Are you looking to settle your debts and move forward financially? Crafting a well-structured letter to request your pay-off amount is a crucial step towards achieving that goal. This process can feel overwhelming, but with the right template, you can communicate clearly and effectively with your creditors. Dive into our article to explore a useful letter template that will help you take control of your finances and pave the way for a fresh start!

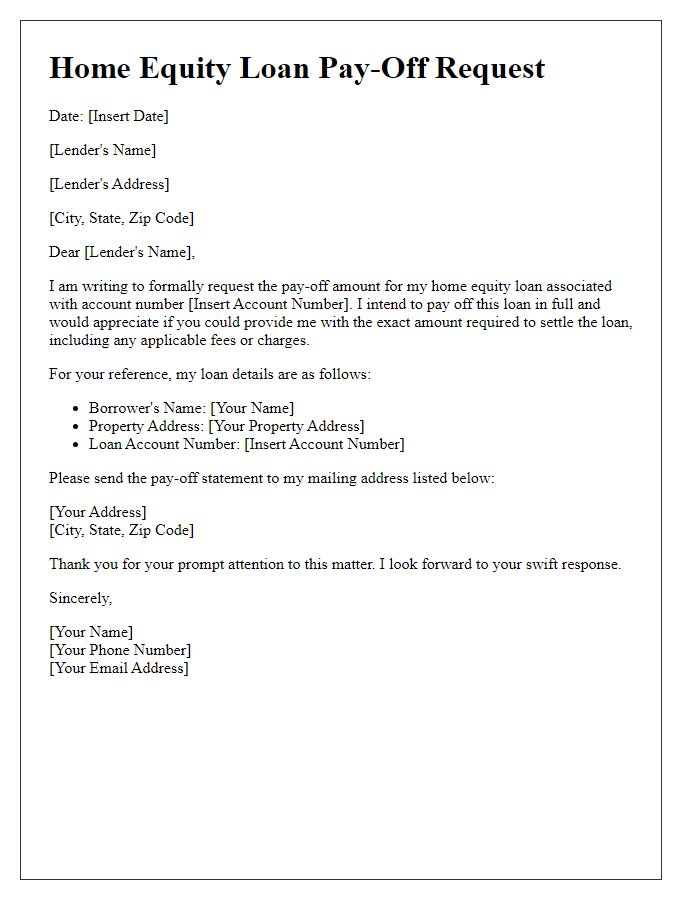

Borrower and Loan Information

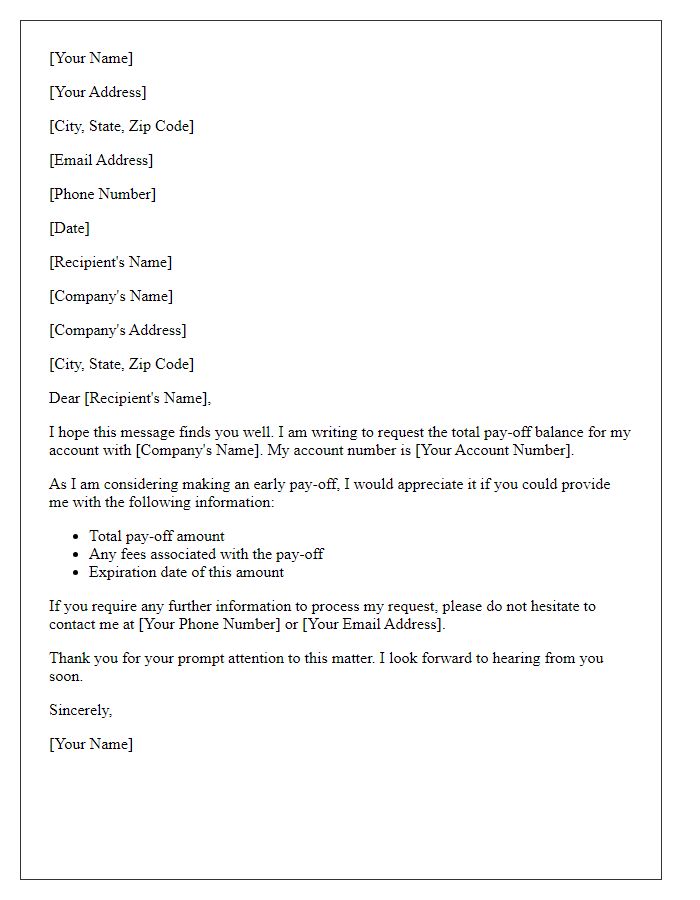

