Are you tired of missing due dates and incurring late fees on your credit card payments? Setting up automatic payments is a simple and effective way to keep your finances on track. With just a few easy steps, you can ensure your payments are made on time, every time. Join us as we explore how to set up automatic payments for your credit card and enjoy peace of mind knowing your finances are handled effortlessly!

Account Information

Setting up automatic payments for credit card accounts streamlines financial management, ensuring timely payments and avoiding late fees. A credit card account number, typically 16 digits, is essential for linking accounts. Payment amounts can be set to either a fixed amount or the minimum payment based on billing statements, which are usually generated monthly. It's crucial to monitor the due date, often the same each month, to ensure funds are available in the linked bank account, preventing overdraft situations. Additionally, providing the financial institution's routing number, usually a 9-digit code, enables seamless transfers between accounts. This system promotes better credit utilization and improves credit scores over time, fostering a positive financial history.

Payment Authorization Details

Setting up automatic payments for credit card transactions ensures timely bill settlements for services or bills. Individuals typically authorize their financial institutions, like Chase or Bank of America, to debit specific amounts from their credit cards, such as monthly utility bills averaging $120. Details required for this setup often include the cardholder's full name, credit card number, expiration date (commonly a four-digit number), and billing address. Additionally, providing a signed authorization form can secure consent for recurring charges. This seamless process aids in avoiding late fees, preserving credit scores, and ensuring uninterrupted access to essential services like internet, phone, and insurance.

Bank Account Details

Setting up automatic payments for credit cards requires specific bank account details that ensure timely and accurate transactions. Provide the account number, a unique identifier for your bank account, and the routing number, a nine-digit code used to identify the financial institution. Include the name of the bank, as seen on official statements, and the account type, whether it is checking or savings. Specify the payment frequency, such as monthly or biweekly, and state the exact amount to be deducted, ensuring that it aligns with your credit card billing cycle, typically due by every 15th or 30th of the month, depending on the issuer. Also, it is prudent to note any changes in the account or payment amount in advance to prevent overdraft fees or missed payments.

Contact Information

Setting up automatic payments for credit cards ensures timely bill payments, reducing late fees and maintaining a good credit score. Credit card issuers such as Visa and Mastercard typically require essential contact information including full name, billing address (which may include street, city, state, and zip code), phone number for customer support, and email address for transaction alerts. Providing an accurate bank account number and routing number facilitates seamless transactions from checking accounts. The process often involves filling a form online or contacting customer service directly. Confirmations may be sent via email or through the issuer's mobile app, providing an additional layer of security and peace of mind.

Terms and Conditions Agreement

To set up automatic payments for a credit card, customers must agree to specific terms and conditions. The agreement outlines essential factors such as payment frequency, typically monthly, and due dates that align with the billing cycle. Customers must provide necessary personal information such as credit card number, expiration date, and billing address. The bank or credit card issuer may outline the consequences of insufficient funds, which could include late fees, interest charges, or potential impact on credit scores. Additionally, conditions regarding cancellation policies should be clearly stated, allowing customers to discontinue automatic payments easily by providing written notice a certain number of days before the next due date. Furthermore, the agreement may specify that terms might change with prior notice, ensuring customers stay informed about potential adjustments in fees or payment structures. Customers must also understand their liability in case of unauthorized transactions, typically limited to $50 unless gross negligence is proven.

