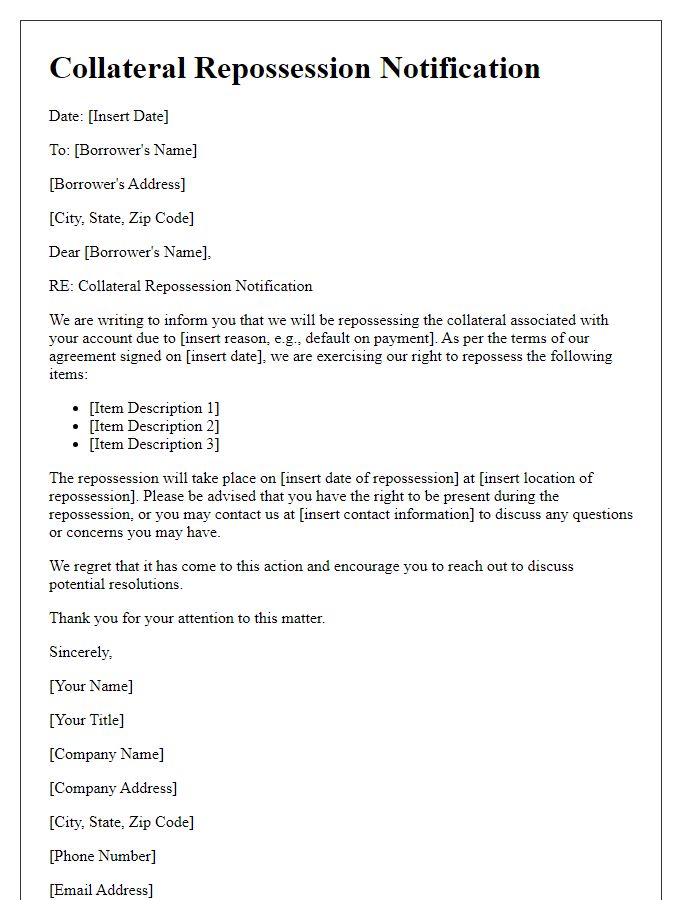

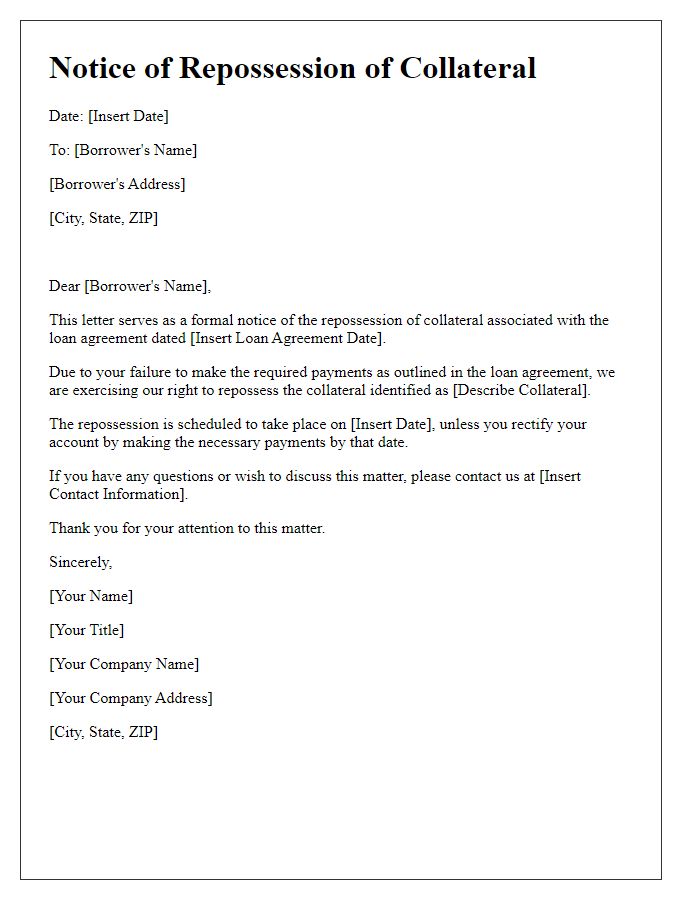

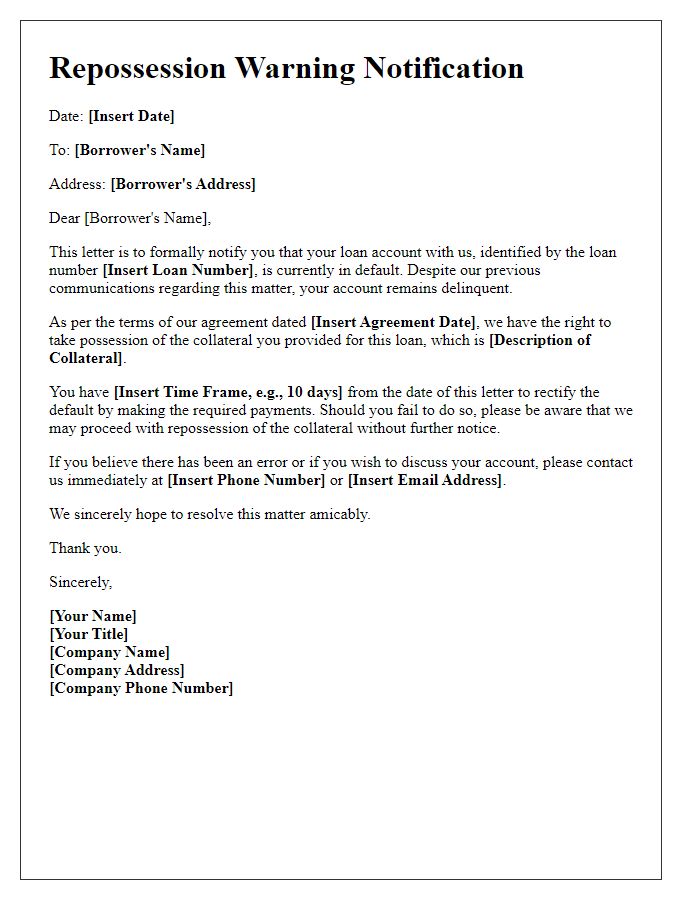

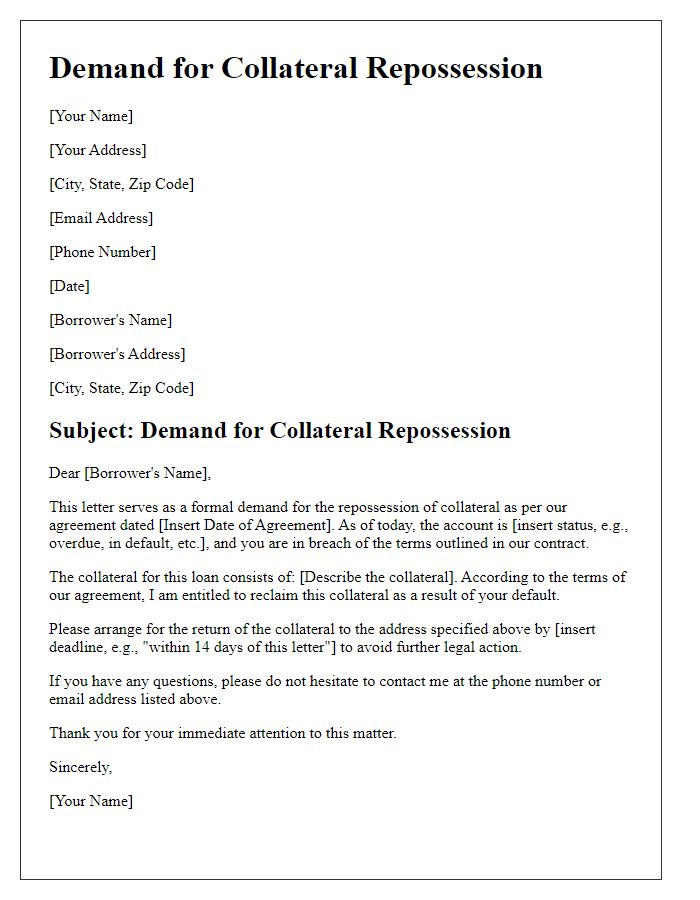

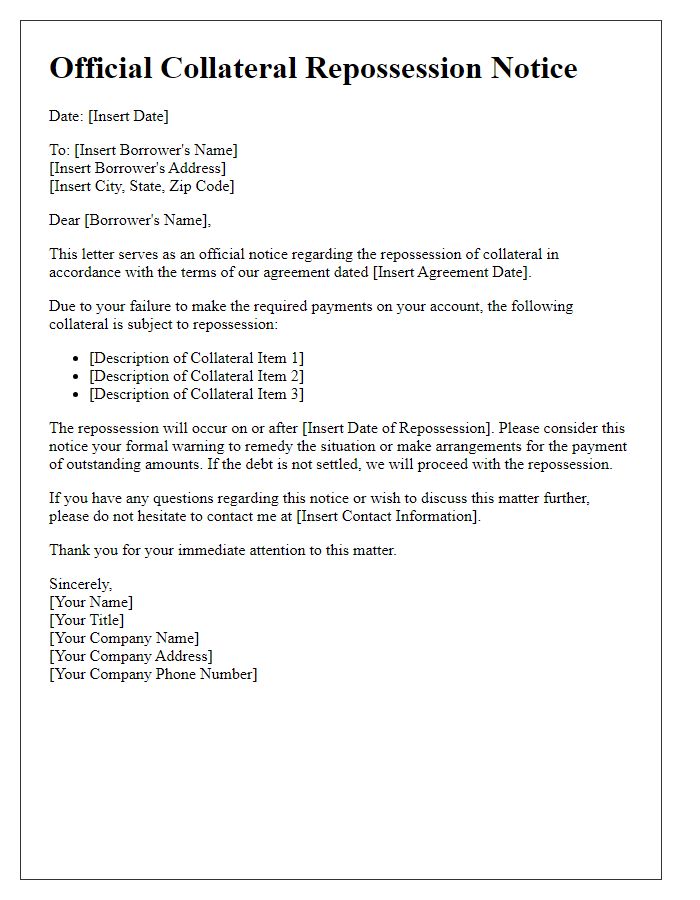

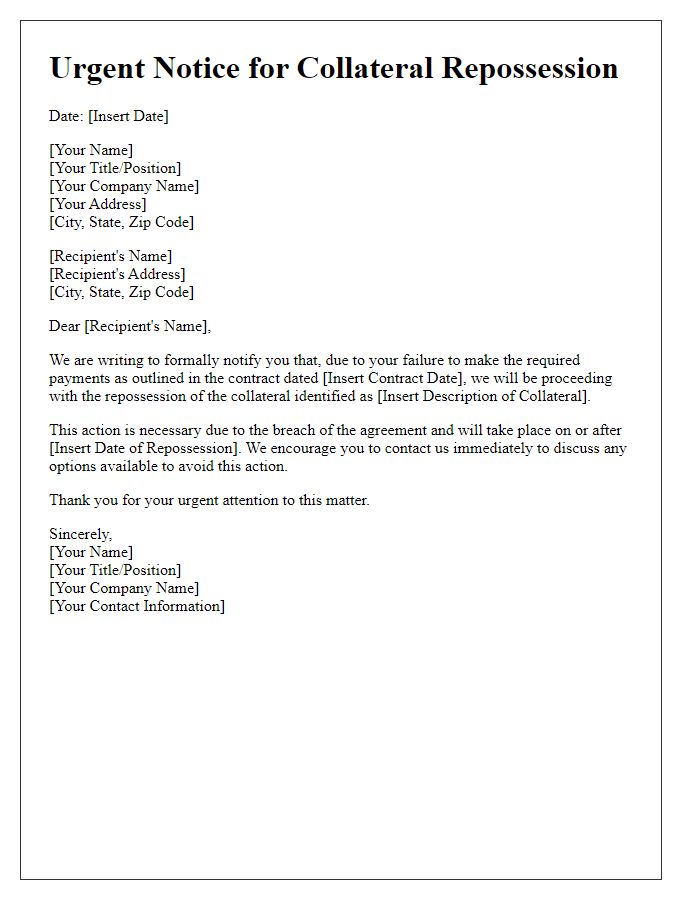

Have you ever encountered a situation where you needed to communicate important information regarding collateral repossession? Crafting a clear and concise