In today's digital age, protecting your identity is more crucial than ever, especially when it comes to credit card fraud. With the rise of online shopping and personal information breaches, having an effective identity theft protection plan can safeguard your financial future. Understanding your rights and taking proactive measures can help you navigate the often overwhelming process of securing your finances. Ready to learn how you can protect yourself? Read on!

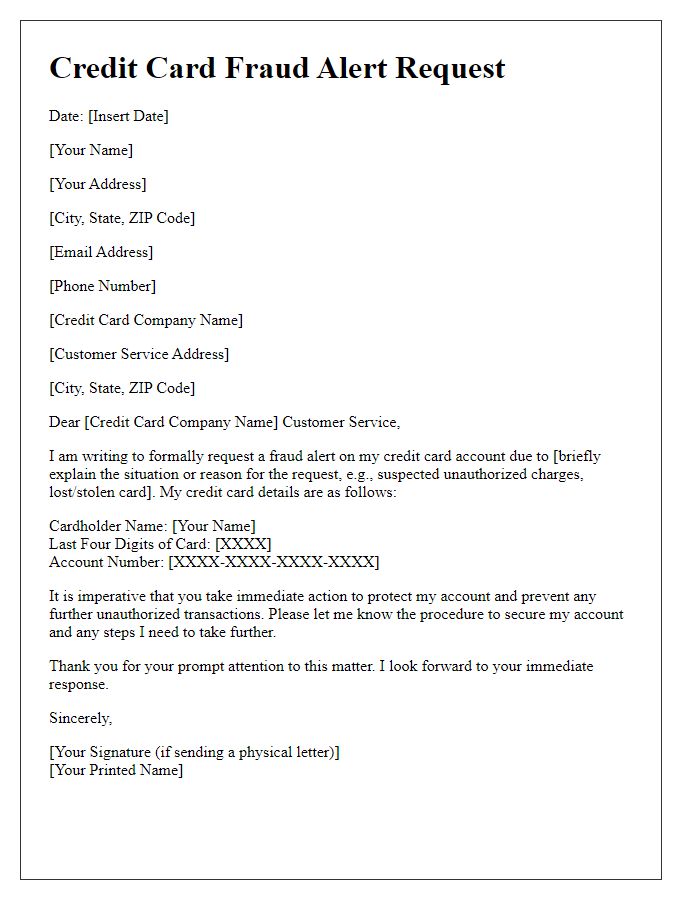