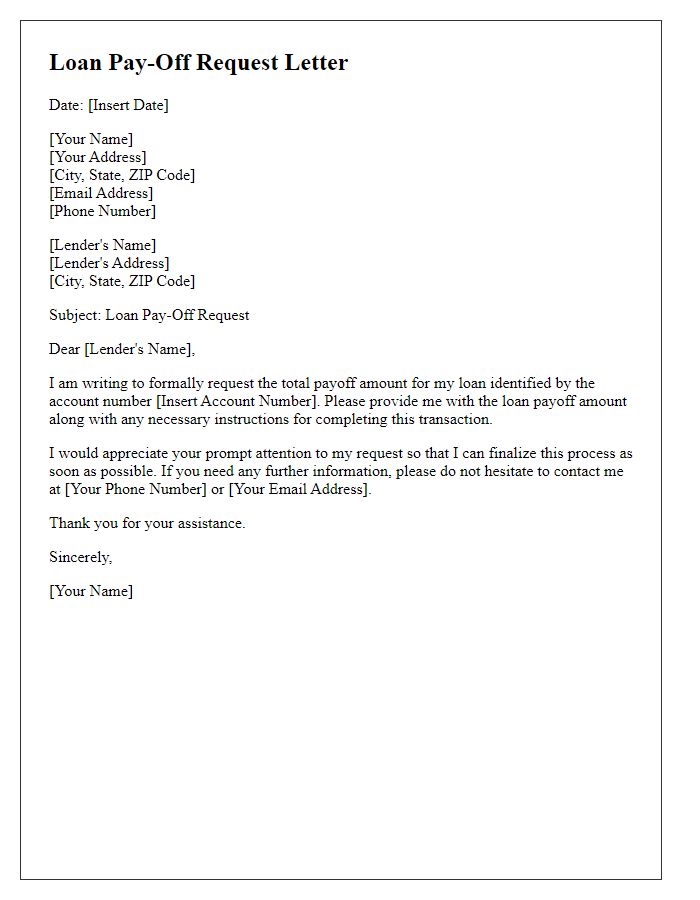

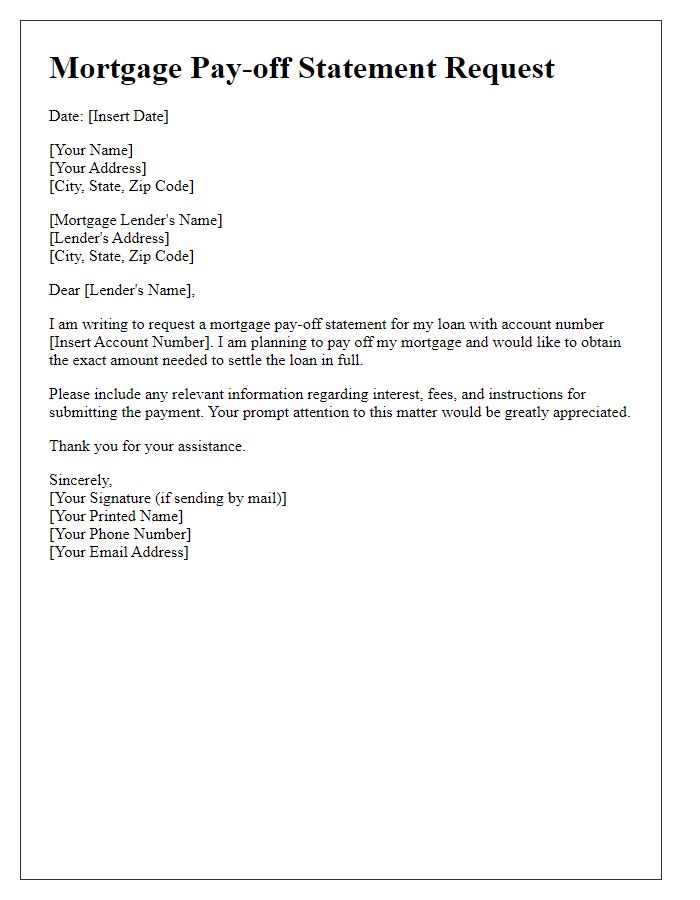

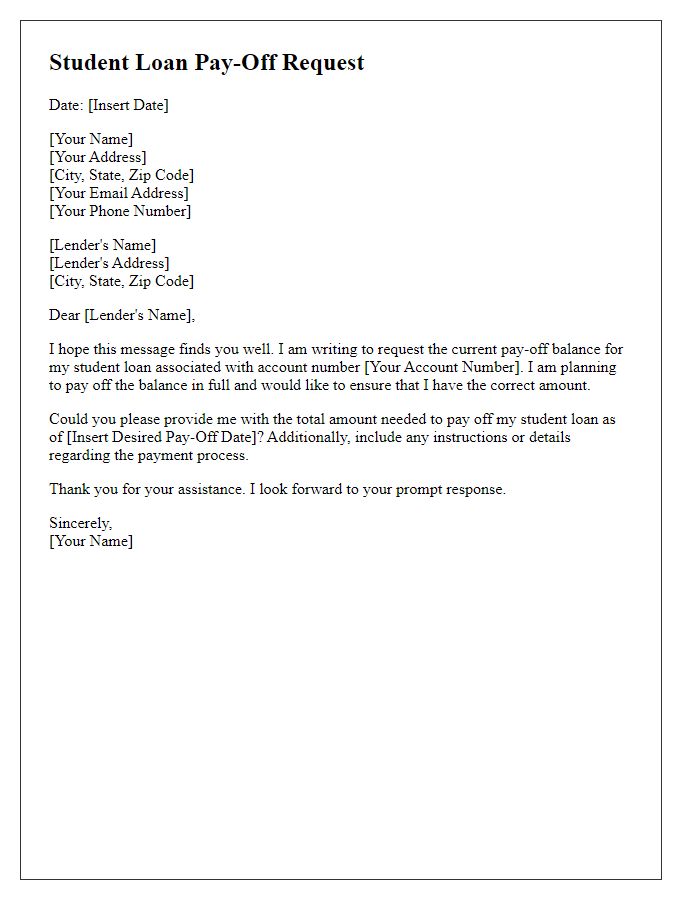

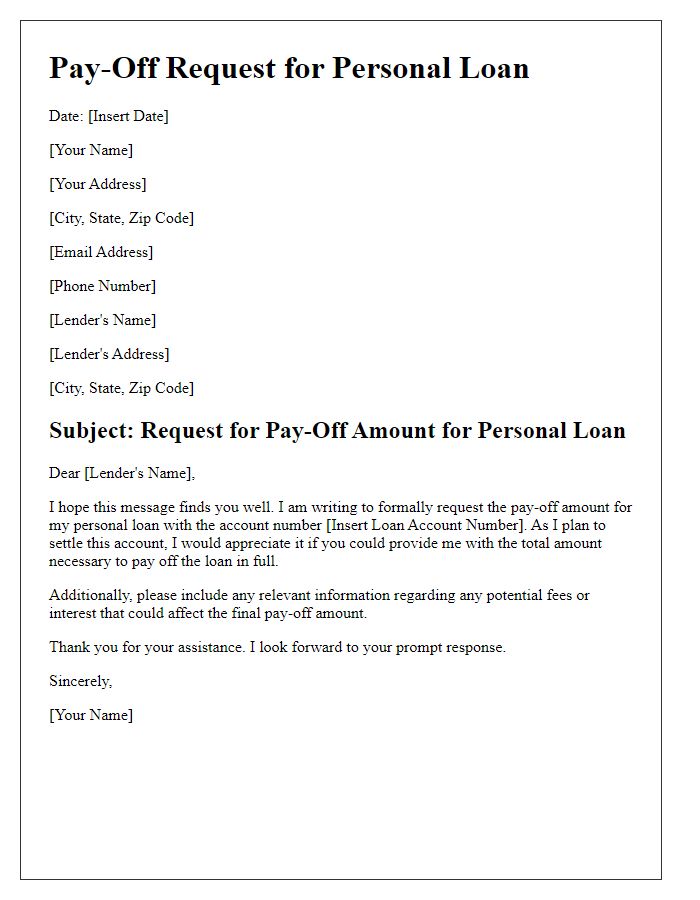

The pay-off amount request is critical for borrowers navigating their financial obligations associated with a loan, typically involving significant sums, often in the range of thousands to hundreds of thousands of dollars. The borrower, identified by their unique account number (which may be a 10 to 20 digit code), must provide essential loan details, including the loan number, type (such as mortgage, personal, or auto loan), and the original loan amount, which can vary from $5,000 to over $500,000, depending on the nature of the loan. It is also important to include the current outstanding balance, often reflected in monthly statements issued by the lending institution. Moreover, specifying the request date is crucial, as it influences the accuracy of the pay-off amount, which can change due to accrued interest or fees, typically calculated daily at a fixed interest rate. Ensuring this information is accurate helps facilitate a smoother transaction and clear communication with the lender.

