Are you looking for a streamlined way to manage your credit card services? We've got you covered with our easy-to-follow letter template designed specifically for contacting your credit card provider's dedicated service team. This template not only simplifies communication but also ensures that all your inquiries are addressed promptly. Dive into our article to discover how this tool can enhance your experience and make your financial management a breeze!

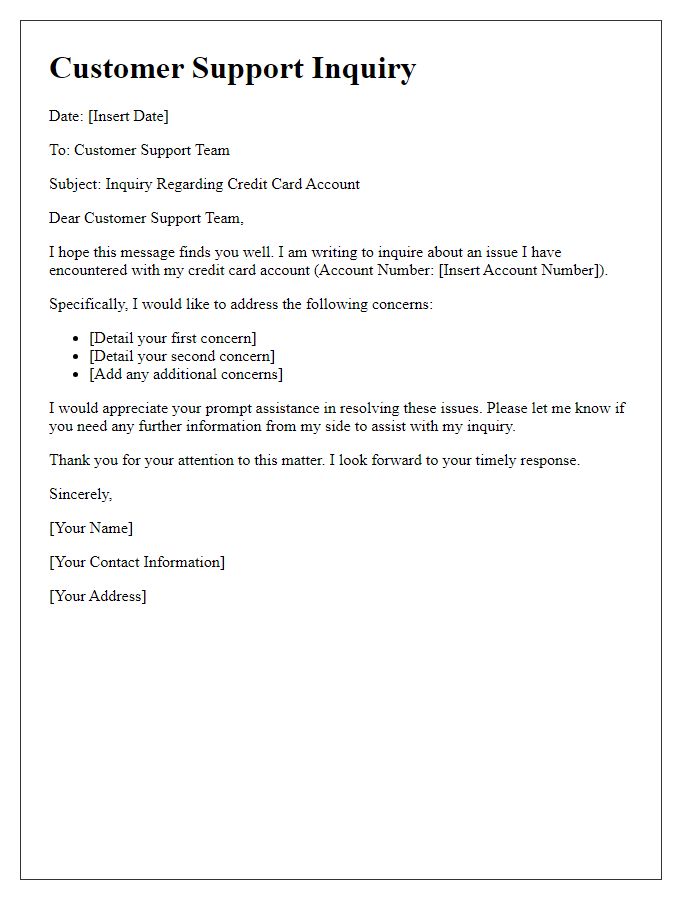

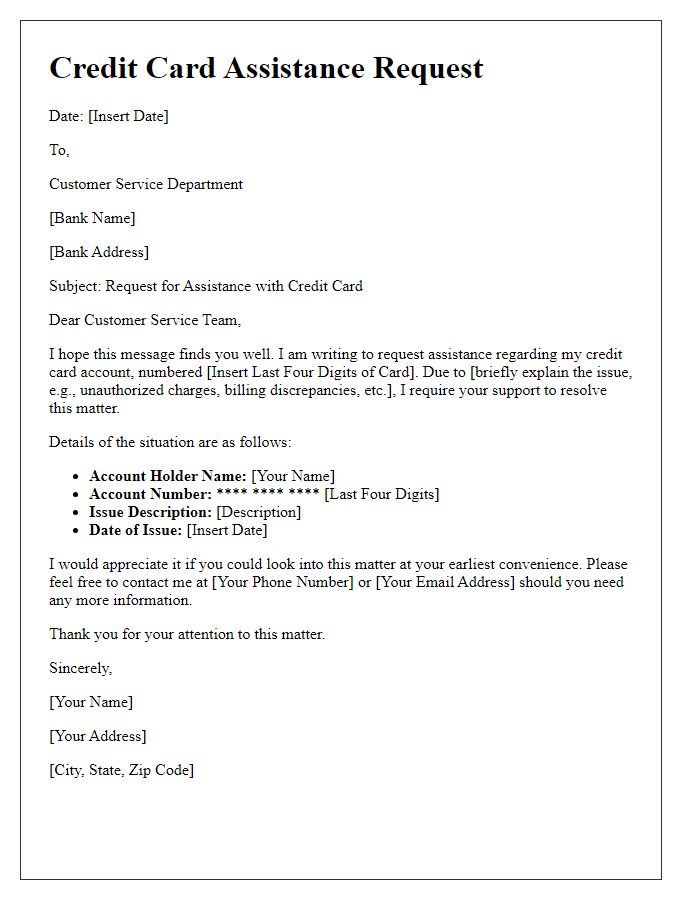

Personalization and recipient details

Credit card dedicated services provide tailored assistance to cardholders, ensuring personalized support and management of their accounts. For instance, top-tier credit card providers like American Express and Chase often feature dedicated service lines available 24/7. These services cater to individual needs, such as customized spending alerts for transactions exceeding predefined thresholds and personalized offers based on spending habits. Cardholders can also enjoy exclusive rewards programs, which may include travel perks or cash-back incentives, enhancing user satisfaction and loyalty. Additionally, dedicated service representatives are routinely trained to handle inquiries about account benefits, fraudulent activities, and account limits, ensuring a comprehensive client experience.

Clear subject line

