Are you curious about your loan balance and how it affects your financial future? Understanding the details of your loan can help you make more informed decisions about managing your finances. With a clear picture of what you owe, you'll be better equipped to plan for payments or even refinance options. Let's dive deeper into the steps to effectively inquire about your loan balance and get the information you need!

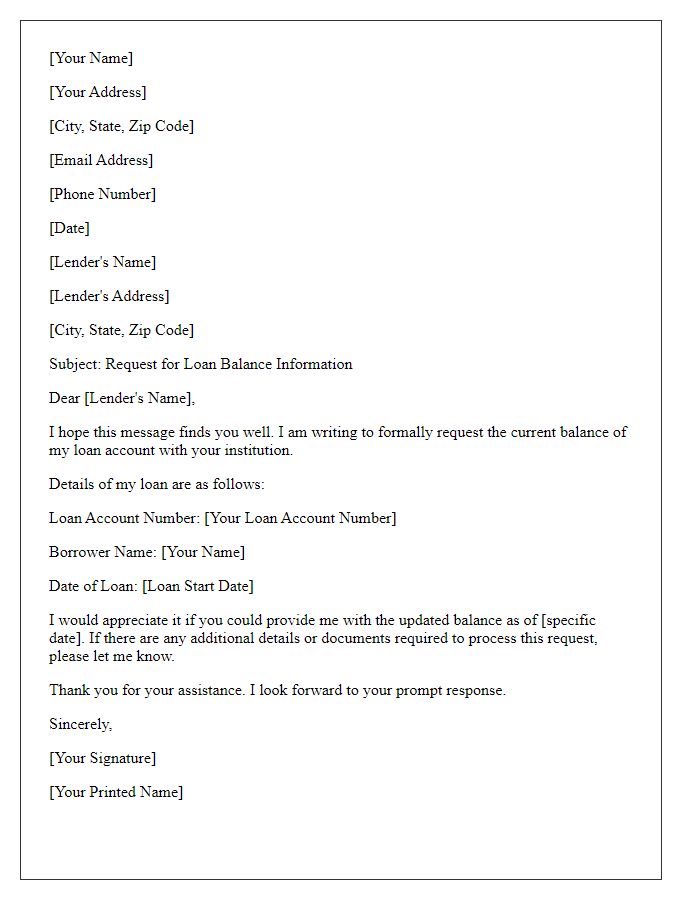

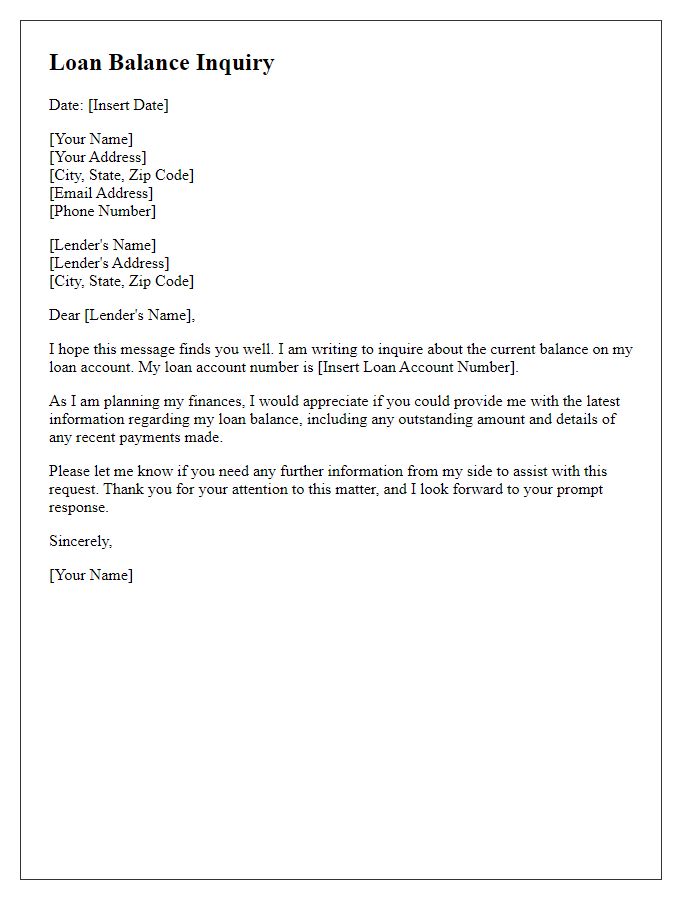

Loan Account Number

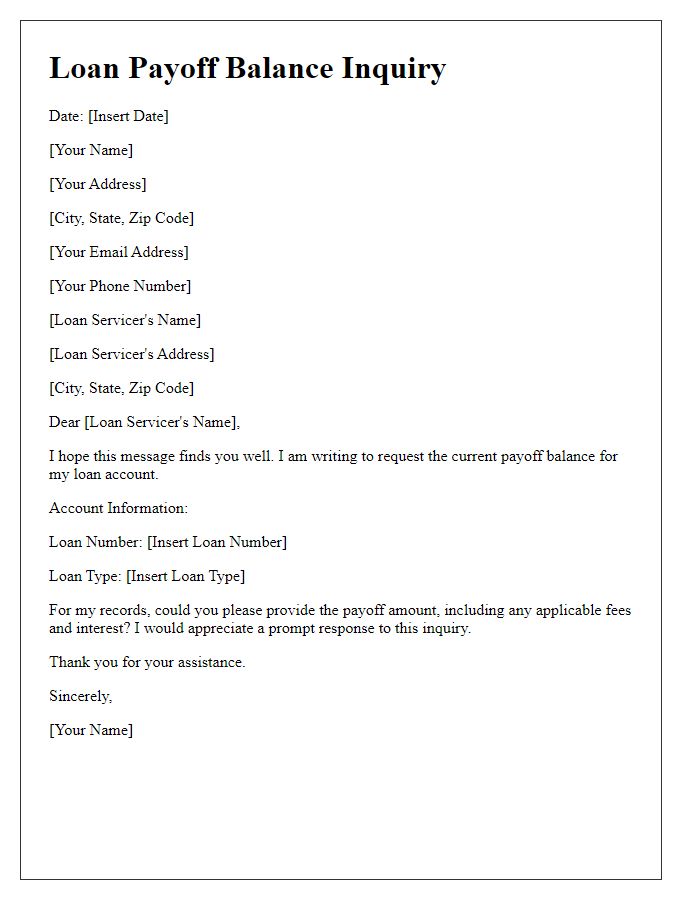

Loan balance inquiries provide essential information regarding outstanding debts. Loan Account Numbers, unique identifiers (typically consisting of 10-16 alphanumeric characters), facilitate tracking specific financial obligations within banking systems. Borrowers often seek to ascertain remaining balances to manage repayments effectively. Interest rates, repayment terms, and financial status can influence loan management strategies. Access to current loan balances is crucial for budgeting and ensuring timely payments to avoid penalties or damage to credit scores. Financial institutions may offer online platforms or customer service representatives to assist with these inquiries, streamlining the process for borrowers.

