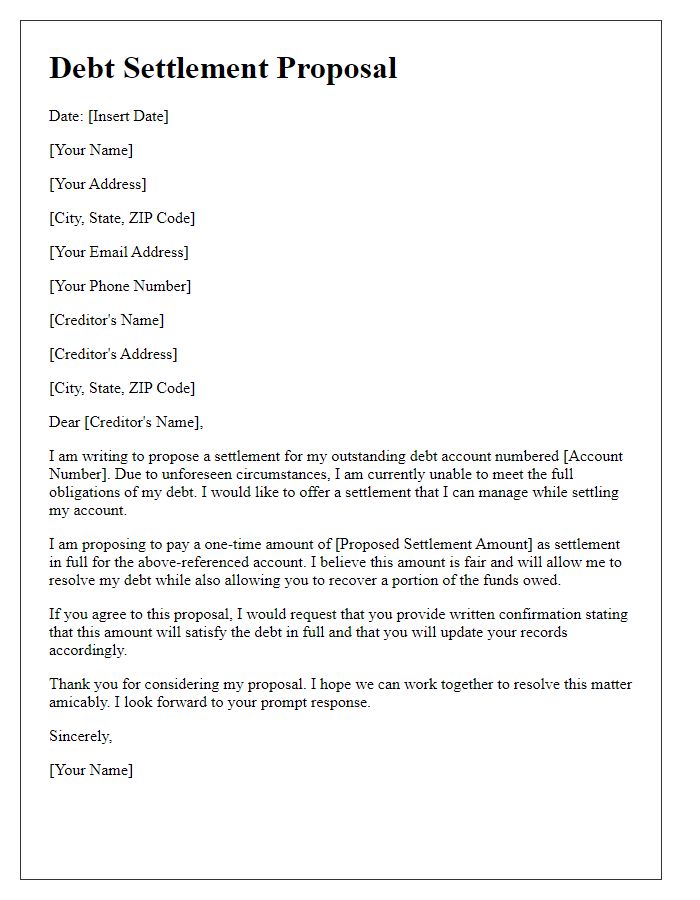

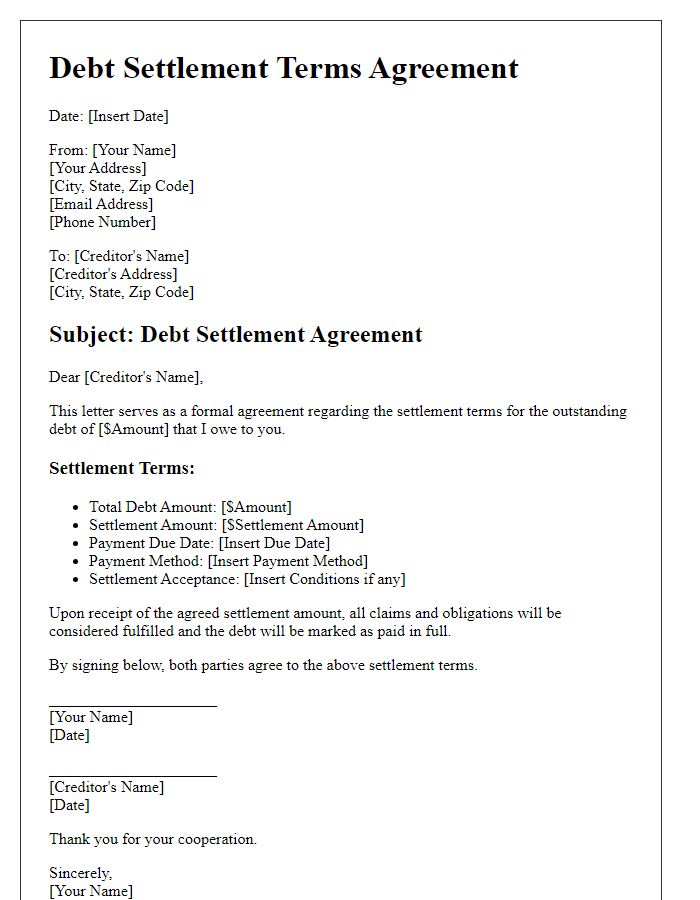

Are you feeling overwhelmed by debt and seeking a way to regain control? A debt settlement agreement can be a lifeline, allowing you to negotiate with your creditors for a more manageable payment. It's essential to understand the ins and outs of this process to ensure you're making informed decisions. If you're curious to learn how to draft an effective letter for your debt settlement agreement, keep reading for helpful tips and templates!