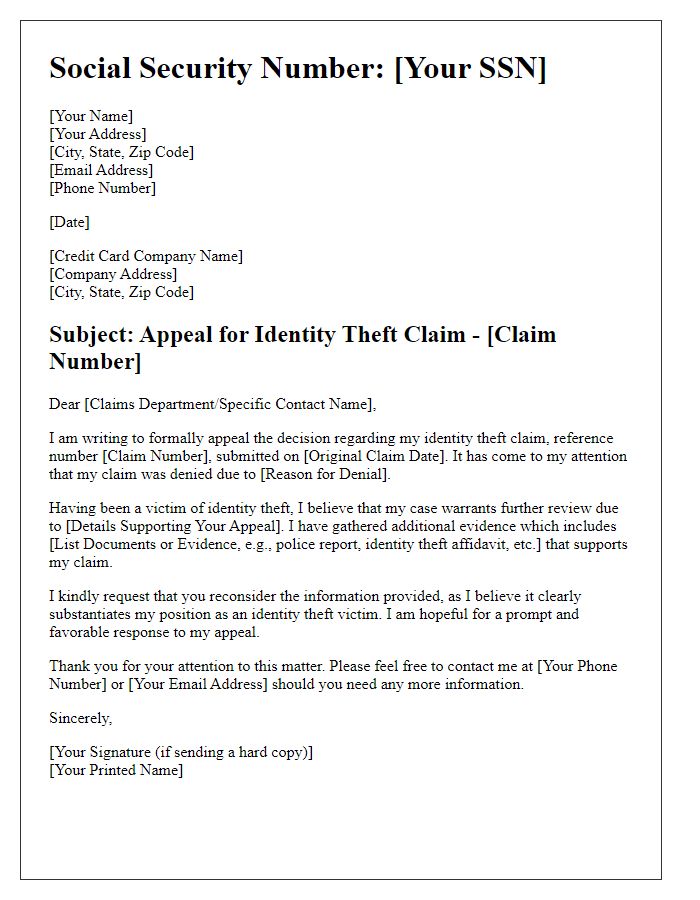

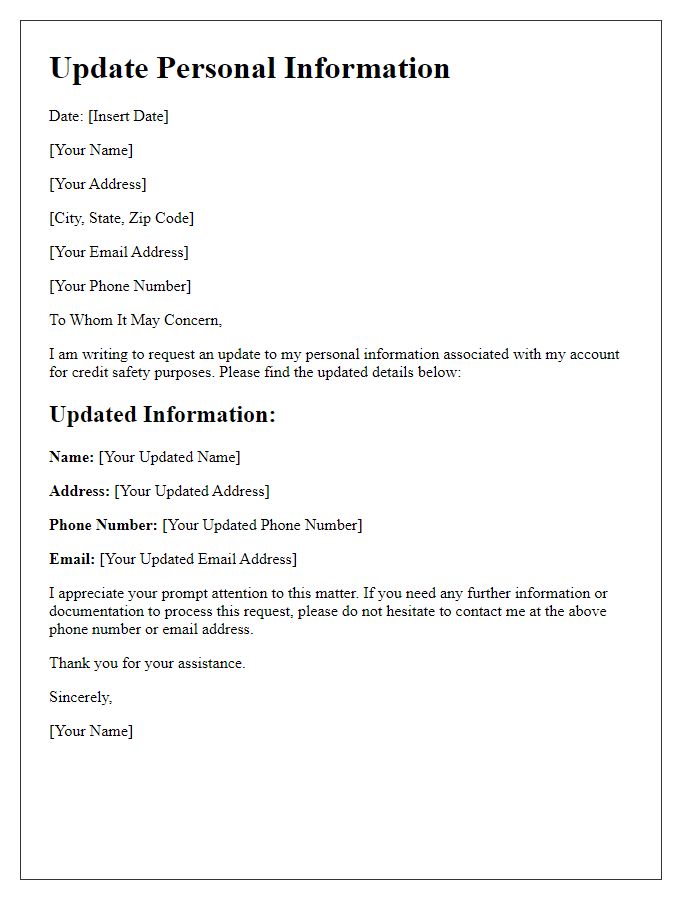

Contact Information

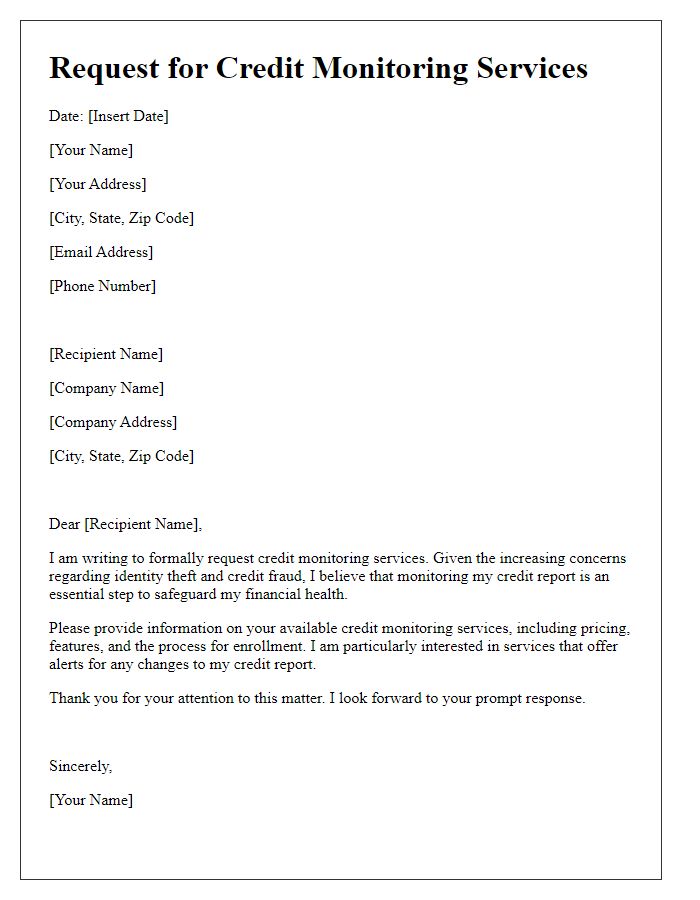

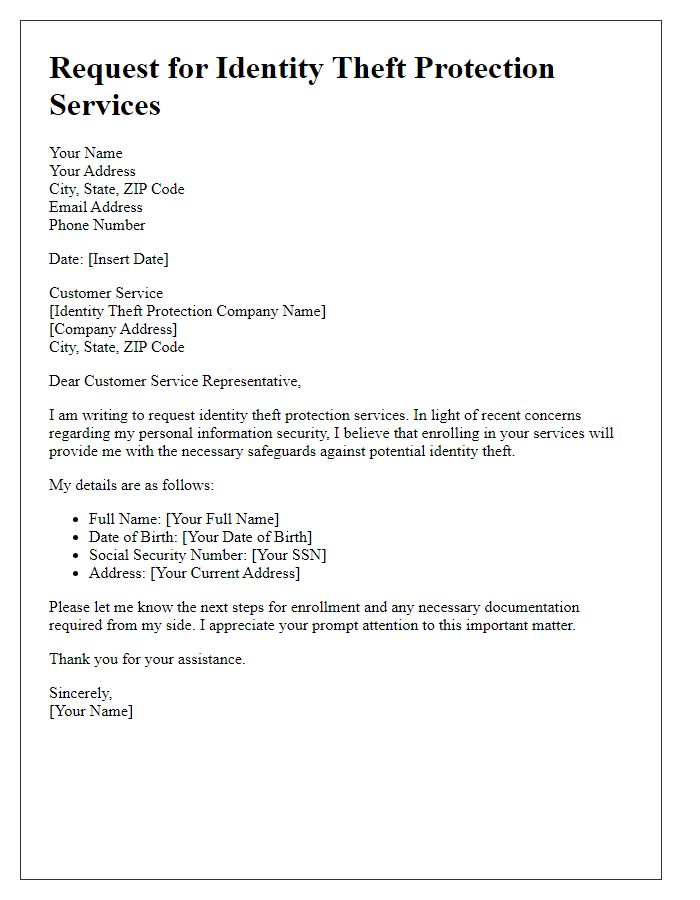

Credit card identity theft protection involves a series of measures designed to safeguard personal financial data, including sensitive information such as Social Security numbers and credit card details. Each year, millions of Americans fall victim to identity theft, with losses exceeding $16 billion in 2022 alone. Effective protection strategies often include monitoring credit reports from major bureaus like Experian, TransUnion, and Equifax. Financial institutions, such as Bank of America and Wells Fargo, typically offer alert services that notify cardholders of suspicious activity. Additionally, consumers can place fraud alerts with the Federal Trade Commission (FTC) and freeze their credit to prevent unauthorized accounts from being opened. Vigilance and proactive management of one's financial accounts are crucial in minimizing risks associated with identity theft.

