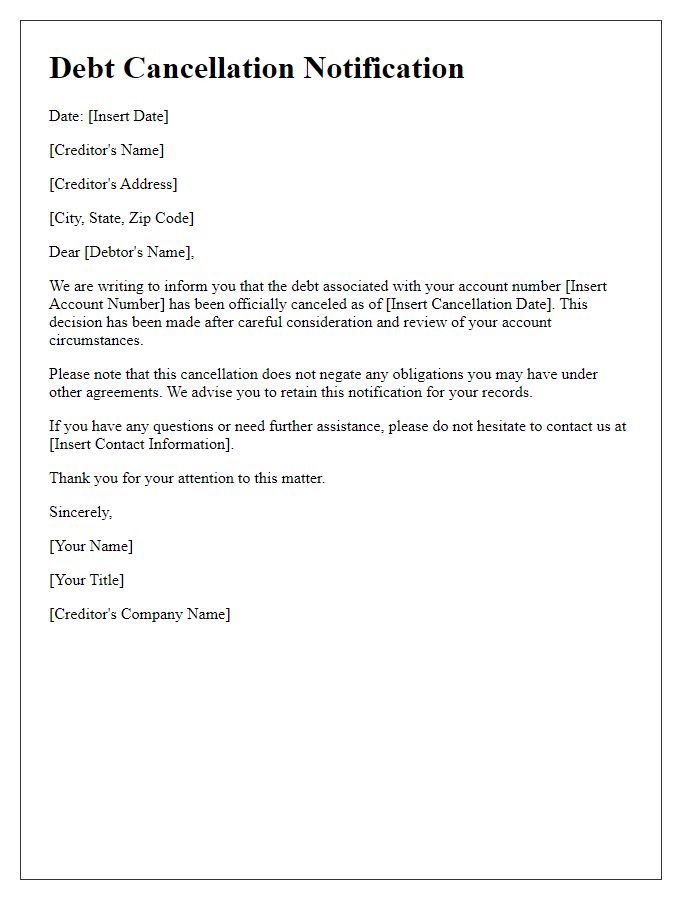

In today's fast-paced world, navigating financial matters can often be overwhelming, especially when it comes to debt management. If you've recently had a debt canceled, you might find yourself wondering how to formally confirm this arrangement. A well-crafted letter can serve as both a record and a reassurance for all parties involved. Ready to uncover the key elements of an effective debt cancellation confirmation letter? Let's dive in!