Clear Identification of Parties Involved

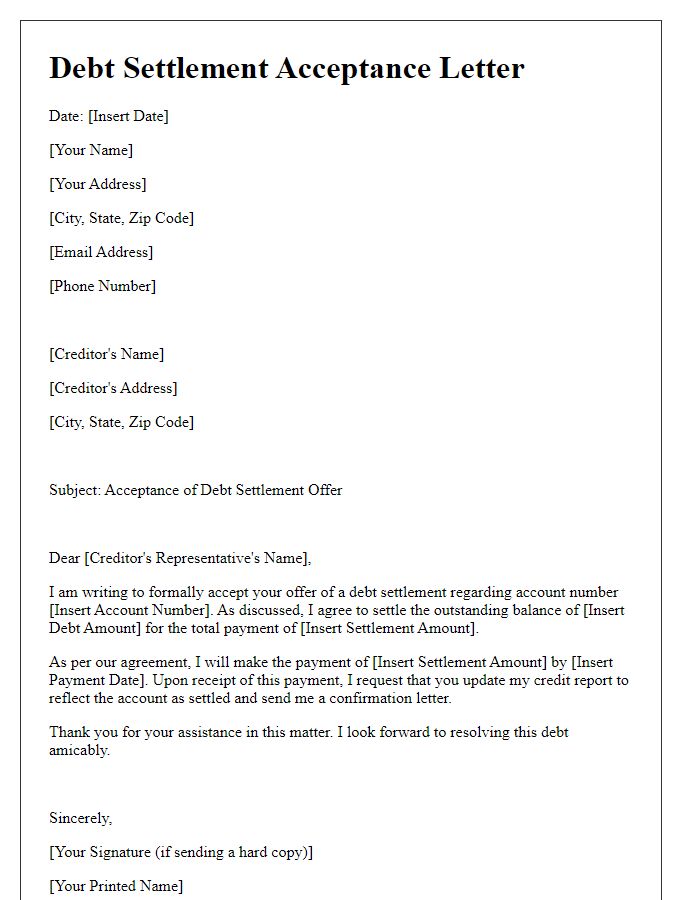

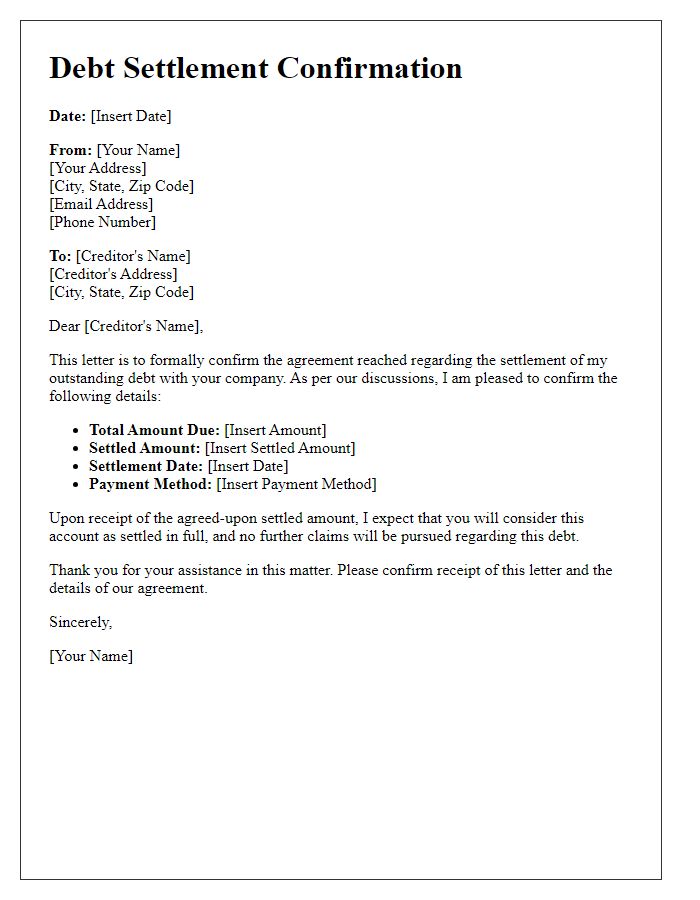

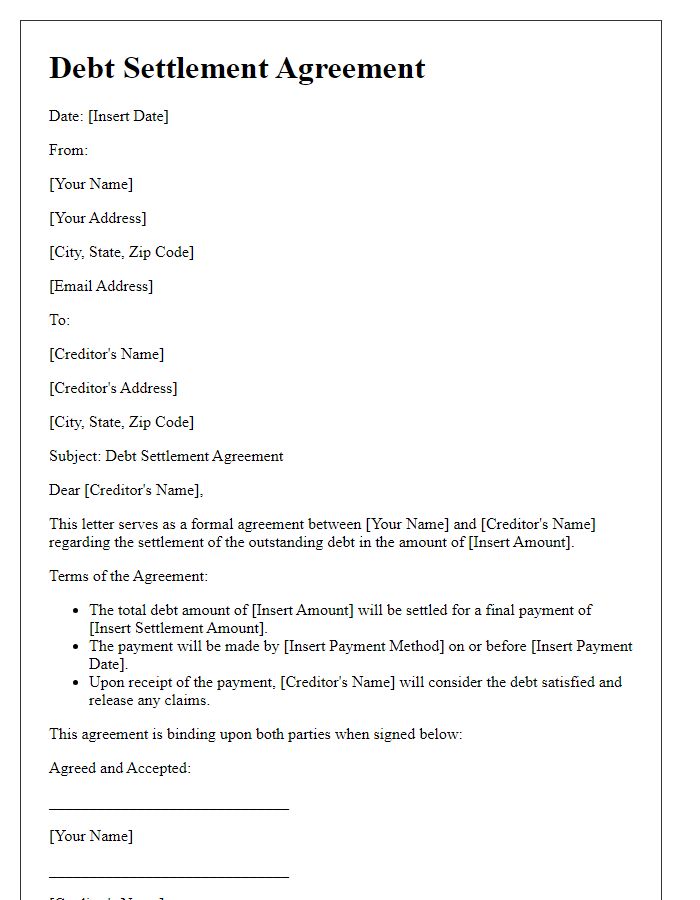

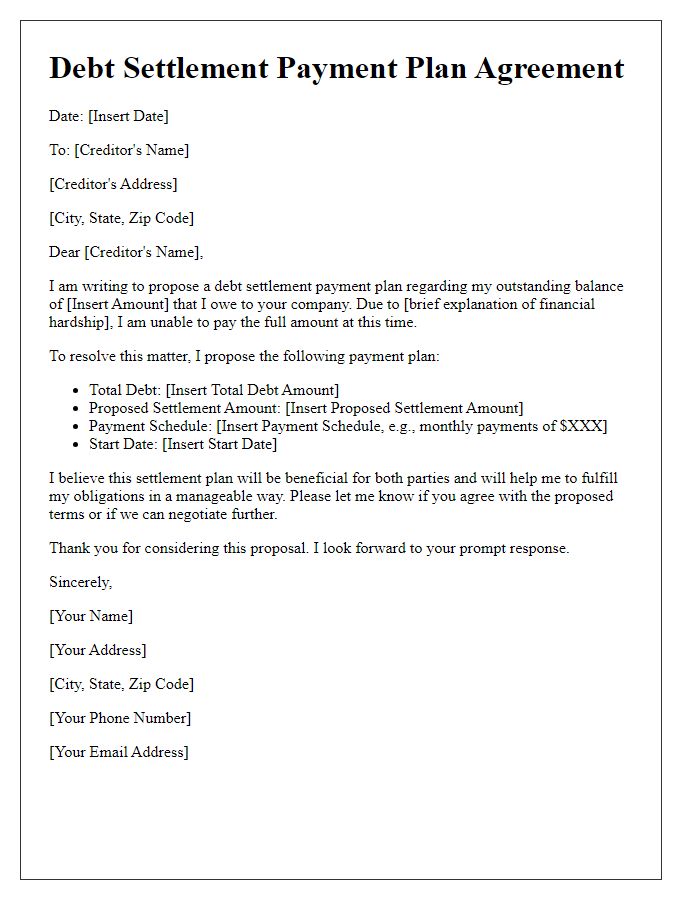

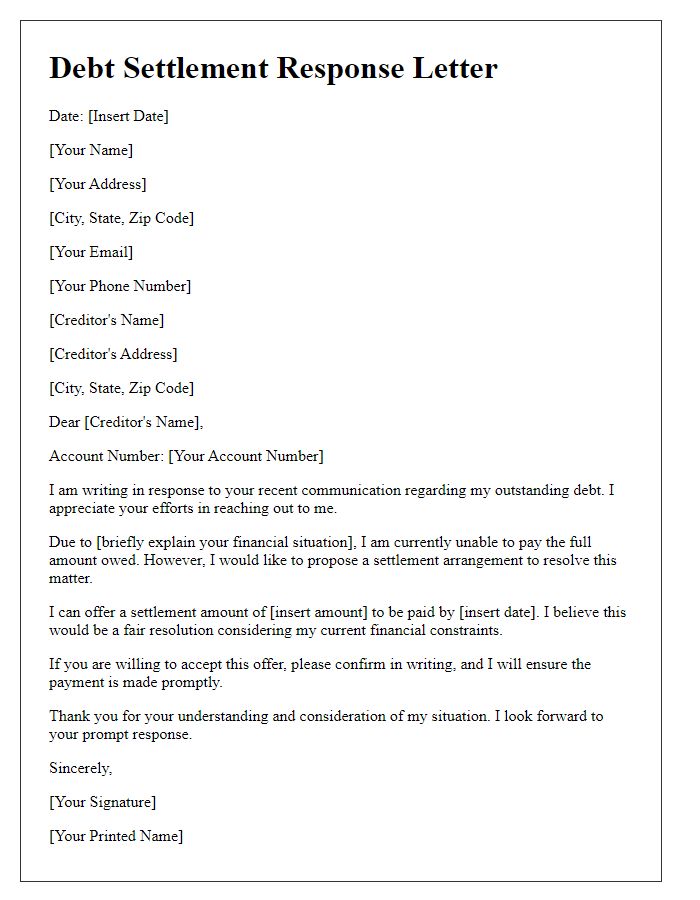

A debt settlement agreement requires clear identification of all parties involved to avoid misunderstandings or disputes. In this context, "Creditor" refers to the individual or organization that is owed the money, such as a bank or financial institution, and typically includes their legal name, business address, and contact information. "Debtor" indicates the individual or entity responsible for the debt, which may include personal information like full name, residential address, and any relevant identification numbers, ensuring accuracy and legal accountability. The agreement should also state the date of the agreement, providing a timestamp for when the terms were established, which is crucial for both parties to reference in future communications. Clear identification promotes transparency and establishes a solid foundation for the terms of the settlement, which may involve specific amounts, payment plans, and timelines.

Detailed Debt Information

Debt settlement agreements provide a structured approach for individuals seeking to manage outstanding obligations. Key components include the principal amount owed, such as $10,000 to XYZ Creditors (a fictitious lending entity), the interest rate (typically around 18% APR), and any additional fees (for instance, a $500 late payment fee). The agreement outlines the total debt timeline, often spanning several months or even years, and specifies a reduced settlement amount, perhaps 60% of the original debt, contingent on timely payments. This legal document may also cite any related events, like bankruptcy filings or attorney involvement, which can impact repayment terms. Ensuring that all parties understand the implications, including potential tax liabilities on forgiven debt, is essential for achieving a successful resolution.

