Hey there! If you're looking to create a letter confirming a payment arrangement, you're in the right place. Crafting a clear and professional confirmation not only helps ensure everyone is on the same page but also builds trust and accountability. Ready to dive into some helpful tips and a handy template? Let's explore more to get you started!

Contact Information

In financial transactions, a payment arrangement serves as a mutual agreement designed to outline the terms under which one party will repay a debt to another. It is critical to specify recipient details, such as name and address, alongside the payer's identification to ensure accurate communication. Payment methods may include direct bank transfers, checks, or other financial services, with specific amounts and due dates detailed in the agreement. Additionally, terms of any potential late fees or interest rates should be clearly stipulated, ensuring both parties have a mutual understanding of obligations. This formal document may also require signatures from both parties to validate the arrangement legally. Clear and organized contact information is essential for future correspondence regarding the status of payments or modifications to the agreement.

Payment Details

Confirmation of payment arrangements involves clear communication of established financial terms. Details should include the total amount due, specific payment timelines, and accepted payment methods, such as bank transfers or credit cards. Emphasize any applicable late fees, with a percentage of the outstanding amount (typically around 1.5% per month). Recipients should be informed of the exact due date, for instance, the 15th of each month. To enhance clarity, outline the consequences of missed payments, possibly including service interruptions or additional charges. Maintain transparency to ensure both parties have a mutual understanding of the arrangement.

Agreement Terms

A payment arrangement confirmation serves to clarify agreed-upon terms between parties. This document outlines the total amount due, which may include principal, interest, and any applicable fees. Payment frequency may be weekly, biweekly, or monthly, ideally specifying exact due dates. Parties should also identify acceptable payment methods, including bank transfers, checks, or digital wallets. Additionally, consequences of missed payments should be detailed, such as additional charges or potential legal actions, underscoring the importance of adhering to the arrangement. Finally, both parties should sign and date the confirmation to ensure mutual acknowledgment of the terms laid out.

Date and Timeline

On October 1, 2023, a payment arrangement was established between the debtor, John Doe, and the creditor, XYZ Financial Services. The first payment of $250 is scheduled for October 10, 2023, followed by subsequent monthly payments of the same amount due on the 10th of each month. The arrangement stipulates that all payments must be completed by March 10, 2024, ensuring a total repayment of $1,500 within this six-month period. Clear communication channels have been established to address any potential issues regarding these payments, facilitating prompt responses to queries related to the arrangement.

Signature and Authorization

This document serves as a confirmation of the payment arrangement established between the client and the service provider. The agreement specifies the payment schedule, amounts due, and the method of payment, ensuring clarity and mutual understanding. The authorized signatures from both parties indicate acceptance of the terms outlined. This arrangement, effective from [Start Date] and set to conclude on [End Date], requires adherence to the stipulated timelines to maintain the account in good standing. Any deviations must be communicated in writing at least 5 business days prior to the due date. Documentation may include invoices, receipts, and correspondence related to payment discussions, providing a comprehensive record for both parties.

