Are you facing the daunting task of drafting a debt acknowledgement request letter? You're not aloneâmany individuals and businesses find themselves needing to clarify outstanding debts in a formal manner. Writing such a letter can feel overwhelming, but it doesn't have to be! Let's dive into some key tips and get you started on the right foot; you'll want to read on for a valuable template to streamline the process.

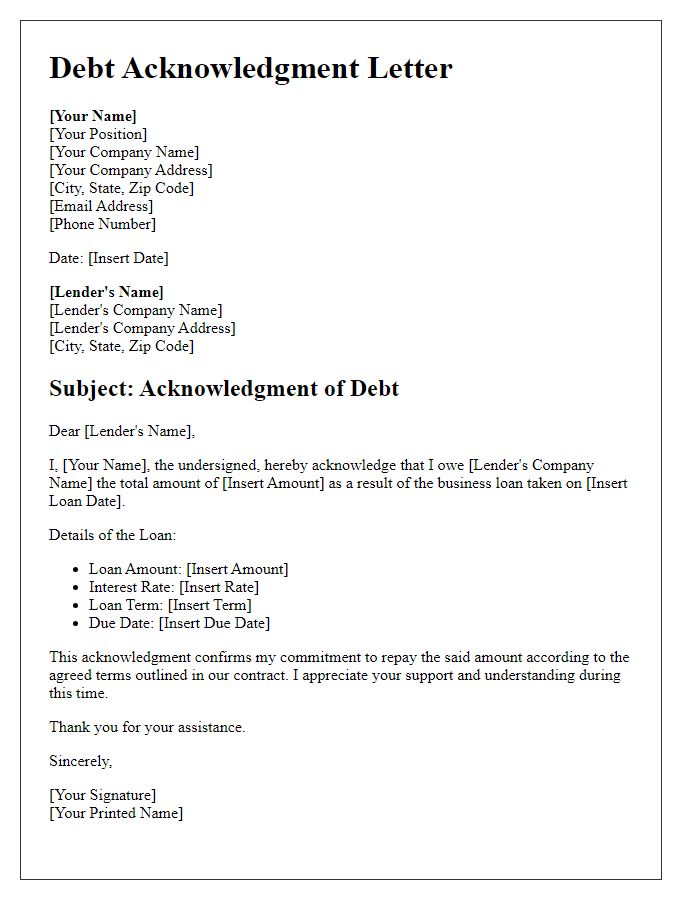

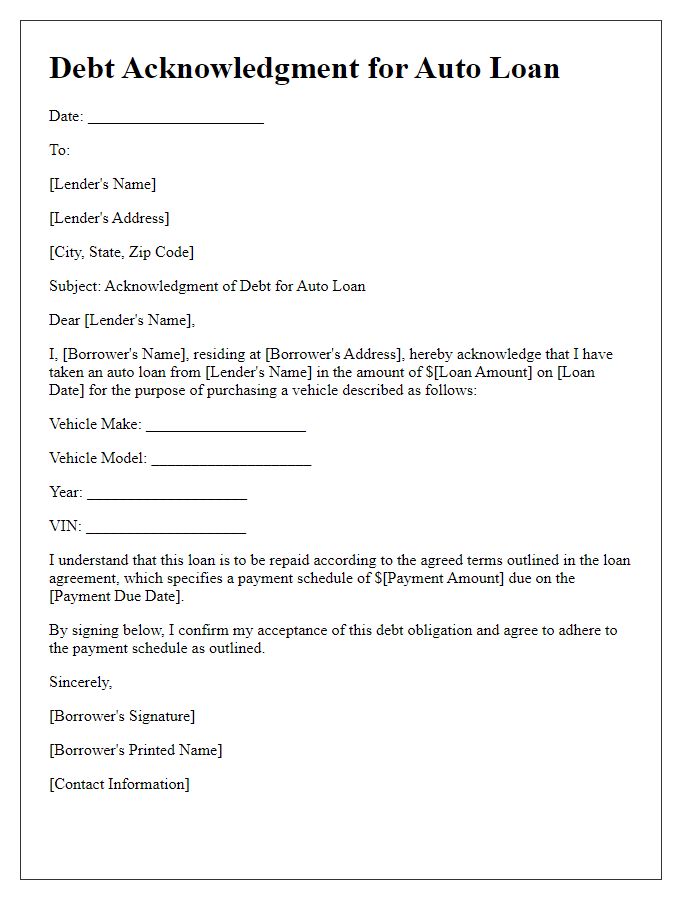

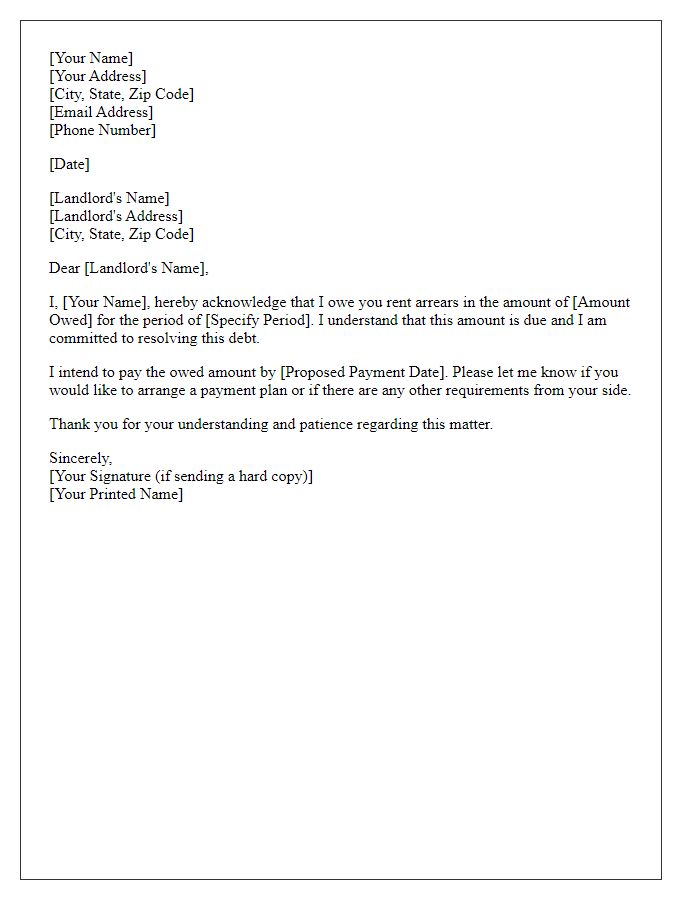

Creditor and debtor identification information

A debt acknowledgement request requires clear identification of both the creditor and debtor to ensure proper communication and record-keeping. The **creditor**, typically a financial institution or an individual owed money, should be referenced by their full name and address, such as **ABC Lending Company, 123 Finance Ave, Suite 500, Loan City, CA 90210**. The **debtor**, the individual or business responsible for repayment, must also be specified with their full name and contact information, for example, **John Doe, 456 Borrower Blvd, Apartment 12, Debt Town, TX 75001**. Including the **account number** or **loan reference ID**, such as **Account #89765432**, associated with the debt facilitates easier tracking and processing of the request. Additionally, the specific amount owed, such as **$5,000**, and the due date, in this case, **June 30, 2023**, should be noted to provide clarity and urgency in the communication.

