Are you finding it challenging to keep up with your credit card payments? You're not alone; many people are seeking ways to manage their debt more effectively, and a repayment assistance plan could be just the solution you need. These plans are designed to provide relief by offering flexible payment options and lower interest rates tailored to your financial situation. Curious about how you can take advantage of these services? Read on to discover more about the credit card repayment assistance plan and how it can help you regain control of your finances!

Personal financial situation and hardship explanation

Personal financial hardship often results from unforeseen circumstances such as job loss, medical emergencies, or significant life changes. Individuals may experience challenges in meeting monthly financial obligations, including credit card repayments. Such situations can lead to increased levels of stress and anxiety, compounded by outstanding debts and accumulating interest rates. Seeking assistance through a credit card repayment plan can provide necessary relief by allowing for reduced payment amounts or modified terms, helping individuals regain financial stability. Professional guidance from financial counseling services can also be beneficial in creating a sustainable repayment strategy tailored to one's unique financial situation.

Specific repayment assistance request details

Many individuals face financial difficulties requiring a structured approach to credit card repayment. A repayment assistance plan typically involves scheduled installments tailored to a personal budget, often reducing monthly payments significantly. Credit card issuers, such as Visa and MasterCard, may offer specific programs for temporary hardship, allowing consumers to request reduced interest rates, extended payment terms, or suspension of payments for a particular period. Essential details for a repayment assistance request often include account numbers, outstanding balances, specific hardship circumstances (medical emergencies, job loss), and proposed payment amounts. By detailing these factors, borrowers can present a comprehensive case for assistance, potentially alleviating their financial stress while maintaining a positive relationship with the creditor.

Credit card account information

Many individuals struggle with credit card debt, often stemming from high interest rates (average 15-25% APR) accruing on their outstanding balances. Credit card accounts, such as Visa, MasterCard, and American Express, typically possess unique identifiers like the 16-digit number printed on the card face. Outstanding debts, often calculated monthly, reveal how financial institutions allow consumers to carry balances, sometimes leading to minimum payments that primarily cover interest. Creditors may offer repayment assistance plans, designed to reduce monthly financial burdens, providing alternatives such as lower interest rates or extended payment terms to facilitate manageable repayment schedules and support fiscal health.

Proposed repayment plan and timeline

A proposed credit card repayment assistance plan outlines a structured method to manage outstanding credit card debt effectively while maintaining financial stability. In 2023, individuals facing challenges like job loss or medical expenses may need to consider negotiation options with financial institutions. A suggested timeline, spanning six months, can include an initial phase of reduced payments, followed by a steady increase, culminating in full repayment by the end of the proposed period. For example, starting with a 30% reduction in monthly payments (for instance, a decrease from $500 to $350) can facilitate manageable adjustments, while maintaining communication with the bank (e.g., Bank of America or Chase) ensures clarity on the modified terms. Detailed documentation regarding this repayment framework is vital, including specific due dates, payment amounts, and total debt owed to ensure accountability and prevent late fees.

Contact information for follow-up and communication

A credit card repayment assistance plan can significantly ease financial burdens for individuals struggling with debt from various credit cards, including Visa and MasterCard. Providing clear contact information is essential for effective follow-up and communication with customers seeking support. This may include dedicated phone lines, such as a toll-free number (1-800-555-0199), or email addresses (support@credithelp.com) specifically set up to address inquiries regarding repayment plans. The inclusion of office hours (Monday to Friday, 9 AM to 5 PM) ensures individuals know when assistance is available. Additionally, a physical mailing address (123 Financial Way, Suite 200, City, State, Zip) can facilitate communication via traditional methods, enhancing accessibility for all clients needing guidance through their repayment journey.

