Are you feeling overwhelmed by credit card debt? You're not aloneâmany people are seeking ways to manage their balances more effectively. A balance transfer credit card offer could be the perfect solution to save on interest and simplify your payments. If you're curious about how it works and the potential benefits, keep reading to discover more!

Clear and engaging headline

Elevate Your Financial Freedom: Transform Your Credit Card Debt with Our Exclusive Balance Transfer Offer!

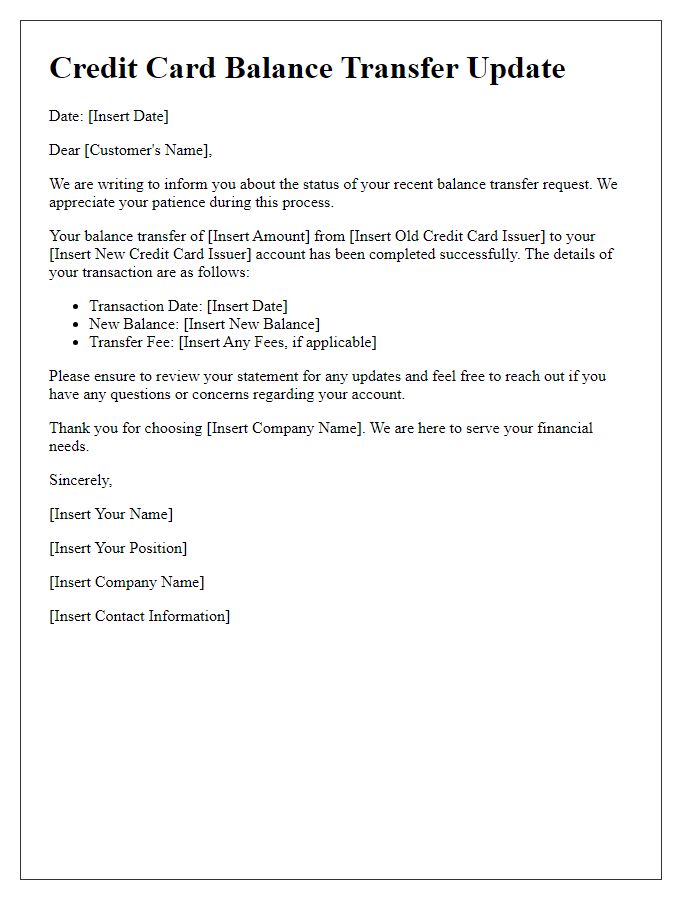

Introductory offer specifics

Credit card balance transfer offers often entice users with attractive introductory rates. For instance, a 0% APR (Annual Percentage Rate) for the first 12 to 18 months allows cardholders to transfer existing high-interest debt without incurring additional interest charges during the promotional period. Specific terms vary among financial institutions; for example, some banks may impose a one-time fee of 3% to 5% on the transferred balance, while others might offer fee-free transfers. Additionally, users often need to meet a minimum credit score, typically around 650, to qualify for these promotions. Monitoring the expiration dates of these offers is crucial to avoid reverting to standard rates, which can exceed 20% APR after the introductory period. Overall, understanding the details of balance transfer offers can lead to significant savings on debt repayment.

Benefits and features

A credit card balance transfer offer provides significant financial relief for individuals seeking to manage and consolidate their debts. This offer typically includes benefits such as an initial low introductory annual percentage rate (APR), often as low as 0% for a set period (usually 12 to 18 months), allowing users to transfer existing high-interest credit card balances to a new card. Key features may include no annual fee, providing additional savings. Many offers propose greater flexibility in payment terms, helping users pay down their debt faster. Other advantages may involve rewards programs, where users can earn points or cashback on purchases made with the new card. To take advantage of this offer, applicants usually require a good to excellent credit score, with minimum transfer amounts ranging from $100 to $5,000. Overall, this financial strategy can significantly reduce interest payments and expedite the journey to financial stability.