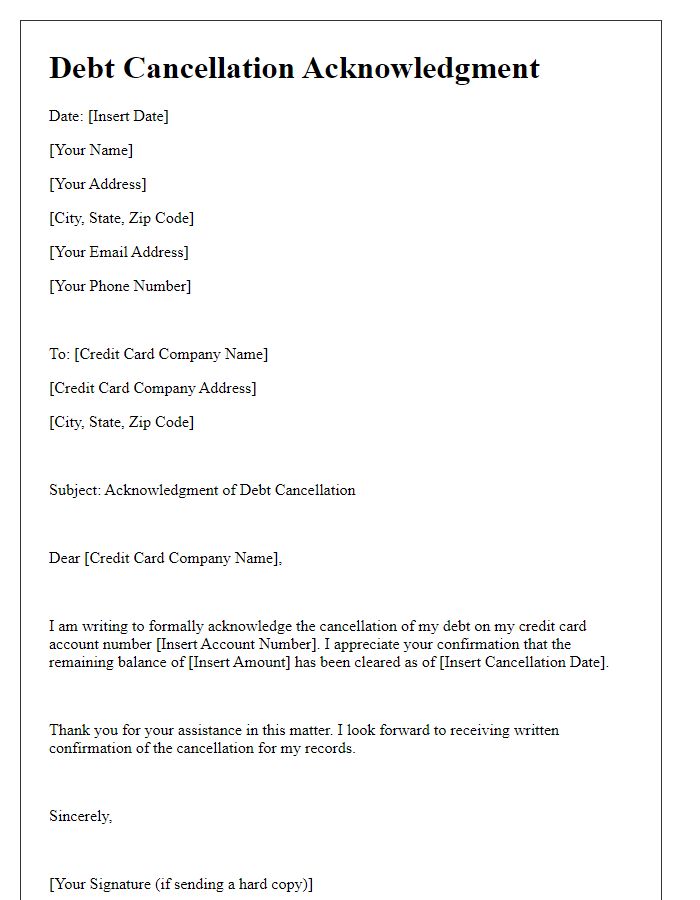

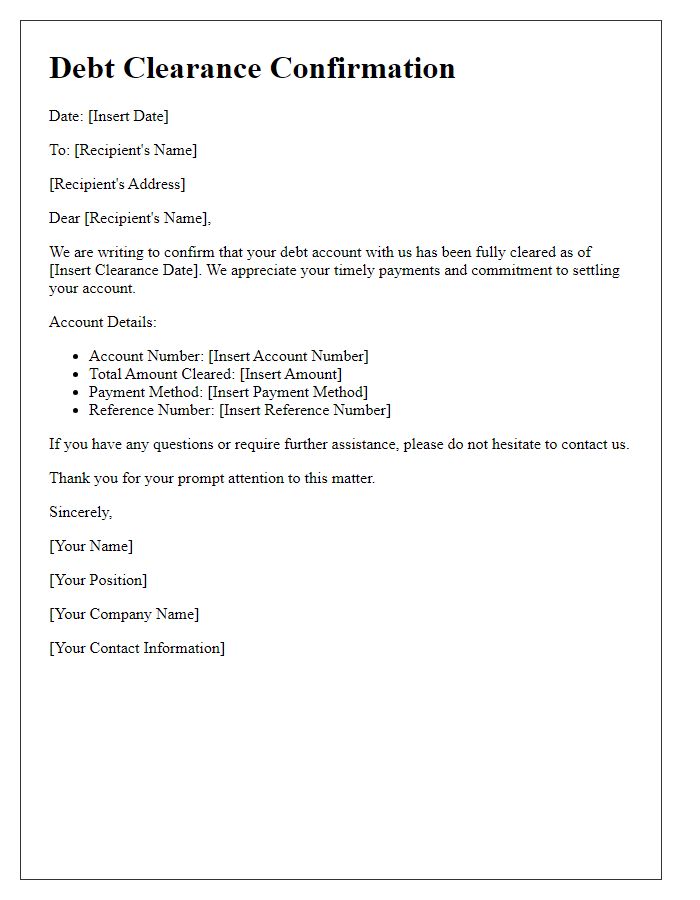

Debtor's full name and contact information

Debtor John Smith, residing at 123 Elm Street, Springfield, IL 62704, can confirm the cancellation of a financial obligation amounting to $5,000 originally due on March 15, 2023. This cancellation is effective as of October 1, 2023, and entails the withdrawal of any prior claim to repayment associated with a loan agreement dated January 10, 2021. Official documentation to support this cancellation will be retained for future reference, ensuring that no further debts are pursued in relation to this agreement.