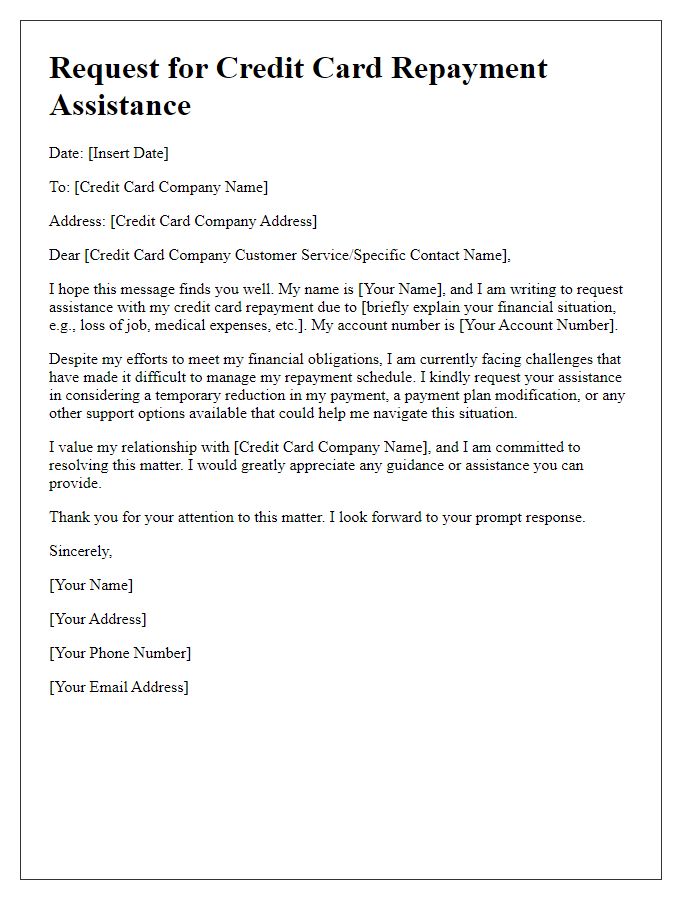

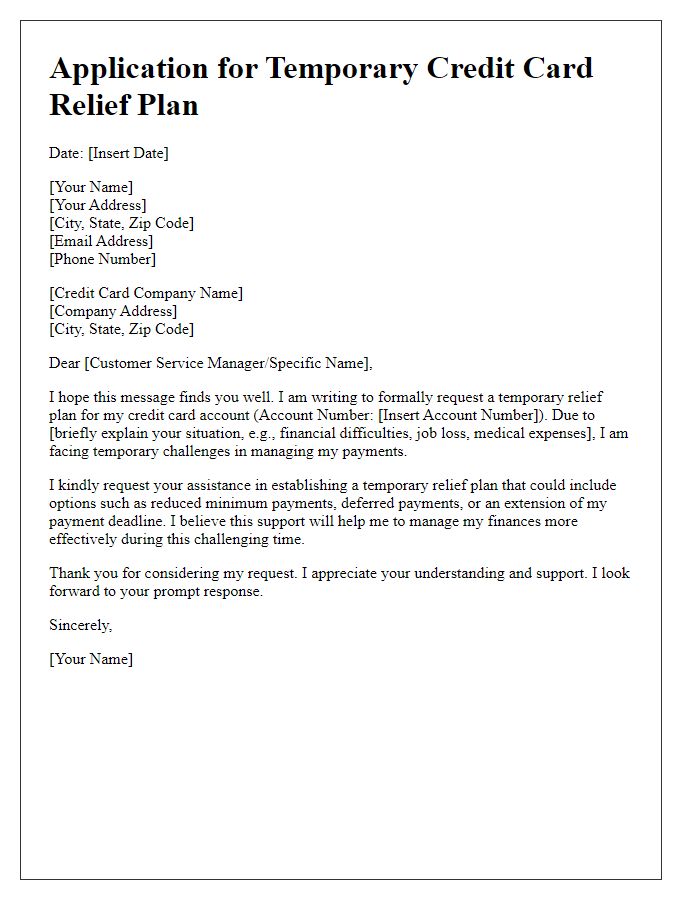

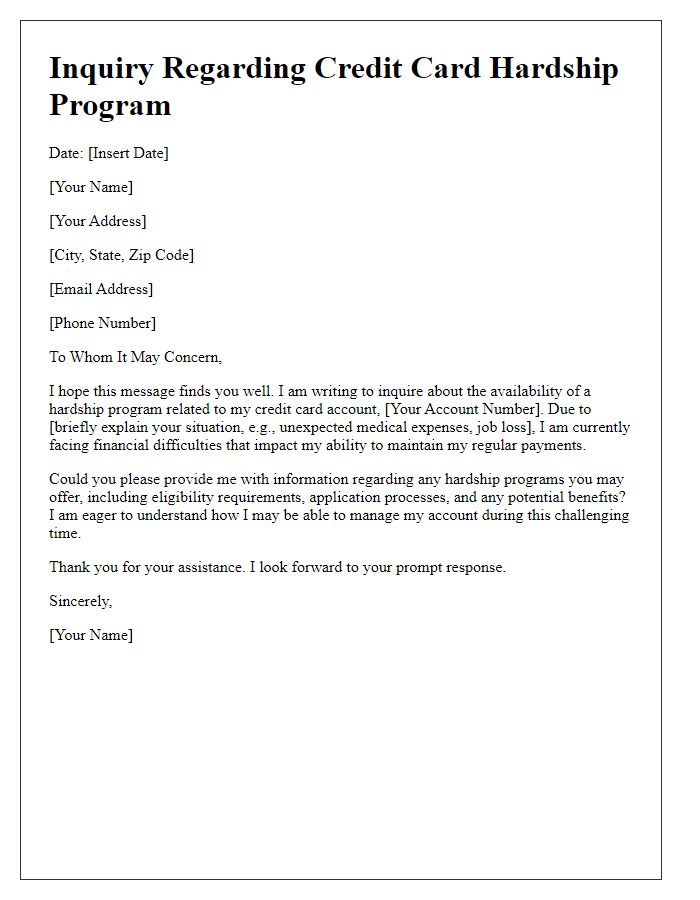

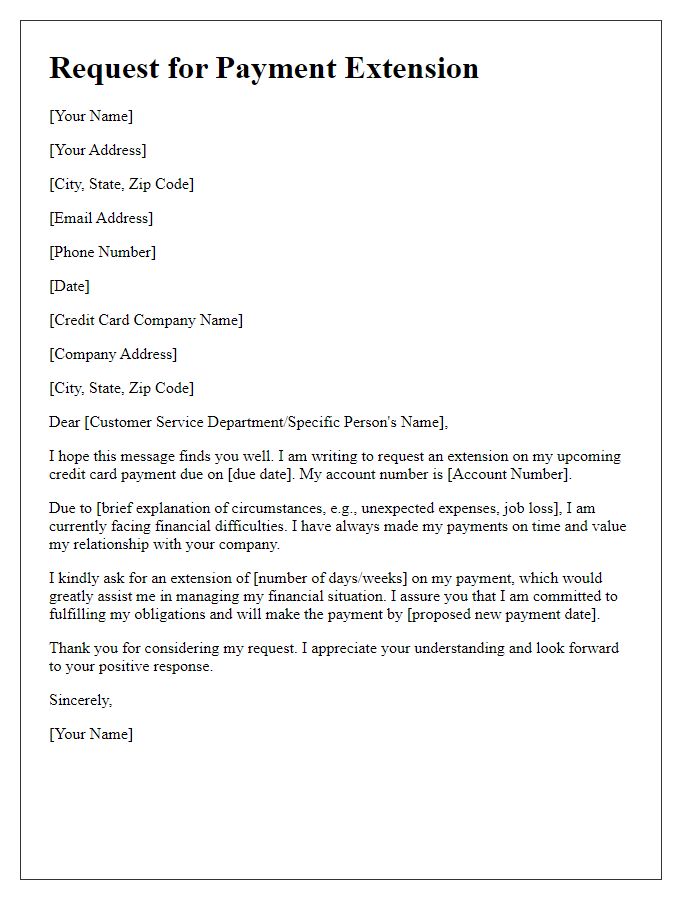