Borrower's Full Name

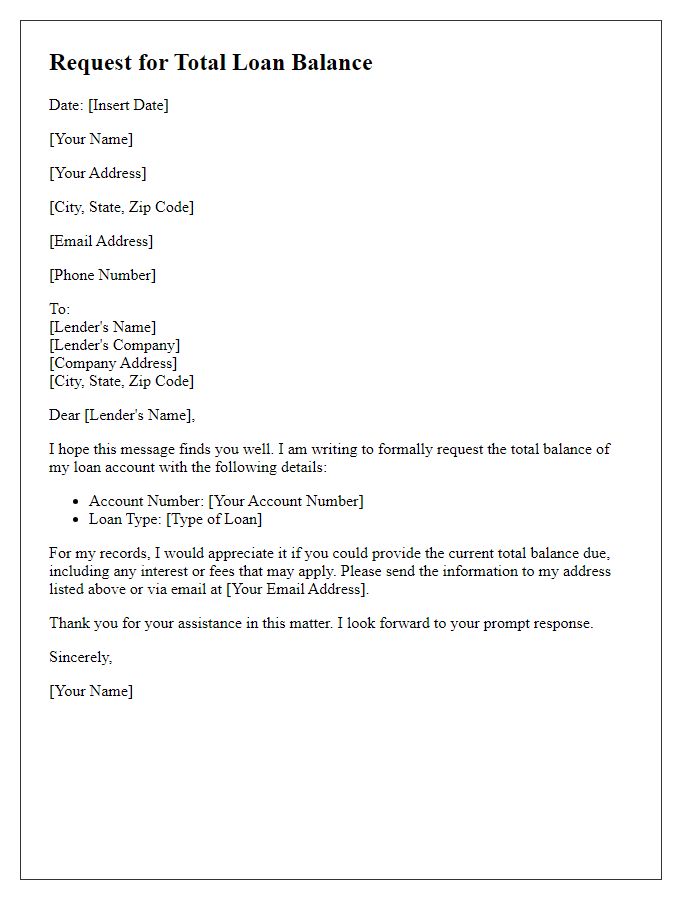

Loan balance inquiries often provide critical insight into a borrower's remaining financial obligation. For instance, borrowers like John Doe may seek information regarding their mortgage balance of $250,000 with XYZ Bank, established in January 2020. This inquiry can clarify aspects such as interest rates impacting future payments, remaining loan duration of 25 years, and the possibility of early repayment penalties. By accessing updated loan statements, borrowers can better understand their financial standing and make informed decisions regarding refinancing or consolidation options.