letter can make all the difference in ensuring that your message is understood and taken seriously. In this article, we'll explore a sample template for a collateral repossession notice, highlighting the essential elements to include. So, if you're ready to learn how to effectively communicate this sensitive matter, read on!

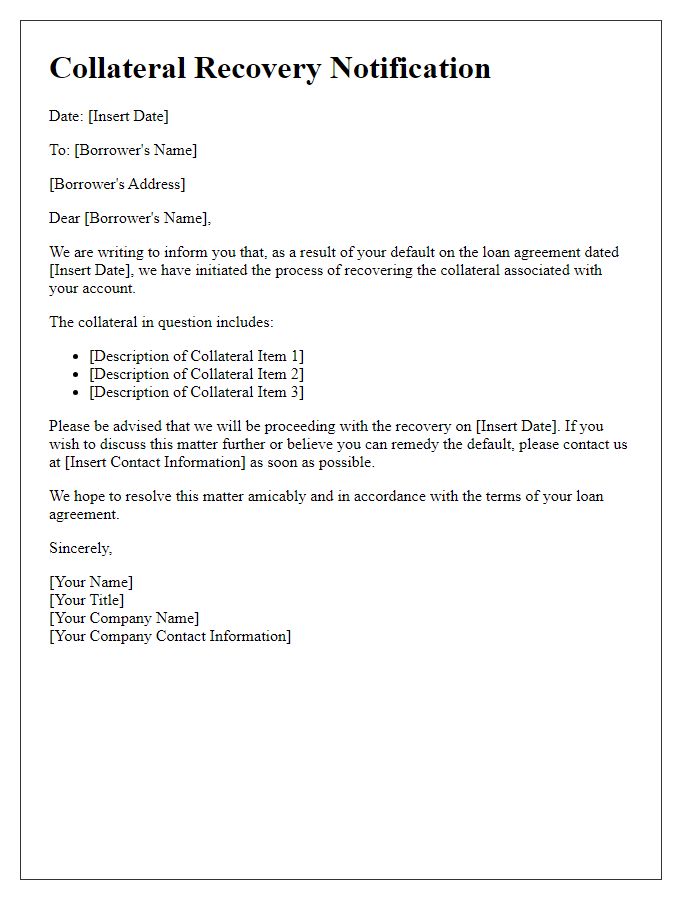

Clear identification of parties involved

The collateral repossession notice identifies the parties involved in the transaction, including the lender, which may be a financial institution or credit agency, and the borrower, who holds the collateralized asset. The lender is typically designated with a formal name, such as "XYZ Financial Services," along with business identification numbers and contact details. The borrower is identified by their full legal name, residential address, and account number associated with the loan or financing agreement. Clear descriptions of the collateral, such as a vehicle make and model, serial number, or property address, ensure that the asset can be easily recognized. This documentation serves to outline the agreement terms, payment defaults, and the legal rights held by the lender concerning the repossession process.