Credit card dedicated service contact offers personalized assistance for cardholders, ensuring prompt resolution of account inquiries and issues. Services include transaction disputes, card activation, balance inquiries, and fraud alerts. Representatives are highly trained to understand individual customer needs, providing tailored support. Accessible channels include phone support, email communication, and live chat options, usually available 24/7 for convenience. Consistent support enhances customer satisfaction, fostering loyalty within a competitive financial landscape.

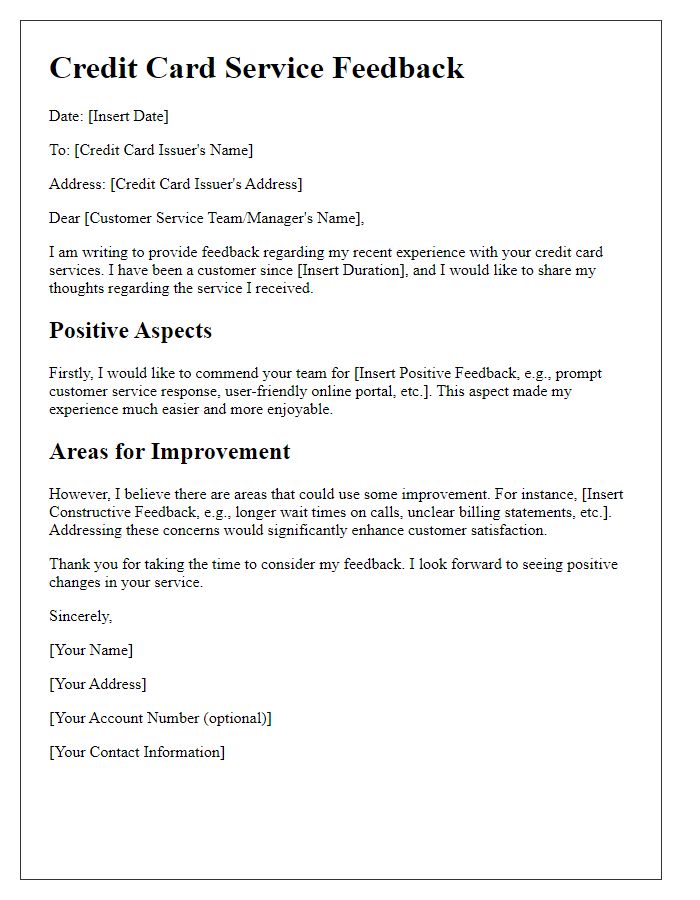

Purpose and context of the letter

Dedicated credit card services provide customers with personalized assistance, enhancing their overall banking experience with institutions like Chase or American Express. Such services typically include 24/7 support via dedicated hotlines, offering assistance with transactions, fraud prevention, and account management. Customer engagement strategies often feature tailored rewards or benefits based on individual spending patterns and preferences, tracked through advanced analytics. The context of this communication might revolve around addressing specific inquiries, resolving issues, or offering updates related to the account, such as changes in interest rates or new promotional offers. Providing clear contact information ensures that customers feel supported in their financial journey, reinforcing the bank's commitment to exceptional service.