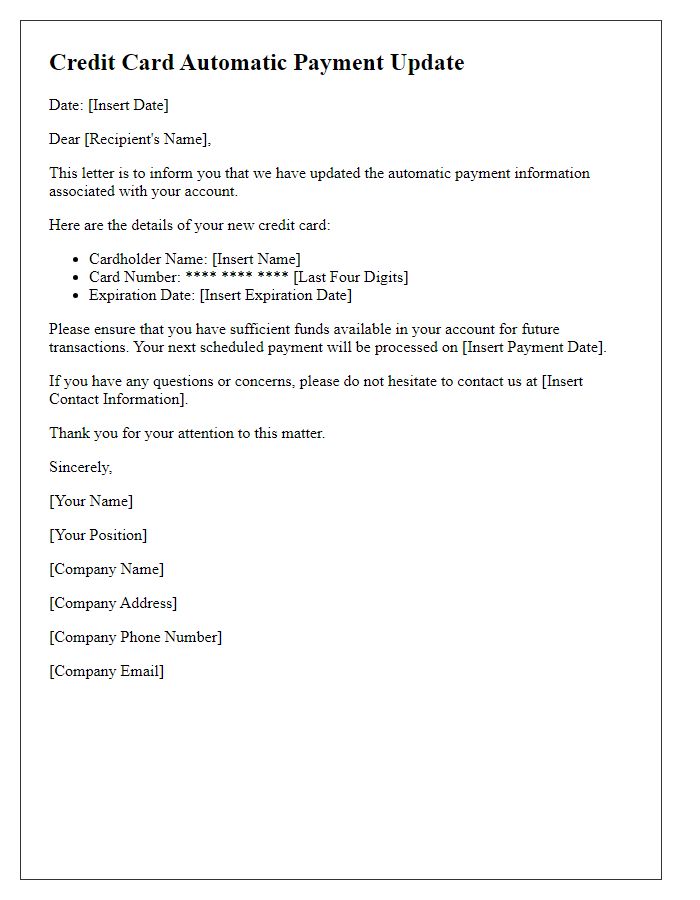

Letter Template For Credit Card Automatic Payment Set Up Samples

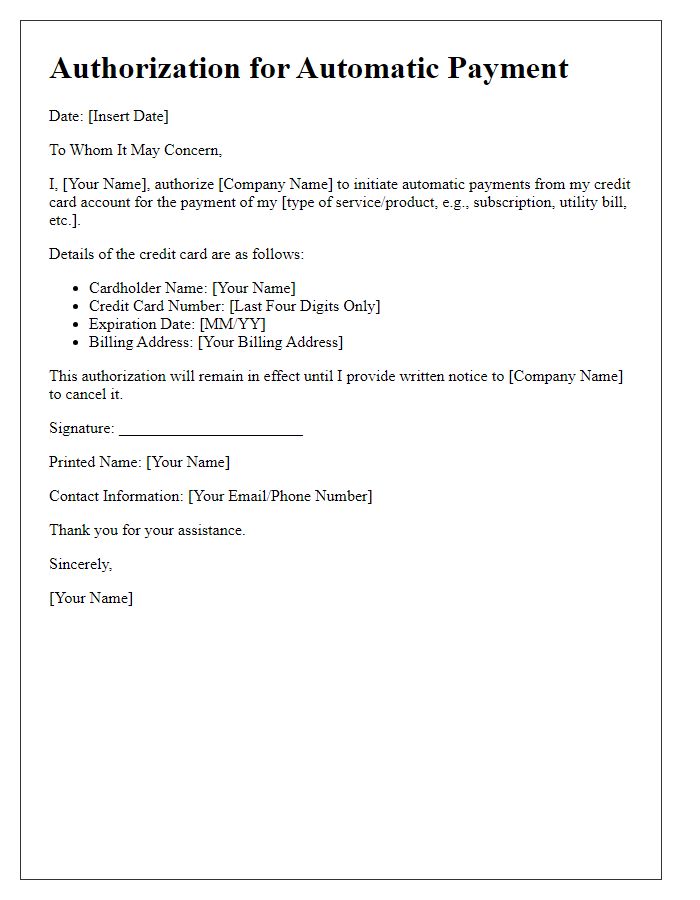

Letter template of authorization for credit card automatic payment setup

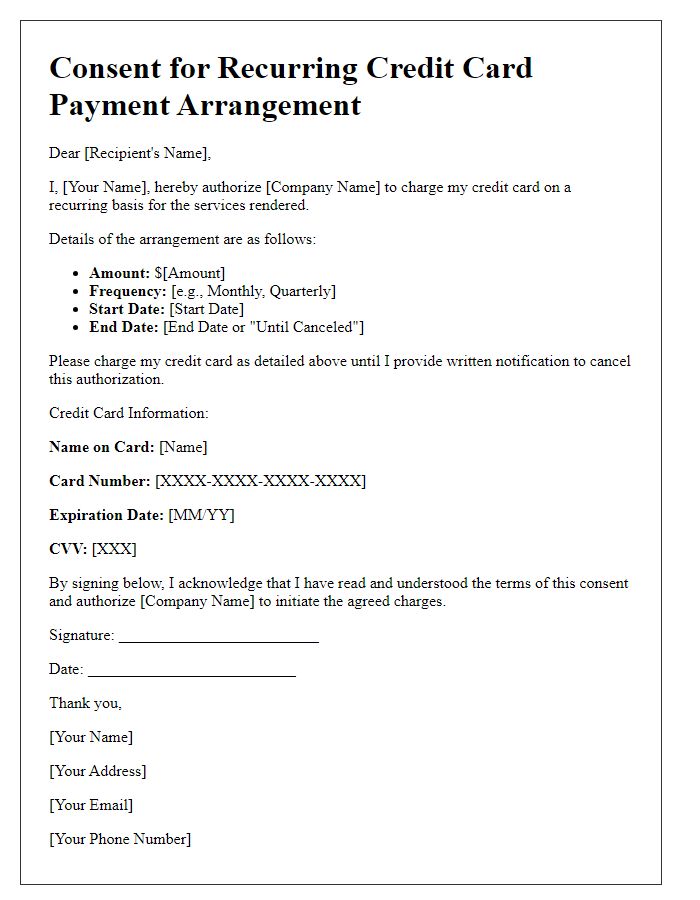

