Are you curious about how to effectively manage your credit card limit? Understanding your usage not only helps improve your credit score but also keeps your finances in check. In this article, we'll explore tips and templates for creating a comprehensive credit card limit usage report that can guide your spending habits. Let's dive in and discover the tools you need to take control of your financial future!

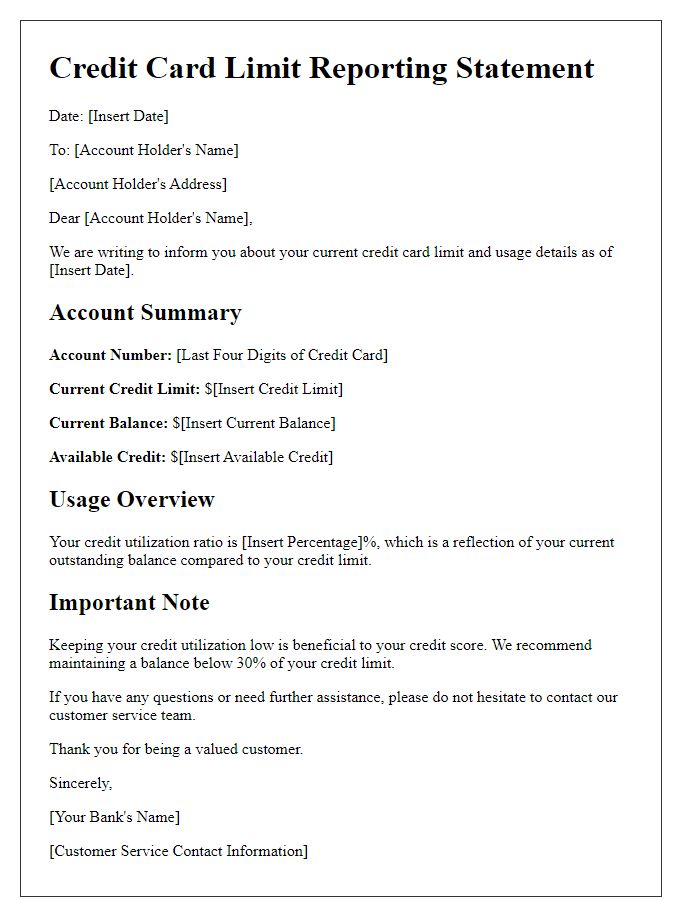

Account information

In financial management, tracking credit card limit usage is essential for maintaining healthy credit scores and ensuring responsible spending. For instance, individuals with a credit card limit of $5,000 should aim to keep their utilization rate below 30%, which translates to approximately $1,500 in outstanding balances. Monitoring accounts through platforms like Experian or Credit Karma can help users stay informed about their spending habits. The FICO credit scoring model factors in credit utilization as 30% of the overall score, underscoring the importance of keeping balances low, especially before significant events like mortgage applications or loan approvals. Regularly reviewing statements for accurate reporting of charges and payments can safeguard against potential errors that might negatively impact financial profiles.

Current credit limit

Current credit limits are vital indicators of financial health and spending capacity for individuals and businesses. For instance, a typical credit card limit might range from $1,000 to $10,000 depending on factors such as credit score, income levels, and the issuing bank's policies. Overspending beyond 30% of this limit can significantly impact credit scores due to increased credit utilization ratio, a key metric used by lenders to assess risk. Regular monitoring of credit limit usage ensures responsible management of debt, fostering positive financial habits and maintaining a good credit history, critical for securing favorable loan terms in the future.