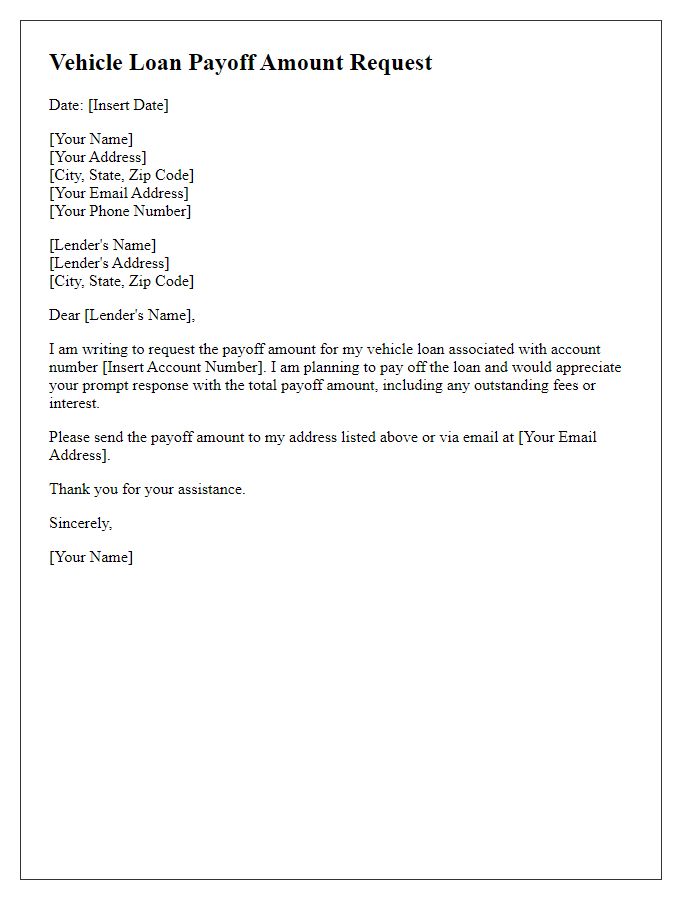

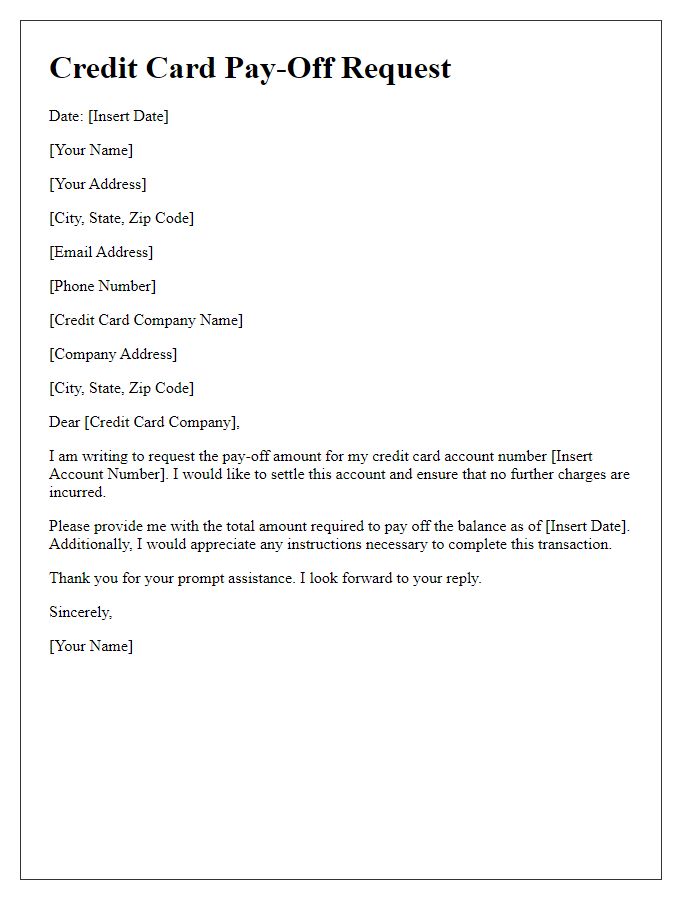

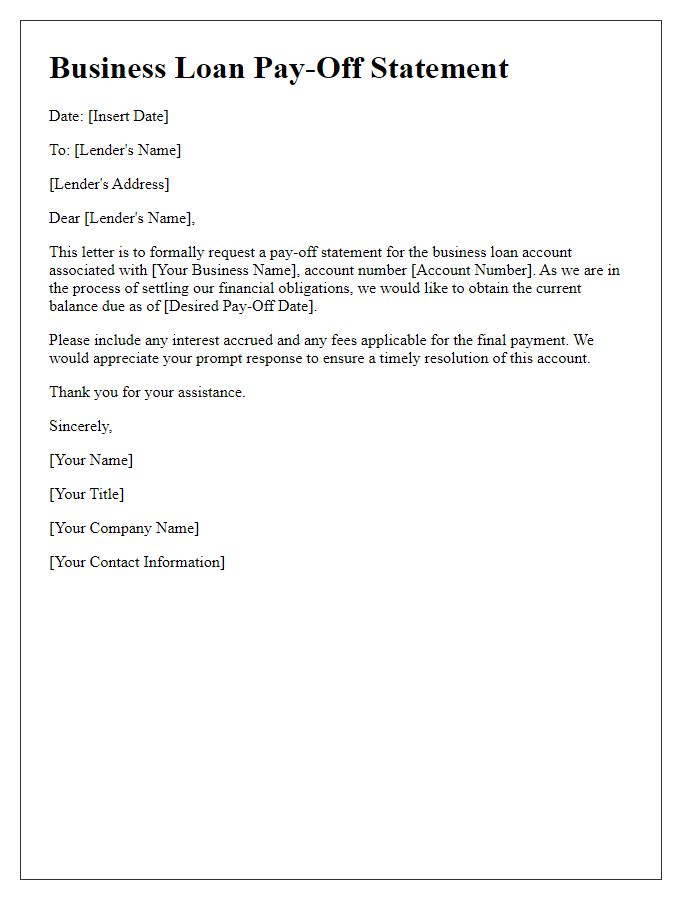

Pay-off Amount Request Statement

A pay-off amount request statement is a formal document indicating the total sum required to settle a loan or mortgage obligation before the scheduled maturity date. This statement often includes the loan account number, the outstanding principal amount, accrued interest, and any additional fees associated with early repayment. Lenders typically provide this request upon receipt of a written inquiry, detailing pertinent information such as interest rates and remaining term length. Timely acquisition of a pay-off amount is crucial for borrowers, especially when refinancing or selling property, ensuring accurate financial planning and obligation resolution.