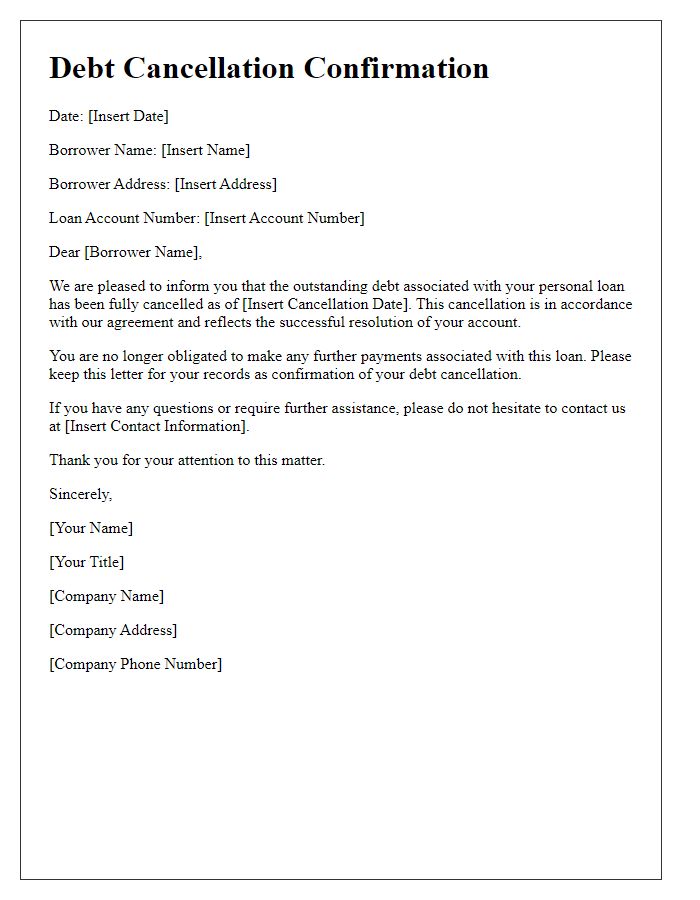

Creditor's full name and contact information

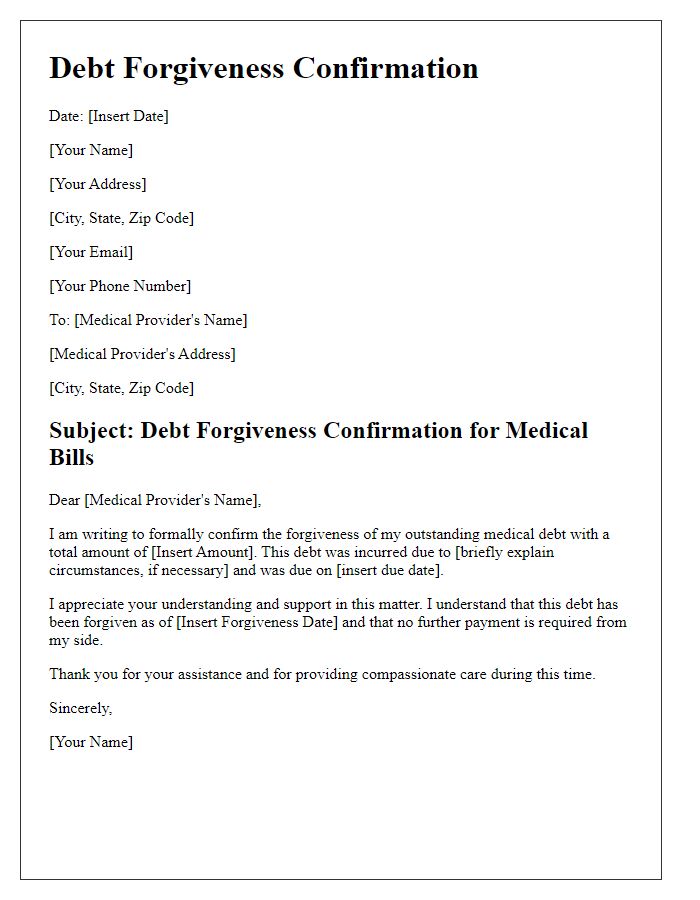

Debt cancellation represents an important financial relief, providing resolution to outstanding obligations. When a creditor, such as a financial institution or individual, formally cancels a debt, it typically involves documentation outlining the terms of the cancellation. This document includes crucial details like the creditor's full name--essential for identification--and accurate contact information, ensuring clear communication channels. The specific debt amount cancelled, the date of the cancellation, and any conditions governing the cancellation may also be highlighted. Proper record-keeping of such confirmations is vital for future financial planning and maintaining personal credit scores.

