Are you feeling overwhelmed by your credit card bills? Excessive usage can lead to financial stress and unexpected debt, which is why it's essential to stay informed about your spending habits. In this article, we'll explore how to recognize the signs of overspending and discuss practical strategies to regain control of your finances. So, let's dive in and discover how you can take charge of your credit card usage today!

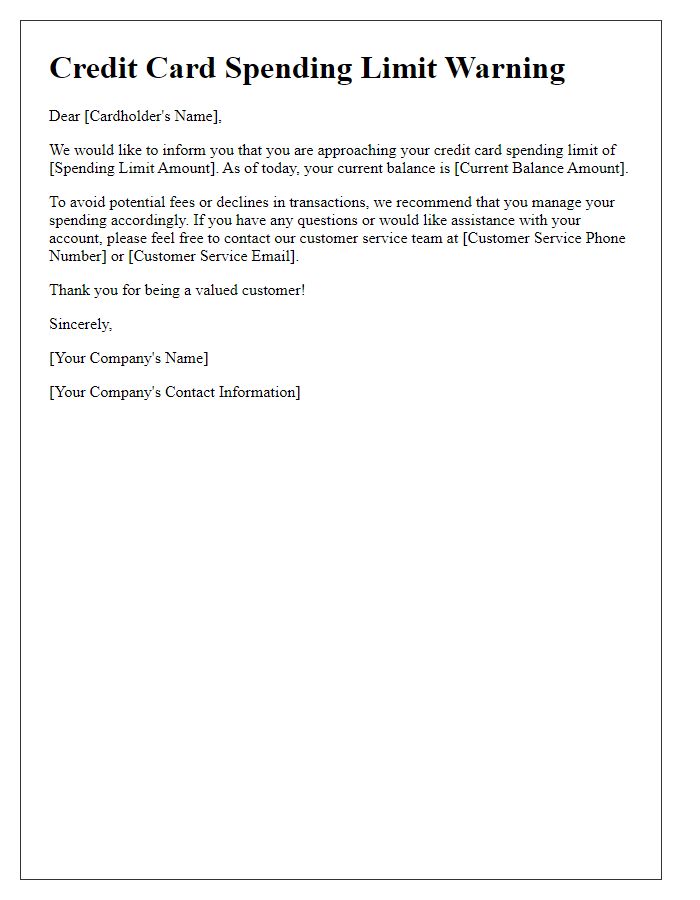

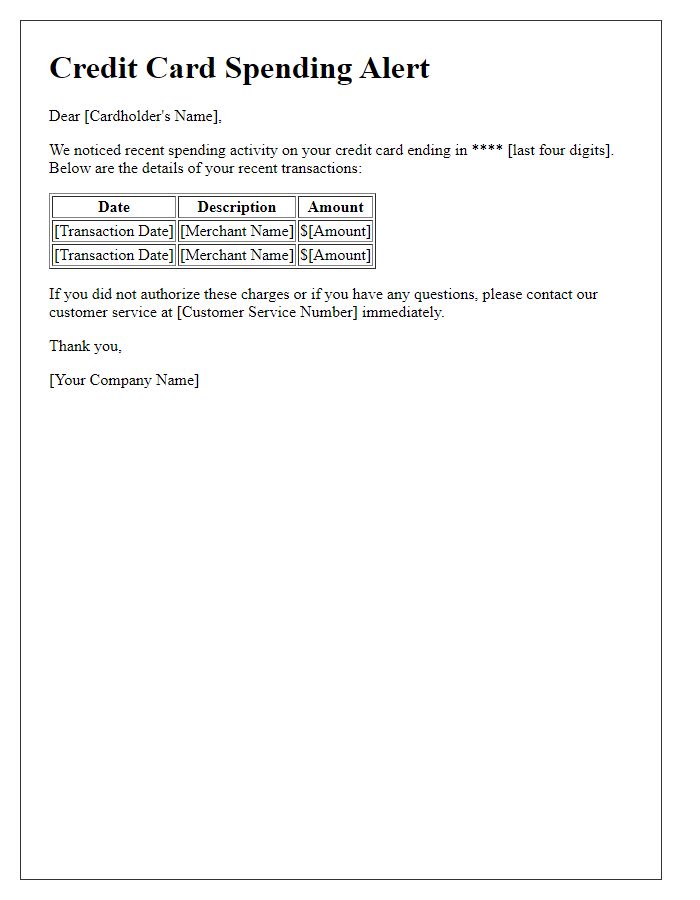

Personalized Account Details

Excessive usage of credit cards often leads to financial strain for account holders, particularly for those with a credit limit exceeding $5,000. Automated alerts generated by financial institutions, like Bank of America or Chase, notify users when spending surpasses 70% of their credit limit within a billing cycle. High transaction frequencies, such as more than 10 charges in a single week, can trigger warnings about potential debt accumulation. Additionally, suspected fraudulent activities may prompt these alerts, especially if transactions occur in unusual locations, such as overseas purchases while the account holder is at home. Early intervention through these alerts aims to prevent further overspending, maintain account security, and encourage responsible financial behavior.

