Have you ever found yourself in a situation where you need to reset your credit card PIN but aren't sure how to start? The process can feel overwhelming, but crafting a clear and concise letter can make it a breeze. In this article, we'll walk you through a simple letter template that will help you request a PIN reset smoothly and efficiently. So, let's dive in and simplify the process together!

Account Information

Credit card Personal Identification Number (PIN) reset requests are critical for maintaining account security. The cardholder must provide essential account information, including the 16-digit credit card number, expiration date (MM/YY), and the last four digits of the Social Security number (SSN) to verify identity. This verification process usually takes place during a defined timeframe, often within business hours from 9 AM to 5 PM, to ensure proper account handling. Additionally, financial institutions may involve a follow-up method, such as a registered email or phone call, to confirm the requester's identity before reissuing a new PIN. Security measures considering potential identity theft scenarios in high-risk areas, such as online transactions or public Wi-Fi networks, enhance the request's safety.

Reason for Request

Credit card holders may require a Personal Identification Number (PIN) reset due to various circumstances. Common reasons for this request include forgetting the current PIN, encountering system errors that prevent PIN entry, or suspecting unauthorized access to the account due to potential data breaches. Additionally, changes in banking practices may prompt users to update their PINs as a precautionary measure. Enhanced security protocols, such as those established after notable breaches at institutions like Capital One in 2019, emphasize the importance of maintaining a secure PIN. Therefore, ensuring that customers have the ability to easily reset their PIN is vital for protecting sensitive financial information.

Security Verification

To reset a credit card Personal Identification Number (PIN), customers must undergo a security verification process. This typically includes providing identification details such as the full credit card number, which is a 16-digit code, and the card expiration date formatted as MM/YY. Additionally, the cardholder may need to confirm their billing address, which includes street name, city, state, and ZIP code, ensuring accuracy with the data on file. For those using online services, an authentication code sent via SMS (standardly a six-digit number) or email may also be required for enhanced security measures. Once successful verification is complete, users can set a new PIN, which ideally should comprise four to six digits, maintaining a level of complexity to enhance security against unauthorized access.

Contact Details

Requesting a credit card PIN reset is essential when experiencing security concerns or forgetting the current PIN. For this process, users typically provide contact details including a primary phone number (area code 555, for example) and an email address (for notifications, often using providers like Gmail or Yahoo). It is crucial to include the credit card issuer's name (e.g., Bank of America, Chase) along with the relevant account numbers (last four digits for security). Providing additional information such as date of birth (MM/DD/YYYY format) or mailing address (including city, state, and ZIP code) may enhance the request's validity. A securely transmitted request through a verified communication channel, such as a bank's official website or customer service line, ensures prompt processing.

Request for Confirmation

Credit card PIN reset procedures are crucial for maintaining financial security. Users must verify their identity through an official channel, such as a bank branch or a secure online portal. The request typically requires personal details like account number, social security number, and potentially, the bank's customer service phone number. Once submitted, financial institutions process the request, often sending a confirmation email or SMS. For instance, major banks like JPMorgan Chase or Bank of America may take up to 48 hours to complete the PIN reset, after which clients receive instructions on creating a new PIN. These protocols ensure unauthorized access is prevented, safeguarding personal and financial information.

