Are you navigating the world of credit cards and feeling a bit overwhelmed by the choice between secured and unsecured options? It's essential to understand the key differences that can impact your financial journey. Secured credit cards require a cash deposit, providing a safety net for both you and the lender, while unsecured cards hinge on your creditworthiness. Dive in with us as we explore the ins and outs of each type so you can make the best decision for your wallet!

Credit limit differentiation

Secured credit cards require a cash deposit that serves as collateral, influencing the credit limit, typically ranging from $200 to $2,500. Unsecured credit cards, in contrast, don't require a deposit, and credit limits can vary widely from $500 to $10,000 or higher, based on creditworthiness, income level, and credit history. For instance, high credit scores (above 700) may qualify individuals for higher limits, while lower scores may result in restrictive caps. Secured cards often benefit those rebuilding credit by reporting to major credit bureaus, whereas unsecured cards offer more flexibility but may carry higher interest rates and fees. Understanding the implications of credit limits in both options can impact financial planning and responsible usage.

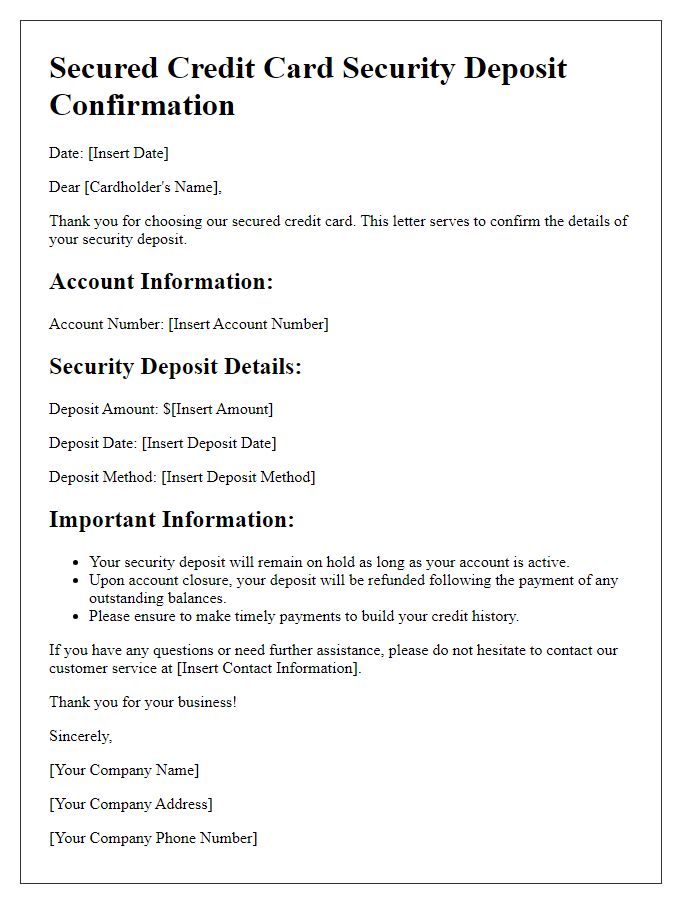

Security deposit requirements

Secured credit cards require a security deposit, typically ranging from $200 to $2,500, which serves as collateral for the credit limit. This deposit is held by the issuing bank (for example, Capital One or Discover) and can be refunded after account closure, provided there are no outstanding balances. Conversely, unsecured credit cards do not necessitate a security deposit, allowing cardholders to access credit limits based on their creditworthiness. However, interest rates may be higher for unsecured cards, especially for individuals with low credit scores. In general, both types of cards help build or improve credit history, making timely payments crucial to enhancing credit scores.