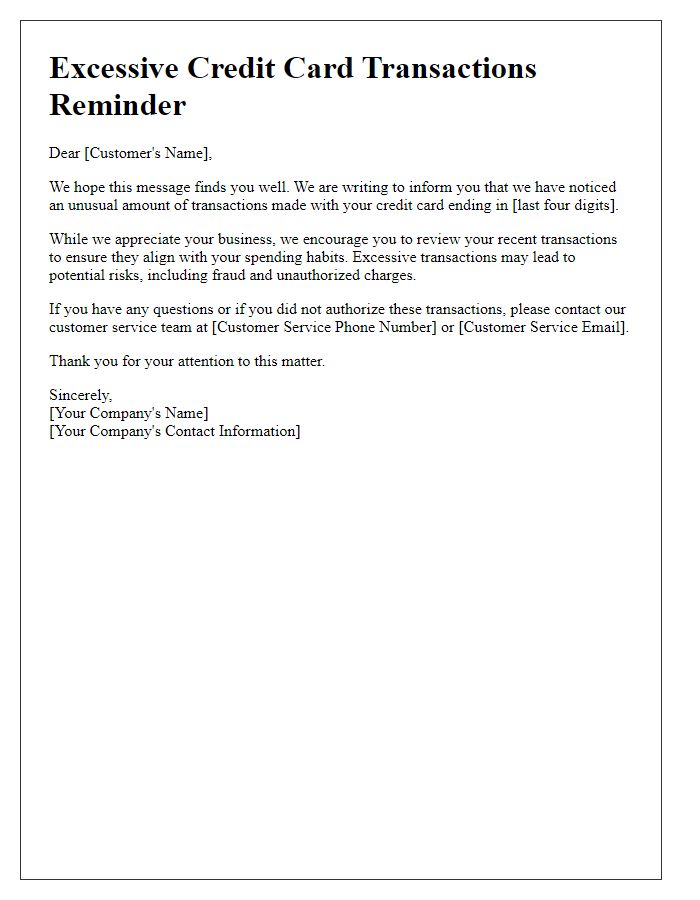

Clear Usage Threshold Information

Excessive credit card usage can lead to financial strain and impact your credit score significantly. Many banks, including major institutions like Chase and Bank of America, set clear usage thresholds, typically at 30% of your credit limit, to help customers manage their spending. For example, if your credit limit is $5,000, exceeding $1,500 may trigger alerts. Frequent alerts can indicate patterns of overspending, potentially affecting your payment history. Establishing a budget and keeping expenditures within recommended limits is essential for maintaining financial health and avoiding high-interest debt accumulation.

Consequences of Excessive Usage

Excessive credit card usage can lead to serious financial consequences, including high-interest debt accumulation. For example, credit cards often charge annual percentage rates (APRs) ranging from 15% to 25%, significantly increasing the total amount owed. Late payment penalties may apply, typically ranging from $25 to $39 depending on the issuer. Additionally, credit utilization ratio (the percentage of credit used compared to the total credit limit) exceeding 30% can negatively impact the credit score, which may hinder future loan approvals or result in less favorable interest rates. Bank fees for exceeding credit limits can further exacerbate the financial strain, costing an additional $35 on average. Responsible usage is essential to maintain financial health and avoid these consequences.

Contact Information for Assistance

Excessive usage of credit cards can lead to financial distress and potential penalties. Institutions monitor spending patterns closely, particularly sudden changes in transaction amounts or frequency, often noted in high-end retail purchases or excessive cash advances. Many credit card providers issue alerts when spending surpasses usual limits, typically set at 30% of the available credit balance. To assist customers, most institutions provide dedicated contact information for support services, often listed on the back of the card or within online banking portals. Customers should ensure they keep this information accessible to address issues promptly and manage their finances effectively.

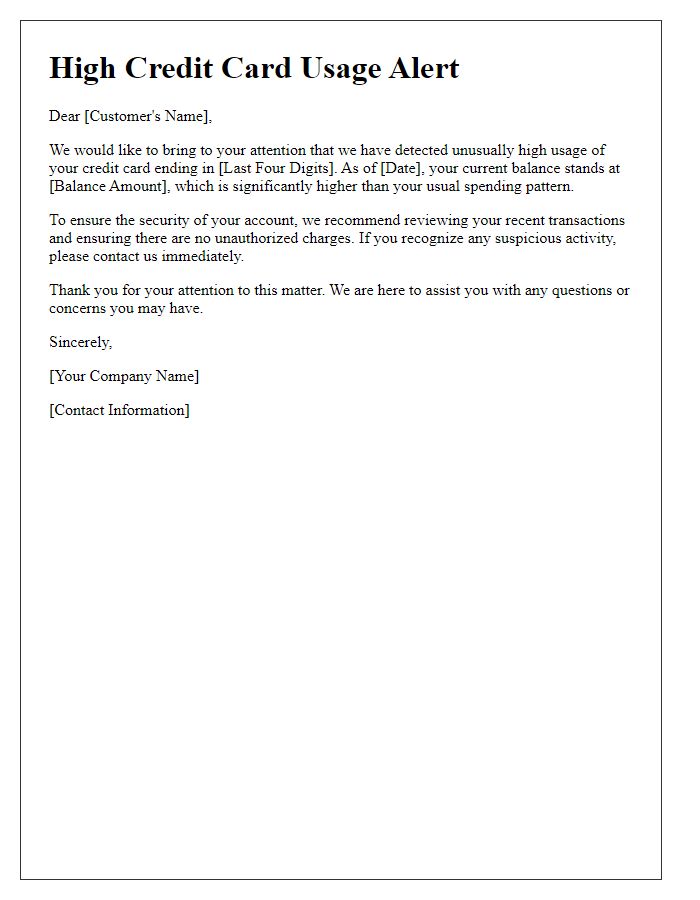

Encouragement for Responsible Usage

Credit card holders often experience excessive charges, especially during shopping events like Black Friday or holiday sales. Responsible credit card usage is crucial for maintaining financial health, as overspending can lead to debt accumulation. For instance, running up a balance exceeding 30% of the credit limit may negatively impact credit scores. Financial institutions recommend monitoring expenditures closely, promoting budgeting strategies. Utilizing mobile banking apps can aid in tracking transactions in real-time, ensuring that cardholders stay within their means. Regularly reviewing monthly statements fosters awareness of spending habits and empowers individuals to make informed financial decisions.

Comments