Letter Template For Confirmation Of Payment Arrangement Samples

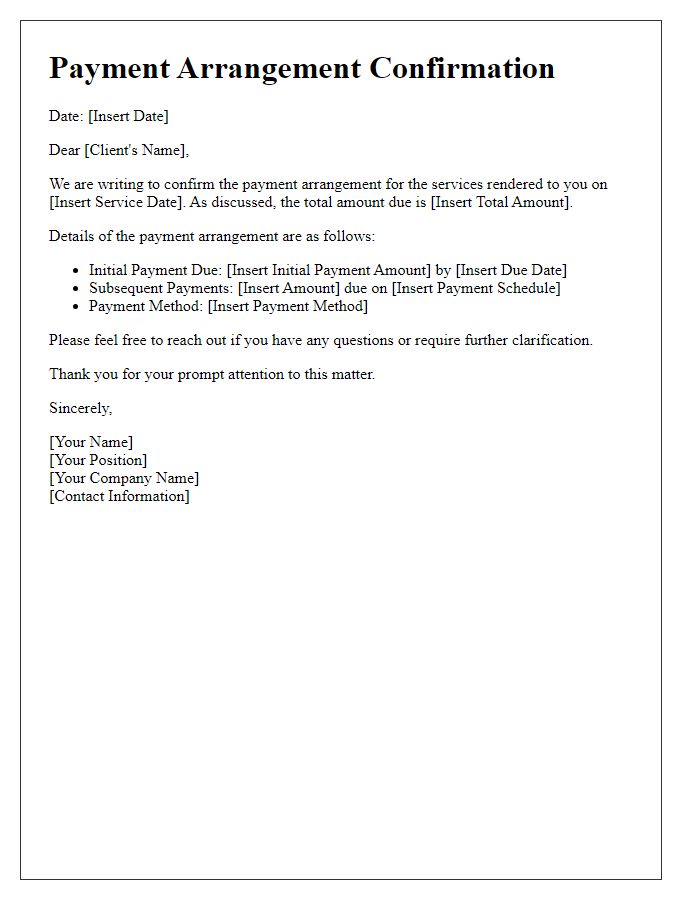

Letter template of payment arrangement confirmation for services rendered

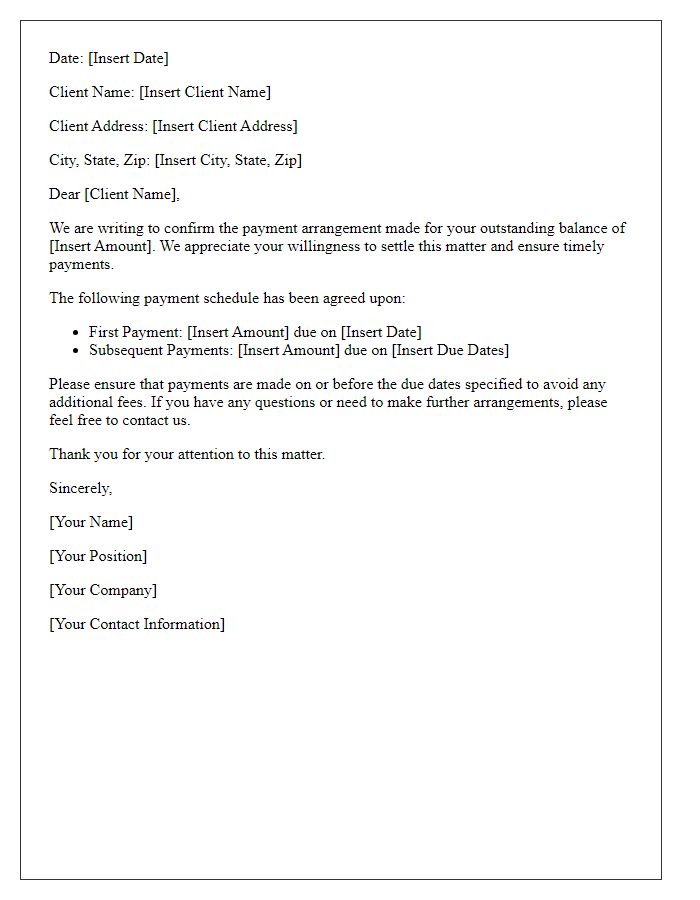

Letter template of payment arrangement confirmation for outstanding balance

