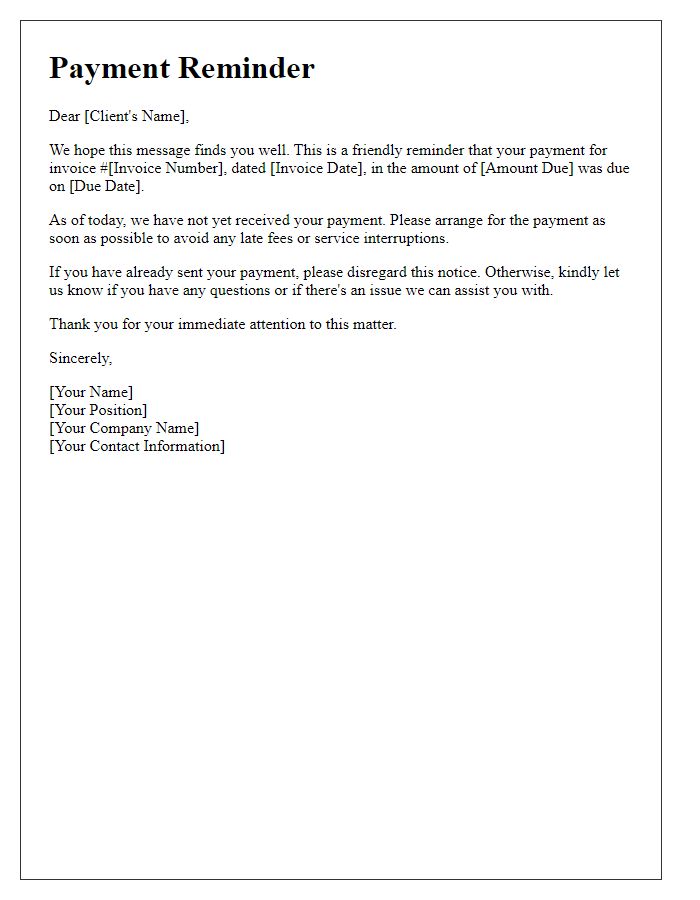

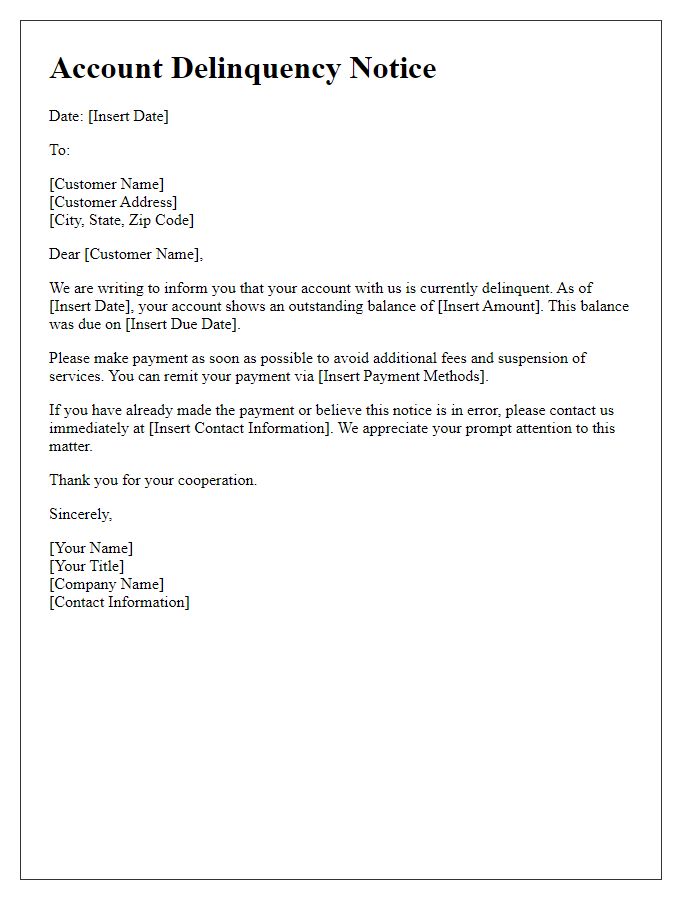

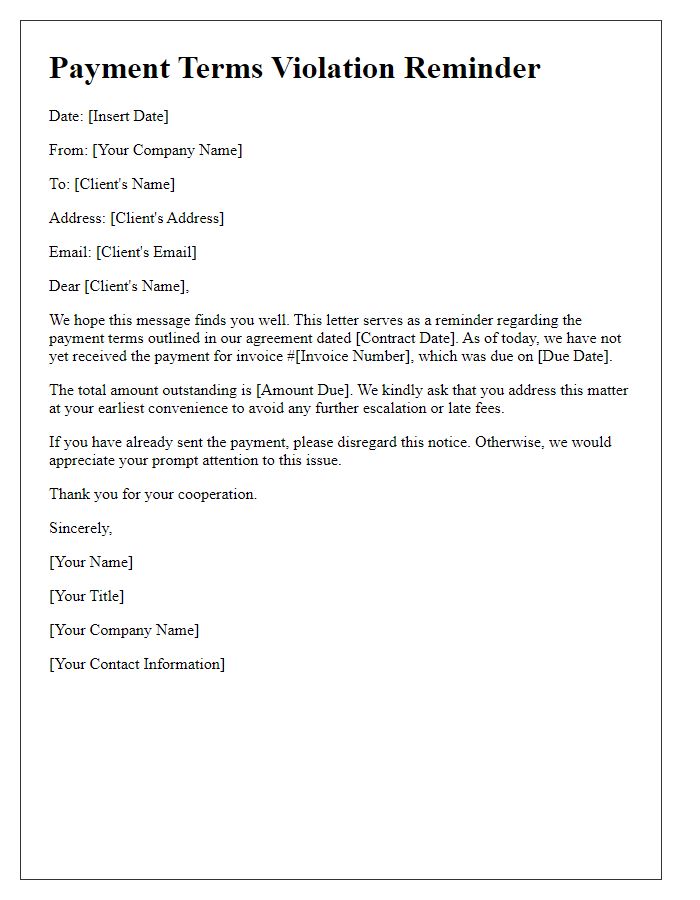

Specific Payment Details and Amount Owed

Late payment notifications can significantly impact financial management for individuals or businesses. The outstanding balance, for instance, accrued from an invoice dated September 15, 2023, stands at $1,500, with a due date of October 15, 2023. According to the terms of service agreed upon, late payments may incur additional fees (typically 5% of the outstanding amount per month) if not resolved within a specified grace period (usually 30 days). Failure to address this matter promptly could result in significant consequences, such as disruption of services or legal action, underscoring the critical need for timely payments to maintain a good standing with creditors.