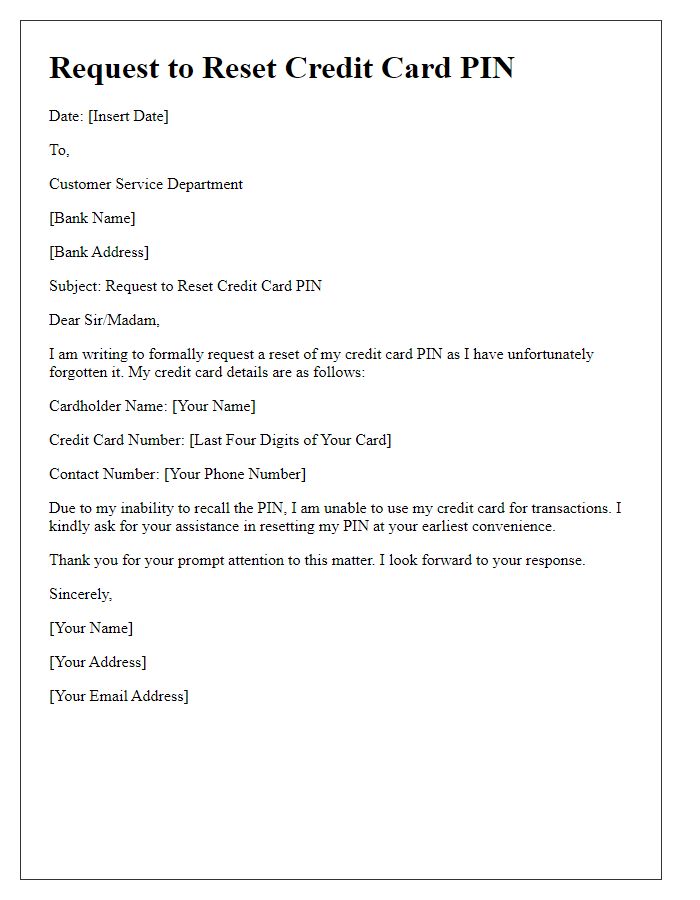

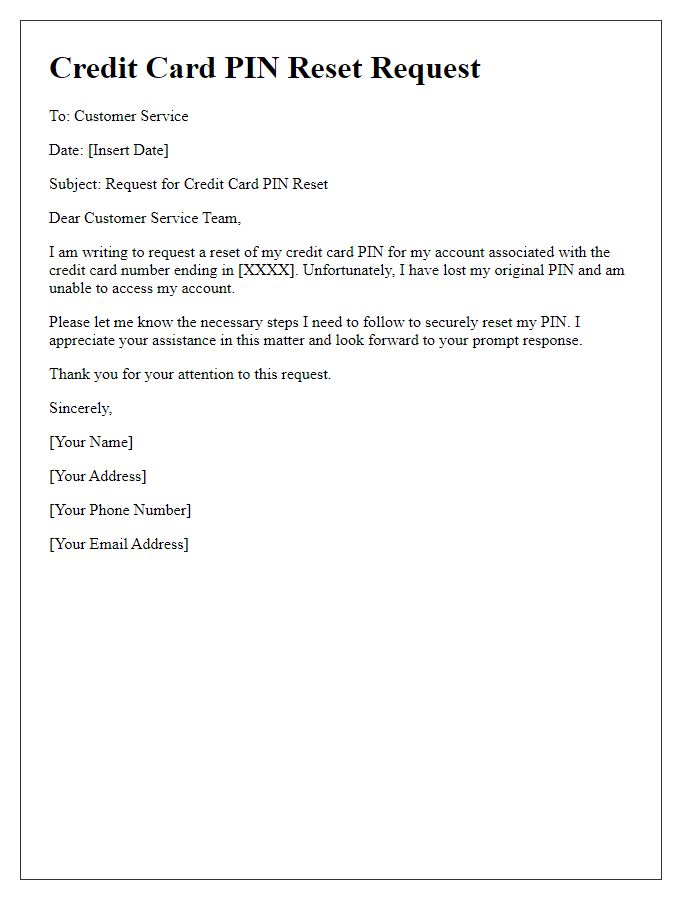

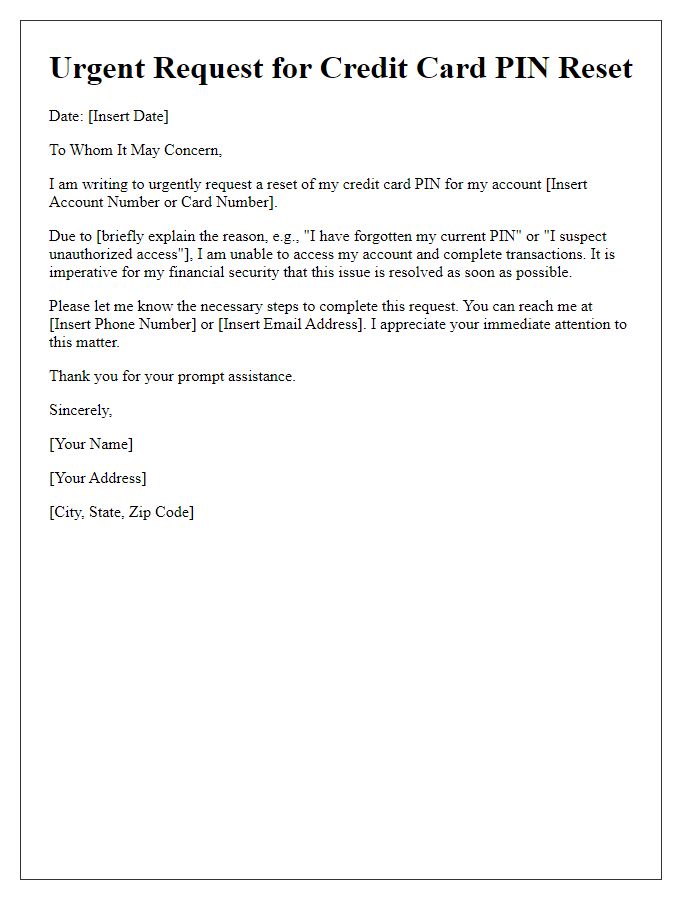