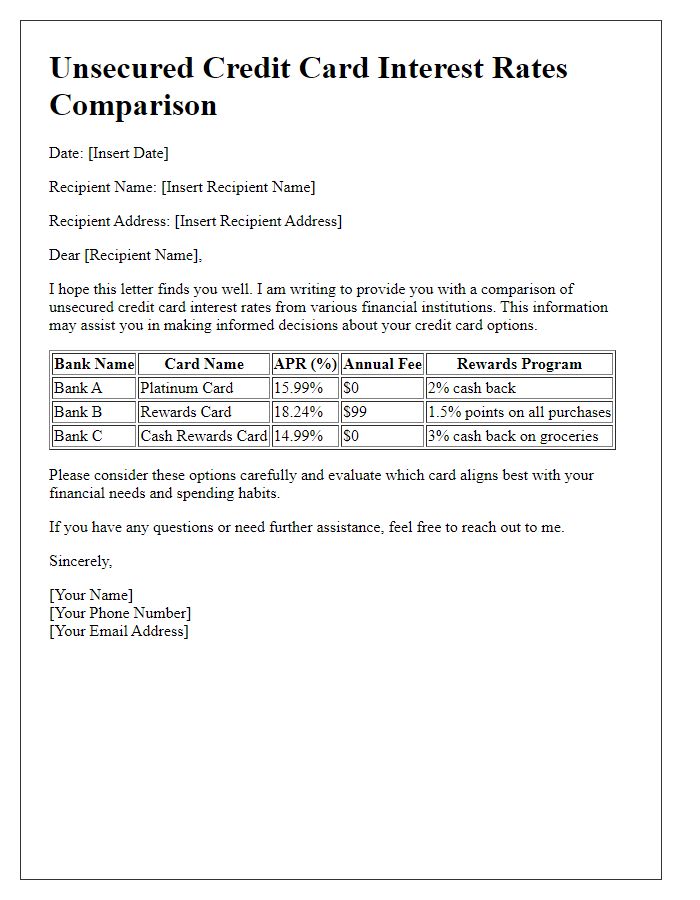

Interest rates comparison

Secured credit cards require a cash deposit as collateral, often ranging from $200 to $2,500, providing lower interest rates compared to unsecured cards. Typical interest rates for secured credit cards may fall between 12% and 24%, depending on the issuer and individual creditworthiness. Unsecured credit cards, however, usually have higher interest rates, ranging from 15% to 30%, due to the increased risk taken by lenders. Additionally, secured cards may offer benefits such as easier approval for those with poor credit history, while many unsecured cards provide rewards systems, promotional offers, and other perks appealing to a broader consumer base. Understanding these differences helps consumers make informed financial decisions.

Eligibility criteria

Secured credit cards require a cash deposit (typically equal to the credit limit) as collateral, allowing individuals with limited or poor credit history to establish or rebuild their credit profile. Unsecured credit cards, on the other hand, do not necessitate any deposit, extending credit based solely on the applicant's creditworthiness as assessed through their credit score, income level, and existing debt obligations. Eligibility criteria for secured cards often include age (at least 18 years), proof of income or employment, and residency status, while unsecured cards usually demand a higher minimum credit score (often 620 or above) and a stable income to qualify for favorable terms and conditions, including interest rates and credit limits.

Reporting to credit bureaus

Secured credit cards, often backed by cash deposits, typically report account activity to major credit bureaus, including Experian, Equifax, and TransUnion. These reports can positively impact credit scores when payments are made on time. Unsecured credit cards, which do not require collateral, also report to credit bureaus, influencing credit history and scores based on usage patterns. Both types of cards contribute to credit profiles, helping build or improve creditworthiness over time. It's crucial to monitor reports regularly for accuracy, ensuring that payment history and credit utilization ratios reflect a responsible borrowing behavior that lenders find favorable.