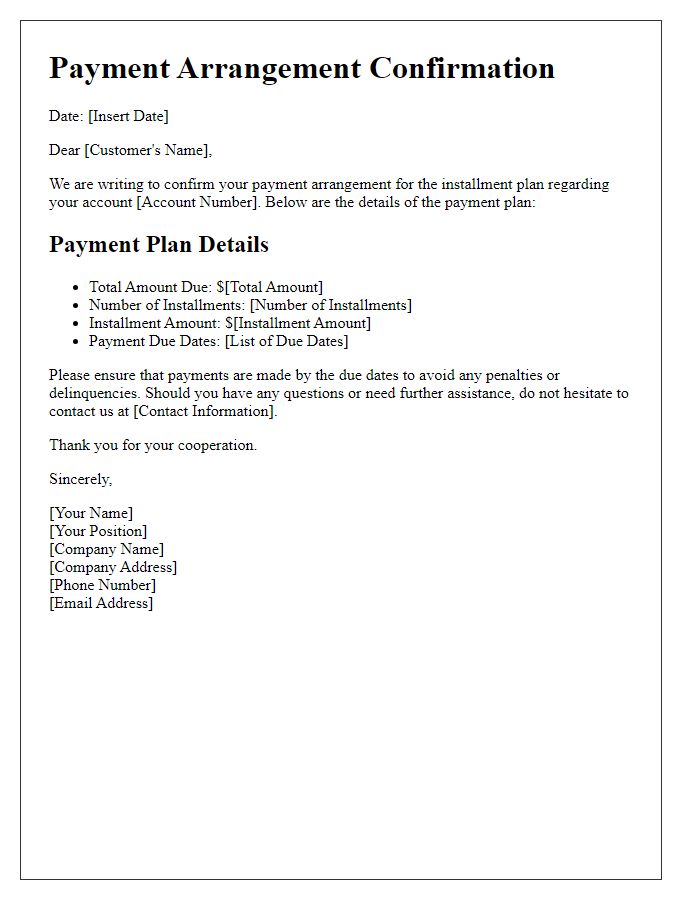

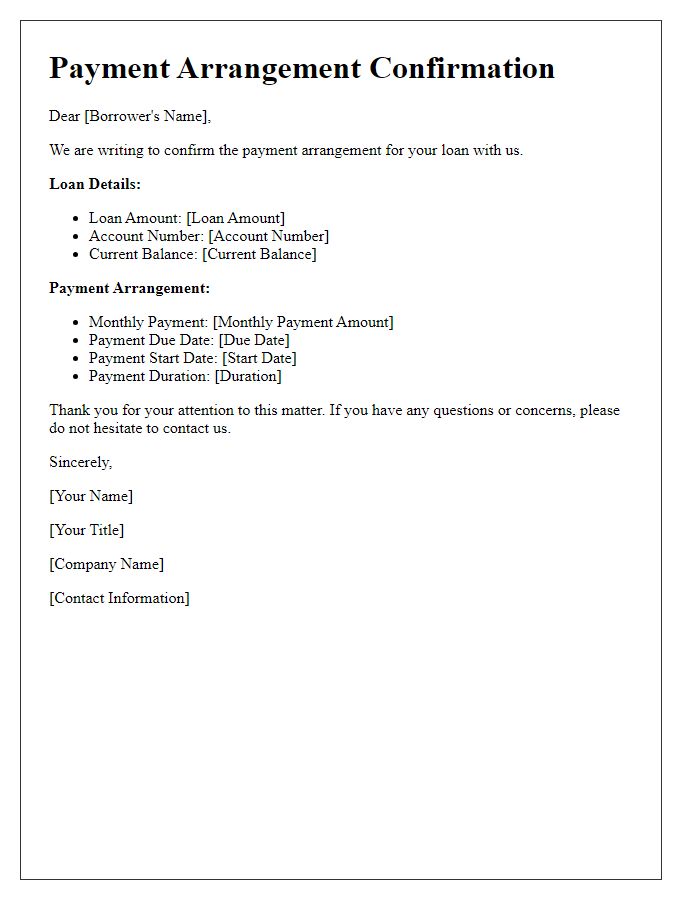

Letter template of payment arrangement confirmation for installment plan

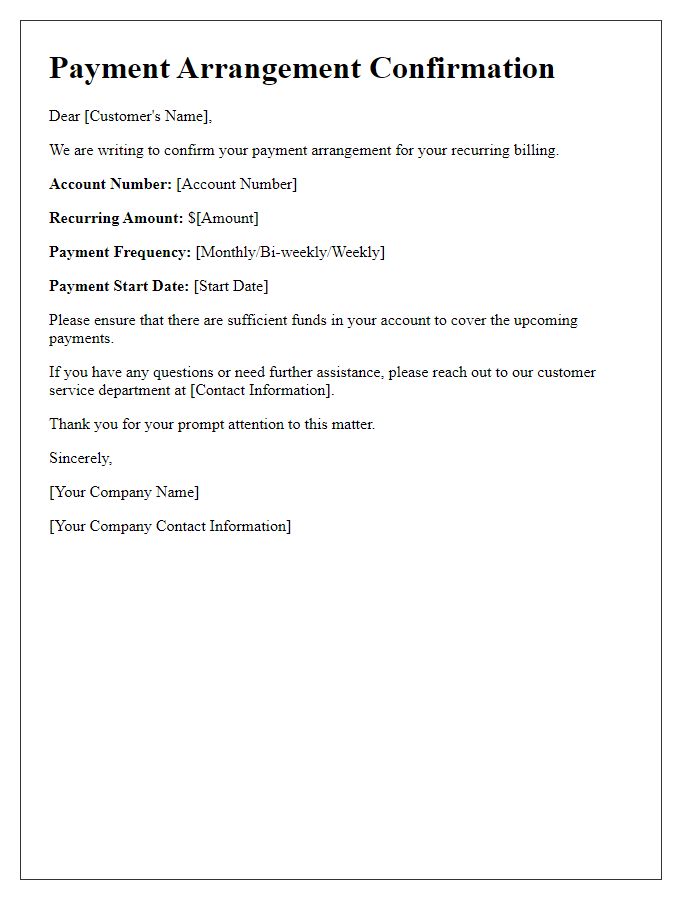

Letter template of payment arrangement confirmation for recurring billing