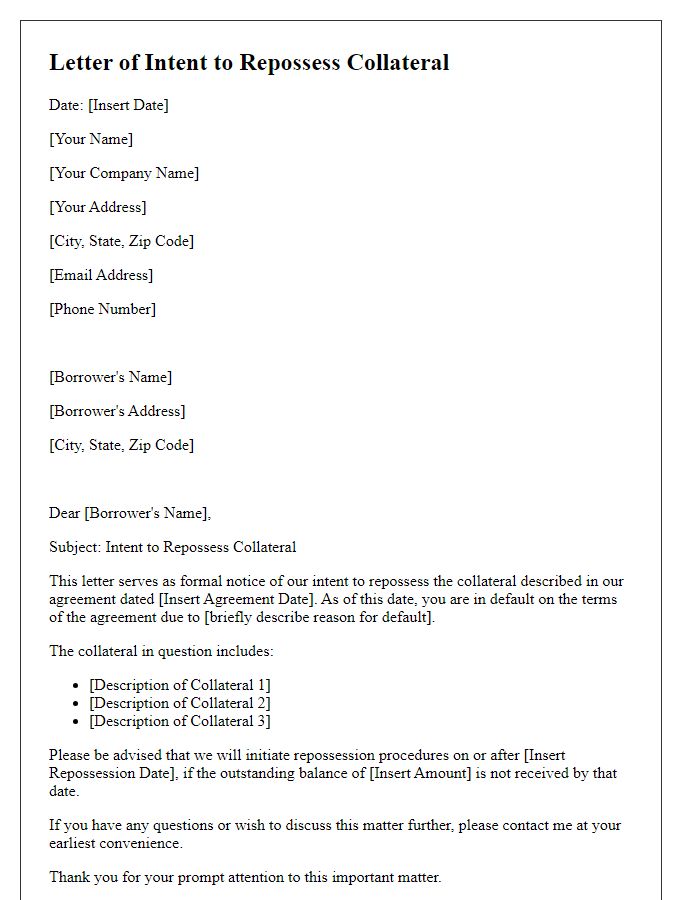

Legal justification and relevant clauses

Collateral repossession notices serve as formal notifications to borrowers regarding the recovery of secured assets due to default on loans. According to the Uniform Commercial Code (UCC), Article 9 governs secured transactions and outlines the conditions under which a lender can reclaim collateral. Key clauses often referenced include UCC SS9-609, which grants the secured party the right to take possession after default. Additionally, UCC SS9-610 discusses the process of selling or licensing the collateral after repossession while ensuring reasonable notification to the debtor. These legal justifications emphasize the lender's entitlement to recover assets like vehicles or equipment used as collateral when payments are not fulfilled, ensuring compliance with statutory obligations throughout the repossession process.

Description of collateral

The collateral involved in this repossession notice includes a high-end 2020 Ford F-150, showcasing a powerful 3.5L EcoBoost V6 engine that delivers robust performance with 400 horsepower. The vehicle, finished in a striking red metallic exterior, features premium package options, including leather seating for five occupants, an advanced infotainment system with a 12-inch touchscreen, and state-of-the-art safety features such as adaptive cruise control and lane-keeping assist. The odometer reads approximately 25,000 miles, indicating regular use while remaining in excellent condition. Additional accessories include a custom tow package and a bed liner, enhancing its utility for hauling or towing. This collateral is a vital asset, valued at approximately $40,000, providing significant financial security for the associated loan agreement.