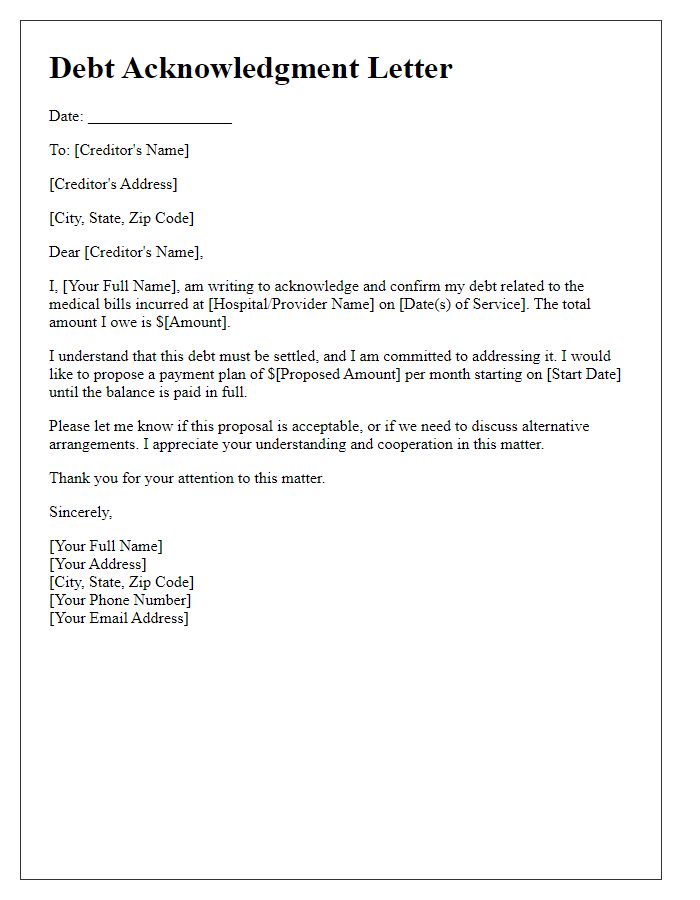

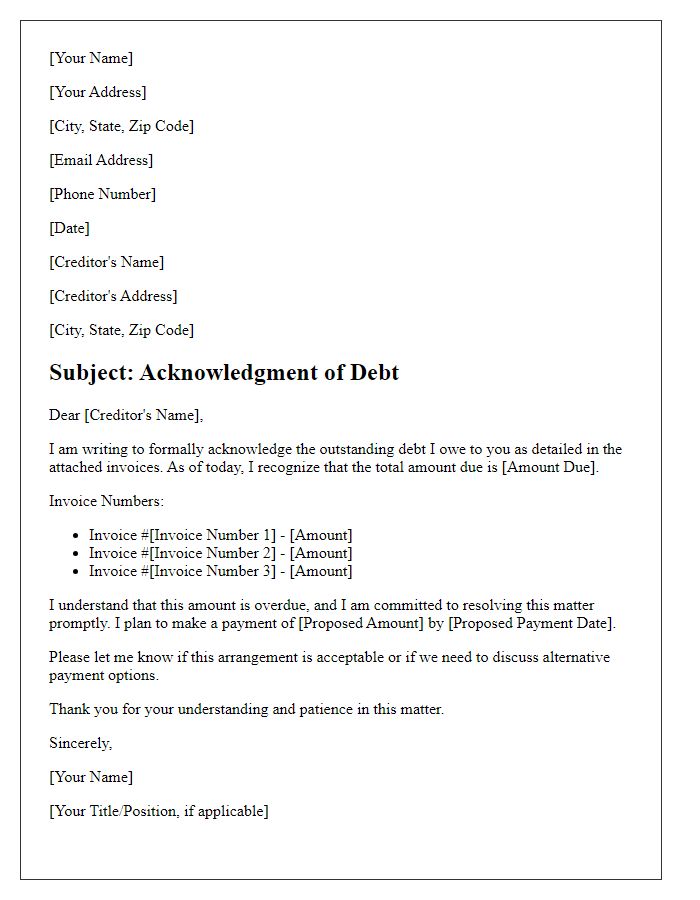

Detailed description of the debt

A debt acknowledgment request is a formal document detailing the outstanding amount owed, specified due dates, and any relevant agreements between the parties involved. The total debt may include principal amounts, accrued interest, and additional fees, reaching figures such as $5,000 in unpaid invoices from a service provider. The due dates may span from late 2022 to mid-2023, affecting multiple business transactions, including invoices numbered 101 through 110. Any previous communication regarding the debt, such as reminder emails sent on February 15, 2023, and March 1, 2023, should be noted to provide context for the request. Legal implications may arise if the debt remains unresolved, affecting credit reports with potential impacts on financing options in the future. Clear identification of the parties involved, including the debtor's business name and any relevant account numbers, ensures accuracy and clarity in the acknowledgment process.