Letter Template For Credit Card Repayment Assistance Plan Samples

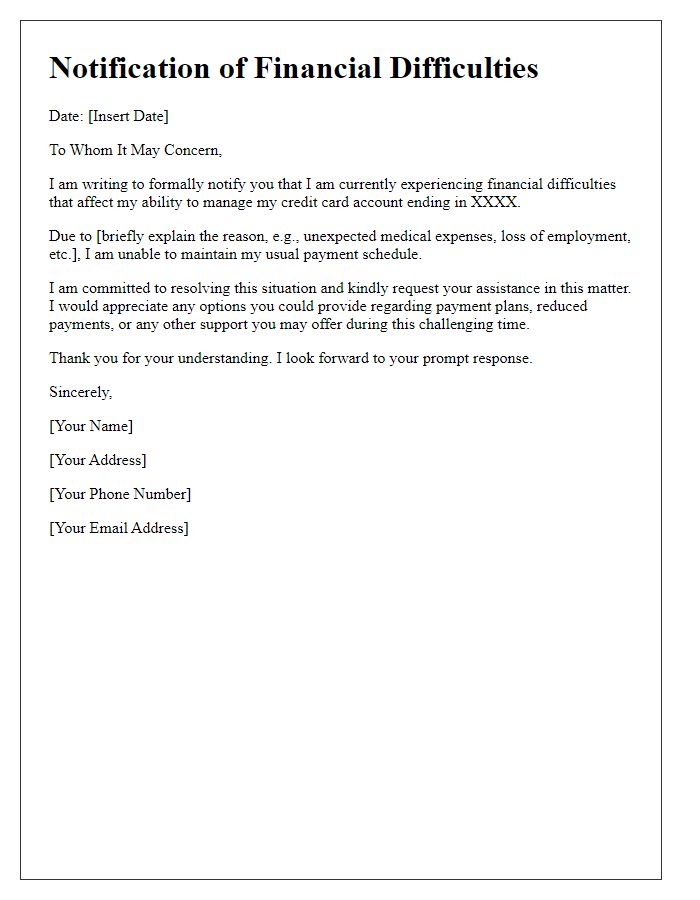

Letter template of notification for financial difficulties with credit card.