Account or reference number associated with the debt

Confirmation of debt cancellation involves acknowledging the discharge of a financial obligation associated with a particular loan or credit. The account number (specific numerical identifier, unique to each debtor) related to this debt must be referenced clearly. This process is often significant for financial records, preventing future claims. It is essential to note the date of cancellation (an important milestone), which signifies legal closure. Additional information such as the creditor's name (institution or individual owed), the total amount settled (specific sum), and any relevant transaction details (such as payment methods used for cancellation) should also be included, ensuring comprehensive documentation for both parties involved.

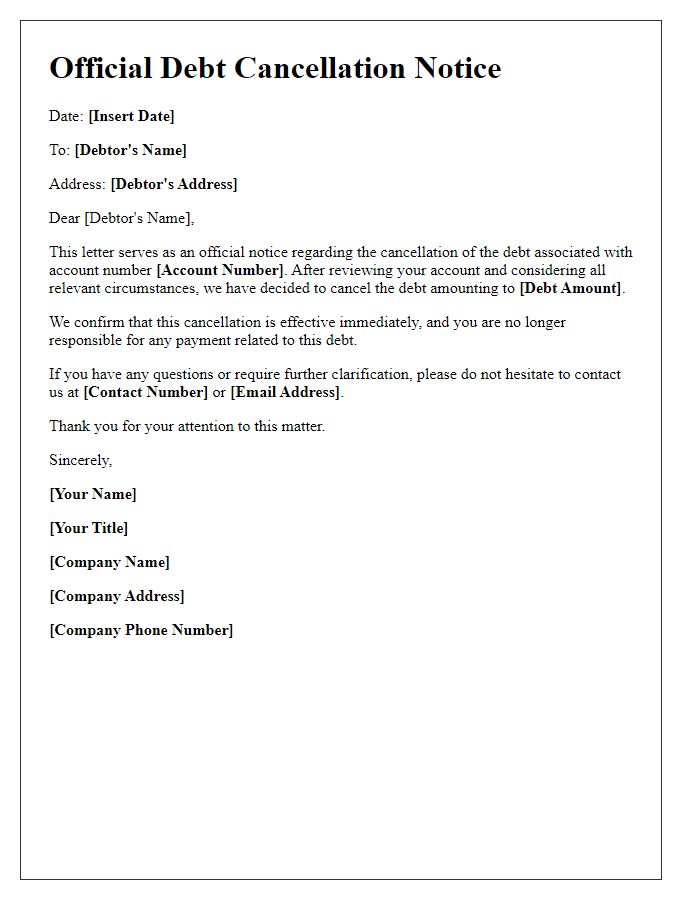

Statement of debt cancellation and current balance

The statement of debt cancellation confirms the removal of outstanding financial obligations, specifically regarding Loan Agreement #12345 with XYZ Financial Services. The original debt amount was $10,000, initiated on January 15, 2020, with a repayment schedule of 36 months. As of October 15, 2023, following successful negotiations and fulfillment of agreed-upon criteria, the debt has been formally canceled. The current balance stands at $0. This cancellation ensures that all related legal claims are terminated and the debtor, John Doe, residing at 123 Main Street, Springfield, is released from any further obligations related to this debt.

Authorized signature and date of confirmation

The confirmation of debt cancellation constitutes a crucial financial agreement between parties, representing the official acknowledgment that the outstanding balance has been eliminated, most typically observed in situations involving personal loans or credit agreements. For instance, on October 1, 2023, a debtor receiving a letter from a creditor, such as a bank or financial institution, serves as formal documentation that the specific debt, amounting to $5,000, has been fully forgiven. This letter, prominently featuring an authorized signature from an executive in the creditor's debt management department, signifies the termination of any legal obligations tied to the debt, providing the debtor with peace of mind and financial freedom. The date of confirmation, in this case, solidifies the transaction's validity, ensuring both parties can reference the agreement recorded on paper for future financial matters or audits.

Comments