Letter Template For Credit Card Secured Versus Unsecured Information Samples

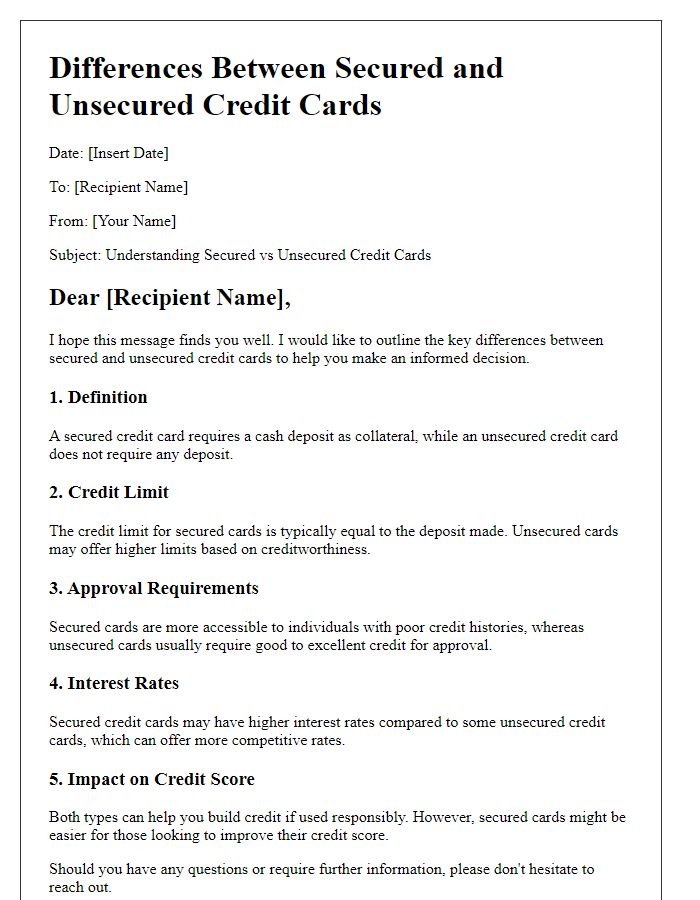

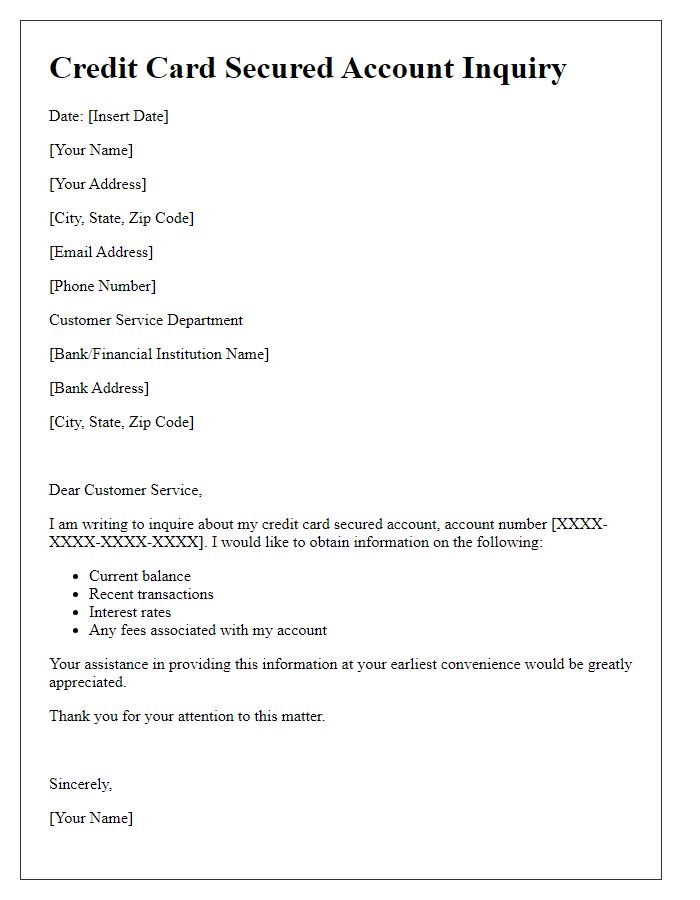

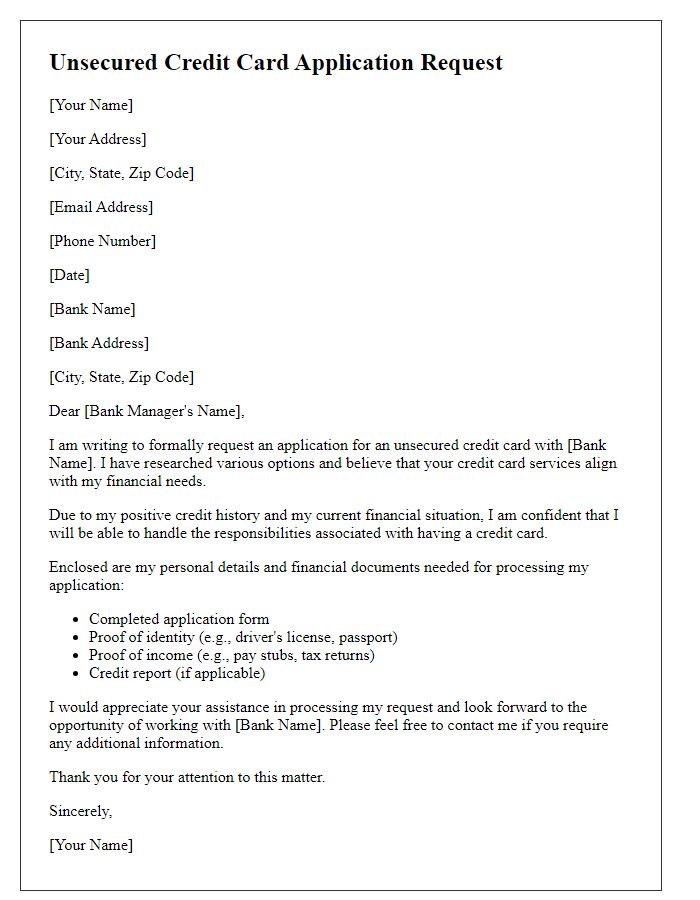

Letter template of differences between secured and unsecured credit cards.

Comments