Are you struggling to keep up with payments and seeking a little flexibility? We understand that life can throw unexpected challenges your way, and it's essential to navigate them with a practical solution. In this article, we'll share a helpful letter template that will make requesting a payment arrangement easier than ever. So, grab your pen and paper, and let's dive into how you can effectively communicate your needs!

Formal Salutation

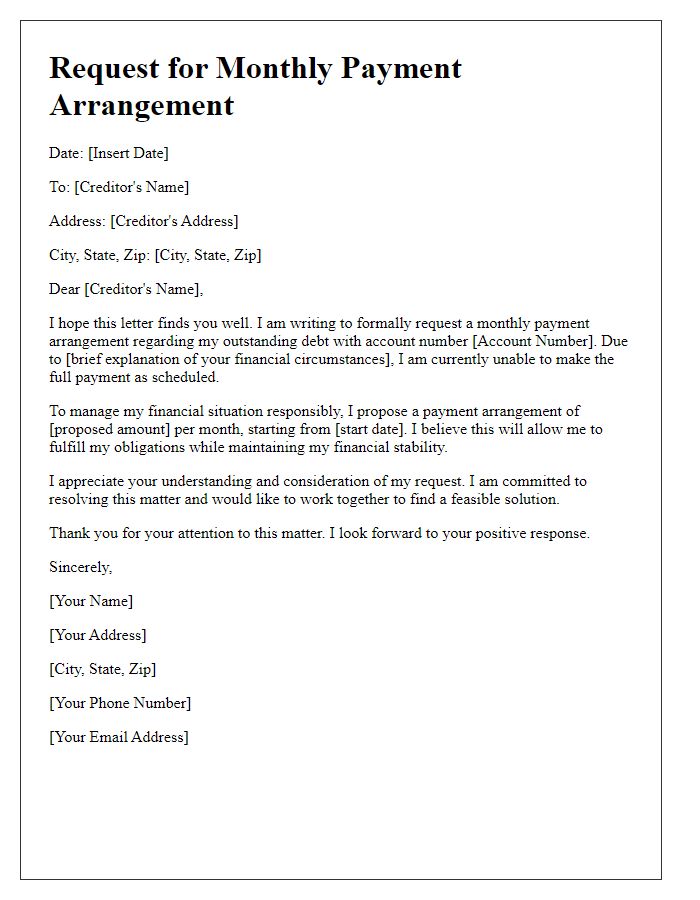

In numerous industries, maintaining cash flow is essential, particularly within small businesses. A formal request for payment arrangements often addresses overdue invoices or payment plans. Details must include the specific amount owed, such as $1,500, due date originally set for March 15, 2023, alongside a clear and courteous request for communication regarding a feasible payment schedule. Additionally, references to any previous correspondence, such as Reminder Emails sent on April 1 and April 15, will provide context for urgency. Contact methods like email or phone numbers also encourage responsiveness, enhancing the likelihood of cooperation from the recipient.