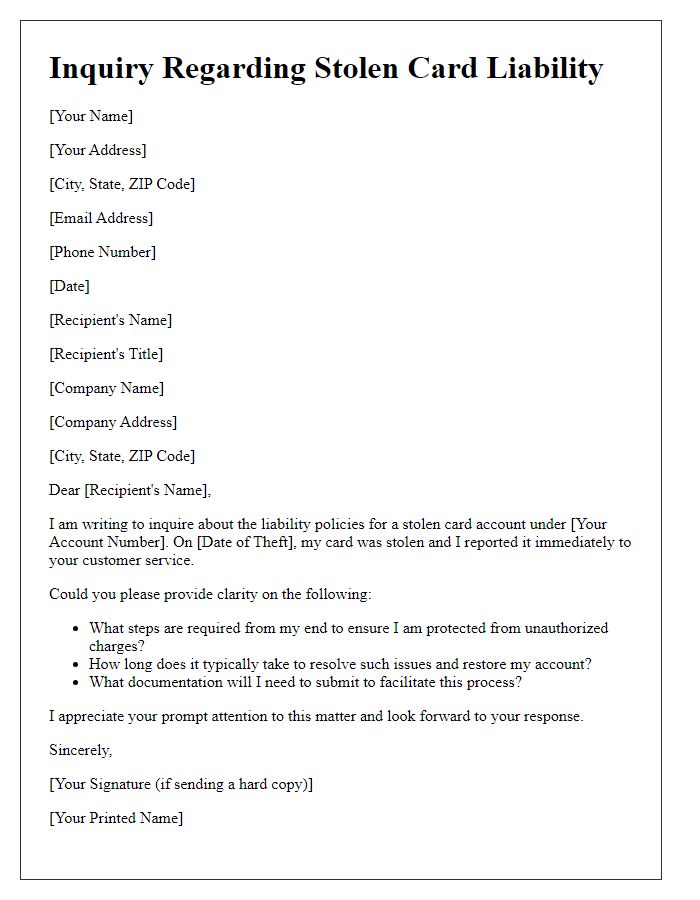

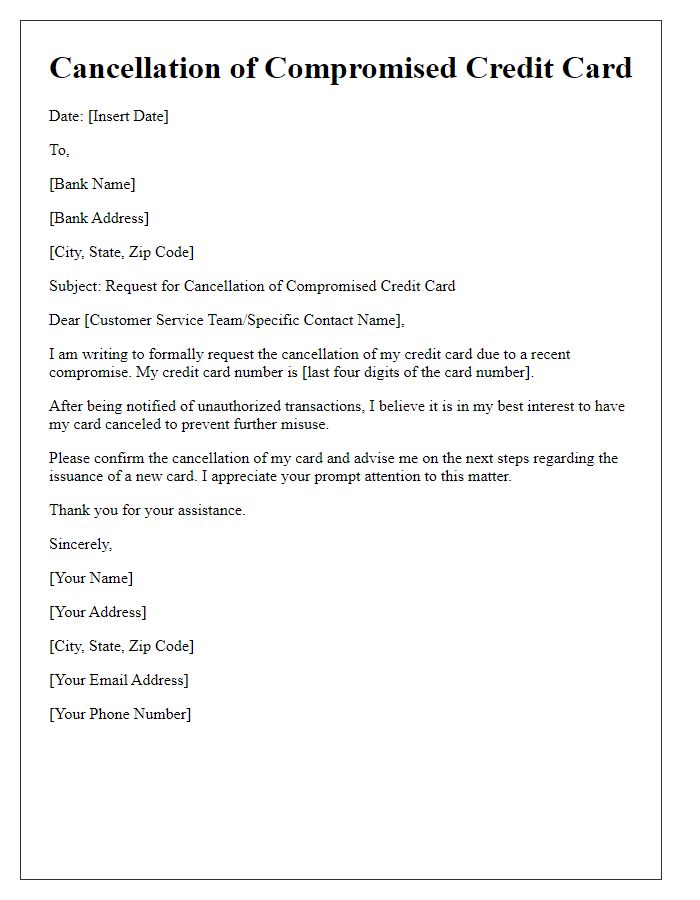

Account Details

Credit card identity theft protection applies to individuals who have experienced unauthorized use of their credit cards. Instances of theft can lead to financial losses, with the Federal Trade Commission reporting 1.4 million identity theft cases in 2020 alone. The protection services monitor transactions across various platforms, including online and in-store purchases, alerting users to potential fraud within seconds. Consumers typically receive notifications through multiple channels such as email, SMS, or an app. These services often include credit monitoring, scoring alerts, and identity restoration assistance, which can be critical for restoring personal finances and credit scores. Statistics indicate that it can take up to 6 months for victims to notice fraudulent activity, underscoring the importance of timely intervention in protecting one's financial identity.