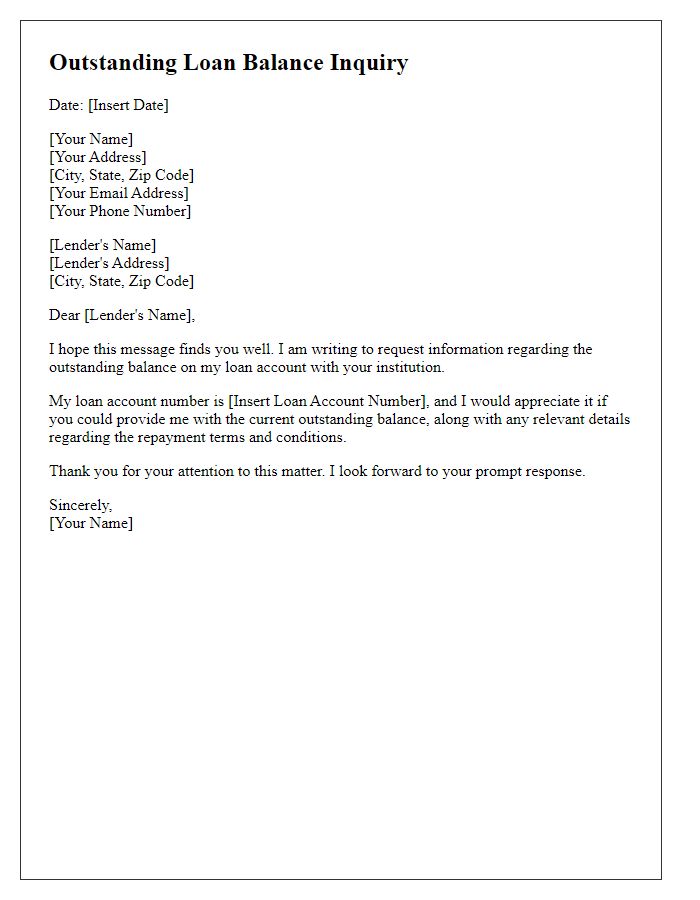

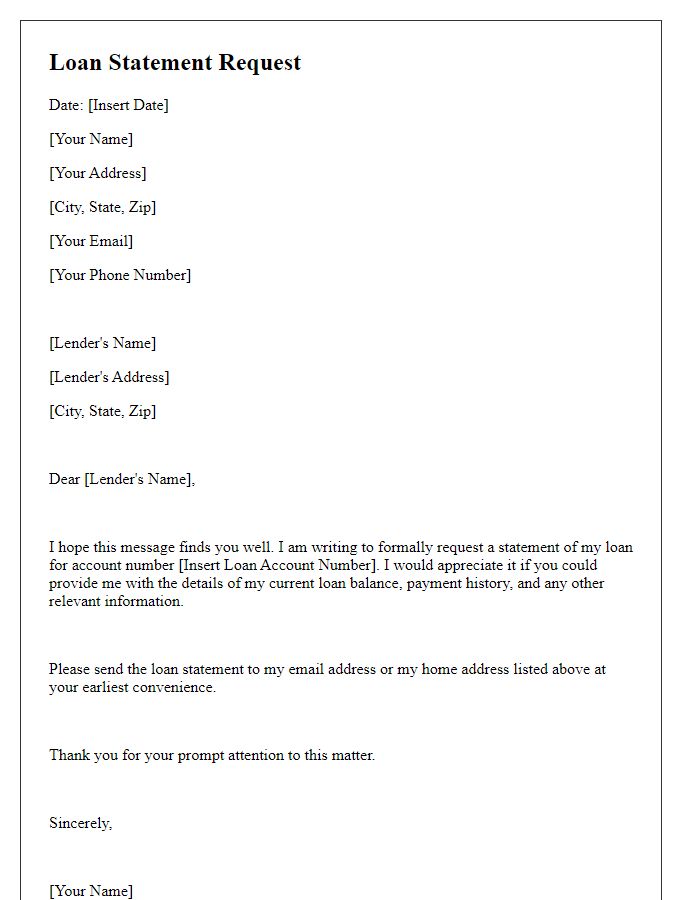

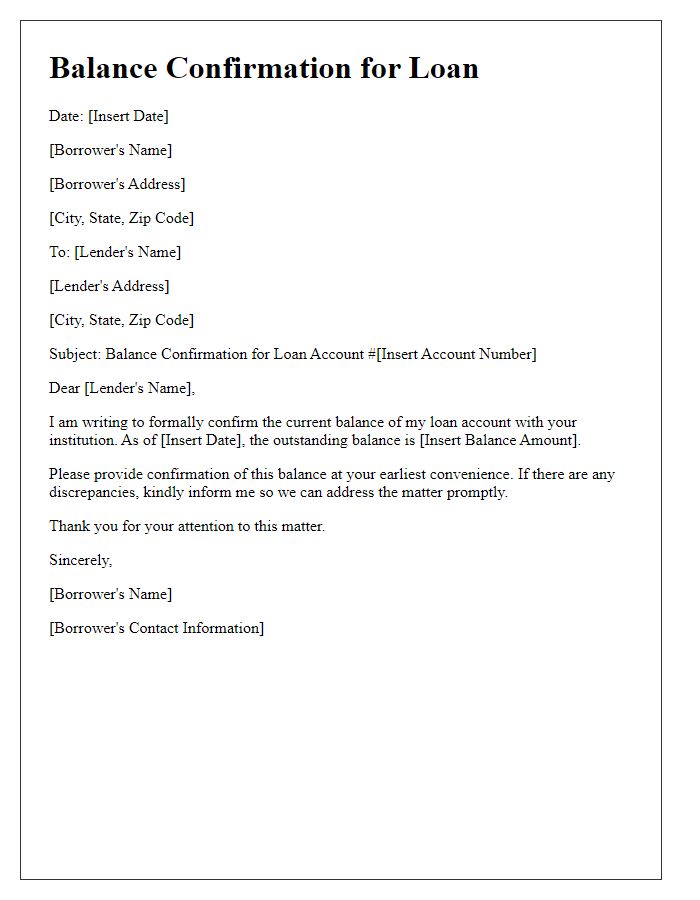

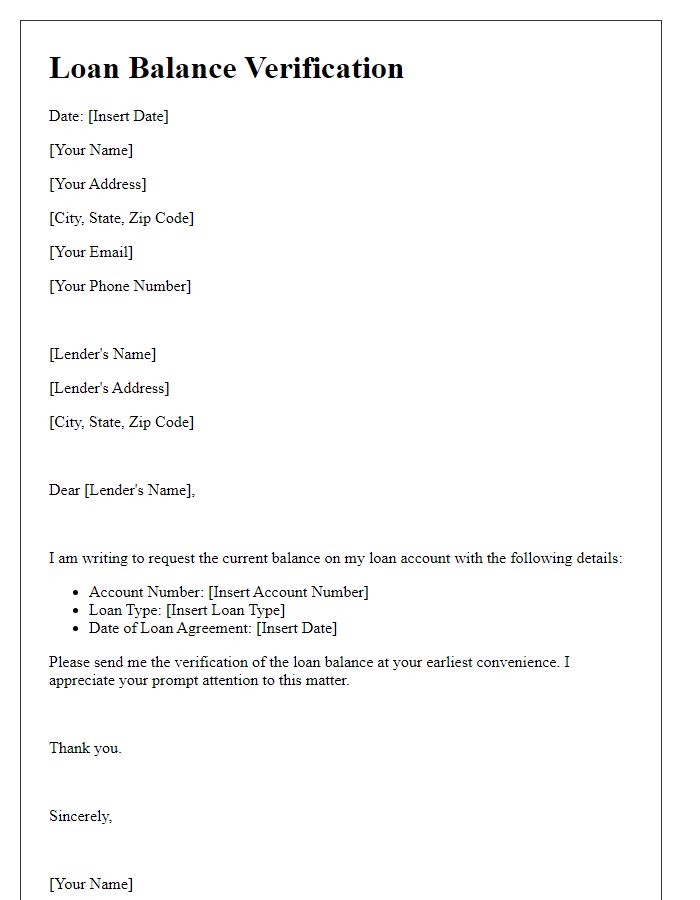

Request for Outstanding Balance

Loan balances provide critical information about financial obligations, such as personal loans, mortgages, and student loans. Understanding the outstanding balance, which represents the total amount owed excluding interest, is essential for effective budgeting and financial planning. For instance, a mortgage balance of $250,000 might indicate a long-term commitment affecting monthly cash flow. Various factors can influence this balance, including payment history, interest rates, and loan terms. Borrowers often inquire about their outstanding balances through detailed statements sent by financial institutions like banks or credit unions, highlighting the importance of accuracy in financial records to avoid any discrepancies that could lead to payment issues or unexpected fees.

