Dealing with credit card debt can feel overwhelming, but you're not alone in this journey. It's important to explore viable options, and a debt settlement offer can be a practical solution to regain your financial footing. By negotiating a reduced amount to pay off your debt, you can alleviate stress and work towards a brighter financial future. Curious about how to draft an effective letter for your credit card debt settlement offer? Let's dive in!

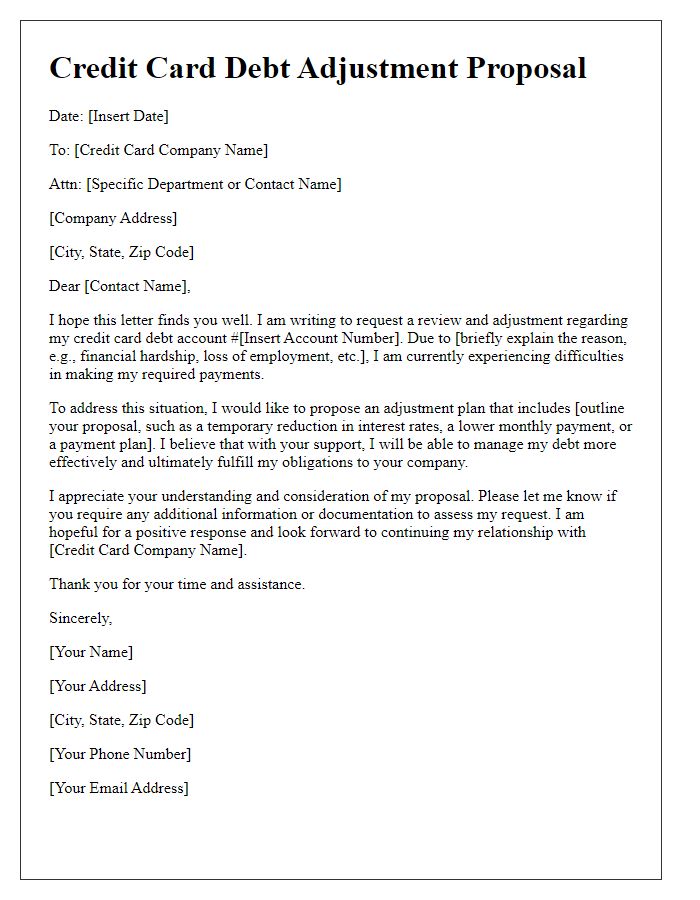

Account information and current balance.

Credit card debt settlement offers may include crucial account information such as the account number, which uniquely identifies the cardholder's account held by the financial institution, and the current balance, representing the total outstanding debt owed by the cardholder, often exceeding hundreds or thousands of dollars. The financial institution involved, such as a national bank or credit union, may provide insight into the interest rates applied to the account, which can be as high as 20-30% annually, impacting the overall debt amount. Moreover, details regarding payment terms and potential settlement percentages, typically ranging from 30-70% of the current balance, can significantly influence the negotiation process for settling the debt. Accurate documentation of these details is essential for establishing a clear communication channel during the settlement negotiations.

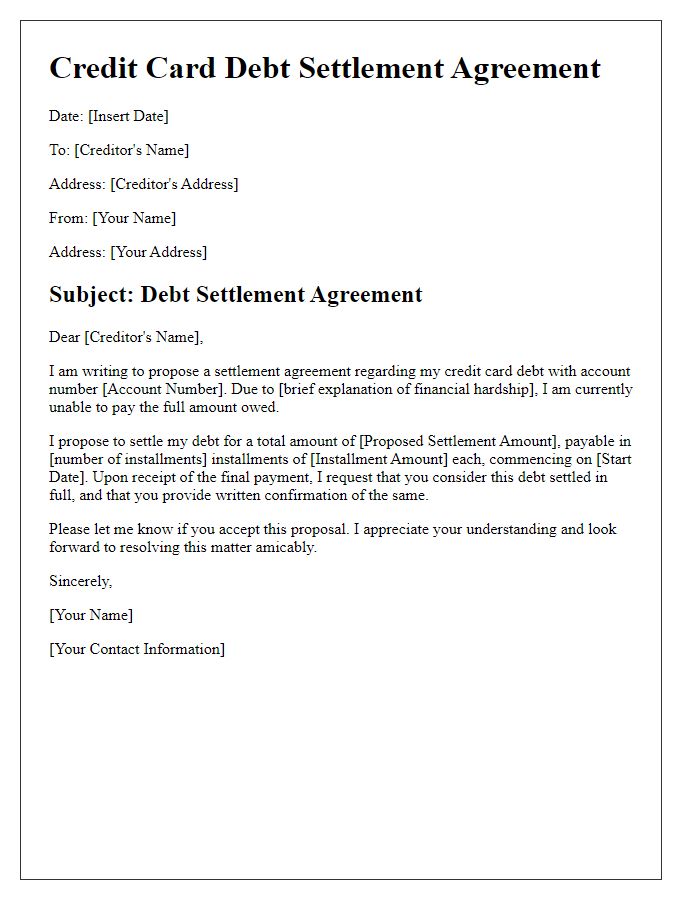

Proposed settlement amount and payment terms.

This topic highlights the process of negotiating credit card debt settlement, wherein individuals propose a specific settlement amount and terms to their creditors. Credit card debt, often associated with high-interest rates, can burden consumers, leading them to seek relief through negotiation. A settlement offer typically includes a proposed reduced balance, which may reflect a significant discount, and a structured payment plan detailing the number and size of payments. For example, a debtor might propose a settlement of $3,000 on a debt of $10,000, suggesting payments over six months. Successful negotiations can result in creditors agreeing to forgive the remaining balance, providing financial relief and a path towards a debt-free future. Additionally, forgiveness of certain debts may have tax implications that should be considered.

Explanation of financial hardship.

During the current economic downturn, many individuals face significant financial hardships, leading to challenges in managing credit card debt obligations. An alarming 40% of American households report difficulty in paying off credit card balances, with average debts exceeding $6,000 per household. Personal circumstances such as job loss, medical emergencies, or unexpected expenses often contribute to this growing financial burden. This economic strain has hindered the ability to meet monthly payments, resulting in mounting interest charges. Many creditors, including major institutions like Citibank and American Express, have implemented flexible repayment options, recognizing the importance of providing assistance to struggling consumers in this precarious financial landscape. Seeking a settlement can ease the burden and allow for a more manageable path towards recovery.

Request for written confirmation of agreement.

Credit card debt settlement offers can significantly impact financial obligations, particularly in relation to outstanding balances owed to issuers like Visa or Mastercard. An agreement typically involves negotiating a reduced payment amount to clear debts, often resulting in financial relief and improved credit scores over time. Requesting written confirmation solidifies the terms of the settlement, ensuring protection against future disputes. Documented agreements often detail specifics such as reduced payment amounts, deadlines for payments, and consequences of non-compliance, essential for maintaining transparency in financial dealings. In many cases, financial institutions may require full payment by a specific date to finalize the settlement, making this confirmation vital for both parties involved.

Contact information for follow-up.

To effectively negotiate a credit card debt settlement offer, ensure to include your full name, address (including city, state, and zip code), email address, and phone number for prompt follow-up. Include your credit card account number (specific account associated with the debt) and the name of the issuing bank or financial institution (such as Chase, Bank of America, etc.). Make sure to specify any preferred times for contact to facilitate communication. Clearly articulate the details of your proposed settlement offer, including the total amount you are willing to pay (proposed settlement amount), and any timelines for payment completion to enhance clarity.

Comments