Incident Description

Identity theft related to credit cards has become a prevalent issue affecting millions of consumers globally. In 2022, reports indicated that over 400,000 cases were linked to unauthorized credit card transactions. Victims often experience financial loss, as fraudulent charges can lead to unexpected expenses, resulting in damage to credit scores. Personal data, such as Social Security numbers and bank account information, can be compromised during data breaches, allowing thieves to apply for new credit cards under someone else's name. Various entities, including financial institutions and credit reporting agencies, play crucial roles in resolving these incidents, yet the process can be lengthy, taking weeks or even months to address fraudulent activities. Awareness and the use of identity theft protection services are vital to safeguarding personal information in today's digital landscape.

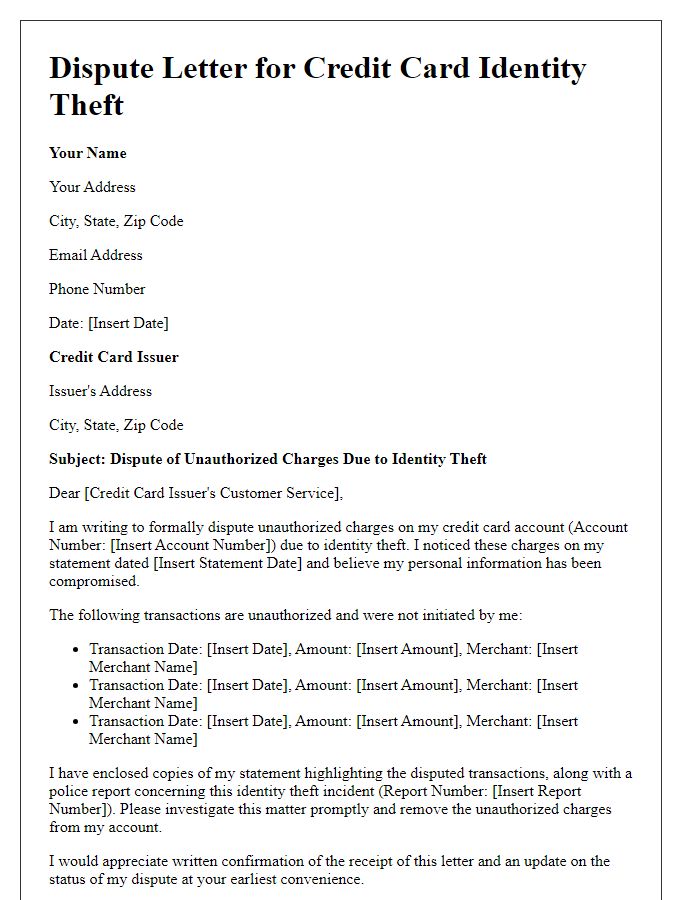

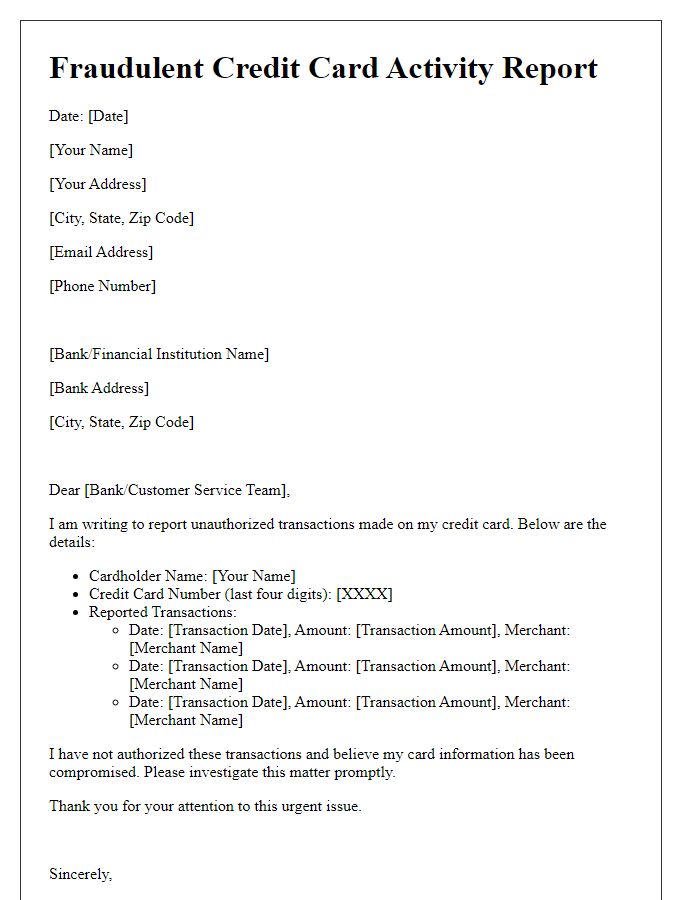

Fraudulent Activity Documentation

Fraudulent activity on credit cards can lead to significant financial loss and stress for consumers. Identity theft, a crime impacting millions in the United States annually, often involves unauthorized transactions. Credit card companies, like Visa and Mastercard, require consumers to document stolen transactions promptly. Relevant details include transaction dates, amounts, and merchant names. The Federal Trade Commission (FTC) provides templates for reporting identity theft, which can assist in gathering essential information. The process includes filing a police report (number required), notifying the credit card issuer (within 60 days), and monitoring credit reports for unauthorized accounts. Awareness of these steps can mitigate damage and reinforce security measures such as two-factor authentication.

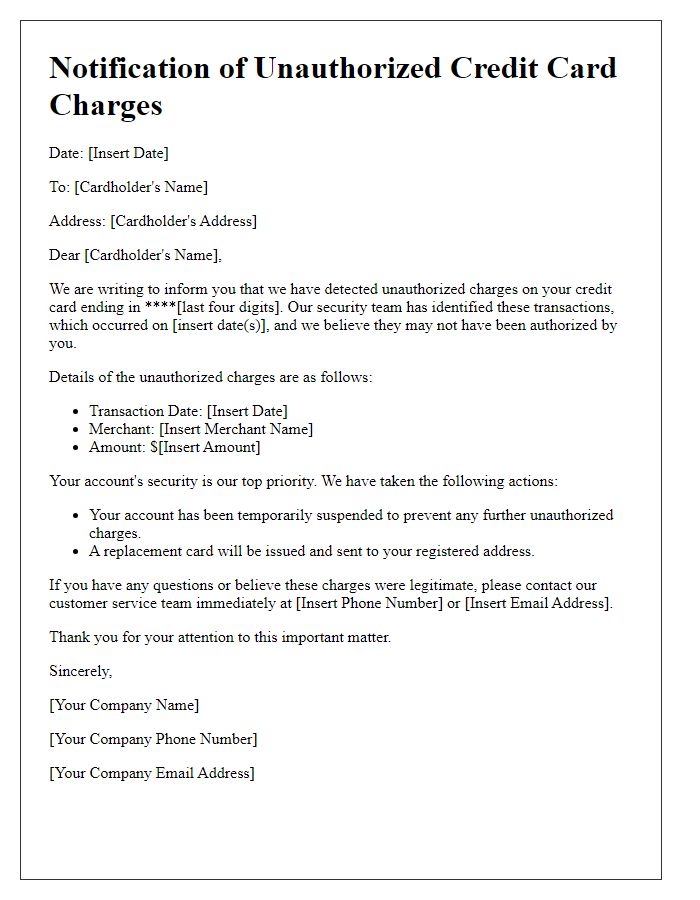

Requested Actions and Follow-up

Identity theft protection for credit card users remains crucial in today's digital age. Consumers must regularly monitor their account statements to quickly identify unauthorized transactions. Services like credit monitoring, offering real-time alerts, can notify users of score changes, suspicious activities, or new accounts opened in their name. Utilizing identity theft protection services, such as LifeLock or IdentityGuard, provides additional layers of security, including recovery assistance. Reporting identity theft incidents to credit card issuers like Visa or MasterCard ensures prompt freezing of accounts, preventing further unauthorized charges. Filing a report with the Federal Trade Commission (FTC) is essential in documenting the breach and receiving guidance on restoring identity. Regularly reviewing credit reports from agencies like Equifax, Experian, and TransUnion helps consumers stay vigilant against identity fraud, ensuring all inaccuracies are promptly contested.

Comments