Hey there! We all know that sometimes life gets busy, and payments can slip through the cracks. If you've found yourself in a situation where a payment reminder is necessary, don't worry; it happens to the best of us. In this article, we'll explore a handy letter template you can use to escalate those reminders effectively and professionally. So, grab a cup of coffee and read on for tips that can make your communication smoother!

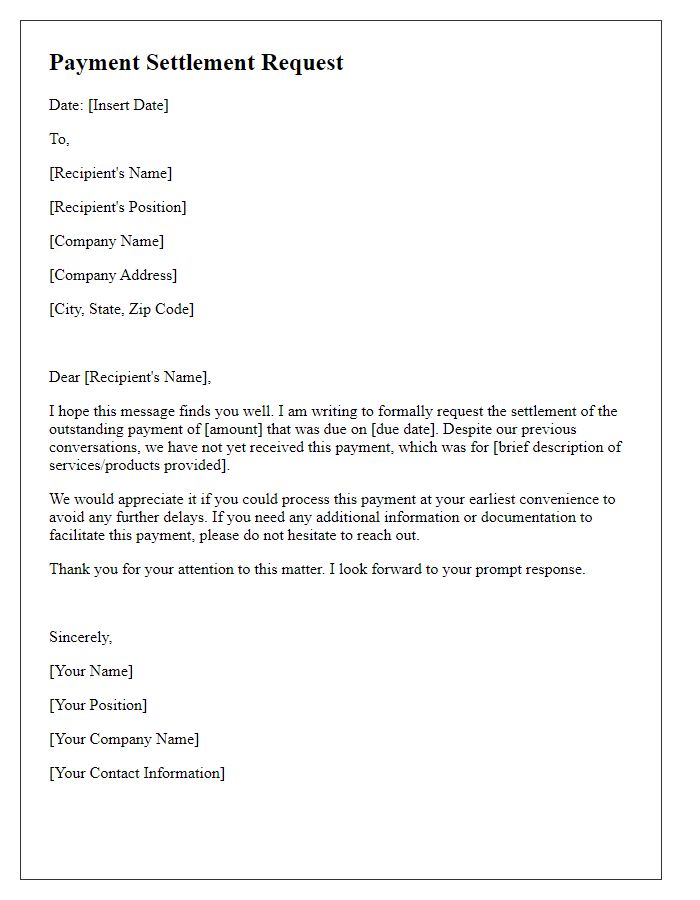

Recipient's Contact Information

A payment reminder escalation should convey urgency and clarity. Ensure all key details, such as the original payment due date, outstanding amount, and reference number, are included. Payment delays beyond thirty days can impact cash flow negatively. Specific recipients, such as accounts payable managers in large organizations, should receive this reminder promptly, often through email or registered mail, ensuring a formal communication channel. Including a payment link or clear instructions for payment methods enhances effectiveness, facilitating quicker resolution of outstanding invoices.

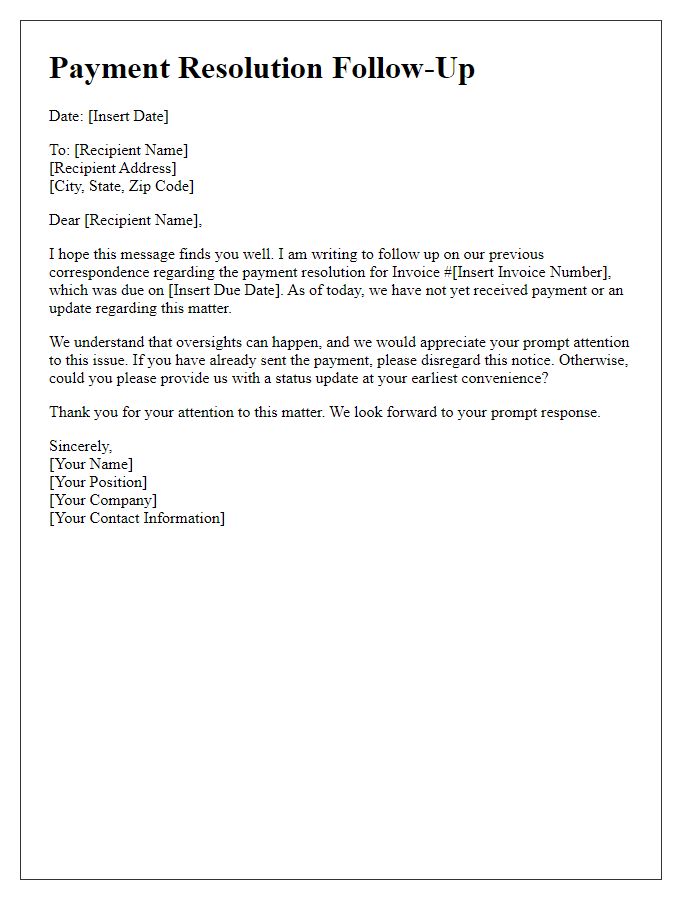

Clear Subject Line

Late payment issues can significantly impact cash flow for businesses, particularly small enterprises. A payment reminder escalation typically involves a structured approach, targeting clients who have surpassed their due dates, often 30 to 90 days past due. Effective subject lines, such as "Urgent: Immediate Action Required for Overdue Payment", enhance visibility and urgency. Communication through email should clearly outline the outstanding balance, invoice number (for example, Invoice #12345 dated February 1, 2023), and specific payment terms originally agreed upon. Maintaining a professional tone while firmly reiterating consequences, like late fees or potential service interruption, helps emphasize the seriousness of the matter.