Request Statement

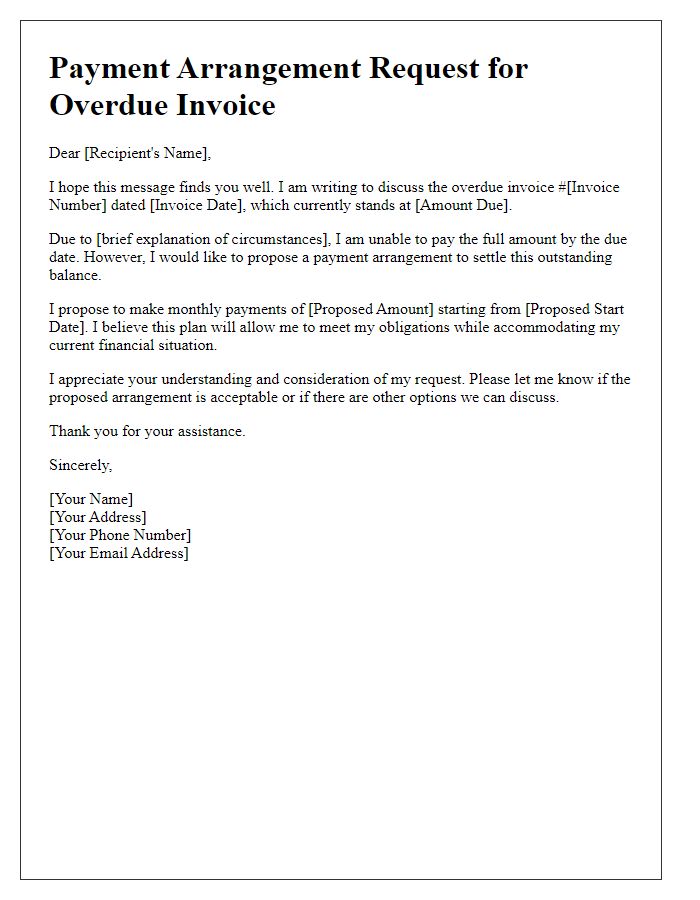

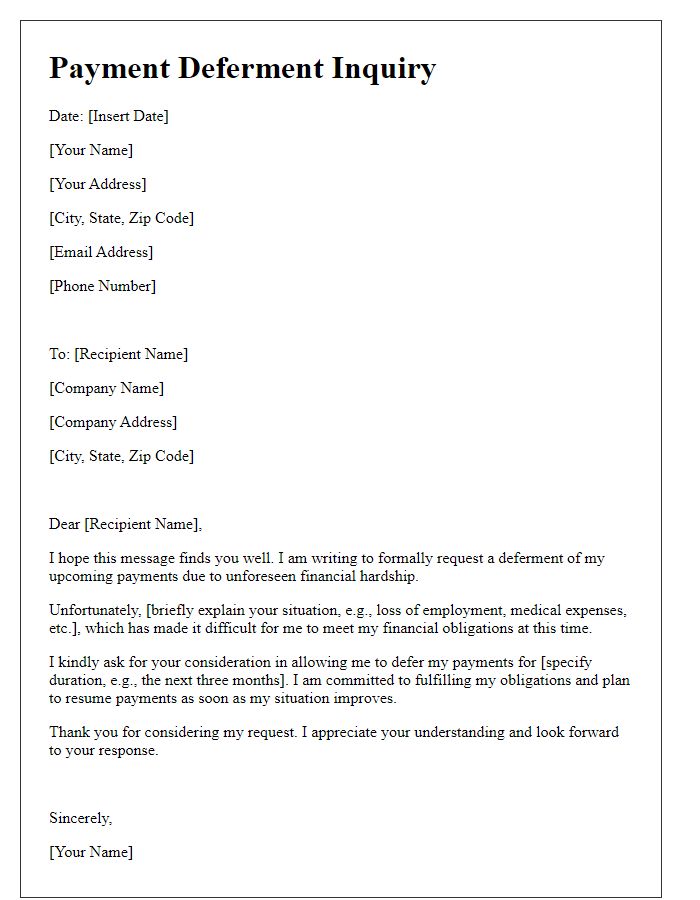

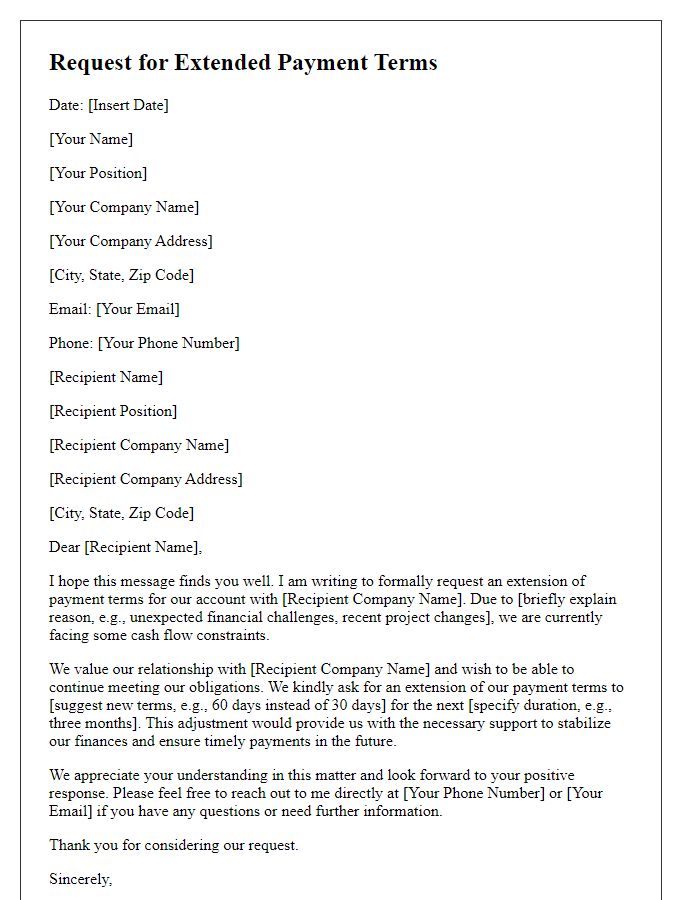

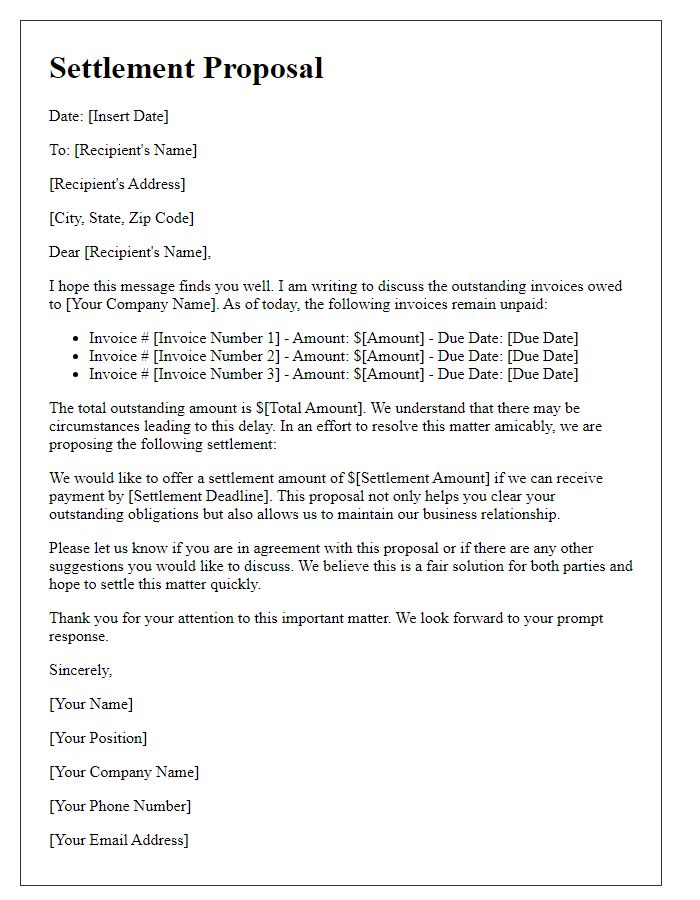

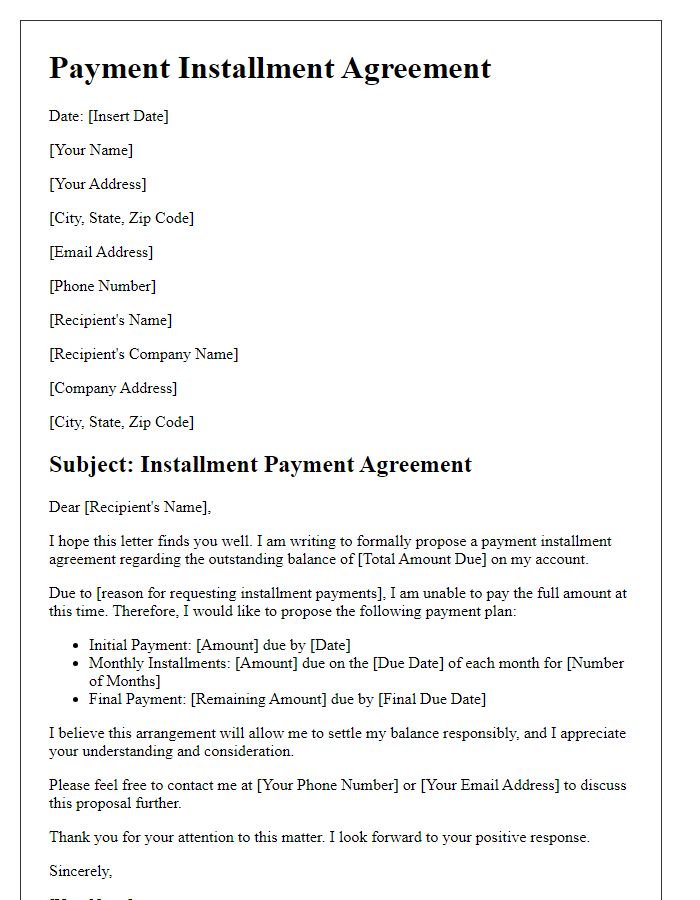

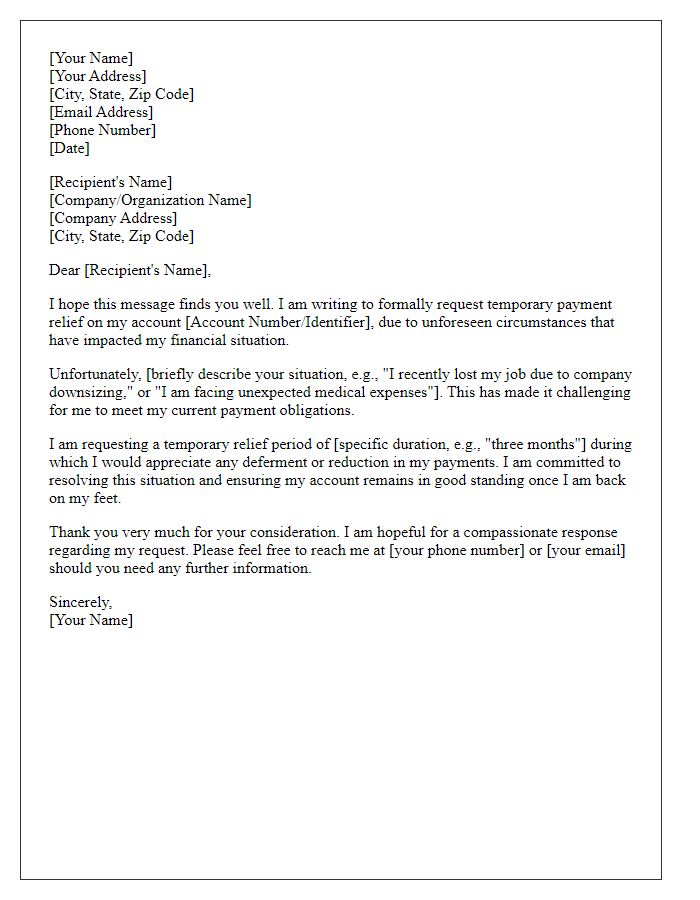

A payment arrangement request is a formal appeal to negotiate flexible payment terms for outstanding debts. This process typically involves specifying the total amount owed, such as past due invoices or loan balances. The request should detail proposed payment amounts, frequency, and the duration of the arrangement. Providing relevant account numbers, such as account #123456789, ensures clear identification of the obligation. It is also crucial to express genuine intent to settle the debt, while referencing previous correspondence or any agreements made, such as payment deferrals due to unforeseen circumstances, like job loss or medical emergencies. Additionally, including contact information for further discussion can facilitate a smoother negotiation process.