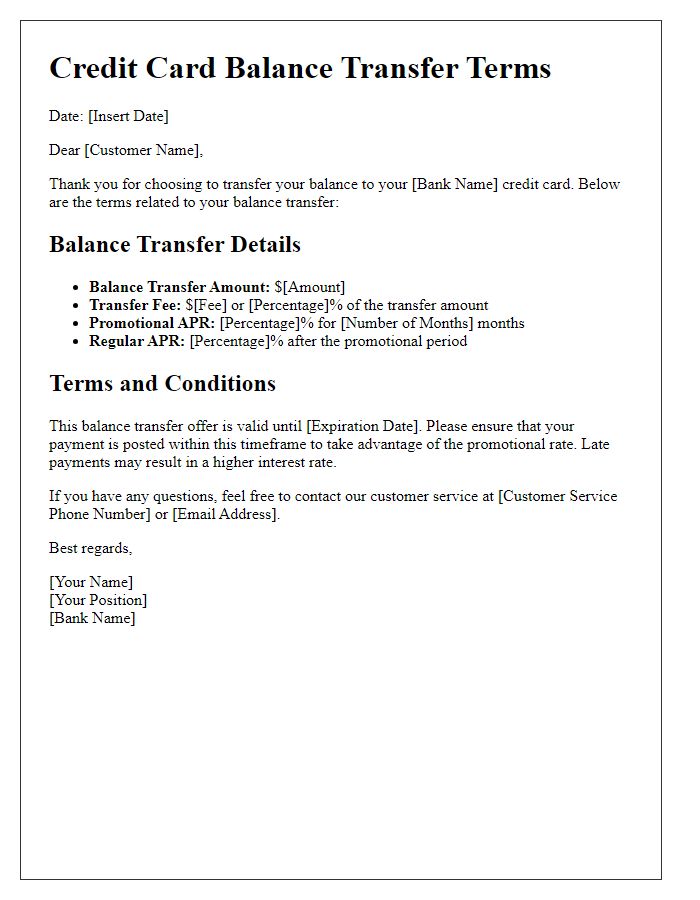

Terms and conditions

A credit card balance transfer offer typically includes important terms and conditions that applicants must understand. The offer may feature a promotional interest rate of 0% for the first 12 months on transferred balances from other credit cards, allowing cardholders to save on interest payments. The transfer fee, often ranging from 3% to 5% of the amount transferred, may apply, impacting the overall savings. Additionally, the standard annual percentage rate (APR) after the promotional period could revert to around 15%-25%, depending on the applicant's creditworthiness. It's essential to highlight that minimum payment terms must be met each month, and missed payments may result in losing the promotional rate and incurring late fees. Moreover, transferred balances must typically be completed within a specified period, which may be 60 days from account opening. Understanding these terms ensures informed financial decisions when considering a balance transfer for debt management.

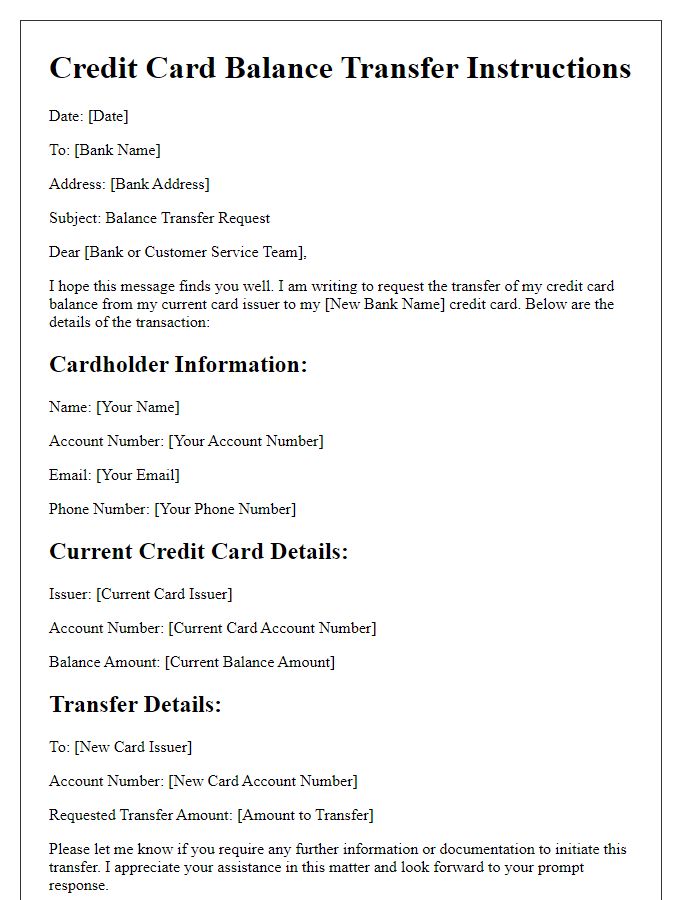

Call to action and contact information

A credit card balance transfer offer provides an opportunity for cardholders to consolidate debt by transferring high-interest balances from one or multiple credit cards to a single card with a lower interest rate. Typically, these offers include promotional interest rates, such as 0% APR for a certain period, which can last from 6 to 18 months, allowing customers to save on interest. To take advantage of this offer, individuals can call the customer service number provided, often found on the back of their credit card, or visit the financial institution's official website for more details on the transfer process and terms. The ideal contact information includes a phone number (e.g., 1-800-555-0199) and a website URL (e.g., www.bankXYZ.com), making it convenient to inquire about the conditions and complete the balance transfer swiftly.

Comments