Hey there! We're excited to let you know that your credit card limit has been increased, giving you more flexibility for your purchases. This change is just one of the many ways we strive to enhance your financial experience with us. With a higher limit, you can take advantage of special opportunities and enjoy the benefits of greater purchasing power. Curious to learn more about what this means for you? Keep reading!

Customer's name and address details

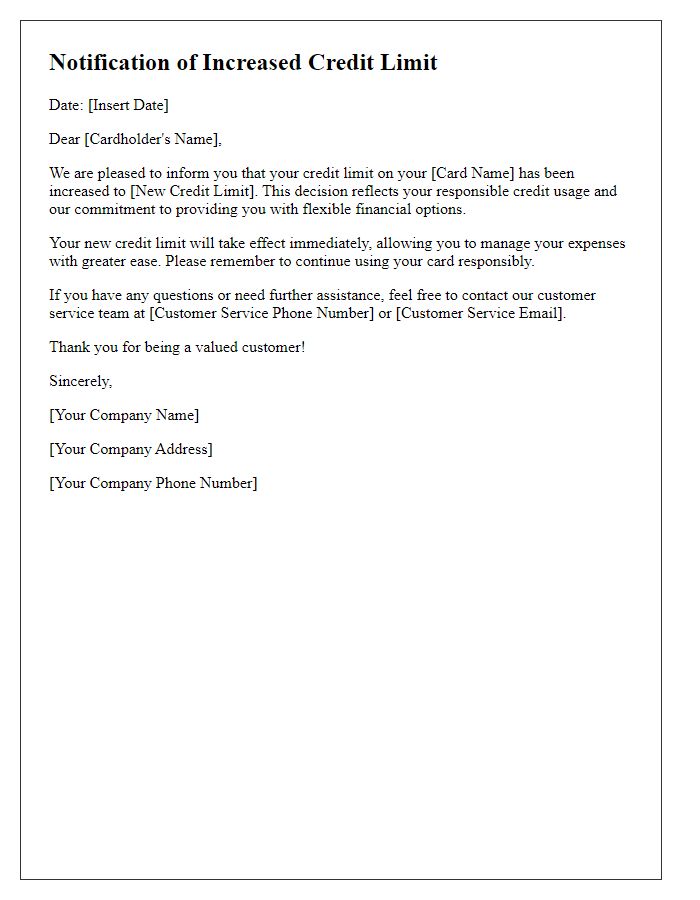

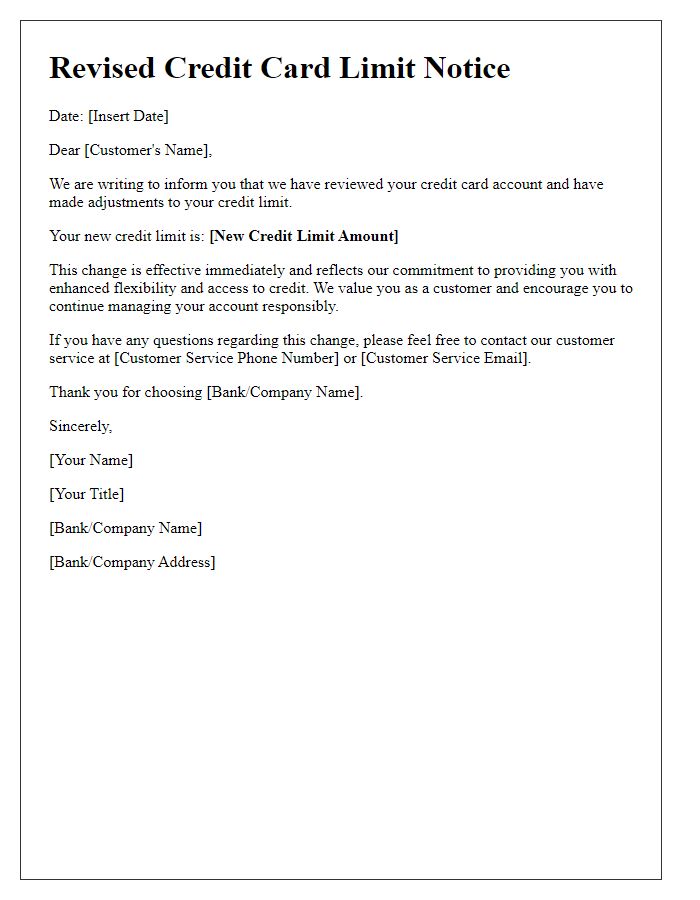

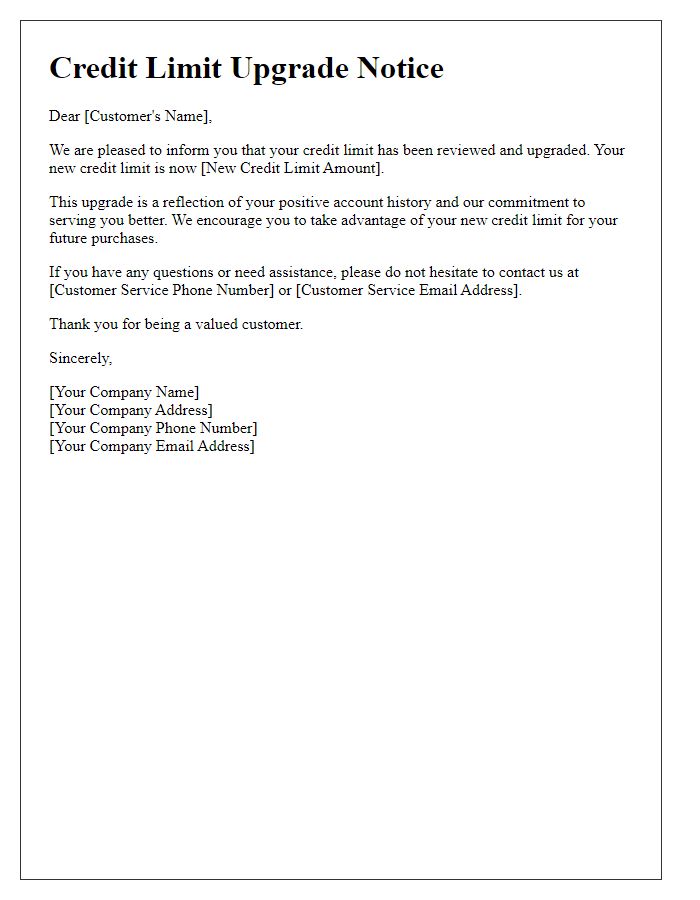

Credit card limits have become a crucial aspect of consumer finance, determining purchasing power and financial flexibility. Credit card issuers, such as major banks or financial institutions, regularly review customer accounts to assess eligibility for increased limits. This typically occurs after a review period that may span six months to a year, based on factors like payment history, credit utilization ratios (preferably below 30%), and overall credit scores (usually above 700 for favorable increases). Notifications about increased limits are often sent via formal letters or digital communications, ensuring that customers, whose names and addresses are verifiable, are informed promptly about these changes to encourage responsible credit usage and deepen customer loyalty.

Celebration and congratulations tone

A recently approved credit card limit increase can provide enhanced financial flexibility and purchasing power for cardholders. Customers may receive notifications from their credit card providers highlighting the new limit, which can often amount to hundreds or even thousands of dollars. This increase can manifest as a reward for responsible credit usage, such as timely payments and maintaining low credit balances. Cardholders can leverage this opportunity for significant purchases, travel expenses, or emergency funds, elevating their consumer experience while contributing to overall credit score improvements. Credit card companies often send these notifications via email or direct mail, celebrating the cardholder's financial achievement.

New credit limit amount

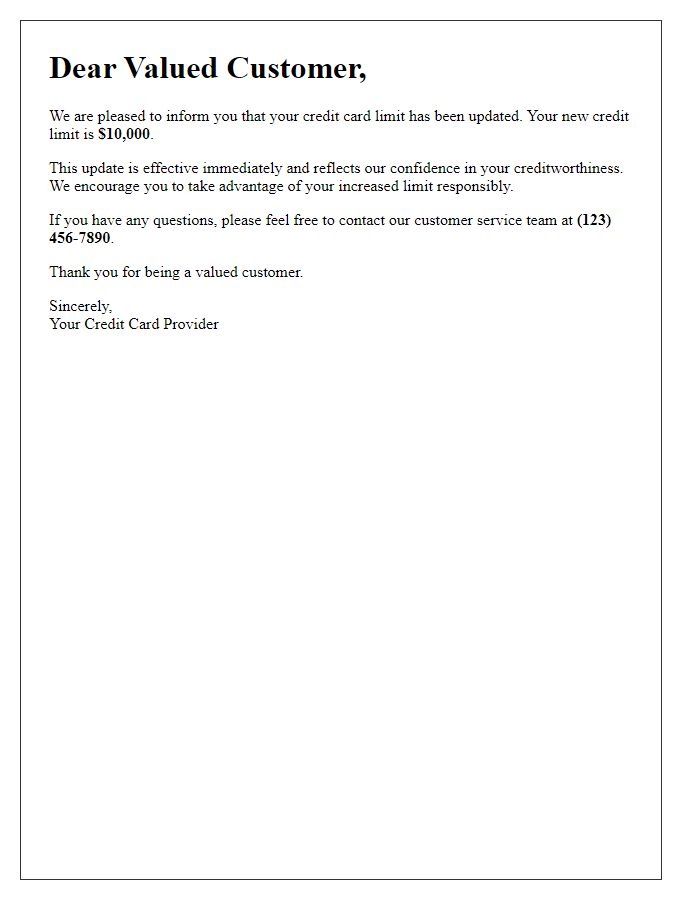