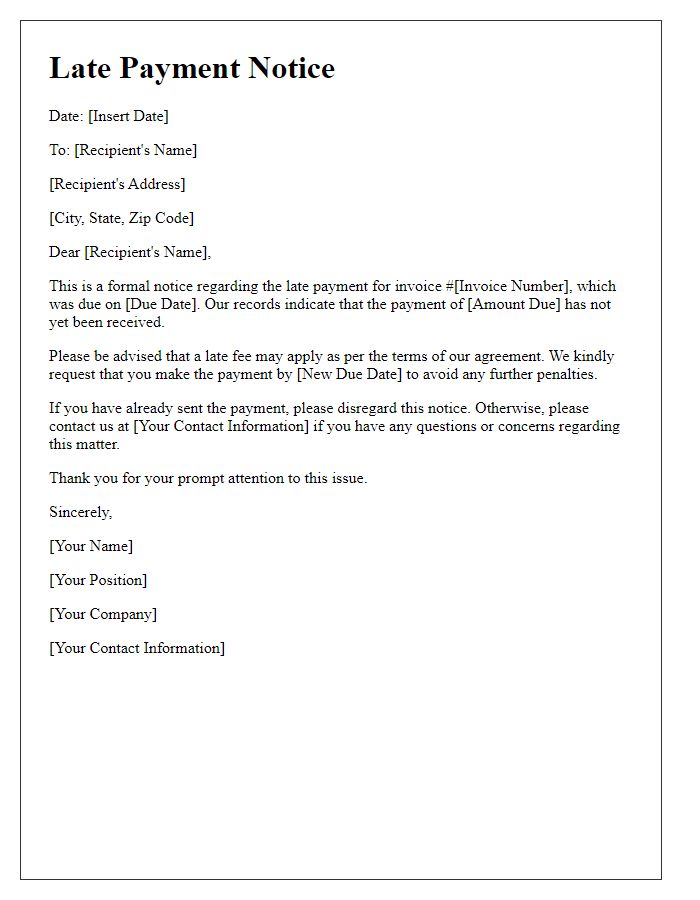

Invoice Details and Outstanding Amount

Delinquent payments can disrupt cash flow, particularly for small businesses. For instance, an overdue invoice dated January 15, 2023, totaling $5,000 could have significant implications on financial stability. The customer, XYZ Corporation located in New York, initially promised payment by February 15, 2023. As of today, March 15, 2023, this amount remains unresolved, prompting the need for a formal escalation of the payment reminder. Consistent follow-up can improve the likelihood of recovering outstanding balances while fostering communication regarding future transactions. Establishing clear payment terms upfront can mitigate risks in future dealings.

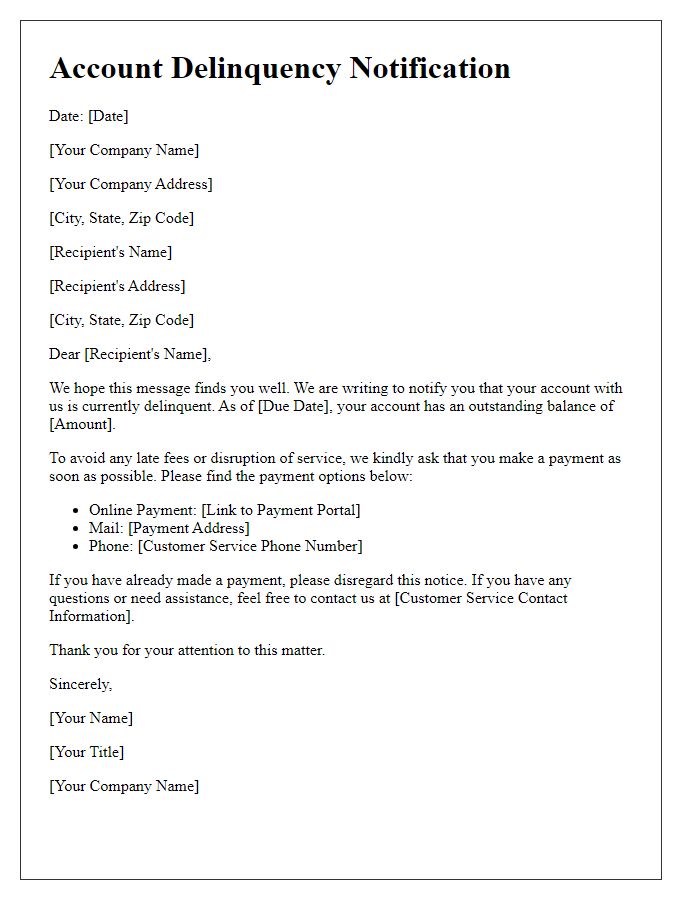

Firm, but Polite Tone

A payment reminder escalation is essential for maintaining cash flow in business operations. In scenarios where invoices remain unpaid beyond the due date, it is vital to reach out to clients for reminders. The approach should balance firmness and politeness to uphold business relationships. Key considerations include specifying the overdue amount, the initial due date, and the action required to settle the payment. Timely follow-ups can prevent further delays, ultimately ensuring financial stability for ongoing projects. Clarity in communication fosters understanding while reinforcing the importance of fulfilling financial commitments.

Call to Action and Payment Instructions

Invoicing delays can significantly impact cash flow for businesses of all sizes. Effective payment reminder escalations are critical for ensuring prompt financial transactions. A well-crafted reminder should include clear payment instructions, such as bank account details, payment methods like credit cards, and deadlines. Including a call to action is essential; phrases like "kindly process your payment by the due date" emphasize urgency. Additionally, specifying the due amount helps avoid confusion, especially if previous communications occurred, enhancing clarity for both parties involved. By addressing these elements, businesses can foster positive customer relationships while securing timely payments.

Comments