Detailed Explanation

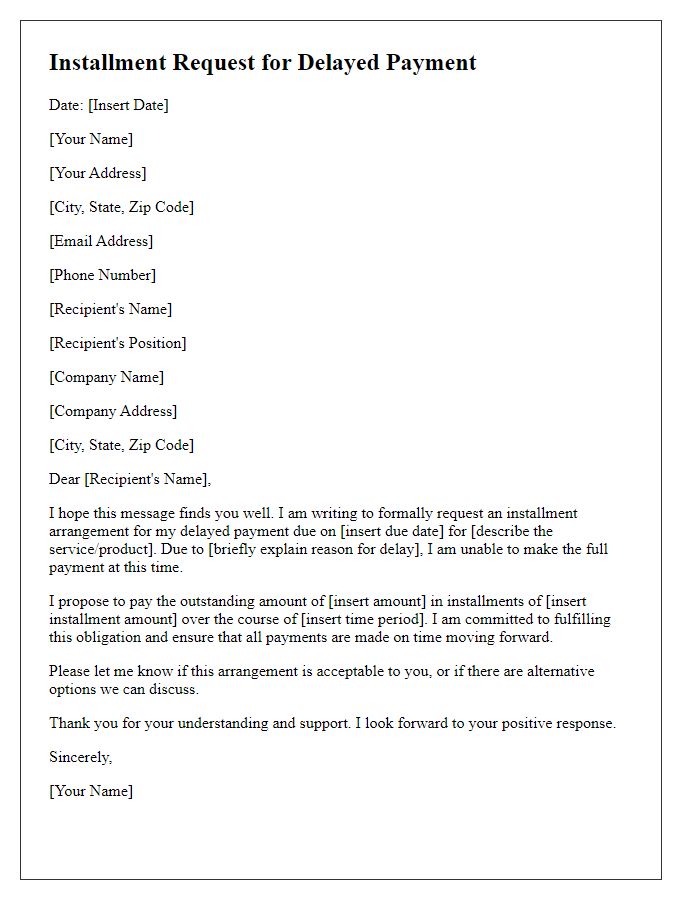

Requesting a payment arrangement can help individuals manage their financial obligations effectively. A clear and concise letter outlining the request is essential. The letter should include specific information: the total amount owed, due dates, and any previous payment history. This letter is often directed to creditors or service providers, such as utility companies or financial institutions. Important elements to address include the proposed payment schedule, such as monthly installment amounts and the duration of the arrangement (for example, six months). Providing context, such as changes in financial circumstances (job loss, medical expenses), may enhance understanding and empathy from the recipient. Additionally, offering a form of communication for further discussion demonstrates willingness to negotiate and collaborate on a feasible plan.