Contact Information

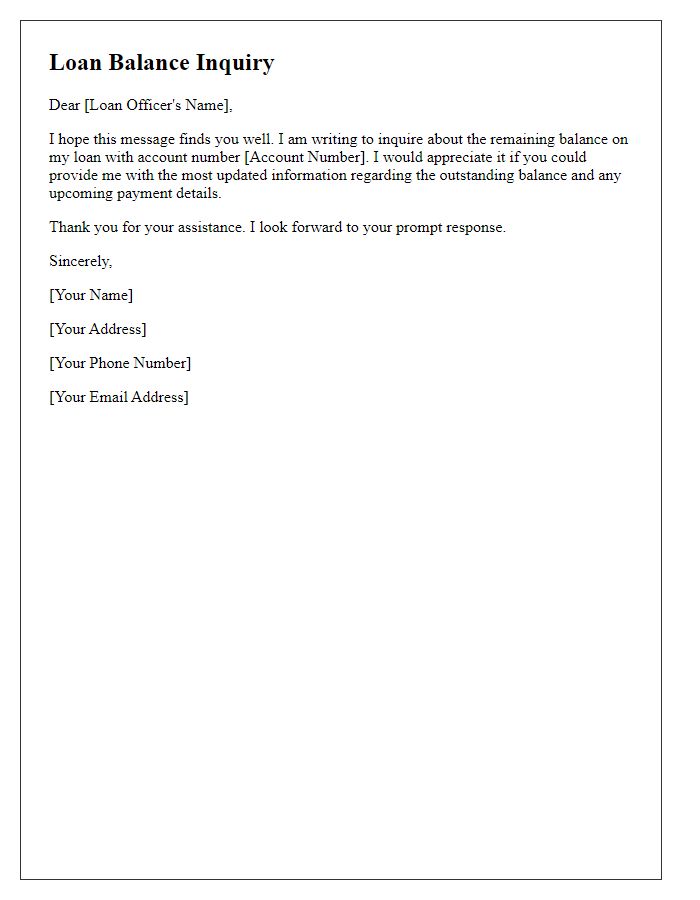

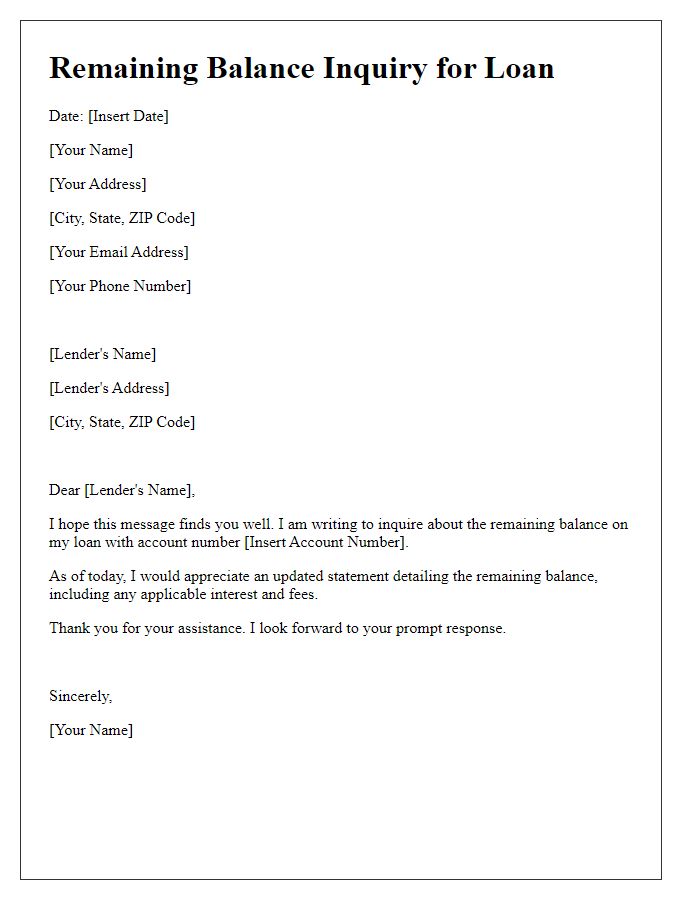

Loan balance inquiries often stem from the need for clear financial understanding and accurate tracking of outstanding debts. Borrowers, regardless of the institution, require up-to-date information regarding their loans, such as the total amount owed, interest rates, and payment schedules. Failing to maintain contact with lending organizations like banks, credit unions, or online lenders may result in confusion and potential errors in debt management. Communication methods such as phone calls, emails, or secure online portals should be utilized to ensure prompt and precise responses. It is vital for borrowers to have their loan account numbers and personal identification ready when initiating such inquiries, enhancing validation and efficiency in obtaining current balance information.

Authorization Consent

Loan balance inquiries often require authorization consent to ensure privacy and security. Borrowers typically submit requests to financial institutions like banks or credit unions to access loan details. Various loan types, such as mortgages or personal loans, might have different policies regarding information disclosure. Institutions often request details like loan account numbers and personal identification to verify identity before providing confidential information. Privacy regulations, such as the Fair Credit Reporting Act (FCRA), highlight the importance of granting explicit consent when accessing loan balances. Understanding the specific loan terms and conditions is crucial for borrowers navigating their inquiries.

Comments