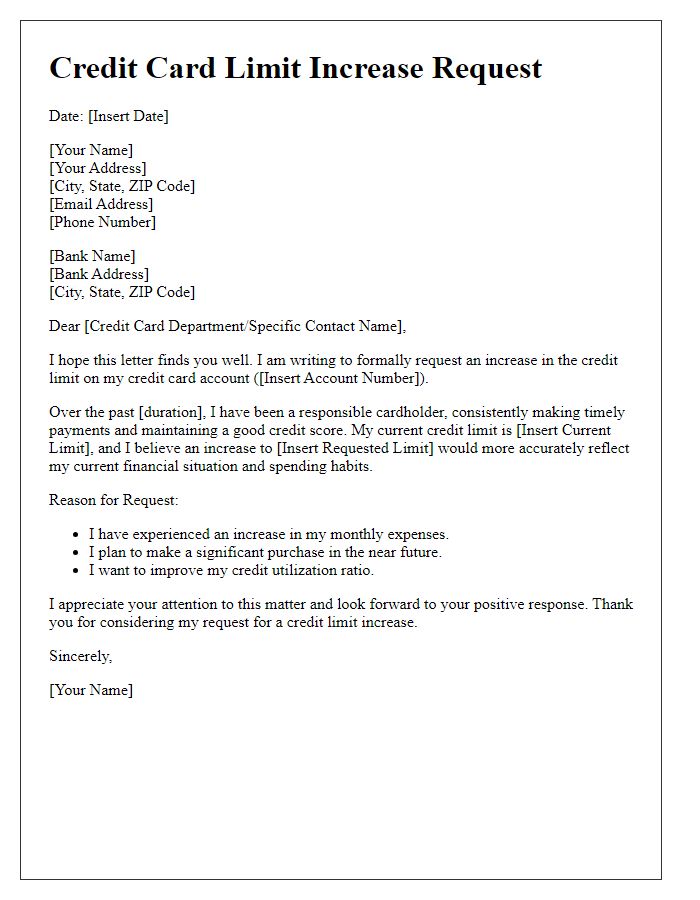

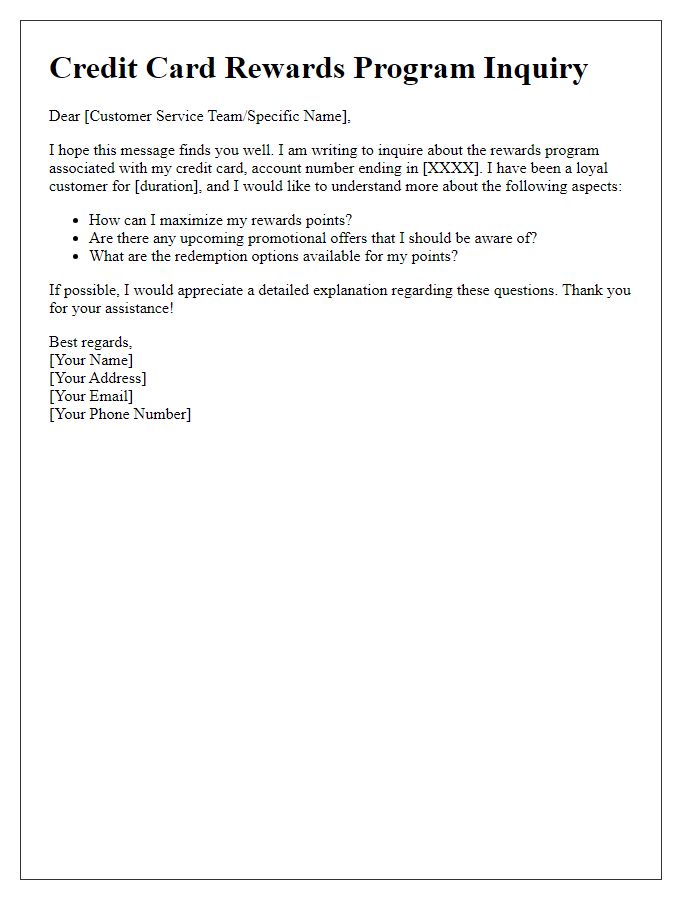

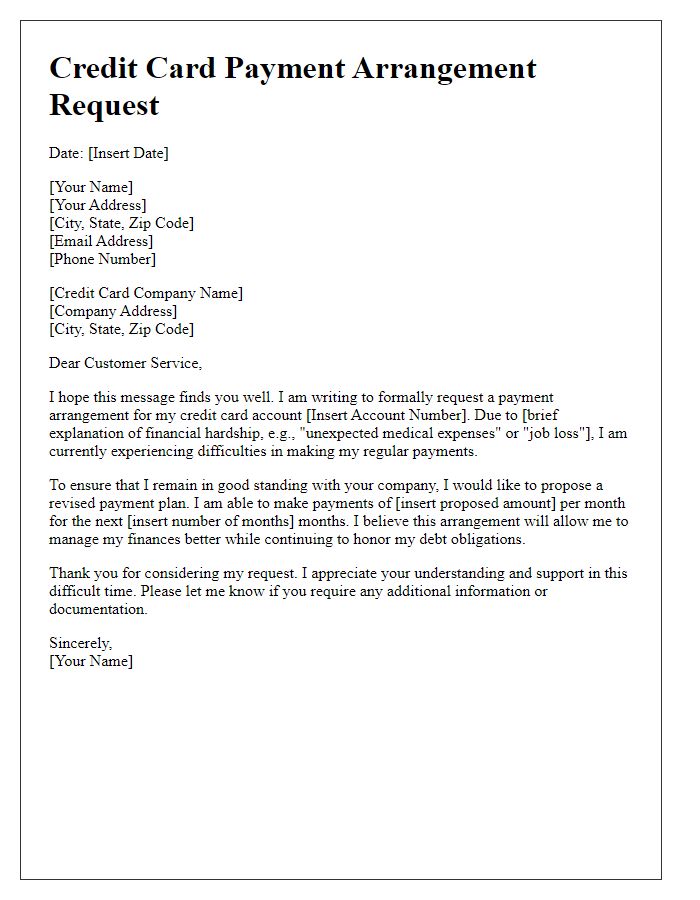

Detailed request or inquiry

Customers seeking dedicated service for credit card inquiries often need detailed assistance regarding specific transactions or account management. A typical case may involve a request related to unauthorized charges, where the cardholder identifies discrepancies in their account statements. Scenarios like these require timely resolution, often involving an investigation into the transactions made between particular dates, such as April 1 to April 15, 2023. The inquiry might also request additional information concerning monthly fees, interest rates, or reward points accrued during a defined period. Additionally, customers may need clarity on policies regarding balance transfers or payment due dates, especially if they are considering taking advantage of promotional offers available at participating merchants. Access to a dedicated customer service team can enhance the overall experience, ensuring tailored support throughout the resolution process.

Contact information and signature

Credit card dedicated service operates through various communication channels, including phone numbers and email addresses that connect customers to financial service representatives. Typically, phone support is available during business hours, with dedicated lines designated for various issues, such as billing inquiries and fraud alerts. Email communication provides an alternative for less urgent matters, allowing customers to outline their concerns in detail. Signature verification may be required for certain transactions or inquiries to ensure account security and identity confirmation. Different credit card issuers may display unique branding elements, including logos and taglines, on their service communication platforms.

Comments