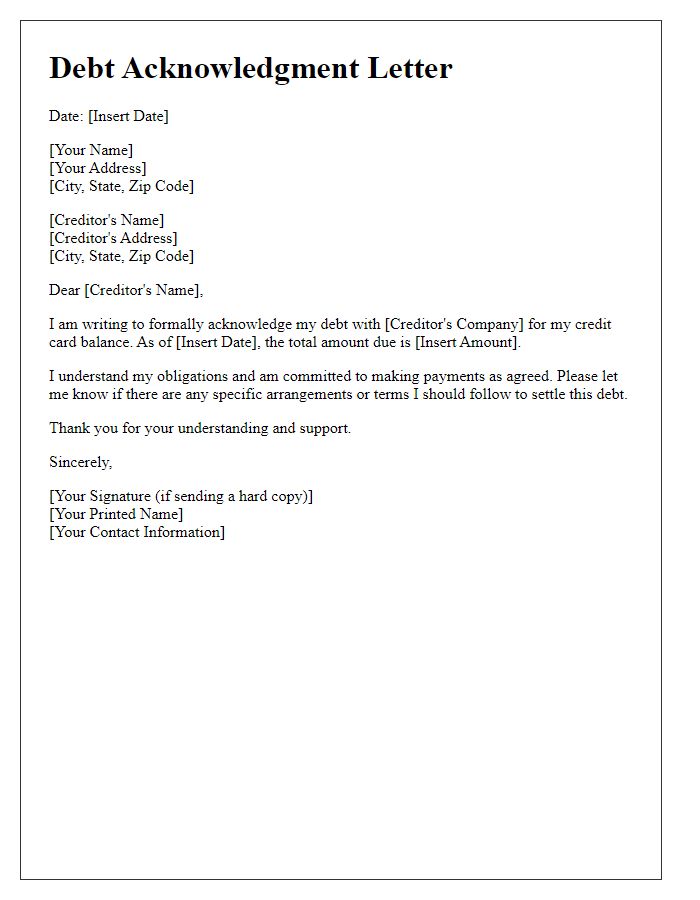

Acknowledgement statement

Acknowledging debt transparency is crucial for financial clarity. A structured debt acknowledgment request often includes specific details. The statement should reference the outstanding amount, such as $5,000, due by a defined date, for example, January 15, 2024. It is important to mention the source, such as a loan agreement from ABC Lending Company located in New York City. Including terms like payment plan or interest rate, which might be 5% annually, enhances understanding of repayment expectations. Additionally, specifying the contact information for inquiries and additional terms can aid in maintaining open communication between parties involved.