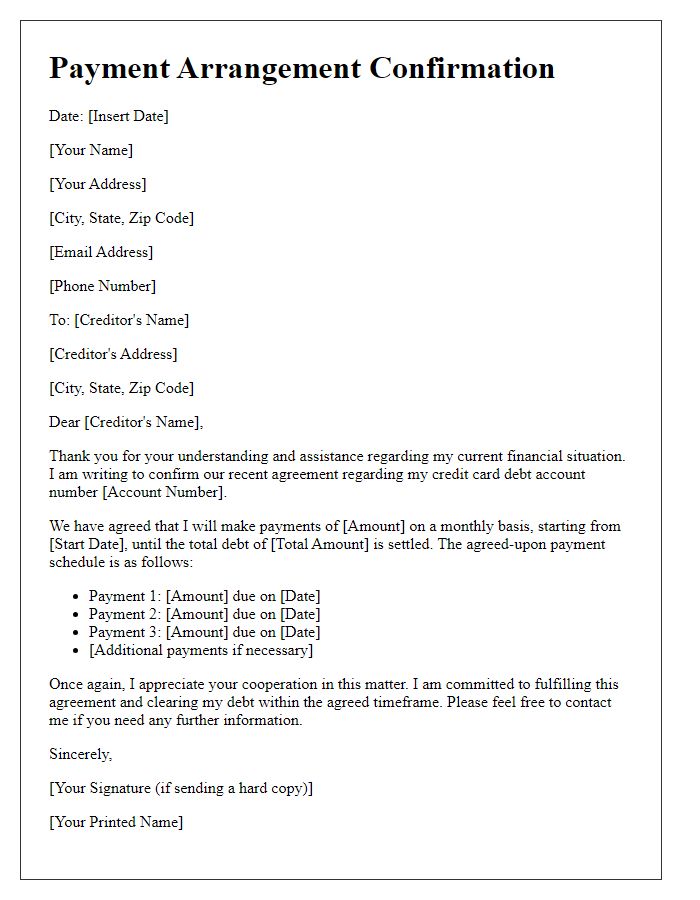

Letter template of payment arrangement confirmation for credit card debt

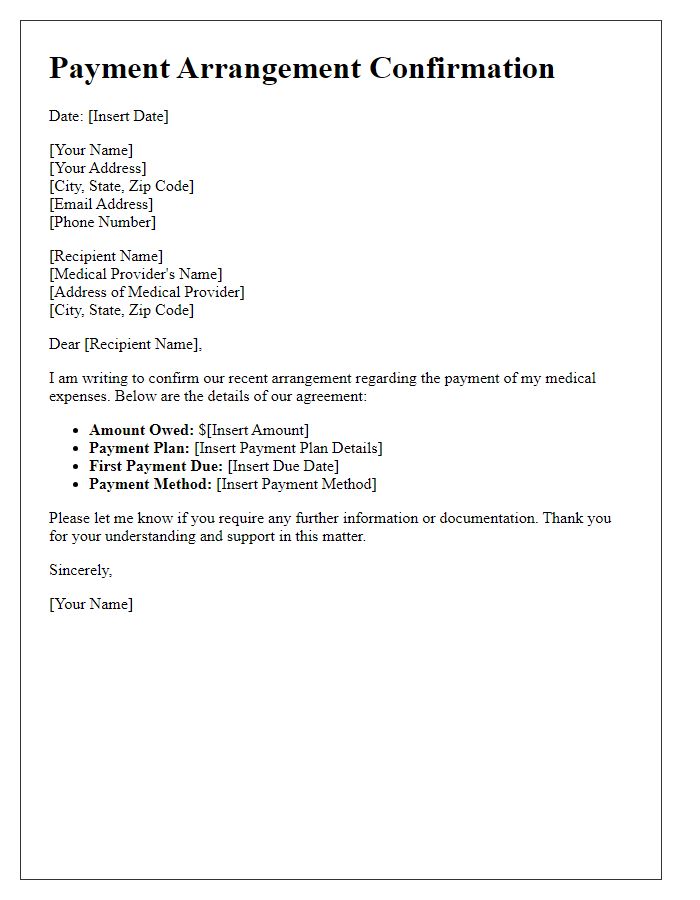

Letter template of payment arrangement confirmation for medical expenses

Comments