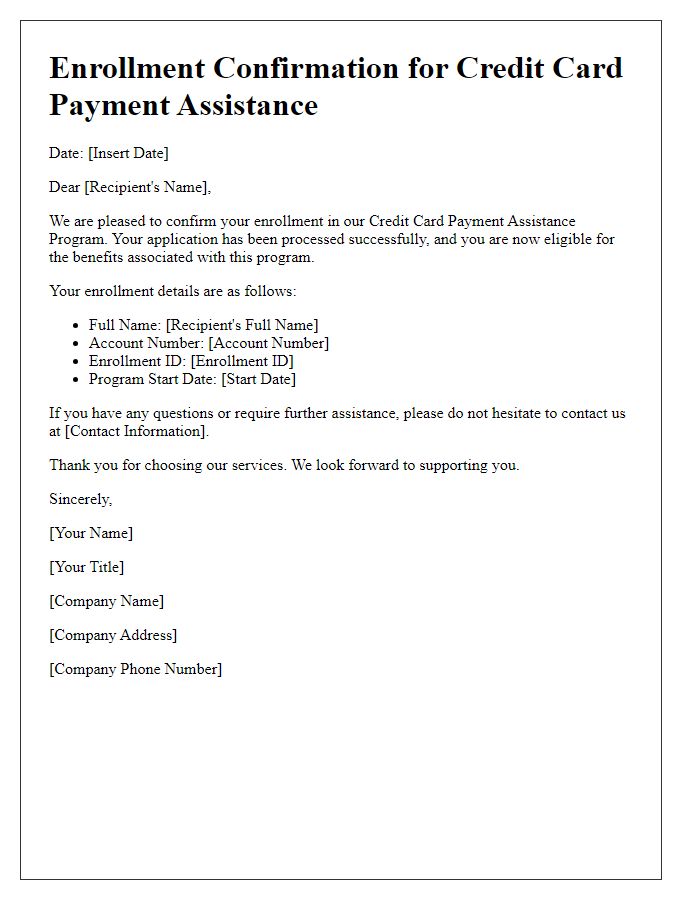

Letter template of confirmation for enrollment in credit card payment assistance.

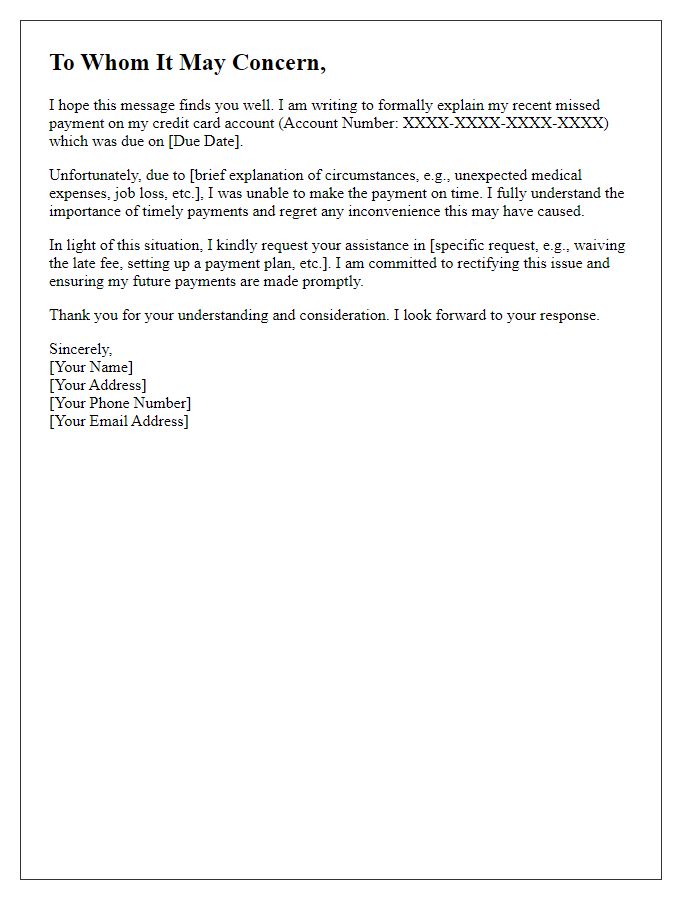

Letter template of explanation for missed credit card payment and assistance needed.

Comments