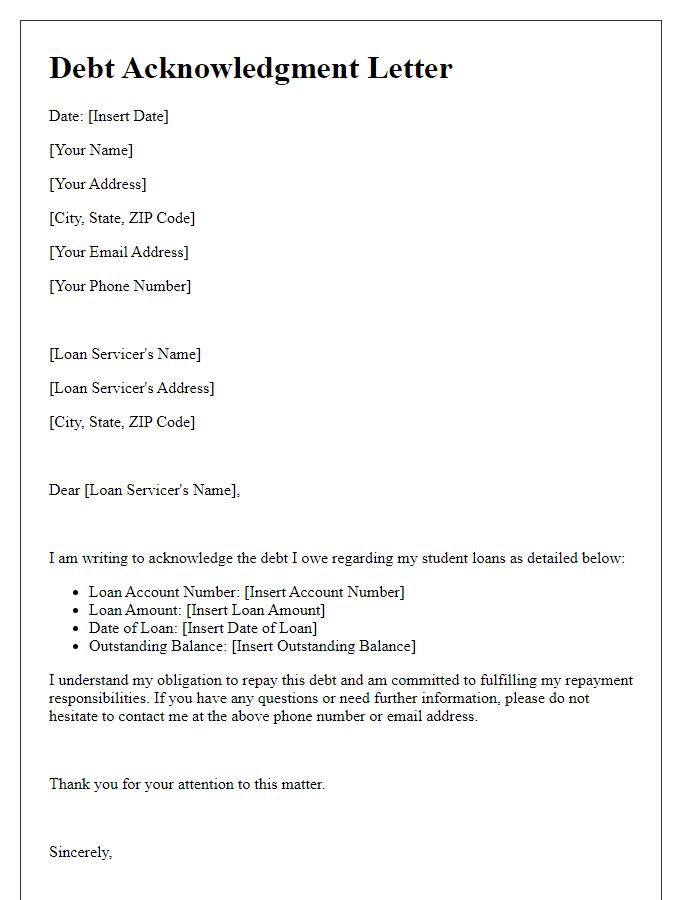

Repayment terms and conditions

The debt acknowledgment request must clearly outline the repayment terms and conditions to ensure mutual understanding between the creditor and debtor. Essential details include the principal amount owed, interest rate (often a specific percentage aligned with municipal regulations), repayment schedule (monthly or quarterly installments), and due dates for each payment. It is crucial to specify any applicable fees for late payments (typically ranging from 5% to 10% of the missed payment). Additionally, the document should detail the consequences of non-payment, including legal action or additional interest accumulation. This formal request serves as a legal record, reinforcing the obligations of both parties as they navigate the repayment process.