Letter template of consent for recurring credit card payment arrangement

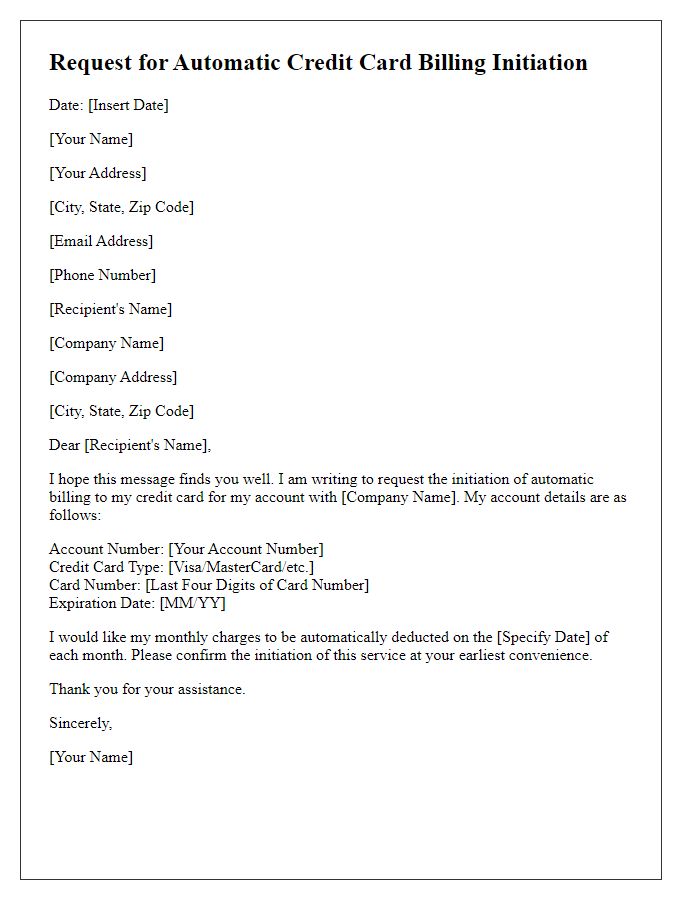

Letter template of instructions for establishing automatic credit card payments

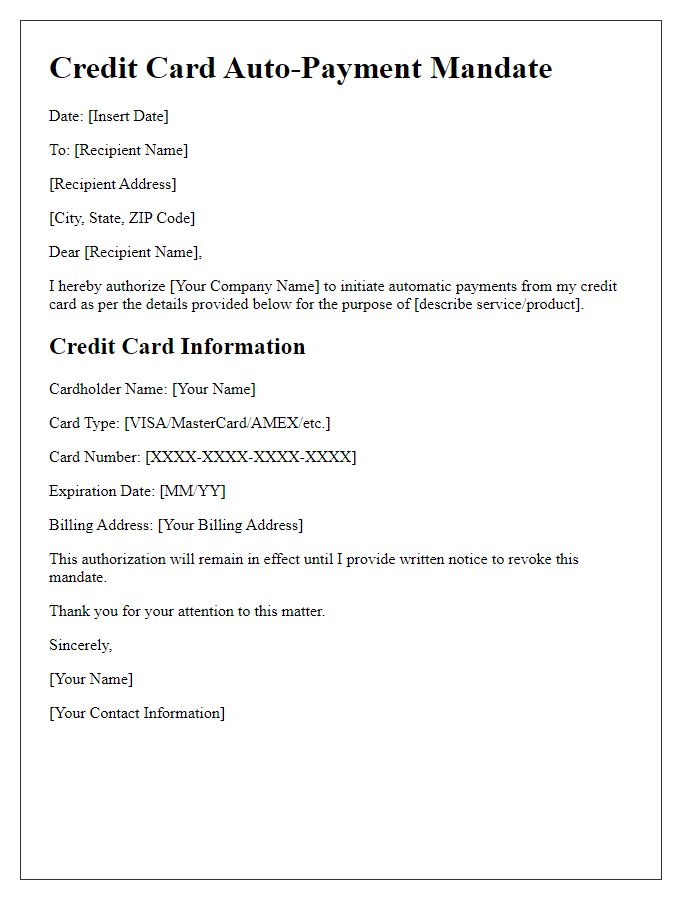

Letter template of mandate for ongoing credit card auto-payment processing

Comments