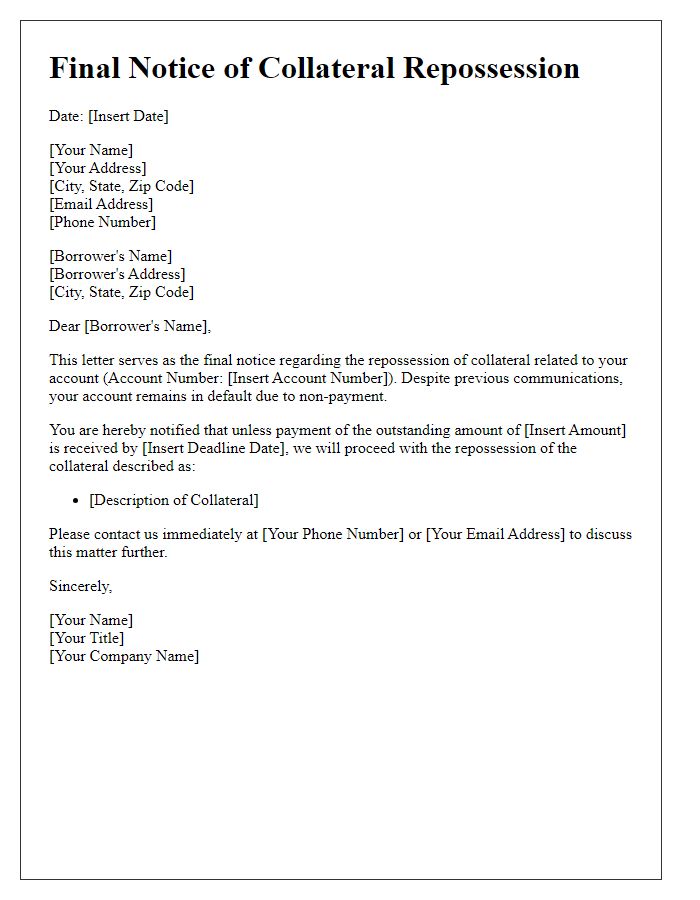

Deadlines and timelines for action

A collateral repossession notice is a formal communication regarding the reclaiming of collateral due to a loan default. This notice typically outlines specific deadlines for the borrower to take action, such as settling outstanding payments, which often range from 10 to 30 days depending on the lender's policies and state regulations. The notice should include the precise date by which the borrower must respond to avoid repossession, often highlighted prominently. In many regions, this period allows borrowers time to rectify financial discrepancies or negotiate payment plans, thereby potentially preventing loss of property, such as vehicles or real estate. Furthermore, the notice may reference relevant state laws or contracts that govern the repossession process, ensuring clarity on the legal implications involved if the action is pursued.

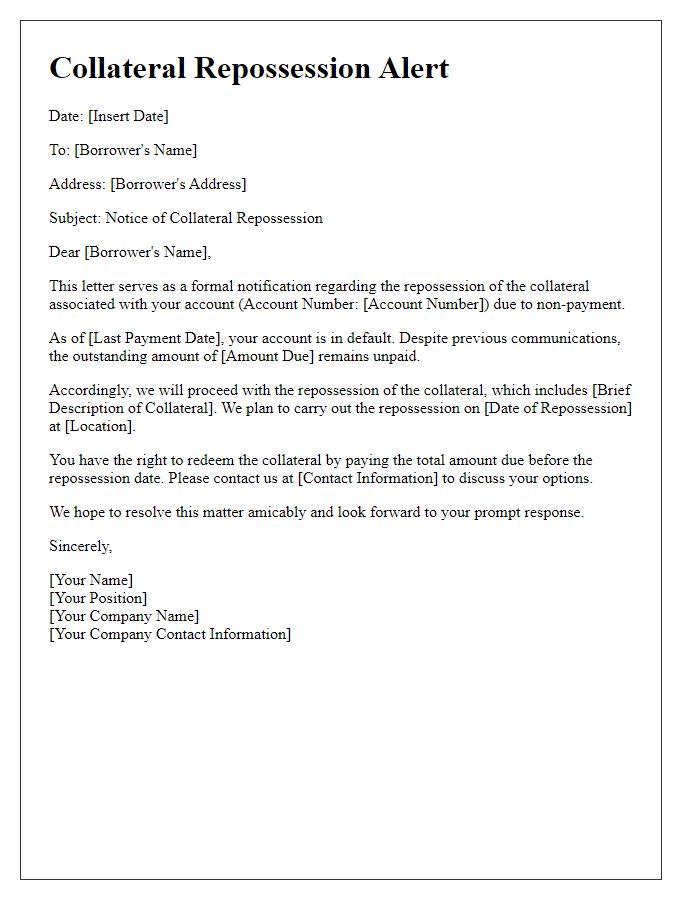

Contact information for queries and resolution

Collateral repossession notices typically include the following crucial elements. The creditor's contact information must remain clear, providing multiple avenues for communication. Include the name of the creditor, their designated phone number often available during business hours (9 AM to 5 PM), and an email address. Additionally, a physical address should be stated for any written correspondence. Providing a clear point of contact, such as a customer service manager, can facilitate resolution. Prompt responses to queries often reduce confusion, aiding in the resolution process regarding the collateral involved in repossession.

Comments