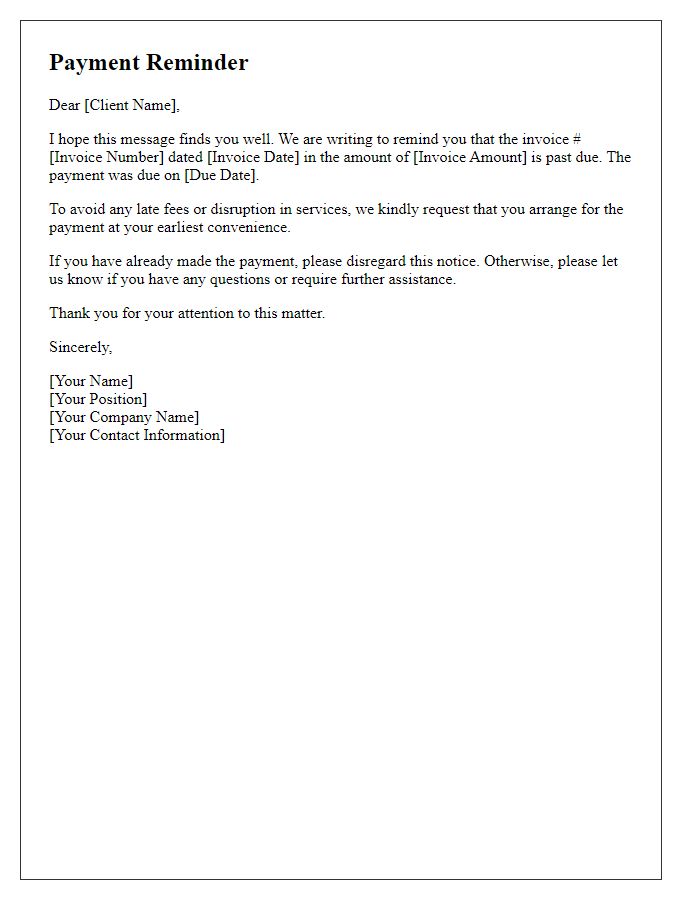

Due Date and Previous Reminders Mentioned

Missed payments can have serious consequences, especially regarding financial obligations like loans or credit cards. The due date for the payment was September 15, 2023. Prior reminders were sent on September 1, 2023, and September 8, 2023, but no payment has been received. It is essential to settle the amount due of $500 to avoid late fees and negative impacts on credit scores. Consistent failure to pay can escalate to collections or legal action, emphasizing the importance of addressing this overdue balance promptly.