Credit card companies often notify customers when their credit limit changes. A credit limit increase can positively impact the customer's credit utilization rate, often leading to an improved credit score. Current credit limit impacts a user's overall financial health, with many financial advisors recommending a utilization rate below 30 percent. For example, if a customer's previous limit was $5,000 and the new limit is $7,500, this change offers the customer additional spending power and flexibility. This is particularly beneficial during emergencies or significant purchases. Notifications typically outline the new limit, any applicable terms, and remind customers that responsible credit use remains essential for maintaining a good credit score.

Effective date of increase

A notification regarding an increased credit limit on a credit card serves to inform the cardholder about the enhanced purchasing power granted by the financial institution. For instance, beginning on a specific effective date, such as December 1, 2023, the cardholder's credit limit may rise from $5,000 to $8,000, enabling greater flexibility for expenses or emergencies. This increase may enhance credit utilization ratios positively, potentially boosting the cardholder's credit score. Moreover, the communication often emphasizes responsible use and timely payments to maintain a healthy credit profile.

Customer service contact information

A credit card limit increase can significantly enhance a cardholder's purchasing power, fostering financial flexibility and potentially improving credit scores. This notification, typically sent via email or postal service, conveys the new limit, such as $5,000, compared to the previous limit of $3,000. Cardholders are encouraged to review updated terms and conditions associated with this change. For any questions or concerns, customer service contact information is provided, including a toll-free hotline like 1-800-555-0199 and email support at support@bankexample.com, ensuring assistance is readily available. The timing of this notification often coincides with a cardholder's positive payment history, reflecting responsible credit usage in terms of on-time payments over the last twelve months.

Comments