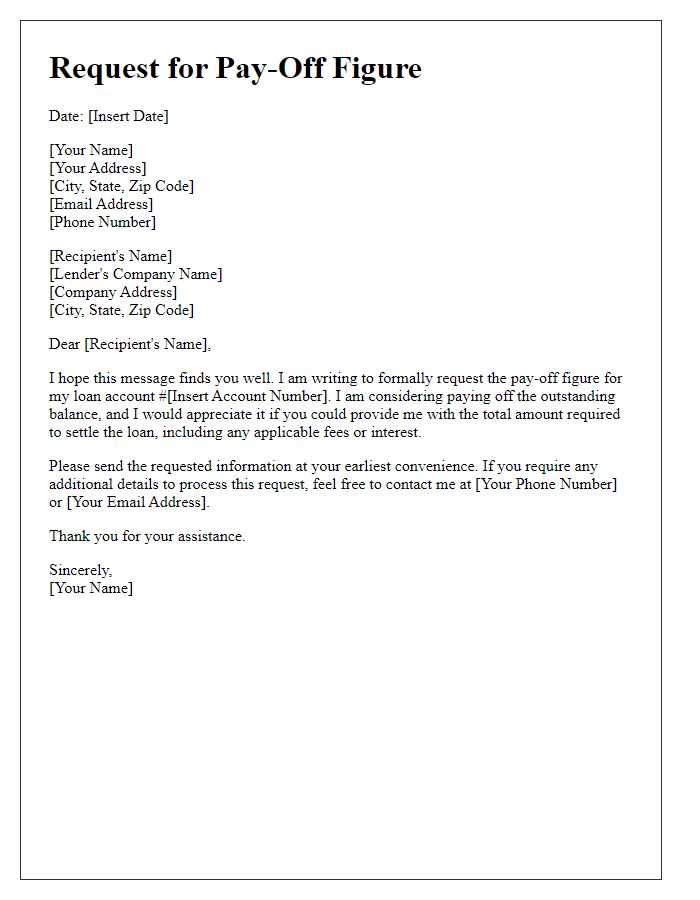

Contact Information for Response

In the context of mortgage accounts, a pay-off amount request is a crucial step in understanding the remaining balance on a loan, often related to real estate transactions. When contacting the loan servicer, it is essential to provide accurate contact information to facilitate a swift response. Important details include the full name of the borrower, the loan number associated with the mortgage, and a preferred method of contact such as a phone number (including area code) or an email address for expedient communication. Additionally, specifying the time frame for which the pay-off amount is needed, typically valid for a short period due to accruing interest, can expedite processing. Keeping a record of this information ensures clarity in correspondence and assists in achieving timely resolution of the pay-off request.

Deadline or Timeframe for Pay-off Quote

When requesting a pay-off amount, it's essential to specify a clear deadline to ensure timely processing and remove uncertainty. Include details such as the exact date (e.g., October 31, 2023) by which the quote is needed, and specify if any particular circumstances, such as a loan discharge or property transfer, contribute to this urgency. The context matters, especially for loans managed by institutions, like mortgage lenders or banks, where processing times may vary. Highlight the importance of obtaining this pay-off amount to prevent unnecessary fees or complications, ensuring you have precise figures for financial planning or legal proceedings.

Acknowledgment of Terms or Conditions

Acknowledgment of terms or conditions is crucial when requesting a pay-off amount for debts, such as personal loans or mortgages. Lenders often outline specific requirements regarding the total sum due, interest rates, and payment deadlines. It's essential to reference account numbers, loan details, and applicable fees associated with early repayment, which may vary based on the financial institution's policies. Timely communication with the lender ensures both parties understand the outstanding balance and prevents misunderstandings. Providing all necessary documentation, such as identification and payment methods, will facilitate the process, ensuring compliance with the lender's conditions.

Comments