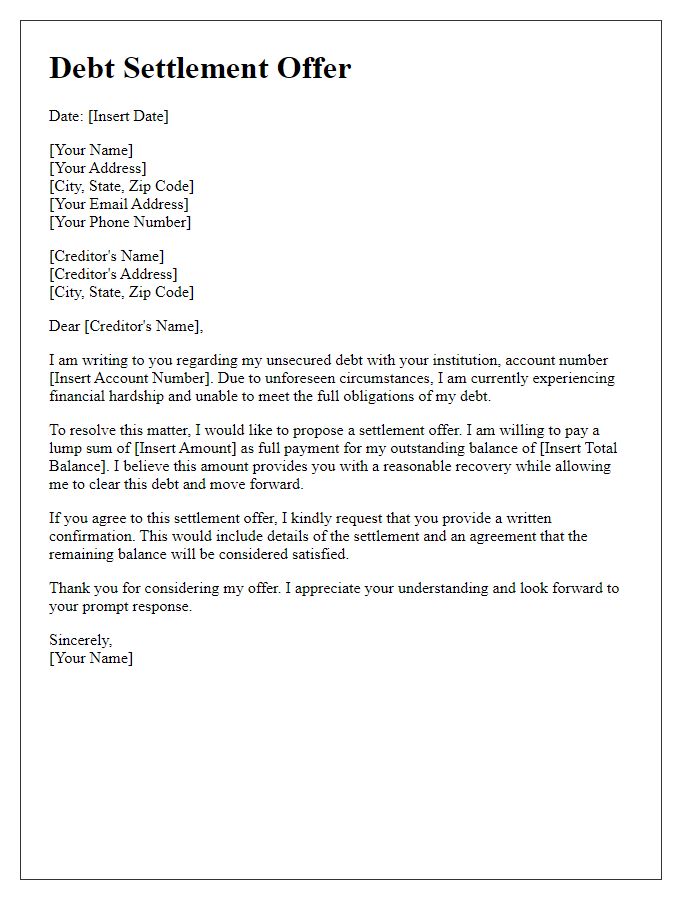

Settlement Amount and Payment Terms

Debt settlement agreements are critical in resolving outstanding financial obligations between creditors and debtors. A settlement amount often reflects a reduced figure that is less than the original debt, providing a feasible option for repayment. Payment terms specify the schedule and method in which payments will be made, such as a lump sum or installment payments over a specified period, often including due dates and accepted payment methods like bank transfers or checks. Specific details like total outstanding debt (for instance, $10,000), agreed settlement amount (for example, $6,000), and payment frequency (monthly or bi-weekly) are essential for clarity and mutual understanding, enhancing the likelihood of successful resolution. Legal provisions may also delineate conditions regarding default or breach, ensuring both parties adhere to the agreed-upon terms.

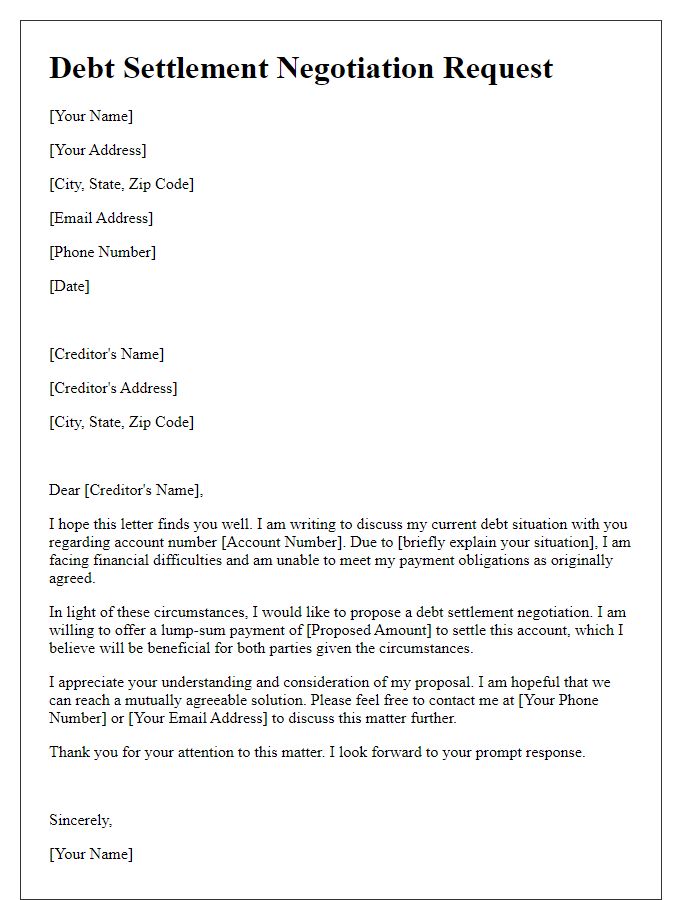

Legal and Binding Language

A debt settlement agreement is a legally binding document outlining the terms between the debtor and creditor regarding the repayment of a financial obligation. This agreement typically specifies the total amount owed, for instance, $10,000, the negotiated settlement amount, often reduced to around $6,000, and the payment schedule, indicating whether it will be a lump sum or installments over a defined period. Additionally, it includes a clause stating the debtor's commitment to make timely payments, ensuring compliance with the agreed terms. Essential details, such as the date of settlement, the parties' names (e.g., John Doe and ABC Financial Services), and the jurisdiction governing the agreement (like New York State law), must be clearly specified. The document may also outline consequences for non-compliance, like potential legal action or additional fees, reinforcing its binding nature.

Confidentiality and Non-Disclosure Clause

Debt settlement agreements often include a confidentiality and non-disclosure clause to protect sensitive information. These clauses ensure parties involved, such as creditors and debtors, do not disclose terms or details of the settlement to unauthorized third parties. Typically, the clause specifies that all terms, amounts, and personal information must remain confidential, fostering trust. Breaches of confidentiality can lead to legal consequences, including potential lawsuits, thus emphasizing the importance of maintaining privacy in financial transactions. Understanding the legal implications and the necessity of discretion is crucial for both parties in these agreements.

Comments