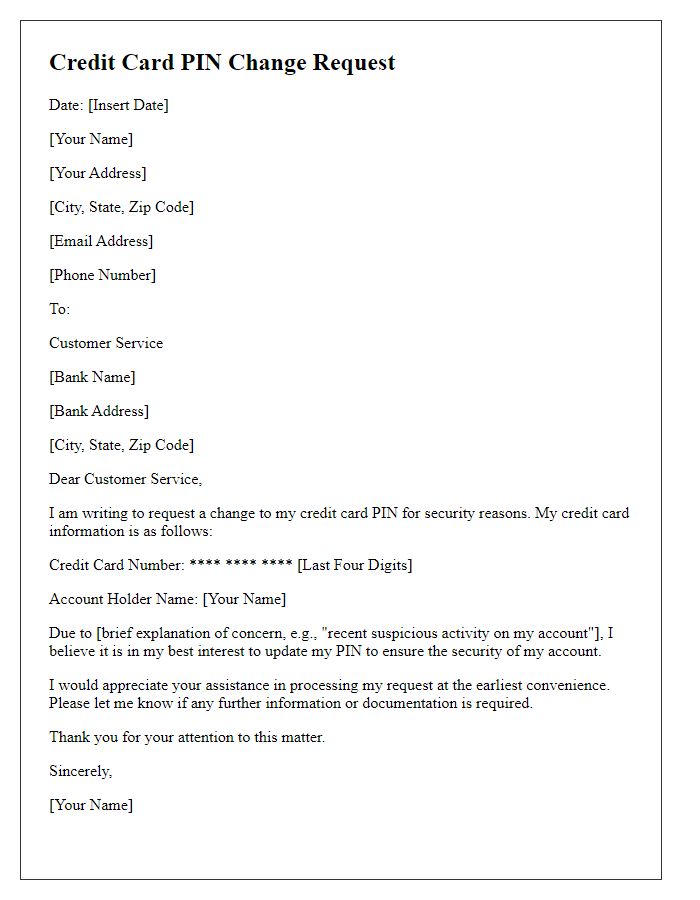

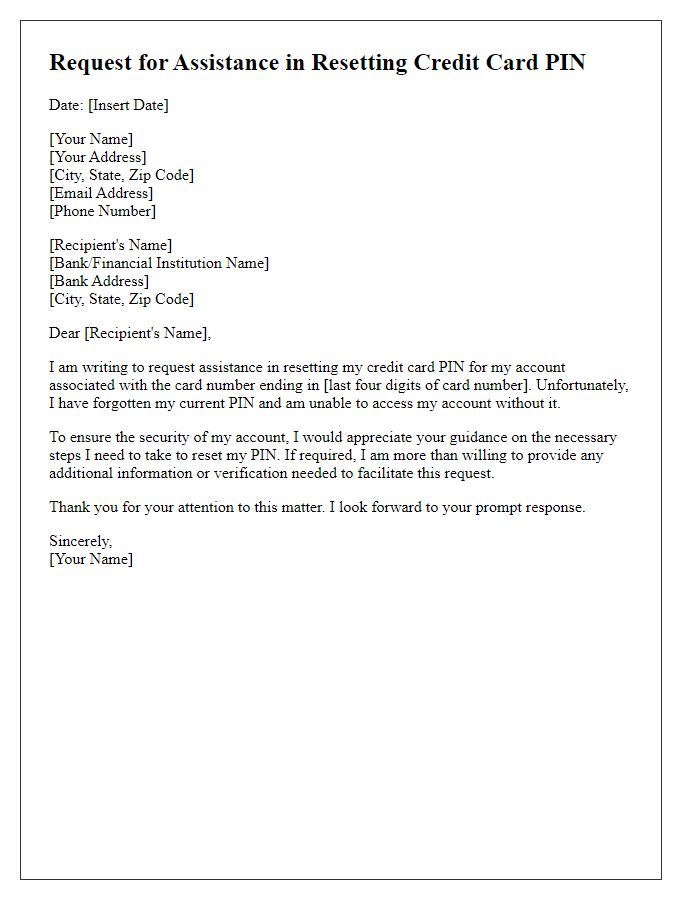

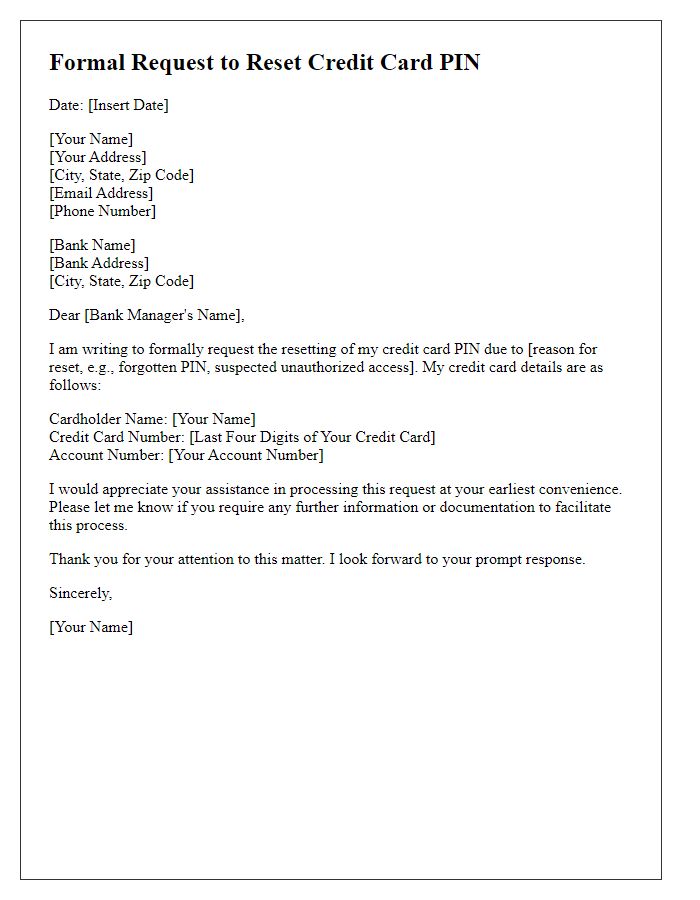

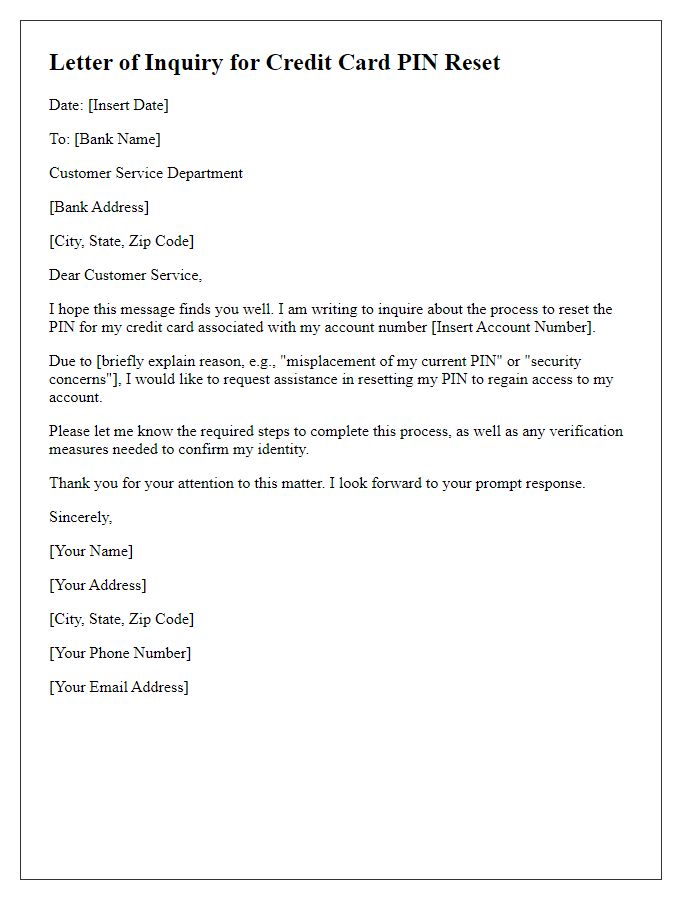

Letter Template For Credit Card Pin Reset Request Samples

Letter template of Request to Reset Credit Card PIN Due to Forgotten PIN

Comments