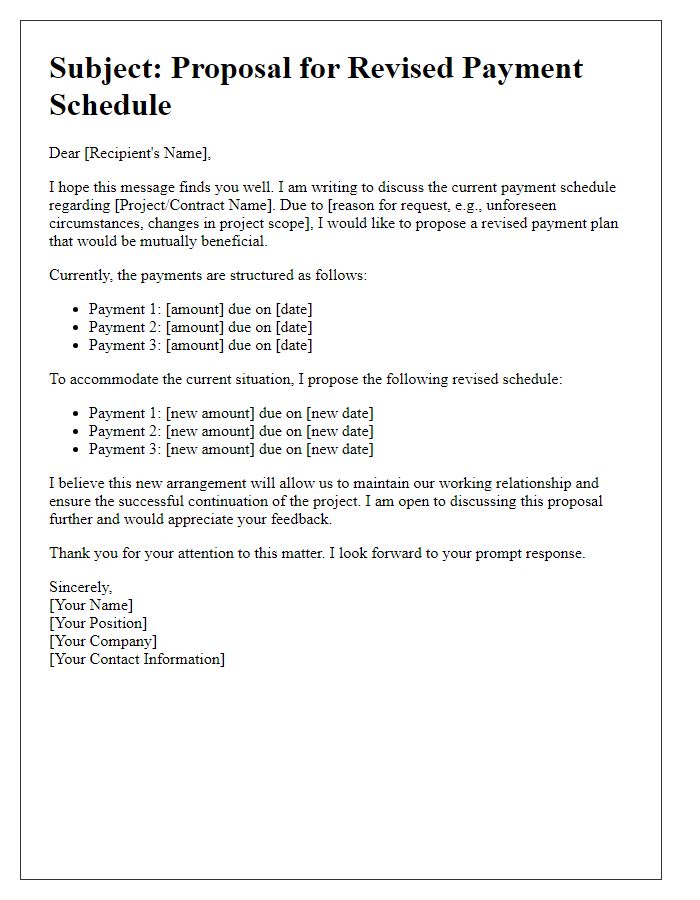

Proposed Payment Terms

In financial discussions, proposed payment terms are essential for establishing clear expectations and avoiding misunderstandings. A common arrangement includes monthly installments, typically spanning three to six months, amounting to the total outstanding balance. Specific conditions may stipulate initial down payments, such as 20% of the total amount, followed by equal payments thereafter. Payment methods may vary, incorporating options like bank transfers or credit card payments. Timely payments are critical, with due dates set for the first of each month. Adjustments may also be necessary based on financial capability, with opportunities for negotiation available. Additional documentation, such as invoices or receipts, is vital for providing transparency and maintaining accurate records throughout the process.

Contact Information

In business and financial contexts, it is essential to maintain clear communication regarding payment arrangements. A well-structured request helps ensure mutual understanding. Contact information should include specific aspects: the name of the individual or department involved, the company's official address with street name and postal code, phone number including area code for clarity, and a professional email address for written correspondence. Including the account number or reference ID related to the financial obligation not only aids in quick identification but also streamlines the follow-up process. Clarity in the request assists in establishing a formal payment plan to address outstanding balances efficiently.

Letter Template For Requesting Payment Arrangement Samples

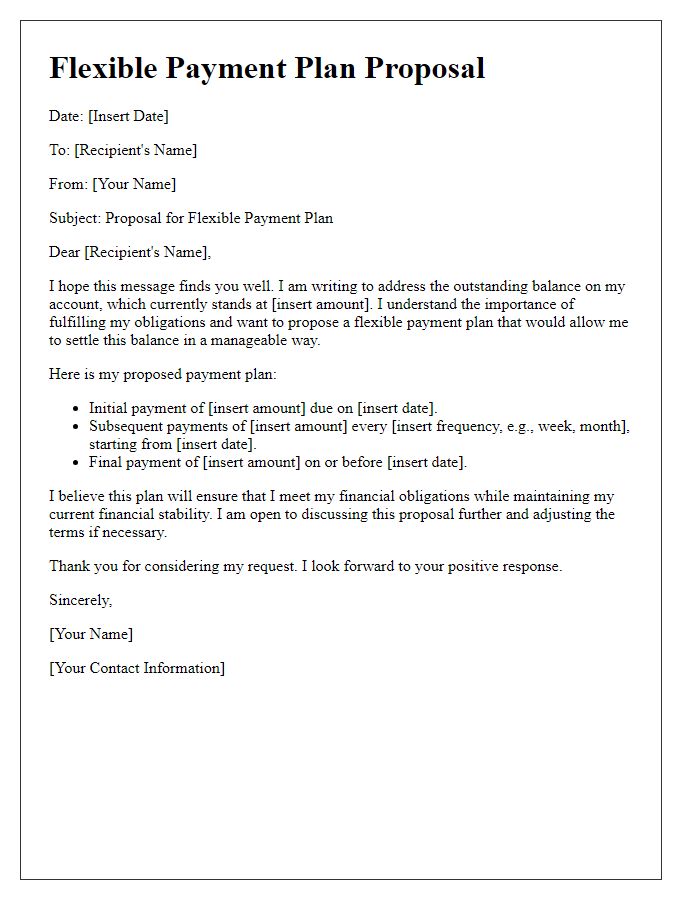

Letter template of flexible payment plan proposal for outstanding balance.

Comments