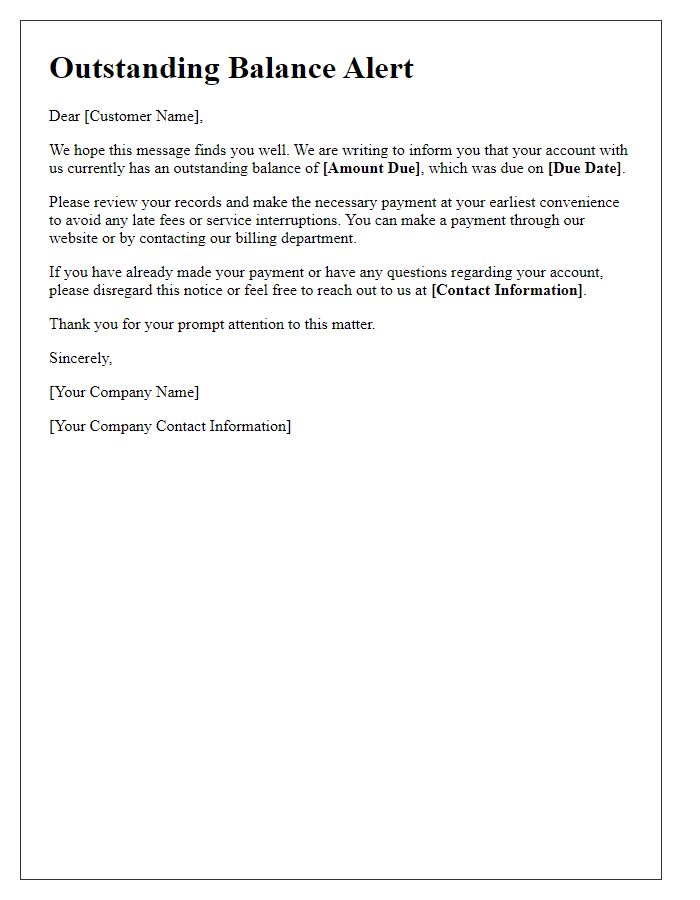

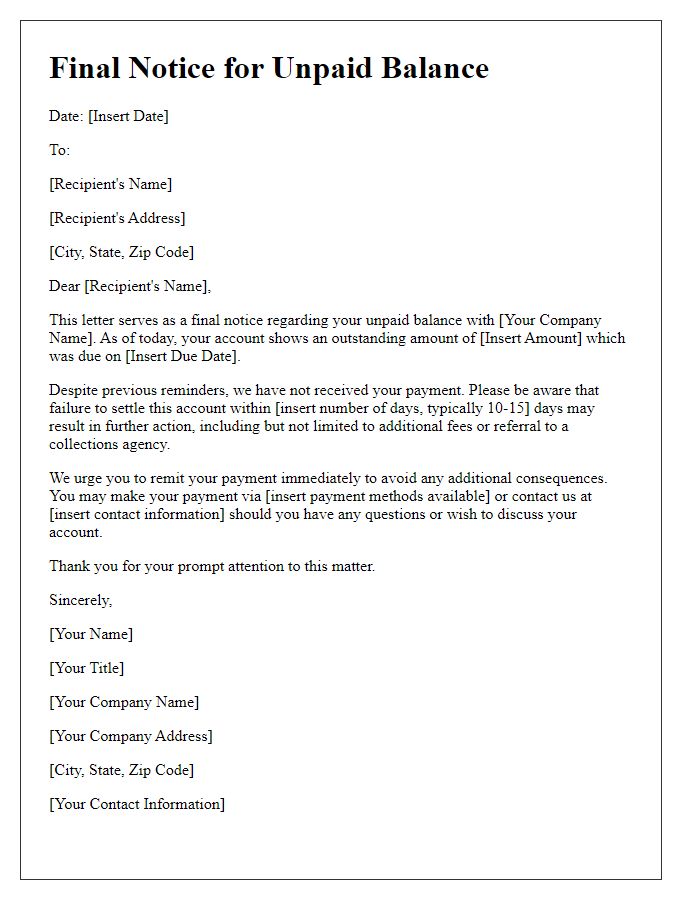

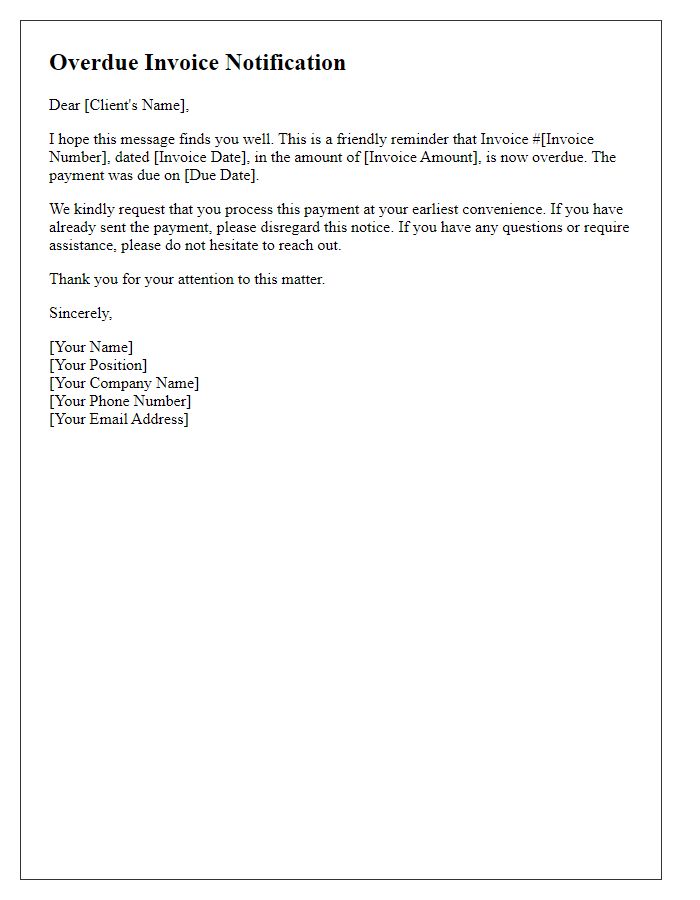

Consequences of Non-payment

Customers who fail to make timely payments on their accounts may encounter serious financial repercussions. Late fees (typically ranging from $25 to $50) can be automatically applied after a grace period, increasing the total amount owed. Additionally, a missed payment can impact credit scores, potentially reducing it by 30 to 100 points depending on the account's status and payment history. Continued non-payment may result in the account being sent to collections, leading to further legal ramifications. In extreme cases, businesses may initiate court proceedings for debt recovery, with potential judgments that could affect future online purchases and access to financial services.

Contact Information for Resolution

Missed payment situations can significantly impact financial standing and credit ratings. Timely communication is crucial to resolving these issues effectively. For example, contact the billing department of your service provider, preferably within a week of the missed payment, to discuss payment arrangements or deferment options. Keep records of any communication, noting dates and representatives' names for clarity. Payment policies vary widely among companies. Some may provide grace periods (ranging from 5 to 30 days) before incurring late fees. Others might offer a resolution through online portals or customer service hotlines, addressing concerns directly. Take proactive steps to avoid further complications such as account suspension or increased interest rates.

Comments