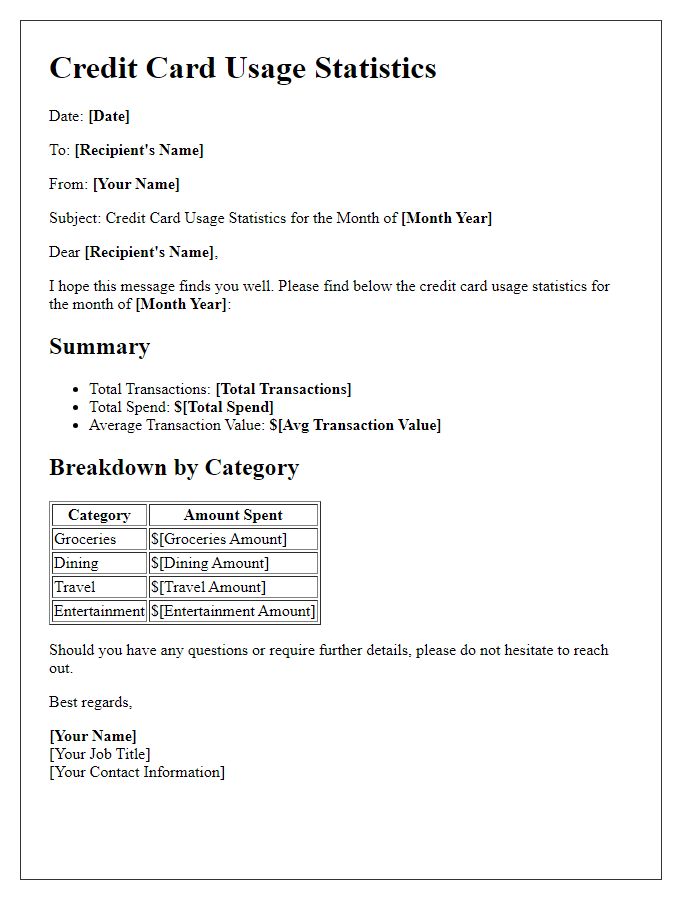

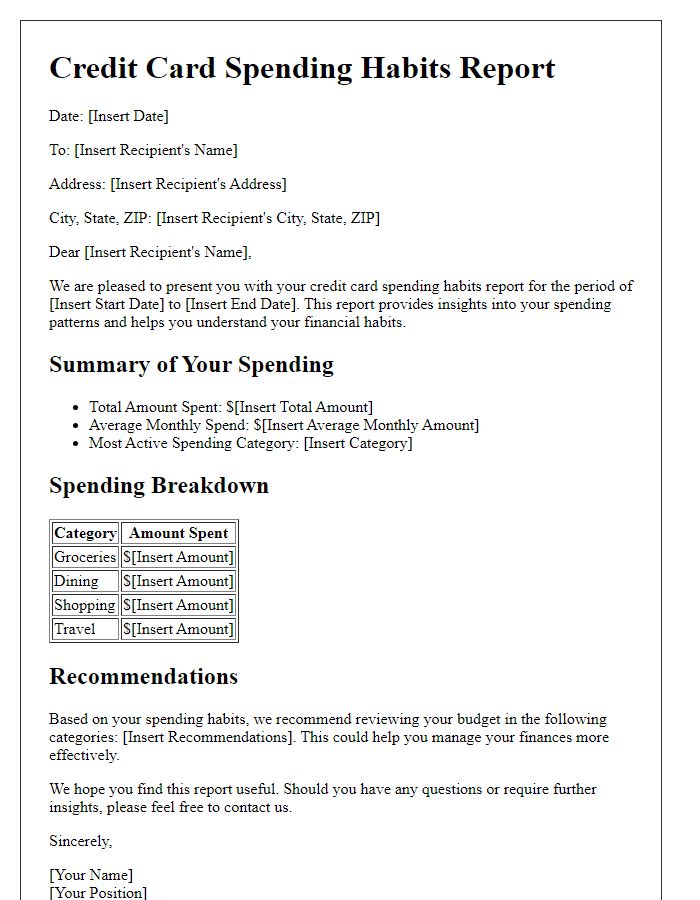

Usage summary

Credit card limit usage reports provide detailed insight into spending habits on credit accounts. These reports typically highlight total credit limit of $5,000, with current balance information indicating used percentage. For instance, a 40% usage equates to $2,000 spent, reflecting a responsible approach to credit management. Transaction categories may include groceries, travel, and dining, illustrating consumer behavior and preferences. Timely payments enhance credit score, which is crucial for future borrowing opportunities. Regular monitoring of these reports assists in maintaining a favorable credit utilization ratio, ideally below 30% for optimal credit health.

Recommendations for responsible use

Maintaining a healthy credit card limit is crucial for financial stability and credit score optimization. Users should aim to keep their credit utilization ratio--the percentage of credit available that they are using--below 30%, as recommended by financial experts. Regularly monitoring spending habits can identify trends and prevent overspending. It's advisable to set monthly budgets aligned with income, reducing the risk of debt accumulation. Arranging autopay for at least the minimum payments helps avoid late fees, which can negatively impact credit history. Lastly, reviewing credit card statements each month for unauthorized charges can bolster account security, ensuring that only legitimate expenses are accounted for.

Contact information for assistance

Credit card limit usage reports inform customers about their spending habits and available credit. Typically sent monthly, these reports highlight total credit limit, utilized credit amount, and remaining balance. Customers seeking assistance can contact dedicated support teams through various channels such as a toll-free number (1-800-XXX-XXXX) or a helpline available via the bank's website. Email support, accessible at support@bankname.com, offers another communication avenue for inquiries or concerns regarding credit limit adjustments, payment processing delays, or account management. Online chat features also provide immediate assistance on platforms like the bank's mobile app, facilitating prompt resolutions for users.

Comments