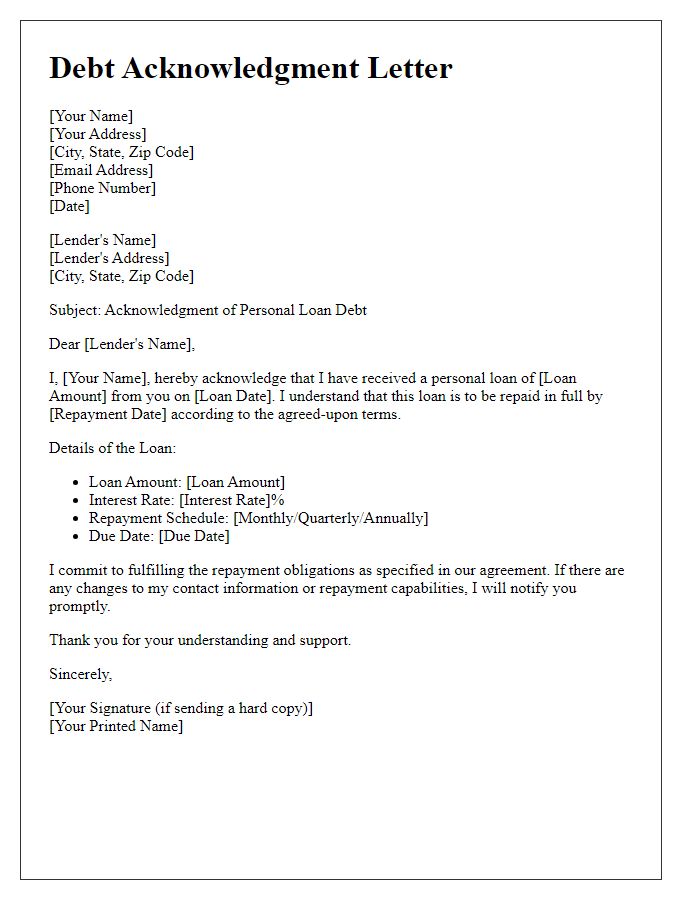

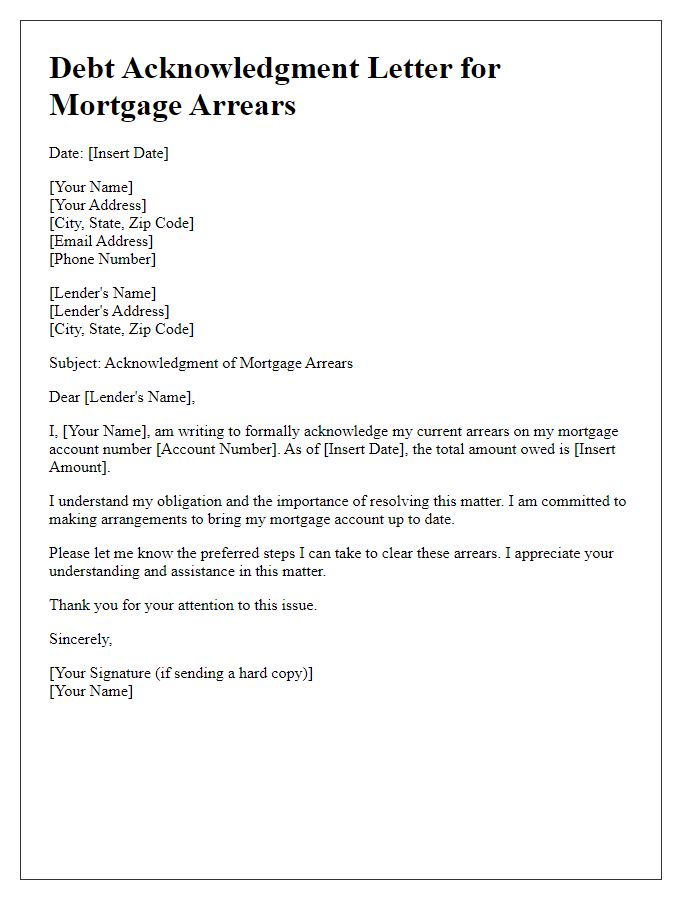

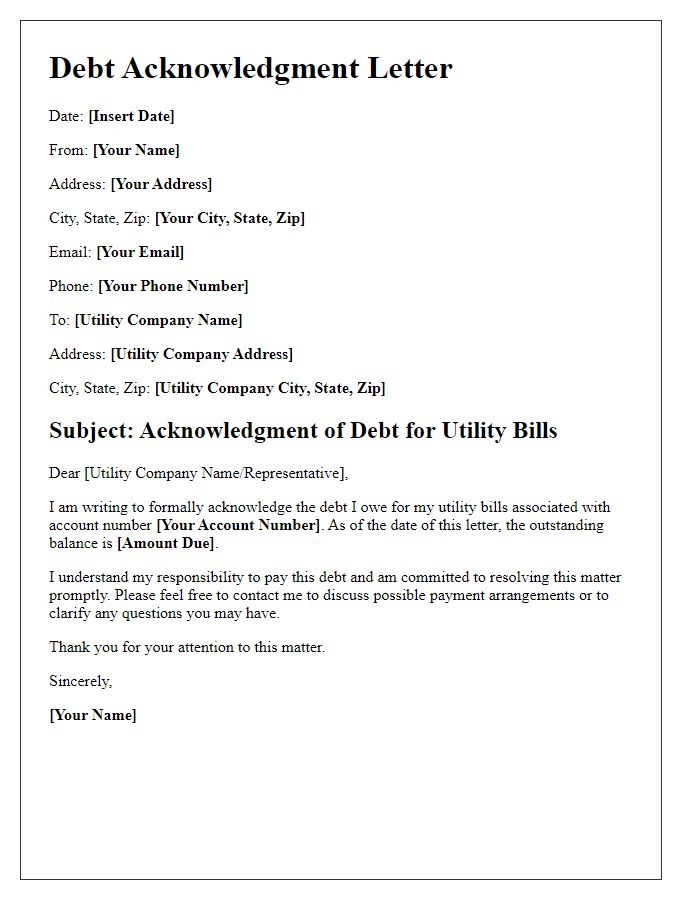

Contact information and signature section

A debt acknowledgment request serves as an official communication regarding outstanding balances. The header should include the sender's contact information, such as name, address, email, and phone number, followed by the date of correspondence. Recipients may be identified as the debtor's name, address, and any relevant account numbers for clarity. The main body should reference the specific debt amount, due date, and any terms of repayment previously agreed upon. Finally, a signature section requires the sender's handwritten name, printed name, and title, if applicable, along with a designated area for the recipient's acknowledgment signature, ensuring both parties maintain a record of the correspondence.

Comments